Reports

Reports

The surgical drills market is witnessing steadiness, largely as a result of the fast-paced technological innovations in surgical methods and medical equipment. The shift toward minimally-invasive surgeries has boosted the need for accuracy-oriented surgical drills that ascertain accuracy, safety, and efficiency, even during complex procedures.

Further, physicians are increasingly dependent on power-assisted drills that curtail the duration of operations and speed up the recovery rate of patients.

Increased volume of surgery, enabled by improved access to healthcare facilities and an elevated in healthcare spending in developing economies, is another important driver to the global market.

Recent surgical drills market trends have largely been centered on the incorporation of digital technologies, automation, and the ecological aspect of products. Some battery-powered and electric surgical drills with improved torque control and safety features are preferred over the conventional pneumatic models due to their versatility and portability.

Furthermore, the use of navigation systems, robotics, and augmented reality is reshaping surgery by guiding surgeons to conduct operations with more precision and finesse. Moreover, there is an ascending inclination toward the use of disposable surgical drills. This results in reducing the infection risk, observing the strict sterilization norms, and operationalizing of workflows in hospitals and clinics.

The surgical drills market competition is an ever-changing scenario that is heavily influenced by the continuous introduction of new features and adoption of strategic initiatives ahead of the competition.

Surgical drills imply specialized instruments that are designed for creating precise holes in bones or the other hard tissues during surgical procedures. They are essential tools in surgical operations across various fields such as orthopedics, dentistry, neurosurgery, and trauma surgery, where precision, stability, and control are paramount. Surgical drills have been engineered to reduce the damage caused to the tissue, reduce heat generation, and provide a smooth cutting, thus, ensuring both - surgical efficiency and patient safety. They differ in shape and size, and are available in several power sources such as pneumatic, electric, and battery-powered. This diversity allows them to effectively meet the demands of contemporary surgical practices.

Surgical drills mainly serve the purpose of allowing surgeons to deliver precise and intricate procedures.

Safety and hygiene are critical aspects in the design of surgical drills. At present, numerous instruments combine disposable components to reduce the possibilities of infections and also comply with the established sterilization standards. Moreover, the use of lightweight materials and design of the ergonomic handle enable better control, allowing surgeons to operate for extended periods without experiencing fatigue.

| Attribute | Detail |

|---|---|

| Surgical Drills Market Drivers |

|

The growing demand for minimally-invasive procedures is a key factor that escalates the demand for surgical drills. Such interventions highlight the use of tiny incisions, less disruption of tissues, and rapid recovery of patients, all of which require accurate and precise instruments of surgery. Surgical drills occupy the central role among these treatments as they offer precision and dexterity required for fine bone and tissue surgery with minimal surgical trauma. Electric and battery-powered drills, in particular, are the most preferred ones due to their easy handling and stable performance in narrowed surgical environments.

Manufacturers are investing in technological advancements of these products, by including better ergonomics, torque control, and noise reduction. The use of robotics and image-guided navigation systems in the surgical field further enhances precision during surgeries. The global demand for next-generation surgical drills is skyrocketing as healthcare providers are embracing these protocols not only for their clinical benefits but also for their economic growth.

The increasing incidences of chronic diseases have a key role in fueling the surgical drills market, as these conditions frequently necessitate surgical interventions for effective treatment. Chronic diseases like cardiovascular disorders, diabetes, osteoporosis, and obesity-associated complications result in several ailments such as fractures, joint damage, and bone deformations.

In the realm of orthopedic care, diabetes and obesity-related patients develop bone and joint diseases that eventually require reconstructive surgeries. Surgical drills facilitate these procedures by improving precision, thereby reducing the risks associated with joint replacements, fracture repairs, and bone corrections for both - medical teams and patients. In a similar manner, osteoporosis, a chronic condition predominantly affecting elderly and middle-aged population, is the root for constant necessity for drill-assisted orthopedic surgeries.

The dental segment also benefits by the growing incidences of chronic diseases. For instance, dental implants use surgical drills to achieve proper placement and durability, thereby making them essential instruments for dental surgeons managing oral complications resulting from chronic conditions.

Manufacturers of surgical drills have re-oriented their focus to produce instruments that prioritize safety, precision, and ergonomic design, addressing the growing burden of chronic ailments. This simplification of the process helps surgeons in execution of the difficult part of the operation more efficiently and, at the same time, to reduce the risk of the patient's suffering.

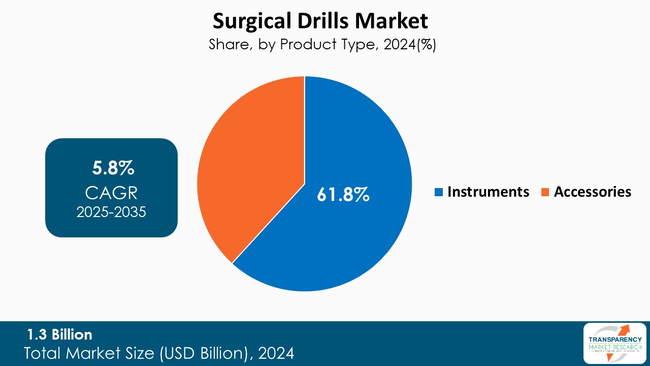

The instruments segment leads the market for surgical drills as it holds a fundamental position in enabling surgical procedures in orthopedics, neurosurgery, and dentistry. Components such as drill bits, hand pieces, and attachments are directly accountable for accuracy, control, and performance during operations, and therefore are paramount to surgical success. Their continuous usage coupled with the need for maintenance and replacement guarantees a steady demand.

In addition, improvements in ergonomics, torque management, and resistance of material have made surgical drill instruments more effective and safer. Instrument improvements are a priority for surgery centers and hospitals to maintain accuracy and minimize surgical risk, further contributing to its dominance in the target market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

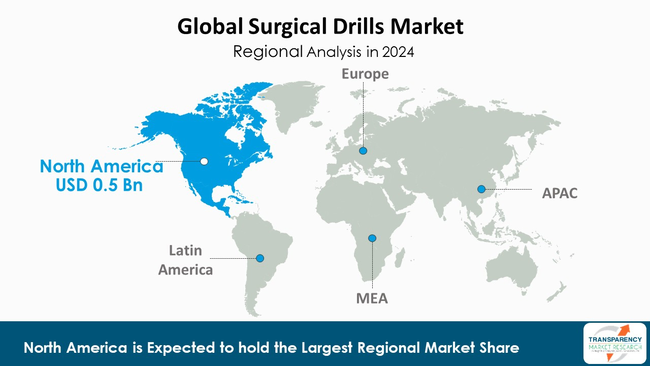

As per the latest surgical drills market analysis, North America dominated in 2024. This is attributed to the region's highly developed healthcare infrastructure, large number of surgeries, and considerable use of advanced medical technologies. High demand for orthopedic, dental, and neurosurgical procedures in the region, which is supported by high healthcare expenditure and good reimbursement policies.

In addition, the continuous research and development activities, together with the rapid adoption of minimally invasive surgical techniques, not only enhance North America's leadership position, but also consolidate its position in the market. The presence of qualified surgeons, modern training institutions, and observance of high quality and safety standards are some of the factors that contribute to the region's dominant market position.

Companies operating in the market for surgical drills are focusing their efforts on innovation, which involves advanced ergonomics, torque control, and safety features, as well as a conscious approach to the environment that includes truly reusable or disposable products. Apart from innovating through R&D, the companies can enhance their market presence by adopting strategies such as collaborations with the other firms using distribution networks that have worldwide exposure, coupled with offering a good after-sale service to their customers.

Stryker, Medtronic, Johnson & Johnson, B. Braun SE, CONMED Corporation, Arthrex, Inc., De Soutter Medical, adeor Medical AG, Brasseler USA, NSK / Nakanishi Inc., Zimmer Biomet, GMI Dental Implantology, Shanghai Bojin Medical Instrument Co., Ltd., Joimax GmbH, and 3M are some of the leading players operating in the global surgical drills market.

Each of these players has been profiled in the surgical drills Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Surgical Drills Market Snapshot

| Attribute | Detail |

|---|---|

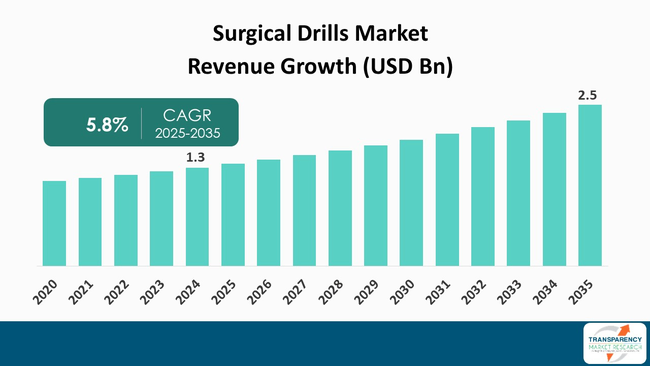

| Size in 2024 | US$ 1.3 Bn |

| Forecast Value in 2035 | US$ 2.5 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Surgical Drills Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global surgical drills market was valued at US$ 1.3 Bn in 2024

The global surgical drills industry is projected to reach more than US$ 2.5 Bn by the end of 2035

The increasing global aging population requiring orthopedic and neurological surgeries, the rising prevalence of chronic diseases and accidental injuries, technological advancements in drill precision and safety features, a growing trend towards minimally invasive procedures, and expansion of healthcare infrastructure in developing countries are some of the factors driving the expansion of surgical drills market.

The CAGR is anticipated to be 5.8% from 2025 to 2035

Stryker, Medtronic, Johnson & Johnson, B. Braun SE, CONMED Corporation, Arthrex, Inc., De Soutter Medical, adeor Medical AG, Brasseler USA, NSK / Nakanishi Inc., Zimmer Biomet, GMI Dental Implantology, Shanghai Bojin Medical Instrument Co., Ltd., Joimax GmbH, and 3M

Table 01: Global Surgical Drills Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Surgical Drills Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 03: Global Surgical Drills Market Value (US$ Bn) Forecast, By Drill Bit Type, 2020 to 2035

Table 04: Global Surgical Drills Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 05: Global Surgical Drills Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Surgical Drills Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 07: Global Surgical Drills Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Surgical Drills Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Surgical Drills Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 10: North America Surgical Drills Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 11: North America Surgical Drills Market Value (US$ Bn) Forecast, By Drill Bit Type, 2020 to 2035

Table 12: North America Surgical Drills Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 13: North America Surgical Drills Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Surgical Drills Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 15: Europe Surgical Drills Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Surgical Drills Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 17: Europe Surgical Drills Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 18: Europe Surgical Drills Market Value (US$ Bn) Forecast, By Drill Bit Type, 2020 to 2035

Table 19: Europe Surgical Drills Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 20: Europe Surgical Drills Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: Europe Surgical Drills Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 22: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 24: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 25: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, By Drill Bit Type, 2020 to 2035

Table 26: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 27: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 28: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 29: Latin America Surgical Drills Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Surgical Drills Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 31: Latin America Surgical Drills Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 32: Latin America Surgical Drills Market Value (US$ Bn) Forecast, By Drill Bit Type, 2020 to 2035

Table 33: Latin America Surgical Drills Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 34: Latin America Surgical Drills Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 35: Latin America Surgical Drills Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 36: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 38: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 39: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, By Drill Bit Type, 2020 to 2035

Table 40: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 41: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Figure 01: Global Surgical Drills Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Surgical Drills Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Surgical Drills Market Revenue (US$ Bn), by Instrument, 2020 to 2035

Figure 04: Global Surgical Drills Market Revenue (US$ Bn), by Accessories, 2020 to 2035

Figure 05: Global Surgical Drills Market Value Share Analysis, By Drill Bit Type, 2024 and 2035

Figure 06: Global Surgical Drills Market Attractiveness Analysis, By Drill Bit Type, 2025 to 2035

Figure 07: Global Surgical Drills Market Revenue (US$ Bn), by Lance-shaped Drills, 2020 to 2035

Figure 08: Global Surgical Drills Market Revenue (US$ Bn), by Pilot Drills, 2020 to 2035

Figure 09: Global Surgical Drills Market Revenue (US$ Bn), by Twist Drills, 2020 to 2035

Figure 10: Global Surgical Drills Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Surgical Drills Market Value Share Analysis, By Usability, 2024 and 2035

Figure 12: Global Surgical Drills Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 13: Global Surgical Drills Market Revenue (US$ Bn), by Reusable Drills, 2020 to 2035

Figure 14: Global Surgical Drills Market Revenue (US$ Bn), by Disposable Drills, 2020 to 2035

Figure 15: Global Surgical Drills Market Value Share Analysis, By Application, 2024 and 2035

Figure 16: Global Surgical Drills Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 17: Global Surgical Drills Market Revenue (US$ Bn), by Orthopedic Surgeries, 2020 to 2035

Figure 18: Global Surgical Drills Market Revenue (US$ Bn), by Neurological Surgeries, 2020 to 2035

Figure 19: Global Surgical Drills Market Revenue (US$ Bn), by Dental Surgeries, 2020 to 2035

Figure 20: Global Surgical Drills Market Revenue (US$ Bn), by ENT Surgeries, 2020 to 2035

Figure 21: Global Surgical Drills Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Surgical Drills Market Value Share Analysis, By End-User, 2024 and 2035

Figure 23: Global Surgical Drills Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 24: Global Surgical Drills Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 25: Global Surgical Drills Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 26: Global Surgical Drills Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Surgical Drills Market Value Share Analysis, By Region, 2024 and 2035

Figure 28: Global Surgical Drills Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 29: North America Surgical Drills Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: North America Surgical Drills Market Value Share Analysis, by Country, 2024 and 2035

Figure 31: North America Surgical Drills Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 32: North America Surgical Drills Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 33: North America Surgical Drills Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 34: North America Surgical Drills Market Value Share Analysis, By Drill Bit Type, 2024 and 2035

Figure 35: North America Surgical Drills Market Attractiveness Analysis, By Drill Bit Type, 2025 to 2035

Figure 36: North America Surgical Drills Market Value Share Analysis, By Usability, 2024 and 2035

Figure 37: North America Surgical Drills Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 38: North America Surgical Drills Market Value Share Analysis, By Application, 2024 and 2035

Figure 39: North America Surgical Drills Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 40: North America Surgical Drills Market Value Share Analysis, By End-User, 2024 and 2035

Figure 41: North America Surgical Drills Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 42: Europe Surgical Drills Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Europe Surgical Drills Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 44: Europe Surgical Drills Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 45: Europe Surgical Drills Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 46: Europe Surgical Drills Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 47: Europe Surgical Drills Market Value Share Analysis, By Drill Bit Type, 2024 and 2035

Figure 48: Europe Surgical Drills Market Attractiveness Analysis, By Drill Bit Type, 2025 to 2035

Figure 49: Europe Surgical Drills Market Value Share Analysis, By Usability, 2024 and 2035

Figure 50: Europe Surgical Drills Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 51: Europe Surgical Drills Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Europe Surgical Drills Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Europe Surgical Drills Market Value Share Analysis, By End-User, 2024 and 2035

Figure 54: Europe Surgical Drills Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 55: Asia Pacific Surgical Drills Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Asia Pacific Surgical Drills Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Asia Pacific Surgical Drills Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Asia Pacific Surgical Drills Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 59: Asia Pacific Surgical Drills Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 60: Asia Pacific Surgical Drills Market Value Share Analysis, By Drill Bit Type, 2024 and 2035

Figure 61: Asia Pacific Surgical Drills Market Attractiveness Analysis, By Drill Bit Type, 2025 to 2035

Figure 62: Asia Pacific Surgical Drills Market Value Share Analysis, By Usability, 2024 and 2035

Figure 63: Asia Pacific Surgical Drills Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 64: Asia Pacific Surgical Drills Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: Asia Pacific Surgical Drills Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 66: Asia Pacific Surgical Drills Market Value Share Analysis, By End-User, 2024 and 2035

Figure 67: Asia Pacific Surgical Drills Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 68: Latin America Surgical Drills Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Latin America Surgical Drills Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 70: Latin America Surgical Drills Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 71: Latin America Surgical Drills Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 72: Latin America Surgical Drills Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 73: Latin America Surgical Drills Market Value Share Analysis, By Drill Bit Type, 2024 and 2035

Figure 74: Latin America Surgical Drills Market Attractiveness Analysis, By Drill Bit Type, 2025 to 2035

Figure 75: Latin America Surgical Drills Market Value Share Analysis, By Usability, 2024 and 2035

Figure 76: Latin America Surgical Drills Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 77: Latin America Surgical Drills Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Latin America Surgical Drills Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 79: Latin America Surgical Drills Market Value Share Analysis, By End-User, 2024 and 2035

Figure 80: Latin America Surgical Drills Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 81: Middle East & Africa Surgical Drills Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 82: Middle East & Africa Surgical Drills Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 83: Middle East & Africa Surgical Drills Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 84: Middle East & Africa Surgical Drills Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 85: Middle East & Africa Surgical Drills Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 86: Middle East & Africa Surgical Drills Market Value Share Analysis, By Drill Bit Type, 2024 and 2035

Figure 87: Middle East & Africa Surgical Drills Market Attractiveness Analysis, By Drill Bit Type, 2025 to 2035

Figure 88: Middle East & Africa Surgical Drills Market Value Share Analysis, By Usability, 2024 and 2035

Figure 89: Middle East & Africa Surgical Drills Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 90: Middle East & Africa Surgical Drills Market Value Share Analysis, By Application, 2024 and 2035

Figure 91: Middle East & Africa Surgical Drills Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 92: Middle East & Africa Surgical Drills Market Value Share Analysis, By End-User, 2024 and 2035

Figure 93: Middle East & Africa Surgical Drills Market Attractiveness Analysis, By End-User, 2025 to 2035