Reports

Reports

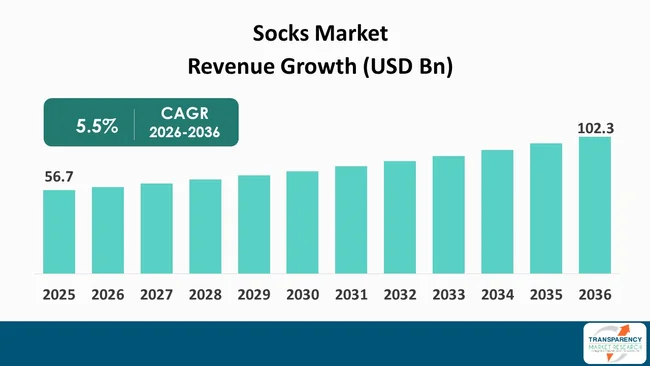

The global socks market size was valued at US$ 56.7 Bn in 2025 and is projected to reach US$ 102.3 Bn by 2036, expanding at a CAGR of 5.5% from 2026 to 2036. Market growth is driven by rising demand for comfort and stylish socks across urban consumers, expanding adoption in athletic and lifestyle segments, increasing focus on performance and hygiene features, e-Commerce expansion, improving textile technologies and manufacturing capabilities, rising disposable incomes, and growing preference for sustainable, fashionable sock solutions in global.

The socks market has evolved from a low-involvement apparel basic into a performance, fashion, and wellness-driven category shaped by material science, branding, and channel innovation. The rise of team sports, fitness culture, and athleisure has elevated socks to a specialty technical item rather than basic hosiery. At the same time, premiumization can be experienced as consumers are increasingly interested in moisture management, anti-odor, seamless knitting, and organic materials.

Top brands, including Nike, Puma, Adidas, Hanesbrands, and Under Armour are reshaping value through product engineering and storytelling related to performance features. Direct-to-consumer approaches and subscription models are giving brands the opportunity to leverage repeat purchase cycles and personalize offerings.

Another factor of structural change is sustainability. Recycled polyester, organic cotton, and bamboo fibers are increasingly at the core of product development as regulatory and consumer demand coalesce. Fast response supply chains are also being adopted by private labels and regional players, minimizing lead times and enabling them to produce seasonally appropriate designs that match footwear and apparel trends.

The growth of the socks market can be mainly attributed to lifestyle changes, changing trends in footwear, and growing consumer awareness about foot health. Urban population is engaging more in fitness exercises, outdoor sports, and organized games, which is driving steady demand for comfort, support, and durable socks. The advent of sneaker culture, along with athleisure fashion, has also made socks pop as a styling piece rather than a concealed garment.

Advancements in materials are also a driver. Shoppers are selecting their socks based on fiber technologies, including moisture-wicking blends, antimicrobial treatment, and temperature-regulating fabrics. This change is also driving replacement and category trading up. Increasing awareness towards medical conditions such as diabetes and varicose veins is leading to a growing demand for compression and non-binding socks.

The penetration of digital retail is redefining buying habits. Online channels give customers the ability to compare features, read reviews and view niche offerings. This transparency has facilitated education of the category and price acceptance for differentiated offerings. Awareness of sustainability is also prevailing in purchase decisions, and brands are being pushed to use recycled and organic fibers. Together, these are turning socks from a commodity product into a performance, fashion, and wellness-driven category with greater consumer engagement and brand involvement.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Today’s active consumers consider workout gear a necessity worth investing in, and socks are a critical component of athletic performance. Running, training, cycling, hiking, and team sport-specific technical socks offer arch support and blister protection, impact cushioning, and moisture management. This information is what propels buyers to decide on sport-specific versions rather than more generic options.

The fitness craze, gym memberships, marathons, and working out at home all have contributed to creating a market for performance socks that get used daily. Consumers also tend to replace socks more frequently, as there is a hygiene concern, and they worry about sweat exposure. They directly claim that sports socks contribute to better performance rather than being simple accessories.

In 2024, Adidas expanded its performance running range with HEAT.RDY and FORMOTION based socks designed to improve airflow and anatomical fit for long distance runners. The company promoted these products through marathon sponsorships and athlete endorsements, thereby linking socks directly to performance outcomes.

Similarly, training communities on social media have normalized specialized gear usage. As amateur participation in marathons, cycling events, and trekking expeditions rises across regions, consumers increasingly recognize the need for purpose built socks. This behavioral change is creating repeat demand and premiumization across athletic sock categories.

The consistent rise in active lifestyles is therefore creating a structural demand shift where sports socks are considered essential equipment, driving higher unit consumption and encouraging innovation led competition among brands.

Sensible material has become a strong driver to the socks industry. Customers are recently choosing products according to the fiber content, environmental impact, comfort, and likewise. Organic cotton, recycled polyester, bamboo fiber, and antimicrobial yarns are being favored over traditional blends. This transition is being backed by growing environmental consciousness and regulatory focus on textile waste.

Brands are adapting by reformulating their lines around sustainable materials, while developing better performance attributes. These socks provide breathability, odor control, and durability while being eco-friendly. The result is to be able to charge more for your product and to appeal to eco-conscious buyers.

For instance, in 2025, PUMA unveiled an expansion of its sustainable essentials range, including socks crafted with recycled polyester and responsibly sourced cotton as part of its Forever Better path. The company emphasized the reduction in water use and carbon emissions during production, with the help of transparent labeling across e-commerce sites.

Certifications and transparency in materials also affect consumers. Fabric technology is being added to the product description, something that rarely occurs in this category. Retailers are allocating shelf space and digital filters for sustainable pieces to make them more discoverable.

This fabric innovation is pushing consumers to trade up from the plain multipacks for luxury socks. Sustainability is evolving from a niche preference into a buying standard, and brands that are leading the way with innovative, responsible materials are seeing higher levels of consumer engagement and loyalty, and market growth.

A growing opportunity in the socks market is medical, compression, and wellness-based items. The increasing incidence of diabetes, obesity, varicose veins, and sedentary hours at work is anticipated to drive the growth of the circulation socks segment. Fashion and sports socks, on the other hand, are trend-driven - meaning that the segment is based on the buyer's need for style and is not heavily influenced by health-related issues.

The Consumer is increasingly towards the needs of non-binding tops, seamless toes, moisture regulation, and graduated compression. Pharmacies, specialty stores, and online health sites are beginning to add to their selection in this space. Specialized socks are being prescribed by doctors and podiatrists as preventative care.

In 2024, Hanesbrands expanded its wellness hosiery line under the Dr. Scholl’s brand to include diabetic and circulation socks with moisture management and odor control, distributing them widely across pharmacy chains and ecommerce platforms. The campaign focused on foot health education rather than fashion appeal.

Work from home culture and long desk hours have also increased awareness around leg fatigue and swelling, encouraging office goers and travelers to adopt compression socks. Airlines and travel influencers now recommend them for long haul flights.

This segment presents an opportunity for brands to diversify beyond traditional retail and enter healthcare distribution channels. With aging populations and rising lifestyle diseases globally, medical and wellness socks represent a high potential category that combines functionality, education, and repeat demand.

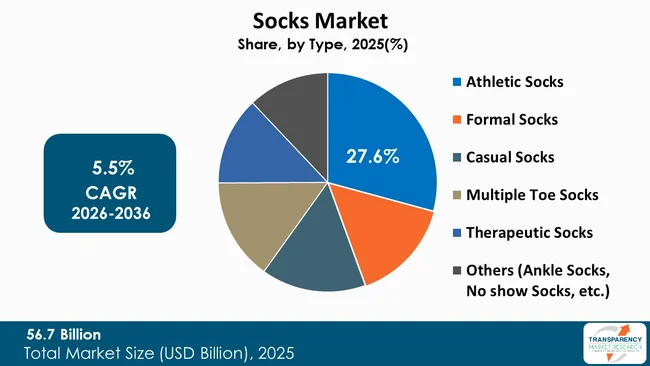

Athletic socks dominate the socks market with a 27.6% share of the global market, owing to their performance characteristics and extensive usage patterns. Consumers who run, train, play sports, and participate in outdoor activities need socks that are cushioned, provide arch support, help control moisture, and are durable. In contrast to casual socks, the sports variants are bought for specific applications, and more frequently replaced because of wear and hygiene reasons.

Brands are focusing energy on sports sock innovation and selling them alongside footwear and apparel. For instance, in 2025, Nike unveiled the new Elite Cushioned training sock line with engineered care of targeted cushioning and sweat-wicking yarns, marketed to its training app community as well as retail as must-have workout gear, not just accessories.

This integration of socks into the broader athletic ecosystem has increased consumer perception of their importance. As fitness participation rises and consumers adopt specialized gear, athletic socks continue to lead the segment in demand and visibility across both online and offline retail channels.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific is the dominating region in the socks market and accounts for 37.2% of global demand, supported by strong manufacturing ecosystems and rising consumer consumption. Countries such as China, India, Vietnam, Bangladesh, Japan, and South Korea play dual roles as large scale producers and fast growing consumer markets.

Increasing urbanization, growth of the middle-class population, and rising participation in sport and fitness activities are reviving demand for athletic and casual socks. The development of e-commerce in India and Southeast Asia has increased the availability of branded and specialized socks. With cost-efficient manufacturing and growing domestic consumption, the Asia Pacific is still the largest production and consumption market for socks.

The region also excels in sourcing sustainable materials, such as bamboo fibers and recycled yarns, further enriching its significance in the global supply chain. With cost-efficient manufacturing and growing domestic consumption, the Asia Pacific is still the largest production and consumption market for socks.

Adidas AG, ASICS Corporation, Bombas, Inc., Darn Tough Vermont, Inc., FALKE KGaA, Gildan Activewear Inc., Golden Lady Company S.p.A., Hanesbrands Inc., Happy Socks AB, Nike, Inc., PUMA SE, Stance, LLC, Under Armour, Inc., VF Corporation, Wigwam Mills, Inc. and other are some of the leading manufacturers operating in the global market.

Each of these companies has been profiled in the Socks industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 56.7 Bn |

| Market Forecast Value in 2036 | US$ 102.3 Bn |

| Growth Rate (CAGR 2026 to 2036) | 5.5% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global socks market was valued at US$ 56.7 Bn in 2025

The global socks industry is projected to reach at US$ 102.3 Bn by the end of 2036

Rising global participation in sports and fitness activities and growing consumer preference for sustainable and advanced materials, are some of the driving factors for this market

The CAGR is anticipated to be 5.5 % from 2026 to 2036

Adidas AG, ASICS Corporation, Bombas, Inc., Darn Tough Vermont, Inc., FALKE KGaA, Gildan Activewear Inc., Golden Lady Company S.p.A., Hanesbrands Inc., Happy Socks AB, Nike, Inc., PUMA SE, Stance, LLC, Under Armour, Inc., VF Corporation, Wigwam Mills, Inc. and other.

Table 01: Global Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 02: Global Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 03: Global Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 04: Global Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 05: Global Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 06: Global Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 07: Global Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 08: Global Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 09: Global Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 10: Global Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 11: Global Socks Market Value (US$ Bn) Projection, By Region 2021 to 2036

Table 12: Global Socks Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Table 13: North America Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 14: North America Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 15: North America Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 16: North America Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 17: North America Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 18: North America Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 19: North America Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 20: North America Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 21: North America Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 22: North America Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 23: North America Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 24: North America Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 25: U.S. Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 26: U.S. Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 27: U.S. Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 28: U.S. Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 29: U.S. Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 30: U.S. Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 31: U.S. Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 32: U.S. Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 33: U.S. Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 34: U.S. Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 35: Canada Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 36: Canada Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 37: Canada Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 38: Canada Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 39: Canada Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 40: Canada Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 41: Canada Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 42: Canada Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 43: Canada Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 44: Canada Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 45: Europe Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 46: Europe Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 47: Europe Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 48: Europe Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 49: Europe Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 50: Europe Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 51: Europe Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 52: Europe Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 53: Europe Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 54: Europe Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 55: Europe Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 56: Europe Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 57: U.K. Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 58: U.K. Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 59: U.K. Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 60: U.K. Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 61: U.K. Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 62: U.K. Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 63: U.K. Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 64: U.K. Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 65: U.K. Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 66: U.K. Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 67: Germany Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 68: Germany Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 69: Germany Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 70: Germany Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 71: Germany Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 72: Germany Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 73: Germany Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 74: Germany Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 75: Germany Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 76: Germany Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 77: France Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 78: France Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 79: France Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 80: France Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 81: France Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 82: France Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 83: France Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 84: France Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 85: France Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 86: France Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 87: Italy Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 88: Italy Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 89: Italy Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 90: Italy Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 91: Italy Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 92: Italy Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 93: Italy Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 94: Italy Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 95: Italy Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 96: Italy Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 97: Spain Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 98: Spain Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 99: Spain Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 100: Spain Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 101: Spain Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 102: Spain Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 103: Spain Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 104: Spain Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 105: Spain Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 106: Spain Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 107: The Netherlands Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 108: The Netherlands Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 109: The Netherlands Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 110: The Netherlands Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 111: The Netherlands Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 112: The Netherlands Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 113: The Netherlands Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 114: The Netherlands Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 115: The Netherlands Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 116: The Netherlands Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 117: Asia Pacific Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 118: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 119: Asia Pacific Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 120: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 121: Asia Pacific Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 122: Asia Pacific Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 123: Asia Pacific Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 124: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 125: Asia Pacific Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 126: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 127: Asia Pacific Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 128: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 129: China Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 130: China Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 131: China Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 132: China Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 133: China Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 134: China Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 135: China Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 136: China Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 137: China Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 138: China Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 139: India Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 140: India Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 141: India Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 142: India Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 143: India Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 144: India Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 145: India Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 146: India Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 147: India Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 148: India Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 149: Japan Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 150: Japan Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 151: Japan Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 152: Japan Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 153: Japan Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 154: Japan Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 155: Japan Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 156: Japan Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 157: Japan Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 158: Japan Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 159: Australia Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 160: Australia Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 161: Australia Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 162: Australia Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 163: Australia Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 164: Australia Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 165: Australia Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 166: Australia Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 167: Australia Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 168: Australia Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 169: South Korea Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 170: South Korea Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 171: South Korea Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 172: South Korea Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 173: South Korea Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 174: South Korea Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 175: South Korea Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 176: South Korea Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 177: South Korea Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 178: South Korea Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 179: ASEAN Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 180: ASEAN Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 181: ASEAN Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 182: ASEAN Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 183: ASEAN Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 184: ASEAN Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 185: ASEAN Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 186: ASEAN Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 187: ASEAN Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 188: ASEAN Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 189: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 190: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 191: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 192: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 193: Middle East & Africa Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 194: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 195: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 196: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 197: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 198: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 199: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 200: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 201: GCC Countries Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 202: GCC Countries Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 203: GCC Countries Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 204: GCC Countries Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 205: GCC Countries Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 206: GCC Countries Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 207: GCC Countries Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 208: GCC Countries Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 209: GCC Countries Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 210: GCC Countries Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 211: South Africa Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 212: South Africa Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 213: South Africa Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 214: South Africa Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 215: South Africa Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 216: South Africa Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 217: South Africa Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 218: South Africa Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 219: South Africa Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 220: South Africa Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 221: Latin America Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 222: Latin America Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 223: Latin America Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 224: Latin America Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 225: Latin America Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 226: Latin America Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 227: Latin America Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 228: Latin America Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 229: Latin America Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 230: Latin America Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 231: Latin America Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 232: Latin America Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 233: Brazil Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 234: Brazil Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 235: Brazil Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 236: Brazil Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 237: Brazil Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 238: Brazil Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 239: Brazil Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 240: Brazil Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 241: Brazil Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 242: Brazil Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 243: Mexico Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 244: Mexico Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 245: Mexico Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 246: Mexico Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 247: Mexico Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 248: Mexico Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 249: Mexico Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 250: Mexico Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 251: Mexico Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 252: Mexico Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 253: Argentina Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 254: Argentina Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 255: Argentina Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Table 256: Argentina Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 257: Argentina Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Table 258: Argentina Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 259: Argentina Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 260: Argentina Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 261: Argentina Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 262: Argentina Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: Global Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 02: Global Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 03: Global Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 04: Global Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 05: Global Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 06: Global Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 07: Global Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 08: Global Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 09: Global Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 10: Global Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 11: Global Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 12: Global Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 13: Global Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 14: Global Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 15: Global Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 16: Global Socks Market Value (US$ Bn) Projection, By Region 2021 to 2036

Figure 17: Global Socks Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Figure 18: Global Socks Market Incremental Opportunities (US$ Bn) Forecast, By Region 2026 to 2036

Figure 19: North America Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 20: North America Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 21: North America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 22: North America Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 23: North America Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 24: North America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 25: North America Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 26: North America Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 27: North America Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 28: North America Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 29: North America Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 30: North America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 31: North America Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 32: North America Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 33: North America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 34: North America Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 35: North America Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 36: North America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 37: U.S. Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 38: U.S. Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 39: U.S. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 40: U.S. Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 41: U.S. Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 42: U.S. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 43: U.S. Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 44: U.S. Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 45: U.S. Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 46: U.S. Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 47: U.S. Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 48: U.S. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 49: U.S. Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 50: U.S. Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 51: U.S. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 52: Canada Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 53: Canada Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 54: Canada Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 55: Canada Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 56: Canada Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 57: Canada Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 58: Canada Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 59: Canada Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 60: Canada Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 61: Canada Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 62: Canada Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 63: Canada Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 64: Canada Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 65: Canada Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 66: Canada Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 67: Europe Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 68: Europe Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 69: Europe Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 70: Europe Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 71: Europe Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 72: Europe Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 73: Europe Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 74: Europe Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 75: Europe Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 76: Europe Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 77: Europe Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 78: Europe Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 79: Europe Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 80: Europe Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 81: Europe Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 82: Europe Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 83: Europe Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 84: Europe Socks Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 85: U.K. Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 86: U.K. Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 87: U.K. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 88: U.K. Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 89: U.K. Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 90: U.K. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 91: U.K. Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 92: U.K. Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 93: U.K. Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 94: U.K. Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 95: U.K. Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 96: U.K. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 97: U.K. Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 98: U.K. Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 99: U.K. Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 100: Germany Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 101: Germany Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 102: Germany Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 103: Germany Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 104: Germany Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 105: Germany Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 106: Germany Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 107: Germany Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 108: Germany Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 109: Germany Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 110: Germany Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 111: Germany Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 112: Germany Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 113: Germany Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 114: Germany Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 115: France Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 116: France Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 117: France Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 118: France Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 119: France Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 120: France Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 121: France Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 122: France Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 123: France Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 124: France Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 125: France Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 126: France Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 127: France Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 128: France Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 129: France Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 130: Italy Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 131: Italy Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 132: Italy Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 133: Italy Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 134: Italy Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 135: Italy Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 136: Italy Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 137: Italy Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 138: Italy Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 139: Italy Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 140: Italy Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 141: Italy Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 142: Italy Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 143: Italy Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 144: Italy Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 145: Spain Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 146: Spain Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 147: Spain Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 148: Spain Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 149: Spain Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 150: Spain Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 151: Spain Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 152: Spain Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 153: Spain Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 154: Spain Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 155: Spain Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 156: Spain Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 157: Spain Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 158: Spain Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 159: Spain Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 160: The Netherlands Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 161: The Netherlands Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 162: The Netherlands Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 163: The Netherlands Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 164: The Netherlands Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 165: The Netherlands Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 166: The Netherlands Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 167: The Netherlands Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 168: The Netherlands Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 169: The Netherlands Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 170: The Netherlands Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 171: The Netherlands Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 172: The Netherlands Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 173: The Netherlands Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 174: The Netherlands Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 175: Asia Pacific Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 176: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 177: Asia Pacific Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 178: Asia Pacific Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 179: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 180: Asia Pacific Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 181: Asia Pacific Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 182: Asia Pacific Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 183: Asia Pacific Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 184: Asia Pacific Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 185: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 186: Asia Pacific Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 187: Asia Pacific Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 188: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 189: Asia Pacific Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 190: Asia Pacific Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 191: Asia Pacific Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 192: Asia Pacific Socks Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 193: China Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 194: China Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 195: China Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 196: China Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 197: China Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 198: China Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 199: China Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 200: China Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 201: China Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 202: China Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 203: China Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 204: China Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 205: China Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 206: China Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 207: China Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 208: India Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 209: India Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 210: India Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 211: India Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 212: India Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 213: India Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 214: India Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 215: India Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 216: India Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 217: India Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 218: India Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 219: India Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 220: India Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 221: India Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 222: India Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 223: Japan Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 224: Japan Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 225: Japan Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 226: Japan Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 227: Japan Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 228: Japan Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 229: Japan Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 230: Japan Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 231: Japan Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 232: Japan Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 233: Japan Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 234: Japan Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 235: Japan Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 236: Japan Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 237: Japan Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 238: Australia Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 239: Australia Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 240: Australia Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 241: Australia Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 242: Australia Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 243: Australia Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 244: Australia Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 245: Australia Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 246: Australia Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 247: Australia Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 248: Australia Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 249: Australia Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 250: Australia Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 251: Australia Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 252: Australia Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 253: South Korea Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 254: South Korea Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 255: South Korea Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 256: South Korea Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 257: South Korea Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 258: South Korea Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 259: South Korea Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 260: South Korea Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 261: South Korea Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 262: South Korea Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 263: South Korea Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 264: South Korea Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 265: South Korea Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 266: South Korea Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 267: South Korea Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 268: ASEAN Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 269: ASEAN Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 270: ASEAN Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 271: ASEAN Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 272: ASEAN Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 273: ASEAN Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 274: ASEAN Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 275: ASEAN Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 276: ASEAN Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 277: ASEAN Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 278: ASEAN Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 279: ASEAN Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 280: ASEAN Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 281: ASEAN Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 282: ASEAN Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 283: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 284: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 285: Middle East & Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 286: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 287: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 288: Middle East & Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 289: Middle East & Africa Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 290: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 291: Middle East & Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 292: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 293: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 294: Middle East & Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 295: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 296: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 297: Middle East & Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 298: Middle East & Africa Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 299: Middle East & Africa Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 300: Middle East & Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 301: GCC Countries Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 302: GCC Countries Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 303: GCC Countries Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 304: GCC Countries Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 305: GCC Countries Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 306: GCC Countries Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 307: GCC Countries Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 308: GCC Countries Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 309: GCC Countries Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 310: GCC Countries Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 311: GCC Countries Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 312: GCC Countries Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 313: GCC Countries Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 314: GCC Countries Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 315: GCC Countries Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 316: South Africa Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 317: South Africa Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 318: South Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 319: South Africa Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 320: South Africa Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 321: South Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 322: South Africa Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 323: South Africa Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 324: South Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 325: South Africa Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 326: South Africa Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 327: South Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 328: South Africa Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 329: South Africa Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 330: South Africa Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 331: Latin America Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 332: Latin America Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 333: Latin America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 334: Latin America Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 335: Latin America Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 336: Latin America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 337: Latin America Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 338: Latin America Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 339: Latin America Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 340: Latin America Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 341: Latin America Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 342: Latin America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 343: Latin America Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 344: Latin America Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 345: Latin America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 346: Latin America Socks Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 347: Latin America Socks Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 348: Latin America Socks Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 349: Brazil Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 350: Brazil Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 351: Brazil Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 352: Brazil Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 353: Brazil Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 354: Brazil Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 355: Brazil Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 356: Brazil Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 357: Brazil Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 358: Brazil Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 359: Brazil Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 360: Brazil Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 361: Brazil Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 362: Brazil Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 363: Brazil Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 364: Mexico Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 365: Mexico Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 366: Mexico Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 367: Mexico Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 368: Mexico Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 369: Mexico Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 370: Mexico Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 371: Mexico Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 372: Mexico Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 373: Mexico Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 374: Mexico Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 375: Mexico Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 376: Mexico Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 377: Mexico Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 378: Mexico Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 379: Argentina Socks Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 380: Argentina Socks Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 381: Argentina Socks Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 382: Argentina Socks Market Value (US$ Bn) Projection, By Material 2021 to 2036

Figure 383: Argentina Socks Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 384: Argentina Socks Market Incremental Opportunities (US$ Bn) Forecast, By Material 2026 to 2036

Figure 385: Argentina Socks Market Value (US$ Bn) Projection, By End-user 2021 to 2036

Figure 386: Argentina Socks Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 387: Argentina Socks Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2026 to 2036

Figure 388: Argentina Socks Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 389: Argentina Socks Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 390: Argentina Socks Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 391: Argentina Socks Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 392: Argentina Socks Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 393: Argentina Socks Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036