Reports

Reports

Analysts’ Viewpoint

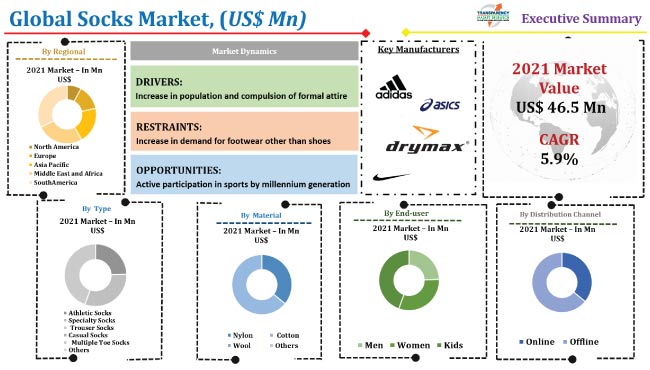

The global socks market has been growing consistently due to the presence of various local as well as international players operating in the global market. Increased use of socks during gym training and outdoor sports activities is projected to propel the demand for socks during the forecast period.

Moreover, socks keep the feet warm, prevent odor, etc., which is expected to create more opportunity for market. The market in Asia Pacific is expected to grow considerably due to a rise in population in developing countries in the region.

Furthermore, key players operating in the market are providing different socks type, such as compression socks, which are available in personalized manner for both men’s market as well as women’s market.

Prominent players in the socks market are also trying to expand their geographical reach and cater to a wider range of consumers by providing products through various distribution channels.

Socks are available in a variety of styles such as ankle socks, bed socks, sports socks, etc., depending on their length, size, color, and intended use. They are also available in various types of materials. Demand for socks has been growing due to an increase in number of people participating in various sports activities.

Rise in participation by athletes and sportspersons is expected to create future business opportunities in market for socks. Increasing demand for footwear other than shoes is likely to restrain the market demand for socks.

People in professional working environment usually prefer wearing standard dress code, which includes formal attire with shoes and socks. Therefore, a rise in number of working population is expected to drive the demand for socks globally.

Moreover, rise in number of school and college going population is also likely to significantly propel the demand for socks, as it is compulsory in several schools and educational institutes worldwide to wear shoes and socks.

According to National Center for Education Statistics 4.9 million students were enrolled in public schools in prekindergarten to grade 12 across the U.S. Socks are also worn as fashion accessories and are custom-made in various colors and patterns, such as personalised socks or custom socks, by manufacturers. This, in turn, is also expected to drive the market for socks globally.

Socks are often worn by athletes in many sports leagues, as sports socks help prevent blisters that may be caused due to running without socks and they can be painful and uncomfortable for athletes.

Moreover, socks also keep snug fit of shoes and prevent fungal infection in the feet which may be caused by sweating. These factors are expected to significantly drive the global socks industry.

Furthermore, increase in number of sports leagues and tournaments organized around the world has fueled the athletic footwear market, which in turn is also estimated to boost the market.

According to the International Olympics Committee 10,500 athletics from 206 nations are expected to participate in the Summer Olympics Games in Paris in 2024.

In terms of type, the global business for socks has been classified into athletics socks, trouser socks, casual socks, multiple toe socks, and others. The athletic socks segment is expected to rise at a notable growth rate during the forecast period due to increase in number of people participating in any type of athletic sports globally.

Moreover, the demand for casual socks, trouser socks, and ankle socks is also expected to rise in significantly, as they are more often worn by people to keep the feet warm during winter and also help reduce feet odor, which is caused by bacteria that tend to live in moist area such as the feet or shoes.

In terms of material, the global socks market has been segregated into nylon, cotton, wool, others. The cotton segment is anticipated to expand at the highest growth rate during the forecast period, as cotton socks are widely available and are also cost-effective.

Moreover, socks are made of cotton are more comfortable, strong, and capable of absorbing moisture, which further boosts their demand.

Furthermore, socks made of nylon and wool are also expected to witness considerable demand during the forecast period, as woolen socks help keep the feet warm in winter, and wool is softer as compared to other materials.

The market in Asia Pacific is expected to rise at a higher growth rate due to the growing population in prominent economies in the region including China and India. Furthermore, rise in number of retail outlets in the region, especially in China, India, Malaysia, and Singapore, is expected to create more future business opportunity in the sales of socks.

Moreover, the presence of larger socks brand in the region is also expected to lead to increased demand in the region.The market in North America and Europe is also expected to expand at a higher growth rate during the forecast period, owing to rising awareness about fitness and health among people in the region.

Companies operating in the global socks market are spending significant amounts on research and development, primarily to cater to the demand from customers. Expansion of product portfolios, geographical presence, and mergers & acquisitions are prominent strategies adopted by key players.

Key players operating in the global market for socks are Adidas A.G, Asics Corporations, Balega, Drymax Technologies Inc, Hanesbrands Inc, Nike Inc, Puma S.E, Renfro Corporation, THORLO, Inc, and Under Armour, Inc.

Key players have been profiled in the printed electronics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 46.6 Mn |

|

Market Forecast Value in 2031 |

US$ 81.6 Mn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market for socks stood at US$ 46.5 Mn in 2021.

The market is estimated to grow at a CAGR of 5.9 % during 2022-2031.

Increase in population and compulsion of formal attire in offices & schools and rise in number of sports leagues and tournaments.

Athletics socks accounted for the highest share of the market in 2021.

Asia Pacific is likely to be the most lucrative market in the next few years.

Adidas A.G, Asics Corporation, Balega, Drymax Technologies Inc., Hanesbrands Inc, Nike Inc, Puma S.E, Renfro Corporation, THORLO, Inc, Under Armour, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Apparel Market Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technology Overview

5.9. COVID-19 Impact Analysis

5.10. Global Socks Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Socks Market Analysis and Forecast, by Product Type

6.1. Global Socks Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Athletic Socks

6.1.2. Specialty Socks

6.1.3. Trouser Socks

6.1.4. Casual Socks

6.1.5. Multiple Toe Socks

6.1.6. Others (Ankle socks, No show socks, Toe Cover, etc.)

6.2. Incremental Opportunity, by Product Type

7. Global Socks Market Analysis and Forecast, by Material

7.1. Global Socks Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

7.1.1. Nylon

7.1.2. Cotton

7.1.3. Wool

7.1.4. Others (Polyester, Waterproof Breathable Membrane, etc.)

7.2. Incremental Opportunity, by Material

8. Global Socks Market Analysis and Forecast, by End-user

8.1. Global Socks Market Size (US$ Mn and Thousand Units) Forecast, by End-user, 2017 - 2031

8.1.1. Men

8.1.2. Women

8.1.3. Kids

8.2. Incremental Opportunity, by End-user

9. Global Socks Market Analysis and Forecast, by Distribution Channel

9.1. Global Socks Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.1.1. E-commerce Websites

9.1.1.2. Company-Owned Websites

9.1.2. Offline

9.1.2.1. Supermarket/Hypermarket

9.1.2.2. Specialty Stores

9.1.2.3. Other Retail Stores

9.2. Incremental Opportunity, by Distribution Channel

10. Global Socks Market Analysis and Forecast, by Region

10.1. Global Socks Market Size (US$ Mn and Thousand Units) Forecast, by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Socks Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Demographic Overview

11.3. Key Trend Analysis

11.3.1. Demand Side

11.3.2. Supply Side

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Price Trend Analysis

11.6.1. Weighted Average Selling Price (US$)

11.7. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

11.7.1. Athletic Socks

11.7.2. Specialty Socks

11.7.3. Trouser Socks

11.7.4. Casual Socks

11.7.5. Multiple Toe Socks

11.7.6. Others (Ankle socks, No show socks, Toe Cover, etc.)

11.8. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

11.8.1. Nylon

11.8.2. Cotton

11.8.3. Wool

11.8.4. Others (Polyester, Waterproof Breathable Membrane etc.)

11.9. Socks Market Size (US$ Mn and Thousand Units) Forecast, by End-user, 2017 - 2031

11.9.1. Men

11.9.2. Women

11.9.3. Kids

11.10. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

11.10.1. Online

11.10.1.1. E-commerce Websites

11.10.1.2. Company-owned Websites

11.10.2. Offline

11.10.2.1. Supermarket/Hypermarket

11.10.2.2. Specialty Stores

11.10.2.3. Other Retail Stores

11.11. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Country and Sub-region, 2017 - 2031

11.11.1. U.S.

11.11.2. Canada

11.11.3. Rest of North America

11.12. Incremental Opportunity Analysis

12. Europe Socks Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Demographic Overview

12.3. Key Trend Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Price Trend Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

12.7.1. Athletic Socks

12.7.2. Specialty Socks

12.7.3. Trouser Socks

12.7.4. Casual Socks

12.7.5. Multiple Toe Socks

12.7.6. Others (Ankle socks, No show socks, Toe Cover, etc.)

12.8. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

12.8.1. Nylon

12.8.2. Cotton

12.8.3. Wool

12.8.4. Others (Polyester, Waterproof Breathable Membrane etc.)

12.9. Socks Market Size (US$ Mn and Thousand Units) Forecast, by End-user, 2017 - 2031

12.9.1. Men

12.9.2. Women

12.9.3. Kids

12.10. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.10.1. Online

12.10.1.1. E-commerce Websites

12.10.1.2. Company-owned Websites

12.10.2. Offline

12.10.2.1. Supermarket/Hypermarket

12.10.2.2. Specialty Stores

12.10.2.3. Other Retail Stores

12.11. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Country and Sub-region, 2017 - 2031

12.11.1. U.K.

12.11.2. Germany

12.11.3. France

12.11.4. Rest of Europe

12.12. Incremental Opportunity Analysis

13. Asia Pacific Socks Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

13.7.1. Athletic Socks

13.7.2. Specialty Socks

13.7.3. Trouser Socks

13.7.4. Casual Socks

13.7.5. Multiple Toe Socks

13.7.6. Others (Ankle socks, No show socks, Toe Cover, etc.)

13.8. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

13.8.1. Nylon

13.8.2. Cotton

13.8.3. Wool

13.8.4. Others (Polyester, Waterproof Breathable Membrane etc.)

13.9. Socks Market Size (US$ Mn and Thousand Units) Forecast, by End-user, 2017 - 2031

13.9.1. Men

13.9.2. Women

13.9.3. Kids

13.10. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.10.1. Online

13.10.1.1. E-commerce Websites

13.10.1.2. Company-owned Websites

13.10.2. Offline

13.10.2.1. Supermarket/Hypermarket

13.10.2.2. Specialty Stores

13.10.2.3. Other Retail Stores

13.11. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Country and Sub-region, 2017 - 2031

13.11.1. China

13.11.2. India

13.11.3. Japan

13.11.4. South Korea

13.11.5. Rest of Asia Pacific

13.12. Incremental Opportunity Analysis

14. Middle East & Africa Socks Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

14.7.1. Athletic Socks

14.7.2. Specialty Socks

14.7.3. Trouser Socks

14.7.4. Casual Socks

14.7.5. Multiple Toe Socks

14.7.6. Others (Ankle socks, No show socks, Toe Cover, etc.)

14.8. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

14.8.1. Nylon

14.8.2. Cotton

14.8.3. Wool

14.8.4. Others (Polyester, Waterproof Breathable Membrane etc.)

14.9. Socks Market Size (US$ Mn and Thousand Units) Forecast, by End-user, 2017 - 2031

14.9.1. Men

14.9.2. Women

14.9.3. Kids

14.10. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company-owned Websites

14.10.2. Offline

14.10.2.1. Supermarket/Hypermarket

14.10.2.2. Specialty Stores

14.10.2.3. Other Retail Stores

14.11. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Country and Sub-region, 2017 - 2031

14.11.1. GCC

14.11.2. South Africa

14.11.3. Rest of Middle East & Africa

14.12. Incremental Opportunity Analysis

15. South America Socks Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Demographic Overview

15.3. Key Trend Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

15.7.1. Athletic Socks

15.7.2. Specialty Socks

15.7.3. Trouser Socks

15.7.4. Casual Socks

15.7.5. Multiple Toe Socks

15.7.6. Others (Ankle socks, No show socks, Toe Cover, etc.)

15.8. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

15.8.1. Nylon

15.8.2. Cotton

15.8.3. Wool

15.8.4. Others (Polyester, Waterproof Breathable Membrane etc.)

15.9. Socks Market Size (US$ Mn and Thousand Units) Forecast, by End-user, 2017 - 2031

15.9.1. Men

15.9.2. Women

15.9.3. Kids

15.10. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.10.1. Online

15.10.1.1. E-commerce Websites

15.10.1.2. Company-owned Websites

15.10.2. Offline

15.10.2.1. Supermarket/Hypermarket

15.10.2.2. Specialty Stores

15.10.2.3. Other Retail Stores

15.11. Socks Market Size (US$ Mn and Thousand Units) Forecast, by Country and Sub-region, 2017 - 2031

15.11.1. Brazil

15.11.2. Rest of South America

15.12. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis-2021 (%)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

16.3.1. Adidas A.G.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue (Segmental Revenue)

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Product Portfolio & Pricing

16.3.2. Asics Corporation

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue (Segmental Revenue)

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Product Portfolio & Pricing

16.3.3. Balega

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue (Segmental Revenue)

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Product Portfolio & Pricing

16.3.4. Drymax Technologies Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue (Segmental Revenue)

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Product Portfolio & Pricing

16.3.5. Hanesbrands Inc.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue (Segmental Revenue)

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Product Portfolio & Pricing

16.3.6. Nike Inc.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue (Segmental Revenue)

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Product Portfolio & Pricing

16.3.7. Puma S.E.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue (Segmental Revenue)

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Product Portfolio & Pricing

16.3.8. Renfro Corporation

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue (Segmental Revenue)

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Product Portfolio & Pricing

16.3.9. THORLO, Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue (Segmental Revenue)

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Product Portfolio & Pricing

16.3.10. Under Armour, Inc.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue (Segmental Revenue)

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Product Portfolio & Pricing

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Material

17.1.3. End-use

17.1.4. Distribution Channel

17.1.5. Geography

17.2. Understanding the Buying Process of the Customers

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Socks Market Volume (Thousand Units) Share, by Product Type, 2017‒2031

Table 2: Global Socks Market Value (US$ Mn) Share, by Product Type, 2017‒2031

Table 3: Global Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Table 4: Global Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Table 5: Global Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Table 6: Global Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Table 7: Global Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Table 8: Global Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Table 9: Global Socks Market Volume (Thousand Units) Share, by Region, 2017‒2031

Table 10: Global Socks Market Value (US$ Mn) Share, by Region, 2017‒2031

Table 11: North America Socks Market Volume (Thousand Units) Share, by Product Type, 2017‒2031

Table 12: North America Socks Market Value (US$ Mn) Share, by Product Type, 2017‒2031

Table 13: North America Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Table 14: North America Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Table 15: North America Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Table 16: North America Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Table 17: North America Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Table 18: North America Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Table 19: North America Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Table 20: North America Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Table 21: Europe Socks Market Volume (Thousand Units) Share, by Product Type, 2017‒2031

Table 22: Europe Socks Market Value (US$ Mn) Share, by Product Type, 2017‒2031

Table 23: Europe Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Table 24: Europe Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Table 25: Europe Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Table 26: Europe Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Table 27: Europe Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Table 28: Europe Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Table 29: Europe Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Table 30: Europe Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Table 31: Asia Pacific Socks Market Volume (Thousand Units) Share, by Product Type, 2017‒2031

Table 32: Asia Pacific Socks Market Value (US$ Mn) Share, by Product Type, 2017‒2031

Table 33: Asia Pacific Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Table 34: Asia Pacific Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Table 35: Asia Pacific Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Table 36: Asia Pacific Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Table 37: Asia Pacific Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Table 38: Asia Pacific Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Table 39: Asia Pacific Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Table 40: Asia Pacific Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Table 41: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Product Type, 2017‒2031

Table 42: Middle East and Africa Socks Market Value (US$ Mn) Share, by Product Type, 2017‒2031

Table 43: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Table 44: Middle East and Africa Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Table 45: Middle East and Africa Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Table 46: Middle East and Africa Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Table 47: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Table 48: Middle East and Africa Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Table 49: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Table 50: Middle East and Africa Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Table 51: South America Socks Market Volume (Thousand Units) Share, by Product Type, 2017‒2031

Table 52: South America Socks Market Value (US$ Mn) Share, by Product Type, 2017‒2031

Table 53: South America Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Table 54: South America Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Table 55: South America Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Table 56: South America Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Table 57: South America Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Table 58: South America Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Table 59: South America Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Table 60: South America Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

List of Figures

Figures 1: Global Socks Market Volume (Thousand Units) Share, by Type, 2017‒2031

Figures 2: Global Socks Market Value (US$ Mn) Share, by Type, 2017‒2031

Figures 3: Global Socks Market Incremental Opportunity (US$ Mn),by Type, 2017‒2031

Figures 4: Global Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Figures 5: Global Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Figures 6: Global Socks Market Incremental Opportunity (US$ Mn),by Material, 2017‒2031

Figures 7: Global Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Figures 8: Global Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Figures 9: Global Socks Market Incremental Opportunity (US$ Mn),by End-user, 2017‒2031

Figures 10: Global Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Figures 11: Global Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Figures 12: Global Socks Market Incremental Opportunity (US$ Mn),by Distribution Channel, 2017‒2031

Figures 13: Global Socks Market Volume (Thousand Units) Share, by Region, 2017‒2031

Figures 14: Global Socks Market Value (US$ Mn) Share, by Region, 2017‒2031

Figures 15: Global Socks Market Incremental Opportunity (US$ Mn),by Region, 2017‒2031

Figures 16: North America Socks Market Volume (Thousand Units) Share, by Type, 2017‒2031

Figures 17: North America Socks Market Value (US$ Mn) Share, by Type, 2017‒2031

Figures 18: North America Socks Market Incremental Opportunity (US$ Mn),by Type, 2017‒2031

Figures 19: North America Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Figures 20: North America Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Figures 21: North America Socks Market Incremental Opportunity (US$ Mn),by Material, 2017‒2031

Figures 22: North America Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Figures 23: North America Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Figures 24: North America Socks Market Incremental Opportunity (US$ Mn),by End-user, 2017‒2031

Figures 25: North America Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Figures 26: North America Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Figures 27: North America Socks Market Incremental Opportunity (US$ Mn),by Distribution Channel, 2017‒2031

Figures 28: North America Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Figures 29: North America Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Figures 30: North America Socks Market Incremental Opportunity (US$ Mn),by Country and Sub-region, 2017‒2031

Figures 31: Europe Socks Market Volume (Thousand Units) Share, by Type, 2017‒2031

Figures 32: Europe Socks Market Value (US$ Mn) Share, by Type, 2017‒2031

Figures 33: Europe Socks Market Incremental Opportunity (US$ Mn),by Type, 2017‒2031

Figures 34: Europe Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Figures 35: Europe Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Figures 36: Europe Socks Market Incremental Opportunity (US$ Mn),by Material, 2017‒2031

Figures 37: Europe Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Figures 38: Europe Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Figures 39: Europe Socks Market Incremental Opportunity (US$ Mn),by End-user, 2017‒2031

Figures 40: Europe Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Figures 41: Europe Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Figures 42: Europe Socks Market Incremental Opportunity (US$ Mn),by Distribution Channel, 2017‒2031

Figures 43: Europe Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Figures 44: Europe Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Figures 45: Europe Socks Market Incremental Opportunity (US$ Mn),by Country and Sub-region, 2017‒2031

Figures 46: Asia Pacific Socks Market Volume (Thousand Units) Share, by Type, 2017‒2031

Figures 47: Asia Pacific Socks Market Value (US$ Mn) Share, by Type, 2017‒2031

Figures 48: Asia Pacific Socks Market Incremental Opportunity (US$ Mn),by Type, 2017‒2031

Figures 49: Asia Pacific Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Figures 50: Asia Pacific Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Figures 51: Asia Pacific Socks Market Incremental Opportunity (US$ Mn),by Material, 2017‒2031

Figures 52: Asia Pacific Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Figures 53: Asia Pacific Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Figures 54: Asia Pacific Socks Market Incremental Opportunity (US$ Mn),by End-user, 2017‒2031

Figures 55: Asia Pacific Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Figures 56: Asia Pacific Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Figures 57: Asia Pacific Socks Market Incremental Opportunity (US$ Mn),by Distribution Channel, 2017‒2031

Figures 58: Asia Pacific Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Figures 59: Asia Pacific Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Figures 60: Asia Pacific Socks Market Incremental Opportunity (US$ Mn),by Country and Sub-region, 2017‒2031

Figures 61: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Type, 2017‒2031

Figures 62: Middle East and Africa Socks Market Value (US$ Mn) Share, by Type, 2017‒2031

Figures 63: Middle East and Africa Socks Market Incremental Opportunity (US$ Mn),by Type, 2017‒2031

Figures 64: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Figures 65: Middle East and Africa Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Figures 66: Middle East and Africa Socks Market Incremental Opportunity (US$ Mn),by Material, 2017‒2031

Figures 67: Middle East and Africa Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Figures 68: Middle East and Africa Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Figures 69: Middle East and Africa Socks Market Incremental Opportunity (US$ Mn),by End-user, 2017‒2031

Figures 70: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Figures 71: Middle East and Africa Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Figures 72: Middle East and Africa Socks Market Incremental Opportunity (US$ Mn),by Distribution Channel, 2017‒2031

Figures 73: Middle East and Africa Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Figures 74: Middle East and Africa Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Figures 75: Middle East and Africa Socks Market Incremental Opportunity (US$ Mn),by Country and Sub-region, 2017‒2031

Figures 76: South America Socks Market Volume (Thousand Units) Share, by Type, 2017‒2031

Figures 77: South America Socks Market Value (US$ Mn) Share, by Type, 2017‒2031

Figures 78: South America Socks Market Incremental Opportunity (US$ Mn),by Type, 2017‒2031

Figures 79: South America Socks Market Volume (Thousand Units) Share, by Material, 2017‒2031

Figures 80: South America Socks Market Value (US$ Mn) Share, by Material, 2017‒2031

Figures 81: South America Socks Market Incremental Opportunity (US$ Mn),by Material, 2017‒2031

Figures 82: South America Socks Market Volume (Thousand Units) Share, by End-user, 2017‒2031

Figures 83: South America Socks Market Value (US$ Mn) Share, by End-user, 2017‒2031

Figures 84: South America Socks Market Incremental Opportunity (US$ Mn),by End-user, 2017‒2031

Figures 85: South America Socks Market Volume (Thousand Units) Share, by Distribution Channel, 2017‒2031

Figures 86: South America Socks Market Value (US$ Mn) Share, by Distribution Channel, 2017‒2031

Figures 87: South America Socks Market Incremental Opportunity (US$ Mn),by Distribution Channel, 2017‒2031

Figures 88: South America Socks Market Volume (Thousand Units) Share, by Country and Sub-region, 2017‒2031

Figures 89: South America Socks Market Value (US$ Mn) Share, by Country and Sub-region, 2017‒2031

Figures 90: South America Socks Market Incremental Opportunity (US$ Mn),by Country and Sub-region, 2017‒2031