Reports

Reports

Analysts’ Viewpoint on Sewage Pump Market Scenario

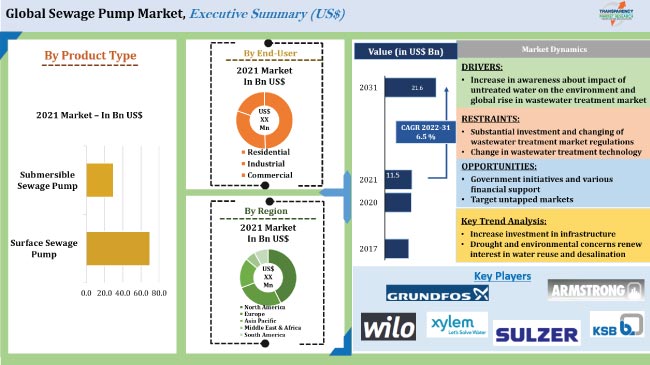

The sewage pump market is driven by rising environmental consciousness and a global increase in trend of wastewater treatment. Submersible sewage pumps account for a significant share of the worldwide sewage pump market. Demand for wastewater treatment facilities is on the rise, as more new plants are built. Rise in the number of residential homes increases the generation of residential sewage, which in turn propels the demand for sewage pumps. Furthermore, rising tendency toward mergers and acquisitions in the sewage pump market, an increase in investment, and a shift in wastewater elements are further increasing the demand for sewage pumps. Major sewage pump manufacturers operating in the market are focusing on research and development in order to accelerate the launch of latest water technology innovations to boost their respective shares and create new opportunities in the market.

A sewage pump transfers or carries liquid and solid sewage to the main sewage system. The sewage ejector pumps liquids and solids into the sewer or septic line. The system consists of a network of pipes, and the waste flows into the main channel by gravity. The two types of sewage pumps are surface sewage/ground sewage pumps and submersible sewage pumps.

Global rise in urbanization is increasing the demand for water and wastewater treatment equipment, which is subsequently boosting the demand for sewage pumps. In general, a sewage pump is used in the primary stage of a wastewater treatment process. The wastewater treatment industry is well-established in developed regions.

According to the World Health Organization's assessment on water treatment development, only around 55% of residential water collected is successfully treated, posing a risk to the environment and the health of millions of people who live near dirty water sources. Increased awareness about this issue among the public has prompted governments and local organizations to create infrastructure for effective wastewater management.

Growing awareness about the environmental and consequences of untreated water drive the sewage pump industry. Furthermore, increased need for clean water along with the underlying megatrend of population expansion drives the growth of the worldwide sewage pump market.

As per KSB Group, there are 16,000 wastewater treatment plants in the U.S. KSB Group estimates that the U.S. water and wastewater industry is growing at a CAGR of 7.4%. In the U.S., Public Private Partnership (PPP) enabled treatment capacity to quadruple between 2016 and 2020, adding 6 million m3/day.

According to the Word Bank, population and economic expansion have accelerated the demand for water supplies. 36% of the world’s population lives in water-scarce regions. Rapid urbanization has caused various water-related difficulties, notably in low- and middle-income nations, such as poor water quality and inadequate water supply and sanitation facilities, particularly in developing peri-urban and informal communities.

As per the UN, global water usage is increasing by 1.0% per annum since 1980, attributed to rise in population, socio-economic development, and changing consumption patterns.

As per the UN, global population has reached 7.6 billion in June 2017 and is expected to reach 9.8 billion by 2050. It is found that 54.0% of the global population lives in cities and this is expected to reach 66.4% by 2050. The UN estimates that global water demand would continue to increase at a similar pace until 2050, accounting for an increase of 20% to 30% above the current level of water use across the globe. Moreover, a rise in water scarcity is boosting the reuse of water. Wastewater treatment plants help wastewater to be reused or dumped in oceans with less toxicity. Thus, rise in wastewater treatment plants drives the demand for sewage pumps across the globe.

In terms of product type, the submersible sewage pump segment is anticipated to dominate the sewage pump market during the forecast period. Demand for pressure sewer systems is increasing. A pressure sewer system contains a tank with submersible sewage pumps for operation. When the sewage level in the tank reaches a set level near the top of the tank, the pump turns on and delivers the sewage into the collection system until the tank is empty. Rise in demand for submersible drainage pumps from municipal, construction, and other sectors is driving the demand for submersible sewage pumps. Surface or non-submersible sewage pumps hold a relatively minor market share. However, demand for surface sewage pumps is expected to increase owing to advances in sewage technology.

In terms of end-user, the sewage pump market has been classified into residential, industrial, and commercial. The residential segment is expected to hold the highest market share during the forecast period. Increase in residential households is leading to an increase in residential sewage, which in turn is driving the demand for sewage pumps.

According to India Brand Equity Foundation, India plans to invest US$ 1.4 Trn on infrastructure over the next five years through the 'National Infrastructure Pipeline.' Infrastructure operations accounted for 13% of overall FDI inflows of US$ 81.72 Bn in FY21. India would need to build 43,000 dwellings every day till 2022 to realize the objective of Housing for All by 2022.

Need for commercial and industrial wastewater treatment is also rising owing to growth in end-user sectors such as oil & gas, chemical, and power generation, which in turn is further fueling the demand for sewage pumps.

Asia Pacific is the largest market for sewage pumps globally. The region has the maximum number of wastewater treatment plants. Massively populated countries such as China and India are the engines of the sewage pump market in Asia Pacific.

The Europe sewage pumps industry market is the second-largest and is a mature market. Growing demand for sewage pumps in Germany, France, and the U.K. is driving the market in the region. North America is the third-largest market globally. Sewage pump demand in the U.S. is increasing. MEA and South America are smaller markets with growing demand for sewage pumps.

The global sewage pump market is consolidated with a few large-scale vendors controlling majority of the market share. Most firms are spending significantly on comprehensive research and development activities, primarily to develop portable sewage vacuum pumps, advanced sewage water treatment plants, wastewater treatment services, and water & wastewater treatment equipment. Mergers and acquisitions are the strategies adopted by key players. Xylem Inc., Sulzer Ltd, KSB SE & Co. KGaA, Wilo Group, Armstrong Fluid Technology, Grundfos Holding A/S, Tsurumi Manufacturing Co. Ltd., The Gorman-Rupp Company, C.R.I. Pumps Private Ltd., and Nanjing Lanshen Pump Corp. Ltd. are the prominent entities operating in this market.

The global sewage pump market is fragmented and highly competitive with both large players as well as many small players filling the landscape. Emergence of new players has led to innovations in sewage pump efficiency, driving research and development in the market. In recent years, the market continues to develop rapidly, and companies try to apply technological trends in the production of sewage pumps.

Each of these players has been profiled in the sewage pump market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 11.5 Bn |

|

Market Forecast Value in 2031 |

US$ 21.6 Bn |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the region as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global sewage pump market stood at US$ 11.5 Bn in 2021

The market is estimated to grow at a CAGR of 6.5% during 2022-2031

The global sewage pump market is likely to reach US$ 21.6 Bn by 2031

Submersible sewage pumps segment is expected to advance at the highest growth rate during the forecast period

The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period

Increase in awareness about impact of untreated water on the environment, global rise in wastewater treatment facilities as well as surge in global demand for water

Xylem Inc., Sulzer Ltd, KSB SE & Co. KGaA, Wilo Group, Armstrong Fluid Technology, Grundfos Holding A/S, Tsurumi Manufacturing Co. Ltd., The Gorman-Rupp Company, C.R.I. Pumps Private Ltd., and Nanjing Lanshen Pump Corp. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Pump Market

5.3.2. Overall Water & Wastewater Management Market

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Overview

5.9. Standards and Regulations

5.10. Global Sewage Pump Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Bn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global Sewage Pump Market Analysis and Forecast, by Product Type

6.1. Global Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by Product Type, 2017 - 2031

6.1.1. Surface Sewage Pump

6.1.2. Submersible Sewage Pump

6.2. Incremental Opportunity, by Product Type

7. Global Sewage Pump Market Analysis and Forecast, by End-user

7.1. Global Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by End-user, 2017 - 2031

7.1.1. Residential

7.1.2. Industrial

7.1.3. Commercial

7.2. Incremental Opportunity, by End-user

8. Global Sewage Pump Market Analysis and Forecast, by Region

8.1. Global Sewage Pump Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, by Region

9. North America Sewage Pump Market Analysis and Forecast

9.1. Regional Snapshot

9.2. COVID 19 Impact Analysis

9.3. Price Trend Analysis

9.3.1. Weighted Average Selling Price (US$)

9.4. Key Trends Analysis

9.4.1. Demand Side

9.4.2. Supply Side

9.5. Key Supplier Analysis

9.6. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by Product Type, 2017 - 2031

9.6.1. Surface Sewage Pump

9.6.2. Submersible Sewage Pump

9.7. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by End-user, 2017 - 2031

9.7.1. Residential

9.7.2. Industrial

9.7.3. Commercial

9.8. Sewage Pump Market (US$ Bn and Thousand Units), by Country & Sub-region, 2017 - 2031

9.8.1. U.S.

9.8.2. Canada

9.8.3. Rest of North America

9.9. Incremental Opportunity Analysis

10. Europe Sewage Pump Market Analysis and Forecast

10.1. Regional Snapshot

10.2. COVID 19 Impact Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Key Trends Analysis

10.4.1. Demand Side

10.4.2. Supply Side

10.5. Key Supplier Analysis

10.6. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by Product Type, 2017 - 2031

10.6.1. Surface Sewage Pump

10.6.2. Submersible Sewage Pump

10.7. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by End-user, 2017 - 2031

10.7.1. Residential

10.7.2. Industrial

10.7.3. Commercial

10.8. Sewage Pump Market (US$ Bn and Thousand Units), by Country & Sub-region, 2017 - 2031

10.8.1. Germany

10.8.2. U.K.

10.8.3. France

10.8.4. Rest of Europe

10.9. Incremental Opportunity Analysis

11. Asia Pacific Sewage Pump Market Analysis and Forecast

11.1. Regional Snapshot

11.2. COVID 19 Impact Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supply Side

11.5. Key Supplier Analysis

11.6. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by Product Type, 2017 - 2031

11.6.1. Surface Sewage Pump

11.6.2. Submersible Sewage Pump

11.7. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by End-user, 2017 - 2031

11.7.1. Residential

11.7.2. Industrial

11.7.3. Commercial

11.8. Sewage Pump Market (US$ Bn and Thousand Units), by Country & Sub-region, 2017 - 2031

11.8.1. China

11.8.2. India

11.8.3. Japan

11.8.4. Rest of Asia Pacific

11.9. Incremental Opportunity Analysis

12. Middle East & Africa Sewage Pump Market Analysis and Forecast

12.1. Regional Snapshot

12.2. COVID 19 Impact Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supply Side

12.5. Key Supplier Analysis

12.6. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by Product Type, 2017 - 2031

12.6.1. Surface Sewage Pump

12.6.2. Submersible Sewage Pump

12.7. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by End-user, 2017 - 2031

12.7.1. Residential

12.7.2. Industrial

12.7.3. Commercial

12.8. Sewage Pump Market (US$ Bn and Thousand Units), by Country & Sub-region, 2017 - 2031

12.8.1. GCC

12.8.2. South Africa

12.8.3. Rest of Middle East & Africa

12.9. Incremental Opportunity Analysis

13. South America Sewage Pump Market Analysis and Forecast

13.1. Regional Snapshot

13.2. COVID 19 Impact Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supply Side

13.5. Key Supplier Analysis

13.6. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by Product Type, 2017 - 2031

13.6.1. Surface Sewage Pump

13.6.2. Submersible Sewage Pump

13.7. Sewage Pump Market (US$ Bn and Thousand Units) Forecast, by End-user, 2017 - 2031

13.7.1. Residential

13.7.2. Industrial

13.7.3. Commercial

13.8. Sewage Pump Market (US$ Bn and Thousand Units), by Country & Sub-region, 2017 - 2031

13.8.1. Brazil

13.8.2. Rest of South America

13.9. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Revenue Share Analysis (%), By Company, (2020)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Xylem Inc.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Sulzer Ltd

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. KSB SE & Co. KGaA

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Wilo Group

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Armstrong Fluid Technology

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Grundfos Holding A/S

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Tsurumi Manufacturing Co. Ltd.

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. The Gorman-Rupp Company

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. C.R.I. Pumps Private Ltd.

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. Nanjing Lanshen Pump Corp. Ltd.

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaway

15.1. Identification of Potential Market Spaces

15.1.1. Product Type

15.1.2. End-user

15.1.3. Region

15.2. Understanding the Procurement Process of Customers

15.3. Prevailing Market Risks

List Of Tables

Table 1: Global Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Table 2: Global Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Table 3: Global Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Table 4: Global Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Table 5: Global Sewage Pump Market Value, by Region, US$ Bn, 2017-2031

Table 6: Global Sewage Pump Market Volume, by Region, Thousand Units, 2017-2031

Table 7: North America Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Table 8: North America Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Table 9: North America Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Table 10: North America Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Table 11: North America Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Table 12: North America Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Table 13: Europe Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Table 14: Europe Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Table 15: Europe Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Table 16: Europe Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Table 17: Europe Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Table 18: Europe Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Table 19: Asia Pacific Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Table 20: Asia Pacific Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Table 21: Asia Pacific Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Table 22: Asia Pacific Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Table 23: Asia Pacific Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Table 24: Asia Pacific Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Table 25: MEA Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Table 26: MEA Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Table 27: MEA Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Table 28: MEA Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Table 29: MEA Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Table 30: MEA Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Table 31: South America Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Table 32: South America Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Table 33: South America Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Table 34: South America Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Table 35: South America Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Table 36: South America Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

List Of Figures

Figure 1: Global Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Figure 2: Global Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 3: Global Sewage Pump Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: Global Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Figure 5: Global Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Figure 6: Global Sewage Pump Market Incremental Opportunity, by End-user, 2021-2031

Figure 7: Global Sewage Pump Market Value, by Region, US$ Bn, 2017-2031

Figure 8: Global Sewage Pump Market Volume, by Region, Thousand Units, 2017-2031

Figure 9: Global Sewage Pump Market Incremental Opportunity, by Region,2021-2031

Figure 10: North America Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Figure 11: North America Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 12: North America Sewage Pump Market Incremental Opportunity, by Product Type, 2021-2031

Figure 13: North America Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Figure 14: North America Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Figure 15: North America Sewage Pump Market Incremental Opportunity, by End-user, 2021-2031

Figure 16: North America Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Figure 17: North America Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Figure 18: North America Sewage Pump Market Incremental Opportunity, by Country & Sub-region, 2021-2031

Figure 19: Europe Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Figure 20: Europe Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 21: Europe Sewage Pump Market Incremental Opportunity, by Product Type, 2021-2031

Figure 22: Europe Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Figure 23: Europe Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Figure 24: Europe Sewage Pump Market Incremental Opportunity, by End-user, 2021-2031

Figure 25: Europe Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Figure 26: Europe Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Figure 27: Europe Sewage Pump Market Incremental Opportunity, by Country & Sub-region, 2021-2031

Figure 28: Asia Pacific Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Figure 29: Asia Pacific Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 30: Asia Pacific Sewage Pump Market Incremental Opportunity, by Product Type, 2021-2031

Figure 31: Asia Pacific Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Figure 32: Asia Pacific Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Figure 33: Asia Pacific Sewage Pump Market Incremental Opportunity, by End-user, 2021-2031

Figure 34: Asia Pacific Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Figure 35: Asia Pacific Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Figure 36: Asia Pacific Sewage Pump Market Incremental Opportunity, by Country & Sub-region, 2021-2031

Figure 37: MEA Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Figure 38: MEA Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 39: MEA Sewage Pump Market Incremental Opportunity, by Product Type, 2021-2031

Figure 40: MEA Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Figure 41: MEA Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Figure 42: MEA Sewage Pump Market Incremental Opportunity, by End-user, 2021-2031

Figure 43: MEA Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Figure 44: MEA Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Figure 45: MEA Sewage Pump Market Incremental Opportunity, by Country & Sub-region, 2021-2031

Figure 46: South America Sewage Pump Market Value, by Product Type, US$ Bn, 2017-2031

Figure 47: South America Sewage Pump Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 48: South America Sewage Pump Market Incremental Opportunity, by Product Type, 2021-2031

Figure 49: South America Sewage Pump Market Value, by End-user, US$ Bn, 2017-2031

Figure 50: South America Sewage Pump Market Volume, by End-user, Thousand Units, 2017-2031

Figure 51: South America Sewage Pump Market Incremental Opportunity, by End-user, 2021-2031

Figure 52: South America Sewage Pump Market Value, by Country & Sub-region, US$ Bn, 2017-2031

Figure 53: South America Sewage Pump Market Volume, by Country & Sub-region, Thousand Units, 2017-2031

Figure 54: South America Sewage Pump Market Incremental Opportunity, by Country & Sub-region, 2021-2031