Reports

Reports

The remote patient monitoring devices market is growing at a faster pace with an increasing need for improved healthcare services and patient care solutions. RPM devices enable the healthcare professionals to monitor the vital signs and health parameters of the patients remotely, and this enables the early treatment of chronic diseases and reduced on-site visits. The trend has picked up particularly after the COVID-19 pandemic when remote care solutions came into focus.

.webp)

Some of the key growth drivers are technology innovation, say - wearable technology and health applications on mobile devices, which are more convenient and accessible to the patient. Greater investments in healthcare IT infrastructure and positive government initiatives are the other growth drivers to adopt RPM solutions.

Moreover, the population of chronic and aging patients is driving demand for real-time monitoring. As more number of patients need specialized and optimized healthcare services, the RPM market will see an exponential growth. By improving patient activation and early intervention, remote monitoring improves health outcomes and reduces healthcare expenditures, and hence it becomes an essential component of healthcare models of the contemporary era.

Remote Patient Monitoring (RPM) technology is a sophisticated device meant for the monitoring of patient health parameters outside the boundary of a hospital setting. Disposable medical sensors and smartwatches are the ones who can track blood glucose, heart rate, and blood pressure in real time.

Growing interest in preventive care and telemedicine is accelerating the use of RPM technology, particularly to treat chronic diseases.

RPM devices facilitate timely intervention through remote data analysis by physicians, hence enhancing patient compliance and involvement in the treatment plan. The COVID-19 pandemic has emphasized such solutions due to their potential to reduce in-clinic visits while enhancing ongoing care.

| Attribute | Detail |

|---|---|

| Remote Patient Monitoring Devices Market Drivers |

|

Increased burden of ailments among the geriatric population is one of the key factors driving the remote patient monitoring (RPM) Devices Industry. The rise in aging population across the globe is raising the prevalence of chronic conditions such as diabetes, hypertension, cardiovascular disease, and arthritis.

RPM technology including wearable monitors, mobile health applications, and telehealth technology enables physicians and healthcare providers to observe the vital signs and medical data of patients in real time.

Government policies and healthcare transformations are the key drivers to the remote patient monitoring (RPM) devices market. With a growing demand for greater access to healthcare and better outcomes, every government in the world is creating policies for adopting sophisticated healthcare technologies such as RPM technologies.

The policies aim at facilitating affordable healthcare to the patients, thereby lowering the cost of medical care, and making the health system more efficient in addressing the increasing epidemic of chronic disease in various populations.

In the United States, for instance, Centers for Medicare & Medicaid Services have introduced reimbursement arrangements that incentivize the utilization of telehealth and remote monitoring services. Reimbursement encouragement will, in turn, see physicians adopt RPM devices in clinical practice, thus improving patient management and care continuity. The reforms enable widespread dissemination of RPM technologies and educate patients to embrace more active strategies towards home self-care.

Additionally, governments’ investments in healthcare infrastructure, i.e., rural underserved areas, is the major facilitator behind the acceleration of RPM device uptake. With such reforms, digital health literacy and greater internet penetration, RPM solution offerings become more convenient and accessible to different classes of patients.

With improved healthcare facilities, government subsidies and continued reforms will drive the RPM devices market, paving the way for innovation and on-time and efficient treatment to the patients. This is a huge leap toward patient centrality in healthcare, which rewards the care givers apart from the patients.

Blood glucose monitors are leading the remote patient monitoring (RPM) market with the growing number of diabetics and the sharp need to track the disease effectively. With millions of diabetics worldwide, there has been an unprecedented demand for continuous monitoring systems. The monitors allow patients to track blood sugar levels in real-time, which allows one to gain vital information to make informed diet-related, exercise-related, and medication-related decisions.

Cloud and smartphone app connectivity enables remote clinician and patient access to facilitate proactive monitoring of the data, hence facilitating disease control. Hyperglycemia excursion alarm capabilities of continuous glucose monitoring systems have transformed diabetes care by simplifying patient safety assurance.

Secondly, the increased focus on preventive care and patient-specific care is favorable to blood glucose monitors. As healthcare initiatives are being shifted toward the remote management of long-term conditions, blood glucose monitors lead the way to better outcomes, fewer complications, and less cost of care. Thus, blood glucose monitoring is a high-selling product in the market of RPM devices.

| Attribute | Detail |

|---|---|

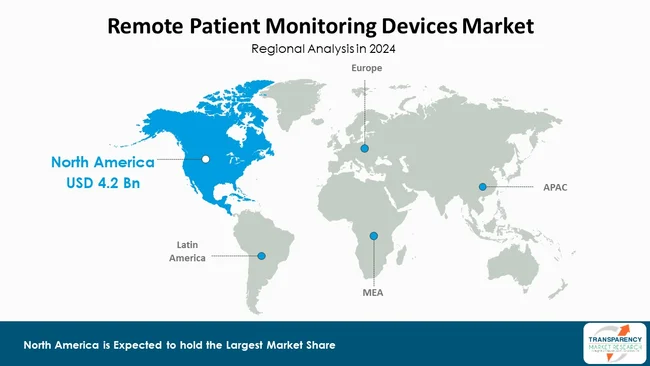

| Leading Region | North America |

The largest market for the remote patient monitoring (RPM) devices industry is North America, having a well-developed healthcare infrastructure and thus a high level of adoption of technology. The United States, for instance, has a more advanced healthcare system with enormous investments in telemedicine and health IT. The infrastructure can support the incorporation of RPM devices into patient care as part of a routine that facilitates effective monitoring and management of chronic conditions.

Apart from that, rising chronic conditions like obesity, cardiovascular disease, and diabetes will determine demand for continuous monitoring technology. The age factor in North America will also determine the trend.

Besides, efficient government policies and payment systems make it favorable for healthcare providers to implement RPM technology, thereby accessible for use by patients.

With cost containment and patient-focused care and enhanced health outcomes as a goal, North America is the market leader for RPM devices, leading in innovation and embracing remote patient care.

Key players in the global remote patient monitoring devices market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Omron Corporation, Koninklijke Philips N.V., Welch Allyn, Abbott, Boston Scientific Corporation, Medtronic, Johnson & Johnson, Biotronik, Masimo, Nihon Kohden Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., MIR – Medical International Research, CareSimple Inc and others are some of the leading key players.

Each of these players has been profiled in the remote patient monitoring devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

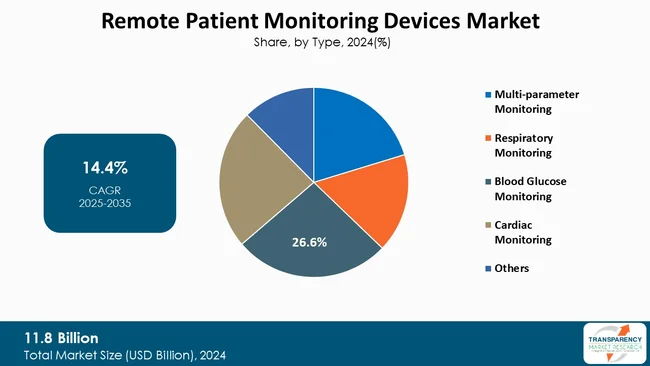

| Size in 2024 | US$ 11.8 Bn |

| Forecast Value in 2035 | US$ 52.7 Bn |

| CAGR | 14.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Remote Patient Monitoring Devices Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 11.8 Bn in 2024.

It is projected to cross US$ 52.7 Bn by the end of 2035.

Growing disease burden among the geriatric population and government support and healthcare reform.

It is anticipated to grow at a CAGR of 14.4% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Omron Corporation, Koninklijke Philips N.V., Welch Allyn, Abbott, Boston Scientific Corporation, Medtronic, Johnson & Johnson, Biotronik, Masimo, Nihon Kohden Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., MIR – Medical International Research, CareSimple Inc, and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Remote Patient Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Remote Patient Monitoring Devices Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario across Key Regions/Countries

5.3. PORTER’s Five Forces Analysis

5.4. PESTLE Analysis

5.5. Supply Chain Analysis

5.6. Go-to-Market Strategy for New Market Entrants

6. Global Remote Patient Monitoring Devices Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2020 to 2035

6.3.1. Multi-parameter Monitoring

6.3.2. Respiratory Monitoring

6.3.3. Blood Glucose Monitoring

6.3.4. Cardiac Monitoring

6.3.5. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Remote Patient Monitoring Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Oncology

7.3.2. Diabetes

7.3.3. Cardiovascular Diseases

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Remote Patient Monitoring Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020 to 2035

8.3.1. Hospitals & Clinics

8.3.2. Home Healthcare Settings

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Remote Patient Monitoring Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Remote Patient Monitoring Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2020 to 2035

10.2.1. Multi-parameter Monitoring

10.2.2. Respiratory Monitoring

10.2.3. Blood Glucose Monitoring

10.2.4. Cardiac Monitoring

10.2.5. Others

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Oncology

10.3.2. Diabetes

10.3.3. Cardiovascular Diseases

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2020 to 2035

10.4.1. Hospitals & Clinics

10.4.2. Home Healthcare Settings

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Remote Patient Monitoring Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2020 to 2035

11.2.1. Multi-parameter Monitoring

11.2.2. Respiratory Monitoring

11.2.3. Blood Glucose Monitoring

11.2.4. Cardiac Monitoring

11.2.5. Others

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Oncology

11.3.2. Diabetes

11.3.3. Cardiovascular Diseases

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2020 to 2035

11.4.1. Hospitals & Clinics

11.4.2. Home Healthcare Settings

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Remote Patient Monitoring Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2020 to 2035

12.2.1. Multi-parameter Monitoring

12.2.2. Respiratory Monitoring

12.2.3. Blood Glucose Monitoring

12.2.4. Cardiac Monitoring

12.2.5. Others

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Oncology

12.3.2. Diabetes

12.3.3. Cardiovascular Diseases

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2020 to 2035

12.4.1. Hospitals & Clinics

12.4.2. Home Healthcare Settings

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Remote Patient Monitoring Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2020 to 2035

13.2.1. Multi-parameter Monitoring

13.2.2. Respiratory Monitoring

13.2.3. Blood Glucose Monitoring

13.2.4. Cardiac Monitoring

13.2.5. Others

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Oncology

13.3.2. Diabetes

13.3.3. Cardiovascular Diseases

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2020 to 2035

13.4.1. Hospitals & Clinics

13.4.2. Home Healthcare Settings

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Remote Patient Monitoring Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2020 to 2035

14.2.1. Multi-parameter Monitoring

14.2.2. Respiratory Monitoring

14.2.3. Blood Glucose Monitoring

14.2.4. Cardiac Monitoring

14.2.5. Others

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Oncology

14.3.2. Diabetes

14.3.3. Cardiovascular Diseases

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2020 to 2035

14.4.1. Hospitals & Clinics

14.4.2. Home Healthcare Settings

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Omron Corporation

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Koninklijke Philips N.V.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Welch Allyn

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Abbott

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Boston Scientific Corporation

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Medtronic

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Johnson & Johnson

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Biotronik

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Masimo

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Nihon Kohden Corporation

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. MIR – Medical International Research

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. CareSimple Inc

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

List of Tables

Table 01: Global Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 02: Global Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 07: North America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: North America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 10: Europe Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 11: Europe Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: Europe Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Asia Pacific Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 15: Asia Pacific Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 16: Asia Pacific Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Latin America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 19: Latin America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Latin America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Middle East & Africa Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 23: Middle East & Africa Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Middle East & Africa Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Remote Patient Monitoring Devices Market Value Share Analysis, By Type, 2024 and 2035

Figure 02: Global Remote Patient Monitoring Devices Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 03: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Multi-parameter Monitoring, 2020 to 2035

Figure 04: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Respiratory Monitoring, 2020 to 2035

Figure 05: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Blood Glucose Monitoring, 2020 to 2035

Figure 06: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Cardiac Monitoring, 2020 to 2035

Figure 07: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Remote Patient Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 09: Global Remote Patient Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 10: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 11: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Diabetes, 2020 to 2035

Figure 12: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Cardiovascular Diseases, 2020 to 2035

Figure 13: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Remote Patient Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Remote Patient Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 16: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 17: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Home Healthcare Settings, 2020 to 2035

Figure 18: Global Remote Patient Monitoring Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Remote Patient Monitoring Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Remote Patient Monitoring Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 21: North America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 22: North America Remote Patient Monitoring Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America Remote Patient Monitoring Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 24: North America Remote Patient Monitoring Devices Market Value Share Analysis, By Type, 2024 and 2035

Figure 25: North America Remote Patient Monitoring Devices Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 26: North America Remote Patient Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 27: North America Remote Patient Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 28: North America Remote Patient Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 29: North America Remote Patient Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 30: Europe Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: Europe Remote Patient Monitoring Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 32: Europe Remote Patient Monitoring Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 33: Europe Remote Patient Monitoring Devices Market Value Share Analysis, By Type, 2024 and 2035

Figure 34: Europe Remote Patient Monitoring Devices Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 35: Europe Remote Patient Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 36: Europe Remote Patient Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 37: Europe Remote Patient Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: Europe Remote Patient Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 39: Asia Pacific Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Asia Pacific Remote Patient Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Asia Pacific Remote Patient Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 42: Asia Pacific Remote Patient Monitoring Devices Market Value Share Analysis, By Type, 2024 and 2035

Figure 43: Asia Pacific Remote Patient Monitoring Devices Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 44: Asia Pacific Remote Patient Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 45: Asia Pacific Remote Patient Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 46: Asia Pacific Remote Patient Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 47: Asia Pacific Remote Patient Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 48: Latin America Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Latin America Remote Patient Monitoring Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 50: Latin America Remote Patient Monitoring Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 51: Latin America Remote Patient Monitoring Devices Market Value Share Analysis, By Type, 2024 and 2035

Figure 52: Latin America Remote Patient Monitoring Devices Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 53: Latin America Remote Patient Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 54: Latin America Remote Patient Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 55: Latin America Remote Patient Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 56: Latin America Remote Patient Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 57: Middle East & Africa - Remote Patient Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Middle East & Africa - Remote Patient Monitoring Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 59: Middle East & Africa - Remote Patient Monitoring Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 60: Middle East & Africa Remote Patient Monitoring Devices Market Value Share Analysis, By Type, 2024 and 2035

Figure 61: Middle East & Africa Remote Patient Monitoring Devices Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 62: Middle East & Africa Remote Patient Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Middle East & Africa Remote Patient Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Middle East & Africa Remote Patient Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Middle East & Africa Remote Patient Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035