Reports

Reports

The industry for positron emission tomography (PET) scanners is thriving, buoyed by advancements in diagnostic imaging technology and ever-increasing capital investments for improving healthcare infrastructure.

More specifically, PET fused with the other imaging modalities (e.g., CT and MRI) has improved diagnostic perspectives that aid in better staging and monitoring of diseases. In addition, greater buy-in from healthcare professionals on early and accurate diagnosis has also greatly aided the adoption of PET scanners. PET scanners are being used frequently in clinical trials to assess new drugs and treatments, offering a reproducible imaging tool for the assessment of response to treatment. Academic and research institutions are increasingly applying PET in molecular imaging, further increasing applications beyond conventional diagnostic use. Furthermore, increasing need for minimally invasive diagnostics continues to propel the extensive application of PET imaging in routine clinical practice, which, in turn, continues to stimulate adoption within both - developed and developing countries.

In recent years, the positron emission tomography [PET] scanners market has experienced a number of significant trends that contribute to its growth. Hybrid forms of imaging (e.g., PET/MRI systems) have increased visibility as they can leverage potential anatomical and functional imaging in one scan.

Furthermore, the digital versions of PET are substituting analog PET versions, as they provide improved image resolution, lower data acquisition times, and reduced patient radiation doses from the scanner. The artificial intelligence-based image analysis has provided improved workflow efficiencies and diagnostic performance as well. Additionally, the newer PET systems are smaller and more transportable, thereby improving access to imaging in outpatient and community healthcare settings.

Strategic alliances with research institutions create innovation in radiotracers and software-driven imaging technology. Furthermore, companies are looking to expand their global footprint through acquisitions and mergers and distribution agreements. Economical solutions are also being sought along with increased production capacities in an attempt to address the escalating demand coming from the developing as well as the developed world.

Positron Emission Tomography (PET) scanners are sophisticated imaging machines employed in medical diagnosis to map metabolic activity in the body. PET scanners create images of organs and tissues based upon the detected gamma rays from injected radiotracers. They are best suited for the diagnosis of cancer, assessing of brain disorders, and monitoring of heart diseases.

PET scans yield valuable information regarding physiological functions that enable correct diagnosis and treatment planning. Unlike most imaging modalities that generally provide structural information, PET imaging allows clinicians to view enteric activity that makes it extremely valuable for detecting disease processes early. This represents a major advantage of PET imaging over imaging modalities focused on providing structural representations of the body.

PET scans utilize radio tracers, commonly short-life radioisotopes. It produces a three-dimensional image that can quantitively detect functional change in organs and tissues down to the smallest amount of functional change.

PET scanners are most often used in oncology, and to diagnose cancer, stage tumors, and evaluate responses to treatment. PET can also evaluate small lesions and assess treatment effectiveness. For instance - whether treatment is reducing the activity of a malignant tumor.

PET scanners are not limited to oncology. However, they are used in cardiology to quantify blood flow and assess viability of the heart muscle. They are also used in neurology to assess and accurately diagnose abnormalities and disorders such as those linked to the Alzheimer's Disease, epilepsy, and Parkinson's disease.

Additionally, AI and digital imaging, including PET imaging, continue to converge in ways that enhance data interpretation and improve workflow efficiency and overall patient care. Small and portable PET systems are being designed to improve access to high advanced imaging capabilities in regional centers and community hospitals. Thus, PET imaging will continue moving forward as a significant part of advanced diagnostics, with valuable information available for the diagnosis and management of disease.

| Attribute | Detail |

|---|---|

| Positron Emission Tomography [PET] Scanners Market Drivers |

|

The rising prevalence of chronic disease is also a significant driver to the positron emission tomography [PET] scanners market based on an increase in demand for advanced diagnostic technology. Future early diagnosis and follow-up will be required for the diagnosis of cancer and the other chronic diseases such as heart disease and neurological diseases. PET scanners can accomplish this with a high degree of accuracy. Their capacity to measure metabolic functioning makes them most desired equipment to ascertain disease condition and response to treatment.

Cancer is one of the largest area where PET scanners are used in considerable volume. PET scanners can determine the measurement of tumor burden at their earliest phase and also assess the success from treatment. In cardiology, PET scans are used to measure blood flow and myocardial viability, which is essential in chronic heart diseases. Such increasing demand for total diagnostics has boosted PET applications worldwide.

Additionally, long-term care of chronic disease implies repeated imaging, thus necessitating effective and dependable technologies even more. In light of patient outcomes and healthcare systems' reduction of disease burden, PET scanners remain fundamental to offering real-time, non-invasive, and precise information and thus driving positron emission tomography [PET] scanners market growth.

For instance, as per the data released by WHO, NCDs, or chronic diseases, accounted for at least 43 million deaths in the year 2021, which is 75% of non-pandemic associated death worldwide. It further states that in the year 2021, 18 million individuals passed away from an NCD at a life age of below 70 years.

Personalized medicine is creating major demand for Positron Emission Tomography (PET) scanners due to the unique value they provide to each patient's biological process. Personalized medicine comprises treatment specific to each patient based upon genetic, molecular, and cellular composition. PET scanners allow a physician to see a patient's functional characteristics in real time and typically obtain a more precise diagnosis and treatment plan leading to better treatment outcomes.

The need for personalized medicine is enhancing the use of PET scanners by allowing accurate assessment of cardiac function, cerebral function, and metabolic conditions. This ability leads to more individualized treatment options, reduced unnecessary procedures, and better clinical outcomes, resulting in a promising positron emission tomography [PET] scanners market.

PET scanners are being employed to provide individualized patient care in cardiology and neurology by endeavoring to characterize the viability of heart muscle and brain disorders. This profiling ability gives physicians an opportunity to tailor therapies based on functional imaging. Patient specific evaluation leads to better patient outcomes by reducing trial-and-error treatments that are meant to improve functional capacity.

Since healthcare systems are shifting toward individualized treatment approaches, the utilization of advanced imaging modalities such as positron emission tomography (PET) will continue its rapid growth. Individualized treatment is one representation of a patient-centered approach, but factors that form personalized medicine are complex and the ability of imaging modalities to accurately, non-invasively, and in a patient-centered manner to transform the practice of personalized medicine into a real growth opportunity for the market.

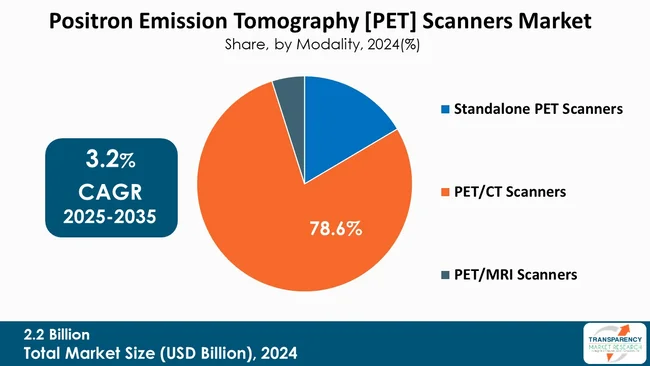

PET/CT scanners are the preferred option in the positron emission tomography (PET) scanners market because they combine functional and anatomical imaging in one scan, which improves diagnostic ability exponentially. PET will give information about the metabolic activity that is occurring in organs or tissues, while Computed Tomography (CT) will give detailed structural images of the same organs or tissues allowing precise localization of abnormalities. The combination of 2 imaging modalities allows clinicians to identify disease earlier, stage cancers more accurately, and monitor treatment effectiveness more confidently.

Moreover, the efficiency of the PET/CT scanner is to improve the comfort for the patient, as well as increase patient-centric workflow in the clinical environment. In oncology, positron emission tomography (PET) scans can define the biology of a tumor, establish a measurement of metabolic activity, and define the biological behavior of a tumor more exactly, that is, how a tumor will react to a given therapy.

| Attribute | Detail |

|---|---|

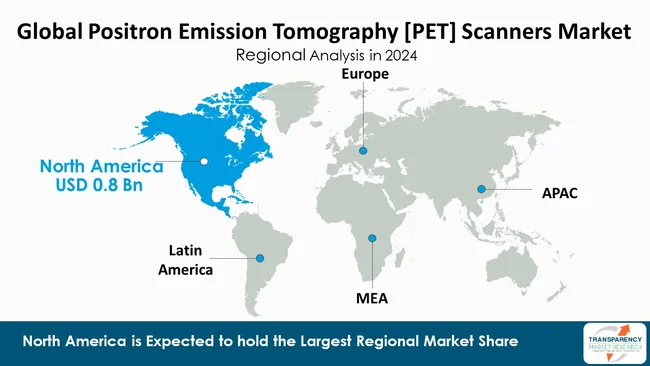

| Leading Region |

|

As per the latest positron emission tomography [PET] scanners market analysis, North America dominated in 2024. This is largely because of its strong healthcare infrastructure and rampant uptake of cutting-edge diagnostic solutions. Moreover, early detection of disease, precise diagnostics, and monitoring of treatments are all highly valued in this region and they are heavily dependent on PET imaging. Not only does high healthcare spending create pressure on hospitals and diagnostics centers to purchase advanced PET technology, but also the generous reimbursement policies further create incentives for investments.

In addition, the region features a high population of innovative world-class manufacturers and research establishments promoting constant innovation into imaging. Increased clinical trials, increasing use of hybrid imaging modalities, high patient and clinician awareness, all support the region's leading position in the market for global PET scanners.

Syndicates in the target market are focusing on innovation in digital technology and new hybrid imaging technology while also employing AI-enabled solutions to explore new opportunities in imaging. Companies are collaborating with research institutes to take advantages of extended distribution channels, thereby, improving the cost performance. In addition to this, they are prioritizing investing in advanced radiotracers, taking advantage of global expansions to secure market share.

GE HealthCare, Siemens Healthcare Private Limited, CANON MEDICAL SYSTEMS CORPORATION, United Imaging Healthcare Co., Ltd., Koninklijke Philips N.V., Mediso Ltd, Kindsway Biotech, Neusoft Medical Systems Co., Ltd., Bruker, Shimadzu Corporation, MinFound Medical Systems Co., Ltd, Shenzhen Basda Medical Apparatus Co., Ltd., Positrigo AG, Positron, and SynchroPET are some of the leading players operating in the global positron emission tomography [PET] scanners market.

Each of these players has been profiled in the positron emission tomography [PET] scanners market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

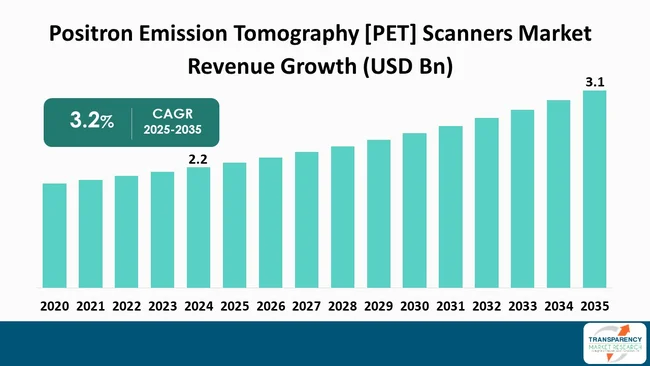

| Size in 2024 | US$ 2.2 Bn |

| Forecast Value in 2035 | US$ 3.1 Bn |

| CAGR | 3.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global positron emission tomography [PET] scanners market was valued at US$ 2.2 Bn in 2024

The global positron emission tomography [PET] scanners industry is projected to reach more than US$ 3.1 Bn by the end of 2035

Rising prevalence of chronic diseases, growing demand for personalized medicine, favorable government policies, growth of diagnostics and imaging clinics, and the integration of advanced technologies with PET scanners are some of the factors driving the expansion of positron emission tomography [PET] scanners market.

The CAGR is anticipated to be 3.2% from 2025 to 2035

GE HealthCare, Siemens Healthcare Private Limited, CANON MEDICAL SYSTEMS CORPORATION, United Imaging Healthcare Co., Ltd., Koninklijke Philips N.V., Mediso Ltd, Kindsway Biotech, Neusoft Medical Systems Co., Ltd., Bruker, Shimadzu Corporation, MinFound Medical Systems Co., Ltd, Shenzhen Basda Medical Apparatus Co., Ltd., Positrigo AG, Positron, and SynchroPET

Table 01: Global Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 03: Global Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 08: North America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 09: North America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 13: Europe - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 14: Europe - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 18: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 19: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Latin America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 24: Latin America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 28: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 29: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Full Ring PET Scanners, 2020 to 2035

Figure 04: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Partial Ring PET Scanners, 2020 to 2035

Figure 05: Global Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Modality, 2024 and 2035

Figure 06: Global Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 07: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Standalone PET Scanners, 2020 to 2035

Figure 08: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by PET/CT Scanners, 2020 to 2035

Figure 09: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by PET/MRI Scanners, 2020 to 2035

Figure 10: Global Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 13: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 14: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 15: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By End-user, 2024 and 2035

Figure 17: Global Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 18: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Hospitals and Ambulatory Surgical Centers, 2020 to 2035

Figure 19: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Diagnostic Imaging Centers, 2020 to 2035

Figure 20: Global Positron Emission Tomography [PET] Scanners Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Region, 2024 and 2035

Figure 22: Global Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 23: North America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: North America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, by Country, 2024 and 2035

Figure 25: North America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 26: North America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 27: North America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 28: North America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Modality, 2024 and 2035

Figure 29: North America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 30: North America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Application, 2024 and 2035

Figure 31: North America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 32: North America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By End-user, 2024 and 2035

Figure 33: North America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 34: Europe - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 36: Europe - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 37: Europe - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 38: Europe - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 39: Europe - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Modality, 2024 and 2035

Figure 40: Europe - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 41: Europe - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Application, 2024 and 2035

Figure 42: Europe - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 43: Europe - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Europe - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 49: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 50: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Modality, 2024 and 2035

Figure 51: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 52: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Asia Pacific - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Latin America - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Latin America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Latin America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Latin America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 60: Latin America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 61: Latin America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Modality, 2024 and 2035

Figure 62: Latin America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 63: Latin America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Latin America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 65: Latin America - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Latin America - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 67: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 69: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 70: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 71: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 72: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Modality, 2024 and 2035

Figure 73: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 74: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By Application, 2024 and 2035

Figure 75: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 76: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Value Share Analysis, By End-user, 2024 and 2035

Figure 77: Middle East & Africa - Positron Emission Tomography [PET] Scanners Market Attractiveness Analysis, By End-user, 2025 to 2035