Reports

Reports

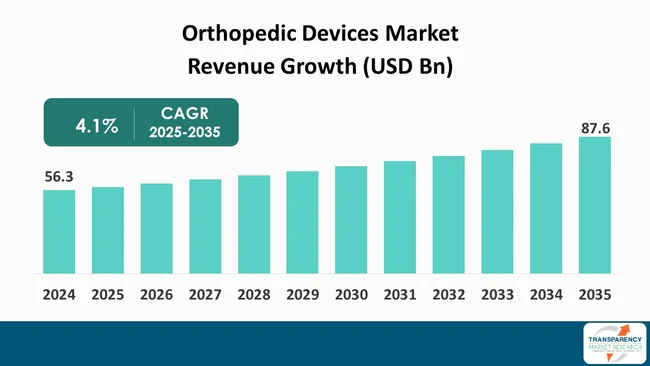

The global orthopedic devices market size was valued at US$ 56.3 billion in 2024 and is projected to reach US$ 87.6 billion by 2035, expanding at a CAGR of 4.1% from 2025 to 2035. The market growth is driven by increasing prevalence of musculoskeletal conditions like osteoarthritis and osteoporosis, rising incidence of sports-related and traumatic injuries, and significant technological advancements.

The orthopedic devices market is witnessing a significant growth owing to the rising number of musculoskeletal diseases and sports injuries. It is reported that lifestyle changes, urbanization, and rising inclination toward sports activities are leading to osteoarthritis, fractures, and ligament sprains.

Incidence of new orthopedic conditions have significantly raised the demand for implants, fixation devices, and joint reconstruction systems. The rising prevalence of obesity has also resulted in rising occurrences of joint disorders, resulting in a high demand for advanced orthopedic devices in healthcare facilities across the globe.

Enhanced access to surgical procedures and the development of healthcare facilities are another significant driver to the orthopedic devices market, especially in emerging economies. The progress of the minimally-invasive technique has reduced the recovery period and as a result patients are more willing to undergo orthopedic surgeries.

Besides, advancements in regional health policies with rising healthcare penetration have pushed the patients to opt for orthopedic procedures.

Recent orthopedic devices market trends do highlight the rising application of advanced biomaterials, usage of 3D technology, and customization of implants. The key benefits of patient-specific implants are their enhanced fit, higher functionality, and decreased probability of post-operative complications.

Moreover, the ongoing trend toward outpatient orthopedic surgery and the use of ambulatory surgical centers is also remarkably contributing to product innovation that prioritizes efficiency and lower cost. Health information technologies such as remote patient monitoring and e-rehabilitation are some of the technologies that are currently used for post-operative care resulting in better patient outcomes.

The competitive landscape of orthopedic devices market features continuous innovation and strategic efforts focused on product differentiation. R&D investments are being made toward the development of new implant types, biosorbing products, and revolutionary fixation devices in favor of modern surgical techniques. In addition, several industry players are forging strategic partnerships to expand their geographical reach through such moves as mergers, acquisitions, and distribution deals.

Orthopedic devices imply medical instruments designed for supporting, stabilizing, or enhancing the function of the musculoskeletal system that constitutes ligaments, bones, joints, and muscles. Orthopedic devices comprise fixation devices, joint implants, prosthetics, and braces that not only restore the lost functions but also provide enhanced benefits, alongside reducing the pain from joint, bone, or ligament disorders.

They are employed in spinal realignment, joint replacement, fixation of fractures and, in rehabilitation through the use of orthotic appliances and braces.

The most commonly used orthopedic devices are the joint replacement implants like the ones used in knee, hip, and shoulder replacement surgeries. The design of these implants resembles that of natural joints, thereby providing notable relief from severe pain and restoring the ability of patients to perform daily activities. On the similar grounds, trauma fixation devices like screws, plates, and rods are enabling fracture repair by realigning the fractured bones and promoting natural healing.

Additionally, a range of spinal devices does offer non-surgical treatment options for scoliosis, degenerative spinal disorders, and herniated discs. The diverse category comprises spinal fusion devices, dynamic stabilization tools, and interbody cages, which restore proper spinal alignment.

Recent advancements in biomaterials has significantly improved the key aspects of orthopaedic devices such as longevity, biocompatibility, and integration capabilities, thereby reducing the chances of occurrence of complications.

The design of prosthetic limbs is such that they closely resemble the natural limbs, both - in terms of movement and form. In addition, they consist of the use of modern materials and the inclusion of sensors that allow for greater adaptability.

| Attribute | Detail |

|---|---|

| Orthopedic Devices Market Drivers |

|

The increased geriatric population is one of the key drivers to orthopedic devices market, as the aging population is more prone to musculoskeletal disorders such as osteoporosis, osteoarthritis, and degenerative spinal problems. Bones tend to lose their strength and joints their elasticity with age, and hence fracture fixation, joint replacement procedures, and spinal treatment become essential.

These demographic changes do provide a consistent need for fixation systems, prosthetics, and implants, which makes orthopedic solutions a priority in keeping the aged population mobile and independent.

As the life expectancy of the world is on the rise, the percentage of individuals aged 60 and above is growing rapidly in the developed economies and emerging economies. This demographic shift has resulted in a higher prevalence of degenerative joint diseases, hip fracture, and spinal conditions. As an outcome, the demand for orthopedic surgeries and rehabilitative assistance tools such as orthotics and braces are on the rise.

The aging population is driving a shift toward minimally-invasive orthopedic procedures, which are associated with shorter recovery times and reduced risks. Therefore, the concept of less intrusive solutions would be both - safer and more attractive.

Clinics, hospitals, medical device companies are actively responding to existing customer needs by expanding orthopedic departments and developing novel technologies inclusive of bioresorbable materials, lightweight implants, and customized solutions, which are specifically designed for geriatric patients.

A key factor driving transformative growth of the orthopedic devices market is the advancements in robotics and computer-assisted surgical technologies. Such innovations have improved the precision of surgery so that the surgeons are able to pre-plan as well as perform complex operations with improved accuracy. In the orthopedic procedures, robotic systems do offer real-time updates and minimize human error. This level of precision results in accurate alignment, superior implant placement, and improved patient outcomes.

Robotic-assisted surgeries also reduce recovery duration and risk of complications, benefiting patients undergoing orthopedics surgeries. By minimizing invasiveness, these platforms are able to cut down on blood loss during surgery, infection risk, and hospital stay duration. This helps to upgrade patient outcomes, makes it convenient for healthcare professionals to cut down on the cost of treatment and, optimizes resources utilization.

Complementing robotic technologies are the computer-assisted tools like navigation systems and digital imaging platforms, which facilitate tailored surgical plans. These tools gather and merge patient-specific data in order to come up with custom approaches that would make it possible for the implant to fit and be aligned without difficulty. Leveraging advanced visualization and preoperative modeling tools, surgeons can anticipate complications, leading to smoother operations as well as remarkable long-term outcomes.

Furthermore, orthopedic device developers are increasingly merging robotics and computer-assisted technologies for the redesigning of field of orthopedic devices. Implants and fixation systems that are being designed to ensure compatibility with the robotic systems, streamlining surgical integration.

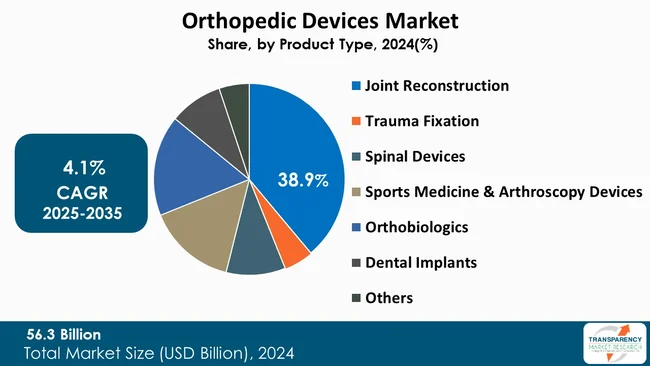

Joint reconstruction segment dominates the current orthopedic devices market. This is due to the global spread of joint disorders such as osteoarthritis and rheumatoid arthritis. Such pathologies are usually accompanied by strong pain and limited mobility, thereby leading to heightened need for surgery.

Technological improvements in implant material, product design, and minimally invasive surgical methods have largely contributed to joint reconstruction surgery's success. The segment is continuously consolidating its position as the leader of the orthopedic devices market due to the growing patient knowledge, the increased number of procedures, and the availability of tailor-made, long-lasting implants.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest orthopedic devices industry analysis, North America captured majority market share in 2024, with an estimated market share of 46.2%. This is attributed to the region’s well-established healthcare infrastructure, higher healthcare expenditure, and broad application of advanced medical technologies. The incidence of orthopedic disorders such as osteoporosis, arthritis, and injuries related to sports is quite high in the region, thereby leading to higher demand for surgical instruments, spinal implants, and trauma fixation devices. The reimbursement measures that motivate healthcare providers also play a significant role in maintaining accessibility to patients for orthopedic procedures.

Besides, North America is also endowed with a solid research facility base, well-qualified surgeons, and continuous technological progress. The region's early acceptance of complex surgical procedures like minimally invasive and robotic surgery makes it a front-runner in the use and development of orthopedic instruments.

Companies operating in the orthopedic devices market direct their attention toward innovating their product portfolios, embracing futuristic biomaterials, and facilitating the technical compatibility of their devices with robotic-assisted platforms.

Stryker, Johnson & Johnson, Zimmer Biomet, Medtronic, Smith+Nephew, Enovis Corporation, NuVasive, Inc., Globus Medical, Orthofix Medical Inc., Össur, Arthrex, Inc., Ottobock, Exactech, Inc., MicroPort Scientific Corporation, and CONMED Corporation are some of the leading players operating in the global market.

Each of these players has been profiled in the orthopedic devices industry research report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 56.3 Bn |

| Forecast Value in 2035 | US$ 87.6 Bn |

| CAGR | 4.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Orthopedic Devices Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global orthopedic devices market was valued at US$ 56.3 Bn in 2024

The global orthopedic devices industry is projected to reach more than US$ 87.6 Bn by the end of 2035

Growing global aging population, increasing prevalence of musculoskeletal conditions like osteoarthritis and osteoporosis, rising incidence of sports-related and traumatic injuries, and significant technological advancements leading to more effective, minimally invasive procedures are some of the factors driving the expansion of orthopedic devices market.

The CAGR is anticipated to be 4.1% from 2025 to 2035

Stryker, Johnson & Johnson, Zimmer Biomet, Medtronic, Smith+Nephew, Enovis Corporation, NuVasive, Inc., Globus Medical, Orthofix Medical Inc., Össur, Arthrex, Inc., Ottobock, Exactech, Inc., MicroPort Scientific Corporation, and CONMED Corporation

Table 01: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Joint Reconstruction, 2020 to 2035

Table 03: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Trauma Fixation, 2020 to 2035

Table 04: Global Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Devices, 2020 to 2035

Table 05: Global Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Fusion Devices, 2020 to 2035

Table 06: Global Orthopedic Devices Market Value (US$ Bn) Forecast, Vertebral Compression Fracture (VCF) Devices, 2020 to 2035

Table 07: Global Orthopedic Devices Market Value (US$ Bn) Forecast, Motion Preservation Devices/Non-Fusion Devices, 2020 to 2035

Table 08: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Sports Medicine & Arthroscopy Devices, 2020 to 2035

Table 09: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Orthobiologics, 2020 to 2035

Table 10: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Anatomy, 2020 to 2035

Table 11: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 13: Global Orthopedic Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 14: North America Orthopedic Devices Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 15: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 16: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Joint Reconstruction, 2020 to 2035

Table 17: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Trauma Fixation, 2020 to 2035

Table 18: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Spinal Devices, 2020 to 2035

Table 19: North America Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Fusion Devices, 2020 to 2035

Table 20: North America Orthopedic Devices Market Value (US$ Bn) Forecast, Vertebral Compression Fracture (VCF) Devices, 2020 to 2035

Table 21: North America Orthopedic Devices Market Value (US$ Bn) Forecast, Motion Preservation Devices/Non-Fusion Devices, 2020 to 2035

Table 22: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Sports Medicine & Arthroscopy Devices, 2020 to 2035

Table 23: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Orthobiologics, 2020 to 2035

Table 24: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Anatomy, 2020 to 2035

Table 25: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 26: North America Orthopedic Devices Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 27: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 28: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 29: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Joint Reconstruction, 2020 to 2035

Table 30: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Trauma Fixation, 2020 to 2035

Table 31: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Spinal Devices, 2020 to 2035

Table 32: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Fusion Devices, 2020 to 2035

Table 33: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, Vertebral Compression Fracture (VCF) Devices, 2020 to 2035

Table 34: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, Motion Preservation Devices/Non-Fusion Devices, 2020 to 2035

Table 35: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Sports Medicine & Arthroscopy Devices, 2020 to 2035

Table 36: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Orthobiologics, 2020 to 2035

Table 37: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Anatomy, 2020 to 2035

Table 38: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 39: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 40: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 41: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 42: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Joint Reconstruction, 2020 to 2035

Table 43: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Trauma Fixation, 2020 to 2035

Table 44: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Spinal Devices, 2020 to 2035

Table 45: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Fusion Devices, 2020 to 2035

Table 46: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, Vertebral Compression Fracture (VCF) Devices, 2020 to 2035

Table 47: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, Motion Preservation Devices/Non-Fusion Devices, 2020 to 2035

Table 48: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Sports Medicine & Arthroscopy Devices, 2020 to 2035

Table 49: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Orthobiologics, 2020 to 2035

Table 50: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Anatomy, 2020 to 2035

Table 51: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 52: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 53: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 54: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 55: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Joint Reconstruction, 2020 to 2035

Table 56: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Trauma Fixation, 2020 to 2035

Table 57: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Spinal Devices, 2020 to 2035

Table 58: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Fusion Devices, 2020 to 2035

Table 59: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, Vertebral Compression Fracture (VCF) Devices, 2020 to 2035

Table 60: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, Motion Preservation Devices/Non-Fusion Devices, 2020 to 2035

Table 61: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Sports Medicine & Arthroscopy Devices, 2020 to 2035

Table 62: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Orthobiologics, 2020 to 2035

Table 63: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Anatomy, 2020 to 2035

Table 64: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 65: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 66: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 67: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 68: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Joint Reconstruction, 2020 to 2035

Table 69: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Trauma Fixation, 2020 to 2035

Table 70: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Spinal Devices, 2020 to 2035

Table 71: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, Spinal Fusion Devices, 2020 to 2035

Table 72: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, Vertebral Compression Fracture (VCF) Devices, 2020 to 2035

Table 73: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, Motion Preservation Devices/Non-Fusion Devices, 2020 to 2035

Table 74: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Sports Medicine & Arthroscopy Devices, 2020 to 2035

Table 75: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Orthobiologics, 2020 to 2035

Table 76: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Anatomy, 2020 to 2035

Table 77: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 78: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Figure 01: Global Orthopedic Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Orthopedic Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Orthopedic Devices Market Revenue (US$ Bn), by Joint Reconstruction, 2020 to 2035

Figure 04: Global Orthopedic Devices Market Revenue (US$ Bn), by Trauma Fixation, 2020 to 2035

Figure 05: Global Orthopedic Devices Market Revenue (US$ Bn), by Spinal Devices, 2020 to 2035

Figure 06: Global Orthopedic Devices Market Revenue (US$ Bn), by Sports Medicine & Arthroscopy Devices, 2020 to 2035

Figure 07: Global Orthopedic Devices Market Revenue (US$ Bn), by Orthobiologics, 2020 to 2035

Figure 08: Global Orthopedic Devices Market Revenue (US$ Bn), by Dental Implants, 2020 to 2035

Figure 09: Global Orthopedic Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Orthopedic Devices Market Value Share Analysis, By Anatomy, 2024 and 2035

Figure 11: Global Orthopedic Devices Market Attractiveness Analysis, By Anatomy, 2025 to 2035

Figure 12: Global Orthopedic Devices Market Revenue (US$ Bn), by Upper Extremity, 2020 to 2035

Figure 13: Global Orthopedic Devices Market Revenue (US$ Bn), by Lower Extremity, 2020 to 2035

Figure 14: Global Orthopedic Devices Market Revenue (US$ Bn), by Spine, 2020 to 2035

Figure 15: Global Orthopedic Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 16: Global Orthopedic Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 17: Global Orthopedic Devices Market Revenue (US$ Bn), by Open Surgery, 2020 to 2035

Figure 18: Global Orthopedic Devices Market Revenue (US$ Bn), by Minimally Invasive / Arthroscopy, 2020 to 2035

Figure 19: Global Orthopedic Devices Market Revenue (US$ Bn), by Robotic- and Navigation-assisted Surgery, 2020 to 2035

Figure 20: Global Orthopedic Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Orthopedic Devices Market Value Share Analysis, By End-User, 2024 and 2035

Figure 22: Global Orthopedic Devices Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 23: Global Orthopedic Devices Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 24: Global Orthopedic Devices Market Revenue (US$ Bn), by Orthopedic Clinics, 2020 to 2035

Figure 25: Global Orthopedic Devices Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 26: Global Orthopedic Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Orthopedic Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 28: Global Orthopedic Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 29: North America Orthopedic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: North America Orthopedic Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 31: North America Orthopedic Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 32: North America Orthopedic Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 33: North America Orthopedic Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 34: North America Orthopedic Devices Market Value Share Analysis, By Anatomy, 2024 and 2035

Figure 35: North America Orthopedic Devices Market Attractiveness Analysis, By Anatomy, 2025 to 2035

Figure 36: North America Orthopedic Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: North America Orthopedic Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: North America Orthopedic Devices Market Value Share Analysis, By End-User, 2024 and 2035

Figure 39: North America Orthopedic Devices Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 40: Europe Orthopedic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Europe Orthopedic Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Europe Orthopedic Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Europe Orthopedic Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 44: Europe Orthopedic Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 45: Europe Orthopedic Devices Market Value Share Analysis, By Anatomy, 2024 and 2035

Figure 46: Europe Orthopedic Devices Market Attractiveness Analysis, By Anatomy, 2025 to 2035

Figure 47: Europe Orthopedic Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 48: Europe Orthopedic Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 49: Europe Orthopedic Devices Market Value Share Analysis, By End-User, 2024 and 2035

Figure 50: Europe Orthopedic Devices Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 51: Asia Pacific Orthopedic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Asia Pacific Orthopedic Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 53: Asia Pacific Orthopedic Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 54: Asia Pacific Orthopedic Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 55: Asia Pacific Orthopedic Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 56: Asia Pacific Orthopedic Devices Market Value Share Analysis, By Anatomy, 2024 and 2035

Figure 57: Asia Pacific Orthopedic Devices Market Attractiveness Analysis, By Anatomy, 2025 to 2035

Figure 58: Asia Pacific Orthopedic Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 59: Asia Pacific Orthopedic Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 60: Asia Pacific Orthopedic Devices Market Value Share Analysis, By End-User, 2024 and 2035

Figure 61: Asia Pacific Orthopedic Devices Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 62: Latin America Orthopedic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: Latin America Orthopedic Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 64: Latin America Orthopedic Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 65: Latin America Orthopedic Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 66: Latin America Orthopedic Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 67: Latin America Orthopedic Devices Market Value Share Analysis, By Anatomy, 2024 and 2035

Figure 68: Latin America Orthopedic Devices Market Attractiveness Analysis, By Anatomy, 2025 to 2035

Figure 69: Latin America Orthopedic Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 70: Latin America Orthopedic Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 71: Latin America Orthopedic Devices Market Value Share Analysis, By End-User, 2024 and 2035

Figure 72: Latin America Orthopedic Devices Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 73: Middle East & Africa Orthopedic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 74: Middle East & Africa Orthopedic Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Middle East & Africa Orthopedic Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 76: Middle East & Africa Orthopedic Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 77: Middle East & Africa Orthopedic Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 78: Middle East & Africa Orthopedic Devices Market Value Share Analysis, By Anatomy, 2024 and 2035

Figure 79: Middle East & Africa Orthopedic Devices Market Attractiveness Analysis, By Anatomy, 2025 to 2035

Figure 80: Middle East & Africa Orthopedic Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 81: Middle East & Africa Orthopedic Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 82: Middle East & Africa Orthopedic Devices Market Value Share Analysis, By End-User, 2024 and 2035

Figure 83: Middle East & Africa Orthopedic Devices Market Attractiveness Analysis, By End-User, 2025 to 2035