Reports

Reports

The growth of the oral thin films market is substantial and driven by the alignment between patient-oriented innovations and the innovations in drug delivery technologies. One of the key market drivers is convenience as well as the ease of use of these films - which are especially advantageous to those patients who have difficulties swallowing pills.

The rapid dissolution in the mouth initiates absorption much more quickly, which again allows for rapid therapeutic effect, particularly useful in acute conditions. The increasing prevalence of chronic disease has also raised demand for more efficacious and compliant drug delivery systems with less invasiveness. Patients want less invasive methods of administration, such as the oral thin film over injections.

.webp)

Improvements in formulation and manufacturing technology have also increased the effectiveness and stability of such products, and their usage has been extended to a range of therapeutic treatments, such as pain management and anti-nausea therapy. Support from regulatory agencies has also facilitated the promotion of new drug delivery systems for generating activity and marketing oral thin films.

The latest trends in the oral thin films industry reflect a dynamic movement toward personalization and functionality in drug delivery systems. The most promising trend is the greater application of bioactive ingredients including herbal extracts and vitamins in oral thin films to meet consumers' demand for natural and holistic healthcare.

Also, polymer technology has advanced to the point where films are now feasible that have the ability to encapsulate an assortment of active pharmaceutical ingredients (APIs) (that are either difficult to solubilize or need to be dose precisely).

Moreover, the direct-to-consumer and e-Commerce models are disrupting how these products are marketed and distributed, which can be made more affordable to the patients. The trend is supported by increased online health education and awareness, thereby allowing consumers to be responsible for their treatment choices through informed decision-making. In addition, partnerships between drug companies and tech companies are fueling breakthrough technologies like smart films that will be able to give immediate feedback on drug adherence.

Oral thin films are innovative drug delivery systems intended to facilitate taking medication in the form of highly thin strips dissolving quickly in the mouth. Administered either buccally or sublingually, they are directly absorbed into the bloodstream.

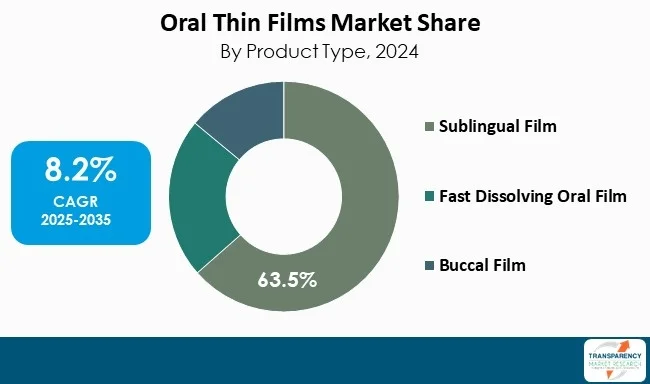

Sublingual films are a type of oral thin films that are placed under the tongue to disintegrate and get absorbed into the systemic circulation within a very short period. This route of administration is utilized for quick action drugs, such as an analgesic or an emergency drug like nitroglycerin.

Fast dissolving films are designed to disintegrate fast without the use of water, making them suitable for dysphagia patients. Fast dissolving oral films are frequently used for over-the-counter medications, vitamins, or supplements.

On the other hand, buccal films are placed between the gum and cheek and generate a prolonged-in-situ effect and enable prolonged release and uptake across the buccal mucosa. This is a helpful technique for drugs that must be delivered slowly over the course of time, like certain hormone replacement drugs or drugs for chronic illness.

Thin oral films have significant application with a variety of therapeutic uses, and have so far proven to be a useful drug dosage form in modern medicine. The most visible use has been in the area of analgesia, wherein the films can deliver analgesics rapidly to induce rapid relief. They are also suitably used for anti-emetics, especially in motion sickness or chemotherapy-induced nausea patients, to elicit speedy relief without swallowing. Moreover, oral thin films are effective delivery vehicles for vitamins, supplements, and the other over-the-counter drugs, which are of interest to consumers in terms of convenience and ease of use.

| Attribute | Detail |

|---|---|

| Oral Thin Films Market Drivers |

|

Convenience and ease of handling are some of the major drivers to the oral thin films market, modifying the swallowing and ingestion process of drugs. Conventional dosage forms such as tablets and capsules at times require water intake to swallow them, which is an issue for specific segments of patients such as children, elderly patients, and individuals with dysphagia or the other impaired swallowing conditions.

Oral thin films circumvent such limitations by offering a convenient option that rapidly dissolves in the mouth without the assistance of extra fluid. Such a factor serves to improve compliance with medication, as patients are more likely to comply with treatment where administration is easy and convenient.

Oral thin films are practical for patients as they are not only easy to use, but have the portable and discreet design that works well with everyday lives. Patients can conveniently store the oral films in their pockets or bags and then take their medication anytime. The flexibility of oral films could be beneficial for patients having chronic conditions, requiring taking the dosage numerous times a day.

Moreover, the fast dissolving ability of oral thin films in the mouth supports quicker onset of action for patients. This is especially important for drugs that offer immediate relief, such as anti-nausea and analgesic medications. The fast absorption of these films increases the potential for an effective dose of drug, improves the patient experience and satisfaction, and solidifies the impression of convenience.

Convenience can be viewed in another sense with oral thin films in that they are able to accommodate a range of active pharmaceutical ingredients (APIs) and flavors. This versatility provides companies with the opportunity of creating customizable products for patients with varying preferences and needs, including the ones who are sensitive to bitter-tasting medicines. Oral thin films can make the therapeutic experience more pleasant by improving acceptability of a medication and potentially enhancing adherence.

The increasing need for patient-specific delivery systems of medications is a primary force in propelling the oral thin films market, as part of the overall trend in healthcare toward personalized and convenient treatment. As more number of healthcare providers see value in treatments being customized to the individualized needs and desires of an individual patient, oral thin films have become a compelling choice that maximizes both - the efficacy of medication and the improve the experience of medication administration.

It is motivated by multiple factors, including higher incidence of chronic disease, the need for improved medication adherence, and escalating patient expectations of the therapy.

One of the major reasons why drug delivery systems have seen a shift is the sudden rise in incidences of chronic diseases such as diabetes, high blood pressure, and mental illnesses. Patients who experience these conditions can be put on long-term medication regimens, which can lead to treatment fatigue making them non-compliant. Oral thin films can help resolve this problem with an easy and convenient way as compared to traditional dosage forms. Oral thin films dissolve in the mouth without needing water, and therefore does not complicate the processes of administration. Oral thin films are particularly easy for swallowing impaired patients or those who are on the go.

Moreover, patient-centric drug delivery systems emphasize the importance of enhancing the overall treatment experience. There are many active pharmaceutical ingredients and flavorings oral thin films can be formulated with, which provide drug manufacturers with the option of making their product distinctive to the patient. Customization optimizes taste and guarantees compliance by providing patients with something to take that is easy and comfortable to swallow.

Sublingual film has a dominant market position of leading oral thin films worldwide. This can be attributed to quick dissolution and direct sublingual absorption into the bloodstream, which provides faster therapeutic responses than the conventional oral preparations. This is especially convenient for those drugs that need speedy action, i.e., analgesics as well as rescue relief medication like nitroglycerin.

Furthermore, the ease of administration makes sublingual films particularly appealing, especially for pill-swallowing-resistant patients like aged and children. The films make it easier to swallow the medication, resulting in improved compliance in patients and that is a big factor in drugs that have long dosing requirements.

| Attribute | Detail |

|---|---|

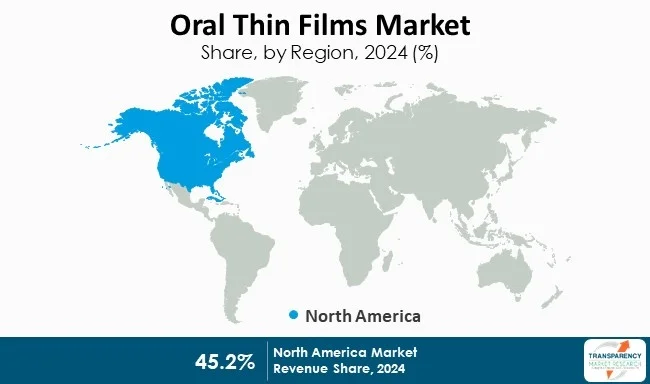

| Leading Region | North America |

As per the latest oral thin films market analysis, North America dominated in the market in 2024. The region has a well-developed healthcare infrastructure and high investment in research and development, and this drives drug delivery system innovation. The system enables the development of innovative oral thin films to address different areas of therapeutic needs. Moreover, the high incidence of chronic diseases like cardiovascular disease and diabetes creates strong demand for effective and convenient drug delivery, hence favoring oral thin films industry.

In addition, greater focus on patient-centered care has fueled the movement towards friendly and less invasive drug-delivery forms such as oral thin films. The regulatory environment in the region also facilitates quick approval and availability of new drugs and hence supports growth in the market.

Several players operating in the oral thin films industry are heavily investing in R&D to create new formulations and increase the efficacy of oral thin films. This includes designing new active pharmaceutical ingredients (APIs) and film characteristics to achieve better stability and absorption.

Aquestive Therapeutics, Inc., ARx, LLC, ZIM LABORATORIES LIMITED, LTS Lohmann Therapie-Systeme AG, Nova Thin Film Pharmaceuticals LLC, Corium Innovations, Inc., CD Formulation, Viatris Inc., C.L. Pharm, Cure Pharmaceutical, Indivior plc, DK Livkon Pvt. LTD., NAL Pharma, Shilpa Therapeutics Pvt. Ltd. and Flagship Biotech International Pvt. Ltd. are some of the leading players operating in the global oral thin films market.

Each of these players has been profiled in the market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 3.8 Bn |

| Forecast Value in 2035 | US$ 9.0 Bn |

| CAGR | 8.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global oral thin films market was valued at US$ 3.8 Bn in 2024.

The global oral thin films industry is projected to reach more than US$ 9.0 Bn by the end of 2035.

Convenience and ease of use of oral thin films, rapid dissolution of film leading to faster absorption, and growing demand for patient-centric drug delivery systems are the factors driving the expansion of oral thin films market.

The CAGR is anticipated to be 8.2% from 2025 to 2035.

Aquestive Therapeutics, Inc., ARx, LLC., ZIM LABORATORIES LIMITED, LTS Lohmann Therapie-Systeme AG, Nova Thin Film Pharmaceuticals LLC, Corium Innovations, Inc., CD Formulation, Viatris Inc., C.L. Pharm, Cure Pharmaceutical, Indivior plc, DK Livkon Pvt. LTD., NAL Pharma, Shilpa Therapeutics Pvt. Ltd., and Flagship Biotech International Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Oral Thin Films Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Oral Thin Films Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Healthcare Expenditure across Key Regions/Countries

5.2. Recent Technological Advancements in Oral Thin Films Industry

5.3. Pricing Trends for Oral Thin Films

5.4. Regulatory Scenario across Key Regions/Countries

5.5. PORTER’s Five Forces Analysis

5.6. PESTEL Analysis

5.7. Value Chain Analysis

5.8. Key Purchase Metrics for End-users

5.9. Go-to-Market Strategy for New Market Entrants

5.10. Key Industry Events (Partnerships, Collaborations, Product approvals, mergers & acquisitions)

5.11. Benchmarking of Key Products Offered by the Leading Competitors

6. Global Oral Thin Films Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Sublingual Film

6.3.2. Fast Dissolving Oral Film

6.3.3. Buccal Film

6.4. Market Attractiveness By Product Type

7. Global Oral Thin Films Market Analysis and Forecasts, By Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Indication, 2020 to 2035

7.3.1. Pain Management

7.3.2. Neurological Disorders

7.3.3. Nausea & Vomiting

7.3.4. Opioid Dependence

7.3.5. Others

7.4. Market Attractiveness By Indication

8. Global Oral Thin Films Market Analysis and Forecasts, By Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Distribution Channel, 2020 to 2035

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness By Distribution Channel

9. Global Oral Thin Films Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Oral Thin Films Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Sublingual Film

10.2.2. Fast Dissolving Oral Film

10.2.3. Buccal Film

10.3. Market Value Forecast By Indication, 2020 to 2035

10.3.1. Pain Management

10.3.2. Neurological Disorders

10.3.3. Nausea & Vomiting

10.3.4. Opioid Dependence

10.3.5. Others

10.4. Market Value Forecast By Distribution Channel, 2020 to 2035

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Indication

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Oral Thin Films Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Sublingual Film

11.2.2. Fast Dissolving Oral Film

11.2.3. Buccal Film

11.3. Market Value Forecast By Indication, 2020 to 2035

11.3.1. Pain Management

11.3.2. Neurological Disorders

11.3.3. Nausea & Vomiting

11.3.4. Opioid Dependence

11.3.5. Others

11.4. Market Value Forecast By Distribution Channel, 2020 to 2035

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Indication

11.6.3. By Distribution Channel

11.6.4. By Country / Sub-region

12. Asia Pacific Oral Thin Films Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Sublingual Film

12.2.2. Fast Dissolving Oral Film

12.2.3. Buccal Film

12.3. Market Value Forecast By Indication, 2020 to 2035

12.3.1. Pain Management

12.3.2. Neurological Disorders

12.3.3. Nausea & Vomiting

12.3.4. Opioid Dependence

12.3.5. Others

12.4. Market Value Forecast By Distribution Channel, 2020 to 2035

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Indication

12.6.3. By Distribution Channel

12.6.4. By Country / Sub-region

13. Latin America Oral Thin Films Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Sublingual Film

13.2.2. Fast Dissolving Oral Film

13.2.3. Buccal Film

13.3. Market Value Forecast By Indication, 2020 to 2035

13.3.1. Pain Management

13.3.2. Neurological Disorders

13.3.3. Nausea & Vomiting

13.3.4. Opioid Dependence

13.3.5. Others

13.4. Market Value Forecast By Distribution Channel, 2020 to 2035

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Indication

13.6.3. By Distribution Channel

13.6.4. By Country / Sub-region

14. Middle East & Africa Oral Thin Films Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Sublingual Film

14.2.2. Fast Dissolving Oral Film

14.2.3. Buccal Film

14.3. Market Value Forecast By Indication, 2020 to 2035

14.3.1. Pain Management

14.3.2. Neurological Disorders

14.3.3. Nausea & Vomiting

14.3.4. Opioid Dependence

14.3.5. Others

14.4. Market Value Forecast By Distribution Channel, 2020 to 2035

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Indication

14.6.3. By Distribution Channel

14.6.4. By Country / Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Aquestive Therapeutics, Inc.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. ARx, LLC.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. ZIM LABORATORIES LIMITED

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. LTS Lohmann Therapie-Systeme AG

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Nova Thin Film Pharmaceuticals LLC

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Corium Innovations, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. CD Formulation

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Viatris Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. C.L. Pharm

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Cure Pharmaceutical

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Indivior plc

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. DK Livkon Pvt. LTD.

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. NAL Pharma

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Shilpa Therapeutics Pvt. Ltd.

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Flagship Biotech International Pvt. Ltd.

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Oral Thin Films Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Oral Thin Films Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 03: Global Oral Thin Films Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 04: Global Oral Thin Films Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America - Oral Thin Films Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America - Oral Thin Films Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 07: North America - Oral Thin Films Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 08: North America - Oral Thin Films Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 09: Europe - Oral Thin Films Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 10: Europe - Oral Thin Films Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 11: Europe - Oral Thin Films Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 12: Europe - Oral Thin Films Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 13: Asia Pacific - Oral Thin Films Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Asia Pacific - Oral Thin Films Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: Asia Pacific - Oral Thin Films Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 16: Asia Pacific - Oral Thin Films Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 17: Latin America - Oral Thin Films Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Latin America - Oral Thin Films Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 19: Latin America - Oral Thin Films Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 20: Latin America - Oral Thin Films Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 21: Middle East & Africa - Oral Thin Films Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Middle East & Africa - Oral Thin Films Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Middle East & Africa - Oral Thin Films Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 24: Middle East & Africa - Oral Thin Films Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Oral Thin Films Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Oral Thin Films Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Oral Thin Films Market Revenue (US$ Bn), by Sublingual Film, 2020 to 2035

Figure 04: Global Oral Thin Films Market Revenue (US$ Bn), by Fast Dissolving Oral Film, 2020 to 2035

Figure 05: Global Oral Thin Films Market Revenue (US$ Bn), by Buccal Film, 2020 to 2035

Figure 06: Global Oral Thin Films Market Value Share Analysis, By Indication, 2024 and 2035

Figure 07: Global Oral Thin Films Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 08: Global Oral Thin Films Market Revenue (US$ Bn), by Pain Management, 2020 to 2035

Figure 09: Global Oral Thin Films Market Revenue (US$ Bn), by Neurological Disorders, 2020 to 2035

Figure 10: Global Oral Thin Films Market Revenue (US$ Bn), by Nausea & Vomiting, 2020 to 2035

Figure 11: Global Oral Thin Films Market Revenue (US$ Bn), by Opioid Dependence, 2020 to 2035

Figure 12: Global Oral Thin Films Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Oral Thin Films Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 14: Global Oral Thin Films Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 15: Global Oral Thin Films Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 16: Global Oral Thin Films Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 17: Global Oral Thin Films Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 18: Global Oral Thin Films Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global Oral Thin Films Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America - Oral Thin Films Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America - Oral Thin Films Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America - Oral Thin Films Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America - Oral Thin Films Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 24: North America - Oral Thin Films Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 25: North America - Oral Thin Films Market Value Share Analysis, By Indication, 2024 and 2035

Figure 26: North America - Oral Thin Films Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 27: North America - Oral Thin Films Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 28: North America - Oral Thin Films Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 29: Europe - Oral Thin Films Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe - Oral Thin Films Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 31: Europe - Oral Thin Films Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 32: Europe - Oral Thin Films Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 33: Europe - Oral Thin Films Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 34: Europe - Oral Thin Films Market Value Share Analysis, By Indication, 2024 and 2035

Figure 35: Europe - Oral Thin Films Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 36: Europe - Oral Thin Films Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 37: Europe - Oral Thin Films Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 38: Asia Pacific - Oral Thin Films Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific - Oral Thin Films Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Asia Pacific - Oral Thin Films Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Asia Pacific - Oral Thin Films Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 42: Asia Pacific - Oral Thin Films Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 43: Asia Pacific - Oral Thin Films Market Value Share Analysis, By Indication, 2024 and 2035

Figure 44: Asia Pacific - Oral Thin Films Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 45: Asia Pacific - Oral Thin Films Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 46: Asia Pacific - Oral Thin Films Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 47: Latin America - Oral Thin Films Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America - Oral Thin Films Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 49: Latin America - Oral Thin Films Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 50: Latin America - Oral Thin Films Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 51: Latin America - Oral Thin Films Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 52: Latin America - Oral Thin Films Market Value Share Analysis, By Indication, 2024 and 2035

Figure 53: Latin America - Oral Thin Films Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 54: Latin America - Oral Thin Films Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 55: Latin America - Oral Thin Films Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 56: Middle East & Africa - Oral Thin Films Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Middle East & Africa - Oral Thin Films Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Middle East & Africa - Oral Thin Films Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Middle East & Africa - Oral Thin Films Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 60: Middle East & Africa - Oral Thin Films Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 61: Middle East & Africa - Oral Thin Films Market Value Share Analysis, By Indication, 2024 and 2035

Figure 62: Middle East & Africa - Oral Thin Films Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 63: Middle East & Africa - Oral Thin Films Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 64: Middle East & Africa - Oral Thin Films Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035