Reports

Reports

The energy sector around the world is witnessing a significant transformation due to advancements in technology, evolving regulations, and shift toward sustainability. The oil & gas sector in particular is also undergoing notable changes in terms of how onshore as well as offshore applications are carried out. The need to modernize cable systems and communication infrastructure in the oil & gas sector has played an important role in inflating the demand for oil & gas downhole cables in recent years. Oil & gas companies are continually finding new ways to smoothen drilling, communications, and other applications. Companies in the oil & gas sector are increasingly leveraging automation/control architecture, IPTV/CCTV/CATV networks, and other advanced systems for an array of applications.

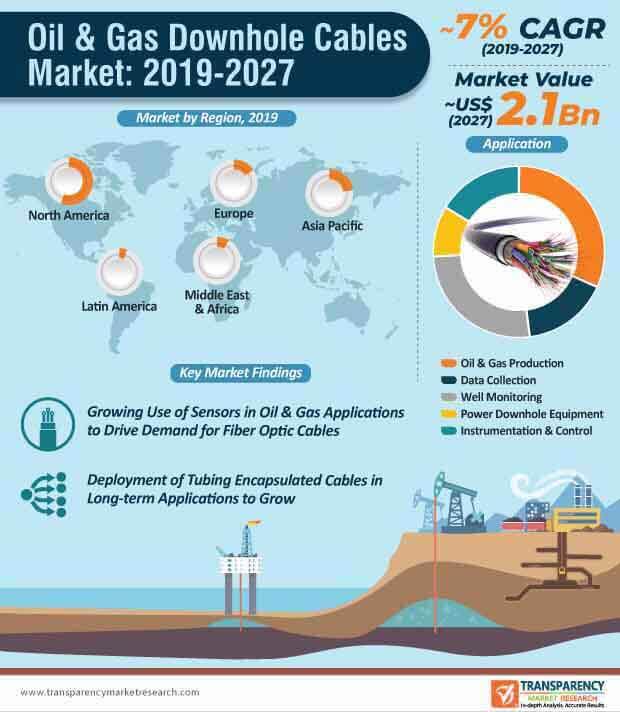

For several decades in the past, the oil & gas industry is finding new solutions that withstand hostile conditions and provide an efficient end-to-end communication. Stakeholders in the oil & gas downhole cables market are primarily focusing on improving quality, reliability, and data integrity of their products to meet the requirement of end users. In addition, participants in the oil & gas downhole cables market are also inclined toward reducing the weight and improving the overall flexibility of their cables. The significant growth in the production of unconventional oil & gas, discovery of new oil & gas fields, and advancements in technology are some of the major factors that are expected to drive the global oil & gas downhole cables market past ~US$ 2.1 Bn mark by the end of 2027.

The demand for tubing encapsulated cables is projected to remain higher than that of fiber optic cables during the forecast period. Tubing encapsulated cables are extensively being used across the global oil & gas sector worldwide for a range of applications, including monitoring the pressure, temperature, and multiple other parameters in oil wells. In addition, tubing encapsulated cables are primarily deployed in long-term applications wherein durability is critical. In the current scenario, tubing encapsulated cables made from polypropylene have gained a significant amount of popularity due to the exceptional survivability of the cable. Stakeholders in the oil & gas downhole cables market are more inclined toward the production of round encapsulated cables in comparison to the square counterpart to reduce weight and wastage of raw materials. Participants in the oil & gas downhole cables market are also expected to focus on an array of other parameters, including crush strength, dynamic friction, cross-sectional twisting, and deployment & retrieval, among others.

While the demand for tubing encapsulated cables is set to witness healthy growth during the forecast period, the demand for fiber optic cables is set to grow at a faster pace. Deployment of fiber optic cables across the oil & gas industry has gained significant momentum in the past few years and the trend is set to continue over the course of the forecast period. Stakeholders in the current market landscape are increasingly offering customized fiber optic cables to fulfill specific applications of end users. The deployment of fiber optic cables is witnessing a considerable surge, particularly for application in hostile environmental and working conditions.

Moreover, oil & gas companies are inclining toward the use of fiber optic cables in oil wells and pipelines for various applications, including temperature sensing and strain sensing. Stakeholders are also focusing on improving the physical and functional aspects of their products for deployment in corrosive, high pressure, high-temperature environments. The ascending demand for sensors in the oil & gas industry has played an important role in increasing the demand for oil & gas downhole cables such as fiber optic cables. The different types of sensors, including distributed strain sensors, distributed acoustic sensors, distributed pressure sensors, distributed temperature sensors, and ocean bottom seismic make use of fiber optic cables. In addition, increasing number of oil & gas companies are inclined toward leveraging the benefits of optic installation to enhance their operational performance and accuracy.

Analysts’ Viewpoint

The global oil & gas downhole cables market is expected to grow at a CAGR of ~7% during the forecast period. The booming oil & gas sector, discovery of new oil & gas wells, and rise in the overall production of oil & gas are some of the leading factors that are anticipated to propel the growth of the oil & gas downhole cables market. In addition, the growing usage of cables in the oil & gas sector, which require high-quality, durable, and high-performing cables will further influence the demand for oil & gas downhole cables during the forecast period. Moreover, advancements in sensor technology have opened up new avenues for stakeholders in the oil & gas downhole cables market landscape due to which, the demand for fiber optic cables will witness healthy growth.

Oil & Gas Downhole Cables Market: Overview

Rise in Unconventional Oil and Gas Production to Drive Oil & Gas Downhole Cables Market

Volatility in Prices of Crude Oil Likely to Hamper Oil & Gas Downhole Cables Market

Rise in Deep-water and Ultra-deep-water Activities across Globe to Provide Opportunities to Oil & Gas Downhole Cables Market

Recent Developments, Expansions, Acquisitions, and New Contracts in Oil & Gas Downhole Cables Market

North America to be a Highly Lucrative Region of Oil & Gas Downhole Cables Market

Oil & Gas Downhole Cables Market is Highly Competitive

Oil & Gas Downhole Cables Market is expected to reach US$ 2.1 Bn By 2027

Oil & Gas Downhole Cables Market is estimated to rise at a CAGR of 7% during forecast period

Increase in discovery of oil and gas fields/wells/blocks is boosting the global oil & gas downhole cables market

North America is more attractive region for vendors in the Oil & Gas Downhole Cables Market

Prominent players operating in the global oil & gas downhole cables market include Prysmian Group, ElandCables, Nexans Group, NKT A/S, ABB Ltd., Marmon Group, GalaxyWire.com, W. L. Gore & Associates, Inc., Belden Inc., LS Cable & System Ltd., AFL, ZTT, Tratos, and TEXCAN Division of Sonepar Canada Inc.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary: Global Oil & Gas Downhole Cables Market

3.1. Market Snapshot

3.2. Top Three Trends

4. Market Overview

4.1. Product Overview

4.2. Key Market Developments

4.3. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1.1. Drivers

5.1.1.2. Restraints

5.1.1.3. Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Regulatory Scenario

5.4. Value Chain Analysis

5.5. Global Oil & Gas Downhole Cables Market: Pricing, by Region, 2018

6. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Analysis, by Type

6.1. Key Findings and Introduction

6.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

6.2.1. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Tubing Encapsulated Cables (TECs), 2018–2027

6.2.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Fiber Optic Cables, 2018–2027

6.2.3. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Others, 2018–2027

6.3. Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

7. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Analysis, by Installation

7.1. Key Findings and Introduction

7.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

7.2.1. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Onshore, 2018–2027

7.2.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Offshore, 2018–2027

7.3. Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

8. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Analysis, by Application

8.1. Key Findings and Introduction

8.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.2.1. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Oil & Gas Production, 2018–2027

8.2.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Data Collection, 2018–2027

8.2.3. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Well Monitoring, 2018–2027

8.2.4. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Power Downhole Equipment, 2018–2027

8.2.5. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Instrumentation & Control, 2018–2027

8.3. Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

9. Global Oil & Gas Downhole Cables Market Analysis, by Region

9.1. Key Findings

9.2. Global Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Region

10. North America Oil & Gas Downhole Cables Market Overview

10.1. Key Findings

10.2. Key Drivers of North America Market

10.3. North America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

10.4. North America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

10.5. North America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.6. North America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Country

10.6.1. U.S. Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

10.6.2. U.S. Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

10.6.3. U.S. Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.6.4. Canada Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

10.6.5. Canada Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

10.6.6. Canada Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.7. North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

10.8. North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

10.9. North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

10.10. North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country

11. Europe Oil & Gas Downhole Cables Market Overview

11.1. Key Findings

11.2. Key Drivers of Europe Market

11.3. Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

11.4. Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

11.5. Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.6. Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Country and Sub-region

11.6.1. U.K. Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

11.6.2. U.K. Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.6.3. U.K. Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.6.4. Norway Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

11.6.5. Norway Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

11.6.6. Norway Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.6.7. Russia & CIS Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

11.6.8. Russia & CIS Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

11.6.9. Russia & CIS Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.6.10. Rest of Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

11.6.11. Rest of Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

11.6.12. Rest of Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.7. Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

11.8. Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

11.9. Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

11.10. Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

12. Asia Pacific Oil & Gas Downhole Cables Market Overview

12.1. Key Findings

12.2. Key Drivers of Asia Pacific Market

12.3. Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

12.4. Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

12.5. Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.6. Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Country and Sub-region

12.6.1. China Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

12.6.2. China Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

12.6.3. China Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.6.4. India Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

12.6.5. India Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

12.6.6. India Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.6.7. ASEAN Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

12.6.8. ASEAN Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

12.6.9. ASEAN Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.6.10. Rest of Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

12.6.11. Rest of Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

12.6.12. Rest of Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.7. Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

12.8. Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

12.9. Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

12.10. Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

13. Latin America Oil & Gas Downhole Cables Market Overview

13.1. Key Findings

13.2. Key Drivers of Latin America Market

13.3. Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

13.4. Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

13.5. Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

13.6. Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Country and Sub-region

13.6.1. Brazil Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

13.6.2. Brazil Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

13.6.3. Brazil Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

13.6.4. Mexico Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

13.6.5. Mexico Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

13.6.6. Mexico Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

13.6.7. Venezuela Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

13.6.8. Venezuela Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

13.6.9. Venezuela Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

13.6.10. Rest of Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

13.6.11. Rest of Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

13.6.12. Rest of Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

13.7. Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

13.8. Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

13.9. Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

13.10. Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

14. Middle East & Africa Oil & Gas Downhole Cables Market Overview

14.1. Key Findings

14.2. Key Drivers of Middle East & Africa Market

14.3. Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

14.4. Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

14.5. Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.6. Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Country and Sub-region

14.6.1. Saudi Arabia Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

14.6.2. Saudi Arabia Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

14.6.3. Saudi Arabia Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.6.4. UAE Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

14.6.5. UAE Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

14.6.6. UAE Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.6.7. Qatar Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

14.6.8. Qatar Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

14.6.9. Qatar Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.6.10. Nigeria Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

14.6.11. Nigeria Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

14.6.12. Nigeria Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.6.13. Rest of Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Type, 2018–2027

14.6.14. Rest of Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Installation, 2018–2027

14.6.15. Rest of Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.7. Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

14.8. Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

14.9. Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

14.10. Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

15. Competition Landscape

15.1. Global Oil & Gas Downhole Cables Market Share Analysis, by Company (2018)

15.2. Competition Matrix

15.2.1. Prysmian Group

15.2.2. Nexans Group

15.2.3. ABB

15.2.4. Belden Inc.

15.2.5. W. L. Gore & Associates, Inc.

15.3. Market Footprint Analysis

15.4. Company Profiles

15.4.1. Prysmian Group

15.4.1.1. Company Details

15.4.1.2. Company Description

15.4.1.3. Business Overview

15.4.1.4. Financial Details

15.4.1.5. Strategic Overview/Recent Developments

15.4.2. Eland Cables

15.4.2.1. Company Details

15.4.2.2. Company Description

15.4.2.3. Business Overview

15.4.3. Nexans Group

15.4.3.1. Company Details

15.4.3.2. Company Description

15.4.3.3. Business Overview

15.4.3.4. Financial Details

15.4.3.5. Strategic Overview/Recent Developments

15.4.4. NKT A/S

15.4.4.1. Company Details

15.4.4.2. Company Description

15.4.4.3. Business Overview

15.4.4.4. Financial Details

15.4.4.5. Strategic Overview/Recent Developments

15.4.5. ABB Ltd.

15.4.5.1. Company Details

15.4.5.2. Company Description

15.4.5.3. Business Overview

15.4.5.4. Financial Details

15.4.5.5. Strategic Overview/Recent Developments

15.4.6. Marmon Group

15.4.6.1. Company Details

15.4.6.2. Company Description

15.4.6.3. Business Overview

15.4.6.4. Strategic Overview/Recent Developments

15.4.7. GalaxyWire.com

15.4.7.1. Company Details

15.4.7.2. Company Description

15.4.7.3. Business Overview

15.4.8. W. L. Gore & Associates, Inc.

15.4.8.1. Company Details

15.4.8.2. Company Description

15.4.8.3. Business Overview

15.4.8.4. Strategic Overview/Recent Developments

15.4.9. Belden Inc.

15.4.9.1. Company Details

15.4.9.2. Company Description

15.4.9.3. Financial Details

15.4.9.4. Business Overview

15.4.9.5. Strategic Overview/Recent Developments

15.4.10. LS Cable & System Ltd.

15.4.10.1. Company Details

15.4.10.2. Company Description

15.4.10.3. Financial Details

15.4.10.4. Business Overview

15.4.10.5. Strategic Overview/Recent Developments

15.4.11. AFL

15.4.11.1. Company Details

15.4.11.2. Company Description

15.4.11.3. Financial Details

15.4.11.4. Business Overview

15.4.11.5. Strategic Overview/Recent Developments

15.4.12. ZTT

15.4.12.1. Company Details

15.4.12.2. Company Description

15.4.12.3. Business Overview

15.4.12.4. Strategic Overview/Recent Developments

15.4.13. Tratos

15.4.13.1. Company Details

15.4.13.2. Company Description

15.4.13.3. Business Overview

15.4.14. TEXCAN Division of Sonepar Canada Inc.

15.4.14.1. Company Details

15.4.14.2. Company Description

15.4.14.3. Business Overview

List of Tables

Table 01: Global Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 02: Global Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 03: Global Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 04: Global Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 05: Global Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 06: Global Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 07: Global Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Region, 2018–2027

Table 08: Global Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 09: North America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Country, 2018–2027

Table 10: North America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 11: North America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 12: North America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 13: North America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 14: North America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 15: North America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 16: North America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 17: U.S. Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 18: U.S. Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 19: U.S. Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 20: U.S. Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 21: U.S. Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 22: U.S. Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 23: Canada Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 24: Canada Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 25: Canada Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 26: Canada Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 27: Canada Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 28: Canada Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 29: Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Country and Sub-region, 2018–2027

Table 30: Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 31: Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 32: Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 33: Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 34: Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 35: Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 36: Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 37: Norway Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 38: Norway Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 39: Norway Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 40: Norway Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 41: Norway Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 42: Norway Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 43: U.K. Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 44: U.K. Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 45: U.K. Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 46: U.K. Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 47: U.K. Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 48: U.K. Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 49: Russia & CIS Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 50: Russia & CIS Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 51: Russia & CIS Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 52: Russia & CIS Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 53: Russia & CIS Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 54: Russia & CIS Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 55: Rest of Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 56: Rest of Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 57: Rest of Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 58: Rest of Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 59: Rest of Europe Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 60: Rest of Europe Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 61: Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Country and Sub-region, 2018–2027

Table 62: Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 63: Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 64: Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 65: Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 66: Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 67: Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 68: Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 69: China Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 70: China Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 71: China Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 72: China Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 73: China Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 74: China Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 75: India Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 76: India Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 77: India Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 78: India Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 79: India Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 80: India Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 81: Australia Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 82: Australia Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 83: Australia Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 84: Australia Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 85: Australia Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 86: Australia Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 87: ASEAN Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 88: ASEAN Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 89: ASEAN Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 90: ASEAN Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 91: ASEAN Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 92: ASEAN Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 93: Rest of Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 94: Rest of Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 95: Rest of Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 96: Rest of Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 97: Rest of Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 98: Rest of Asia Pacific Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 99: Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Country and Sub-region, 2018–2027

Table 100: Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 101: Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 102: Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 103: Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 104: Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 105: Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 106: Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 107: Brazil Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 108: Brazil Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 109: Brazil Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 110: Brazil Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 111: Brazil Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 112: Brazil Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 113: Mexico Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 114: Mexico Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 115: Mexico Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 116: Mexico Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 117: Mexico Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 118: Mexico Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 119: Venezuela Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 120: Venezuela Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 121: Venezuela Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 122: Venezuela Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 123: Venezuela Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 124: Venezuela Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 125: Rest of Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 126: Rest of Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 127: Rest of Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 128: Rest of Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 129: Rest of Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 130: Rest of Latin America Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 131: Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Country and Sub-region, 2018–2027

Table 132: Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 133: Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 134: Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 135: Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 136: Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 137: Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 138: Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 139: Saudi Arabia Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 140: Saudi Arabia Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 141: Saudi Arabia Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 142: Saudi Arabia Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 143: Saudi Arabia Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 144: Saudi Arabia Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 145: UAE Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 146: UAE Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 147: UAE Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 148: UAE Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 149: UAE Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 150: UAE Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 151: Qatar Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 152: Qatar Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 153: Qatar Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 154: Qatar Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 155: Qatar Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 156: Qatar Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 157: Nigeria Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 158: Nigeria Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 159: Nigeria Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 160: Nigeria Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 161: Nigeria Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 162: Nigeria Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

Table 163: Rest of Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Type, 2018–2027

Table 164: Rest of Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 165: Rest of Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Application, 2018–2027

Table 166: Rest of Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 167: Rest of Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) Forecast, by Installation, 2018–2027

Table 168: Rest of Middle East & Africa Oil & Gas Downhole Cables Market Value (US$ Mn) Forecast, by Installation, 2018–2027

List of Figures

Figure 01: Global Oil & Gas Downhole Cables Market Value Share Analysis, by Type

Figure 02: Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

Figure 03: Global Oil & Gas Downhole Cables Market Volume Share Analysis, by Installation

Figure 04: Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

Figure 05: Global Oil & Gas Downhole Cables Market Volume Share Analysis, by Application

Figure 06: Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 07: Global Oil & Gas Downhole Cables Market Volume Share Analysis, by Region

Figure 08: Global Oil & Gas Downhole Cables Market Attractiveness Analysis, by Region

Figure 09: North America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn), 2018–2027

Figure 10: North America Oil & Gas Downhole Cables Market Value Share Analysis, by Country

Figure 11: North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country

Figure 12: North America Oil & Gas Downhole Cables Market Value Share Analysis, by Type

Figure 13: North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

Figure 14: North America Oil & Gas Downhole Cables Market Volume Share Analysis, by Application

Figure 15: North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 16: North America Oil & Gas Downhole Cables Market Volume Share Analysis, by Installation

Figure 17: North America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

Figure 18: Europe Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn), 2018–2027

Figure 19: Europe Oil & Gas Downhole Cables Market Value Share Analysis, by Country and Sub-region

Figure 20: Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Europe Oil & Gas Downhole Cables Market Value Share Analysis, by Type

Figure 22: Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

Figure 23: Europe Oil & Gas Downhole Cables Market Value Share Analysis, by Application

Figure 24: Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 25: Europe Oil & Gas Downhole Cables Market Value Share Analysis, by Installation

Figure 26: Europe Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

Figure 27: Asia Pacific Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn), 2018–2027

Figure 28: Asia Pacific Oil & Gas Downhole Cables Market Value Share Analysis, by Country and Sub-region

Figure 29: Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

Figure 30: Asia Pacific Oil & Gas Downhole Cables Market Value Share Analysis, by Type

Figure 31: Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

Figure 32: Asia Pacific Oil & Gas Downhole Cables Market Value Share Analysis, by Application

Figure 33: Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 34: Asia Pacific Oil & Gas Downhole Cables Market Value Share Analysis, by Installation

Figure 35: Asia Pacific Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

Figure 36: Latin America Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn), 2018–2027

Figure 37: Latin America Oil & Gas Downhole Cables Market Value Share Analysis, by Country and Sub-region

Figure 38: Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

Figure 39: Latin America Oil & Gas Downhole Cables Market Value Share Analysis, by Type

Figure 40: Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

Figure 41: Latin America Oil & Gas Downhole Cables Market Value Share Analysis, by Application

Figure 42: Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 43: Latin America Oil & Gas Downhole Cables Market Value Share Analysis, by Application

Figure 44: Latin America Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 45: Middle East & Africa Oil & Gas Downhole Cables Market Volume (Kilometers) and Value (US$ Mn), 2018–2027

Figure 46: Middle East & Africa Oil & Gas Downhole Cables Market Value Share Analysis, by Country and Sub-region

Figure 47: Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Country and Sub-region

Figure 48: Middle East & Africa Oil & Gas Downhole Cables Market Value Share Analysis, by Type

Figure 49: Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Type

Figure 50: Middle East & Africa Oil & Gas Downhole Cables Market Value Share Analysis, by Application

Figure 51: Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Application

Figure 52: Middle East & Africa Oil & Gas Downhole Cables Market Value Share Analysis, by Installation

Figure 53: Middle East & Africa Oil & Gas Downhole Cables Market Attractiveness Analysis, by Installation

Figure 54: Global Oil & Gas Downhole Cables Market Share Analysis, by Company, 2018