Reports

Reports

The COVID-19 pandemic has changed the way any industry functions, including the packaging industry. Due to the growing incidence of hand sanitizer ingestion by children, manufacturers in the North America child resistant bottles market are increasing the availability for child resistant packaging in hand sanitizer products with information about hazards to young children. The U.S.-based company Berry Cleaning and Medical Packaging is being publicized for its child resistant closures among other products such as medical packer bottles and oval bottles to support healthcare systems during coronavirus pandemic.

Production activities in the North America child resistant bottles market are taking place in a staggered manner due to volatile demand and supply, owing to the ongoing pandemic. Focus in niche requirements such as child resistant bottles is anticipated to be less as compared to other essential packaging requirements such as in homecare and pharmaceutical applications.

A variety of products is being developed in child resistant packaging to prevent young children from accessing potentially harmful substances. However, manufacturers in the North America child resistant bottles market need to align with stringent regulatory guidelines to demonstrate the efficacy of child resistant packaging solutions. They are following the 16 CFR 1700.20 American regulation to cater to both reclosable and non-reclosable packaging of medicines and non-medicines.

Companies in the North America child resistant bottles market are required to conduct product tests with a given number of sample size consisting of children and adults to demonstrate if a packaging is child resistant or not.

Apart from pharmaceuticals, manufacturers in the North America child resistant bottles market are expanding their product portfolio in beauty items, chemicals, and cleaners to broaden their revenue streams. Stakeholders are increasing their production capabilities in glass and plastic containers, compounded with a large inventory of container styles and sizes that align with the brand and the manufacturing process.

Right from the smallest 1-ounce travel sizes to large gallon-sized containers, manufacturers are increasing their focus in child resistant protective container caps and closures.

Soft squeeze PET (Polyethylene Terephthalate) bottles and liquid bottles with child resistant caps & dosing syringes are translating into incremental opportunities for manufacturers in the North America child resistant bottles market. The U.S. Plastic Corporation - a supplier of industrial and commercial plastic products based in Ohio is gaining popularity for its comprehensive product portfolio in PET low profile jars with child resistant cap closures and PET unicorn bottles with child resistant cap closures.

Innovative technologies in products involve gapless surface-to-surface seal with the cap and the bottleneck, thus preventing odor leak from occurring. Companies in the North America child resistant bottles market are increasing the availability of tamper-evident seals with child resistant caps that help to prevent immediate access to medications, industrial chemicals, and household cleaners.

Untapped opportunities in CBD (Cannabidiol) oil packaging is grabbing the attention of companies in the North America child resistant bottles market. SGD Pharma - a specialist in pharmaceutical glass primary packaging, is expanding a complete range of child resistant packaging solutions for CBD oils whilst meeting international regulatory standards.

The global CBD market is predicted to advance at an astonishing CAGR in the upcoming decade. Hence, manufacturers in the North America child resistant bottles market are capitalizing on this opportunity to develop child resistant closures and tamper-evident seals to ensure the safety and integrity of CBD oil products.

Analysts’ Viewpoint

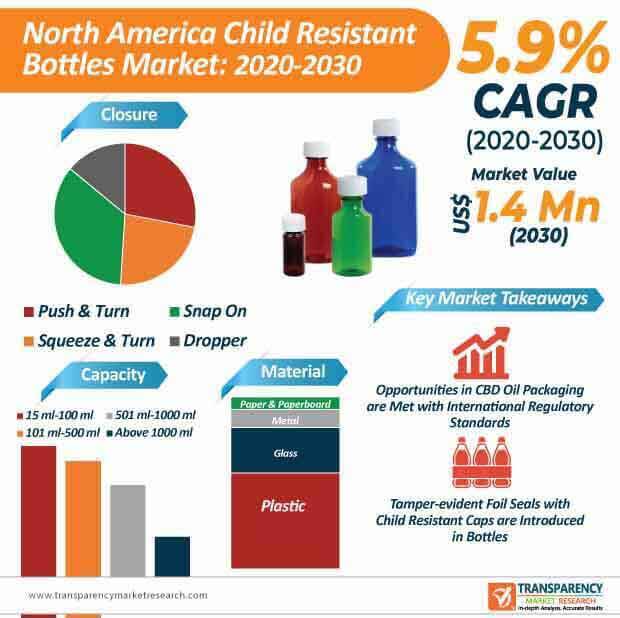

Since an increasing number of individuals is spending long hours at home due to the COVID-19 pandemic, consumers are seeking child resistant packaging for potentially hazardous substances in retail stores. In order to take innovation a step further, manufacturers in the North America child resistant bottles market are introducing tamper-evident foil seals with child resistant caps that require great dexterity in children under the age of five. However, stringent regulations pertaining to demonstration of rigorous tests involving children and adults are emerging as a hurdle for product innovation. Hence, companies should make the most of such regulations by innovating in solutions such as pull rings, which require great dexterity, thus explaining an estimated growth rate of 5.9% of the market during the forecast period.

1. Executive Summary

1.1. Market Outlook

1.2. Market Analysis

1.3. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage

2.2. Market Definition

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation Trends

4. Key Success Factors

4.1. Product Adoption Analysis

4.2. Product USPs / Features

5. Child Resistant Bottles Market Demand Analysis 2015–2019 and Forecast, 2020–2030

5.1. Historical Market Volume (Units) Analysis, 2015–2019

5.2. Current and Future Market Volume (Units) Projections, 2020–2030

5.3. Y-o-Y Growth Trend Analysis

6. Child Resistant Bottles Market - Pricing Analysis

6.1. Regional Pricing Analysis

6.2. Pricing Break-up

6.3. Average Pricing Analysis Benchmark

7. Child Resistant Bottles Market Demand (Value in US$ Mn) Analysis 2015–2019 and Forecast, 2020–2030

7.1. Historical Market Value (US$ Mn) Analysis, 2015–2019

7.2. Current and Future Market Value (US$ Mn) Projections, 2020–2030

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. North America Packaging Market Outlook

8.2. North America Rigid Packaging Market Outlook

8.3. North America Bottles Packaging Market Outlook

8.4. North America Child Resistant Packaging Market Outlook

8.5. Key Industry Perspective: What Industry Leaders are saying?

8.6. Macro-Economic Factors

8.6.1. America GDP Growth Outlook

8.6.2. GDP Per Capita

8.6.3. Manufacturing Value Added

8.6.4. Industrial Production

8.7. Forecast Factors - Relevance & Impact

8.7.1. North America Industrial Sector Growth

8.7.2. Regional Manufacturing Value Added Growth

8.7.3. Segmental Revenue Growth of Key Players

8.7.4. Top Companies Historical Revenue Growth

8.8. Value Chain Analysis

8.8.1. Key Participants

8.8.1.1. Raw Material Suppliers

8.8.1.2. Child Resistant Bottles Manufacturers

8.8.1.3. Distributors

8.8.2. Profitability Margin

8.9. Impact of COVID-19

8.9.1. Current Statistics and Probable Future Impact

8.9.2. Current Economic Projection – GDP/GVA and Probable Impact

8.9.3. Impact of COVID-19 on Child Resistant Bottles Market

8.10. Market Dynamics

8.10.1. Drivers

8.10.2. Restraints

8.10.3. Opportunity Analysis

8.10.4. Trends

9. North America Child Resistant Bottles Market Analysis 2015–2019 and Forecast 2020–2030

9.1. Introduction

9.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis, by Market Taxonomy, 2015–2019

9.3. Market Size (US$ Mn) and Volume (Units) Forecast, by Market Taxonomy, 2020–2030

9.3.1. By Capacity

9.3.1.1. 15 ml – 100 ml

9.3.1.2. 101 ml – 500 ml

9.3.1.3. 501 ml -1000 ml

9.3.1.4. Above 1000 ml

9.3.2. By Material

9.3.2.1. Plastic

9.3.2.1.1. Polyethylene (PE)

9.3.2.1.2. Polyethylene Terephthalate (PET)

9.3.2.1.3. Polypropylene (PP)

9.3.2.1.4. Others (PVC, etc.)

9.3.2.2. Glass

9.3.2.3. Metal

9.3.2.4. Paper & Paperboard

9.3.3. By Closure

9.3.3.1. Push & Turn

9.3.3.2. Squeeze & Turn

9.3.3.3. Snap On

9.3.3.4. Dropper

9.4. Market Attractiveness Analysis

9.4.1. By Capacity

9.4.2. By Material

9.4.3. By Closure

10. Child Resistant Bottles Market Country wise Analysis 2020 & 2030

10.1. USA Child Resistant Bottles Market Analysis

10.1.1. Market Volume (Units) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

10.1.1.1. By Capacity

10.1.1.2. By Material

10.1.1.3. By Closure

10.2. Canada Child Resistant Bottles Market Analysis

10.2.1. Market Volume (Units) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

10.2.1.1. By Capacity

10.2.1.2. By Material

10.2.1.3. By Closure

11. Market Structure Analysis

11.1. Market Analysis, by Tier of Companies

11.2. Market Share Analysis of Top Players

11.3. Market Presence Analysis

11.3.1. By Regional footprint of Players

11.3.2. Product footprint by Players

12. Competition Analysis

12.1. Competition Dashboard

12.2. Competition Benchmarking

12.3. Competition Deep Dive

(North America & Latin America specific Manufacturers)

12.3.1. Berry Global Inc.

12.3.1.1. Overview

12.3.1.2. Product Portfolio

12.3.1.3. Profitability by Market Segments

12.3.1.4. Sales Footprint

12.3.1.5. Strategy Overview

12.3.1.5.1. Marketing Strategy

12.3.1.5.2. Product Strategy

12.3.1.5.3. Channel Strategy

12.3.2. Gerresheimer AG.

12.3.2.1. Overview

12.3.2.2. Product Portfolio

12.3.2.3. Profitability by Market Segments

12.3.2.4. Sales Footprint

12.3.2.5. Strategy Overview

12.3.2.5.1. Marketing Strategy

12.3.2.5.2. Product Strategy

12.3.2.5.3. Channel Strategy

12.3.3. O.BERK Company

12.3.3.1. Overview

12.3.3.2. Product Portfolio

12.3.3.3. Profitability by Market Segments

12.3.3.4. Sales Footprint

12.3.3.5. Strategy Overview

12.3.3.5.1. Marketing Strategy

12.3.3.5.2. Product Strategy

12.3.3.5.3. Channel Strategy

12.3.4. Silgan Holdings, Inc.

12.3.4.1. Overview

12.3.4.2. Product Portfolio

12.3.4.3. Profitability by Market Segments

12.3.4.4. Sales Footprint

12.3.4.5. Strategy Overview

12.3.4.5.1. Marketing Strategy

12.3.4.5.2. Product Strategy

12.3.4.5.3. Channel Strategy

12.3.5. Comar LLC

12.3.5.1. Overview

12.3.5.2. Product Portfolio

12.3.5.3. Profitability by Market Segments

12.3.5.4. Sales Footprint

12.3.5.5. Strategy Overview

12.3.5.5.1. Marketing Strategy

12.3.5.5.2. Product Strategy

12.3.5.5.3. Channel Strategy

12.3.6. SGD Pharma

12.3.6.1. Overview

12.3.6.2. Product Portfolio

12.3.6.3. Profitability by Market Segments

12.3.6.4. Sales Footprint

12.3.6.5. Strategy Overview

12.3.6.5.1. Marketing Strategy

12.3.6.5.2. Product Strategy

12.3.6.5.3. Channel Strategy

12.3.7. CL Smith

12.3.7.1. Overview

12.3.7.2. Product Portfolio

12.3.7.3. Profitability by Market Segments

12.3.7.4. Sales Footprint

12.3.7.5. Strategy Overview

12.3.7.5.1. Marketing Strategy

12.3.7.5.2. Product Strategy

12.3.7.5.3. Channel Strategy

12.3.8. Bormioli Pharma

12.3.8.1. Overview

12.3.8.2. Product Portfolio

12.3.8.3. Profitability by Market Segments

12.3.8.4. Sales Footprint

12.3.8.5. Strategy Overview

12.3.8.5.1. Marketing Strategy

12.3.8.5.2. Product Strategy

12.3.8.5.3. Channel Strategy

12.3.9. FH Packaging

12.3.9.1. Overview

12.3.9.2. Product Portfolio

12.3.9.3. Profitability by Market Segments

12.3.9.4. Sales Footprint

12.3.9.5. Strategy Overview

12.3.9.5.1. Marketing Strategy

12.3.9.5.2. Product Strategy

12.3.9.5.3. Channel Strategy

12.3.10. Origin Pharma Packaging

12.3.10.1. Overview

12.3.10.2. Product Portfolio

12.3.10.3. Profitability by Market Segments

12.3.10.4. Sales Footprint

12.3.10.5. Strategy Overview

12.3.10.5.1. Marketing Strategy

12.3.10.5.2. Product Strategy

12.3.10.5.3. Channel Strategy

*The above list is indicative in nature and is subject to change during the course of research

13. Assumptions and Acronyms Used

14. Research Methodology

List of Tables

Table 01: North America Child Resistant Bottles Market Value (US$ Mn) by Capacity, 2015H-2030F

Table 02: North America Child Resistant Bottles Market Volume (Mn Units) by Capacity, 2015H-2030F

Table 03: North America Child Resistant Bottles Market Value (US$ Mn) by Material, 2015H-2030F

Table 04: North America Child Resistant Bottles Market Volume (Mn Units) by Material, 2015H-2030F

Table 05: North America Child Resistant Bottles Market Value (US$ Mn) by Closure, 2015H-2030F

Table 06: North America Child Resistant Bottles Market Volume (Mn Units) by Closure, 2015H-2030F

Table 07: North America Child Resistant Bottles Market Value (US$ Mn) by Country, 2015H-2030F

Table 08: North America Child Resistant Bottles Market Volume (Mn Units) by Country, 2015H-2030F

Table 09: U.S. Child Resistant Bottles Market Value (US$ Mn) and Volume (Mn Units), by Capacity, Material, and Closure, 2015H-2030F

Table 10: Canada Child Resistant Bottles Market Value (US$ Mn) and Volume (Mn Units), by Capacity, Material, and Closure, 2015H-2030

List of Figures

Figure 01: North America Child Resistant Bottles Market Share Analysis by Capacity, 2020E & 2030F

Figure 02: North America Child Resistant Bottles Market Y-o-Y Analysis by Capacity, 2019A-2030F

Figure 03: North America Child Resistant Bottles Market Attractiveness Analysis by Capacity, 2020E-2030F

Figure 04: North America Child Resistant Bottles Market Share Analysis by Material, 2020E & 2030F

Figure 05: North America Child Resistant Bottles Market Y-o-Y Analysis by Material, 2019A-2030F

Figure 06: North America Child Resistant Bottles Market Attractiveness Analysis by Material, 2020E-2030F

Figure 07: North America Child Resistant Bottles Market Share Analysis by Closure, 2020E & 2030F

Figure 08: North America Child Resistant Bottles Market Y-o-Y Analysis by Closure, 2019A-2030F

Figure 09: North America Child Resistant Bottles Market Attractiveness Analysis by Closure, 2020E-2030F

Figure 10: North America Child Resistant Bottles Market Share Analysis by Country, 2020E & 2030F

Figure 11: North America Child Resistant Bottles Market Y-o-Y Analysis by Country, 2019A-2030F

Figure 12: North America Child Resistant Bottles Market Attractiveness Analysis by Country, 2020E-2030F