Reports

Reports

Health screenings and check-ups for new babies are still relevant during the coronavirus outbreak. These check-ups help families to make informed decisions about how to protect their infants. Hence, stakeholders in the newborn screening market are increasing awareness about additional precautions that need to be taken such as in cases of follow-up testing after the screening results are received.

Since healthcare is one of the essential industries worldwide, state and territorial newborn screening programs are being carried out even during the COVID-19 situation. Healthcare providers in the newborn screening market are capitalizing on this opportunity to offer comprehensive services in blood spot screening, hearing, and critical congenital heart disease (CCHD) test. Clinicians in the U.S. are increasing the availability of contact information and listing it on official state pages to keep individuals abreast with all updates.

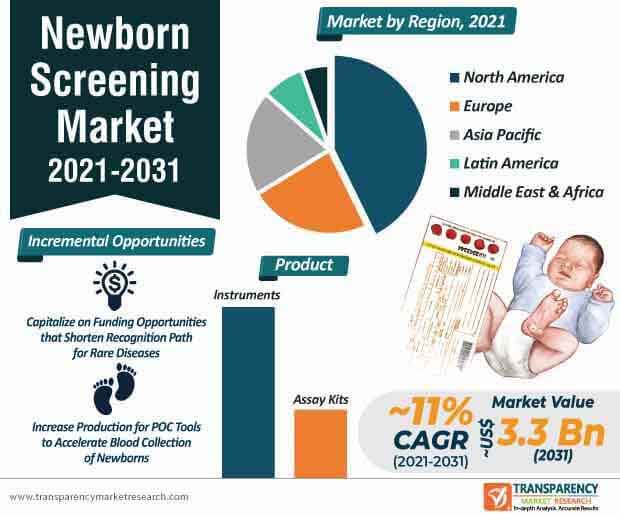

The newborn screening market is projected to reach the valuation of US$ 3.3 Bn by 2031. This is evident since the number of conditions assessable by newborn screening methods is increasing, resulting in additional cost for the healthcare system. Moreover, lack of data on long-term consequences of new conditions and scarce follow-up information for screened conditions are hampering the decision making process of healthcare providers. Hence, there is a need to standardize valuation techniques for pediatric health states in the newborn screening market.

There is a need to clarify methodological strengths and flaws in cost effectiveness and cost utility analysis of new pediatric health states.

Companies in the newborn screening market are focusing on reducing the morbidity and mortality associated with heritable disorders in newborns and children. Altarum - a non-profit research and consulting organization has been selected by the Health Resources and Services Administration (HRSA) to lead the Innovations in Newborn Screening Interoperability Resource Center. Such initiatives explain why the newborn screening market is expected to advance at a robust CAGR of ~11% during the forecast period.

In order to improve medical outcomes of newborns and children, healthcare providers are taking efforts to enhance the connectivity between state public health newborn screening programs and healthcare providers. This is being achieved with the help of information management and technical assistance for newborn screening programs.

Healthcare providers in the newborn screening market are setting their collaboration wheels in motion to assess the current state of pediatric screening. Rare disease-focused organizations such as the EveryLife Foundation for Rare Diseases, Retrophin, Inc., BioMarin Pharmaceutical Inc., Orchard Therapeutics Inc., and Sarepta Therapeutics have joined forces to evaluate the capacity of newborn screening in the U.S. Timely diagnosis to all newborns who may benefit from new treatments requires careful evaluation from healthcare organizations.

The evaluation by organizations in the newborn screening market will ensure policy recommendations that enable equitable access to newborn screening for all babies in the U.S.

Companies in the newborn screening market are expanding their revenue streams for babies with rare diseases. The European Commission is gaining recognition for shortening the path to rare disease diagnosis by increasing funding and tender opportunities for newborn screening and digital technologies. This is evident since thousands of distinct rare diseases are affecting a significant amount of newborns in Europe.

Moreover, Nigeria is gaining popularity for introducing its $2 10-minute rapid point-of-care tool, which has the potential to transform sickle cell screening for newborns. Thus, healthcare providers are unlocking growth opportunities in Africa to reduce child mortality with the help of innovations in sickle cell screening. The integration of newborn screening into existing primary healthcare immunization programs is being achieved within limited resources in Africa.

Analysts’ Viewpoint

The safe follow-up on newborn screening results has become a priority for healthcare providers and individuals during the COVID-19 outbreak. Rapid point-of-care tools are replacing conventional screening methods of collecting blood samples on a filter paper in cases of newborns suffering from sickle cell anemia. Despite many achievements, significant delays between the screening and the availability of the treatment are inhibiting growth of the newborn screening market. Hence, healthcare organizations should collaborate on R&D to make advancements in diagnostic medical technologies to reduce morbidity and mortality rate of newborns. Efforts should be made to increase the connectivity between state public health newborn screening programs and healthcare providers.

Newborn screening market is projected to reach the valuation of US$ 3.3 Bn by 2031

Newborn screening market is projected to expand at a CAGR of ~11% from 2021 to 2031

Newborn screening market is driven by rise in prevalence and incidence of critical congenital heart diseases across the globe

The instruments segment dominated the global newborn screening market and the trend is likely to continue during the forecast period

Key players in the global newborn screening market include PerkinElmer, Inc., Trivitron Healthcare, Natus Medical Incorporated, Medtronic Plc, Thermo Fisher Scientific, Inc

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Global Newborn Screening Market Forecast

4.4. Global Newborn Screening Market Outlook

5. Market Outlook

5.1. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.2. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.3. Overview of the Neonatal Research Funding/Grants

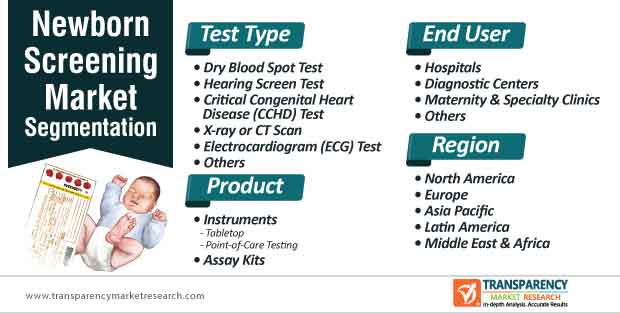

6. Global Newborn Screening Market Analysis, by Product

6.1. Introduction

6.2. Global Newborn Screening Market Value Share and Attractiveness Analysis, by Product

6.3. Global Newborn Screening Market Forecast, by Product

6.3.1. Instruments

6.3.1.1. Tabletop

6.3.1.2. Point-of-Care Testing

6.3.2. Assay Kits

6.4. Global Newborn Screening Market Analysis, by Product

7. Global Newborn Screening Market Analysis, by Test Type

7.1. Introduction

7.2. Global Newborn Screening Market Value Share and Attractiveness Analysis, by Test Type

7.3. Global Newborn Screening Market Forecast, by Test Type

7.3.1. Dry Blood Spot Test

7.3.2. Hearing Screen Test

7.3.3. Critical Congenital Heart Disease (CCHD) Test

7.3.4. X-ray or CT Scan

7.3.5. Electrocardiogram (ECG) Test

7.3.6. Others

7.4. Global Newborn Screening Market Analysis, by Test Type

8. Global Newborn Screening Market Analysis, by End-user

8.1. Introduction

8.2. Global Newborn Screening Market Value Share and Attractiveness Analysis, by End-user

8.3. Global Newborn Screening Market Forecast, by End-user

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Maternity & Specialty Clinics

8.3.4. Others

8.4. Global Newborn Screening Market Analysis, by End-user

9. Global Newborn Screening Market Analysis, by Region

9.1. Global Newborn Screening Market Scenario, by Region/Country

9.2. Global Newborn Screening Market Value Share and Attractiveness Analysis, by Region

9.3. Global Newborn Screening Market Forecast, by Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East & Africa

10. North America Newborn Screening Market Analysis

10.1. North America Newborn Screening Market Overview

10.2. North America Newborn Screening Market Value Share and Attractiveness Analysis, by Country

10.3. North America Newborn Screening Market Forecast, by Country

10.3.1. U.S.

10.3.2. Canada

10.4. North America Newborn Screening Market Value Share and Attractiveness Analysis, by Product

10.5. North America Newborn Screening Market Forecast, by Product

10.5.1. Instruments

10.5.1.1. Tabletop

10.5.1.2. Point-of-Care Testing

10.5.2. Assay Kits

10.6. North America Newborn Screening Market Value Share and Attractiveness Analysis, by Test Type

10.7. North America Newborn Screening Market Forecast, by Test Type

10.7.1. Dry Blood Spot Test

10.7.2. Hearing Screen Test

10.7.3. Critical Congenital Heart Disease (CCHD) Test

10.7.4. X-ray or CT Scan

10.7.5. Electrocardiogram (ECG) Test

10.7.6. Others

10.8. North America Newborn Screening Market Value Share and Attractiveness Analysis, by End-user

10.9. North America Newborn Screening Market Forecast, by End-user

10.9.1. Hospitals

10.9.2. Diagnostic Centers

10.9.3. Maternity & Specialty Clinics

10.9.4. Others

11. Europe Newborn Screening Market Analysis

11.1. Europe Newborn Screening Market Overview

11.2. Europe Newborn Screening Market Value Share and Attractiveness Analysis, by Country/Sub-region

11.3. Europe Newborn Screening Market Forecast, by Country/Sub-region

11.3.1. Germany

11.3.2. France

11.3.3. U.K.

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

11.4. Europe Newborn Screening Market Value Share and Attractiveness Analysis, by Product

11.5. Europe Newborn Screening Market Forecast, by Product

11.5.1. Instruments

11.5.1.1. Tabletop

11.5.1.2. Point-of-Care Testing

11.5.2. Assay Kits

11.6. Europe Newborn Screening Market Value Share and Attractiveness Analysis, by Test Type

11.7. Europe Newborn Screening Market Forecast, by Test Type

11.7.1. Dry Blood Spot Test

11.7.2. Hearing Screen Test

11.7.3. Critical Congenital Heart Disease (CCHD) Test

11.7.4. X-ray or CT Scan

11.7.5. Electrocardiogram (ECG) Test

11.7.6. Others

11.8. Europe Newborn Screening Market Value Share and Attractiveness Analysis, by End-user

11.9. Europe Newborn Screening Market Forecast, by End-user

11.9.1. Hospitals

11.9.2. Diagnostic Centers

11.9.3. Maternity & Specialty Clinics

11.9.4. Others

12. Asia Pacific Newborn Screening Market Analysis

12.1. Asia Pacific Newborn Screening Market Overview

12.2. Asia Pacific Newborn Screening Market Value Share and Attractiveness Analysis, by Country/Sub-region

12.3. Asia Pacific Newborn Screening Market Forecast, by Country/Sub-region

12.3.1. Japan

12.3.2. China

12.3.3. India

12.3.4. South Korea

12.3.5. Rest of Asia Pacific

12.4. Asia Pacific Newborn Screening Market Value Share and Attractiveness Analysis, by Product

12.5. Asia Pacific Newborn Screening Market Forecast, by Product

12.5.1. Instruments

12.5.1.1. Tabletop

12.5.1.2. Point-of-Care Testing

12.5.2. Assay Kits

12.6. Asia Pacific Newborn Screening Market Value Share and Attractiveness Analysis, by Test Type

12.7. Asia Pacific Newborn Screening Market Forecast, by Test Type

12.7.1. Dry Blood Spot Test

12.7.2. Hearing Screen Test

12.7.3. Critical Congenital Heart Disease (CCHD) Test

12.7.4. X-ray or CT Scan

12.7.5. Electrocardiogram (ECG) Test

12.7.6. Others

12.8. Asia Pacific Newborn Screening Market Value Share and Attractiveness Analysis, by End-user

12.9. Asia Pacific Newborn Screening Market Forecast, by End-user

12.9.1. Hospitals

12.9.2. Diagnostic Centers

12.9.3. Maternity & Specialty Clinics

12.9.4. Others

13. Latin America Newborn Screening Market Analysis

13.1. Latin America Newborn Screening Market Overview

13.2. Latin America Newborn Screening Market Value Share and Attractiveness Analysis, by Country/Sub-region

13.3. Latin America Newborn Screening Market Forecast, by Country/Sub-region

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Rest of Latin America

13.4. Latin America Newborn Screening Market Value Share and Attractiveness Analysis, by Product

13.5. Latin America Newborn Screening Market Forecast, by Product

13.5.1. Instruments

13.5.1.1. Tabletop

13.5.1.2. Point-of-Care Testing

13.5.2. Assay Kits

13.6. Latin America Newborn Screening Market Value Share and Attractiveness Analysis, by Test Type

13.7. Latin America Newborn Screening Market Forecast, by Test Type

13.7.1. Dry Blood Spot Test

13.7.2. Hearing Screen Test

13.7.3. Critical Congenital Heart Disease (CCHD) Test

13.7.4. X-ray or CT Scan

13.7.5. Electrocardiogram (ECG) Test

13.7.6. Others

13.8. Latin America Newborn Screening Market Value Share and Attractiveness Analysis, by End-user

13.9. Latin America Newborn Screening Market Forecast, by End-user

13.9.1. Hospitals

13.9.2. Diagnostic Centers

13.9.3. Maternity & Specialty Clinics

13.9.4. Others

14. Middle East & Africa Newborn Screening Market Analysis

14.1. Middle East & Africa Newborn Screening Market Overview

14.2. Middle East & Africa Newborn Screening Market Value Share and Attractiveness Analysis, by Country/Sub-region

14.3. Middle East & Africa Newborn Screening Market Forecast, by Country/Sub-region

14.3.1. GCC Countries

14.3.2. South Africa

14.3.3. Rest of Middle East & Africa

14.4. Middle East & Africa Newborn Screening Market Value Share and Attractiveness Analysis, by Product

14.5. Middle East & Africa Newborn Screening Market Forecast, by Product

14.5.1. Instruments

14.5.2. Tabletop

14.5.3. Point-of-Care Testing

14.5.4. Assay Kits

14.6. Middle East & Africa Newborn Screening Market Value Share and Attractiveness Analysis, by Test Type

14.7. Middle East & Africa Newborn Screening Market Forecast, by Test Type

14.7.1. Dry Blood Spot Test

14.7.2. Hearing Screen Test

14.7.3. Critical Congenital Heart Disease (CCHD) Test

14.7.4. X-ray or CT Scan

14.7.5. Electrocardiogram (ECG) Test

14.7.6. Others

14.8. Middle East & Africa Newborn Screening Market Value Share and Attractiveness Analysis, by End-user

14.9. Middle East & Africa Newborn Screening Market Forecast, by End-user

14.9.1. Hospitals

14.9.2. Diagnostic Centers

14.9.3. Maternity & Specialty Clinics

14.9.4. Others

15. Competition Landscape

15.1. Competition Matrix

15.2. Company Share Analysis, 2019

15.3. Company Profiles

15.3.1. PerkinElmer, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Trivitron Healthcare

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Natus Medical Incorporated

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Medtronic plc

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Thermo Fisher Scientific, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Bio-Rad Laboratories, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. GE Healthcare (General Electric Company)

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. ZenTech S.A.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. MP BIOMEDICALS

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Baebies, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Masimo

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

List of Tables

Table 01: Global Newborn Screening Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Newborn Screening Market Value (US$ Mn) Forecast, by Instruments, 2017–2031

Table 03: Global Newborn Screening Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 04: Global Newborn Screening Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Newborn Screening Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Newborn Screening Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Newborn Screening Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Newborn Screening Market Value (US$ Mn) Forecast, by Instruments, 2017–2031

Table 09: North America Newborn Screening Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 10: North America Newborn Screening Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Newborn Screening Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Newborn Screening Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 13: Europe Newborn Screening Market Value (US$ Mn) Forecast, by Instruments, 2017–2031

Table 14: Europe Newborn Screening Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 15: Europe Newborn Screening Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Newborn Screening Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Newborn Screening Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Newborn Screening Market Size (US$ Mn) Forecast, by Instruments, 2017–2031

Table 19: Asia Pacific Newborn Screening Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

Table 20: Asia Pacific Newborn Screening Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Newborn Screening Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Newborn Screening Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Latin America Newborn Screening Market Value (US$ Mn) Forecast, by Instruments, 2017–2031

Table 24: Latin America Newborn Screening Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 25: Latin America Newborn Screening Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Newborn Screening Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Newborn Screening Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Newborn Screening Market Value (US$ Mn) Forecast, by Instruments, 2017–2031

Table 29: Middle East & Africa Newborn Screening Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 30: Middle East & Africa Newborn Screening Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Newborn Screening Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Newborn Screening Market Value Share, by Product, 2019

Figure 03: Global Newborn Screening Market Value Share, by End-user, 2019

Figure 04: Global Newborn Screening Market Value Share, by Test Type, 2019

Figure 05: Global Newborn Screening Market Value Share, by Region, 2019

Figure 06: Global Newborn Screening Market Value Share Analysis, by Product, 2019 and 2031

Figure 07: Global Newborn Screening Market Revenue (US$ Mn), by Instruments, 2017–2031

Figure 08: Global Newborn Screening Market Revenue (US$ Mn), by Assay Kits, 2017–2031

Figure 09: Global Newborn Screening Market Attractiveness Analysis, by Product, 2021–2031

Figure 10: Global Newborn Screening Market Value Share Analysis, by Test Type, 2019 and 2031

Figure 11: Global Newborn Screening Market Revenue (US$ Mn), by Dry Blood Spot Test, 2017–2031

Figure 12: Global Newborn Screening Market Revenue (US$ Mn), by Hearing Screen Test, 2017–2031

Figure 13: Global Newborn Screening Market Revenue (US$ Mn), by Critical Congenital Heart Disease (CCHD) Test, 2017–2031

Figure 14: Global Newborn Screening Market Revenue (US$ Mn), by X-ray or CT Scan, 2017–2031

Figure 15: Global Newborn Screening Market Revenue (US$ Mn), by Electrocardiogram (ECG) Test, 2017–2031

Figure 16: Global Newborn Screening Market Revenue (US$ Mn), by Others, 2017–2031

Figure 17: Global Newborn Screening Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 18: Global Newborn Screening Market Value Share Analysis, by End-user, 2019 and 2031

Figure 19: Global Newborn Screening Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 20: Global Newborn Screening Market Revenue (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 21: Global Newborn Screening Market Revenue (US$ Mn), by Maternity & Specialty Clinics, 2017–2031

Figure 22: Global Newborn Screening Market Revenue (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 23: Global Newborn Screening Market Attractiveness Analysis, by End-user, 2021–2031

Figure 24: Global Newborn Screening Market Value Share Analysis, by Region, 2019 and 2031

Figure 25: Global Newborn Screening Market Analysis, by Region

Figure 26: North America Newborn Screening Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 27: North America Newborn Screening Market Value Share (%), by Country, 2019 and 2031

Figure 28: North America Newborn Screening Market Attractiveness, by Country, 2021–2031

Figure 29: North America Newborn Screening Market Value Share Analysis, by Product, 2019 and 2031

Figure 30: North America Newborn Screening Market Attractiveness, by Product, 2021–2031

Figure 31: North America Newborn Screening Market Value Share Analysis, by Test Type, 2019 and 2031

Figure 32: North America Newborn Screening Market Attractiveness, by Test Type, 2021–2031

Figure 33: North America Newborn Screening Market Value Share Analysis, by End-user, 2019 and 2031

Figure 34: North America Newborn Screening Market Attractiveness, by End-user, 2021–2031

Figure 35: Europe Newborn Screening Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 36: Europe Newborn Screening Market Value Share (%), by Country/Sub-region, 2019 and 2031

Figure 37: Europe Newborn Screening Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 38: Europe Newborn Screening Market Value Share Analysis, by Product, 2019 and 2031

Figure 39: Europe Newborn Screening Market Attractiveness, by Product, 2021–2031

Figure 40: Europe Newborn Screening Market Value Share Analysis, by Test Type, 2019 and 2031

Figure 41: Europe Newborn Screening Market Attractiveness, by Test Type, 2021–2031

Figure 42: Europe Newborn Screening Market Value Share Analysis, by End-user, 2019 and 2031

Figure 43: Europe Newborn Screening Market Attractiveness, by End-user, 2021–2031

Figure 44: Asia Pacific Newborn Screening Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 45: Asia Pacific Newborn Screening Market Value Share (%), by Country/Sub-region, 2019 and 2031

Figure 46: Asia Pacific Newborn Screening Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 47: Asia Pacific Newborn Screening Market Value Share Analysis, by Product, 2019 and 2031

Figure 48: Asia Pacific Newborn Screening Market Attractiveness, by Product, 2021–2031

Figure 49: Asia Pacific Newborn Screening Market Value Share Analysis, by Test Type, 2019 and 2031

Figure 50: Asia Pacific Newborn Screening Market Attractiveness, by Test Type, 2021–2031

Figure 51: Asia Pacific Newborn Screening Market Value Share Analysis, by End-user, 2019 and 2031

Figure 52: Asia Pacific Newborn Screening Market Attractiveness, by End-user, 2021–2031

Figure 53: Latin America Newborn Screening Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 54: Latin America Newborn Screening Market Value Share (%), by Country/Sub-region, 2019 and 2031

Figure 55: Latin America Newborn Screening Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 56: Latin America Newborn Screening Market Value Share Analysis, by Product, 2019 and 2031

Figure 57: Latin America Newborn Screening Market Attractiveness, by Product, 2021–2031

Figure 58: Latin America Newborn Screening Market Value Share Analysis, by Test Type, 2019 and 2031

Figure 59: Latin America Newborn Screening Market Attractiveness, by Test Type, 2021–2031

Figure 60: Latin America Newborn Screening Market Value Share Analysis, by End-user, 2019 and 2031

Figure 61: Latin America Newborn Screening Market Attractiveness, by End-user, 2021–2031

Figure 62: Middle East & Africa Newborn Screening Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 63: Middle East & Africa Newborn Screening Market Value Share (%), by Country/Sub-region, 2019 and 2031

Figure 64: Middle East & Africa Newborn Screening Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 65: Middle East & Africa Newborn Screening Market Value Share Analysis, by Product, 2019 and 2031

Figure 66: Middle East & Africa Newborn Screening Market Attractiveness, by Product, 2021–2031

Figure 67: Middle East & Africa Newborn Screening Market Value Share Analysis, by Test Type, 2019 and 2031

Figure 68: Middle East & Africa Newborn Screening Market Attractiveness, by Test Type, 2021–2031

Figure 69: Middle East & Africa Newborn Screening Market Value Share Analysis, by End-user, 2019 and 2031

Figure 70: Middle East & Africa Newborn Screening Market Attractiveness, by End-user, 2021–2031

Figure 71: Global Newborn Screening Market Share, by Company, 2019