Reports

Reports

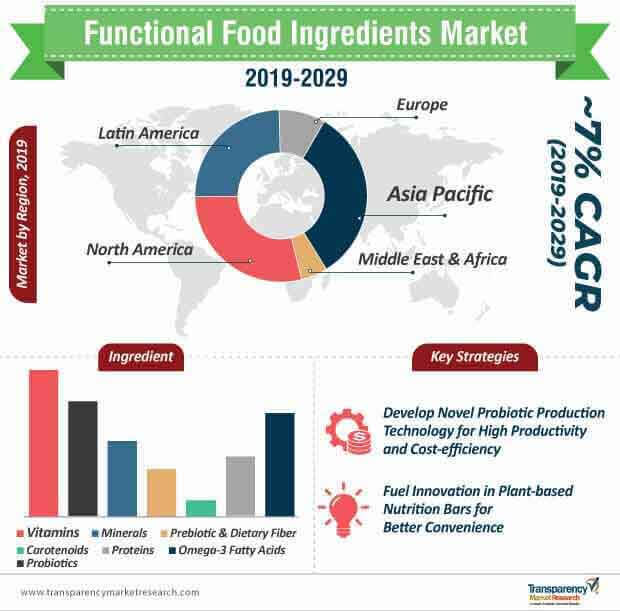

The global functional food ingredients market is estimated to reach a production level of ~3,360 metric tons in the year 2029. Due to the high growth potential of this market, manufacturers are innovating on novel probiotic technologies that increase production in cost-efficient ways.

The unique technology involves metabolite agnostics that speed up the fermentation of probiotic strains. This helps reduce the time of the production of the probiotics, and increases yield outcome. Since conventional production methods involve a lengthy fermentation period, manufacturers are adopting new technologies that accelerate the fermentation process and reduce the cost of probiotic products for consumers. This results in a win-win situation for both, manufacturers and consumers.

Manufacturers are also innovating on first-of-its-kind high-protein and high-lutein chilli with decreased levels of pungency. The micro-injection technology enriches protein in chillies, which contributes as a useful addition to functional food ingredients. Also, cross-breeding helps stabilize the formulation, and standardization of the process increases the bioavailability of the phytonutrients for the development of nutraceuticals.

Convenience and on-the-go foods are driving market growth for functional food ingredients. Likewise, nutritional bars hold intrinsic health value for consumers. The production of vitamin-based ingredients is currently valued at ~156 billion metric tons. This is why manufacturers are adding specific nutrients such as vitamins, minerals, dietary fibers, and prebiotics to cater to the specific functional purposes of consumers.

Consumers demand products that boost energy levels, which is very convenient as far as energy bars are concerned. Since protein is one of the top functional food ingredients, manufacturers are innovating on protein bars that aid in weight management, improved muscle mass, and increased energy. Due to the high demand for natural ingredients without allergens, manufacturers are producing energy bars made with nuts and soy.

For consumers suffering from lactose intolerance, manufacturers are producing plant-based bars using almond butter, cocoa butter, pea protein, sunflower seeds, and the like. With the growing awareness about gluten-free and GMO-free (Genetically Modified Organisms) food products, manufacturers are producing functional food ingredients that are also free from artificial flavors and preservatives.

Product development and innovation are important pillars that support market growth for functional food ingredients. However, manufacturers are challenged with the redundant perception of consumers about functional food ingredients. Common misconceptions such as the side effects of food supplements may hamper market growth.

Also, stringent regulations have an influence on the market growth of functional food ingredients. Due to these regulations, companies need to compete for health claims with multiple attempts of clinical trials and approvals from government authorities, which also increases the cost. As such, high investment poses a hurdle for emerging market players that have limited financial resources.

Hence, market players should maximize on consumer acceptance. The success of food supplements and other products with new functional ingredients depends upon the interplay between knowledge management and deployment amongst consumers. Also, consumer-related research prior to new product development (NDP) will help manufacturers understand their needs and increase consumer acceptance for functional food ingredients.

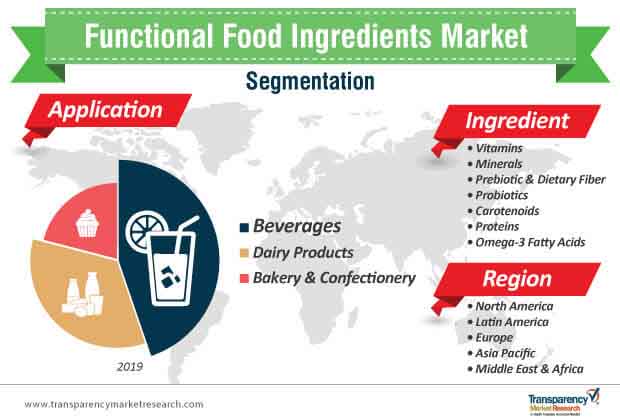

Analysts’ Viewpoint

Analysts of the functional food ingredients market anticipate incremental opportunities in beverage and dairy product applications. Companies can profit from shifting consumer preferences in food and beverage products that support digestive wellness. For instance, PepsiCo — a leading American multinational food and beverage corporation, announced the acquisition of KeVita — a producer of probiotic and kombucha drinks, to increase its portfolio in functional food and beverage products. However, manufacturers are challenged by the common misconceptions of consumers and strict regulations in the landscape. Thus, 'clean label' and 'free of additives & preservatives' are defining the freshness of products amongst consumers. Market players should develop advanced technologies with relation to probiotic dietary supplements and tap into opportunities in plant-based products for sports nutrition.

Increased Spending on Health Benefitting Functional Food Ingredients Market

Demand for Functional Foods to Remain High Compared to Functional Beverages

Stringent Regulations on Functional Food Ingredients Hindering Market Growth

Growing Health Awareness among Consumers to Increase Demand

Functional Food Ingredients Market: Competitive Landscape

Functional Food Ingredients Market: Key Developments

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Fortune

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Global Functional Food Ingredients Market Analysis Scenario

3.1. Market Size (Value US$) and Volume (MT) Forecast

3.1.1. Market Size (Value US$) and Y-o-Y Growth

3.1.2. Absolute $ Opportunity

3.2. Global Functional Food Ingredients Production Outlook

3.3. Industry Value and Supply Chain Analysis

3.4. Trade Analysis

3.5. Functional Food Ingredients Market Outlook

3.5.1. Oilseeds market summary

3.5.2. Market Outlook: Edible oil

4. Market Dynamics

4.1. Macro-economic Factors

4.2. Drivers

4.2.1. Supply Side

4.2.2. Demand Side

4.3. Restraints

4.4. Opportunity

4.5. Forecast Factors – Relevance and Impact

5. Global Functional Food Ingredients Market Analysis and Forecast, By Region

5.1. Introduction

5.1.1. Basis Point Share (BPS) Analysis By Region

5.1.2. Y-o-Y Growth Projections By Region

5.2. Market Size (Value US$) and Volume (MT) Forecast By Region

5.2.1. North America

5.2.2. Europe

5.2.3. APAC

5.2.4. Latin America

5.2.5. Middle East and Africa

5.3. Market Attractiveness Analysis By Region

6. Global Functional Food Ingredients Market Analysis, By Ingredient

6.1. Introduction

6.1.1. Y-o-Y Growth Comparison, By Ingredient

6.1.2. Basis Point Share (BPS) Analysis, By Ingredient

6.2. Market Size (Value US$) and Volume (MT) Forecast By Ingredient

6.2.1. Vitamins

6.2.2. Minerals

6.2.3. Prebiotics and Dietary Fibres

6.2.4. Probiotics

6.2.5. Carotenoids

6.2.6. Proteins

6.2.7. Omega-3 Fatty Acids

6.3. Market Attractiveness Analysis, By Ingredient

6.4. Prominent Trends

7. Global Functional Food Ingredients Market Analysis, By Application

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison, By Application

7.1.2. Basis Point Share (BPS) Analysis, By Application

7.2. Market Size (Value US$) and Volume (MT) Forecast By Application

7.2.1. Beverages

7.2.2. Dairy Products

7.2.3. Infant Food

7.2.4. Bakery & Confectionery

7.3. Market Attractiveness Analysis, By Application

7.4. Prominent Trends

8. Global Functional Food Ingredients Regional Market Pricing Analysis

9. North America Functional Food Ingredients Market Analysis and Forecast

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Country

9.1.2. Y-o-Y Growth Projections By Country

9.2. Market Size (Value US$) and Volume (MT) Forecast By Market Segments

9.2.1. By Country

9.2.1.1. U.S.

9.2.1.2. Canada

9.2.2. By Ingredient

9.2.3. By Application

9.3. Market Attractiveness Analysis

9.3.1. By Country

9.3.2. By Ingredient

9.3.3. By Application

9.4. Prominent Trends

9.5. Drivers and Restraints: Impact Analysis

10. Latin America Functional Food Ingredients Market Analysis and Forecast

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.2. Market Size (Value US$) and Volume (MT) Forecast By Market Segments

10.2.1. By Country

10.2.1.1. Brazil

10.2.1.2. Mexico

10.2.1.3. Argentina

10.2.1.4. Rest of Latin America

10.2.2. By Ingredient

10.2.3. By Application

10.3. Market Attractiveness Analysis

10.3.1. By Country

10.3.2. By Ingredient

10.3.3. By Application

10.4. Prominent Trends

10.5. Drivers and Restraints: Impact Analysis

11. Europe Functional Food Ingredients Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. Market Size (Value US$) and Volume (MT) Forecast By Market Segments

11.2.1. By Country

11.2.1.1. EU4

11.2.1.2. U.K.

11.2.1.3. Nordic

11.2.1.4. Russia

11.2.1.5. Poland

11.2.1.6. Rest of Europe

11.2.2. By Ingredient

11.2.3. By Application

11.3. Market Attractiveness Analysis

11.3.1. By Country

11.3.2. By Ingredient

11.3.3. By Application

11.4. Prominent Trends

11.5. Drivers and Restraints: Impact Analysis

12. APAC Functional Food Ingredients Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Market Size (Value US$) and Volume (MT) Forecast By Market Segments

12.2.1. By Country

12.2.1.1. China

12.2.1.2. India

12.2.1.3. Japan

12.2.1.4. ASEAN

12.2.1.5. Australia and New Zealand

12.2.1.6. Rest of APAC

12.2.2. By Ingredient

12.2.3. By Application

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Ingredient

12.3.3. By Application

12.4. Prominent Trends

12.5. Drivers and Restraints: Impact Analysis

13. MEA Functional Food Ingredients Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Market Size (Value US$) and Volume (MT) Forecast By Market Segments

13.2.1. By Country

13.2.1.1. GCC

13.2.1.2. North Africa

13.2.1.3. South Africa

13.2.1.4. Rest of MEA

13.2.2. By Ingredient

13.2.3. By Application

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Ingredient

13.3.3. By Application

13.4. Prominent Trends

13.5. Drivers and Restraints: Impact Analysis

14. Competition Landscape

14.1. Competition Dashboard

14.2. Competitive Benchmarking

14.3. Profitability and Gross Margin Analysis By Competition

14.4. Competition Deep-dive

14.5. Company Profiles- By Ingredient (Details–Overview, Financials, Products, Strategy, Recent Developments) (Tentative list)

14.6. Company Profile By Global Key Players

14.6.1. Archer Daniels Midland Company

14.6.1.1. Overview

14.6.1.2. Product Portfolio

14.6.1.3. Profitability by Market Segments (Product/Channel/Region)

14.6.1.4. Sales Footprint

14.6.1.5. Strategy Overview

14.6.1.6. Marketing Strategy

14.6.1.7. Product Strategy

14.6.2. BASF SE

14.6.2.1. Overview

14.6.2.2. Product Portfolio

14.6.2.3. Profitability by Market Segments (Product/Channel/Region)

14.6.2.4. Sales Footprint

14.6.2.5. Strategy Overview

14.6.2.6. Marketing Strategy

14.6.2.7. Product Strategy

14.6.3. Cargill, Incorporated

14.6.3.1. Overview

14.6.3.2. Product Portfolio

14.6.3.3. Profitability by Market Segments (Product/Channel/Region)

14.6.3.4. Sales Footprint

14.6.3.5. Strategy Overview

14.6.3.6. Marketing Strategy

14.6.3.7. Product Strategy

14.6.4. Arla Foods Ingredients Group P/S

14.6.4.1. Overview

14.6.4.2. Product Portfolio

14.6.4.3. Profitability by Market Segments (Product/Channel/Region)

14.6.4.4. Sales Footprint

14.6.4.5. Strategy Overview

14.6.4.6. Marketing Strategy

14.6.4.7. Product Strategy

14.6.5. E. I. Du Pont De Nemours and Company

14.6.5.1. Overview

14.6.5.2. Product Portfolio

14.6.5.3. Profitability by Market Segments (Product/Channel/Region)

14.6.5.4. Sales Footprint

14.6.5.5. Strategy Overview

14.6.5.6. Marketing Strategy

14.6.5.7. Product Strategy

14.6.6. Kerry Group PLC

14.6.6.1. Overview

14.6.6.2. Product Portfolio

14.6.6.3. Profitability by Market Segments (Product/Channel/Region)

14.6.6.4. Sales Footprint

14.6.6.5. Strategy Overview

14.6.6.6. Marketing Strategy

14.6.6.7. Product Strategy

14.6.7. Corbion N.V

14.6.7.1. Overview

14.6.7.2. Product Portfolio

14.6.7.3. Profitability by Market Segments (Product/Channel/Region)

14.6.7.4. Sales Footprint

14.6.7.5. Strategy Overview

14.6.7.6. Marketing Strategy

14.6.7.7. Product Strategy

14.6.8. Dr. Paul Lohmann Gmbh KG

14.6.8.1. Overview

14.6.8.2. Product Portfolio

14.6.8.3. Profitability by Market Segments (Product/Channel/Region)

14.6.8.4. Sales Footprint

14.6.8.5. Strategy Overview

14.6.8.6. Marketing Strategy

14.6.8.7. Product Strategy

14.6.9. Minerals Technologies Inc

14.6.9.1. Overview

14.6.9.2. Product Portfolio

14.6.9.3. Profitability by Market Segments (Product/Channel/Region)

14.6.9.4. Sales Footprint

14.6.9.5. Strategy Overview

14.6.9.6. Marketing Strategy

14.6.9.7. Product Strategy

14.6.10. Tate & Lyle PLC

14.6.10.1. Overview

14.6.10.2. Product Portfolio

14.6.10.3. Profitability by Market Segments (Product/Channel/Region)

14.6.10.4. Sales Footprint

14.6.10.5. Strategy Overview

14.6.10.6. Marketing Strategy

14.6.10.7. Product Strategy

14.6.11. AkzoNobel N.V.

14.6.11.1. Overview

14.6.11.2. Product Portfolio

14.6.11.3. Profitability by Market Segments (Product/Channel/Region)

14.6.11.4. Sales Footprint

14.6.11.5. Strategy Overview

14.6.11.6. Marketing Strategy

14.6.11.7. Product Strategy

14.6.12. Jungbunzlauer Suisse AG

14.6.12.1. Overview

14.6.12.2. Product Portfolio

14.6.12.3. Profitability by Market Segments (Product/Channel/Region)

14.6.12.4. Sales Footprint

14.6.12.5. Strategy Overview

14.6.12.6. Marketing Strategy

14.6.12.7. Product Strategy

14.6.13. Ingredion Inc.

14.6.13.1. Overview

14.6.13.2. Product Portfolio

14.6.13.3. Profitability by Market Segments (Product/Channel/Region)

14.6.13.4. Sales Footprint

14.6.13.5. Strategy Overview

14.6.13.6. Marketing Strategy

14.6.13.7. Product Strategy

14.6.14. Koninklijke DSM N.V.

14.6.14.1. Overview

14.6.14.2. Product Portfolio

14.6.14.3. Profitability by Market Segments (Product/Channel/Region)

14.6.14.4. Sales Footprint

14.6.14.5. Strategy Overview

14.6.14.6. Marketing Strategy

14.6.14.7. Product Strategy

14.6.15. Dairy Crest Group PLC

14.6.15.1. Overview

14.6.15.2. Product Portfolio

14.6.15.3. Profitability by Market Segments (Product/Channel/Region)

14.6.15.4. Sales Footprint

14.6.15.5. Strategy Overview

14.6.15.6. Marketing Strategy

14.6.15.7. Product Strategy

14.6.16. Global Specialty Ingredients (M) Sdn. Bhd. (GSI)

14.6.16.1. Overview

14.6.16.2. Product Portfolio

14.6.16.3. Profitability by Market Segments (Product/Channel/Region)

14.6.16.4. Sales Footprint

14.6.16.5. Strategy Overview

14.6.16.6. Marketing Strategy

14.6.16.7. Product Strategy

14.6.17. Excellent Health Products Co., Ltd (EHP)

14.6.17.1. Overview

14.6.17.2. Product Portfolio

14.6.17.3. Profitability by Market Segments (Product/Channel/Region)

14.6.17.4. Sales Footprint

14.6.17.5. Strategy Overview

14.6.17.6. Marketing Strategy

14.6.17.7. Product Strategy

14.6.18. Supreem Pharmaceuticals Mysore Pvt. Ltd.

14.6.18.1. Overview

14.6.18.2. Product Portfolio

14.6.18.3. Profitability by Market Segments (Product/Channel/Region)

14.6.18.4. Sales Footprint

14.6.18.5. Strategy Overview

14.6.18.6. Marketing Strategy

14.6.18.7. Product Strategy

14.6.19. Bio Actives Japan Corporation

14.6.19.1. Overview

14.6.19.2. Product Portfolio

14.6.19.3. Profitability by Market Segments (Product/Channel/Region)

14.6.19.4. Sales Footprint

14.6.19.5. Strategy Overview

14.6.19.6. Marketing Strategy

14.6.19.7. Product Strategy

14.6.20. FENCHEM BIOTEK LTD.

14.6.20.1. Overview

14.6.20.2. Product Portfolio

14.6.20.3. Profitability by Market Segments (Product/Channel/Region)

14.6.20.4. Sales Footprint

14.6.20.5. Strategy Overview

14.6.20.6. Marketing Strategy

14.6.20.7. Product Strategy

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global Functional Food Ingredients Market Size (US$ Mn) Analysis and Forecast by Region, 2014-2029

Table 02: Global Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Region, 2014-2029

Table 03: Global Functional Food Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredient, 2014-2029

Table 04: Global Functional Food Ingredients Market Volume (MT) Analysis and Historical by Ingredient, 2014-2018

Table 05: Global Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Ingredient, 2019-2029

Table 06: Global Functional Food Ingredients Market Size (US$ Mn) Historical by Application, 2014-2018

Table 07: Global Functional Food Ingredients Market Size (US$ Mn) Forecast by Application, 2019-2029

Table 08: Global Functional Food Ingredients Market Volume (MT) Hostorical by Application, 2014-2018

Table 09: Global Functional Food Ingredients Market Volume (MT) Forecast by Application, 2019-2029

Table 10: North America Functional Food Ingredients Market Size (US$ Mn) Historical by Country, 2014-2018

Table 11: North America Functional Food Ingredients Market Size (US$ Mn) Forecast by Country, 2019-2029

Table 12: North America Functional Food Ingredients Market Volume (MT) Historical by Country, 2014-2018

Table 13: North America Functional Food Ingredients Market Volume (MT) Forecast by Country, 2019-2029

Table 14: North America Functional Food Ingredients Market Value (US$ Mn) Analysis and Historical by Ingredient, 2014-2018

Table 15: North America Functional Food Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredient, 2019-2029

Table 16: North America Functional Food Ingredients Market Volume (MT) Analysis and Historical by Ingredient, 2014-2018

Table 17: North America Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Ingredient, 2019-2029

Table 18: North America Functional Food Ingredients Market Size (US$ Mn) Historical by Application, 2014-2018

Table 19: North America Functional Food Ingredients Market Size (US$ Mn) Forecast by Application, 2019-2029

Table 20: North America Functional Food Ingredients Market Volume (MT) Forecast by Application, 2014-2029

Table 21: Latin America Functional Food Ingredients Market Size (US$ Mn) Historical by Country, 2014-2018

Table 22: Latin America Functional Food Ingredients Market Size (US$ Mn) Forecast by Country, 2019-2029

Table 23: Latin America Functional Food Ingredients Market Volume (MT) Historical by Country, 2014-2018

Table 24: Latin America Functional Food Ingredients Market Volume (MT) Forecast by Country, 2019-2029

Table 25: Latin America Functional Food Ingredients Market Value (US$ Mn) Analysis and Historical by Ingredient, 2014-2018

Table 26: Latin America Functional Food Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredient, 2019-2029

Table 27: Latin America Functional Food Ingredients Market Volume (MT) Analysis and Historical by Ingredient, 2014-2018

Table 28: Latin America Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Ingredient, 2019-2029

Table 29: Latin America Functional Food Ingredients Market Size (US$ Mn) Historcial by Application, 2014-2018

Table 30: Latin America Functional Food Ingredients Market Size (US$ Mn) Forecast by Application, 2019-2029

Table 31: Latin America Functional Food Ingredients Market Volume (MT) Historical by Application, 2014-2018

Table 32: Latin America Functional Food Ingredients Market Volume (MT) Forecast by Application, 2019-2029

Table 33: Europe Functional Food Ingredients Market Size (US$ Mn) Historical by Country, 2014-2018

Table 34: Europe Functional Food Ingredients Market Size (US$ Mn) Forecast by Country, 2019-2029

Table 35: Europe Functional Food Ingredients Market Volume (MT) Historical by Country, 2014-2018

Table 36: Europe Functional Food Ingredients Market Volume (MT) Forecast by Country, 2019-2029

Table 37 Europe Functional Food Ingredients Market Value (US$ Mn) Analysis and Historical by Ingredient, 2014-2018

Table 38: Europe Functional Food Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredient, 2019-2029

Table 39: Europe Functional Food Ingredients Market Volume (MT) Analysis and Historical by Ingredient, 2014-2018

Table 40: Europe Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Ingredient, 2019-2029

Table 41: Europe Functional Food Ingredients Market Size (US$ Mn) Historical by Application, 2014-2018

Table 42: Europe Functional Food Ingredients Market Size (US$ Mn) Forecast by Application, 2019-2029

Table 43: Europe Functional Food Ingredients Market Volume (MT) Historical by Application, 2014-2018

Table 44: Europe Functional Food Ingredients Market Volume (MT) Forecast by Application, 2019-2029

Table 45: APAC Functional Food Ingredients Market Size (US$ Mn) Historical by Country, 2014-2018

Table 46: APAC Functional Food Ingredients Market Size (US$ Mn) Forecast by Country, 2019-2029

Table 47: APAC Functional Food Ingredients Market Volume (MT) Historical by Country, 2014-2018

Table 48: APAC Functional Food Ingredients Market Volume (MT) Forecast by Country, 2019-2029

Table 49: APAC Functional Food Ingredients Market Value (US$ Mn) Analysis and Historical by Ingredient, 2014-2018

Table 50: APAC Functional Food Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredient, 2019-2029

Table 51: APAC Functional Food Ingredients Market Volume (MT) Analysis and Historical by Ingredient, 2014-2018

Table 52: APAC Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Ingredient, 2019-2029

Table 53: APAC Functional Food Ingredients Market Size (US$ Mn) Historical by Application, 2014-2018

Table 54: APAC Functional Food Ingredients Market Size (US$ Mn) Forecast by Application, 2019-2029

Table 55: APAC Functional Food Ingredients Market Volume (MT) Historical by Application, 2014-2018

Table 56: APAC Functional Food Ingredients Market Volume (MT) Forecast by Application, 2019-2029

Table 57: MEA Functional Food Ingredients Market Size (US$ Mn) Historical by Country, 2014-2018

Table 58: MEA Functional Food Ingredients Market Size (US$ Mn) Forecast by Country, 2019-2029

Table 59: MEA Functional Food Ingredients Market Volume (MT) Historical by Country, 2014-2018

Table 60: MEA Functional Food Ingredients Market Volume (MT) Forecast by Country, 2019-2029

Table 61: MEA Functional Food Ingredients Market Value (US$ Mn) Analysis and Historical by Ingredient, 2014-2018

Table 62: MEA Functional Food Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredient, 2019-2029

Table 63: MEA Functional Food Ingredients Market Volume (MT) Analysis and Historical by Ingredient, 2014-2018

Table 64: MEA Functional Food Ingredients Market Volume (MT) Analysis and Forecast by Ingredient, 2019-2029

Table 65: MEA Functional Food Ingredients Market Size (US$ Mn) Historical by Application, 2014-2018

Table 66: MEA Functional Food Ingredients Market Size (US$ Mn) Forecast by Application, 2019-2029

Table 67: MEA Functional Food Ingredients Market Volume (MT) Historical by Application, 2014-2018

Table 68: MEA Functional Food Ingredients Market Volume (MT) Forecast by Application, 2019-2029

List of Figures

Figure 01: Global Functional Food Ingredients Market Value (US$ Mn) and Volume (000’MT) Forecast, 2014-2029

Figure 02: Global Functional Food Ingredients Market Absolute $ Opportunity (US$ Mn), 2014-2029

Figure 03: Global Functional Food Ingredients Market Share (%) & BPS Analysis by Region, 2014, 2019 & 2029

Figure 04: Global Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Region, 2014-2029

Figure 05: Global Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Region, 2014–2029

Figure 06: Global Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Region, 2014–2029

Figure 07: Global Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredient, 2014–2029

Figure 08: Global Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Ingredient, 2014–2029

Figure 09: Global Functional Food Ingredients Market Share (%) & BPS Analysis by Ingredient, 2014, 2019 & 2029

Figure 10: Global Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Ingredient, 2014-2029

Figure 11: Global Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2014–2029

Figure 12: Global Functional Food Ingredients Market Share (%) & BPS Analysis by Application, 2014, 2019 & 2029

Figure 13: Global Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Application, 2014–2029

Figure 14: Global Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Application, 2014-2029

Figure 15: Global Functional Food Ingredients Market Attractiveness Analysis by Region, 2014-2029

Figure 16: Global Functional Food Ingredients Market Attractiveness Analysis by Ingredient, 2014-2029

Figure 17: Global Functional Food Ingredients Market Attractiveness Analysis by Application, 2014-2029

Figure 18: North America Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Country, 2014-2029

Figure 19: North America Functional Food Ingredients Market Share (%) & BPS Analysis by Country, 2014, 2019 & 2029

Figure 20: North America Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Country, 2014–2029

Figure 21: North America Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Country, 2014-2029

Figure 22: North America Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredient, 2014–2029

Figure 23: North America Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Ingredient, 2014–2029

Figure 24: North America Functional Food Ingredients Market Share (%) & BPS Analysis by Ingredient, 2014, 2019 & 2029

Figure 25: North America Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Ingredient, 2014-2029

Figure 26: North America Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2014–2029

Figure 27: North America Functional Food Ingredients Market Share (%) & BPS Analysis by Application, 2014, 2019 & 2029

Figure 28: North America Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Application, 2014–2029

Figure 29: North America Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Application, 2014-2029

Figure 30: North America Functional Food Ingredients Market Attractiveness Analysis by Country, 2014-2029

Figure 31: North America Functional Food Ingredients Market Attractiveness Analysis by Ingredient, 2014-2029

Figure 32: North America Functional Food Ingredients Market Attractiveness Analysis by Application, 2014-2029

Figure 33: Latin America Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Country, 2014-2029

Figure 34: Latin America Functional Food Ingredients Market Share (%) & BPS Analysis by Country, 2014, 2019 & 2029

Figure 35: Latin America Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Country, 2014–2029

Figure 36: Latin America Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Country, 2014-2029

Figure 37: Latin America Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredient, 2014–2029

Figure 38: Latin America Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Ingredient, 2014–2029

Figure 39: Latin America Functional Food Ingredients Market Share (%) & BPS Analysis by Ingredient, 2014, 2019 & 2029

Figure 40: Latin America Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Ingredient, 2014-2029

Figure 41: Latin America Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2014–2029

Figure 42: Latin America Functional Food Ingredients Market Share (%) & BPS Analysis by Application, 2014, 2019 & 2029

Figure 43: Latin America Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Application, 2014–2029

Figure 44: Latin America Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Application, 2014-2029

Figure 45: Latin America Functional Food Ingredients Market Attractiveness Analysis by Country, 2014-2029

Figure 46: Latin America Functional Food Ingredients Market Attractiveness Analysis by Ingredient, 2014-2029

Figure 47: Latin America Functional Food Ingredients Market Attractiveness Analysis by Application, 2014-2029

Figure 48: Europe Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Country, 2014-2029

Figure 49: Europe Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Country, 2014–2029

Figure 50: Europe Functional Food Ingredients Market Share (%) & BPS Analysis by Country, 2014, 2019 & 2029

Figure 51: Europe Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Country, 2014-2029

Figure 52: Europe Functional Food Ingredients Market Share (%) & BPS Analysis by EU5 Country, 2014, 2019 & 2029

Figure 53: Europe Functional Food Ingredients Market Y-o-Y Growth Rate (%) by EU5 Country, 2014-2029

Figure 54: Europe Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredient, 2014–2029

Figure 55: Europe Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Ingredient, 2014–2029

Figure 56: Europe Functional Food Ingredients Market Share (%) & BPS Analysis by Ingredient, 2014, 2019 & 2029

Figure 57: Europe Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Ingredient, 2014-2029

Figure 58: Europe Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2014–2029

Figure 59: Europe Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Application, 2014–2029

Figure 60: Europe Functional Food Ingredients Market Share (%) & BPS Analysis by Application, 2014, 2019 & 2029

Figure 61: Europe Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Application, 2014-2029

Figure 62: Europe Functional Food Ingredients Market Attractiveness Analysis by Country, 2014-2029

Figure 63: Europe Functional Food Ingredients Market Attractiveness Analysis by Ingredient, 2014-2029

Figure 64: Europe Functional Food Ingredients Market Attractiveness Analysis by Application, 2014-2029

Figure 65: APAC Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Country, 2014-2029

Figure 66: APAC Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Country, 2014–2029

Figure 67: APAC Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by ASEAN Country, 2014-2029

Figure 68: APAC Functional Food Ingredients Market Volume (MT) Analysis & Forecast by ASEAN Country, 2014–2029

Figure 69: APAC Functional Food Ingredients Market Share (%) & BPS Analysis by Country, 2014, 2019 & 2029

Figure 70: APAC Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Country, 2014-2029

Figure 71: APAC Functional Food Ingredients Market Share (%) & BPS Analysis by ASEAN Country, 2014, 2019 & 2029

Figure 72: APAC Functional Food Ingredients Market Y-o-Y Growth Rate (%) by ASEAN Country, 2014-2029

Figure 73: APAC Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredient, 2014–2029

Figure 74: APAC Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Ingredient, 2014–2029

Figure 75: APAC Functional Food Ingredients Market Share (%) & BPS Analysis by Ingredient, 2014, 2019 & 2029

Figure 76: APAC Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Ingredient, 2014-2029

Figure 77: APAC Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2014–2029

Figure 78: APAC Functional Food Ingredients Market Share (%) & BPS Analysis by Application, 2014, 2019 & 2029

Figure 79: APAC Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Application, 2014–2029

Figure 80: APAC Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Application, 2014-2029

Figure 81: APAC Functional Food Ingredients Market Attractiveness Analysis by Country, 2014-2029

Figure 82: APAC Functional Food Ingredients Market Attractiveness Analysis by Ingredient, 2014-2029

Figure 83: APAC Functional Food Ingredients Market Attractiveness Analysis by Application, 2014-2029

Figure 84: MEA Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Country, 2014-2029

Figure 85: MEA Functional Food Ingredients Market Share (%) & BPS Analysis by Country, 2014, 2019 & 2029

Figure 86: MEA Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Country, 2014–2029

Figure 87: MEA Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Country, 2014-2029

Figure 88: MEA Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredient, 2014–2029

Figure 89: MEA Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Ingredient, 2014–2029

Figure 90: MEA Functional Food Ingredients Market Share (%) & BPS Analysis by Ingredient, 2014, 2019 & 2029

Figure 91: MEA Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Ingredient, 2014-2029

Figure 92: MEA Functional Food Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2014–2029

Figure 93: MEA Functional Food Ingredients Market Share (%) & BPS Analysis by Application, 2014, 2019 & 2029

Figure 94: MEA Functional Food Ingredients Market Volume (MT) Analysis & Forecast by Application, 2014–2029

Figure 95: MEA Functional Food Ingredients Market Y-o-Y Growth Rate (%) by Application, 2014-2029

Figure 96: MEA Functional Food Ingredients Market Attractiveness Analysis by Country, 2014-2029

Figure 97: MEA Functional Food Ingredients Market Attractiveness Analysis by Ingredient, 2014-2029

Figure 98: MEA Functional Food Ingredients Market Attractiveness Analysis by Application, 2014-2029