Reports

Reports

India biomass market is poised to witness continued growth driven by increased demand for renewable energy coupled with supportive policy related to biomass power and biofuels, circular-economy initiatives, and ample agricultural waste. Biomass feedstock’s in the form of forestry waste, crop straw, and dedicated energy crops are converted through gasification, combustion, and anaerobic digestion methods to heat, generate electricity, biogas, and industrial-grade pellets for use across rural households and industry.

The key drivers of this growth include energy security concerns, commitments to carbon reduction, government incentives, and increased investments in palletization and bio-CNG. Key players and project developers are emphasizing supply-chain aggregation, modern gasifier plants, decentralized digesters, and pelleting plants while negotiating offtake agreements with states and industries. Technology vendors are improving the thermal efficiency and emissions control, and logistics service providers and farmer cooperatives are reducing losses in haulage. Initiatives such as public-private partnerships, capacity-building programs for farmers, concessional finance mechanisms, and recognition by policy-makers regarding the importance of accessible feedstock procurement, are now enabling scale. The future development—and the rate of commercial adoption—would be depending on the extent to which supply-chain integration continues to be fostered.

The biomass market refers to the production as well as utilization of energy from organic materials that may include agricultural residues, energy crops, and forestry waste. Biomass is increasingly being seen as an important renewable energy source that is helping India with its clean energy transition and rural energy security.

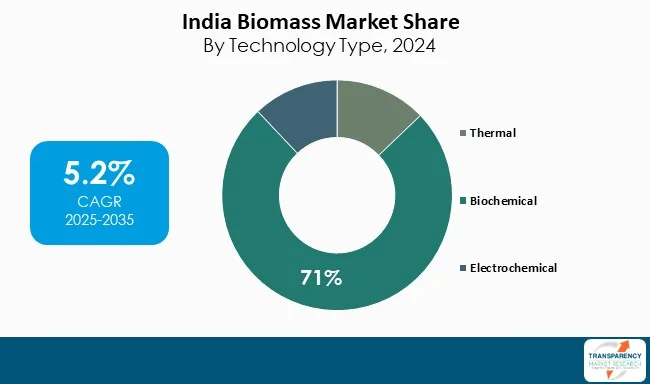

Biomass is practically converted into heat, electricity, or bio-CNG or industrial pellets by direct combustion, gasification, and anaerobic digestion, is utilized across all sectors for power generation, rural cooking and heating, industrial boiler, or blending transportation fuel. In India, biomass can play main roles in waste to energy projects, stopping stubble burning, and providing decent livelihoods to farmers. Distributed power projects utilizing biomass enable rural electrification and fossil fuel use reduction.

| Attribute | Detail |

|---|---|

| India Biomass Market Drivers |

|

India biomass market continues to see rapid growth due to favorable government policies and incentives for renewable energy deployment (hence, decrease reliance on conventional fossil fuels). The Ministry of New and Renewable Energy (MNRE) has led the way in launching the programs that benefit co-generation for sugar mills, new biomass-based power generation, bio-CNG development, and biomass pellets. Programs such as the SATAT (Sustainable Alternative Towards Affordable Transportation) and National Bio-Energy Mission provide a structural framework in place, which encourages both - the public and private sectors for participating in business and projects in biomass. By providing financial incentives in the form of capital subsidies, viability gap funding, and concessional interest rates, the government is attempting to lower the barriers of entry for developers and technology providers, so more players will be willing to develop products and business across both rural and industrial efforts.

India has a vast agricultural sector that provides an ample of scope for the biomass industry, as it produces large volumes of biomass residues that can be used as feedstock for renewable energy generation. Every year, millions of tons of crop residues generated by crops including paddy straw, sugarcane bagasse, cotton stalks, wheat straw, and maize husks remain waste and are burned in open fields, thereby causing significant health environmental problems. Biomass energy solutions offer a productive outlet to convert this surplus waste of agriculture back into value products such as electricity, industrial steam, biomass pellets, and bio-CNG. Converting waste into energy provides immense advantages to renewable energy platform and also creates an opportunity to establish a circular economy where residues would no longer be regarded as waste but viewed as potential investors/revenue generators.

The rural supply chain opportunity reinforces the market's long-term sustainability. Farmers can capitalize on crop residues by selling to aggregators or biomass power developers, thus creating another source of income beyond traditional farming. This will ultimately provide economic advantages in rural areas while curbing the hazardous practice of stubble burning, while at the same time, decentralized biomass initiatives such as microgrids- digesters and pelletization units are being undertaken in rural contexts to improve energy access, reduce reliance on grid electricity, and provide energy for small and medium enterprises (SMEs). The synergistic benefits of rural development and energy security make the use of agricultural residues an especially appealing prospect.

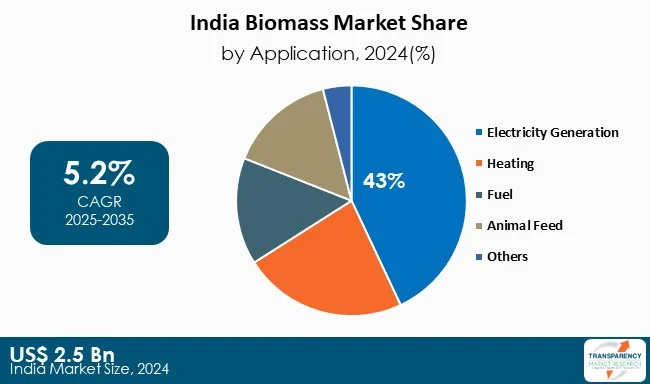

Electricity generation is the largest segment of the biomass industry in India due to its significant connection to sugar mills through bagasse cogeneration, and its role in meeting increasing demand for power. The government's Renewable Purchase Obligations (RPOs), feed-in tariffs, and Ministry of New and Renewable Energy (MNRE) programs provide a policy push, thereby supplying a consistent feedstock. As a result, biomass-based electricity generation is the most scalable and widely implemented application in India given this dual advantage in terms of reliable capacity addition, as well as waste-to-energy.

| Attribute | Detail |

|---|---|

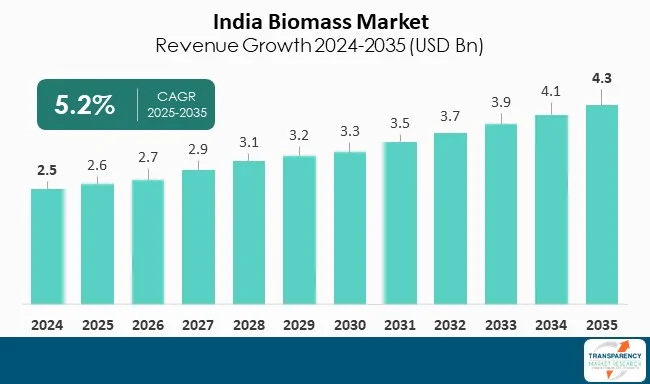

| Market Size Value in 2024 | US$ 2.5 Bn |

| Market Forecast Value in 2035 | US$ 4.3 Bn |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 2.5 Bn in 2024

The market is expected to grow at a CAGR of 5.2% from 2025 to 2035

Government policies and incentives accelerating biomass adoption and abundant agricultural residues and rural supply chain potential

Electricity generation held the largest share under application segment in 2024

Abellon CleanEnergy Limited, Ecostan, Singhal Udyog, Growmore Biotech Ltd., Punjab Renewable Energy Systems Private Limited, Sree Amman Briquettes and Bio Fuels, Neerpati Biofuels Private Limited, Shirke Energy, TERI MEHAR AGRO FUEL INDUSTRIES, and KKR Bio Fuels

Table 1 India Biomass Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 India Biomass Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 India Biomass Market Volume (Tons) Forecast, by Structure, 2020 to 2035

Table 4 India Biomass Market Value (US$ Bn) Forecast, by Structure, 2020 to 2035

Table 5 India Biomass Market Volume (Tons) Forecast, by Conversion Technology 2020 to 2035

Table 6 India Biomass Market Value (US$ Bn) Forecast, by Conversion Technology 2020 to 2035

Table 7 India Biomass Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 8 India Biomass Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 India Biomass Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 10 India Biomass Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 11 India Biomass Market Volume (Tons) Forecast, by Zone, 2020 to 2035

Table 12 India Biomass Market Value (US$ Bn) Forecast, by Zone, 2020 to 2035

Figure 1 India Biomass Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 2 India Biomass Market Attractiveness, by Type

Figure 3 India Biomass Market Volume Share Analysis, by Structure, 2024, 2027, and 2035

Figure 4 India Biomass Market Attractiveness, by Structure

Figure 5 India Biomass Market Volume Share Analysis, by Conversion Technology, 2024, 2027, and 2035

Figure 6 India Biomass Market Attractiveness, by Conversion Technology

Figure 7 India Biomass Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 8 India Biomass Market Attractiveness, by Application

Figure 9 India Biomass Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 10 India Biomass Market Attractiveness, by End-use

Figure 11 India Biomass Market Volume Share Analysis, by Zone, 2024, 2027, and 2035

Figure 12 India Biomass Market Attractiveness, by Zone