Reports

Reports

Patient-centric healthcare is an emerging value-based model for healthcare delivery, which has resulted in an improvement in care quality, better outcomes, and greater patient satisfaction. Growing focus on patient-centric healthcare delivery via application programming interfaces (APIs) has been noted over the recent past and the emergence of a host of services, such as wearable medical devices and remote patient monitoring has spurred the demand for healthcare API solutions.

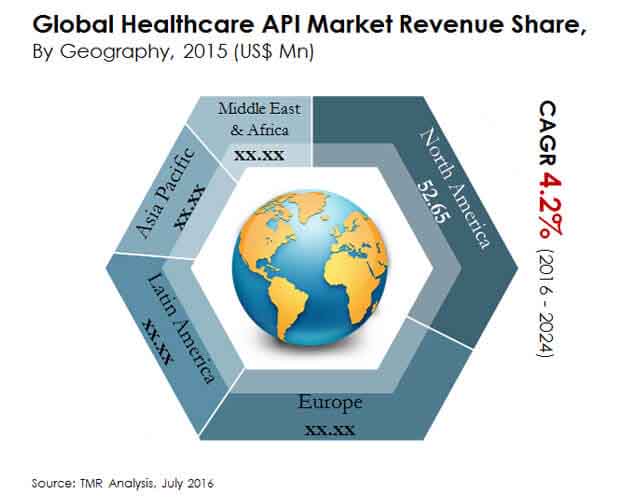

The gradual rise in the acceptance and adoption of healthcare API solutions by doctors, patients, and payers is expected to benefit the global market during the forecast period. The revenue generated by the global healthcare API market was pegged at US$162.4 mn in 2015 and expanding at a 4.2% CAGR, the market revenue is poised to reach US$234.2 mn by 2024.

The global market for healthcare API is led by North America. The region has emerged as the key revenue generator thanks to the presence of several prominent players. With limited public IT infrastructure development across emerging economies, the large-scale adoption of healthcare IT solutions is still considered to be a long-term opportunity for countries in developing economies. As a result, most players providing healthcare API solutions garner a significant portion of their revenue from the North America and Europe markets.

However, an increasing number of players are now working toward expanding their footprint across several emerging economies in Asia Pacific and Latin America owing to the immense opportunities in store and the untapped potential countries such as Brazil, India, China, and Japan present.

Asia Pacific is projected to be the fastest-growing region in the healthcare API market, expanding at a 4.5% CAGR during the forecast period. The growing demand for API-based electronic health record services and wearable medical devices is anticipated to drive the healthcare API market in the region. The Latin America healthcare API market is likely to be fuelled by the rising demand for remote patient monitoring and appointment services.

The key end users of healthcare API solutions include healthcare payers, healthcare providers, patients, and vendors. The healthcare providers segment is the leading end user and the segment is also projected to expand at the highest CAGR of 4.5% during the forecast period. To a large extent, this growth can be attributed to large hospitals and laboratories looking for automated solutions for the management of non-core activities such as patient appointment booking and order tracking.

Given the ease and flexibility the healthcare application programming interface provides in scheduling appointments with doctors, the appointment segment is the most preferred healthcare API service. The segment is also anticipated to expand at the highest CAGR of 4.3% from 2016 to 2024.

Some of the leading healthcare API service providers are MuleSoft, Inc., Practo Technologies Pvt. Ltd., Epic Systems Corporation, Microsoft Corporation, Allscripts Healthcare Solutions Inc., General Electric Company, Greenway Health, LLC, eClinicalWorks LLC, Practice Fusion, Inc., and Apple, Inc.

Healthcare API Market to Gain More Impetus from Cloud-based API services

The development of the steam autoclaves market is acquiring footing because of the presence of severe guidelines to guarantee patients wellbeing and developing presence of cutting edge medical services offices. On the other side, an expanding number of players are currently pursuing growing their impression across a few arising economies in Asia Pacific and Latin America inferable from the gigantic chances coming up and the undiscovered potential nations, for example, Brazil, India, China, and Japan present.

Notwithstanding these development prospects, the factor, for example, expanded take-up of expendable items which are intended to be utilized once and required less sterilization is hampering the development of the worldwide steam autoclave market. Moreover, higher extract obligation forced on the clinical gadgets are affecting adversely on the development of the general steam autoclave market, particularly in the creating areas. By the by, developing mindfulness about medical services across the agricultural nations is setting out development open doors for the vital participants working in the worldwide steam autoclave market.

The medical care API market is required to observe hearty development sooner rather than later as medical care keeps on receiving cloud answers for better tolerant consideration, in the midst of expanding move by governments. The worldwide medical services API market is likewise seeing a developing interest for cloud-based APIs which make it simpler to coordinate information, and give basic admittance to patients to collaboration during basic crises.

The rising interest for APIs and enormous venture of tech monsters like Amazon, Microsoft, and Apple in the field are required to set out critical open doors for major parts in the medical care API market. Regardless of the significant zones covered by tech goliaths, the APIs stay open to the production of new applications which show restraint driven and improve the nature of care for patients’ altogether. The developing move by programs like MediCaid for medical services administrators to move to the cloud is additionally expected to drive development of the medical services API market.

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Healthcare API Market Snapshot

2.2. Global Healthcare API Market Revenue, 2014 – 2024 (US$ Mn) and Year-on-Year Growth (%)

3. Global Healthcare API Market Analysis, 2014 – 2024 (US$ Mn)

3.1. Overview

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Key Trend Analysis

3.4. Global Healthcare API Market Analysis, By Services, 2014 – 2024 (US$ Mn)

3.4.1. Electronic Health Record Access

3.4.2. Appointments

3.4.3. Remote Patient Monitoring

3.4.4. Payment

3.4.5. Medical Device (Wearable)

3.5. Global Healthcare API Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

3.5.1. On-Premise

3.5.2. Cloud-based

3.6. Global Healthcare API Market Analysis, By End-User, 2014 – 2024 (US$ Mn)

3.6.1. Healthcare Payers

3.6.2. Healthcare Providers

3.6.3. Patients

3.6.4. Vendors

3.7. Competitive Landscape

3.7.1. Market Positioning of Key Players, 2015

3.7.2. Competitive Strategies Adopted by Leading Players

4. North America Healthcare API Market Analysis, 2014 – 2024 (US$ Mn)

4.1. North America Healthcare API Market Analysis, By Services, 2014 – 2024 (US$ Mn)

4.1.1. Electronic Health Record Access

4.1.2. Appointments

4.1.3. Remote Patient Monitoring

4.1.4. Payment

4.1.5. Medical Device (Wearable)

4.2. North America Healthcare API Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

4.2.1. On-Premise

4.2.2. Cloud-based

4.3. North America Healthcare API Market Analysis, By End-User, 2014 – 2024 (US$ Mn)

4.3.1. Healthcare Payers

4.3.2. Healthcare Providers

4.3.3. Patients

4.3.4. Vendors

5. Europe Healthcare API Market Analysis, 2014 – 2024 (US$ Mn)

5.1. Europe Healthcare API Market Analysis, By Services, 2014 – 2024 (US$ Mn)

5.1.1. Electronic Health Record Access

5.1.2. Appointments

5.1.3. Remote Patient Monitoring

5.1.4. Payment

5.1.5. Medical Device (Wearable)

5.2. Europe Healthcare API Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

5.2.1. On-Premise

5.2.2. Cloud-based

5.3. Europe Healthcare API Market Analysis, By End-User, 2014 – 2024 (US$ Mn)

5.3.1. Healthcare Payers

5.3.2. Healthcare Providers

5.3.3. Patients

5.3.4. Vendors

6. Asia Pacific (APAC) Healthcare API Market Analysis, 2014 – 2024 (US$ Mn)

6.1. APAC Healthcare API Market Analysis, By Services, 2014 – 2024 (US$ Mn)

6.1.1. Electronic Health Record Access

6.1.2. Appointments

6.1.3. Remote Patient Monitoring

6.1.4. Payment

6.1.5. Medical Device (Wearable)

6.2. APAC Healthcare API Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

6.2.1. On-Premise

6.2.2. Cloud-based

6.3. APAC Healthcare API Market Analysis, By End-User, 2014 – 2024 (US$ Mn)

6.3.1. Healthcare Payers

6.3.2. Healthcare Providers

6.3.3. Patients

6.3.4. Vendors

7. Middle East and Africa (MEA) Healthcare API Market Analysis, 2014 – 2024 (US$ Mn)

7.1. MEA Healthcare API Market Analysis, By Services, 2014 – 2024 (US$ Mn)

7.1.1. Electronic Health Record Access

7.1.2. Appointments

7.1.3. Remote Patient Monitoring

7.1.4. Payment

7.1.5. Medical Device (Wearable)

7.2. MEA Healthcare API Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

7.2.1. On-Premise

7.2.2. Cloud-based

7.3. MEA Healthcare API Market Analysis, By End-User, 2014 – 2024 (US$ Mn)

7.3.1. Healthcare Payers

7.3.2. Healthcare Providers

7.3.3. Patients

7.3.4. Vendors

8. Latin America Healthcare API Market Analysis, 2014 – 2024 (US$ Mn)

8.1. Latin America Healthcare API Market Analysis By Services, 2014 – 2024 (US$ Mn)

8.1.1. Electronic Health Record Access

8.1.2. Appointments

8.1.3. Remote Patient Monitoring

8.1.4. Payment

8.1.5. Medical Device (Wearable)

8.2. Latin America Healthcare API Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

8.2.1. On-Premise

8.2.2. Cloud-based

8.3. Latin America Healthcare API Market Analysis, By End-User, 2014 – 2024 (US$ Mn)

8.3.1. Healthcare Payers

8.3.2. Healthcare Providers

8.3.3. Patients

8.3.4. Vendors

9. Global Healthcare API Market Analysis, Country Snippets (US$ Mn)

9.1. The U.S.

9.2. Canada

9.3. The U.K.

9.4. Germany

9.5. France

9.6. Italy

9.7. Australia

9.8. China

9.9. Japan

9.10. India

9.11. Indonesia

9.12. The UAE

9.13. Saudi Arabia

9.14. South Africa

9.15. Brazil

10. Company Profiles

10.1. Microsoft Corporation

10.1.1. Company Details (HQ, Foundation Year, Employee Strength)

10.1.2. Market Presence, By Segment and Geography

10.1.3. Key Developments

10.1.4. Strategy and Historical Roadmap

10.1.5. Revenue and Operating Profit

10.2. Apple Inc.

10.2.1. Company Details (HQ, Foundation Year, Employee Strength)

10.2.2. Market Presence, By Segment and Geography

10.2.3. Key Developments

10.2.4. Strategy and Historical Roadmap

10.2.5. Revenue and Operating Profit

10.3. Greenway Health, LLC

10.3.1. Company Details (HQ, Foundation Year, Employee Strength)

10.3.2. Market Presence, By Segment and Geography

10.3.3. Key Developments

10.3.4. Strategy and Historical Roadmap

10.3.5. Revenue and Operating Profit

10.4. MuleSoft, Inc.

10.4.1. Company Details (HQ, Foundation Year, Employee Strength)

10.4.2. Market Presence, By Segment and Geography

10.4.3. Key Developments

10.4.4. Strategy and Historical Roadmap

10.4.5. Revenue and Operating Profit

10.5. General Electric Company

10.5.1. Company Details (HQ, Foundation Year, Employee Strength)

10.5.2. Market Presence, By Segment and Geography

10.5.3. Key Developments

10.5.4. Strategy and Historical Roadmap

10.5.5. Revenue and Operating Profit

10.6. Practice Fusion, Inc.

10.6.1. Company Details (HQ, Foundation Year, Employee Strength)

10.6.2. Market Presence, By Segment and Geography

10.6.3. Key Developments

10.6.4. Strategy and Historical Roadmap

10.6.5. Revenue and Operating Profit

10.7. Epic Systems Corporation

10.7.1. Company Details (HQ, Foundation Year, Employee Strength)

10.7.2. Market Presence, By Segment and Geography

10.7.3. Key Developments

10.7.4. Strategy and Historical Roadmap

10.7.5. Revenue and Operating Profit

10.8. Allscripts Healthcare Solutions Inc.

10.8.1. Company Details (HQ, Foundation Year, Employee Strength)

10.8.2. Market Presence, By Segment and Geography

10.8.3. Key Developments

10.8.4. Strategy and Historical Roadmap

10.8.5. Revenue and Operating Profit

10.9. eClinicalWorks LLC.

10.9.1. Company Details (HQ, Foundation Year, Employee Strength)

10.9.2. Market Presence, By Segment and Geography

10.9.3. Key Developments

10.9.4. Strategy and Historical Roadmap

10.9.5. Revenue and Operating Profit

10.10. Practo Technologies Pvt. Ltd.

10.10.1. Company Details (HQ, Foundation Year, Employee Strength)

10.10.2. Market Presence, By Segment and Geography

10.10.3. Key Developments

10.10.4. Strategy and Historical Roadmap

10.10.5. Revenue and Operating Profit

List of Tables

Table No: 1 Healthcare API Market Snapshot

Table No: 2 Global Healthcare API Market Size and Forecast, By Deployment Model, 2014 - 2024 (US$ Mn)

Table No: 3 Global Healthcare API Market Size and Forecast, By Services, 2014 - 2024 (US$ Mn)

Table No: 4 Global Healthcare API Market Size and Forecast, By End-Users, 2014 - 2024 (US$ Mn)

Table No: 5 North America Healthcare API Market Size and Forecast, By Deployment Model, 2014 - 2024 (US$ Mn)

Table No: 6 North America Healthcare API Market Size and Forecast, By Services, 2014 - 2024 (US$ Mn)

Table No: 7 North America Healthcare API Market Size and Forecast, By End-User, 2014 - 2024 (US$ Mn)

Table No: 8 Europe Healthcare API Market Size and Forecast, By Deployment Model, 2014 - 2024 (US$ Mn)

Table No: 9 Europe Healthcare API Market Size and Forecast, By Services, 2014 - 2024 (US$ Mn)

Table No: 10 Europe Healthcare API Market Size and Forecast, By End-Users, 2014 - 2024 (US$ Mn)

Table No: 11 Asia Pacific Healthcare API Market Size and Forecast, By Deployment Model, 2014 - 2024 (US$ Mn)

Table No: 12 Asia Pacific Healthcare API Market Size and Forecast, By Services, 2014 - 2024 (US$ Mn)

Table No: 13 Asia Pacific Healthcare API Market Size and Forecast, By End-Users, 2014 - 2024 (US$ Mn)

Table No: 14 MEA Healthcare API Market Size and Forecast, By Deployment Model, 2014 - 2024 (US$ Mn)

Table No: 15 MEA Healthcare API Market Size and Forecast, By Services, 2014 - 2024 (US$ Mn)

Table No: 16 MEA Healthcare API Market Size and Forecast, By End-Users, 2014 - 2024 (US$ Mn)

Table No: 17 Latin America Healthcare API Market Size and Forecast, By Deployment Model, 2014 - 2024 (US$ Mn)

Table No: 18 Latin America Healthcare API Market Size and Forecast, By Services, 2014 - 2024 (US$ Mn)

Table No: 19 Latin America Healthcare API Market Size and Forecast, By End-Users, 2014 - 2024 (US$ Mn)

Table No: 20 Country Snippets Healthcare API Market, 2014-2024 (US$ Mn)

List of Figures

Figure No: 1 Global Healthcare API Market Revenue, 2014 – 2024 (US$ Mn) and Y-o-Y Growth (%)

Figure No: 2 Global Healthcare API Market Revenue (US$ Mn), 2016 & 2024

Figure No: 3 Global Healthcare API Market Growth, By Region, 2016 - 2024

Figure No: 4 Global Healthcare API Market Revenue Share, By Deployment Model, 2015 and 2024 (%)

Figure No: 5 Global Healthcare API Market Revenue Share, By Services, 2015 and 2024 (%)

Figure No: 6 Global Healthcare API Market Revenue Share, By End-Users,2015 and 2024 (%)

Figure No: 7 (A) Market Positioning of Key Players, 2015

Figure No: 7 (B) Market Share Analysis of Key Players, 2015

Figure No: 8 North America Healthcare API Market Revenue, 2014-2024 (US$ Mn)

Figure No: 9 North America Healthcare API Market Revenue Share, By Deployment Model, 2015 and 2024 (%)

Figure No: 10 North America Healthcare API Market Revenue Share, By Services, 2015 and 2024 (%)

Figure No: 11 North America Healthcare API Market Revenue Share, By End-Users, 2015 and 2024 (%)

Figure No: 12 Europe Healthcare API Market Revenue, 2014-2024 (US$ Mn)

Figure No: 13 Europe Healthcare API Market Revenue Share, By Deployment Model, 2015 and 2024 (%)

Figure No: 14 Europe Healthcare API Market Revenue Share, By Services, 2015 and 2024 (%)

Figure No: 15 Europe Healthcare API Market Revenue Share, By End-Users, 2015 and 2024 (%)

Figure No: 16 Asia Pacific Healthcare API Market Revenue, 2014-2024 (US$ Mn)

Figure No: 17 Asia Pacific Healthcare API Market Revenue Share, By Deployment Model, 2015 and 2024 (%)

Figure No: 18 Asia Pacific Healthcare API Market Revenue Share, By Services, 2015 and 2024 (%)

Figure No: 19 Asia Pacific Healthcare API Market Revenue Share, By End-Users, 2015 and 2024 (%)

Figure No: 20 MEA Healthcare API Market Revenue, 2014-2024 (US$ Mn)

Figure No: 21 MEA Healthcare API Market Revenue Share, By Deployment Model, 2015 and 2024 (%)

Figure No: 22 MEA Healthcare API Market Revenue Share, By Services, 2015 and 2024 (%)

Figure No: 23 MEA Healthcare API Market Revenue Share, By End-Users, 2015 and 2024 (%)

Figure No: 24 Latin America Healthcare API Market Revenue, 2014-2024 (US$ Mn)

Figure No: 25 Latin America Healthcare API Market Revenue Share, By Deployment Model, 2015 and 2024 (%)

Figure No: 26 Latin America Healthcare API Market Revenue Share, By Services,2015 and 2024 (%)

Figure No: 27 Latin America Healthcare API Market Revenue Share, By End-Users, 2015 and 2024 (%)

Figure No: 28 Revenue and Operating Income (US$ Mn)

Figure No: 29 Net sales and Operating Income (US$ Mn)

Figure No: 30 Healthcare segment Revenue & Profit (US$ Mn)