Reports

Reports

The respiratory monitoring devices market is witnessing geometric progression due to increased consciousness about the health of lungs and rise in incidences of long-term respiratory conditions like asthma and chronic obstructive pulmonary disease (COPD). The devices are required for continuous monitoring, which allows for interventions at an early stage and enhanced outcomes for patients.

.webp)

Technological progress including the integration of telemedicine and AI is making respiratory products more valuable in an attempt to make them usable for remote monitoring and data analysis. The pandemic has forced this shift with the COVID-19 pandemic that has placed in the spotlight the importance of efficient respiratory monitoring systems.

Additionally, greater demand is fueled by an older population and rising healthcare expenditures. As both - healthcare providers and patients seek alternative means of managing respiratory disease, the market will expand and provide opportunities for innovation and investment.

Respiratory monitoring devices are used for monitoring and regulating respiratory health through the measurement of various parameters such as airflow, oxygen saturation, and respiratory rate. The devices are paramount in the diagnosis and treatment of COPD and asthma.

Products such as portable and wearable devices and services such as telemedicine are enhancing patient monitoring capacity and facilitating remote care provision. Respiratory monitoring products were also needed for the COVID-19 pandemic, and the market demand for respiratory monitoring devices is heightened since then.

Although challenges like regulatory problems and the need for ease of use designs persist, the trend for the respiratory monitoring devices market is otherwise extremely favorable with enormous growth opportunities being fueled by technological advancements and focus on preventive care.

| Attribute | Detail |

|---|---|

| Respiratory Monitoring Devices Market Drivers |

|

The incidence of user respiratory diseases is one of the key reasons behind the respiratory monitoring devices market. Respiratory diseases such as chronic asthma, chronic obstructive pulmonary disease (COPD), and pneumonia occur in millions of individuals globally, thereby leading to increased demand for correct monitoring. Urbanization, pollution, smoking, and population growth are responsible causatives and raise the vulnerability to respiratory disease.

With these conditions on the rise, the healthcare systems have been stretched to perform timely with accurate monitoring to properly manage the patient's condition in advance. Respiratory monitoring equipment like spirometers, pulse oximeters, and portable monitoring equipment enable health practitioners to track real-time critical respiratory information. Exacerbations are then detected in advance, treatment regimens are tailored, and outcomes of the patient are improved.

Also, the COVID-19 pandemic has elevated respiratory health monitoring as a matter of urgent requirement even further, thereby driving heightened awareness and need for the devices. Integration of cutting-edge technologies, such as telemedicine and artificial intelligence, is facilitating enhanced performance and availability of respiratory monitoring solutions. Market growth of respiratory monitoring devices, in general, is being driven by rising cases of respiratory disease, presenting opportunities to invest and innovate in this vital healthcare space.

Wearable technology and telemedicine are the primary drivers of industry growth in the respiratory monitoring device market. Wearable technology, as exemplified by a smartwatch and fitness tracker that monitors respiratory performance, provides immediate feedback to the wearer about such important metrics as oxygen saturation and respiratory rate. This allows patients to be more aware of their health and monitor and manage chronic respiratory disease more effectively.

Telemedicine also shifted the mode of healthcare delivery, especially respiratory monitoring. Tele consults make it possible for health care providers to monitor patients' respiratory status without meeting in person, as it is easy and more convenient to access health care services. It is preferred by most individuals with mobility impairment or rural dwellers.

The use of these devices improves the patient compliance and participation since the patients can easily view and forward their medical information to healthcare providers. In addition, the use of sophisticated algorithms and artificial intelligence in the devices improves the accuracy of monitoring and predictive analysis, thereby intervention is prompt.

Since medical models will increasingly move toward prevention and remote monitoring of patients, the intersection of telemedicine and wearable technology is transforming respiratory monitoring devices with innovative solutions to meet evolving patient and provider demands.

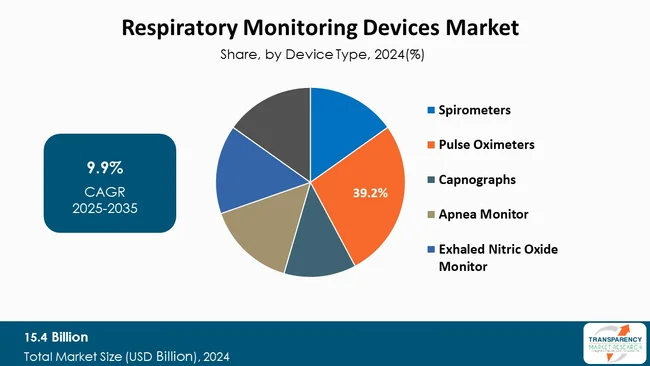

Pulse oximeters have monopoly in the market for respiratory monitor equipment due to their simplicity of use, non-invasive nature, and effectiveness in providing up-to-date information on the oxygen saturation level (SpO2) and patient pulse rate. Since being a critical instrument in the treatment of respiratory disease, pulse oximeters are being utilized almost entirely in hospitals and home care, and hence within accessible distance from the sizeable population of patients.

Their lack of complexity is their best attribute; patients simply place the device on a finger and receive readings immediately without any need for training. Their lack of complexity has been popular with patients suffering from diseases such as asthma and COPD.

Further, home care and telemedicine technologies have triggered additional growth for pulse oximeters. Pulse oximeters allow experts to carry out their work from distant locations, which ensures timely intervention and efficient management of pulmonary diseases.

The present pandemic of COVID-19 has also heightened public awareness regarding the respiratory condition, with even more individuals turning to the use of pulse oximeters as a crucial piece of equipment in monitoring patients' oxygen levels either at home or in healthcare settings. Such a combined effect places pulse oximeters among high-performing product types in the respiratory monitoring device market, with more expansion and enhancement induced.

| Attribute | Detail |

|---|---|

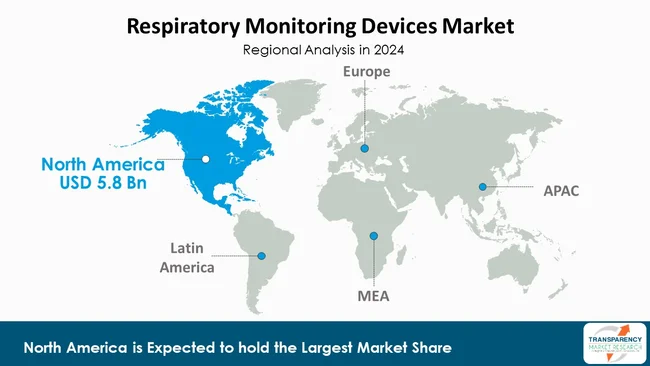

| Leading Region | North America |

North America is leading the market for respiratory monitoring devices due to some of the prominent reasons. The first and foremost reason is that the region has good-established healthcare infrastructure and technology uptake rates, which help in adopting the latest respiratory monitoring solutions timely. The location of the U.S. as the epicenter of the major pharmaceutical and medical device corporations with a strong research and development base increases the innovation in respiratory monitoring devices.

Besides, an abundant occurrence of respiratory diseases like asthma and chronic obstructive pulmonary disease (COPD) has created the way for efficient monitoring devices. Heightened awareness of respiratory health, especially because of the COVID-19 pandemic, has also heightened the utilization of these devices.

Further, favorable government policies and payment systems encourage healthcare providers to use cutting-edge monitoring technology. It is this complementarity between technology leadership, prevalent diseases, and favorable regulatory regimes that puts North America in leadership role of the respiratory monitoring devices industry, with steady growth and prospects for investment.

Key players in the global market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Medtronic, CONTEC MEDICAL SYSTEMS CO.,LTD, SIBELMED, Clarity, GE Healthcare, Masimo, Philips Healthcare, MGC Diagnostics Corporation, Drägerwerk AG & Co. KGaA, Narang Medical Limited and others are some of the leading key players.

Each of these players has been profiled in the respiratory monitoring devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 15.4 Bn |

| Forecast Value in 2035 | US$ 43.3 Bn |

| CAGR | 9.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Respiratory Monitoring Devices Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 15.4 Bn in 2024.

It is projected to cross US$ 43.3 Bn by the end of 2035.

Rising prevalence of respiratory diseases and advancements in wearable technology and telemedicine.

It is anticipated to grow at a CAGR of 9.9% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Medtronic, CONTEC MEDICAL SYSTEMS CO.,LTD, SIBELMED, Clarity, GE HealthCare, Masimo, Philips Healthcare, MGC Diagnostics Corporation, Drägerwerk AG & Co. KGaA, Narang Medical Limited, and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Respiratory Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Respiratory Monitoring Devices Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements

5.2. PORTER’s Five Forces Analysis

5.3. Key Industry Events

5.4. PESTEL Analysis

5.5. Value Chain Analysis

5.6. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.7. Pricing Analysis (Brand pricing, Average Selling Price by Region/Country)

5.8. Research and Development Trends

5.9. Go-to-Market Strategy for New Market Entrants

6. Global Respiratory Monitoring Devices Market Analysis and Forecast, by Device Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Device Type, 2020 to 2035

6.3.1. Spirometers

6.3.2. Pulse Oximeters

6.3.3. Capnographs

6.3.4. Apnea Monitor

6.3.5. Exhaled Nitric Oxide Monitor

6.3.6. Others

6.4. Market Attractiveness Analysis, by Device Type

7. Global Respiratory Monitoring Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Sleep Apnea

7.3.2. COPD

7.3.3. Asthma

7.3.4. Acute Respiratory Distress Syndrome (ARDS)

7.3.5. Pulmonary Hypertension

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Respiratory Monitoring Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020 to 2035

8.3.1. Hospitals & Clinics

8.3.2. Home-care Settings

8.3.3. Ambulatory Surgical Centers

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Respiratory Monitoring Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Respiratory Monitoring Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Device Type, 2020 to 2035

10.2.1. Spirometers

10.2.2. Pulse Oximeters

10.2.3. Capnographs

10.2.4. Apnea Monitor

10.2.5. Exhaled Nitric Oxide Monitor

10.2.6. Others

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Sleep Apnea

10.3.2. COPD

10.3.3. Asthma

10.3.4. Acute Respiratory Distress Syndrome (ARDS)

10.3.5. Pulmonary Hypertension

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2020 to 2035

10.4.1. Hospitals & Clinics

10.4.2. Home-care Settings

10.4.3. Ambulatory Surgical Centers

10.4.4. Others

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Device Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Respiratory Monitoring Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Device Type, 2020 to 2035

11.2.1. Spirometers

11.2.2. Pulse Oximeters

11.2.3. Capnographs

11.2.4. Apnea Monitor

11.2.5. Exhaled Nitric Oxide Monitor

11.2.6. Others

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Sleep Apnea

11.3.2. COPD

11.3.3. Asthma

11.3.4. Acute Respiratory Distress Syndrome (ARDS)

11.3.5. Pulmonary Hypertension

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2020 to 2035

11.4.1. Hospitals & Clinics

11.4.2. Home-care Settings

11.4.3. Ambulatory Surgical Centers

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Device Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Respiratory Monitoring Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Device Type, 2020 to 2035

12.2.1. Spirometers

12.2.2. Pulse Oximeters

12.2.3. Capnographs

12.2.4. Apnea Monitor

12.2.5. Exhaled Nitric Oxide Monitor

12.2.6. Others

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Sleep Apnea

12.3.2. COPD

12.3.3. Asthma

12.3.4. Acute Respiratory Distress Syndrome (ARDS)

12.3.5. Pulmonary Hypertension

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2020 to 2035

12.4.1. Hospitals & Clinics

12.4.2. Home-care Settings

12.4.3. Ambulatory Surgical Centers

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Device Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Respiratory Monitoring Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Device Type, 2020 to 2035

13.2.1. Spirometers

13.2.2. Pulse Oximeters

13.2.3. Capnographs

13.2.4. Apnea Monitor

13.2.5. Exhaled Nitric Oxide Monitor

13.2.6. Others

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Sleep Apnea

13.3.2. COPD

13.3.3. Asthma

13.3.4. Acute Respiratory Distress Syndrome (ARDS)

13.3.5. Pulmonary Hypertension

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2020 to 2035

13.4.1. Hospitals & Clinics

13.4.2. Home-care Settings

13.4.3. Ambulatory Surgical Centers

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Device Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Respiratory Monitoring Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Device Type, 2020 to 2035

14.2.1. Spirometers

14.2.2. Pulse Oximeters

14.2.3. Capnographs

14.2.4. Apnea Monitor

14.2.5. Exhaled Nitric Oxide Monitor

14.2.6. Others

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Sleep Apnea

14.3.2. COPD

14.3.3. Asthma

14.3.4. Acute Respiratory Distress Syndrome (ARDS)

14.3.5. Pulmonary Hypertension

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2020 to 2035

14.4.1. Hospitals & Clinics

14.4.2. Home-care Settings

14.4.3. Ambulatory Surgical Centers

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Device Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Medtronic

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. CONTEC MEDICAL SYSTEMS CO.,LTD

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. SIBELMED

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Clarity

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. GE Healthcare

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Masimo

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Philips Healthcare

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. MGC Diagnostics Corporation

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Drägerwerk AG & Co. KGaA

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Narang Medical Limited

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Global Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 02: Global Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 07: North America Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: North America Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 10: Europe Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 11: Europe Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: Europe Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Asia Pacific Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 15: Asia Pacific Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 16: Asia Pacific Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Latin America Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 19: Latin America Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Latin America Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Middle East & Africa Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 23: Middle East & Africa Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Middle East & Africa Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Respiratory Monitoring Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 02: Global Respiratory Monitoring Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 03: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Spirometers, 2020 to 2035

Figure 04: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Pulse Oximeters, 2020 to 2035

Figure 05: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Capnographs, 2020 to 2035

Figure 06: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Apnea Monitor, 2020 to 2035

Figure 07: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Exhaled Nitric Oxide Monitor, 2020 to 2035

Figure 08: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 09: Global Respiratory Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Respiratory Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 11: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Sleep Apnea, 2020 to 2035

Figure 12: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by COPD, 2020 to 2035

Figure 13: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Asthma, 2020 to 2035

Figure 14: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Acute Respiratory Distress Syndrome (ARDS), 2020 to 2035

Figure 15: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Pulmonary Hypertension, 2020 to 2035

Figure 16: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Respiratory Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 18: Global Respiratory Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 19: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 20: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Home-care Settings, 2020 to 2035

Figure 21: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 22: Global Respiratory Monitoring Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Respiratory Monitoring Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Respiratory Monitoring Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America - Respiratory Monitoring Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America - Respiratory Monitoring Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Respiratory Monitoring Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 29: North America Respiratory Monitoring Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 30: North America Respiratory Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 31: North America Respiratory Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 32: North America Respiratory Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 33: North America Respiratory Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 34: Europe - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe - Respiratory Monitoring Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 36: Europe - Respiratory Monitoring Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 37: Europe Respiratory Monitoring Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 38: Europe Respiratory Monitoring Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 39: Europe Respiratory Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 40: Europe Respiratory Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 41: Europe Respiratory Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 42: Europe Respiratory Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 43: Asia Pacific - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific - Respiratory Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Asia Pacific - Respiratory Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Asia Pacific Respiratory Monitoring Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 47: Asia Pacific Respiratory Monitoring Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 48: Asia Pacific Respiratory Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 49: Asia Pacific Respiratory Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 50: Asia Pacific Respiratory Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 51: Asia Pacific Respiratory Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 52: Latin America - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Latin America - Respiratory Monitoring Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 54: Latin America - Respiratory Monitoring Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 55: Latin America Respiratory Monitoring Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 56: Latin America Respiratory Monitoring Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 57: Latin America Respiratory Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 58: Latin America Respiratory Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 59: Latin America Respiratory Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 60: Latin America Respiratory Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 61: Middle East & Africa - Respiratory Monitoring Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Middle East & Africa - Respiratory Monitoring Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 63: Middle East & Africa - Respiratory Monitoring Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 64: Middle East & Africa Respiratory Monitoring Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 65: Middle East & Africa Respiratory Monitoring Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 66: Middle East & Africa Respiratory Monitoring Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: Middle East & Africa Respiratory Monitoring Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 68: Middle East & Africa Respiratory Monitoring Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 69: Middle East & Africa Respiratory Monitoring Devices Market Attractiveness Analysis, By End-user, 2025 to 2035