Reports

Reports

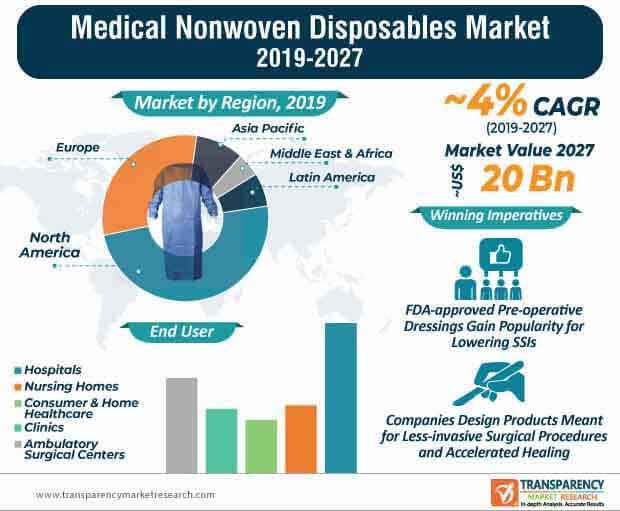

Recent outbreak of COVID-19 (coronavirus epidemic) has created an unprecedented demand for nonwoven-based facemasks. Existing fear of infectious diseases such as SARS and H1N1 continues to drive the medical nonwoven disposables market. Fighting infection has become one of the key focus points for healthcare providers, as nonwovens help to keep costs at bay. Moreover, guidelines issued by the WHO under the Infection Prevention and Control (IPC) program are creating awareness among users to practice hygiene on a personal level. This is evident since the revenue of consumer & home healthcare end user segment of the medical nonwoven disposables market is projected to grow exponentially during the forecast period.

Nonwoven face masks and other medical nonwoven disposable products are being pervasively used in hospitals and nursing homes in the light of the coronavirus epidemic. Thus, analysts of Transparency Market Research (TMR) opine that the market for medical nonwoven disposables will continue to grow, owing to the high prevalence of infectious diseases.

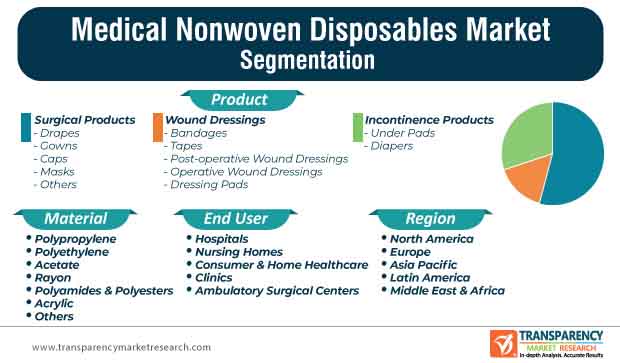

Nonwoven materials are increasingly replacing traditional reusable materials in gowns and drapes. As such, the revenue of polypropylene is predicted to increase throughout the forecast period and the market for medical nonwoven disposables is expected to reach a value of ~US$ 20 Bn by the end of 2028. Moreover, single-use materials are easy-to-use, safe to dispose, and serve as an economical solution to healthcare providers and consumers. The medical nonwoven disposables market continues to grow, as companies tap opportunities by increasing the production of wipes.

Though reusable materials are constantly evolving, patients and healthcare providers are favoring disposable gowns and drapes, owing to their attributes of being more solid, reliable, and having reproducible bacterial impermeability. As such, drapes and gowns surgical products are leading in the market landscape. Hence, manufacturers in the medical nonwoven disposables market are increasing R&D to make products that are lightweight and accelerate healing. Medical nonwoven disposable products play a pivotal role in frequent wetting or repeated wash applications.

Spunlace materials are a novel introduction in the medical nonwoven disposables market. Manufacturers are increasing their production capabilities to develop greener wipes that reduce environmental footprint. However, material suppliers need to identify more sustainable and low-price polymers that help to reduce the cost of end-use products. Hence, equipment suppliers in the market for medical nonwoven disposables must innovate with new raw materials that improve production processes, resulting in increased availability of low-cost and sustainable products.

Due to the ever-increasing global population, companies in the medical nonwoven disposables market are scaling value-grab opportunities by increasing the production of ‘sensitive’ products such as baby wipes. They are increasing the efforts to market these products attributing to no fragrance, no alcohol, and as hypoallergenic products. Companies in the market for medical nonwoven disposables are increasingly focusing on lyocell-based nonwovens that address consumer demands for environmentally sustainable products. Breakthrough innovations are paving the way for baby wipes made from bio-based polymers.

The total consumption of nonwovens in medical applications is growing at a rapid pace. Apart from drapes and gowns, companies in the medical nonwoven disposables market are gauging incremental opportunities by developing implantables, sutures, and blood filters from nonwovens. Moreover, the revenue of medical nonwovens for wound care applications is estimated to surge aggressively in the market landscape. On the other hand, high prevalence of healthcare-associated infections (HAIs) is driving the growth for the medical nonwoven disposables market.

Companies in the market for medical nonwoven disposables are increasing their efficacy in drylaid, spunlaid, and meltblown nonwovens. For instance, the Freudenberg Group— a leading supplier of housewares and cleaning products offers drylaid, wetlaid, and spunlaid nonwovens used in medical industry, automotive, and apparel construction. In emerging markets of Asia Pacific, doctors who are trained abroad and educated about the advantages of single-use solutions are helping in bolstering market growth.

Analysts’ Viewpoint

The healthcare industry is focused on delivering antiseptic agents in medical nonwoven disposable products to reduce the incidences of HAIs. Companies in the medical nonwoven disposables market landscape are increasing their production capacities to develop spunlace, needlepunch, and dispersible-based pre-moistened personal cleansing cloths, which are more hygienic, and is a standardized approach that can offer better skin care and improve patient quality of life.

Flushable wipes are a novel product introduction in the market landscape. However, suppliers need to develop products made from low-price materials and make products that satisfy the demand for sustainable solutions. Hence, companies should collaborate with their sales and marketing staff to identify consumer segments that are willing to pay premium price for sustainable hygiene products.

Medical nonwoven disposables market is anticipated to grow at a CAGR of 4% during the forecast period

The end-use segments in medical nonwoven disposables market are Hospitals, Nursing Homes, Consumer and Home Health Care, Clinics, Ambulatory Surgical Centers

Medical nonwoven disposables market is driven by technological advancements in healthcare, increase in demand for advancements in wound dressing techniques, and rise in government initiatives for manufacturing nonwoven medical fabric

2020 is the base year calculated in medical nonwoven disposables market report

Key players in the global medical nonwoven disposables market include Domtar Corporation, Freudenberg & Co. KG, Medtronic Plc., Paul Hartmann AG, Medline Industries, Inc., Asahi Kasei Corporation, Essity AB, Mölnlycke Health Care, and Kimberly-Clark Corporation

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Global Medical Nonwoven Disposables Market: Market Snapshot

3.2. Global Medical Nonwoven Disposables Market: Opportunity Map

4. Market Overview

4.1. Global Medical Nonwoven Disposables Market : Product Overview

4.2. Global Medical Nonwoven Disposables Market : Key Industry Developments

4.3. Market Dynamics

4.3.1. Drivers and Restraints Snapshot Analysis

4.3.2. Drivers

4.3.2.1. Rising geriatric population which is more prone to hospital-acquired infections

4.3.2.2. More efficiency over woven products

4.3.2.3. Increase in number of surgical procedures globally

4.3.2.4. Technological advancements

4.3.2.5. Government initiatives

4.3.3. Restraints

4.3.3.1. High cost of raw materials

4.3.3.2. Regulatory scenario

4.3.3.3. Unfavorable economic conditions

4.3.4. Opportunity Analysis

4.3.4.1. Technological development and innovation

4.3.4.2. Expansion in emerging economies such as countries in Asia Pacific, South Africa, and Brazil

4.4. Opportunity Analysis

4.5. Global Medical Nonwoven Disposables Market Revenue Projection

4.6. Porter’s Five Forces Analysis

4.7. Medical Nonwoven Disposables Market Outlook

5. Market Outlook

5.1. Key Product Feature

5.2. Healthcare Overview

6. Medical Nonwoven Disposables Market Analysis, by Product

6.1. Key Findings

6.2. Introduction

6.3. Global Medical Nonwoven Disposables Market Value Share Analysis, by Product

6.4. Global Medical Nonwoven Disposables Market Forecast, by Product

6.4.1. Surgical Products

6.4.1.1. Drapes

6.4.1.2. Gowns

6.4.1.3. Caps

6.4.1.4. Masks

6.4.1.5. Others

6.4.2. Wound Dressings

6.4.2.1. Bandages

6.4.2.2. Tapes

6.4.2.3. Post-operative Wound Dressings

6.4.2.4. Operative Wound Dressings

6.4.2.5. Dressing Pads

6.4.3. Incontinence Products

6.4.3.1. Under Pads

6.4.3.2. Diapers

6.5. Medical Nonwoven Disposables Market Attractiveness Analysis, by Product

7. Global Medical Nonwoven Disposables Market Analysis, by Material Type

7.1. Key Findings

7.2. Introduction

7.3. Global Medical Nonwoven Disposables Market Value Share Analysis, by Material Type

7.4. Global Medical Nonwoven Disposables Market Forecast, by Material Type

7.4.1. Polypropylene

7.4.2. Polyethylene

7.4.3. Acetate

7.4.4. Rayon

7.4.5. Polyamides & Polyester

7.4.6. Acrylic

7.4.7. Others

7.5. Medical Nonwoven Disposables Market Attractiveness Analysis, by Material

8. Global Medical Nonwoven Disposables Market Analysis, by End-user

8.1. Key Findings

8.2. Introduction

8.3. Global Medical Nonwoven Disposables Market Value Share Analysis, by End-user

8.4. Global Medical Nonwoven Disposables Market Forecast, by End-user

8.4.1. Hospitals

8.4.2. Nursing Homes

8.4.3. Consumer & Home Healthcare

8.4.4. Clinics

8.4.5. Ambulatory Surgical Centers

8.5. Global Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user

9. Global Medical Nonwoven Disposables Market Analysis, by Region

9.1. Global Market Scenario

9.2. Global Medical Nonwoven Disposables Market Value Share Analysis, by Region

9.3. Global Medical Nonwoven Disposables Market Forecast, by Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East & Africa

9.4. Global Medical Nonwoven Disposables Market Attractiveness Analysis, by Region

10. North America Medical Nonwoven Disposables Market Analysis

10.1. Key Findings

10.2. North America Medical Nonwoven Disposables Market Overview

10.3. North America Market Value Share Analysis, by Product

10.4. North America Medical Nonwoven Disposables Market Forecast, by Product

10.4.1. North America Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products

10.4.1.1. Drapes

10.4.1.2. Gowns

10.4.1.3. Caps

10.4.1.4. Masks

10.4.1.5. Others

10.4.2. North America Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings

10.4.3. North America Medical Nonwoven Disposables Market Forecast, by Wound Dressings

10.4.3.1. Bandages

10.4.3.2. Tapes

10.4.3.3. Post-operative Wound Dressings

10.4.3.4. Operative Wound Dressings

10.4.3.5. Dressing Pads

10.4.4. North America Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products

10.4.5. North America Medical Nonwoven Disposables Market Forecast, by Incontinence Products

10.4.5.1. Under Pads

10.4.5.2. Diapers

10.5. North America Medical Nonwoven Disposables Market Value Share Analysis, by Material

10.6. North America Medical Nonwoven Disposables Market Forecast, by Material

10.6.1. Polypropylene

10.6.2. Polyethylene

10.6.3. Acetate

10.6.4. Rayon

10.6.5. Polyamides & Polyesters

10.6.6. Acrylic

10.6.7. Others

10.7. North America Medical Nonwoven Disposables Market Value Share Analysis, by End-user

10.8. North America Medical Nonwoven Disposables Market Forecast, by End-user

10.8.1. Hospitals

10.8.2. Nursing Homes

10.8.3. Consumer & Home Healthcare

10.8.4. Clinics

10.8.5. Ambulatory Surgical Centers

10.9. North America Medical Nonwoven Disposables Market Value Share Analysis, by Country

10.10. North America Medical Nonwoven Disposables Market Forecast, by Country

10.10.1. U.S.

10.10.2. Canada

10.11. North America Medical Nonwoven Disposables Market Attractiveness Analysis

10.12. Market Trends

11. Europe Medical Nonwoven Disposables Market Analysis

11.1. Key Findings

11.2. Europe Medical Nonwoven Disposables Market Overview

11.3. Europe Market Value Share Analysis, by Product

11.4. Europe Medical Nonwoven Disposables Market Forecast, by Product

11.4.1. Europe Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products

11.4.1.1. Drapes

11.4.1.2. Gowns

11.4.1.3. Caps

11.4.1.4. Masks

11.4.1.5. Others

11.4.2. Europe Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings

11.4.3. Europe Medical Nonwoven Disposables Market Forecast, by Wound Dressings

11.4.3.1. Bandages

11.4.3.2. Tapes

11.4.3.3. Post-operative Wound Dressings

11.4.3.4. Operative Wound Dressings

11.4.3.5. Dressing Pads

11.4.4. Europe Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products

11.4.5. Europe Medical Nonwoven Disposables Market Forecast, by Incontinence Products

11.4.5.1. Under Pads

11.4.5.2. Diapers

11.5. Europe Medical Nonwoven Disposables Market Value Share Analysis, by Material

11.6. Europe Medical Nonwoven Disposables Market Forecast, by Material

11.6.1. Polypropylene

11.6.2. Polyethylene

11.6.3. Acetate

11.6.4. Rayon

11.6.5. Polyamides & Polyesters

11.6.6. Acrylic

11.6.7. Others

11.7. Europe Medical Nonwoven Disposables Market Value Share Analysis, by End-user

11.8. Europe Medical Nonwoven Disposables Market Forecast, by End-user

11.8.1. Hospitals

11.8.2. Nursing Homes

11.8.3. Consumer & Home Healthcare

11.8.4. Clinics

11.8.5. Ambulatory Surgical Centers

11.9. Europe Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region

11.10. Europe Medical Nonwoven Disposables Market Forecast, by Country/Sub-region

11.10.1. Germany

11.10.2. France

11.10.3. Italy

11.10.4. Spain

11.10.5. U.K.

11.10.6. Rest of Europe

11.11. Europe Medical Nonwoven Disposables Market Attractiveness Analysis

11.12. Market Trends

12. Asia Pacific Medical Nonwoven Disposables Market Analysis

12.1. Key Findings

12.2. Asia Pacific Medical Nonwoven Disposables Market Overview

12.3. Asia Pacific Market Value Share Analysis, by Product

12.4. Asia Pacific Medical Nonwoven Disposables Market Forecast, by Product

12.4.1. Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products

12.4.1.1. Drapes

12.4.1.2. Gowns

12.4.1.3. Caps

12.4.1.4. Masks

12.4.1.5. Others

12.4.2. Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings

12.4.3. Asia Pacific Medical Nonwoven Disposables Market Forecast, by Wound Dressings

12.4.3.1. Bandages

12.4.3.2. Tapes

12.4.3.3. Post-operative Wound Dressings

12.4.3.4. Operative Wound Dressings

12.4.3.5. Dressing Pads

12.4.4. Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products

12.4.5. Asia Pacific Medical Nonwoven Disposables Market Forecast, by Incontinence Products

12.4.5.1. Under Pads

12.4.5.2. Diapers

12.5. Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Material

12.6. Asia Pacific Medical Nonwoven Disposables Market Forecast, by Material

12.6.1. Polypropylene

12.6.2. Polyamides & Polyesters

12.6.3. Polyethylene

12.6.4. Acetate

12.6.5. Rayon

12.6.6. Acrylic

12.6.7. Others

12.7. Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by End-user

12.8. Asia Pacific Medical Nonwoven Disposables Market Forecast, by End-user

12.8.1. Hospitals

12.8.2. Nursing Homes

12.8.3. Consumer & Home Healthcare

12.8.4. Clinics

12.8.5. Ambulatory Surgical Centers

12.9. Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region

12.10. Asia Pacific Medical Nonwoven Disposables Market Forecast, by Country/Sub-region

12.10.1. India

12.10.2. China

12.10.3. Japan

12.10.4. Rest of Asia Pacific

12.11. Asia Pacific Medical Nonwoven Disposables Market Attractiveness Analysis

12.12. Market Trends

13. Latin America Medical Nonwoven Disposables Market Analysis

13.1. Key Findings

13.2. Latin America Medical Nonwoven Disposables Market Overview

13.3. Latin America Market Value Share Analysis, by Product

13.4. Latin America Medical Nonwoven Disposables Market Forecast, by Product

13.4.1. Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products

13.4.1.1. Drapes

13.4.1.2. Gowns

13.4.1.3. Caps

13.4.1.4. Masks

13.4.1.5. Others

13.4.2. Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings

13.4.3. Latin America Medical Nonwoven Disposables Market Forecast, by Wound Dressings

13.4.3.1. Bandages

13.4.3.2. Tapes

13.4.3.3. Post-operative Wound Dressings

13.4.3.4. Operative Wound Dressings

13.4.3.5. Dressing Pads

13.4.4. Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products

13.4.5. Latin America Medical Nonwoven Disposables Market Forecast, by Incontinence Products

13.4.5.1. Under Pads

13.4.5.2. Diapers

13.5. Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Material

13.6. Latin America Medical Nonwoven Disposables Market Forecast, by Material

13.6.1. Polypropylene

13.6.2. Polyethylene

13.6.3. Acetate

13.6.4. Rayon

13.6.5. Polyamides & Polyesters

13.6.6. Acrylic

13.6.7. Others

13.7. Latin America Medical Nonwoven Disposables Market Value Share Analysis, by End-user

13.8. Latin America Medical Nonwoven Disposables Market Forecast, by End-user

13.8.1. Hospitals

13.8.2. Nursing Homes

13.8.3. Consumer & Home Healthcare

13.8.4. Clinics

13.8.5. Ambulatory Surgical Centers

13.9. Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region

13.10. Latin America Medical Nonwoven Disposables Market Forecast, by Country/Sub-region

13.10.1. Brazil

13.10.2. Mexico

13.10.3. Rest of Latin America

13.11. Latin America Medical Nonwoven Disposables Market Attractiveness Analysis

13.12. Market Trends

14. Middle East & Africa Medical Nonwoven Disposables Market Analysis

14.1. Key Findings

14.2. Middle East & Africa Medical Nonwoven Disposables Market Overview

14.3. Middle East & Africa Market Value Share Analysis, by Product

14.4. Middle East & Africa Medical Nonwoven Disposables Market Forecast, by Product

14.4.1. Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products

14.4.1.1. Drapes

14.4.1.2. Gowns

14.4.1.3. Caps

14.4.1.4. Masks

14.4.1.5. Others

14.4.2. Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings

14.4.3. Middle East & Africa Medical Nonwoven Disposables Market Forecast, by Wound Dressings

14.4.3.1. Bandages

14.4.3.2. Tapes

14.4.3.3. Post-operative Wound Dressings

14.4.3.4. Operative Wound Dressings

14.4.3.5. Dressing Pads

14.4.4. Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products

14.4.5. Middle East & Africa Medical Nonwoven Disposables Market Forecast, by Incontinence Products

14.4.5.1. Under Pads

14.4.5.2. Diapers

14.5. Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Material

14.6. Middle East & Africa Medical Nonwoven Disposables Market Forecast, by Material

14.6.1. Polypropylene

14.6.2. Polyethylene

14.6.3. Acetate

14.6.4. Rayon

14.6.5. Polyamides & Polyesters

14.6.6. Acrylic

14.6.7. Others

14.7. Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by End-user

14.8. Middle East & Africa Medical Nonwoven Disposables Market Forecast, by End-user

14.8.1. Hospitals

14.8.2. Nursing Homes

14.8.3. Consumer & Home Healthcare

14.8.4. Clinics

14.8.5. Ambulatory Surgical Centers

14.9. Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region

14.10. Middle East & Africa Medical Nonwoven Disposables Market Forecast, by Country/Sub-region

14.10.1. South Africa

14.10.2. Saudi Arabia

14.10.3. Rest of Middle East & Africa

14.11. Middle East & Africa Medical Nonwoven Disposables Market Attractiveness Analysis

14.12. Market Trends

15. Competition Analysis

15.1. Global Medical Nonwoven Disposables Market Share Analysis, by Company (2018)

15.2. Competition Matrix

15.3. Company Profile

15.3.1. Kimberly-Clark Corporation

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Medline Industries, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Mölnlycke Health Care

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Paul Hartmann AG

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Ahlstrom Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Medtronic

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Asahi Kasei Corporation

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Freudenberg & Co. KG

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Svenska Cellulosa Aktiebolaget SCA

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Domtar Corporation

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Product, 2018–2028

Table 02: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Surgical Products, 2018–2028

Table 03: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Wound Dressings, 2018–2028

Table 04: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Incontinence Products, 2018–2028

Table 05: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Material, 2018–2028

Table 06: Global Medical Nonwoven Disposables Market Value (US$ Mn), by End-user, 2018–2028

Table 07: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Region, 2018–2028

Table 08: North America Medical Nonwoven Disposables Market Value (US$ Mn), by Product, 2018–2028

Table 09: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Surgical Products, 2018–2028

Table 10: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Wound Dressings, 2018–2028

Table 11: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Incontinence Products, 2018–2028

Table 12: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Material, 2018–2028

Table 13: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 14: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Country, 2018–2028

Table 15: Europe Medical Nonwoven Disposables Market Value (US$ Mn), by Product, 2018–2028

Table 16: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Surgical Products, 2018–2028

Table 17: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Wound Dressings, 2018–2028

Table 18: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Incontinence Products, 2018–2028

Table 19: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Material, 2018–2028

Table 20: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 21: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 22: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn), by Product, 2018–2028

Table 23: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Surgical Products, 2018–2028

Table 24: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Wound Dressings, 2018–2028

Table 25: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Incontinence Products, 2018–2028

Table 26: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Material, 2018–2028

Table 27: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 28: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 29: Latin America Medical Nonwoven Disposables Market Value (US$ Mn), by Product, 2018–2028

Table 30: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Surgical Products, 2018–2028

Table 31: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Wound Dressings, 2018–2028

Table 32: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Incontinence Products, 2018–2028

Table 33: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Material, 2018–2028

Table 34: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 35: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 36: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn), by Product, 2018–2028

Table 37: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Surgical Products, 2018–2028

Table 38: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Wound Dressings, 2018–2028

Table 39: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Incontinence Products, 2018–2028

Table 40: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Material, 2018–2028

Table 41: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 42: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

List of Figures

Figure 01: Global Medical Nonwoven Disposables Market Value (US$ Mn) and Distribution, by Region, 2019 and 2028

Figure 02: Global Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, 2018–2028

Figure 03: Market Value Share, by Product (2019)

Figure 04: Market Value Share, by Material (2019)

Figure 05: Market Value Share, by End-user (2019)

Figure 06: Market Value Share, by Region (2019)

Figure 07: Global Medical Nonwoven Disposable Market Value Share Analysis, by Product, 2019 and 2028

Figure 08: Global Medical Nonwoven Disposables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Surgical Products, 2018–2028

Figure 09: Global Medical Nonwoven Disposables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Wound Dressings, 2018–2028

Figure 10: Global Medical Nonwoven Disposables Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Incontinence Products, 2018–2028

Figure 11: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Drapes, 2018–2028

Figure 12: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Gowns, 2018–2028

Figure 13: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Caps, 2018–2028

Figure 14: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Masks, 2018–2028

Figure 15: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2028

Figure 16: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Bandages, 2018–2028

Figure 17: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Tapes, 2018–2028

Figure 18: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Post-operative Wound Dressings, 2018–2028

Figure 19: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Operative Wound Dressings, 2018–2028

Figure 20: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Dressing Pads, 2018–2028

Figure 21: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Under Pads, 2018–2028

Figure 22: Global Medical Nonwoven Disposable Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diapers, 2018–2028

Figure 23: Medical Nonwoven Disposables Market Attractiveness Analysis, by Product, 2020–2028

Figure 24: Global Medical Nonwoven Disposable Market Value Share Analysis, by Material, 2019 and 2028

Figure 25: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Polypropylene, 2018–2028

Figure 26: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Polyethylene, 2018–2028

Figure 27: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Acetate, 2018–2028

Figure 28: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Rayon, 2018–2028

Figure 29: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Polyamides & Polyesters, 2018–2028

Figure 30: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Acrylic, 2018–2028

Figure 31: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Others, 2018–2028

Figure 32: Global Medical Nonwoven Disposables Market Attractiveness Analysis, by Material, 2020–2028

Figure 33: Global Medical Nonwoven Disposable Market Value Share Analysis, by End-user, 2019 and 2028

Figure 34: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Hospitals, 2018–2028

Figure 35: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Nursing Homes, 2018–2028

Figure 36: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Consumer & Home Healthcare, 2018–2028

Figure 37: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Clinics, 2018–2028

Figure 38: Global Medical Nonwoven Disposables Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2018–2028

Figure 39: Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user, 2020–2028

Figure 40: Global Medical Nonwoven Disposables Market Value Share Analysis, by Region, 2019 and 2028

Figure 41: Medical Nonwoven Disposables Market Attractiveness Analysis, by Region, 2020–2028

Figure 42: North America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, 2019 and 2028

Figure 43: North America Medical Nonwoven Disposables Market Attractiveness Analysis, by Country

Figure 44: North America Medical Nonwoven Disposables Market Value Share Analysis, by Product, 2019 and 2028

Figure 45: North America Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products, 2019 and 2028

Figure 46: North America Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings, 2019 and 2028

Figure 47: North America Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products, 2019 and 2028

Figure 48: North America Medical Nonwoven Disposables Market Value Share Analysis, by Material, 2019 and 2028

Figure 49: North America Medical Nonwoven Disposables Market Value Share Analysis, by End-user, 2019 and 2028

Figure 50: North America Medical Nonwoven Disposables Market Value Share Analysis, by Country, 2019 and 2028

Figure 51: North America Medical Nonwoven Disposables Market Attractiveness Analysis, by Product, 2020-2028

Figure 52: North America Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user, 2020-2028

Figure 53: North America Medical Nonwoven Disposables Market Attractiveness Analysis, by Material, 2020-2028

Figure 54: Europe Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, 2018–2028

Figure 55: Europe Medical Nonwoven Disposables Market Attractiveness Analysis, by Country/Sub-region, 2020-2028

Figure 56: Europe Medical Nonwoven Disposables Market Value Share Analysis, by Product, 2019 and 2028

Figure 57: Europe Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products, 2019 and 2028

Figure 58: Europe Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings, 2019 and 2028

Figure 59: Europe Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products, 2019 and 2028

Figure 60: Europe Medical Nonwoven Disposables Market Value Share Analysis, by Material, 2019 and 2028

Figure 61: Europe Medical Nonwoven Disposables Market Value Share Analysis, by End-user, 2019 and 2028

Figure 62: Europe Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 63: Europe Medical Nonwoven Disposables Market Attractiveness Analysis, by Product, 2020-2028

Figure 64: Europe Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user, 2020-2028

Figure 65: Europe Medical Nonwoven Disposables Market Attractiveness Analysis, by Material, 2020-2028

Figure 66: Asia Pacific Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, 2018–2028

Figure 67: Asia Pacific Medical Nonwoven Disposables Market Attractiveness Analysis, by Country/Sub-region, 2020-2028

Figure 68: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Product, 2019 and 2028

Figure 69: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products, 2019 and 2028

Figure 70: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings, 2019 and 2028

Figure 71: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products, 2019 and 2028

Figure 72: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Material, 2019 and 2028

Figure 73: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by End-user, 2019 and 2028

Figure 74: Asia Pacific Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 75: Asia Pacific Medical Nonwoven Disposables Market Attractiveness Analysis, by Product, 2020-2028

Figure 76: Asia Pacific Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user, 2020-2028

Figure 77: Asia Pacific Medical Nonwoven Disposables Market Attractiveness Analysis, by Material, 2020-2028

Figure 78: Latin America Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, 2018-2028

Figure 79: Latin America Medical Nonwoven Disposables Market Attractiveness Analysis, by Country/Sub-region, 2020-2028

Figure 80: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Product, 2019 and 2028

Figure 81: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products, 2019 and 2028

Figure 82: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings, 2019 and 2028

Figure 83: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products, 2019 and 2028

Figure 84: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Material, 2019 and 2028

Figure 85: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by End-user, 2019 and 2028

Figure 86: Latin America Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 87: Latin America Medical Nonwoven Disposables Market Attractiveness Analysis, by Product, 2020-2028

Figure 88: Latin America Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user, 2020-2028

Figure 89: Latin America Medical Nonwoven Disposables Market Attractiveness Analysis, by Material, 2020-2028

Figure 90: Middle East & Africa Medical Nonwoven Disposables Market Value (US$ Mn) Forecast, 2019 and 2028

Figure 91: Middle East & Africa Medical Nonwoven Disposables Market Attractiveness Analysis, by Country/Sub-region, 2020-2028

Figure 92: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Product, 2019 and 2028

Figure 93: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Surgical Products, 2019 and 2028

Figure 94: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Wound Dressings, 2019 and 2028

Figure 95: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Incontinence Products, 2019 and 2028

Figure 96: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Material, 2019 and 2028

Figure 97: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by End-user, 2019 and 2028

Figure 98: Middle East & Africa Medical Nonwoven Disposables Market Value Share Analysis, by Country/Sub-region 2019 and 2028

Figure 99: Middle East & Africa Medical Nonwoven Disposables Market Attractiveness Analysis, by Product, 2020-2028

Figure 100: Middle East & Africa Medical Nonwoven Disposables Market Attractiveness Analysis, by End-user, 2020-2028

Figure 101: Middle East & Africa Medical Nonwoven Disposables Market Attractiveness Analysis, by Material, 2020-2028

Figure 102: Global Medical Nonwoven Disposables Market Share Analysis, by Company (2019)