Reports

Reports

Fluorine-18 market is driven by ongoing development of cyclotron facilities and advancements in radiochemistry. Production technologies have improved the efficiency and availability of fluorine-18, thereby making it more accessible for medical applications.

The clinical adoption gets accelerated by increased reimbursement coverage for PET procedures with F-18 tracers, improved GMP guidelines, and faster lot-release procedures. Moreover, the service providers are increasingly adopting remote monitoring and preventive maintenance measures in order to minimize the downtime and improve the delivery of tracers, which are time-sensitive and have a half-life of approximately 110 minutes.

The other critical drivers of the market include the chemistry and workflow advancements. Production times are reduced by automated synthesis modules, modular cassette kits, and microfluidic reactors, and reproducible, multi-tracer operations on a single line, thereby optimizing asset utilization.

O-18 recycling and the other recycling programs counterbalance feedstock cost and supply risk, with computer-based QA/QC packages integrating radio-TLC, HPLC, and endotoxin testing, thereby minimizing batch-release intervals. A strong clinical pipeline of F-18 labeled molecules in neurology, cardiology, and urology expands applications beyond standard glucose metabolism imaging. This expansion enables high cyclotron load factors regardless of the volume of oncology-related imaging.

Recent trends imply the emergence of compact cyclotrons located adjacent to hospitals to complement centralized radiopharmacies for balancing production throughput and available proximity. Facilities have begun to standardize electronic batch records and serialization to be able to pass audits and have standardization to sharing records across multiple facilities.

Logistics teams are optimizing "last-mile" delivery routes for product shipments, incorporating real-time temperature and radiation monitoring throughout the shipment process. Sustainability is surfacing as a differentiator in radio pharmacy, which targets solvent reduction and closed-loop management of O-18, while energy-efficient shielding material practices are emerging as well.

The industry is defined by network and vertical integration. Various stakeholders, for one, are creating multi-node cyclotron grids that feature back-up capacity. In addition, sterile finish suites are being added to centralized command centers for remote diagnostics of fill equipment.

Earlier acquisition of proprietary tracers is ensured through partnerships with universities, while promising chemistries are scaled up faster due to tech-transfer and co-development agreements. Companies are also engaging in focused M&A to obtain regional distribution, expand hot-cell fleets, and in-license molecules that are at later stages.

Fluorine-18 (F-18) is a positron-emitting fluorine isotope with unstable nature as the first choice for different applications in PET and nuclear medicine. F-18 is a positron-emitting radionuclide with physical half-life of approximately 110 minutes. F-18 can be applied when precise positron emission tomography (PET) is needed.

The production of F-18 implies using a cyclotron by proton irradiation of oxygen-18 enriched water. It is mainly due to its perfect decay pattern and relatively short half-life that F-18 keeps being a leading figure in life science research and diagnostic imaging.

The most prevalent application of F-18 is its incorporation into fluorodeoxyglucose (FDG), a glucose analogue and radiopharmaceutical, among a host of others. F-18 FDG is an agent for imaging tissue metabolism of glucose, hence enabling identification of abnormal or possibly cancerous metabolic processes.

With its imaging potential, F-18 FDG finds use in diagnosis, staging, and monitoring of a variety of diseases and conditions of interest.

Fluorine-18 is exceptional as a diagnostic imaging isotope due to its ideal imaging properties. Not only does its positron emission lead to high-quality, high-definition images, but the relatively long half-life of 110 minutes gives a reasonable timeframe for radiolabeling, quality assurance, transport of the radioligand, and imaging. The impact of fluorine-18's relatively extended half-life is most striking in practical clinical use and the intent to reduce unnecessary radiation dose-of-image for the patient.

The applications of fluorine-18 is not limited solely to clinical imaging applications; but also plays a fundamental role in the next stage of development to investigate the possibility of novel radiotracers in neurologic, cardiovascular, and infectious diseases. Fluorine can be used in much more versatile ways in radiochemistry, so as to develop new PET probes that could be modified to have greater specificity and/or sensitivity. Thus, in the context of the rapidly evolving new radiotracers, the F-18 isotope remains central for clinical and advanced biomedical innovation use.

| Attribute | Detail |

|---|---|

| Fluorine-18 Market Drivers |

|

Growing incidences of cancer is, by far, the single largest factor driving the fluorine-18 market as it does correlate with the demand for complex diagnostic imaging devices. Early cancer diagnosis is vital for reducing the impact of cancer and lowering mortality rates at the global level, significantly extending patient survival.

In general, PET scans are the primary tools for fluorine-18 as they detect the abnormal metabolic activities of cancer tissues. Fluorine-18 plays a significant role in cancer screening, diagnosis, and treatment planning, thereby enabling healthcare professionals to make informed decisions regarding patient care.

Fluorine-18-labeled fluorodeoxyglucose (F-18 FDG) is the imaging technique of the highest standard in cancer treatment, which enables the direct visualization of glucose metabolism in tumors.

In addition to diagnostic opportunities FDG has with fluorine-18, they can also be crucial in treatment response assessment by enabling assessment of treatment effectiveness, as well as the recurrence or progression of disease. F-18 is used in oncology PET imaging with F-18 (FDG) and can assess whether or not patients have responded to radionuclide targeted therapies, chemotherapy, or radiotherapy.

The growth of the fluorine-18 industry is primarily driven by the increasing demand for medical imaging, necessitating advanced diagnostic equipment for accurate disease diagnosis. Medical imaging has become a part of oncology but is also part of cardiology, neurology, and infectious disease management.

Fluorine-18, being a part of positron emission tomography (PET), delivers the high-resolution images on which the doctors can view the biological processes at a molecular level. The trend of using specific imaging techniques is contributing to the growing use of F-18 tracers in different parts of the globe.

With advancements in healthcare infrastructure and increasing patient awareness, there is a positive trend of patients opting for imaging procedures aimed at preventive treatment and early detection. Due to the advantages of strong binding between the biomolecules, Fluorine-18 is a perfect candidate for radiopharmaceutical development. The multi-disciplinary application of F-18 tracers not only attracts the demand from regular imaging but also the routine that consolidates the need for this diversified user to allow the steady growth in their supply chain.

Increasing need for medical imaging is the major growth driver to the fluorine-18 market since healthcare systems are increasingly requiring sophisticated diagnostic equipment to detect diseases efficiently. Medical imaging has applications in cancer treatment apart from cardiology, neurology, and the treatment of infectious diseases.

With the increasing number of healthcare centers and awareness among patients, increasing number of patients are undergoing imaging tests for preoperative staging and early detection. As a result of its therapeutic half-life and binding energy with various biomolecules, fluorine-18 is a serious candidate for the production of radiopharmaceuticals. The multi-disciplinary use of F-18 tracers makes them increasingly prevalent in standard imaging protocols as well. Such diversified use enables sustained progress in the supply chain of F-18.

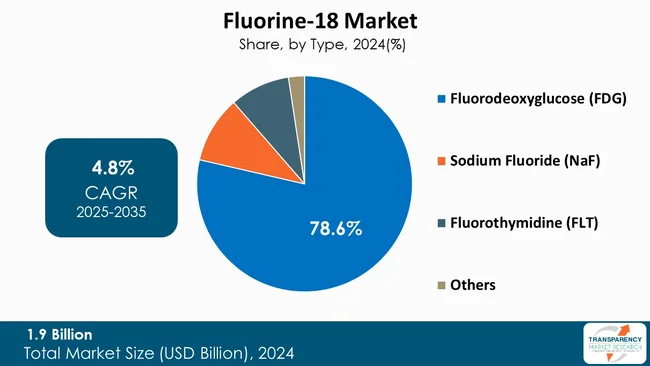

The dominant type in the market for Fluorine-18 compounds is Fluorodeoxyglucose (FDG), a PET radiopharmaceutical used especially in oncology. As an oncology marker, it has wide applicability. The protocols that are already in practice, clinical guidelines, FDG's reproducibility as well as licensing have all cemented its use as a benchmark in oncological imaging.

Outside oncology, FDG is utilized in cardiology and neurology, with its uses extended even more. Having a solid evidence base, well-documented safety profile, and worldwide availability, it holds out the prospect of consistent demand. Therefore, FDG is the anchor tracer in fluorine-18 industry.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest fluorine-18 market analysis, North America dominated in 2024. This is mostly due to the presence of numerous factors like the well-established health infrastructure, extensive use of PET imaging, and the favorable availability of cyclotron units. The region boasts well-established channels of distribution, which facilitate delivery of short-lived radioisotopes like F-18 timely. Also, PET scanning is richly funded by pro-confirmative reimbursement policies and increased healthcare spending, which in turn establish adequate infrastructure to enable clinical practice.

Some of the major strategies adopted by the key market players of the target market are the broadening of the networks of cyclotrons to ensure a dependable supply of isotopes, investing in automated synthesis technologies and the creation of new tracers of F-18 for the targeting of various diseases. Additionally, companies are concentrating resources on forging partnerships, satisfying regulations, and introduction of digital ordering systems.

Lantheus Holdings, Inc., Siemens Healthineers AG, Curium Austria GmbH, GE HealthCare, Blue Earth Diagnostics, China lsotope & Radiation Corporation, Eli Lilly and Company, Yantai Dongcheng Pharmaceutical Group Co., Ltd., Advanced Accelerator Applications SA, Telix Pharmaceuticals Limited, SOFIE Co., Cardinal Health, Life Molecular Imaging, IBA Radiopharma Solutions, and ECKERT & ZIEGLER are some of the leading players operating in the global fluorine-18 market.

Each of these players has been profiled in the fluorine-18 market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

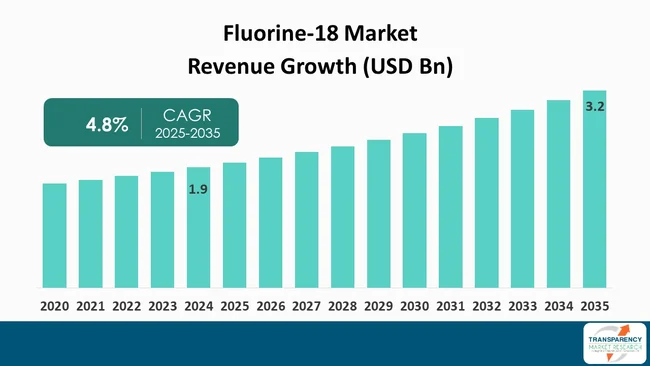

| Size in 2024 | US$ 1.9 Bn |

| Forecast Value in 2035 | US$ 3.2 Bn |

| CAGR | 4.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Fluorine-18 Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global fluorine-18 market was valued at US$ 1.9 Bn in 2024

The global fluorine-18 industry is projected to reach more than US$ 3.2 Bn by the end of 2035

Increasing prevalence of chronic diseases, particularly cancer, advancements in medical imaging technologies, innovations in radiopharmaceutical production and favorable regulatory environments are some of the factors driving the expansion of fluorine-18 market.

The CAGR is anticipated to be 4.8% from 2025 to 2035

Lantheus Holdings, Inc., Siemens Healthineers AG, Curium Austria GmbH, GE HealthCare, Blue Earth Diagnostics, China lsotope & Radiation Corporation, Eli Lilly and Company, Yantai Dongcheng Pharmaceutical Group Co., Ltd., Advanced Accelerator Applications SA, Telix Pharmaceuticals Limited, SOFIE Co., Cardinal Health, Life Molecular Imaging, IBA Radiopharma Solutions, and ECKERT & ZIEGLER

Table 01: Global Fluorine-18 Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 02: Global Fluorine-18 Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 03: Global Fluorine-18 Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Fluorine-18 Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Fluorine-18 Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Fluorine-18 Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Fluorine-18 Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 08: North America Fluorine-18 Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 09: North America Fluorine-18 Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Fluorine-18 Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Fluorine-18 Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe Fluorine-18 Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 13: Europe Fluorine-18 Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 14: Europe Fluorine-18 Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Fluorine-18 Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Fluorine-18 Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific Fluorine-18 Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 18: Asia Pacific Fluorine-18 Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 19: Asia Pacific Fluorine-18 Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Fluorine-18 Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Fluorine-18 Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America Fluorine-18 Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 23: Latin America Fluorine-18 Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 24: Latin America Fluorine-18 Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Fluorine-18 Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Fluorine-18 Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa Fluorine-18 Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 28: Middle East & Africa Fluorine-18 Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 29: Middle East & Africa Fluorine-18 Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa Fluorine-18 Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Fluorine-18 Market Value Share Analysis, By Type, 2024 and 2035

Figure 02: Global Fluorine-18 Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 03: Global Fluorine-18 Market Revenue (US$ Bn), by Fluorodeoxyglucose (FDG), 2020 to 2035

Figure 04: Global Fluorine-18 Market Revenue (US$ Bn), by Sodium Fluoride (NaF), 2020 to 2035

Figure 05: Global Fluorine-18 Market Revenue (US$ Bn), by Fluorothymidine (FLT), 2020 to 2035

Figure 06: Global Fluorine-18 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Fluorine-18 Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 08: Global Fluorine-18 Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 09: Global Fluorine-18 Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 10: Global Fluorine-18 Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 11: Global Fluorine-18 Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 12: Global Fluorine-18 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Fluorine-18 Market Value Share Analysis, By Application, 2024 and 2035

Figure 14: Global Fluorine-18 Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 15: Global Fluorine-18 Market Revenue (US$ Bn), by Medical Imaging, 2020 to 2035

Figure 16: Global Fluorine-18 Market Revenue (US$ Bn), by Radiopharmaceutical Production, 2020 to 2035

Figure 17: Global Fluorine-18 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Fluorine-18 Market Value Share Analysis, By End-user, 2024 and 2035

Figure 19: Global Fluorine-18 Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 20: Global Fluorine-18 Market Revenue (US$ Bn), by Hospitals & Ambulatory Surgical Centers, 2020 to 2035

Figure 21: Global Fluorine-18 Market Revenue (US$ Bn), by Diagnostic Imaging Clinics, 2020 to 2035

Figure 22: Global Fluorine-18 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Fluorine-18 Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Fluorine-18 Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Fluorine-18 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Fluorine-18 Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Fluorine-18 Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Fluorine-18 Market Value Share Analysis, By Type, 2024 and 2035

Figure 29: North America Fluorine-18 Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 30: North America Fluorine-18 Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 31: North America Fluorine-18 Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 32: North America Fluorine-18 Market Value Share Analysis, By Application, 2024 and 2035

Figure 33: North America Fluorine-18 Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 34: North America Fluorine-18 Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: North America Fluorine-18 Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Europe Fluorine-18 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Europe Fluorine-18 Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 38: Europe Fluorine-18 Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 39: Europe Fluorine-18 Market Value Share Analysis, By Type, 2024 and 2035

Figure 40: Europe Fluorine-18 Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 41: Europe Fluorine-18 Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 42: Europe Fluorine-18 Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 43: Europe Fluorine-18 Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Europe Fluorine-18 Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Europe Fluorine-18 Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Europe Fluorine-18 Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Asia Pacific Fluorine-18 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Asia Pacific Fluorine-18 Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Asia Pacific Fluorine-18 Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Asia Pacific Fluorine-18 Market Value Share Analysis, By Type, 2024 and 2035

Figure 51: Asia Pacific Fluorine-18 Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 52: Asia Pacific Fluorine-18 Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 53: Asia Pacific Fluorine-18 Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 54: Asia Pacific Fluorine-18 Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Asia Pacific Fluorine-18 Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Asia Pacific Fluorine-18 Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Asia Pacific Fluorine-18 Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Latin America Fluorine-18 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Latin America Fluorine-18 Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Latin America Fluorine-18 Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Latin America Fluorine-18 Market Value Share Analysis, By Type, 2024 and 2035

Figure 62: Latin America Fluorine-18 Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 63: Latin America Fluorine-18 Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 64: Latin America Fluorine-18 Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 65: Latin America Fluorine-18 Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Latin America Fluorine-18 Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Latin America Fluorine-18 Market Value Share Analysis, By End-user, 2024 and 2035

Figure 68: Latin America Fluorine-18 Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 69: Middle East & Africa Fluorine-18 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Middle East & Africa Fluorine-18 Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 71: Middle East & Africa Fluorine-18 Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 72: Middle East & Africa Fluorine-18 Market Value Share Analysis, By Type, 2024 and 2035

Figure 73: Middle East & Africa Fluorine-18 Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 74: Middle East & Africa Fluorine-18 Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 75: Middle East & Africa Fluorine-18 Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 76: Middle East & Africa Fluorine-18 Market Value Share Analysis, By Application, 2024 and 2035

Figure 77: Middle East & Africa Fluorine-18 Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 78: Middle East & Africa Fluorine-18 Market Value Share Analysis, By End-user, 2024 and 2035

Figure 79: Middle East & Africa Fluorine-18 Market Attractiveness Analysis, By End-user, 2025 to 2035