Reports

Reports

Analysts’ Viewpoint on Market Scenario

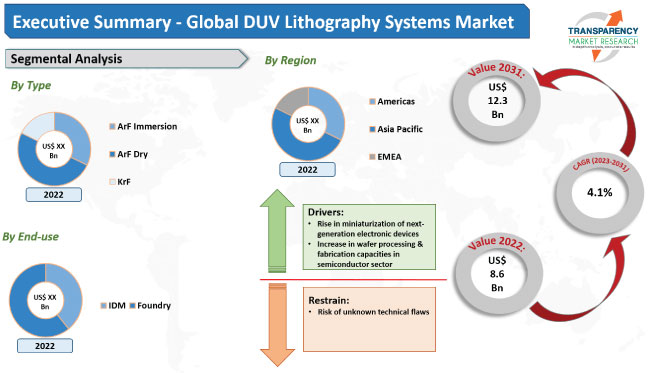

Growth in wafer processing and fabrication capacities in the semiconductor sector and increase in demand for miniaturized electronic components are expected to fuel the global DUV lithography systems market size during the forecast period. The industry in Asia Pacific is likely to grow at a steady pace in the near future owing to the increase in demand for sensors and memory devices in consumer electronics, IoT-based devices, and industrial components in the region.

Expansion in the semiconductor sector is anticipated to create lucrative opportunities for key market players. Rise in adoption of chips fabricated with DUV lithography systems for 5G, Artificial Intelligence, and IoT systems is projected to positively impact the market growth in the next few years.

Deep Ultraviolet (DUV) lithography is a photolithography technology used to pattern circuits onto silicon wafers in the semiconductor sector. It transfers a pattern onto a photosensitive material (photoresist) on the wafer, which is then used to etch the underlying substrate to create the desired circuit using light with a wavelength of 193 nm or 157 nm.

DUV lithography is critical for semiconductor device scaling, as it facilitates the production of smaller and more densely packed transistors. These transistors help manufacturers develop a wide range of semiconductor technologies and nodes.

Advancements in lithography play a key role in miniaturization of next-generation electronic devices. Semiconductor vendors are focusing on the development of miniaturized electronics with low power consumption rates. This is likely to spur DUV lithography systems market growth in the next few years.

DUV lithography systems are used to pattern fine structures with high resolution and accuracy in advanced miniaturized packaging. This is necessary for the creation of 3D packages with high interconnect density, such as Fan-out Wafer Level Packaging (FOWLP) and System-in-Package (SiP) devices. These packages enable the integration of multiple components into a single compact package, which is crucial for meeting the demands of modern electronics, such as small size, high performance, and low power consumption.

In advanced miniaturized packaging, DUV lithography systems use specialized optics and illumination systems, as well as specialized photoresists, to pattern features with sub-10 nm resolution. These systems are also intended to address the challenges of patterning non-planar surfaces and the increase in aspect ratios of features in advanced packaging.

Miniaturization enables chip makers to fit more structures onto a chip. This makes the chip faster and more efficient. It also leads to a decrease in production costs. Hence, rise in demand for robust and low-cost chips is projected to fuel DUV lithography systems market expansion in the near future.

Implementation of advanced lithography technologies helps enhance wafer processing and fabrication capacities in the semiconductor sector. This, in turn, supports the upscaling of semiconductor devices and boosts the demand for high-performance electronics.

DUV lithography systems allow for the production of smaller and more densely packed transistors, which is crucial to cater to the needs of modern electronics. Usage of DUV lithography in wafer fabrication enables semiconductor companies to produce chips with higher performance and functionality. This is estimated to fuel market progress in the next few years.

Advancements in wafer fabrication capacities and lithography technologies have led to a decline in the cost of semiconductor devices, making them more accessible to a wide range of customers. Vendors in the semiconductor sector are investing significantly in R&D of new fabrication processes and expansion of the existing facilities. This is likely to drive the market in the near future.

According to the latest DUV lithography systems market trends, the KrF type segment is expected to account for the largest share during the forecast period. KrF (Krypton Fluoride) lithography is employed for the fabrication of integrated circuits. It uses ultraviolet light, which is generated from a KrF excimer laser, to transfer a pattern from a mask onto a substrate coated with a light-sensitive material.

KrF lithography is particularly well-suited for the production of advanced integrated circuits due to its high resolution and ability to pattern small features. It is typically utilized for the production of cutting-edge devices with high-end performance requirements, such as those found in high-performance computing, mobile devices, and other applications that demand high levels of computational power. Additionally, KrF lithography is employed in the production of photomasks and display panels for flat-screen televisions and monitors.

Key players are focusing on launching new products to increase their DUV lithography systems market share. In June 2022, Canon Inc. launched a new “Grade 10” productivity upgrade option for its FPA-6300ES6a KrF semiconductor lithography equipment. The upgrade facilitates a throughput of 300 wafers per hour.

According to the latest DUV lithography systems market analysis, the foundry end-use segment dominated the market during the forecast period. The segment held major share of 66.0% in 2022.

Growth of the segment can be ascribed to the increase in production of semiconductor wafers. DUV systems offer higher throughput than other lithography technologies, enabling foundries to produce more devices in a shorter period of time. In 2020, the annual capacity of manufacturing facilities managed by TSMC and its subsidiaries surpassed 12 million 12-inch equivalent wafers.

Asia Pacific is projected to constitute the largest share from 2023 to 2031. Presence of major lithography system manufacturers and foundries is expected to fuel market statistics in the region during the forecast period. Taiwan and South Korea are key growth engines of the industry in Asia Pacific. Taiwan accounted for nearly 26.0% share of semiconductor revenue in 2021, ranking second globally.

Adoption of DUV lithography systems is high in the Americas. The region held significant share in 2022. Surge in development of advanced miniaturized IC packaging is projected to boost market dynamics in the Americas in the near future.

The global industry is consolidated, with a small number of large-scale vendors controlling the entire share. Most of the companies are investing significantly in R&D of new products. ASML, Canon Inc., and Nikon Precision Inc. are prominent entities operating in this sector.

Each of these players has been profiled in the DUV lithography systems industry report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 8.6 Bn |

|

Market Forecast Value in 2031 |

US$ 12.3 Bn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Volume in Units |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 8.6 Bn in 2022

It is expected to grow at a CAGR of 4.1% from 2023 to 2031

It is estimated to reach US$ 12.3 Bn by the end of 2031

Rise in miniaturization of next-generation electronic devices and increase in wafer processing & fabrication capacities in semiconductor sector

The foundry segment held 66.0% share in 2022

Asia Pacific is more lucrative for vendors

Taiwan accounted for 38.0% share in 2022

ASML, Canon Inc., and Nikon Precision Inc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global DUV Lithography Systems Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Semiconductor Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. DUV Lithography Systems Market Analysis By Type

5.1. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

5.1.1. ArF Immersion

5.1.2. ArF Dry

5.1.3. KrF

5.2. Market Attractiveness Analysis, By Type

6. DUV Lithography Systems Market Analysis By End-use

6.1. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

6.1.1. IDM

6.1.2. Foundry

6.2. Market Attractiveness Analysis, By End-use

7. DUV Lithography Systems Market Analysis and Forecast, By Region

7.1. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Region, 2017–2031

7.1.1. Americas

7.1.2. Asia Pacific

7.1.3. EMEA

7.2. Market Attractiveness Analysis, By Region

8. Americas DUV Lithography Systems Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

8.3.1. ArF Immersion

8.3.2. ArF Dry

8.3.3. KrF

8.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

8.4.1. IDM

8.4.2. Foundry

8.5. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

8.5.1. U.S.

8.5.2. Rest of Americas

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By End-use

8.6.3. By Country/Sub-region

9. U.S. DUV Lithography Systems Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

9.3.1. ArF Immersion

9.3.2. ArF Dry

9.3.3. KrF

9.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

9.4.1. IDM

9.4.2. Foundry

9.5. Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-use

10. Asia Pacific DUV Lithography Systems Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

10.3.1. ArF Immersion

10.3.2. ArF Dry

10.3.3. KrF

10.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

10.4.1. IDM

10.4.2. Foundry

10.5. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.5.1. China

10.5.2. Japan

10.5.3. South Korea

10.5.4. Taiwan

10.5.5. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By End-use

10.6.3. By Country/Sub-region

11. China DUV Lithography Systems Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

11.3.1. ArF Immersion

11.3.2. ArF Dry

11.3.3. KrF

11.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

11.4.1. IDM

11.4.2. Foundry

11.5. Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-use

12. Japan DUV Lithography Systems Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

12.3.1. ArF Immersion

12.3.2. ArF Dry

12.3.3. KrF

12.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

12.4.1. IDM

12.4.2. Foundry

12.5. Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-use

13. South Korea DUV Lithography Systems Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

13.3.1. ArF Immersion

13.3.2. ArF Dry

13.3.3. KrF

13.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

13.4.1. IDM

13.4.2. Foundry

13.5. Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By End-use

14. Taiwan DUV Lithography Systems Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

14.3.1. ArF Immersion

14.3.2. ArF Dry

14.3.3. KrF

14.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

14.4.1. IDM

14.4.2. Foundry

14.5. Market Attractiveness Analysis

14.5.1. By Type

14.5.2. By End-use

15. Rest of Asia Pacific DUV Lithography Systems Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

15.3.1. ArF Immersion

15.3.2. ArF Dry

15.3.3. KrF

15.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

15.4.1. IDM

15.4.2. Foundry

15.5. Market Attractiveness Analysis

15.5.1. By Type

15.5.2. By End-use

16. EMEA DUV Lithography Systems Market Analysis and Forecast

16.1. Market Snapshot

16.2. Drivers and Restraints: Impact Analysis

16.3. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Type, 2017–2031

16.3.1. ArF Immersion

16.3.2. ArF Dry

16.3.3. KrF

16.4. DUV Lithography Systems Market Size (US$ Bn) Analysis & Forecast, By End-use, 2017–2031

16.4.1. IDM

16.4.2. Foundry

16.5. DUV Lithography Systems Market Size (US$ Bn) and Volume (Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

16.5.1. Europe

16.5.2. Middle East & Africa

16.6. Market Attractiveness Analysis

16.6.1. By Type

16.6.2. By End-use

16.6.3. By Country/Sub-region

17. Competition Assessment

17.1. Global DUV Lithography Systems Market Competition Matrix - a Dashboard View

17.1.1. Global DUV Lithography Systems Market Company Share Analysis, by Value (2022)

17.1.2. Technological Differentiator

18. Company Profiles (Global Manufacturers/Suppliers)

18.1. ASML

18.1.1. Overview

18.1.2. Product Portfolio

18.1.3. Sales Footprint

18.1.4. Key Subsidiaries or Distributors

18.1.5. Strategy and Recent Developments

18.1.6. Key Financials

18.2. Canon Inc.

18.2.1. Overview

18.2.2. Product Portfolio

18.2.3. Sales Footprint

18.2.4. Key Subsidiaries or Distributors

18.2.5. Strategy and Recent Developments

18.2.6. Key Financials

18.3. Nikon Precision Inc.

18.3.1. Overview

18.3.2. Product Portfolio

18.3.3. Sales Footprint

18.3.4. Key Subsidiaries or Distributors

18.3.5. Strategy and Recent Developments

18.3.6. Key Financials

19. Recommendation

19.1. Opportunity Assessment

19.1.1. By Type

19.1.2. By End-use

19.1.3. By Region

List of Tables

Table 1: Global DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 2: Global DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 3: Global DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 4: Global DUV Lithography Systems Market Size & Forecast, By Region, Value (US$ Bn), 2017-2031

Table 5: Global DUV Lithography Systems Market Size & Forecast, By Region, Volume (Units), 2017-2031

Table 6: Americas DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 7: Americas DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 8: Americas DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 9: Americas DUV Lithography Systems Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 10: Americas DUV Lithography Systems Market Size & Forecast, By Country, Volume (Units), 2017-2031

Table 11: U.S. DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 12: U.S. DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 13: U.S. DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 14: Asia Pacific DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 15: Asia Pacific DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 16: Asia Pacific DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 17: Asia Pacific DUV Lithography Systems Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 18: Asia Pacific DUV Lithography Systems Market Size & Forecast, By Country, Volume (Units), 2017-2031

Table 19: China DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 20: China DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 21: China DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 22: Japan DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 23: Japan DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 24: Japan DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 25: South Korea DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 26: South Korea DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 27: South Korea DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 28: Taiwan DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 29: Taiwan DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 30: Taiwan DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 31: Rest of Asia Pacific DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 32: Rest of Asia Pacific DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 33: Rest of Asia Pacific DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 34: EMEA DUV Lithography Systems Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 35: EMEA DUV Lithography Systems Market Size & Forecast, By Type, Volume (Units), 2017-2031

Table 36: EMEA DUV Lithography Systems Market Size & Forecast, By End-use, Value (US$ Bn), 2017-2031

Table 37: EMEA DUV Lithography Systems Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 38: EMEA DUV Lithography Systems Market Size & Forecast, By Country, Volume (Units), 2017-2031

List of Figures

Figure 01: Global DUV Lithography Systems Market Share Analysis, by Region

Figure 02: Global DUV Lithography Systems Market Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global DUV Lithography Systems Market, Value (US$ Bn), 2017-2031

Figure 04: Global DUV Lithography Systems Market, Volume (Units), 2017-2031

Figure 05: Global DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 06: Global DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 07: Global DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 08: Global DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 09: Global DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 10: Global DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 11: Global DUV Lithography Systems Market Size & Forecast, By Region, Revenue (US$ Bn), 2017-2031

Figure 12: Global DUV Lithography Systems Market Share Analysis, by Region, 2022 and 2031

Figure 13: Global DUV Lithography Systems Market Attractiveness, By Region, Value (US$ Bn), 2022-2031

Figure 14: Americas DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 15: Americas DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 16: Americas DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 17: Americas DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 18: Americas DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 19: Americas DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 20: Americas DUV Lithography Systems Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 21: Americas DUV Lithography Systems Market Share Analysis, by Country, 2022 and 2031

Figure 22: Americas DUV Lithography Systems Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 23: U.S. DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 24: U.S. DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 25: U.S. DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 26: U.S. DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 27: U.S. DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 28: U.S. DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 29: Asia Pacific DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 30: Asia Pacific DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 31: Asia Pacific DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 32: Asia Pacific DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 33: Asia Pacific DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 34: Asia Pacific DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 35: Asia Pacific DUV Lithography Systems Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 36: Asia Pacific DUV Lithography Systems Market Share Analysis, by Country, 2022 and 2031

Figure 37: Asia Pacific DUV Lithography Systems Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 38: China DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 39: China DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 40: China DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 41: China DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 42: China DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 43: China DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 44: Japan DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 45: Japan DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 46: Japan DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 47: Japan DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 48: Japan DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 49: Japan DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 50: South Korea DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 51: South Korea DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 52: South Korea DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 53: South Korea DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 54: South Korea DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 55: South Korea DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 56: Taiwan DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 57: Taiwan DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 58: Taiwan DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 59: Taiwan DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 60: Taiwan DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 61: Taiwan DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 62: Rest of Asia DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 63: Rest of Asia DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 64: Rest of Asia DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 65: Rest of Asia DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 66: Rest of Asia DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 67: Rest of Asia DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 68: EMEA DUV Lithography Systems Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 69: EMEA DUV Lithography Systems Market Share Analysis, by Type, 2022 and 2031

Figure 70: EMEA DUV Lithography Systems Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 71: EMEA DUV Lithography Systems Market Size & Forecast, By End-use, Revenue (US$ Bn), 2017-2031

Figure 72: EMEA DUV Lithography Systems Market Share Analysis, by End-use, 2022 and 2031

Figure 73: EMEA DUV Lithography Systems Market Attractiveness, By End-use, Value (US$ Bn), 2022-2031

Figure 74: EMEA DUV Lithography Systems Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 75: EMEA DUV Lithography Systems Market Share Analysis, by Country, 2022 and 2031

Figure 76: EMEA DUV Lithography Systems Market Attractiveness, By Country, Value (US$ Bn), 2022-2031