Reports

Reports

Analysts’ Viewpoint on Driver Assistance Systems for Locomotives Market Scenario

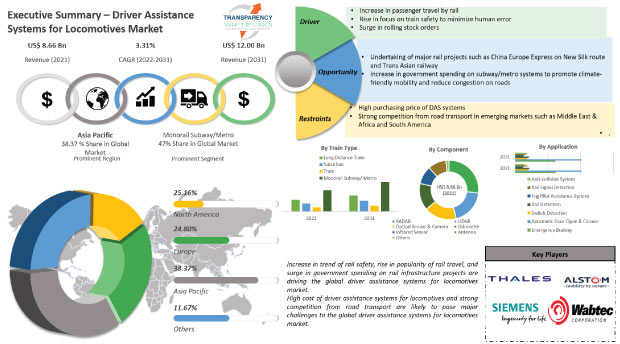

Increase in demand for driver assistance systems for locomotives can be ascribed to the growth in popularity of rail travel, rise in focus on rail safety, upgrade of existing metro/subway networks, and construction of new metro networks in major cities. Key players operating in the global market are focusing on the development of high-value applications such as anti-collision systems, rail detection and rail signal detection, and components such as RADAR and LIDAR to offer their clients with a product portfolio that is innovative, technologically advanced, and cost effective. Manufacturers in the driver assistance systems for locomotives market are tapping into incremental opportunities in the rail industry to broaden their revenue streams by offering back-end ADAS-related services.

Driver assistance systems for locomotives are systems developed to automate/enhance various locomotive functions and help locomotive drivers operate locomotives more safely and efficiently. These systems help minimize human error, avoid rail accidents, and achieve better safety for passengers/freight being transported by railways. The global driver assistance systems for locomotives market is primarily driven by the promotion of rail transportation by governments as an eco-friendly alternative to road and air transport. The market is also estimated to grow due to the increase in global trade, which is leading to the construction of international rail networks such as China Europe Express, Trans Asian Railway, and Gulf Railway. Ongoing projects under initiatives such as OBOR (One Belt One Road) and BRI (Belt and Road Initiative), and upgrade of existing subway/metro networks and construction of new ones are also augmenting the market.

The monorail subway/metro segment of the global driver assistance systems for locomotives market is estimated to reach a value of ~US$ 4.23 Bn by the end of 2022. Major cities all over the world are upgrading their metro/subway systems or constructing new ones to ease road congestion and reduce pollution levels caused by vehicular traffic. These new metro trains are equipped with cutting-edge assisted driving features such as automatic door open and closure systems and anti-collision systems. In developing countries, freight train operators are opting to retrofit their old locomotives with advanced driver assistance system (ADAS) features to improve safety and efficiency; and save costs. Rail passengers are increasingly demanding greater safety in passenger trains. This demand for increased safety in rail travel is anticipated to boost the market for advanced driver assistance systems for locomotives, as ADAS features reduce human intervention in the operation of locomotives, thus enhancing the safety of locomotives.

Orders for rolling stock equipment, such as locomotives and train cars with advanced innovative features (including ADAS), are rising owing to the commencement of several international railway infrastructure projects such as China Europe Express, Trans Asian Railway, and Lagos Calabar Railway. Anti-collision systems, rail signal detection systems, and fog pilot assistance systems are some of the recent innovations in the rolling stock industry, which are expected to boost the demand for driver assistance systems for locomotives. Introduction of new laser-based obstacle detection systems is also likely to boost the driver assistance systems for locomotives market.

Rail projects such as California High-Speed Rail are being constructed in developed regions such as North America, wherein trains are expected to travel at average speeds of 300 km/hr. Driver assistance systems for locomotives are increasingly being integrated into locomotives of such trains to ensure better safety and efficiency in operations. This is also driving the sales of driver assistance systems for locomotives in developed markets. The driver assistance systems for locomotives market is estimated to witness a rapid increase in the adoption of smart and connected technologies such as Internet of Things (IoT) technologies, telematics, laser-based obstacle scanning systems, and infrared sensors. Additionally, new revenue opportunities such as back-end data processing, analysis of data collected by these systems, and issuing of the over the air (OTA) updates for these systems are likely to emerge for key players in the driver assistance systems for the locomotives market.

In terms of application, the automatic door open and closure segment held major share of 40.41% of the driver assistance systems for locomotives market in 2021. The segment is estimated to maintain the status quo and expand at a growth rate of more than 3% during the forecast period. This is primarily due to the extensive usage of automatic door open and closure in monorails, subways, and metro systems across the globe. The anti-collision systems segment is projected to expand rapidly at a CAGR of 5.94% due to the wide application of anti-collision systems in high-speed trains.

In terms of component, the global driver assistance systems for locomotives has been split into RADAR, LIDAR, optical sensor & camera, odometer, infrared sensor, antenna, and others. The antenna segment dominated the global driver assistance systems for locomotives market with 26.69% share in 2021. Furthermore, the segment is expected to grow at a CAGR of 1.63% during the forecast period. Antenna-based systems are cheaper to implement and maintain than other ADAS systems for locomotives. These driver assistance systems for locomotives are used in industries such as freight haulage and bulk haulage. The LIDAR segment is estimated to grow at a CAGR of 5.73% primarily due to its application in high-speed trains and increasing demand for laser-based obstacle detection systems.

In terms of volume, Asia Pacific held 38.37% share of the global driver assistance systems for locomotives market in 2021. This was primarily attributed to the significant demand for train travel, upgrade of metro systems in major cities, and construction of many high-speed rail projects as well as the presence of major OEMs such as Hitachi Rail Systems, Kawasaki Heavy Industries, and Beijing Traffic Control Technology Co. Ltd in the region. Japan and China accounted for 26.81% and 24.72% share, respectively, of the Asia Pacific market in 2021.

North America and Europe are also prominent markets for driver assistance systems for locomotives. These held 25.16% and 24.80% share, respectively, of the global market in 2021. Automatic door open and closure is a rapidly growing application segment of the driver assistance systems for locomotives market in these regions. South America is a larger market for driver assistance systems for locomotives as compared to Middle East & Africa; however, the market in Middle East & Africa is anticipated to grow at a faster pace due to the execution of big ticket projects, such as Etihad Railway, Gulf Railway, and Algiers and Cairo Metro, in the region.

The global driver assistance systems for locomotives market is fairly consolidated with the largest vendors controlling majority of the share. Most of the firms are spending significantly on comprehensive research and development activities, primarily to develop highly advanced products. Expansion of product portfolios and mergers and acquisitions are the major strategies adopted by key players. Thales Group, Alstom S.A., Hitachi Ltd, SIEMENS AG, Mitsubishi Electric, Kawasaki Heavy industries, Ltd., ABB, Construcciones y Auxiliar de Ferrocarriles, S.A. (CAF), Beijing Traffic Control Technology Co., Ltd, Wabtec Corporation, Stadler Rail, Robert Bosch GmbH, and Knorr-Bremse AG are the prominent entities operating in the market.

Each of these players has been profiled in the driver assistance systems for locomotives market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 8.66 Bn |

|

Market Forecast Value in 2031 |

US$ 12.00 Bn |

|

Growth Rate (CAGR) |

3.31% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value & Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The driver assistance systems for locomotives market was valued at US$ 8.66 Bn in 2021

The driver assistance systems for locomotives market is expected to expand at a CAGR of 3.31% by 2031.

The driver assistance systems for locomotives market would be worth US$ 12 Bn in 2031

Prominent players operating in the driver assistance systems for locomotives market are Thales Group, Alstom S.A., Hitachi Ltd, SIEMENS AG, Mitsubishi Electric, Kawasaki Heavy industries, Ltd., ABB, Construcciones y Auxiliar de Ferrocarriles, S.A. (CAF), Beijing Traffic Control Technology Co., Ltd, Wabtec Corporation, Stadler Rail, Robert Bosch GmbH, and Knorr-Bremse AG

The U.S. is a prominent market for driver assistance systems for locomotives due to the retrofitting of old locomotives with ADAS systems and construction of high speed rail

The monorail subway/ metro segment accounts for the largest share of the driver assistance systems for locomotives market

Rising adoption of laser-based obstacle scanning and detection systems, anti-collison systems, and emergency braking to enhance the safety of locomotives; and increasing usage of automatic door open and closure systems in metro trains are some of the prominent trends in the driver assistance systems for locomotives market

Asia Pacific is the most lucrative region of the driver assistance systems for locomotives market and holds the dominant market share

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Market Definition / Scope / Limitations

1.4. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Bn, 2017‒2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Macro-Economic Factors

3.3.1. GDP & GDP Growth Rate

3.3.2. Component Value Added Growth

3.4. Forecast Factors - Relevance & Impact

3.4.1. Global Driver Assistance for Locomotive Market Growth

3.5. Market Dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunity

3.6. Market Factor Analysis

3.6.1. Porter’s Five Force Analysis

3.6.2. SWOT Analysis

3.7. Regulatory Scenario

4. Key Trend Analysis

5. Industry Ecosystem Analysis

5.1. Value Chain Analysis

5.1.1. Raw Technology Supplier

5.1.2. Component Manufacturer

5.1.3. System Suppliers

5.1.4. Tier 1 Players

5.1.5. Tier Players

5.1.6. OEMs/ End-users

5.2. Vendor Matrix

5.3. Gross Margin Analysis

6. Global Driver Assistance for Locomotive Market Volume (Units) and Value (US$ Bn) Analysis and Forecast, 2017‒2031

6.1. Current and Future Market Value (US$ Bn) Projections, 2017‒2031

6.1.1. Y-o-Y Growth Trend Analysis

6.1.2. Absolute $ Opportunity Analysis

7. Pricing Analysis

7.1.1. Regional Driver Assistance for Locomotive Pricing (US$), 2017‒2031

7.1.2. Cost Structure Analysis

7.1.3. Profit Margin Analysis

8. COVID-19 Impact Analysis – Driver Assistance for Locomotive Market

9. Impact Factors

9.1.1. Rapid Urbanization

9.1.2. Growth of Rail Transport

9.1.3. Growth in Demand for Railway Safety

10. Global Driver Assistance for Locomotive Market, by Train Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Train Type, 2017‒2031

10.2.1. Long Distance Train

10.2.2. Suburban

10.2.3. Tram

10.2.4. Monorail Subway/ Metro

11. Global Driver Assistance for Locomotive Market, by Application

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

11.2.1. Emergency Braking

11.2.2. Automatic Door Open & Closure

11.2.3. Switch Detection

11.2.4. Rail Detection

11.2.5. Fog Pilot Assistance System

11.2.6. Rail Signal Detection

12. Global Driver Assistance for Locomotive Market, by Component

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

12.2.1. RADAR

12.2.2. LIDAR

12.2.3. Optical Sensor & Camera

12.2.4. Odometer

12.2.5. Infrared Sensor

12.2.6. Antenna

12.2.7. Others

13. Global Driver Assistance for Locomotive Market, by Region

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Region, 2017‒2031

13.2.1. North America

13.2.2. Europe

13.2.3. Asia Pacific

13.2.4. Middle East & Africa

13.2.5. South America

14. North America Driver Assistance for Locomotive Market

14.1. Market Snapshot

14.2. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Train Type, 2017‒2031

14.2.1. Long Distance Train

14.2.2. Suburban

14.2.3. Tram

14.2.4. Monorail Subway/ Metro

14.3. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

14.3.1. Emergency Braking

14.3.2. Automatic Door Open & Closure

14.3.3. Switch Detection

14.3.4. Rail Detection

14.3.5. Fog Pilot Assistance System

14.3.6. Rail Signal Detection

14.4. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

14.4.1. RADAR

14.4.2. LIDAR

14.4.3. Optical Sensor & Camera

14.4.4. Odometer

14.4.5. Infrared Sensor

14.4.6. Antenna

14.4.7. Others

14.5. Key Country Analysis – North America Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017‒2031

14.5.1. U. S.

14.5.2. Canada

14.5.3. Mexico

15. Europe Driver Assistance for Locomotive Market

15.1. Market Snapshot

15.2. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Train Type, 2017‒2031

15.2.1. Long Distance Train

15.2.2. Suburban

15.2.3. Tram

15.2.4. Monorail Subway/ Metro

15.3. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

15.3.1. Emergency Braking

15.3.2. Automatic Door Open & Closure

15.3.3. Switch Detection

15.3.4. Rail Detection

15.3.5. Fog Pilot Assistance System

15.3.6. Rail Signal Detection

15.4. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

15.4.1. RADAR

15.4.2. LIDAR

15.4.3. Optical Sensor & Camera

15.4.4. Odometer

15.4.5. Infrared Sensor

15.4.6. Antenna

15.4.7. Others

15.5. Key Country Analysis – Europe Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017‒2031

15.5.1. Germany

15.5.2. U. K.

15.5.3. France

15.5.4. Italy

15.5.5. Spain

15.5.6. Nordic Countries

15.5.7. Russia & CIS

15.5.8. Rest of Europe

16. Asia Pacific Driver Assistance for Locomotive Market

16.1. Market Snapshot

16.2. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Train Type, 2017‒2031

16.2.1. Long Distance Train

16.2.2. Suburban

16.2.3. Tram

16.2.4. Monorail Subway/ Metro

16.3. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

16.3.1. Emergency Braking

16.3.2. Automatic Door Open & Closure

16.3.3. Switch Detection

16.3.4. Rail Detection

16.3.5. Fog Pilot Assistance System

16.3.6. Rail Signal Detection

16.4. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

16.4.1. RADAR

16.4.2. LIDAR

16.4.3. Optical Sensor & Camera

16.4.4. Odometer

16.4.5. Infrared Sensor

16.4.6. Antenna

16.4.7. Others

16.5. Key Country Analysis – Asia Pacific Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017‒2031

16.5.1. China

16.5.2. India

16.5.3. Japan

16.5.4. ASEAN Countries

16.5.5. South Korea

16.5.6. ANZ

16.5.7. Rest of Asia Pacific

17. Middle East & Africa Driver Assistance for Locomotive Market

17.1. Market Snapshot

17.2. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Train Type, 2017‒2031

17.2.1. Long Distance Train

17.2.2. Suburban

17.2.3. Tram

17.2.4. Monorail Subway/ Metro

17.3. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

17.3.1. Emergency Braking

17.3.2. Automatic Door Open & Closure

17.3.3. Switch Detection

17.3.4. Rail Detection

17.3.5. Fog Pilot Assistance System

17.3.6. Rail Signal Detection

17.4. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

17.4.1. RADAR

17.4.2. LIDAR

17.4.3. Optical Sensor & Camera

17.4.4. Odometer

17.4.5. Infrared Sensor

17.4.6. Antenna

17.4.7. Others

17.5. Key Country Analysis – Middle East & Africa Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017‒2031

17.5.1. GCC

17.5.2. South Africa

17.5.3. Turkey

17.5.4. Rest of Middle East & Africa

18. South America Driver Assistance for Locomotive Market

18.1. Market Snapshot

18.2. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Train Type, 2017‒2031

18.2.1. Long Distance Train

18.2.2. Suburban

18.2.3. Tram

18.2.4. Monorail Subway/ Metro

18.3. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

18.3.1. Emergency Braking

18.3.2. Automatic Door Open & Closure

18.3.3. Switch Detection

18.3.4. Rail Detection

18.3.5. Fog Pilot Assistance System

18.3.6. Rail Signal Detection Diesel

18.4. Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

18.4.1. RADAR

18.4.2. LIDAR

18.4.3. Optical Sensor & Camera

18.4.4. Odometer

18.4.5. Infrared Sensor

18.4.6. Antenna

18.4.7. Others

18.5. Key Country Analysis – South America Driver Assistance for Locomotive Market Volume (Units) & Value (US$ Bn) Analysis & Forecast, 2017‒2031

18.5.1. Brazil

18.5.2. Argentina

18.5.3. Rest of South America

19. Competitive Landscape

19.1. Company Share Analysis/ Brand Share Analysis, 2020

19.2. Key Strategy Analysis

19.2.1. Strategic Overview - Expansion, M&A, Partnership

19.2.2. Product & Marketing Strategy

19.3. Company Analysis for each player

19.3.1. Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

20. Company Profile/ Key Players – Driver Assistance for Locomotive Market

20.1.1. Thales Group

20.1.1.1. Company Overview

20.1.1.2. Company Footprints

20.1.1.3. Production Locations

20.1.1.4. Product Portfolio

20.1.1.5. Competitors & Customers

20.1.1.6. Subsidiaries & Parent Organization

20.1.1.7. Recent Developments

20.1.1.8. Financial Analysis

20.1.1.9. Profitability

20.1.1.10. Revenue Share

20.1.2. Alstom S.A.

20.1.2.1. Company Overview

20.1.2.2. Company Footprints

20.1.2.3. Production Locations

20.1.2.4. Product Portfolio

20.1.2.5. Competitors & Customers

20.1.2.6. Subsidiaries & Parent Organization

20.1.2.7. Recent Developments

20.1.2.8. Financial Analysis

20.1.2.9. Profitability

20.1.2.10. Revenue Share

20.1.3. Hitachi Ltd

20.1.3.1. Company Overview

20.1.3.2. Company Footprints

20.1.3.3. Production Locations

20.1.3.4. Product Portfolio

20.1.3.5. Competitors & Customers

20.1.3.6. Subsidiaries & Parent Organization

20.1.3.7. Recent Developments

20.1.3.8. Financial Analysis

20.1.3.9. Profitability

20.1.3.10. Revenue Share

20.1.4. SIEMENS AG

20.1.4.1. Company Overview

20.1.4.2. Company Footprints

20.1.4.3. Production Locations

20.1.4.4. Product Portfolio

20.1.4.5. Competitors & Customers

20.1.4.6. Subsidiaries & Parent Organization

20.1.4.7. Recent Developments

20.1.4.8. Financial Analysis

20.1.4.9. Profitability

20.1.4.10. Revenue Share

20.1.5. Mitsubishi Electric

20.1.5.1. Company Overview

20.1.5.2. Company Footprints

20.1.5.3. Production Locations

20.1.5.4. Product Portfolio

20.1.5.5. Competitors & Customers

20.1.5.6. Subsidiaries & Parent Organization

20.1.5.7. Recent Developments

20.1.5.8. Financial Analysis

20.1.5.9. Profitability

20.1.5.10. Revenue Share

20.1.6. Kawasaki Heavy industries, Ltd.

20.1.6.1. Company Overview

20.1.6.2. Company Footprints

20.1.6.3. Production Locations

20.1.6.4. Product Portfolio

20.1.6.5. Competitors & Customers

20.1.6.6. Subsidiaries & Parent Organization

20.1.6.7. Recent Developments

20.1.6.8. Financial Analysis

20.1.6.9. Profitability

20.1.6.10. Revenue Share

20.1.7. ABB

20.1.7.1. Company Overview

20.1.7.2. Company Footprints

20.1.7.3. Production Locations

20.1.7.4. Product Portfolio

20.1.7.5. Competitors & Customers

20.1.7.6. Subsidiaries & Parent Organization

20.1.7.7. Recent Developments

20.1.7.8. Financial Analysis

20.1.7.9. Profitability

20.1.7.10. Revenue Share

20.1.8. Construcciones y Auxiliar de Ferrocarriles, S.A. (CAF)

20.1.8.1. Company Overview

20.1.8.2. Company Footprints

20.1.8.3. Production Locations

20.1.8.4. Product Portfolio

20.1.8.5. Competitors & Customers

20.1.8.6. Subsidiaries & Parent Organization

20.1.8.7. Recent Developments

20.1.8.8. Financial Analysis

20.1.8.9. Profitability

20.1.8.10. Revenue Share

20.1.9. Beijing Traffic Control Technology Co., Ltd

20.1.9.1. Company Overview

20.1.9.2. Company Footprints

20.1.9.3. Production Locations

20.1.9.4. Product Portfolio

20.1.9.5. Competitors & Customers

20.1.9.6. Subsidiaries & Parent Organization

20.1.9.7. Recent Developments

20.1.9.8. Financial Analysis

20.1.9.9. Profitability

20.1.9.10. Revenue Share

20.1.10. Wabtec Corporation

20.1.10.1. Company Overview

20.1.10.2. Company Footprints

20.1.10.3. Production Locations

20.1.10.4. Product Portfolio

20.1.10.5. Competitors & Customers

20.1.10.6. Subsidiaries & Parent Organization

20.1.10.7. Recent Developments

20.1.10.8. Financial Analysis

20.1.10.9. Profitability

20.1.10.10. Revenue Share

20.1.11. Stadler Rail

20.1.11.1. Company Overview

20.1.11.2. Company Footprints

20.1.11.3. Production Locations

20.1.11.4. Product Portfolio

20.1.11.5. Competitors & Customers

20.1.11.6. Subsidiaries & Parent Organization

20.1.11.7. Recent Developments

20.1.11.8. Financial Analysis

20.1.11.9. Profitability

20.1.11.10. Revenue Share

20.1.12. Robert Bosch GmbH

20.1.12.1. Company Overview

20.1.12.2. Company Footprints

20.1.12.3. Production Locations

20.1.12.4. Product Portfolio

20.1.12.5. Competitors & Customers

20.1.12.6. Subsidiaries & Parent Organization

20.1.12.7. Recent Developments

20.1.12.8. Financial Analysis

20.1.12.9. Profitability

20.1.12.10. Revenue Share

20.1.13. Knorr-Bremse AG

20.1.13.1. Company Overview

20.1.13.2. Company Footprints

20.1.13.3. Production Locations

20.1.13.4. Product Portfolio

20.1.13.5. Competitors & Customers

20.1.13.6. Subsidiaries & Parent Organization

20.1.13.7. Recent Developments

20.1.13.8. Financial Analysis

20.1.13.9. Profitability

20.1.13.10. Revenue Share

List of Tables

Table 1: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Table 2: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Table 3: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Table 4: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 5: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Table 6: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 7: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Region, 2017‒2031

Table 8: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Table 10: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Table 11: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Table 12: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 13: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Table 14: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 15: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country, 2017‒2031

Table 16: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Table 18: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Table 19: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Table 20: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 21: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Table 22: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 23: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country & Sub-region, 2017‒2031

Table 24: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 25: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Table 26: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Table 27: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Table 28: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 29: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Table 30: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 31: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country & Sub-region, 2017‒2031

Table 32: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 33: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Table 34: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Table 35: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Table 36: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 37: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Table 38: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 39: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country & Sub-region, 2017‒2031

Table 40: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 41: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Table 42: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Table 43: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Table 44: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 45: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Table 46: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 47: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country & Sub-region, 2017‒2031

Table 48: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 1: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Figure 2: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Figure 3: Global Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Train Type, Value (US$ Bn), 2021‒2031

Figure 4: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 5: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 6: Global Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 7: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 8: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 9: Global Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 10: Global Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Region, 2017‒2031

Figure 11: Global Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 12: Global Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Region, Value (US$ Bn), 2021‒2031

Figure 13: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Figure 14: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Figure 15: North America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Train Type, Value (US$ Bn), 2021‒2031

Figure 16: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 17: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 18: North America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 19: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 20: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 21: North America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 22: North America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 23: North America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 24: North America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031

Figure 25: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Figure 26: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Figure 27: Europe Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Train Type, Value (US$ Bn), 2021‒2031

Figure 28: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 29: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 30: Europe Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 31: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 32: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 33: Europe Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 34: Europe Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 35: Europe Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 36: Europe Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 37: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Figure 38: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Figure 39: Asia Pacific Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Train Type, Value (US$ Bn), 2021‒2031

Figure 40: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 41: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 42: Asia Pacific Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 43: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 44: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 45: Asia Pacific Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 46: Asia Pacific Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 47: Asia Pacific Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 48: Asia Pacific Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 49: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Figure 50: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Figure 51: Middle East & Africa Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Train Type, Value (US$ Bn), 2021‒2031

Figure 52: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 53: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 54: Middle East & Africa Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 55: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 56: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 57: Middle East & Africa Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 58: Middle East & Africa Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 59: Middle East & Africa Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 60: Middle East & Africa Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Country, Value (US$ Bn), 2021‒2031

Figure 61: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Train Type, 2017‒2031

Figure 62: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Train Type, 2017‒2031

Figure 63: South America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Train Type, Value (US$ Bn), 2021‒2031

Figure 64: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 65: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 66: South America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 67: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 68: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 69: South America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Component, Value (US$ Bn), 2021‒2031

Figure 70: South America Driver Assistance Systems for Locomotives Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 71: South America Driver Assistance Systems for Locomotives Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 72: South America Driver Assistance Systems for Locomotives Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031