Reports

Reports

As managing the flow of documents remains an immense, complex, and critical task for many sectors, especially financial services, governments, and long-distance marketing and publishing, a lot of focus has been placed on turning paper into zeros and ones. In an attempt to fuel the concept of digital business, several organizations are moving towards highly collaborative, secure, and integrated cloud-enabled systems. In today’s technology-powered landscape, where industries are in the midst of a major shift from dealing with physical documentation to digital, legacy solutions are at their peril, and advanced document capture software has been garnering increased traction as a viable solution.

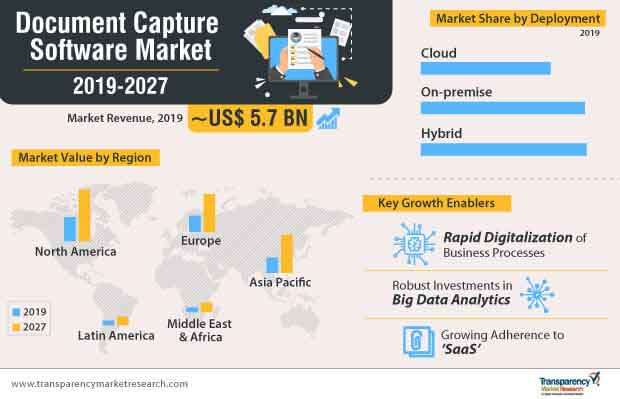

In recent years, both, large and small organizations are beginning to rapidly invest in big data analytics, and in the new generation of cloud and hybrid-based platforms, and the result is likely to lead to the increased demand for document capture software. In the latest study, seasoned analysts at Transparency Market Research predict that, the document capture software market will reach a value of ~US$ 5.7 billion in 2019, registering an impressive CAGR of ~ 10% through to 2027.

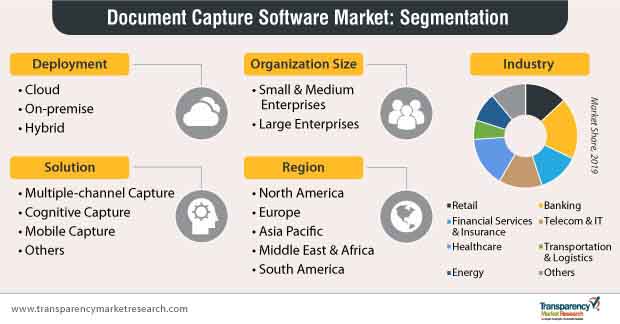

With greater availability of cloud-based utilities and 'Platform as a Service' tools to fuel the next wave of innovation in the 'paperless' journey, making the pivot has been a relatively easy undertaking for enterprises. Shrinking workforce and a wide range of issues associated with managing paper records have compelled organizations to leverage cloud-based services, thereby potentially raising the demand for Software-as-a-Service-based services that facilitate easy accessibility and pay-per-use. While cloud computing had a profound impact on document capture software solutions, stakeholders are likely to center their focus on 'mobile-friendly' developments, as today’s professionals are constantly in motion, and require continuous access to important files and documents.

As global businesses show no signs of returning to time-consuming manual paper processing, market vendors are moving away from 'one size fits all' model to offering personalized products and services that are affordable even for small businesses. Although small- and mid-sized enterprises (SMEs) lagged far behind large enterprises in terms of financing and exploiting new technologies, several governments are taking initiatives to upgrade their management skills and the capacity to gather technology, in order to transform the existing scenario. As SMEs account for ~95% of the total enterprises across the globe, market players are focusing on improving their subscription models that allow SMEs to adopt document management solutions without investing in any infrastructure.

Document capture software has been becoming an essential tool across a number of industries to streamline their operations, freeing up resources to focus on their core business initiatives. According to TMR’s analysts, the document capture software markets in North America and Europe will continue to show positive growth, in the view of greater awareness and accessibility of technological developments, along with the growing adoption in healthcare and BFSI sectors to meet routine document imaging needs.

High growth opportunities are expected in developing countries in Asia Pacific, on account of a notable spike in the number of SMEs in the region, which gives a boost to subscription-based models of document capture software.

Analysts’ Viewpoint

Although report authors maintain an optimistic outlook of the market, risks associated with data sharing and security, along with lack of professional expertise, are likely to create obstacles in the steady growth of the market. To that end, the success of market players will hinge on their ability to provide user-friendly solutions with enhanced security and scalability. Enabling 'multi-format' and 'multi-channel' models without damaging the original files will unlock yet another opportunity to retain and gain new segments of customers.

Document Capture Software Market in Brief

Document Capture Software Market: Definition

Asia Pacific Document Capture Software Market– Snapshot

Key Growth Drivers of the Document Capture Software Market

Key Challenges Faced by Document Capture Software Market Players

Document Capture Software Market– Competitive Landscape

Document Capture SoftwareMarket - Company Profile Snapshot

Other major players operating in the global document capture software market and profiled in the report include

Companies are shifting toward AI and machine learning, and upgrading their skills to gain a competitive advantage in the document capture software market, apart from maintaining their position in the market.

The document capture software market is expected to reach US$ 12.6 Bn by 2027

The document capture software market registering an impressive CAGR of 10% through to 2027.

Key players operating in the document capture software market are Adobe Systems Incorporated, Canon, Inc., DocStar, Hyland Software, Inc., ABBYY, Artsyl Technologies, Inc., Eastman Kodak Company, KnowedgeLake Inc., Oracle Corporation, Kofax Inc., Xerox Corporation, IBM Corporation, Newgen Software Technologies Ltd., Nuance Communications, Inc., Meniko

Asia Pacific is one of the fastest growing regions in the document capture software market.

Growing Penetration of Cloud Based Services and Digitalization of Business Processes are the major factors that drives the Document Capture Software Market.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Document Capture Software Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn)

4.2.3. Key Regional Socio-Political-Technological Developments and Their Impact Considerations

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Ecosystem Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Regulations and Policies

4.6. Case Study: Integration of AI/ Machine Learning and Big Data Analytics in Document Capture Software

4.7. Adoption Analysis (%) of Document Capture Software Solutions, by Source Recognition

4.7.1. Handwritten

4.7.2. Printed

4.8. Global Document Capture Software Market and Forecast, 2013 - 2027

4.8.1. Market Revenue Analysis (US$ Mn)

4.8.1.1. Historic Growth Trends, 2013-2018

4.8.1.2. Forecast Trends, 2019-2027

4.9. Market Opportunity Analysis

4.9.1. By Deployment

4.9.2. By Solution

4.9.3. By Enterprise Size

4.9.4. By Industry

4.9.5. By Region

4.10. Market Outlook

4.11. Competitive Scenario and Trends

4.11.1. Document Capture Software Market Concentration Rate

4.11.1.1. List of New Entrants

4.11.2. Mergers & Acquisitions, Expansions

5. Global Document Capture Software Market and Forecast, By Deployment

5.1. Overview& Definitions

5.2. Document Capture Software Market Size (US$ Mn) Forecast, By Deployment, 2017 - 2027

5.2.1. Cloud

5.2.2. On-premise

5.2.3. Hybrid

6. Global Document Capture Software Market and Forecast, By Solution

6.1. Overview& Definitions

6.2. Document Capture Software Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

6.2.1. Multiple-Channel Capture

6.2.2. Cognitive Capture

6.2.3. Mobile Capture

6.2.4. Others

7. Global Document Capture Software Market and Forecast, By Enterprise Size

7.1. Overview & Definitions

7.2. Document Capture Software Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

7.2.1. Small and Medium Enterprises

7.2.2. Large Enterprises

8. Global Document Capture Software Market and Forecast, By Industry

8.1. Overview

8.2. Document Capture Software Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

8.2.1. Retail

8.2.2. Banking

8.2.3. Financial Services & Insurance

8.2.4. Telecom & IT

8.2.5. Healthcare

8.2.6. Transportation & Logistics

8.2.7. Energy

8.2.8. Others (Education, Manufacturing)

9. Global Document Capture Software Market and Forecast, by Region

9.1. Overview

9.2. Document Capture Software Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Document Capture Software Market and Forecast

10.1. Key Findings

10.2. Document Capture Software Market Size (US$ Mn) Forecast, By Deployment, 2017 - 2027

10.2.1. Cloud

10.2.2. On-premise

10.2.3. Hybrid

10.3. Document Capture Software Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

10.3.1. Multiple-Channel Capture

10.3.2. Cognitive Capture

10.3.3. Mobile Capture

10.3.4. Others

10.4. Document Capture Software Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

10.4.1. Small and Medium Enterprises

10.4.2. Large Enterprises

10.5. Document Capture Software Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

10.5.1. Retail

10.5.2. Banking

10.5.3. Financial Services & Insurance

10.5.4. Telecom & IT

10.5.5. Healthcare

10.5.6. Transportation & Logistics

10.5.7. Energy

10.5.8. Others (Education, Manufacturing)

10.6. Document Capture Software Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

11. Europe Document Capture Software Market and Forecast

11.1. Key Findings

11.2. Document Capture Software Market Size (US$ Mn) Forecast, By Deployment, 2017 - 2027

11.2.1. Cloud

11.2.2. On-premise

11.2.3. Hybrid

11.3. Document Capture Software Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

11.3.1. Multiple-Channel Capture

11.3.2. Cognitive Capture

11.3.3. Mobile Capture

11.3.4. Others

11.4. Document Capture Software Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

11.4.1. Small and Medium Enterprises

11.4.2. Large Enterprises

11.5. Document Capture Software Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

11.5.1. Retail

11.5.2. Banking

11.5.3. Financial Services & Insurance

11.5.4. Telecom & IT

11.5.5. Healthcare

11.5.6. Transportation & Logistics

11.5.7. Energy

11.5.8. Others (Education, Manufacturing)

11.6. Document Capture Software Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

11.6.1. Germany

11.6.2. France

11.6.3. UK

11.6.4. Rest of Europe

12. Asia Pacific Document Capture Software Market and Forecast

12.1. Key Findings

12.2. Document Capture Software Market Size (US$ Mn) Forecast, By Deployment, 2017 - 2027

12.2.1. Cloud

12.2.2. On-premise

12.2.3. Hybrid

12.3. Document Capture Software Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

12.3.1. Multiple-Channel Capture

12.3.2. Cognitive Capture

12.3.3. Mobile Capture

12.3.4. Others

12.4. Document Capture Software Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

12.4.1. Small and Medium Enterprises

12.4.2. Large Enterprises

12.5. Document Capture Software Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

12.5.1. Retail

12.5.2. Banking

12.5.3. Financial Services & Insurance

12.5.4. Telecom & IT

12.5.5. Healthcare

12.5.6. Transportation & Logistics

12.5.7. Energy

12.5.8. Others (Education, Manufacturing)

12.6. Document Capture Software Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Rest of Asia Pacific

13. Middle East & Africa (MEA) Document Capture Software Market and Forecast

13.1. Key Findings

13.2. Document Capture Software Market Size (US$ Mn) Forecast, By Deployment, 2017 - 2027

13.2.1. Cloud

13.2.2. On-premise

13.2.3. Hybrid

13.3. Document Capture Software Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

13.3.1. Multiple-Channel Capture

13.3.2. Cognitive Capture

13.3.3. Mobile Capture

13.3.4. Others

13.4. Document Capture Software Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

13.4.1. Small and Medium Enterprises

13.4.2. Large Enterprises

13.5. Document Capture Software Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

13.5.1. Retail

13.5.2. Banking

13.5.3. Financial Services & Insurance

13.5.4. Telecom & IT

13.5.5. Healthcare

13.5.6. Transportation & Logistics

13.5.7. Energy

13.5.8. Others (Education, Manufacturing)

13.6. Document Capture Software Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of MEA

14. South America Document Capture Software Market and Forecast

14.1. Key Findings

14.2. Document Capture Software Market Size (US$ Mn) Forecast, By Deployment, 2017 - 2027

14.2.1. Cloud

14.2.2. On-premise

14.2.3. Hybrid

14.3. Document Capture Software Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

14.3.1. Multiple-Channel Capture

14.3.2. Cognitive Capture

14.3.3. Mobile Capture

14.3.4. Others

14.4. Document Capture Software Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

14.4.1. Small and Medium Enterprises

14.4.2. Large Enterprises

14.5. Document Capture Software Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

14.5.1. Retail

14.5.2. Banking

14.5.3. Financial Services & Insurance

14.5.4. Telecom & IT

14.5.5. Healthcare

14.5.6. Transportation & Logistics

14.5.7. Energy

14.5.8. Others (Education, Manufacturing)

14.6. Document Capture Software Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

14.6.1. Brazil

14.6.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), By Company (2018)

16. Company Profiles(Details – Business Overview, Sales Area/Geographical Presence, Revenue and Strategy)

16.1. ABBYY Software

16.1.1. Business Overview

16.1.2. Sales Area/Geographical Presence

16.1.3. Revenue and Strategy

16.2. Adobe Systems Software Ltd.

16.2.1. Business Overview

16.2.2. Sales Area/Geographical Presence

16.2.3. Revenue and Strategy

16.3. Artsyl Technologies, Inc

16.3.1. Business Overview

16.3.2. Sales Area/Geographical Presence

16.3.3. Revenue and Strategy

16.4. Canon, Inc.

16.4.1. Business Overview

16.4.2. Sales Area/Geographical Presence

16.4.3. Revenue and Strategy

16.5. Capsys Technologies, LLC

16.5.1. Business Overview

16.5.2. Sales Area/Geographical Presence

16.5.3. Revenue and Strategy

16.6. DocuLexInc

16.6.1. Business Overview

16.6.2. Sales Area/Geographical Presence

16.6.3. Revenue and Strategy

16.7. EMC Corp.

16.7.1. Business Overview

16.7.2. Sales Area/Geographical Presence

16.7.3. Revenue and Strategy

16.8. Ephesoft Inc.

16.8.1. Business Overview

16.8.2. Sales Area/Geographical Presence

16.8.3. Revenue and Strategy

16.9. Hyland Software Inc.

16.9.1. Business Overview

16.9.2. Sales Area/Geographical Presence

16.9.3. Revenue and Strategy

16.10. IBM Corporation

16.10.1. Business Overview

16.10.2. Sales Area/Geographical Presence

16.10.3. Revenue and Strategy

16.11. Knowledge Lake Inc.

16.11.1. Business Overview

16.11.2. Sales Area/Geographical Presence

16.11.3. Revenue and Strategy

16.12. Kodak Company

16.12.1. Business Overview

16.12.2. Sales Area/Geographical Presence

16.12.3. Revenue and Strategy

16.13. Kofax, Inc.

16.13.1. Business Overview

16.13.2. Sales Area/Geographical Presence

16.13.3. Revenue and Strategy

16.14. Meniko

16.14.1. Business Overview

16.14.2. Sales Area/Geographical Presence

16.14.3. Revenue and Strategy

16.15. Notable Solutions Inc.

16.15.1. Business Overview

16.15.2. Sales Area/Geographical Presence

16.15.3. Revenue and Strategy

16.16. Nuance Communications, Inc.

16.16.1. Business Overview

16.16.2. Sales Area/Geographical Presence

16.16.3. Revenue and Strategy

16.17. Oracle Corp.

16.17.1. Business Overview

16.17.2. Sales Area/Geographical Presence

16.17.3. Revenue and Strategy

16.18. Xerox Corporation

16.18.1. Business Overview

16.18.2. Sales Area/Geographical Presence

16.18.3. Revenue and Strategy

17. Key Takeaways

List of Tables

Table: 01 List of Acquisitions by Major Players - Adobe Systems Software Ltd.

Table: 02 List of Acquisitions by Major Players - Canon Inc.

Table: 03 List of Acquisitions by Major Players - EMC Corp.

Table: 04 List of Acquisitions by Major Players - IBM Corporation

Table: 05 List of Acquisitions by Major Players - Kodak

Table: 06 List of Acquisitions by Major Players - Xerox Corporation

Table: 07 Global Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Deployment, 2017 - 2027

Table: 08 Global Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Industry, 2017 - 2027

Table: 09 Global Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Solution, 2017 - 2027

Table: 10 Global Document Capture Software Market Size and Forecast, By Organization Size, 2016 – 2027 (US$ Mn)

Table: 11 Global Document Capture Software Market Size and Forecast, By Region, 2016 – 2027 (US$ Mn)

Table: 12 North America Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Deployment, 2017 - 2027

Table: 13 North America Document Capture Software Market CAGR (%), by Deployment

Table: 14 North America Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Industry, 2017 - 2027

Table: 15 North America Document Capture Software Market CAGR (%), by Industry

Table: 16 North America Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Solution, 2017 - 2027

Table: 17 North America Document Capture Software Market CAGR (%), by Solution

Table: 18 North America Document Capture Software Market Size and Forecast, By Organization Size, 2016 – 2027 (US$ Mn)

Table: 19 North America Document Capture Software Market CAGR (%), by Organization Size

Table: 20 North America Document Capture Software Market Size and Forecast, By Country, 2016 – 2027 (US$ Mn)

Table: 21 North America Document Capture Software Market CAGR (%), By Country

Table: 22 Europe Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Deployment, 2017 - 2027

Table: 23 Europe Document Capture Software Market CAGR (%), by Deployment

Table: 24 Europe Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Industry, 2017 - 2027

Table: 25 Europe Document Capture Software Market CAGR (%), by Industry

Table: 26 Europe Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Solution, 2017 - 2027

Table: 27 Europe Document Capture Software Market CAGR (%), by Solution

Table: 28 Europe Document Capture Software Market Size and Forecast, By Organization Size, 2016 – 2027 (US$ Mn)

Table: 29 Europe Document Capture Software Market CAGR (%), by Organization Size

Table: 30 Europe Document Capture Software Market Size and Forecast, By Country, 2016 – 2027 (US$ Mn)

Table: 31 Europe Document Capture Software Market CAGR (%), By Country

Table: 32 Asia Pacific Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Deployment, 2017 - 2027

Table: 33 Asia Pacific Document Capture Software Market CAGR (%), by Deployment

Table: 34 Asia Pacific Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Industry, 2016 – 2027

Table: 35 Asia Pacific Document Capture Software Market CAGR (%), by Industry

Table: 36 Asia Pacific Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Solution, 2017 - 2027

Table: 37 Asia Pacific Document Capture Software Market CAGR (%), by Solution

Table: 38 Asia Pacific Document Capture Software Market Size and Forecast, By Organization Size, 2016 – 2027 (US$ Mn)

Table: 39 Asia Pacific Document Capture Software Market CAGR (%), by Organization Size

Table: 40 Asia Pacific Document Capture Software Market Size and Forecast, By Country, 2016 – 2027 (US$ Mn)

Table: 41 Asia Pacific Document Capture Software Market CAGR (%), By Country

Table: 42 Middle East & Africa Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Deployment, 2017 - 2027

Table: 43 Middle East & Africa Document Capture Software Market CAGR (%), by Deployment

Table: 44 Middle East & Africa Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Industry, 2017 - 2027

Table: 45 Middle East & Africa Document Capture Software Market CAGR (%), by Industry

Table: 46 Middle East & Africa Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Solution, 2017 - 2027

Table: 47 Middle East & Africa Document Capture Software Market CAGR (%), by Solution

Table: 48 Middle East & Africa Document Capture Software Market Size and Forecast, By Organization Size, 2016 – 2027 (US$ Mn)

Table: 49 Middle East & Africa Document Capture Software Market CAGR (%), by Organization Size

Table: 50 MEA Document Capture Software Market Size and Forecast, By Country, 2016 – 2027 (US$ Mn)

Table: 51 Middle East & Africa Document Capture Software Market CAGR (%), By Country

Table: 52 South America Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Deployment, 2017 - 2027

Table: 53 South America Document Capture Software Market CAGR (%), by Deployment

Table: 54 South America Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Industry, 2017 - 2027

Table: 55 South America Document Capture Software Market CAGR (%), by Industry

Table: 56 South America Document Capture Software Market Revenue (US$ Mn) Forecast and CAGR (%), by Solution, 2017 - 2027

Table: 57 South America Document Capture Software Market CAGR (%), by Solution

Table: 58 South America Document Capture Software Market Size and Forecast, By Organization Size, 2016 – 2027 (US$ Mn)

Table: 59 South America Document Capture Software Market CAGR (%), by Organization Size

Table: 60 South America Document Capture Software Market Size and Forecast, By Country, 2016 – 2027 (US$ Mn)

Table: 61 South America Document Capture Software Market CAGR (%), By Country

List of Figures

Figure: 01 Global Market Value (US$ Mn)

Figure: 02 Global Market Share and CAGR (%)

Figure: 03 Historic growth trends, 2012-2017 (US$ Mn)

Figure: 04 Forecast trends, 2018-2027 (US$ Mn)

Figure: 05 Global Document Capture Software Market Value Share Analysis, by Deployment, 2019 and 2027

Figure: 06 Global Document Capture Software Market Attractiveness Analysis, By Deployment

Figure: 07 Global Document Capture Software Market Value Share Analysis, by Industry, 2019 and 2027

Figure: 08 Global Document Capture Software Market Attractiveness Analysis, By Industry

Figure: 09 Global Document Capture Software Market Value Share Analysis, by Solution, 2019 and 2027

Figure: 10 Global Document Capture Software Market Attractiveness Analysis, By Solution

Figure: 11 Global Document Capture Software Market Value Share Analysis, by Organization Size, 2019 and 2027

Figure: 12 Global Document Capture Software Market Attractiveness Analysis, By Region

Figure: 13 North America Document Capture Software Market Attractiveness Analysis, By Deployment

Figure: 14 North America Document Capture Software Market Attractiveness Analysis, By Industry

Figure: 15 North America Document Capture Software Market Attractiveness Analysis, By Solution

Figure: 16 North America Document Capture Software Market Attractiveness Analysis, By Organization Size

Figure: 17 North America Document Capture Software Market Attractiveness Analysis, By Country

Figure: 18 Europe Document Capture Software Market Attractiveness Analysis, By Deployment

Figure: 19 Europe Document Capture Software Market Attractiveness Analysis, By Industry

Figure: 20 Europe Document Capture Software Market Attractiveness Analysis, By Solution

Figure: 21 Europe Document Capture Software Market Attractiveness Analysis, By Organization Size

Figure: 22 Europe Document Capture Software Market Attractiveness Analysis, By Country

Figure: 23 Asia Pacific Document Capture Software Market Attractiveness Analysis, By Deployment

Figure: 24 Asia Pacific Document Capture Software Market Attractiveness Analysis, By Industry

Figure: 25 Asia Pacific Document Capture Software Market Attractiveness Analysis, By Solution

Figure: 26 Asia Pacific Document Capture Software Market Attractiveness Analysis, By Organization Size

Figure: 27 Asia Pacific Document Capture Software Market Attractiveness Analysis, By Country

Figure: 28 Middle East & Africa Document Capture Software Market Attractiveness Analysis, By Deployment

Figure: 29 Middle East & Africa Document Capture Software Market Attractiveness Analysis, By Industry

Figure: 30 Middle East & Africa Document Capture Software Market Attractiveness Analysis, By Solution

Figure: 31 Middle East & Africa Document Capture Software Market Attractiveness Analysis, By Organization Size

Figure: 32 MEA Document Capture Software Market Attractiveness Analysis, By Country

Figure: 33 South America Document Capture Software Market Attractiveness Analysis, By Deployment

Figure: 34 South America Document Capture Software Market Attractiveness Analysis, By Industry

Figure: 35 South America Document Capture Software Market Attractiveness Analysis, By Solution

Figure: 36 South America Document Capture Software Market Attractiveness Analysis, By Organization Size

Figure: 37 South America Document Capture Software Market Attractiveness Analysis, By Country

Figure: 38 Segment Revenue (US$ Mn) - Adobe Systems Incorporated

Figure: 39 Segment Revenue (US$ Mn) - Canon, Inc.

Figure: 40 Segment Revenue (US$ Mn) - Dell EMC

Figure: 41 Segment Revenue (US$ Mn) - Eastman Kodak Company

Figure: 42 Segment Revenue (US$ Mn) - Oracle Corporation

Figure: 43 Segment Revenue (US$ Mn) - Xerox Corporation

Figure: 44 Segment Revenue (US$ Mn) - IBM Corporation

Figure: 45 Segment Revenue (US$ Mn) - Nuance Communications, Inc.