Reports

Reports

Analysts’ Viewpoint on Market Scenario

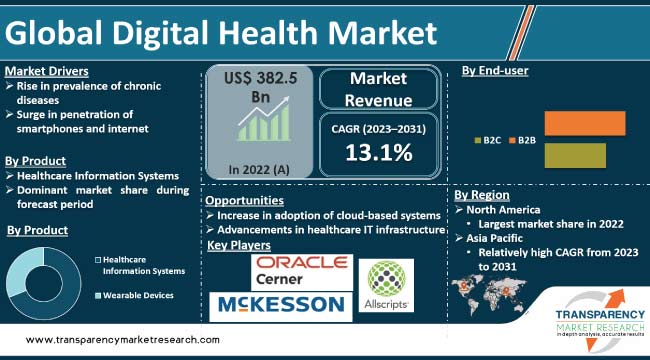

Increase in prevalence of chronic diseases and surge in penetration of smartphones and internet are expected to propel the digital health market size during the forecast period. Advancements in healthcare IT infrastructure are likely to offer lucrative opportunities to vendors in the market.

Manufacturers in the global digital health industry are introducing advanced healthcare platforms and applications to improve user experience. They are also expanding their production capabilities to increase their digital health market share. Rise in usage of digital health platforms is encouraging investors and manufacturers to develop effective wearable devices and telehealth services.

Digital health involves the use of wearable technologies, telehealth and telemedicine, mobile health (mHealth), health Information Technology (IT), and personalized medicine. Digital care solutions rely on various computing platforms, networking software, and sensors to facilitate healthcare services. Digital health technologies are employed in a wide range of applications such as general wellness and medical equipment. They are also utilized in medical diagnosis and the development of drugs and medical devices.

Digital health technologies majorly consist of healthcare information systems and wearable devices. EHR/EMR, Clinical Decision Support System (CDSS), Computerized Physician Order Entry (CPOE), and mHealth are some examples of healthcare information systems. Pain management devices, rehabilitation devices, respiratory therapy devices, and insulin pumps are some examples of wearable devices.

Emergence of the COVID-19 pandemic led to rapid growth in adoption of digital health. The pandemic highlighted the importance of digital solutions in healthcare delivery as they offered remote access to healthcare services and helped minimize the risk of virus transmission. Moreover, new ideas and procedures in digital health were put to the test during the pandemic.

Digital health infrastructure was a huge help during the period of social isolation that caused an interruption in the provision of healthcare services. The use of telemedicine made it easier to maintain service continuity, which greatly benefited both patients and healthcare professionals. In addition to reducing emergency room visits, the adoption of digital health for COVID-19 screening improved the efficiency of the healthcare system.

During lockdowns, several emerging technologies in digital health - including mHealth, telemedicine, eHealth, and digital therapeutics - became well-known and were frequently utilized for patient follow-up, clinical treatment, and diagnostics, showcasing their potential beyond just healthcare. Thus, the pandemic highlighted the need for robust digital infrastructure, data privacy and security measures, and regulatory frameworks to support the widespread implementation of digital health solutions.

Prevalence of diabetes, cardiovascular diseases, and other chronic diseases is increasing rapidly worldwide due to the aging population and unhealthy food habits. According to the American Heart Association, Cardiovascular Diseases (CVDs) account for 17.3 million deaths each year, which is more than the deaths caused due to cancer. Thus, surge in prevalence of chronic diseases is fueling the digital health market expansion.

According to Partnership to Fight Chronic Disease (PFCD), chronic diseases are the leading cause of death and disability in the U.S. Nearly 133 million people in the U.S., 45% of the population, have at least one chronic disease. Chronic diseases account for seven in 10 deaths in the U.S., with over 1.7 million deaths each year.

Additionally, CVDs are the leading cause of death globally, taking an estimated 17.9 million lives each year. Coronary heart disease is the most common type of heart disease, leading to the death of 375,476 people in 2021. In 2021, over 30% of both men and women in the U.S. reported themselves as obese. Moreover, from 2011 to 2021, the prevalence of Chronic Obstructive Pulmonary Disease (COPD) increased from 8.7% to 12.8% across the globe.

Surge in investment in healthcare IT infrastructure development is projected to spur the digital health market growth in the next few years. Digital technology is a rapidly evolving landscape that has the potential to revolutionize healthcare across the globe. Governments worldwide are investing in AI and the Internet of Medical Things (IoMT) to bridge the healthcare gap. However, high cost associated with the installation of various technologies and the risk of cyberattacks are major factors leading to the digital health market limitation.

Cloud-based digital health systems, mobile devices, and mobile apps are gaining traction among end-users. Enterprises are increasingly employing identity and access management to validate users and supervise access by various people.

Rise in penetration of smartphones and internet is boosting the digital health market progress. Patients can connect with healthcare doctors remotely via telemedicine platforms using smartphones and high-speed internet. Remote patient monitoring has significantly increased access to healthcare, particularly for people living in remote or disadvantaged locations.

According to the latest digital health market trends, the healthcare information systems product segment is expected to dominate the business during the forecast period. Growth of the segment can be ascribed to rise in need for accurate health and fitness monitoring and real-time population management. Surge in investment in healthcare IT infrastructure and upgradation of telehealth hardware and software components are also boosting the segment. Major vendors are launching new healthcare information systems to increase their market revenue in the segment.

According to the latest digital health market analysis, the services component is projected to hold largest share from 2023 to 2031. Increase in adoption of digital health products, such as population health management, revenue cycle management, and EHR/EMR, is propelling the segment

The B2B end-user segment is estimated to dominate the sector during the forecast period. B2B organizations are increasingly adopting digital health services to facilitate robust healthcare delivery. They are incorporating digital health solutions into their services to improve employee health, productivity, and overall well-being.

According to the latest digital health market forecast, North America is expected to hold largest share from 2023 to 2031, followed by Europe. Rise in investment in the R&D of digital health solutions is fueling the market dynamics of the region.

Surge in government investment in healthcare IT infrastructure and increase in launch of new digital health solutions are boosting the market statistics in Europe. Germany and the U.K. are major markets for digital health in the region.

The industry in Asia Pacific is anticipated to grow at the fastest rate during the forecast period due to rise in adoption of digital health solutions, especially in India, Australia, and New Zealand. Surge in penetration of smartphones and internet is also fueling the market trajectory in the region.

Digital health companies are adopting various growth strategies, such as new product launches, mergers & acquisitions, partnerships, and collaborations to expand their customer base. Agfa-Gevaert N.V., Cerner Corporation, Allscripts Healthcare Solutions, Inc., McKesson Corporation, Philips Healthcare, GE Healthcare, Siemens Healthineers, Epic Systems Corporation, Merative, Alphabet Inc., Qualcomm, Inc., UnitedHealth Group (Optum), and Cisco Systems, Inc. are key entities operating in this industry.

Each of these players has been profiled in the digital health market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Details |

|---|---|

|

Market Value in 2022 |

US$ 382.5 Bn |

|

Market Forecast Value in 2031 |

US$ 1.1 Trn |

|

Growth Rate (CAGR) |

13.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn/Trn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 382.5 Bn in 2022

It is projected to reach US$ 1.1 Trn by the end of 2031

It is anticipated to be 13.1% from 2023 to 2031

Rise in prevalence of chronic diseases and surge in penetration of smartphones and internet

The services component segment accounted for major share of 45.4% in 2022

North America is expected to record the highest demand from 2023 to 2031

Agfa-Gevaert N.V., Cerner Corporation, Allscripts Healthcare Solutions, Inc., McKesson Corporation, Philips Healthcare, GE Healthcare, Siemens Healthineers, Epic Systems Corporation, Merative, Alphabet Inc., Qualcomm, Inc., UnitedHealth Group (Optum), and Cisco Systems, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Digital Health Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Digital Health Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Trends

5.1.1. Increase in Adoption of Cloud-based Systems

5.1.2. Virtualization Technologies and Technological Advancements Add New Dimensions to Healthcare IT

5.2. Digital Therapeutic Business, Opportunities, and Entry Barriers for New Market Entrants

5.3. Qualitative Information on Business Models in Digital Health Market

5.4. Traditional Business Model: Challenges to Traditional Business Model

5.5. New Digital Health Business Model

5.6. Adoption of Digital Healthcare, by End-users

5.7. Impact Factor for Digital Therapeutic Demand

5.8. Global Healthcare Expenditure, by Major Countries

5.9. Digital Medicine Business Model

5.10. Factors Increasing Traction of Digital Therapeutic Products

5.10.1. Healthcare Costs

5.10.2. Value-based Payment Models

5.10.3. Venture Funding

5.10.4. Others

6. Global Digital Health Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Healthcare Information Systems

6.3.1.1. Clinical Solutions

6.3.1.1.1. EHR/EMR

6.3.1.1.2. Clinical Decision Support System (CDSS)

6.3.1.1.3. Computerized Physician Order Entry (CPOE)

6.3.1.1.4. mHealth

6.3.1.1.4.1. Connected Medical Devices

6.3.1.1.4.2. mHealth Components

6.3.1.1.4.2.1. Fitness App

6.3.1.1.4.2.2. Medical Reference

6.3.1.1.4.2.3. Fitness App

6.3.1.1.4.2.4. Wellness

6.3.1.1.4.2.5. Medical Condition Management

6.3.1.1.4.2.6. Nutrition

6.3.1.1.4.2.7. Remote Consultation

6.3.1.1.4.2.8. Reminders and Alerts

6.3.1.1.4.2.9. Others

6.3.1.1.5. Telehealth

6.3.1.1.6. Population Health Management

6.3.1.1.7. Others

6.3.1.2. Non-clinical Solutions

6.3.2. Wearable Devices

6.3.2.1. Diagnostic and Monitoring Devices

6.3.2.2. Digital Therapeutic Devices

6.3.2.2.1. Pain Management Devices

6.3.2.2.2. Rehabilitation Devices

6.3.2.2.3. Respiratory Therapy Devices

6.3.2.2.4. Insulin Pumps

6.4. Market Attractiveness Analysis, by Product

7. Global Digital Health Market Analysis and Forecast, by Component

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Component, 2017-2031

7.3.1. Software

7.3.2. Hardware

7.3.3. Services

7.4. Market Attractiveness Analysis, by Component

8. Global Digital Health Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. B2C

8.3.1.1. Patients

8.3.1.2. Caregivers

8.3.2. B2B

8.3.2.1. Providers

8.3.2.2. Payers

8.3.2.3. Employers

8.3.2.4. Pharmaceutical Companies

8.3.2.5. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Digital Health Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Digital Health Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Healthcare Information Systems

10.2.1.1. Clinical Solutions

10.2.1.1.1. EHR/EMR

10.2.1.1.2. Clinical Decision Support System (CDSS)

10.2.1.1.3. Computerized Physician Order Entry (CPOE)

10.2.1.1.4. mHealth

10.2.1.1.4.1. Connected Medical Devices

10.2.1.1.4.2. mHealth Components

10.2.1.1.4.2.1. Fitness App

10.2.1.1.4.2.2. Medical Reference

10.2.1.1.4.2.3. Fitness App

10.2.1.1.4.2.4. Wellness

10.2.1.1.4.2.5. Medical Condition Management

10.2.1.1.4.2.6. Nutrition

10.2.1.1.4.2.7. Remote Consultation

10.2.1.1.4.2.8. Reminders and Alerts

10.2.1.1.4.2.9. Others

10.2.1.1.5. Telehealth

10.2.1.1.6. Population Health Management

10.2.1.1.7. Others

10.2.1.2. Non-clinical Solutions

10.2.2. Wearable Devices

10.2.2.1. Diagnostic and Monitoring Devices

10.2.2.2. Digital Therapeutic Devices

10.2.2.2.1. Pain Management Devices

10.2.2.2.2. Rehabilitation Devices

10.2.2.2.3. Respiratory Therapy Devices

10.2.2.2.4. Insulin Pumps

10.3. Market Value Forecast, by Component, 2017-2031

10.3.1. Software

10.3.2. Hardware

10.3.3. Services

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. B2C

10.4.1.1. Patients

10.4.1.2. Caregivers

10.4.2. B2B

10.4.2.1. Providers

10.4.2.2. Payers

10.4.2.3. Employers

10.4.2.4. Pharmaceutical Companies

10.4.2.5. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Component

10.6.3. By End-user

10.6.4. By Country

11. Europe Digital Health Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Healthcare Information Systems

11.2.1.1. Clinical Solutions

11.2.1.1.1. EHR/EMR

11.2.1.1.2. Clinical Decision Support System (CDSS)

11.2.1.1.3. Computerized Physician Order Entry (CPOE)

11.2.1.1.4. mHealth

11.2.1.1.4.1. Connected Medical Devices

11.2.1.1.4.2. mHealth Components

11.2.1.1.4.2.1. Fitness App

11.2.1.1.4.2.2. Medical Reference

11.2.1.1.4.2.3. Fitness App

11.2.1.1.4.2.4. Wellness

11.2.1.1.4.2.5. Medical Condition Management

11.2.1.1.4.2.6. Nutrition

11.2.1.1.4.2.7. Remote Consultation

11.2.1.1.4.2.8. Reminders and Alerts

11.2.1.1.4.2.9. Others

11.2.1.1.5. Telehealth

11.2.1.1.6. Population Health Management

11.2.1.1.7. Others

11.2.1.2. Non-clinical Solutions

11.2.2. Wearable Devices

11.2.2.1. Diagnostic and Monitoring Devices

11.2.2.2. Digital Therapeutic Devices

11.2.2.2.1. Pain Management Devices

11.2.2.2.2. Rehabilitation Devices

11.2.2.2.3. Respiratory Therapy Devices

11.2.2.2.4. Insulin Pumps

11.3. Market Value Forecast, by Component, 2017-2031

11.3.1. Software

11.3.2. Hardware

11.3.3. Services

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. B2C

11.4.1.1. Patients

11.4.1.2. Caregivers

11.4.2. B2B

11.4.2.1. Providers

11.4.2.2. Payers

11.4.2.3. Employers

11.4.2.4. Pharmaceutical Companies

11.4.2.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Component

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Digital Health Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Healthcare Information Systems

12.2.1.1. Clinical Solutions

12.2.1.1.1. EHR/EMR

12.2.1.1.2. Clinical Decision Support System (CDSS)

12.2.1.1.3. Computerized Physician Order Entry (CPOE)

12.2.1.1.4. mHealth

12.2.1.1.4.1. Connected Medical Devices

12.2.1.1.4.2. mHealth Components

12.2.1.1.4.2.1. Fitness App

12.2.1.1.4.2.2. Medical Reference

12.2.1.1.4.2.3. Fitness App

12.2.1.1.4.2.4. Wellness

12.2.1.1.4.2.5. Medical Condition Management

12.2.1.1.4.2.6. Nutrition

12.2.1.1.4.2.7. Remote Consultation

12.2.1.1.4.2.8. Reminders and Alerts

12.2.1.1.4.2.9. Others

12.2.1.1.5. Telehealth

12.2.1.1.6. Population Health Management

12.2.1.1.7. Others

12.2.1.2. Non-clinical Solutions

12.2.2. Wearable Devices

12.2.2.1. Diagnostic and Monitoring Devices

12.2.2.2. Digital Therapeutic Devices

12.2.2.2.1. Pain Management Devices

12.2.2.2.2. Rehabilitation Devices

12.2.2.2.3. Respiratory Therapy Devices

12.2.2.2.4. Insulin Pumps

12.3. Market Value Forecast, by Component, 2017-2031

12.3.1. Software

12.3.2. Hardware

12.3.3. Services

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. B2C

12.4.1.1. Patients

12.4.1.2. Caregivers

12.4.2. B2B

12.4.2.1. Providers

12.4.2.2. Payers

12.4.2.3. Employers

12.4.2.4. Pharmaceutical Companies

12.4.2.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Component

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Digital Health Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Healthcare Information Systems

13.2.1.1. Clinical Solutions

13.2.1.1.1. EHR/EMR

13.2.1.1.2. Clinical Decision Support System (CDSS)

13.2.1.1.3. Computerized Physician Order Entry (CPOE)

13.2.1.1.4. mHealth

13.2.1.1.4.1. Connected Medical Devices

13.2.1.1.4.2. mHealth Components

13.2.1.1.4.2.1. Fitness App

13.2.1.1.4.2.2. Medical Reference

13.2.1.1.4.2.3. Fitness App

13.2.1.1.4.2.4. Wellness

13.2.1.1.4.2.5. Medical Condition Management

13.2.1.1.4.2.6. Nutrition

13.2.1.1.4.2.7. Remote Consultation

13.2.1.1.4.2.8. Reminders and Alerts

13.2.1.1.4.2.9. Others

13.2.1.1.5. Telehealth

13.2.1.1.6. Population Health Management

13.2.1.1.7. Others

13.2.1.2. Non-clinical Solutions

13.2.2. Wearable Devices

13.2.2.1. Diagnostic and Monitoring Devices

13.2.2.2. Digital Therapeutic Devices

13.2.2.2.1. Pain Management Devices

13.2.2.2.2. Rehabilitation Devices

13.2.2.2.3. Respiratory Therapy Devices

13.2.2.2.4. Insulin Pumps

13.3. Market Value Forecast, by Component, 2017-2031

13.3.1. Software

13.3.2. Hardware

13.3.3. Services

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. B2C

13.4.1.1. Patients

13.4.1.2. Caregivers

13.4.2. B2B

13.4.2.1. Providers

13.4.2.2. Payers

13.4.2.3. Employers

13.4.2.4. Pharmaceutical Companies

13.4.2.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Component

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Digital Health Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017-2031

14.2.1. Healthcare Information Systems

14.2.1.1. Clinical Solutions

14.2.1.1.1. EHR/EMR

14.2.1.1.2. Clinical Decision Support System (CDSS)

14.2.1.1.3. Computerized Physician Order Entry (CPOE)

14.2.1.1.4. mHealth

14.2.1.1.4.1. Connected Medical Devices

14.2.1.1.4.2. mHealth Components

14.2.1.1.4.2.1. Fitness App

14.2.1.1.4.2.2. Medical Reference

14.2.1.1.4.2.3. Fitness App

14.2.1.1.4.2.4. Wellness

14.2.1.1.4.2.5. Medical Condition Management

14.2.1.1.4.2.6. Nutrition

14.2.1.1.4.2.7. Remote Consultation

14.2.1.1.4.2.8. Reminders and Alerts

14.2.1.1.4.2.9. Others

14.2.1.1.5. Telehealth

14.2.1.1.6. Population Health Management

14.2.1.1.7. Others

14.2.1.2. Non-clinical Solutions

14.2.2. Wearable Devices

14.2.2.1. Diagnostic and Monitoring Devices

14.2.2.2. Digital Therapeutic Devices

14.2.2.2.1. Pain Management Devices

14.2.2.2.2. Rehabilitation Devices

14.2.2.2.3. Respiratory Therapy Devices

14.2.2.2.4. Insulin Pumps

14.3. Market Value Forecast, by Component, 2017-2031

14.3.1. Software

14.3.2. Hardware

14.3.3. Services

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. B2C

14.4.1.1. Patients

14.4.1.2. Caregivers

14.4.2. B2B

14.4.2.1. Providers

14.4.2.2. Payers

14.4.2.3. Employers

14.4.2.4. Pharmaceutical Companies

14.4.2.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Component

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Agfa-Gevaert N.V.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Cerner Corporation

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Allscripts Healthcare Solutions, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. McKesson Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Philips Healthcare

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. GE Healthcare

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Siemens Healthineers

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Epic Systems Corporation.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Merative

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Alphabet Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Qualcomm, Inc.

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. UnitedHealth Group (Optum)

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. Cisco Systems, Inc.

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

List of Tables

Table 01: Global Digital Health Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 02: Global Digital Health Market Value (US$ Bn) Forecast, by Healthcare Information Systems, 2017-2031

Table 03: Global Digital Health Market Value (US$ Bn) Forecast, by Clinical Solutions, 2017-2031

Table 04: Global Digital Health Market Value (US$ Bn) Forecast, by mHealth, 2017-2031

Table 05: Global Digital Health Market Value (US$ Bn) Forecast, by mHealth Applications, 2017-2031

Table 06: Global Digital Health Market Value (US$ Bn) Forecast, by Wearable Devices, 2017-2031

Table 07: Global Digital Health Market Value (US$ Bn) Forecast, by Digital Therapeutic Devices, 2017-2031

Table 08: Global Digital Health Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 09: Global Digital Health Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 10: Global Digital Health Market Value (US$ Bn) Forecast, by B2B, 2017-2031

Table 11: Global Digital Health Market Value (US$ Bn) Forecast, by B2C, 2017-2031

Table 12: Global Digital Health Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Digital Health Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 14: North America Digital Health Market Value (US$ Bn) Forecast, by Healthcare Information Systems, 2017-2031

Table 15: North America Digital Health Market Value (US$ Bn) Forecast, by Clinical Solutions, 2017-2031

Table 16: North America Digital Health Market Value (US$ Bn) Forecast, by mHealth, 2017-2031

Table 17: North America Digital Health Market Value (US$ Bn) Forecast, by mHealth Applications, 2017-2031

Table 18: North America Digital Health Market Value (US$ Bn) Forecast, by Wearable Devices, 2017-2031

Table 19: North America Digital Health Market Value (US$ Bn) Forecast, by Digital Therapeutic Devices, 2017-2031

Table 20: North America Digital Health Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 21: North America Digital Health Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 22: North America Digital Health Market Value (US$ Bn) Forecast, by B2B, 2017-2031

Table 23: North America Digital Health Market Value (US$ Bn) Forecast, by B2C, 2017-2031

Table 24: North America Digital Health Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 25: Europe Digital Health Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 26: Europe Digital Health Market Value (US$ Bn) Forecast, by Healthcare Information Systems, 2017-2031

Table 27: Europe Digital Health Market Value (US$ Bn) Forecast, by Clinical Solutions, 2017-2031

Table 28: Europe Digital Health Market Value (US$ Bn) Forecast, by mHealth, 2017-2031

Table 29: Europe Digital Health Market Value (US$ Bn) Forecast, by mHealth Applications, 2017-2031

Table 30: Europe Digital Health Market Value (US$ Bn) Forecast, by Wearable Devices, 2017-2031

Table 31: Europe Digital Health Market Value (US$ Bn) Forecast, by Digital Therapeutic Devices, 2017-2031

Table 32: Europe Digital Health Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 33: Europe Digital Health Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 34: Europe Digital Health Market Value (US$ Bn) Forecast, by B2B, 2017-2031

Table 35: Europe Digital Health Market Value (US$ Bn) Forecast, by B2C, 2017-2031

Table 36: Europe Digital Health Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 37: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 38: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Healthcare Information Systems, 2017-2031

Table 39: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Clinical Solutions, 2017-2031

Table 40: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by mHealth, 2017-2031

Table 41: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by mHealth Applications, 2017-2031

Table 42: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Wearable Devices, 2017-2031

Table 43: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Digital Therapeutic Devices, 2017-2031

Table 44: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 45: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 46: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by B2B, 2017-2031

Table 47: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by B2C, 2017-2031

Table 48: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 49: Latin America Digital Health Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 50: Latin America Digital Health Market Value (US$ Bn) Forecast, by Healthcare Information Systems, 2017-2031

Table 51: Latin America Digital Health Market Value (US$ Bn) Forecast, by Clinical Solutions, 2017-2031

Table 52: Latin America Digital Health Market Value (US$ Bn) Forecast, by mHealth, 2017-2031

Table 53: Latin America Digital Health Market Value (US$ Bn) Forecast, by mHealth Applications, 2017-2031

Table 54: Latin America Digital Health Market Value (US$ Bn) Forecast, by Wearable Devices, 2017-2031

Table 55: Latin America Digital Health Market Value (US$ Bn) Forecast, by Digital Therapeutic Devices, 2017-2031

Table 56: Latin America Digital Health Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 57: Latin America Digital Health Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 58: Latin America Digital Health Market Value (US$ Bn) Forecast, by B2B, 2017-2031

Table 59: Latin America Digital Health Market Value (US$ Bn) Forecast, by B2C, 2017-2031

Table 60: Latin America Digital Health Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 61: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 62: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Healthcare Information Systems, 2017-2031

Table 63: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Clinical Solutions, 2017-2031

Table 64: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by mHealth, 2017-2031

Table 65: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by mHealth Applications, 2017-2031

Table 66: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Wearable Devices, 2017-2031

Table 67: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Digital Therapeutic Devices, 2017-2031

Table 68: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 69: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 70: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by B2B, 2017-2031

Table 71: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by B2C, 2017-2031

Table 72: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, by Region, 2017-2031

List of Figures

Figure 01: Global Digital Health Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Digital Health Market Value Share Analysis, by Product, 2023 and 2031

Figure 03: Global Digital Health Market Attractiveness Analysis, by Product, 2023-2031

Figure 04: Global Digital Health Market Revenue (US$ Bn), by Healthcare Information Systems, 2017-2031

Figure 05: Global Digital Health Market Revenue (US$ Bn), by Wearable Devices, 2017-2031

Figure 06: Global Digital Health Market Value Share Analysis, by Component, 2022 and 2031

Figure 07: Global Digital Health Market Attractiveness Analysis, by Component, 2023-2031

Figure 08: Global Digital Health Market Revenue (US$ Bn), by Software, 2017-2031

Figure 09: Global Digital Health Market Revenue (US$ Bn), by Hardware, 2017-2031

Figure 10: Global Digital Health Market Revenue (US$ Bn), by Services, 2017-2031

Figure 11: Global Digital Health Market Attractiveness Analysis, by End-user, 2023-2031

Figure 12: Global Digital Health Market Revenue (US$ Bn), by B2C, 2017-2031

Figure 13: Global Digital Health Market Revenue (US$ Bn), by B2B, 2017-2031

Figure 14: Global Digital Health Market Value Share Analysis, by Region, 2022 and 2031

Figure 15: Global Digital Health Market Attractiveness Analysis, by Region, 2023-2031

Figure 16: North America Digital Health Market Value (US$ Bn) Forecast, 2017-2031

Figure 17: North America Digital Health Market Value Share Analysis, by Product, 2022 and 2031

Figure 18: North America Digital Health Market Attractiveness Analysis, by Product, 2023-2031

Figure 19: North America Digital Health Market Value Share Analysis, by Component, 2022 and 2031

Figure 20: North America Digital Health Market Attractiveness Analysis, by Component, 2023-2031

Figure 21: North America Digital Health Market Value Share Analysis, by End-user, 2022 and 2031

Figure 22: North America Digital Health Market Attractiveness Analysis, by End-user, 2023-2031

Figure 23: North America Digital Health Market Value Share Analysis, by Country, 2022 and 2031

Figure 24: North America Digital Health Market Attractiveness Analysis, by Country, 2023-2031

Figure 25: North America Digital Health Market Value (US$ Bn) Forecast, 2017-2031

Figure 26: Europe Digital Health Market Value Share Analysis, by Product, 2022 and 2031

Figure 27: Europe Digital Health Market Attractiveness Analysis, by Product, 2023-2031

Figure 28: Europe Digital Health Market Value Share Analysis, by Component, 2022 and 2031

Figure 29: Europe Digital Health Market Attractiveness Analysis, by Component, 2023-2031

Figure 30: Europe Digital Health Market Value Share Analysis, by End-user, 2022 and 2031

Figure 31: Europe Digital Health Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Europe Digital Health Market Value Share Analysis, by Country, 2022 and 2031

Figure 33: Europe Digital Health Market Attractiveness Analysis, by Country, 2023-2031

Figure 34: Europe Digital Health Market Value (US$ Bn) Forecast, 2017-2031

Figure 35: Asia Pacific Digital Health Market Value Share Analysis, by Product, 2022 and 2031

Figure 36: Asia Pacific Digital Health Market Attractiveness Analysis, by Product, 2023-2031

Figure 37: Asia Pacific Digital Health Market Value Share Analysis, by Component, 2022 and 2031

Figure 38: Asia Pacific Digital Health Market Attractiveness Analysis, by Component, 2023-2031

Figure 39: Asia Pacific Digital Health Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Asia Pacific Digital Health Market Attractiveness Analysis, by End-user, 2023-2031

Figure 41: Asia Pacific Digital Health Market Value Share Analysis, by Country, 2022 and 2031

Figure 42: Asia Pacific Digital Health Market Attractiveness Analysis, by Country, 2023-2031

Figure 43: Asia Pacific Digital Health Market Value (US$ Bn) Forecast, 2017-2031

Figure 44: Latin America Digital Health Market Value Share Analysis, by Product, 2023 and 2031

Figure 45: Latin America Digital Health Market Attractiveness Analysis, by Product, 2023-2031

Figure 46: Latin America Digital Health Market Value Share Analysis, by Component, 2022 and 2031

Figure 47: Latin America Digital Health Market Attractiveness Analysis, by Component, 2023-2031

Figure 48: Latin America Digital Health Market Value Share Analysis, by End-user, 2022 and 2031

Figure 49: Latin America Digital Health Market Attractiveness Analysis, by End-user, 2023-2031

Figure 50: Latin America Digital Health Market Value Share Analysis, by Country, 2022 and 2031

Figure 51: Latin America Digital Health Market Attractiveness Analysis, by Country, 2023-2031

Figure 52: Latin America Digital Health Market Value (US$ Bn) Forecast, 2017-2031

Figure 53: Middle East & Africa Digital Health Market Value Share Analysis, by Product, 2022 and 2031

Figure 54: Middle East & Africa Digital Health Market Attractiveness Analysis, by Product, 2023-2031

Figure 55: Middle East & Africa Digital Health Market Value Share Analysis, by Component, 2022 and 2031

Figure 56: Middle East & Africa Digital Health Market Attractiveness Analysis, by Component, 2023-2031

Figure 57: Middle East & Africa Digital Health Market Value Share Analysis, by End-user, 2022 and 2031

Figure 58: Middle East & Africa Digital Health Market Attractiveness Analysis, by End-user, 2023-2031

Figure 59: Middle East & Africa Digital Health Market Value Share Analysis, by Country, 2022 and 2031

Figure 60: Middle East & Africa Digital Health Market Attractiveness Analysis, by Country, 2023-2031

Figure 61: Middle East & Africa Digital Health Market Value (US$ Bn) Forecast, 2017-2031