Reports

Reports

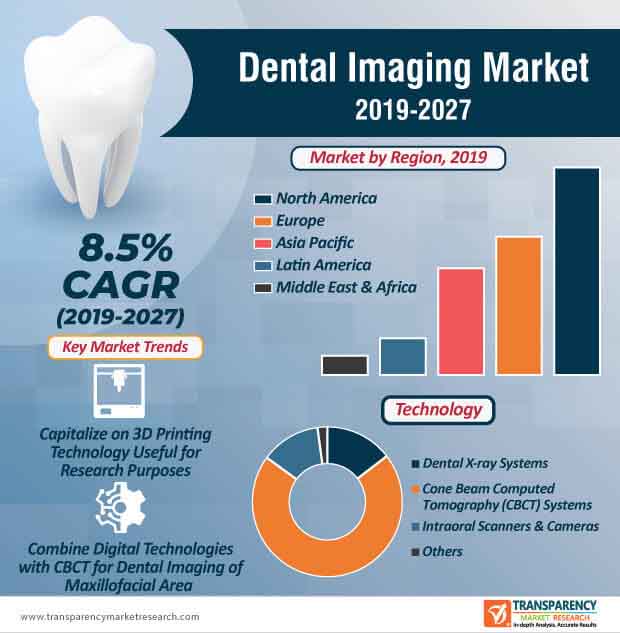

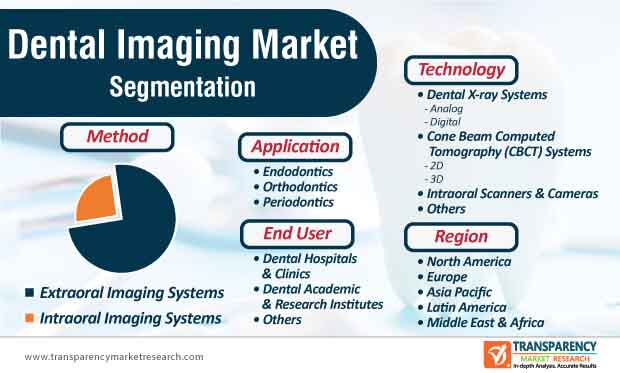

Non-interruptive cameras are being highly publicized for their various advantages, including high-quality still photos and videos, in the dental imaging market. This is evident since intraoral scanners & cameras technology segment account for the a significant share of the dental imaging market. As such, the market is estimated to reach a value of ~US$ 6 Bn by the end of 2027. Hence, manufacturers are increasing their production capacities to develop non-interruptive cameras that are easy to use and can be loupe-mounted. For instance, Futudent-a provider of superior dental camera technology, introduced the Futudent non-interruptive camera, which is time and cost-efficient.

Non-interruptive cameras help to save and share data whilst catering to the convenience of dentists and individuals. Hence, manufacturers are increasing their production capabilities to make these novel cameras readily available in dental hospitals. As such, dental hospitals & clinics end user segment is anticipated for exponential growth in the market for dental imaging.

Cone Beam Computed Tomography (CBCT) systems are considered as the gold standard for dental imaging of oral and maxillofacial area of individuals. Hence, companies in the dental imaging market are increasing their efficacy in digital technologies to optimize CBCT imaging. As such, the CBCT technology segment is leading the market for dental imaging and the global market is estimated to grow at a favorable CAGR of 8.5% during the forecast period.

Companies in the dental imaging market are increasing R&D in dental radiology, since it plays a pivotal role in diagnostic assessment of dental patients and prognostic evaluation of dental diseases. However, intraoral and conventional radiographic procedures pose limitations in 2D projections, thus leading to issues of misrepresentation and superimposition. Hence, companies are increasing the availability of CBCT to overcome the limitations of conventional computed tomography (CT). Advantages of CBCT are instrumental for the generation of 3D data at lower radiation dose and cost.

Increased research spending by companies in the dental imaging market have led to innovations in X-ray radiography. As such, the technique of 3D radiographic imaging is being combined with CBCT for diagnosis of various dental diseases. X-ray imaging is gaining popularity as a non-invasive technique for the assessment of hard tissues before surgery. Moreover, dental X-ray systems dictate the second-highest revenue among all technologies in the market for dental imaging. Hence, manufacturers are increasing their efficacy in sensors that are capable of capturing high-quality images.

With the influx of latest technologies, X-ray systems are being gradually digitalized, while companies in the market for dental imaging are tapping value-grab opportunities in indirect and direct digital radiography. However, periapical films can only provide 2D images which lead to issues of image distortion. Hence, companies in the dental imaging market should collaborate with researchers to overcome the shortcomings of image compression using tomosynthesis in imaging.

The image-guided implant dentistry is gaining attention of stakeholders in the dental imaging market. For instance, Image Navigation- a specialist in dental teaching and clinical technologies, announced the launch of their advanced image-guided implant dentistry system at the International Dental Show 2019 in Germany. The introduction of new image-guided implant systems is being used with CBCT scanners to conduct intra-surgical navigation. Lightning-fast speed of these novel systems is proving beneficial for dentists in the field of endodontics. As such, endodontic and orthodontic application segments are estimated for exponential growth in the dental imaging market.

Sub-millimeter accuracy and a robotic auto-stop attributes of image-guided implant systems are being highly publicized in the market for dental imaging. These novel systems are generating revenue streams for companies, owing to its safety and automatic features. Dentists can ensure maximum safety during implant procedures, since advanced image-guided implant systems stop automatically and instantly turn off the drill outside the of the planned surgical area. Thus, integration of freehand surgery and unfettered vision of the surgical site aid in effective intra-surgical clinical judgment.

Analysts’ Viewpoint

Innovative digital imaging solutions are creating incremental opportunities for companies in the dental imaging market. Advanced computer-aided design (CAD) and computer-aided manufacturing (CAM) systems are being increasingly used to create crowns and fixed partial dentures.

CBCT has introduced breakthrough innovations in the imaging of the maxillofacial region, owing to its advantages from diagnosis to treatment planning. However, lack of proper education and awareness among dentists has led to unnecessary referrals for CBCT imaging. Hence, companies should target their marketing and advertising efforts toward 3D radiographic imaging and other digital imaging techniques to bolster their credibility in the global market landscape. Companies should explore opportunities in orthodontic and cosmetic dentistry solutions by strategically increasing the availability of CBCT systems.

Dental imaging market to reach valuation of ~US$ 6 Bn by 2027

Dental imaging market is expected to expand at a CAGR of 8.5% during 2019 - 2027

Dental imaging market is driven by rise in demand for dental imaging services and adoption of technologically advanced dental imaging

The cone beam computed tomography (CBCT) systems segment held a major share of the dental imaging market

Key players in the dental imaging market include Envista (Danaher), Carestream Health, PLANMECA OY, DENTSPLY Sirona, Midmark Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Dental Imaging Market

4. Market Overview

4.1. Introduction

4.1.1. End-user Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Dental Imaging Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Technological Advancements

5.2. Key Industry Events (Mergers, Acquisitions, Product Launch & Approvals, etc.)

5.3. Epidemiology of Dental Diseases in Key Countries/Regions

6. Global Dental Imaging Market Analysis and Forecast, by Technology

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Technology, 2017–2027

6.3.1. Dental X-ray Systems

6.3.1.1. Analog

6.3.1.2. Digital

6.3.2. Cone Beam Computed Tomography (CBCT) Systems

6.3.2.1. 2D

6.3.2.2. 3D

6.3.3. Intraoral Scanners and Cameras

6.3.4. Others

6.4. Market Attractiveness, by Technology

7. Global Dental Imaging Market Analysis and Forecast, by Method

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Method, 2017–2027

7.3.1. Extraoral Imaging Systems

7.3.2. Intraoral Imaging Systems

7.4. Market Attractiveness, by Method

8. Global Dental Imaging Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2027

8.3.1. Endodontics

8.3.2. Orthodontics

8.3.3. Periodontics

8.4. Market Attractiveness, by Application

9. Global Dental Imaging Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2027

9.3.1. Dental Hospitals and Clinics

9.3.2. Dental Academic and Research Institutes

9.3.3. Others

9.4. Market Attractiveness, by End-user

10. Global Dental Imaging Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Dental Imaging Market Analysis and Forecast

11.1. 11.1.Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technology, 2017–2027

11.2.1. Dental X-ray Systems

11.2.1.1. Analog

11.2.1.2. Digital

11.2.2. Cone Beam Computed Tomography (CBCT) Systems

11.2.2.1. 2D

11.2.2.2. 3D

11.2.3. Intraoral Scanners and Cameras

11.2.4. Others

11.3. Market Value Forecast, by Method, 2017–2027

11.3.1. Extraoral Imaging Systems

11.3.2. Intraoral Imaging Systems

11.4. Market Value Forecast, by Application, 2017–2027

11.4.1. Endodontics

11.4.2. Orthodontics

11.4.3. Periodontics

11.5. Market Value Forecast, by End-user, 2017–2027

11.5.1. Dental Hospitals and Clinics

11.5.2. Dental Academic and Research Institutes

11.5.3. Others

11.6. Market Value Forecast, by Country, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Technology

11.7.2. By Method

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Dental Imaging Market Analysis and Forecast

12.1. 12.1.Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technology, 2017–2027

12.2.1. Dental X-ray Systems

12.2.1.1. Analog

12.2.1.2. Digital

12.2.2. Cone Beam Computed Tomography (CBCT) Systems

12.2.2.1. 2D

12.2.2.2. 3D

12.2.3. Intraoral Scanners and Cameras

12.2.4. Others

12.3. Market Value Forecast, by Method, 2017–2027

12.3.1. Extraoral Imaging Systems

12.3.2. Intraoral Imaging Systems

12.4. Market Value Forecast, by Application, 2017–2027

12.4.1. Endodontics

12.4.2. Orthodontics

12.4.3. Periodontics

12.5. Market Value Forecast, by End-user, 2017–2027

12.5.1. Dental Hospitals and Clinics

12.5.2. Dental Academic and Research Institutes

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Russia

12.6.7. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Technology

12.7.2. By Method

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Dental Imaging Market Analysis and Forecast

13.1. 13.1.Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technology, 2017–2027

13.2.1. Dental X-ray Systems

13.2.1.1. Analog

13.2.1.2. Digital

13.2.2. Cone Beam Computed Tomography (CBCT) Systems

13.2.2.1. 2D

13.2.2.2. 3D

13.2.3. Intraoral Scanners and Cameras

13.2.4. Others

13.3. Market Value Forecast, by Method, 2017–2027

13.3.1. Extraoral Imaging Systems

13.3.2. Intraoral Imaging Systems

13.4. Market Value Forecast, by Application, 2017–2027

13.4.1. Endodontics

13.4.2. Orthodontics

13.4.3. Periodontics

13.5. Market Value Forecast, by End-user, 2017–2027

13.5.1. Dental Hospitals and Clinics

13.5.2. Dental Academic and Research Institutes

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2027

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Technology

13.7.2. By Method

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Dental Imaging Market Analysis and Forecast

14.1. 14.1.Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Technology, 2017–2027

14.2.1. Dental X-ray Systems

14.2.1.1. Analog

14.2.1.2. Digital

14.2.2. Cone Beam Computed Tomography (CBCT) Systems

14.2.2.1. 2D

14.2.2.2. 3D

14.2.3. Intraoral Scanners and Cameras

14.2.4. Others

14.3. Market Value Forecast, by Method, 2017–2027

14.3.1. Extraoral Imaging Systems

14.3.2. Intraoral Imaging Systems

14.4. Market Value Forecast, by Application, 2017–2027

14.4.1. Endodontics

14.4.2. Orthodontics

14.4.3. Periodontics

14.5. Market Value Forecast, by End-user, 2017–2027

14.5.1. Dental Hospitals and Clinics

14.5.2. Dental Academic and Research Institutes

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2027

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Technology

14.7.2. By Method

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Dental Imaging Market Analysis and Forecast

15.1. 15.1.Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Technology, 2017–2027

15.2.1. Dental X-ray Systems

15.2.1.1. Analog

15.2.1.2. Digital

15.2.2. Cone Beam Computed Tomography (CBCT) Systems

15.2.2.1. 2D

15.2.2.2. 3D

15.2.3. Intraoral Scanners and Cameras

15.2.4. Others

15.3. Market Value Forecast, by Method, 2017–2027

15.3.1. Extraoral Imaging Systems

15.3.2. Intraoral Imaging Systems

15.4. Market Value Forecast, by Application, 2017–2027

15.4.1. Endodontics

15.4.2. Orthodontics

15.4.3. Periodontics

15.5. Market Value Forecast, by End-user, 2017–2027

15.5.1. Dental Hospitals and Clinics

15.5.2. Dental Academic and Research Institutes

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2027

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Israel

15.6.4. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Technology

15.7.2. By Method

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share/Ranking Analysis, by Company (2018)

16.3. Company Profiles

16.3.1. Envista (Danaher)

16.3.1.1. Company Overview

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. Carestream Health

16.3.2.1. Company Overview

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. PLANMECA OY

16.3.3.1. Company Overview

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. Dentsply Sirona

16.3.4.1. Company Overview

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Midmark Corporation

16.3.5.1. Company Overview

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. THE YOSHIDA DENTAL MFG. CO., LTD.

16.3.6.1. Company Overview

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. VATECH

16.3.7.1. Company Overview

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. Owandy Radiology

16.3.8.1. Company Overview

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. FONA Dental, s.r.o.

16.3.9.1. Company Overview

16.3.9.2. Company Financials

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. Trident S.r.l.

16.3.10.1. Company Overview

16.3.10.2. Company Financials

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

*Note: Financial details for companies that do not report this information in public domain might not be captured

List of Tables

Table 01: Global Dental Imaging Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 02: Global Dental Imaging Market Value (US$ Mn) Forecast, by Dental X-ray Systems, 2017–2027

Table 03: Global Pressure Ulcers Treatment Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Table 04: Global Dental Imaging Market Value (US$ Mn) Forecast, by Method, 2017–2027

Table 05: Global Dental Imaging Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 06: Global Dental Imaging Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 07: Global Dental Imaging Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08: North America Dental Imaging Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 09: North America Dental Imaging Market Value (US$ Mn) Forecast, by Dental X-ray Systems, 2017–2027

Table 10: North America Dental Imaging Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Table 11: North America Dental Imaging Market Value (US$ Mn) Forecast, by Method, 2017–2027

Table 12: North America Endoscopic Vessel Harvesting Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 13: North America Dental Imaging Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 14: North America Dental Imaging Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 15: Europe Dental Imaging Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 16: Europe Dental Imaging Market Value (US$ Mn) Forecast, by Dental X-ray Systems, 2017–2027

Table 17: Europe Dental Imaging Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Table 18: Europe Dental Imaging Market Value (US$ Mn) Forecast, by Method, 2017–2027

Table 19: Europe Endoscopic Vessel Harvesting Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 20: Europe Dental Imaging Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 21: Europe Dental Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 23: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by Dental X-ray Systems, 2017–2027

Table 24: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Table 25: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by Method, 2017–2027

Table 26: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 27: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 28: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 29: Latin America Dental Imaging Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 30: Latin America Dental Imaging Market Value (US$ Mn) Forecast, by Dental X-ray Systems, 2017–2027

Table 31: Latin America Dental Imaging Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Table 32: Latin America Dental Imaging Market Value (US$ Mn) Forecast, by Method, 2017–2027

Table 33: Latin America Endoscopic Vessel Harvesting Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 34: Latin America Dental Imaging Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 35: Latin America Dental Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 36: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 37: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast, by Dental X-ray Systems, 2017–2027

Table 38: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Table 39: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast, by Method, 2017–2027

Table 40: Middle East & Africa Endoscopic Vessel Harvesting Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 41: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 42: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Dental Imaging Market Value (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global Dental Imaging Market Value (US$ Mn), by Technology, 2018

Figure 03: Global Dental Imaging Market Value Share, by Technology, 2018

Figure 04: Global Dental Imaging Market Value Share, by Method, 2018

Figure 05: Global Dental Imaging Market Value Share, by Application, 2018

Figure 06: Global Dental Imaging Market Value Share, by End-user, 2018

Figure 07: Global Dental Imaging Market Value Share, by Region, 2018

Figure 08: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 09: Global Dental Imaging Market Value Share (%), by Technology, 2018 and 2027

Figure 10: Global Dental Imaging Market Value Share, by Dental X-ray Systems, 2018 and 2027

Figure 11: Global Dental Imaging Market Attractiveness, by Dental X-ray Systems, 2019–2027

Figure 12: Global Dental Imaging Market Value Share, by Cone Beam Computed Tomography (CBCT) Systems, 2018 and 2027

Figure 13: Global Dental Imaging Market Attractiveness, by Cone Beam Computed Tomography (CBCT) Systems, 2019–2027

Figure 14: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Dental X-ray Systems, 2017–2027

Figure 15: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Cone Beam Computed Tomography (CBCT) Systems, 2017–2027

Figure 16: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Intraoral Scanners and Cameras, 2017–2027

Figure 17: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2027

Figure 18: Global Dental Imaging Market Attractiveness Analysis, by Technology, 2019–2027

Figure 19: Global Dental Imaging Market Value Share (%), by Method, 2018 and 2027

Figure 20: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Extraoral Imaging Systems, 2017–2027

Figure 21: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Intraoral Imaging Systems, 2017–2027

Figure 22: Global Dental Imaging Market Attractiveness Analysis, by Method, 2019–2027

Figure 23: Global Dental Imaging Market Value Share (%), by Application, 2018 and 2027

Figure 24: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Endodontics, 2017–2027

Figure 25: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Orthodontics, 2017–2027

Figure 26: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Periodontics, 2017–2027

Figure 27: Global Dental Imaging Market Attractiveness Analysis, by Application, 2019–2027

Figure 28: Global Dental Imaging Market Value Share (%), by End-user, 2018 and 2027

Figure 29: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Dental Hospitals and Clinics, 2017–2027

Figure 30: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Dental Academic and Research Institutes , 2017–2027

Figure 31: Global Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2027

Figure 32: Global Dental Imaging Market Attractiveness Analysis, by End-user, 2019–2027

Figure 33: Global Dental Imaging Market Value Share (%), by Region, 2018 and 2027

Figure 34: Global Dental Imaging Market Attractiveness Analysis, by Region, 2019–2027

Figure 35: North America Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 36: North America Dental Imaging Market Value Share, by Technology, 2018 and 2027

Figure 37: North America Dental Imaging Market Attractiveness, by Technology, 2019–2027

Figure 38: North America Dental Imaging Market Value Share, by Dental X-ray Systems, 2018 and 2027

Figure 39: North America Dental Imaging Market Attractiveness, by Dental X-ray Systems, 2019–2027

Figure 40: North America Dental Imaging Market Value Share, by Cone Beam Computed Tomography (CBCT) Systems, 2018 and 2027

Figure 41: North America Dental Imaging Market Attractiveness, by Cone Beam Computed Tomography (CBCT) Systems, 2019–2027

Figure 42: North America Dental Imaging Market Value Share, by Method, 2018 and 2027

Figure 43: North America Dental Imaging Market Attractiveness, by Method, 2019–2027

Figure 44: North America Dental Imaging Market Value Share, by Application, 2018 and 2027

Figure 45: North America Dental Imaging Market Attractiveness, by Application, 2019–2027

Figure 46: North America Dental Imaging Market Value Share, by End-user, 2018 and 2027

Figure 47: North America Dental Imaging Market Attractiveness, by End-user, 2019–2027

Figure 48: North America Dental Imaging Market Value Share (%), by Country, 2018 and 2027

Figure 49: North America Dental Imaging Market Attractiveness, by Country, 2019–2027

Figure 50: Europe Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 51: Europe Dental Imaging Market Value Share, by Technology, 2018 and 2027

Figure 52: Europe Dental Imaging Market Attractiveness, by Technology, 2019–2027

Figure 53: Europe Dental Imaging Market Value Share, by Dental X-ray Systems, 2018 and 2027

Figure 54: Europe Dental Imaging Market Attractiveness, by Dental X-ray Systems, 2019–2027

Figure 55: Europe Dental Imaging Market Value Share, by Cone Beam Computed Tomography (CBCT) Systems, 2018 and 2027

Figure 56: Europe Dental Imaging Market Attractiveness, by Cone Beam Computed Tomography (CBCT) Systems, 2019–2027

Figure 57: Europe Dental Imaging Market Value Share, by Method, 2018 and 2027

Figure 58: Europe Dental Imaging Market Attractiveness, by Method, 2019–2027

Figure 59: Europe Dental Imaging Market Value Share, by Application, 2018 and 2027

Figure 60: Europe Dental Imaging Market Attractiveness, by Application, 2019–2027

Figure 61: Europe Dental Imaging Market Value Share, by End-user, 2018 and 2027

Figure 62: Europe Dental Imaging Market Attractiveness, by End-user, 2019–2027

Figure 63: Europe Dental Imaging Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 64: Europe Dental Imaging Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 65: Asia Pacific Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 66: Asia Pacific Dental Imaging Market Value Share, by Technology, 2018 and 2027

Figure 67: Asia Pacific Dental Imaging Market Attractiveness, by Technology, 2019–2027

Figure 68: Asia Pacific Dental Imaging Market Value Share, by Dental X-ray Systems, 2018 and 2027

Figure 69: Asia Pacific Dental Imaging Market Attractiveness, by Dental X-ray Systems, 2019–2027

Figure 70: Asia Pacific Dental Imaging Market Value Share, by Cone Beam Computed Tomography (CBCT) Systems, 2018 and 2027

Figure 71: Asia Pacific Dental Imaging Market Attractiveness, by Cone Beam Computed Tomography (CBCT) Systems, 2019–2027

Figure 72: Asia Pacific Dental Imaging Market Value Share, by Method, 2018 and 2027

Figure 73: Asia Pacific Dental Imaging Market Attractiveness, by Method, 2019–2027

Figure 74: Asia Pacific Dental Imaging Market Value Share, by Application, 2018 and 2027

Figure 75: Asia Pacific Dental Imaging Market Attractiveness, by Application, 2019–2027

Figure 76: Asia Pacific Dental Imaging Market Value Share, by End-user, 2018 and 2027

Figure 77: Asia Pacific Dental Imaging Market Attractiveness, by End-user, 2019–2027

Figure 78: Asia Pacific Dental Imaging Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 79: Asia Pacific Dental Imaging Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 80: Latin America Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 81: Latin America Dental Imaging Market Value Share, by Technology, 2018 and 2027

Figure 82: Latin America Dental Imaging Market Attractiveness, by Technology, 2019–2027

Figure 83: Latin America Dental Imaging Market Value Share, by Dental X-ray Systems, 2018 and 2027

Figure 84: Latin America Dental Imaging Market Attractiveness, by Dental X-ray Systems, 2019–2027

Figure 85: Latin America Dental Imaging Market Value Share, by Cone Beam Computed Tomography (CBCT) Systems, 2018 and 2027

Figure 86: Latin America Dental Imaging Market Attractiveness, by Cone Beam Computed Tomography (CBCT) Systems, 2019–2027

Figure 87: Latin America Dental Imaging Market Value Share, by Method, 2018 and 2027

Figure 88: Latin America Dental Imaging Market Attractiveness, by Method, 2019–2027

Figure 89: Latin America Dental Imaging Market Value Share, by Application, 2018 and 2027

Figure 90: Latin America Dental Imaging Market Attractiveness, by Application, 2019–2027

Figure 91: Latin America Dental Imaging Market Value Share, by End-user, 2018 and 2027

Figure 92: Latin America Dental Imaging Market Attractiveness, by End-user, 2019–2027

Figure 93: Latin America Dental Imaging Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 94: Latin America Dental Imaging Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 95: Middle East & Africa Dental Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 96: Middle East & Africa Dental Imaging Market Value Share, by Technology, 2018 and 2027

Figure 97: Middle East & Africa Dental Imaging Market Attractiveness, by Technology, 2019–2027

Figure 98: Middle East & Africa Dental Imaging Market Value Share, by Dental X-ray Systems, 2018 and 2027

Figure 99: Middle East & Africa Dental Imaging Market Attractiveness, by Dental X-ray Systems, 2019–2027

Figure 100: Middle East & Africa Dental Imaging Market Value Share, by Cone Beam Computed Tomography (CBCT) Systems, 2018 and 2027

Figure 101: Middle East & Africa Dental Imaging Market Attractiveness, by Cone Beam Computed Tomography (CBCT) Systems, 2019–2027

Figure 102: Middle East & Africa Dental Imaging Market Value Share, by Method, 2018 and 2027

Figure 103: Middle East & Africa Dental Imaging Market Attractiveness, by Method, 2019–2027

Figure 104: Middle East & Africa Dental Imaging Market Value Share, by Application, 2018 and 2027

Figure 105: Middle East & Africa Dental Imaging Market Attractiveness, by Application, 2019–2027

Figure 106: Middle East & Africa Dental Imaging Market Value Share, by End-user, 2018 and 2027

Figure 107: Middle East & Africa Dental Imaging Market Attractiveness, by End-user, 2019–2027

Figure 108: Middle East & Africa Dental Imaging Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 109: Middle East & Africa Dental Imaging Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 110: Market Position Analysis, 2018, by Tier and Size of the Company

Figure 111: Danaher Dental Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 112: Danaher R&D Expenses (US$ Mn), 2017–2018

Figure 113: Danaher Breakdown of Net Sales (%), by Region, 2018

Figure 114: Danaher Breakdown of Net Sales (%), by Business Segment, 2018

Figure 115: Dentsply Sirona Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 116: Dentsply Sirona R&D Expenses (US$ Mn), 2017–2018

Figure 117: Dentsply Sirona Breakdown of Net Sales (%), by Region, 2018

Figure 118: Dentsply Sirona Breakdown of Net Sales (%), by Business Segment, 2018