Reports

Reports

The market for addiction treatment has expanded significantly over the last two years due to heightened awareness of addiction disorders as well as the wider variety of available treatments. As society's stigma over addiction lessens, more number of patients are seeking the services of the market, which, in turn, is driving growth.

The players in the market include the rehabilitation facilities, outpatient clinics, and telemedicine services, all which deliver traditional and alternative treatments. The development of integrative treatment and specially designed interventions, such as cognitive-behavioral therapy and drug-assisted treatment, has also enhanced treatment efficacy.

.webp)

North America dominates the market based on high rates of addiction and a well-established healthcare system. But the likes of the Asia-Pacific region are also going through growth spurts, driven by increasing disposable income and increasing access to healthcare. Technological advancements like digital therapeutics and mobile health are transforming the horizon with affordable and adaptable treatment.

Moreover, research funding and government initiatives are driving innovation toward addiction treatment. With changing landscape, focus on whole-person care and extended recovery methods is becoming increasingly popular to not only make patients free from addiction but also realize long-term wellness. Overall, the drug addiction treatment market will rise steadily as it adjusts to new threats and opportunities.

Addiction treatment is a diverse group of therapeutic interventions aimed at facilitating recovery from substance and behavior addictions. Addiction treatment is mainly a multi-modal treatment involving medical, psychologic, and social support that seems to overcome the complex nature of addiction. Treatment methods range from a variety of inpatient rehab facilities with in-depth care and structured environment, and outpatient treatments by which patients can maintain their regular lifestyle during treatment.

Treatment also varies with individual treatment as each person becomes addicted in a different way. Evidence-based treatments such as motivational interviewing and cognitive behavioural therapy (CBT) are often employed in an attempt to inform the patient about all they do and help them learn how to adapt. Medication-assisted treatment (MAT) is also essential in an attempt to treat withdrawal symptoms and decrease substance cravings such as in alcohol and opioids.

The framework for the treatment of addiction is evolving with greater integration of technology through the utilization of telemedicine services and mobile applications to provide easier access to care. The need for integrated treatment of addiction through the address of psychological, social, and environmental determinants of addiction also grows. Overall treatment must not only make individuals sober but also in sustaining long-term recovery and overall quality of life.

| Attribute | Detail |

|---|---|

| Addiction Treatment Market Drivers |

|

The growing number of substance use disorder cases is one of the drivers to the treatment market for addiction epidemic, an escalating public health issue. The trend is supported by enhanced access to illegal drugs, economic and social factors, and the ongoing opioid crisis. As victim numbers grow for addiction, growing demands for effective intervention have pushed healthcare professionals and policymakers to spend on addiction treatment. As understanding has improved, it has also pushed a discerning focus on early intervention and prevention strategies, again stimulating market growth.

Geographically, the treatment market for addiction is advanced in North America, where drug use disorders are widespread and have witnessed widespread treatment centers with support groups being established. However, regions like Asia-Pacific and Europe are also witnessing robust growth on the back of growing awareness and changing healthcare infrastructures.

The market is leaning toward whole and customized treatment approaches, which are aimed at the unique requirements of an individual, like behavior therapies and drug-assisted treatment. As both - private and public sectors invest to improve the availability of treatment as well as service provision, the addiction treatment market is expected to expand further.

Increased acceptability and awareness toward treatment of addiction is a major force driving addiction treatment business, transforming its growth into an exponential scale. With society's perception toward addiction gradually changing for the better, people have increasingly started accepting it as a disease, rather than poor character.

Public campaigns that have informed the people about the character of addiction, as to why and how it affects and is handled, through sensitization, have contributed their own bit. More media coverage and campaigns by health agencies have also made it easier today to talk freely about addiction without fear, with victims free to speak openly about the condition without fear of stigma.

There is better awareness in general, with more treatment-seeking. Doctors are more focused than ever on developing low-cost and combined care systems that are very flexible to whatever kind of population. The market is best established in North America, where the runaway pandemic of substance use disorders has led to broad investment in facilities and services.

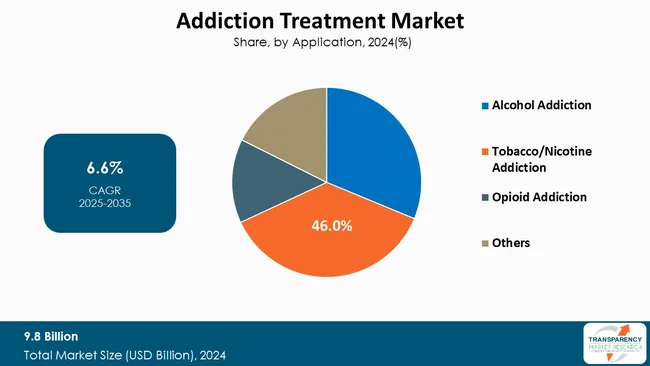

Tobacco and nicotine dependency applications are the leading addiction treatment due to the massive smoking disease burden and rate of need for a successful cessation approach. With an estimated 1.3 billion tobacco users globally, never before have there been so many who need targeted intervention. The applications leverage technology in their capabilities to give person-centered assistance, immediate feedback, and social support that render them very effective quit attempts tools.

Also included in these apps are coping strategies for cognitive behavior techniques, which make them more robust as they provide an individual with the ability to manage cravings and triggers. Also, mobile technology exists everywhere and anytime to everybody, and this makes a major contribution to motivation in the long run.

Growing health awareness of the effect caused by smoking tobacco and control of tobacco products has generated extra demand for quitting products. The mobile applications for tobacco and nicotine dependency are hence market leaders in the category of dependency treatments, which keep evolving and capture the consumer.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America dominates addiction treatment as a result of multiple strong drivers, led by the exceptionally high rates of drug use disorders incidence and sophisticated healthcare infrastructure. Growing concern about addiction as a public health crisis in the wake of the opioid epidemic has boosted investment in treatment capacity and services. There has been greater public and private investment in treatment services, prevention programs, and research that has made the establishment of programs of care for integration possible.

In addition, North America is subject to cutting-edge healthcare technology and an educated population of addiction professionals such as counselors, therapists, and physicians. Access to an unparalleled combination of treatment modalities-ranging from inpatient recovery to outpatient and telehealth treatment-is provided to individuals so that they can receive the proper type of care that suits their needs.

In addition, social stigma for addiction has slowly been debunked, and more and more individuals have come in for assistance without fear of being judged. Grass roots movements and community-based initiatives have contributed significantly toward placing trends of recovery and addiction today in the mainstream dialogue. North America is not just the hub of new and emerging patterns of treatment, as it were, but a healthful environment for those recovering, and it ensures that it remains at the top regarding treatment.

Key players in the global Addiction Treatment Market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Alkermes, GlaxoSmithKline plc, Pfizer, Inc., Mallinckrodt, Hikma Pharmaceuticals PLC, Titan Pharmaceuticals, Inc., Camurus, Braeburn Pharmaceuticals, Lundbeck and others are some of the leading key players.

Each of these players has been profiled in the Addiction Treatment Market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 9.8 Bn |

| Forecast Value in 2035 | US$ 19.8 Bn |

| CAGR | 6.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Addiction Treatment Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 9.8 Bn in 2024.

It is projected to cross US$ 19.8 Bn by the end of 2035.

Rising prevalence of substance abuse and growing awareness and acceptance of treatment.

It is anticipated to grow at a CAGR of 6.6% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Alkermes, GlaxoSmithKline plc, Pfizer, Inc., Mallinckrodt, Hikma Pharmaceuticals PLC, Titan Pharmaceuticals, Inc., Camurus, Braeburn Pharmaceuticals, Lundbeck, and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Addiction Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Addiction Treatment Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events

5.2. PESTEL Analysis

5.3. Product/Brand Analysis

5.4. Regulatory Scenario by Key Countries/Regions

5.5. PORTER’s Five Forces Analysis

5.6. Supply Chain Analysis

5.7. Pipeline Analysis

6. Global Addiction Treatment Market Analysis and Forecast, by Drug

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug, 2020 to 2035

6.3.1. Bupropion

6.3.2. Varenicline

6.3.3. Acamprosate

6.3.4. Disulfiram

6.3.5. Naltrexone

6.3.6. Methadone

6.3.7. Nicotine Replacement Products

6.3.8. Others

6.4. Market Attractiveness Analysis, by Drug

7. Global Addiction Treatment Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Alcohol Addiction

7.3.2. Tobacco/Nicotine Addiction

7.3.3. Opioid Addiction

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Addiction Treatment Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2020 to 2035

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Addiction Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Addiction Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug, 2020 to 2035

10.2.1. Bupropion

10.2.2. Varenicline

10.2.3. Acamprosate

10.2.4. Disulfiram

10.2.5. Naltrexone

10.2.6. Methadone

10.2.7. Nicotine Replacement Products

10.2.8. Others

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Alcohol Addiction

10.3.2. Tobacco/Nicotine Addiction

10.3.3. Opioid Addiction

10.3.4. Others

10.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug

10.6.2. By Application

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Addiction Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug, 2020 to 2035

11.2.1. Bupropion

11.2.2. Varenicline

11.2.3. Acamprosate

11.2.4. Disulfiram

11.2.5. Naltrexone

11.2.6. Methadone

11.2.7. Nicotine Replacement Products

11.2.8. Others

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Alcohol Addiction

11.3.2. Tobacco/Nicotine Addiction

11.3.3. Opioid Addiction

11.3.4. Others

11.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug

11.6.2. By Application

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Addiction Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug, 2020 to 2035

12.2.1. Bupropion

12.2.2. Varenicline

12.2.3. Acamprosate

12.2.4. Disulfiram

12.2.5. Naltrexone

12.2.6. Methadone

12.2.7. Nicotine Replacement Products

12.2.8. Others

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Alcohol Addiction

12.3.2. Tobacco/Nicotine Addiction

12.3.3. Opioid Addiction

12.3.4. Others

12.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug

12.6.2. By Application

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Addiction Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug, 2020 to 2035

13.2.1. Bupropion

13.2.2. Varenicline

13.2.3. Acamprosate

13.2.4. Disulfiram

13.2.5. Naltrexone

13.2.6. Methadone

13.2.7. Nicotine Replacement Products

13.2.8. Others

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Alcohol Addiction

13.3.2. Tobacco/Nicotine Addiction

13.3.3. Opioid Addiction

13.3.4. Others

13.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug

13.6.2. By Application

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Addiction Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug, 2020 to 2035

14.2.1. Bupropion

14.2.2. Varenicline

14.2.3. Acamprosate

14.2.4. Disulfiram

14.2.5. Naltrexone

14.2.6. Methadone

14.2.7. Nicotine Replacement Products

14.2.8. Others

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Alcohol Addiction

14.3.2. Tobacco/Nicotine Addiction

14.3.3. Opioid Addiction

14.3.4. Others

14.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug

14.6.2. By Application

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Alkermes

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. GlaxoSmithKline plc

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Pfizer, Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Mallinckrodt

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Hikma Pharmaceuticals PLC

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Titan Pharmaceuticals, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Camurus

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Braeburn Pharmaceuticals

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Lundbeck

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

List of Tables

Table 01: Global Addiction Treatment Market Value (US$ Bn) Forecast, By Drug, 2020 to 2035

Table 02: Global Addiction Treatment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Addiction Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 04: Global Addiction Treatment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Addiction Treatment Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Addiction Treatment Market Value (US$ Bn) Forecast, By Drug, 2020 to 2035

Table 07: North America Addiction Treatment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: North America Addiction Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 09: Europe Addiction Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 10: Europe Addiction Treatment Market Value (US$ Bn) Forecast, By Drug, 2020 to 2035

Table 11: Europe Addiction Treatment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: Europe Addiction Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 13: Asia Pacific Addiction Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Asia Pacific Addiction Treatment Market Value (US$ Bn) Forecast, By Drug, 2020 to 2035

Table 15: Asia Pacific Addiction Treatment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 16: Asia Pacific Addiction Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 17: Latin America Addiction Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Latin America Addiction Treatment Market Value (US$ Bn) Forecast, By Drug, 2020 to 2035

Table 19: Latin America Addiction Treatment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Latin America Addiction Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 21: Middle East & Africa Addiction Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Middle East & Africa Addiction Treatment Market Value (US$ Bn) Forecast, By Drug, 2020 to 2035

Table 23: Middle East & Africa Addiction Treatment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Middle East & Africa Addiction Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Addiction Treatment Market Value Share Analysis, By Drug, 2024 and 2035

Figure 02: Global Addiction Treatment Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 03: Global Addiction Treatment Market Revenue (US$ Bn), by Bupropion, 2020 to 2035

Figure 04: Global Addiction Treatment Market Revenue (US$ Bn), by Varenicline, 2020 to 2035

Figure 05: Global Addiction Treatment Market Revenue (US$ Bn), by Acamprosate, 2020 to 2035

Figure 06: Global Addiction Treatment Market Revenue (US$ Bn), by Disulfiram, 2020 to 2035

Figure 07: Global Addiction Treatment Market Revenue (US$ Bn), by Naltrexone, 2020 to 2035

Figure 08: Global Addiction Treatment Market Revenue (US$ Bn), by Methadone, 2020 to 2035

Figure 09: Global Addiction Treatment Market Revenue (US$ Bn), by Nicotine Replacement Products, 2020 to 2035

Figure 10: Global Addiction Treatment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Addiction Treatment Market Value Share Analysis, By Application, 2024 and 2035

Figure 12: Global Addiction Treatment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 13: Global Addiction Treatment Market Revenue (US$ Bn), by Alcohol Addiction, 2020 to 2035

Figure 14: Global Addiction Treatment Market Revenue (US$ Bn), by Tobacco/Nicotine Addiction, 2020 to 2035

Figure 15: Global Addiction Treatment Market Revenue (US$ Bn), by Opioid Addiction, 2020 to 2035

Figure 16: Global Addiction Treatment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Addiction Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 18: Global Addiction Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 19: Global Addiction Treatment Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 20: Global Addiction Treatment Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 21: Global Addiction Treatment Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 22: Global Addiction Treatment Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Addiction Treatment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America Addiction Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: North America Addiction Treatment Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Addiction Treatment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Addiction Treatment Market Value Share Analysis, By Drug, 2024 and 2035

Figure 28: North America Addiction Treatment Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 29: North America Addiction Treatment Market Value Share Analysis, By Application, 2024 and 2035

Figure 30: North America Addiction Treatment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 31: North America Addiction Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 32: North America Addiction Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 33: Europe Addiction Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Addiction Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Europe Addiction Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Europe Addiction Treatment Market Value Share Analysis, By Drug, 2024 and 2035

Figure 37: Europe Addiction Treatment Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 38: Europe Addiction Treatment Market Value Share Analysis, By Application, 2024 and 2035

Figure 39: Europe Addiction Treatment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 40: Europe Addiction Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 41: Europe Addiction Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 42: Asia Pacific Addiction Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Asia Pacific Addiction Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 44: Asia Pacific Addiction Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 45: Asia Pacific Addiction Treatment Market Value Share Analysis, By Drug, 2024 and 2035

Figure 46: Asia Pacific Addiction Treatment Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 47: Asia Pacific Addiction Treatment Market Value Share Analysis, By Application, 2024 and 2035

Figure 48: Asia Pacific Addiction Treatment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 49: Asia Pacific Addiction Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 50: Asia Pacific Addiction Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 51: Latin America Addiction Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Latin America Addiction Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 53: Latin America Addiction Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 54: Latin America Addiction Treatment Market Value Share Analysis, By Drug, 2024 and 2035

Figure 55: Latin America Addiction Treatment Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 56: Latin America Addiction Treatment Market Value Share Analysis, By Application, 2024 and 2035

Figure 57: Latin America Addiction Treatment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 58: Latin America Addiction Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 59: Latin America Addiction Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 60: Middle East & Africa Addiction Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Middle East & Africa Addiction Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 62: Middle East & Africa Addiction Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 63: Middle East & Africa Addiction Treatment Market Value Share Analysis, By Drug, 2024 and 2035

Figure 64: Middle East & Africa Addiction Treatment Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 65: Middle East & Africa Addiction Treatment Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Middle East & Africa Addiction Treatment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Middle East & Africa Addiction Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 68: Middle East & Africa Addiction Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035