Reports

Reports

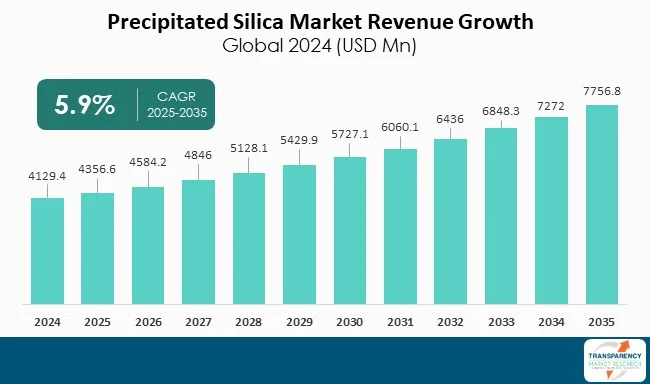

The precipitated silica market is anticipated to grow at a CAGR of 5.9% during the forecast period owing to the rise in demand for eco-friendly and fuel efficient tires, as the environmental regulations related to tires are becoming stringent. The growth in usage of precipitated silica in non-tire rubber applications like hoses, belts, footwear aids the expansion of the market. The expanding sectors such as oral hygiene and personal care use precipitated silica as cleansing and thickening agent.

Rapid industrialization and growth in automotive sales in emerging economies further enhance the demand of precipitated silica. Advancements in manufacturing technologies, and shift from carbon black to silica for sustainability and better performance propel the demand for precipitated silica from different sectors.

Tire manufacturers are investing significantly in research and development activities and partnerships for integrating precipitated silica into their products. Asia Pacific accounts for 32.9% share of global precipitated silica market owing to presence of the major rubber and tire manufacturers in countries such as China, Japan, and India.

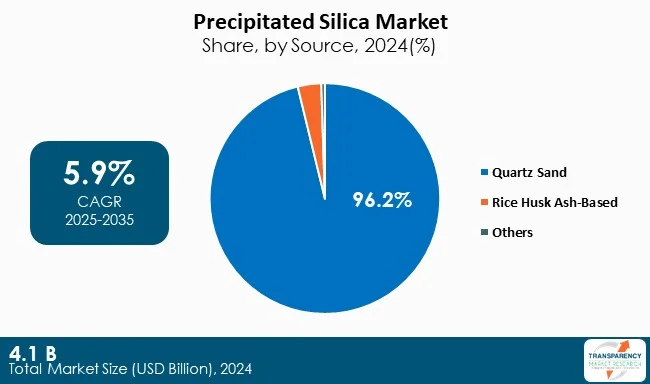

Precipitated silica is a kind of silica produced by the reaction of sodium silicate with hydrochloric or sulfuric acid. The process comprises creation of a solution of sodium silicate, its reaction with acid within controlled conditions for precipitating silica particles, washing the precipitate for removing impurities, drying the washed precipitate, and milling the dried silica for achieving the required particle size. The process is designed for preventing the formation of gel, which favors the precipitation of distinct silica particles.

Maintaining the pH within a particular range during precipitation is vital for controlling the properties and particle size. Proper agitation makes sure that there is uniform mixing and prevents the localized concentration. Precipitated silica possesses high density of hydroxyl groups on its surface and the high surface area, thereby making it highly reactive. It is useful in verticals such as paints, rubber, cosmetics, and plastics, among others.

Precipitated silica serves as a reinforcing filler in rubber. It enhances the mechanical strength of the plastics. It acts as an anti-caking agent in different products in pharmaceuticals and food. Precipitated silica facilitates the creation of transparent or white rubber products. In cosmetics and personal care products such as gels, creams, and lotions, precipitated silica is utilized as a thickening agent and absorbent, thereby facilitating the attainment of desired texture and consistency. Precipitated silica is a vital ingredient in toothpastes, as it functions as a cleaning, polishing, and thickening agent.

| Attribute | Detail |

|---|---|

| Precipitated Silica Market Drivers |

|

The global precipitated silica market is witnessing a significant growth as it is becoming more integrated in the tire and rubber sector. This is one of the most powerful end-users of precipitated silica and contributes to a major share of global demand. Precipitated silica serves as a rubber reinforcing filler, wherein it provides abrasion resistance, strength in tension, and fuel economy in tires. As the global auto industry shifts its direction toward electrically efficient and lower-emission vehicles, there is a steep upsurge in the use of green tires that substitute conventional carbon black fillers with precipitated silica.

Regions like Europe and North America are witnessing high demand due to their strict fuel economy standards and emission regulations, which are among the toughest in the world. The EU Tire Labeling Regulation (2020/740) and U.S. CAFÉ Standards represent two different regulatory frameworks that push tire manufacturers to choose materials that improve performance while minimizing environmental impact. The real advantage of precipitated silica lies in its ability to enhance both - structural strength and flexibility, optimize tread patterns, and boost energy efficiency, all without compromising tire lifespan.

In addition, the market is seeing a mounting momentum in emerging economies, particularly within the Asia Pacific, as a result of growing automotive manufacturing bases, urbanization, and increasing middle class population requiring improved quality, long-lasting tires. China, India, and Indonesia are now also spurring environmental overhauls in the auto sector, advancing toward sustainable tire technologies over the long-term.

Tire companies such as Michelin, Bridgestone, and Continental have been making substantial investments in R&D for maximizing the utilization of precipitated silica in products. Michelin's use of high-dispersion silica in its energy saver and primacy 4 tires, for example, has allowed it to reduce rolling resistance quantitatively and improve road grip. This has certainly improved the performance.

Precipitated silica has registered a phenomenal uptake in the oral care industry, particularly in the toothpaste formulation. It is a gentle, abrasive thickener, and polishing agent that provides enhanced cleaning performance without injuring enamel.

The transition from conventional calcium-based abrasives to silica-based alternatives is largely attributed to the better ability of silica to balance efficiency with safety. Precipitated silica assists manufacturers in attaining desirable aesthetics of the product, enhanced rheology, and formulation stability. Large toothpaste companies such as Colgate-Palmolive, Unilever, and Procter & Gamble have adopted high-end grades of precipitated silica within whitening, herbal, and enamel care product lines. These businesses are also driving innovation in fluoride compatibility and sensory performance, both of which are domains where silica is critical. Consumer demand is fast shifting toward premium oral care products providing targeted solutions such as whitening, plaque control, and gum protection. Precipitated silica makes these functional benefits possible by being a perfect polishing agent that removes extrinsic stains without affecting tooth sensitivity. Further, its contribution to gel-based and clear formulation developments has also been critical, particularly in high-end as well as natural product segments.

In addition, market conditions in Asia-Pacific and Latin America, fueled by urbanization and growth in modern retail chains have established a fertile growth environment for both - mass-market and premium oral care brands.

On the manufacturing side, players such as Solvay, Evonik, and Huber Engineered Materials have increased product capacities to address this increasing demand. For example, Huber's Zeodent range of dental silicas provides customized particle sizes and structures to match different levels of abrasiveness and polishing, giving manufacturer’s choice to create differentiated products.

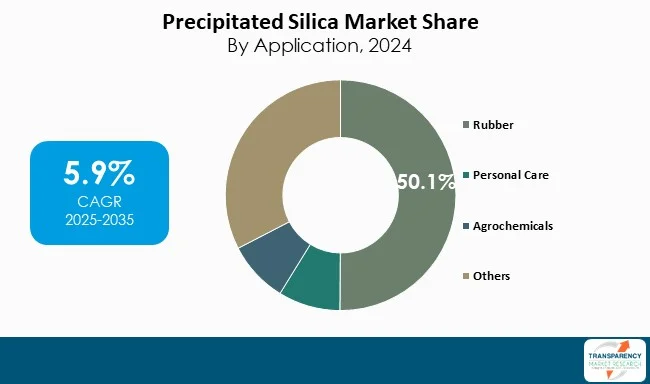

The leading application segment in the precipitated silica market is rubber. Precipitated silica performs a critical function of improving the rubber products' performance. Precipitated silica has an extensive application as a reinforcing filler in the production of tires, where it boosts tensile strength, abrasion resistance, and wet traction, as well as minimizing rolling resistance. These advantages lead to improved fuel efficiency and road safety, thereby making silica-filled rubber highly sought after, particularly for high-performance and green tires.

Outside the tire sector, precipitated silica has widespread use in non-tire rubber products like shoe soles, conveyor belts, hoses, seals, and gaskets. These products benefit from silica with added durability, flexibility, and resistance to aging. Increasing automobile and industrial industries around the world keep demand for these kinds of products on the rise. Also, the shift from the use of regular carbon black to silica on account of environmental and performance concerns proves the predominance of the use of rubber in precipitated silica.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific, Which Consists of 32.8% Share of Global Market |

Asia Pacific represents 32.8% of the world's precipitated silica market with its sizeable rubber and tire production base, particularly in China, India, and Japan. Industrialization, increasing automotive production, and demand for footwear and non-tire rubber products accelerate consumption. Lower cost structures for production and rising domestic consumption also fuel the region to be at the top of the market.

Europe holds 29.1% of the total precipitated silica market across the globe based on its established automobile sector, rigorous environmental protection policies supporting green tires, and significant demand for eco-friendly materials. The region's dominant position in industrial rubber products, adhesives, and personal care items also propels consumption. Technological growth and investments in green manufacturing also back the growth of the market in Europe.

North America accounts for a 20.4% share of the global market for precipitated silica as a result of its developed automotive industry, need for high-performing tires, and dominant position in the personal care and food sectors. North America is also favored by advancements in technology, strict quality requirements, and rising use of silica in rubber alternatives, oral care products, and industrial processes where enhanced product performance is needed.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 4.1 Bn |

| Market Forecast Value in 2035 | US$ 7.7 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn/Bn for Value & Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Precipitated Silica market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The precipitated silica market was valued at US$ 4.1 Bn in 2024

The precipitated silica industry is expected to grow at a CAGR of 5.9% from 2025 to 2035

Rising demand from tire and rubber industry and growing adoption in oral care and toothpaste applications.

Rubber was the largest application segment and its value is anticipated to grow at a CAGR of 6.4% during the forecast period.

Asia Pacific was the most lucrative region in 2024

MLA Group, Madhu Silica Pvt Ltd, PQ Corporation, Tata Chemicals Ltd, Oriental Silicas Corporation, Brisil Technologies Pvt Ltd, Solvay S.A., QEMETICA, W.R. Grace & Co., and Evonik Industries AG.

Table 1 Global Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 2 Global Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 3 Global Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 4 Global Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 5 Global Precipitated Silica Market Volume (Kilo Tons) Forecast, by Region, 2025 to 2035

Table 6 Global Precipitated Silica Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 7 North America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 8 North America Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 9 North America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 10 North America Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 11 North America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country, 2025 to 2035

Table 12 North America Precipitated Silica Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 13 U.S. Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 14 U.S. Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 15 U.S. Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 16 U.S. Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 17 Canada Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 18 Canada Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 19 Canada Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 20 Canada Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 21 Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 22 Europe Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 23 Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 24 Europe Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 25 Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 26 Europe Precipitated Silica Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 27 Germany Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 28 Germany Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 29 Germany Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 30 Germany Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 31 U.K. Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 32 U.K. Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 33 U.K. Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 34 U.K. Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 35 France Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 36 France Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 37 France Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 38 France Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 39 Spain Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 40 Spain Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 41 Spain Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 42 Spain Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 43 Italy Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 44 Italy Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 45 Italy Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 46 Italy Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 47 Russia & CIS Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 48 Russia & CIS Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 49 Russia & CIS Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 50 Russia & CIS Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 51 Rest of Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 52 Rest of Europe Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 53 Rest of Europe Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 54 Rest of Europe Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 55 Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 56 Asia Pacific Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 57 Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 58 Asia Pacific Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 59 Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 60 Asia Pacific Precipitated Silica Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 61 China Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 62 China Precipitated Silica Market Value (US$ Bn) Forecast, by Source 2025 to 2035

Table 63 China Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 64 China Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 65 India Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 66 India Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 67 India Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 68 India Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 69 Japan Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 70 Japan Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 71 Japan Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 72 Japan Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 73 ASEAN Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 74 ASEAN Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 75 ASEAN Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 76 ASEAN Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 77 Rest of Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 78 Rest of Asia Pacific Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 79 Rest of Asia Pacific Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 80 Rest of Asia Pacific Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 81 Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 82 Latin America Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 83 Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 84 Latin America Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 85 Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Latin America Precipitated Silica Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 Brazil Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 88 Brazil Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 89 Brazil Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 90 Brazil Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 91 Mexico Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 92 Mexico Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 93 Mexico Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 94 Mexico Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 95 Rest of Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 96 Rest of Latin America Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 97 Rest of Latin America Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 98 Rest of Latin America Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 99 Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 100 Middle East & Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 101 Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 102 Middle East & Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 103 Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 104 Middle East & Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 105 GCC Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 106 GCC Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 107 GCC Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 108 GCC Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 109 South Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 110 South Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 111 South Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 112 South Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 113 Rest of Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 114 Rest of Middle East & Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 115 Rest of Middle East & Africa Precipitated Silica Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 116 Rest of Middle East & Africa Precipitated Silica Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Figure 1 Global Precipitated Silica Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 2 Global Precipitated Silica Market Attractiveness, by Source

Figure 3 Global Precipitated Silica Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Precipitated Silica Market Attractiveness, by Application

Figure 5 Global Precipitated Silica Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 6 Global Precipitated Silica Market Attractiveness, by Region

Figure 7 North America Precipitated Silica Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 8 North America Precipitated Silica Market Attractiveness, by Source

Figure 9 North America Precipitated Silica Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 10 North America Precipitated Silica Market Attractiveness, by Application

Figure 11 North America Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 12 Europe Precipitated Silica Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 13 Europe Precipitated Silica Market Attractiveness, by Source

Figure 14 Europe Precipitated Silica Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 15 Europe Precipitated Silica Market Attractiveness, by Application

Figure 16 Europe Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 17 Europe Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 18 Asia Pacific Precipitated Silica Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 19 Asia Pacific Precipitated Silica Market Attractiveness, by Source

Figure 20 Asia Pacific Precipitated Silica Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 Asia Pacific Precipitated Silica Market Attractiveness, by Application

Figure 22 Asia Pacific Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Asia Pacific Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 24 Latin America Precipitated Silica Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 25 Latin America Precipitated Silica Market Attractiveness, by Source

Figure 26 Latin America Precipitated Silica Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 27 Latin America Precipitated Silica Market Attractiveness, by Application

Figure 28 Latin America Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Latin America Precipitated Silica Market Attractiveness, by Country and Sub-region

Figure 30 Middle East & Africa Precipitated Silica Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 31 Middle East & Africa Precipitated Silica Market Attractiveness, by Source

Figure 32 Middle East & Africa Precipitated Silica Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 33 Middle East & Africa Precipitated Silica Market Attractiveness, by Application

Figure 34 Middle East & Africa Precipitated Silica Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 35 Middle East & Africa Precipitated Silica Market Attractiveness, by Country and Sub-region