Reports

Reports

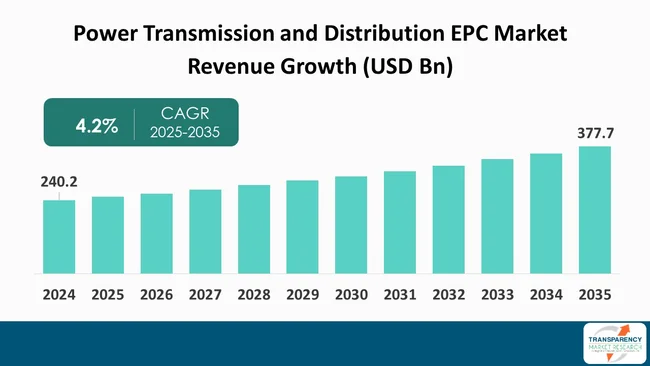

The global power transmission and distribution EPC Market size was valued at US$ 240.2 billion in 2024 and is projected to reach US$ 377.7 billion by 2035, expanding at a CAGR of 4.2% from 2025 to 2035. The market growth is driven by growth in residential construction & housing stock upgrades, material & product innovation and energy cost pressures

The global power transmission and distribution (T&D) EPC (Engineering, Procurement, and Construction) market is witnessing strong growth attributed to various ongoing trends including the rise in demand for electricity, urban growth, and generation of renewable energy. The T&D EPC process focuses on the development and refurbishment of the transmission system (e.g., high voltage power lines), substations, transformers, and smart grid systems by transmitting and distributing electricity from power generation locations to use by end-users.

The drivers of growth are associated with governments’ support of grid modernization, increase in electrification in developing countries, and technological advancements; for e.g. - flexible alternating current transmission systems (FACTS), smart grid.

The key players such as KEC International Ltd., Kalpataru Projects International Limited, Sterlite Electric Limited, and Larsen & Toubro are emphasizing investing in innovation and digitalization to improve project delivery. Efforts are being made toward expanding renewable energy EPC projects, advancing technologies (e.g., energy storage, grid automation), and strategic partnerships.

The global power transmission and distribution (T&D) EPC (Engineering, Procurement, and Construction) market implies end-to-end services deployed for developing and maintaining distribution assets and electrical transmission. This involves planning, procurement of materials and equipment, engineering, and construction of high-voltage transmission lines, transformers, substations, and distribution networks. T&D systems provide reliability and efficiency regarding transfer of electricity from the generation plant to the end-consumer. Applications are in power utilities and industries, and also include urban infrastructure and smart grids.

The power transmission and distribution EPC industry is focused on upgrading aged grids as a part of providing reliable power to the consumer through applications that include high-voltage direct current (HVDC) technology and smart grid development. The EPC value proposition ensures that the consulting team has technical subject matter expertise and constructability to complete projects on time. This is vital to upgrade access to electricity and modernize and sustain the global electricity power infrastructure, as the demand for energy increases and the desire for sustainability targets for electrification increases.

| Attribute | Detail |

|---|---|

| Drivers |

|

The increasing global energy demand resulting from urbanization is impacting the power transmission and distribution networks all over the world. The International Energy Agency (IEA) noted a growth of 2.2% in global energy demand in 2024, which is faster than the average of the previous 10 years. This growth has largely stemmed from increasing urban population, economic activity, and technological take-up.

Urban population accounts for roughly 75% of the world’s primary energy consumption. As urban population generates most of the global greenhouse gas emissions, they house approximately two-third of the world’s population and about 68% is projected to live in cities in 2050. The urbanization trend is generating a vast and growing end-use load from residential, commercial, and industrial consumers that require large and resilient power transmission and distribution infrastructure.

Increasing cooling requirements from extreme heatwaves in heavily populated economies such as China, India, and Southeast Asia have driven the demand for electricity substantially higher. Additionally, the expansion of technologies powered by electricity - such as data centers, electric vehicles, and smart devices contributes to strain on the grid. These trends do prompt utilities and governments to invest even more in faster modernization of grid to increase system capacity, improve efficiency, and reduce outages.

High-voltage direct current (HVDC) lines, automated control systems, and smart grids are becoming the norm for effectively delivering electricity for meeting the rising, and often variable demand. Extending and/or upgrading the capability of transmission infrastructure including lines and substations is crucial for population centers. For this reason, the power transmission and distribution EPC sector is important for engineering, procuring, and constructing these increasingly complex systems to sustainably support further economic growth and urbanization.

The rapid switch to renewable energy and modernization of the electricity grid are the essential forces altering the global power transmission and distribution EPC market. The IRENA has reported that deploying renewable energy globally reached an all-time high, with a record addition of 582 GW of renewable capacity in the year 2024, but the pace must increase significantly to meet COP28 UAE Consensus targets.

This switch is based on policies committing to net-zero emissions, increased investments into solar, wind, and hydroelectric power generation, as well as the need to move away from fossil fuels at a global scale.

. Modernized technology can make the grid more reliable, allow for disruption of supply, and enable two-way power flows to accommodate distributed energy resources.

Governments and utilities are prioritizing the creation of smart grids, digital controls, and the development of grid-scale battery storage to stabilize the supply to meet the demand. There is renewed investment into supply chain resilience and domestic clean technology manufacturing. The quick integration of renewables and the modernization of the grid represents an opportunity in the EPC market for a significant amount of growth while it supports the global energy transition to sustainable, resilient, and flexible power, to afford greater access to clean energy resources and deliver climate beneficial impacts.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 240.2 Billion |

| Market Forecast Value in 2035 | US$ 377.7 Billion |

| Growth Rate (CAGR) | 4.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Global Power Transmission and Distribution EPC Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Project Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The power transmission and distribution EPC market was valued at US$ 240.2 Billion in 2024

The power transmission and distribution EPC industry is expected to grow at a CAGR of 4.2% from 2025 to 2035

Rising global energy demand, urbanization and accelerated transition to renewable energy and grid modernization

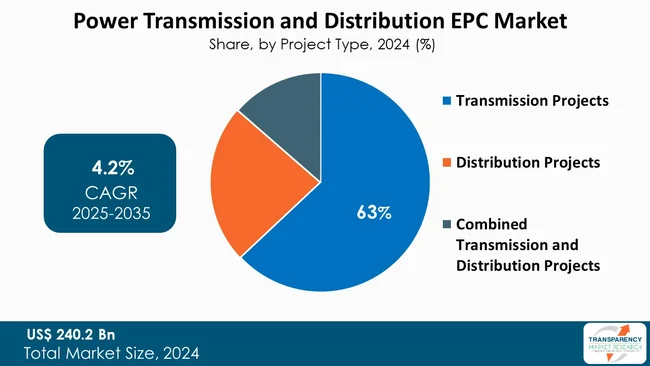

The transmission projects type held the largest shares within the project type segment and was anticipated to grow at an estimated CAGR of 5.1% during the forecast period

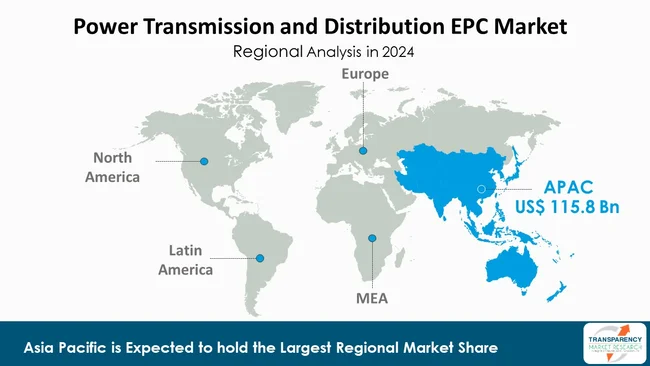

Asia Pacific was the most lucrative region in 2024

Nexans, Larsen & Toubro Limited, KEC International Ltd., Sterlite Electric Limited, Tata Projects Limited, SPML Infra Limited and WSP Global Inc. are the major players in the power transmission and distribution EPC market

Table 1 Global Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 2 Global Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 3 Global Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 4 Global Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 5 Global Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 6 Global Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 7 North America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 8 North America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 9 North America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 10 North America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 11 North America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 12 North America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13 U.S. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 14 U.S. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 15 U.S. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 16 U.S. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 17 U.S. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 18 Canada Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 19 Canada Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 20 Canada Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 21 Canada Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 22 Canada Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 23 Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 24 Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 25 Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 26 Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 27 Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 28 Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 29 Germany Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 30 Germany Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 31 Germany Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 32 Germany Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 33 Germany Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 34 France Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 35 France Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 36 France Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 37 France Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 38 France Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 39 U.K. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 40 U.K. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 41 U.K. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 42 U.K. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 43 U.K. Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 44 Italy Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 45 Italy Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 46 Italy Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 47 Italy Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 48 Italy Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 49 Spain Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 50 Spain Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 51 Spain Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 52 Spain Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 53 Spain Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 54 Russia & CIS Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 55 Russia & CIS Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 56 Russia & CIS Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 57 Russia & CIS Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 58 Russia & CIS Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 59 Rest of Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 60 Rest of Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 61 Rest of Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 62 Rest of Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 63 Rest of Europe Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 64 Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 65 Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 66 Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 67 Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 68 Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 69 Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 70 China Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type 2020 to 2035

Table 71 China Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 72 China Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 73 China Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 74 China Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 75 Japan Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 76 Japan Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 77 Japan Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 78 Japan Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 79 Japan Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 80 India Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 81 India Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 82 India Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 83 India Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 84 India Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 85 ASEAN Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 86 ASEAN Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 87 ASEAN Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 88 ASEAN Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 89 ASEAN Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 90 Rest of Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 91 Rest of Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 92 Rest of Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 93 Rest of Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 94 Rest of Asia Pacific Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 95 Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 96 Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 97 Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 98 Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 99 Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 100 Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 101 Brazil Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 102 Brazil Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 103 Brazil Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 104 Brazil Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 105 Brazil Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 106 Mexico Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 107 Mexico Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 108 Mexico Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 109 Mexico Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 110 Mexico Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 111 Rest of Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 112 Rest of Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 113 Rest of Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 114 Rest of Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 115 Rest of Latin America Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 116 Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 117 Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 118 Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 119 Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 120 Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 121 Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 122 GCC Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 123 GCC Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 124 GCC Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 125 GCC Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 126 GCC Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 South Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 128 South Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 129 South Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 130 South Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 131 South Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 132 Rest of Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Project Type, 2020 to 2035

Table 133 Rest of Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 134 Rest of Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 135 Rest of Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by Voltage Level, 2020 to 2035

Table 136 Rest of Middle East & Africa Power Transmission and Distribution EPC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Power Transmission and Distribution EPC Market Attractiveness, by Project Type

Figure 2 Global Power Transmission and Distribution EPC Market Attractiveness, by Service Type

Figure 3 Global Power Transmission and Distribution EPC Market Attractiveness, by Technology

Figure 4 Global Power Transmission and Distribution EPC Market Attractiveness, by Voltage Level

Figure 5 Global Power Transmission and Distribution EPC Market Attractiveness, by End-use

Figure 6 Global Power Transmission and Distribution EPC Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 7 Global Power Transmission and Distribution EPC Market Attractiveness, by Region

Figure 8 North America Power Transmission and Distribution EPC Market Attractiveness, by Project Type

Figure 9 North America Power Transmission and Distribution EPC Market Attractiveness, by Service Type

Figure 10 North America Power Transmission and Distribution EPC Market Attractiveness, by Technology

Figure 11 North America Power Transmission and Distribution EPC Market Attractiveness, by Voltage Level

Figure 12 North America Power Transmission and Distribution EPC Market Attractiveness, by End-use

Figure 13 North America Power Transmission and Distribution EPC Market Attractiveness, by Country and Sub-region

Figure 14 Europe Power Transmission and Distribution EPC Market Attractiveness, by Project Type

Figure 15 Europe Power Transmission and Distribution EPC Market Attractiveness, by Service Type

Figure 16 Europe Power Transmission and Distribution EPC Market Attractiveness, by Technology

Figure 17 Europe Power Transmission and Distribution EPC Market Attractiveness, by Voltage Level

Figure 18 Europe Power Transmission and Distribution EPC Market Attractiveness, by End-use

Figure 19 Europe Power Transmission and Distribution EPC Market Attractiveness, by Country and Sub-region

Figure 20 Asia Pacific Power Transmission and Distribution EPC Market Attractiveness, by Project Type

Figure 21 Asia Pacific Power Transmission and Distribution EPC Market Attractiveness, by Service Type

Figure 22 Asia Pacific Power Transmission and Distribution EPC Market Attractiveness, by Technology

Figure 23 Asia Pacific Power Transmission and Distribution EPC Market Attractiveness, by Voltage Level

Figure 24 Asia Pacific Power Transmission and Distribution EPC Market Attractiveness, by End-use

Figure 25 Asia Pacific Power Transmission and Distribution EPC Market Attractiveness, by Country and Sub-region

Figure 26 Latin America Power Transmission and Distribution EPC Market Attractiveness, by Project Type

Figure 27 Latin America Power Transmission and Distribution EPC Market Attractiveness, by Service Type

Figure 28 Latin America Power Transmission and Distribution EPC Market Attractiveness, by Technology

Figure 29 Latin America Power Transmission and Distribution EPC Market Attractiveness, by Voltage Level

Figure 30 Latin America Power Transmission and Distribution EPC Market Attractiveness, by End-use

Figure 31 Latin America Power Transmission and Distribution EPC Market Attractiveness, by Country and Sub-region

Figure 32 Middle East & Africa Power Transmission and Distribution EPC Market Attractiveness, by Project Type

Figure 33 Middle East & Africa Power Transmission and Distribution EPC Market Attractiveness, by Service Type

Figure 34 Middle East & Africa Power Transmission and Distribution EPC Market Attractiveness, by Technology

Figure 35 Middle East & Africa Power Transmission and Distribution EPC Market Attractiveness, by Voltage Level

Figure 36 Middle East & Africa Power Transmission and Distribution EPC Market Attractiveness, by End-use

Figure 37 Middle East & Africa Power Transmission and Distribution EPC Market Attractiveness, by Country and Sub-region