Reports

Reports

Analyst Viewpoint

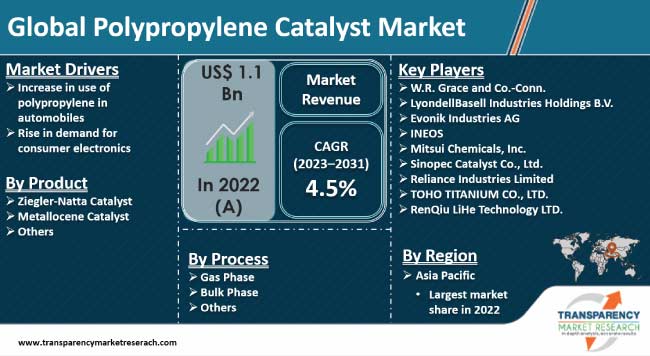

Increase in use of polypropylene in automobiles and rise in demand for consumer electronics are fueling the polypropylene catalyst market size. Polypropylene catalysts have a high tolerance to temperature, chemicals, and moisture, thereby being widely utilized to manufacture mechanical components in electronic devices and vehicles. Surge in popularity of electric vehicles and rise in awareness regarding sustainability are driving the market landscape.

Advancements in manufacturing facilities and rapid industrialization are likely to offer lucrative polypropylene catalyst market opportunities to leading players. Manufacturers of polypropylene catalysts are focusing on production expansion by setting up new production facilities. They are investing in new product launches to expand their product portfolio and increase their polypropylene catalyst industry share.

Polypropylene catalyst is used in the conversion process of propylene to polypropylene. This process is termed as polymerization. Various catalysts are employed for this conversion, including the Ziegler-Natta catalyst and metallocene catalyst. Polypropylene is a crucial element in the manufacturing sector due to its several properties such as mechanical strength, heat resistance, rigidity, chemical resistance, and integral hinge. Manufacturers utilize high-quality catalysts for polypropylene production to improve component quality, durability, and reliability.

Metallocene polypropylene is extensively employed in food and medical packaging processes due to its contamination-resistance properties. The advantages of catalysts in polypropylene production in the packaging sector include flexibility, heat resistance, moisture resistance, and enhanced product shelf life. Moreover, polypropylene has high tensile strength, making it suitable for use in textiles, laboratory equipment, electronic devices, and automobile components.

Small automotive components are manufactured through injection molding procedure using polypropylene as it is corrosion-resistant and has high heat tolerance. Hence, the automotive sector is one of the largest consumers of polypropylene catalysts. Increase in production and sales of automobiles across the globe is driving the demand for polypropylene catalysts. Production of electric vehicles is increasing due to continuous innovations in polypropylene catalyst technology, thereby fostering the polypropylene catalyst market value.

According to the Argonne National Laboratory, in December 2023, 117,690 Hybrid Electric Vehicles (HEVs) were sold in the U.S., of which 31,825 were cars and 85,865 were Light Trucks (LTs), up 70.3% from the sales in December 2022. Increase in awareness about sustainability and implementation of stringent government regulations on pollution control are boosting the polypropylene catalyst market progress.

Consumer electronics, such as televisions, smartphones, laptops, computers, and air conditioners, consist of multiple mechanical components. Polypropylene is used to manufacture these components to make them rust-resistant, corrosion-resistant, and operate precisely under fluctuating temperatures and voltage supplies. Increase in demand for consumer electronics is augmenting the polypropylene catalyst market expansion.

According to the India Brand Equity Foundation, in 2023, electronics exports increased by 13.8%, the highest in the last 6 years. India aims to achieve electronics manufacturing worth US$ 300 Bn by 2026. Thus, increase in investment in the manufacturing of electronic appliances is bolstering the market expansion.

As per the latest polypropylene catalyst market analysis, Asia Pacific dominated the sector in 2022. Expansion in automotive sector is propelling the market dynamics of the region. Polypropylene catalyst is utilized to manufacture small components in vehicles. Rise in demand for lightweight vehicles and increase in popularity of electric vehicles are driving the demand for polypropylene catalysts in Asia Pacific. Moreover, surge in vehicle sales is fostering the market polypropylene catalyst statistics in the region.

According to the India Brand Equity Foundation, India registered sales of around 261,633 passenger vehicles in 2021, acquiring 12.9% of the total market share. Similarly, as per the China Association of Automobile Manufacturers, approximately 310,000 commercial vehicles were manufactured in China in 2021, increasing 35.5% every month.

Leading players in the market are investing in technological advancements in polypropylene catalysts to improve product quality and performance. High-temperature tolerance and innovation in manufacturing procedures are recent polypropylene catalyst market trends. Manufacturers are conducting research and development activities to analyze consumer demands and introduce new products accordingly.

Some of the leading companies in the market are W. R. Grace & Co.-Conn, LyondellBasell Industries Holdings B.V., Evonik Industries AG, INEOS, Mitsui Chemicals, Inc., Sinopec Catalyst Co., Ltd., Reliance Industries Limited, Toho Titanium Co., Ltd., and Renqiu Lihe Technology Co., Ltd.

These companies have been profiled in the polypropylene catalyst market report based on parameters, such as business strategies, financial overview, product portfolio, company overview, recent developments, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.1 Bn |

| Market Forecast (Value) in 2031 | US$ 1.7 Bn |

| Growth Rate (CAGR) | 4.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Tons | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.1 Bn in 2022

It is projected to grow at a CAGR of 4.5% from 2023 to 2031

Increase in use of polypropylene in automobiles and rise in demand for consumer electronics

Asia Pacific was the most lucrative region in 2022

W. R. Grace & Co.-Conn, LyondellBasell Industries Holdings B.V., Evonik Industries AG, INEOS, Mitsui Chemicals, Inc., Sinopec Catalyst Co., Ltd., Reliance Industries Limited, Toho Titanium Co., Ltd., and Renqiu Lihe Technology Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. Product Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2022

5. Price Trend Analysis

6. Global Polypropylene Catalyst Market Analysis and Forecast, by Product, 2020–2031

6.1. Introduction and Definitions

6.2. Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.2.1. Ziegler-Natta Catalyst

6.2.2. Metallocene Catalyst

6.2.3. Others

6.3. Global Polypropylene Catalyst Market Attractiveness, by Product

7. Global Polypropylene Catalyst Market Analysis and Forecast, by Process, 2020–2031

7.1. Introduction and Definitions

7.2. Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

7.2.1. Gas Phase

7.2.2. Bulk Phase

7.2.3. Others

7.3. Global Polypropylene Catalyst Market Attractiveness, by Process

8. Global Polypropylene Catalyst Market Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.2.1. Films

8.2.2. Fibers

8.2.3. Tubes

8.2.4. Injection-molded Products

8.2.5. Others

8.3. Global Polypropylene Catalyst Market Attractiveness, by Application

9. Global Polypropylene Catalyst Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Polypropylene Catalyst Market Attractiveness, by Region

10. North America Polypropylene Catalyst Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.3. North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

10.4. North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.5.1. U.S. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.2. U.S. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

10.5.3. U.S. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.4. Canada Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.5. Canada Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

10.5.6. Canada Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.6. North America Polypropylene Catalyst Market Attractiveness Analysis

11. Europe Polypropylene Catalyst Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.3. Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.4. Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. Germany Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.5.2. Germany Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.5.3. Germany Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.4. France Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.5.5. France Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.5.6. France Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.7. U.K. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.5.8. U.K. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.5.9. U.K. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.10. Italy Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.5.11. Italy. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.5.12. Italy Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.13. Russia & CIS Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.5.14. Russia & CIS Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.5.15. Russia & CIS Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.16. Rest of Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.5.17. Rest of Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

11.5.18. Rest of Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.6. Europe Polypropylene Catalyst Market Attractiveness Analysis

12. Asia Pacific Polypropylene Catalyst Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product

12.3. Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

12.4. Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. China Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.5.2. China Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

12.5.3. China Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.4. Japan Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.5.5. Japan Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

12.5.6. Japan Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.7. India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.5.8. India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

12.5.9. India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.10. ASEAN Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.5.11. ASEAN Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

12.5.12. ASEAN Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.13. Rest of Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.5.14. Rest of Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

12.5.15. Rest of Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.6. Asia Pacific Polypropylene Catalyst Market Attractiveness Analysis

13. Latin America Polypropylene Catalyst Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.3. Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

13.4. Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. Brazil Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.5.2. Brazil Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

13.5.3. Brazil Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.4. Mexico Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.5.5. Mexico Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

13.5.6. Mexico Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.7. Rest of Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.5.8. Rest of Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

13.5.9. Rest of Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.6. Latin America Polypropylene Catalyst Market Attractiveness Analysis

14. Middle East & Africa Polypropylene Catalyst Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.3. Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

14.4. Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5. Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

14.5.1. GCC Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.5.2. GCC Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

14.5.3. GCC Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.4. South Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.5.5. South Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

14.5.6. South Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.7. Rest of Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.5.8. Rest of Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

14.5.9. Rest of Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.6. Middle East & Africa Polypropylene Catalyst Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Polypropylene Catalyst Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. W.R. Grace and Co.-Conn

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. LyondellBasell Industries Holdings B.V.

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Evonik Industries AG

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. INEOS

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Mitsui Chemicals, Inc.

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Sinopec Catalyst Co., Ltd.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Reliance Industries Limited

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Toho Titanium Co., Ltd.

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. RenQiu LiHe Technology Co., Ltd.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 2: Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 3: Global Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 4: Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 5: Global Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 6: Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: Global Polypropylene Catalyst Market Forecast, by Region, 2020–2031

Table 8: Global Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 9: North America Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 10: North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 11: North America Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 12: North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 13: North America Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 14: North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: North America Polypropylene Catalyst Market Forecast, by Country, 2020–2031

Table 16: North America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 17: U.S. Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 18: U.S. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 19: U.S. Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 20: U.S. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 21: U.S. Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 22: U.S. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Canada Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 24: Canada Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 25: Canada Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 26: Canada Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 27: Canada Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 28: Canada Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Europe Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 30: Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 31: Europe Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 32: Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 33: Europe Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 34: Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Europe Polypropylene Catalyst Market Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 38: Germany Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 39: Germany Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 40: Germany Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 41: Germany Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 42: Germany Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: France Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 44: France Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 45: France Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 46: France Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 47: France Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 48: France Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 49: U.K. Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 50: U.K. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 51: U.K. Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 52: U.K. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 53: U.K. Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 54: U.K. Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Italy Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 56: Italy Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 57: Italy Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 58: Italy Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 59: Italy Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 60: Italy Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 61: Spain Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 62: Spain Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 63: Spain Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 64: Spain Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 65: Spain Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 66: Spain Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Russia & CIS Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 68: Russia & CIS Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 69: Russia & CIS Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 70: Russia & CIS Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 71: Russia & CIS Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 72: Russia & CIS Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: Rest of Europe Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 74: Rest of Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 75: Rest of Europe Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 76: Rest of Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 77: Rest of Europe Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 78: Rest of Europe Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 79: Asia Pacific Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 80: Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 81: Asia Pacific Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 82: Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 83: Asia Pacific Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 84: Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Asia Pacific Polypropylene Catalyst Market Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 88: China Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product 2020–2031

Table 89: China Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 90: China Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 91: China Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 92: China Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 93: Japan Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 94: Japan Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 95: Japan Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 96: Japan Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 97: Japan Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 98: Japan Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: India Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 100: India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 101: India Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 102: India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 103: India Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 104: India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 105: India Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 106: India Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application 2020–2031

Table 107: ASEAN Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 108: ASEAN Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 109: ASEAN Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 110: ASEAN Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 111: ASEAN Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 112: ASEAN Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: Rest of Asia Pacific Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 114: Rest of Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 115: Rest of Asia Pacific Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 116: Rest of Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 117: Rest of Asia Pacific Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 118: Rest of Asia Pacific Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 119: Latin America Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 120: Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 121: Latin America Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 122: Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 123: Latin America Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 124: Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 125: Latin America Polypropylene Catalyst Market Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 128: Brazil Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 129: Brazil Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 130: Brazil Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 131: Brazil Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 132: Brazil Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 133: Mexico Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 134: Mexico Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 135: Mexico Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 136: Mexico Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 137: Mexico Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 138: Mexico Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 139: Rest of Latin America Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 140: Rest of Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 141: Rest of Latin America Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 142: Rest of Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 143: Rest of Latin America Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 144: Rest of Latin America Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 145: Middle East & Africa Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 146: Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 147: Middle East & Africa Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 148: Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 149: Middle East & Africa Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 150: Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 151: Middle East & Africa Polypropylene Catalyst Market Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 154: GCC Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 155: GCC Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 156: GCC Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 157: GCC Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 158: GCC Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 159: South Africa Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 160: South Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 161: South Africa Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 162: South Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 163: South Africa Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 164: South Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 165: Rest of Middle East & Africa Polypropylene Catalyst Market Forecast, by Product, 2020–2031

Table 166: Rest of Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 167: Rest of Middle East & Africa Polypropylene Catalyst Market Forecast, by Process, 2020–2031

Table 168: Rest of Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020–2031

Table 169: Rest of Middle East & Africa Polypropylene Catalyst Market Forecast, by Application, 2020–2031

Table 170: Rest of Middle East & Africa Polypropylene Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Polypropylene Catalyst Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 2: Global Polypropylene Catalyst Market Attractiveness, by Product

Figure 3: Global Polypropylene Catalyst Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 4: Global Polypropylene Catalyst Market Attractiveness, by Process

Figure 5: Global Polypropylene Catalyst Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 6: Global Polypropylene Catalyst Market Attractiveness, by Application

Figure 7: Global Polypropylene Catalyst Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Polypropylene Catalyst Market Attractiveness, by Region

Figure 9: North America Polypropylene Catalyst Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 10: North America Polypropylene Catalyst Market Attractiveness, by Product

Figure 11: North America Polypropylene Catalyst Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 12: North America Polypropylene Catalyst Market Attractiveness, by Process

Figure 13: North America Polypropylene Catalyst Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 14: North America Polypropylene Catalyst Market Attractiveness, by Application

Figure 15: North America Polypropylene Catalyst Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Polypropylene Catalyst Market Attractiveness, by Country

Figure 17: Europe Polypropylene Catalyst Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 18: Europe Polypropylene Catalyst Market Attractiveness, by Product

Figure 19: Europe Polypropylene Catalyst Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 20: Europe Polypropylene Catalyst Market Attractiveness, by Process

Figure 21: Europe Polypropylene Catalyst Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 22: Europe Polypropylene Catalyst Market Attractiveness, by Application

Figure 23: Europe Polypropylene Catalyst Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe Polypropylene Catalyst Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Polypropylene Catalyst Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 26: Asia Pacific Polypropylene Catalyst Market Attractiveness, by Product

Figure 27: Asia Pacific Polypropylene Catalyst Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 28: Asia Pacific Polypropylene Catalyst Market Attractiveness, by Process

Figure 29: Asia Pacific Polypropylene Catalyst Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 30: Asia Pacific Polypropylene Catalyst Market Attractiveness, by Application

Figure 31: Asia Pacific Polypropylene Catalyst Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific Polypropylene Catalyst Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Polypropylene Catalyst Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 34: Latin America Polypropylene Catalyst Market Attractiveness, by Product

Figure 35: Latin America Polypropylene Catalyst Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 36: Latin America Polypropylene Catalyst Market Attractiveness, by Process

Figure 37: Latin America Polypropylene Catalyst Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 38: Latin America Polypropylene Catalyst Market Attractiveness, by Application

Figure 39: Latin America Polypropylene Catalyst Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America Polypropylene Catalyst Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Polypropylene Catalyst Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 42: Middle East & Africa Polypropylene Catalyst Market Attractiveness, by Product

Figure 43: Middle East & Africa Polypropylene Catalyst Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 44: Middle East & Africa Polypropylene Catalyst Market Attractiveness, by Process

Figure 45: Middle East & Africa Polypropylene Catalyst Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 46: Middle East & Africa Polypropylene Catalyst Market Attractiveness, by Application

Figure 47: Middle East & Africa Polypropylene Catalyst Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa Polypropylene Catalyst Market Attractiveness, by Country and Sub-region