Reports

Reports

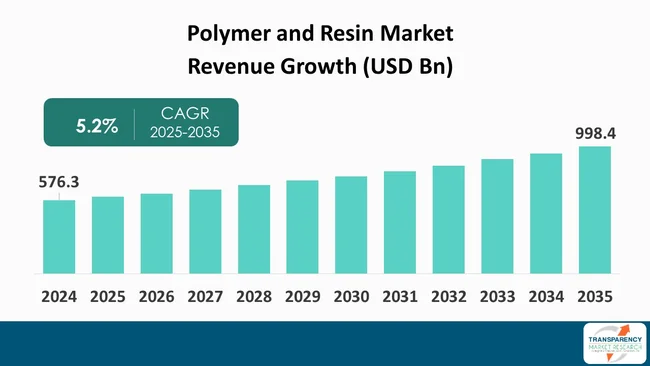

The global polymer and resin market size was valued at US$ 576.3 billion in 2024 and is projected to reach US$ 998.4 billion by 2035, expanding at a CAGR of 5.2% from 2025 to 2035. The market growth is driven rising demand from the automotive and transportation sector, and expansion of the packaging industry across emerging economies.

The worldwide polymer and resin market is witnessing steadiness. The main attributes are the increased consumption in the automotive, packaging, and construction sectors. Light polymers such as polypropylene, polyethylene, and polyamide are being used extensively to replace metal parts in order to improve fuel consumption and comply with the sustainability requirements of the mobility sector.

At the same time, resins such as epoxy, polyester, and acrylic continue to be the major products in coatings, adhesives, and composites, with their usage being extended by packaging and infrastructure sectors in the emerging economies. The innovation followed by sizable consumption have been accelerated by the rapid development of e-Commerce, urbanization, and the transition to electric vehicles apart from the existing trends.

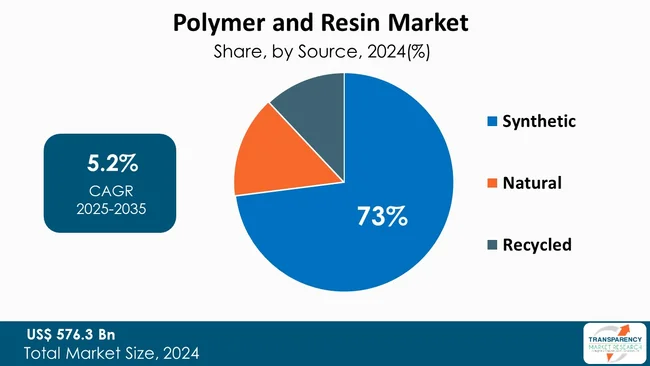

Synthetic polymers hold the largest share due to their scalability and cost efficiency. However, the shift to bio-based and recyclable polymers is getting stronger as environmental regulations become stricter. Asia Pacific leads with respect to global production and consumption. Europe and North America follow, where the next market growth is being shaped by the continuous investments in advanced materials and circular value chains.

Polymers and resins are highly regarded for their durability, versatility, and cheapness. Polymers are made up of long chains of repeating molecular units and are thus the structural components of majority of the products, whereas resins are the base materials or the precursors to the production of polymers. At the same time, they are the adhesives, binders, or coatings in various applications.

The biggest polymers such as polypropylene (PP), polyethylene (PE), polystyrene (PS), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and acrylonitrile butadiene styrene (ABS) are the main factors in construction, packaging, and automotive. The use of high-performance polymers such as polycarbonate (PC), polyamide (PA), polytetrafluoroethylene (PTFE), and polyether ether ketone (PEEK) in aerospace, electronics, and medical sectors is due to their exceptional thermal and mechanical properties.

Industrial production is largely driven by the use of phenolic resins, epoxy resins, polyester resins, melamine-formaldehyde, urea-formaldehyde, alkyd resins, and acrylic resins. These resins are essential components in composites, coatings, adhesives, and molding compounds. There is a rising environmental concern, which has led to the increased use of recyclable and bio-based polymers and resins that are less harmful to the environment. Worldwide producers are progressively putting their money in technological innovation and in the implementation of circular production models as a way to improve the performance of the materials, lower the carbon footprints, and being able to satisfy the demand, which keeps changing in sectors with rapid growth all over the world.

| Attribute | Detail |

|---|---|

| Polymer and Resin Market Drivers |

|

The increased usage of polymers and resins in the automotive and transportation industry has been a major factor that has led to the expansion of the market for polymers and resins worldwide. To lower the weight of vehicles, enhance fuel efficiency, and reduce carbon emissions, the lightweight polymers that include polypropylene (PP), polyurethane (PU), and polyamide (PA) are increasingly replacing the traditional metals.

It is worth noting that a 10% vehicle weight reduction can fuel the vehicle economy by 6-8%, thus the economic and environmental benefits of polymers made evident. In comparison with less than 100 kilograms that was the average plastic and polymer composites weight in vehicles two decades ago, modern vehicles are equipped with more than 150 kilograms of these materials thus reflecting the industry's trend of shifting to advanced materials.

Epoxy, polyester, and acrylic resins are the prime sources of general metal protective layers, bonding agents, and composite materials in the automotive industry due to the performance, resistance to attack, and beauty enhancement requirements. The extensive use of electric vehicles (EVs) will be the main reason for the further increased demand for polymers as these vehicles are dependent on the usage of lightweight materials if they are to be able to carry the heavy batteries.

The International Energy Agency (IEA) has stated that worldwide sales of EVs surpassed 14 Mn units in 2024 thus creating considerable opportunities for high-performance polymers and resins. The rapid growth in public transit projects and the aircraft industry, in turn, is a double hit to the market of polymers and resins reinforcing its expansion. As automotive manufacturers are chasing sustainability and efficiency, polymers and resins remain to be the main players in turning the concept of next-generation mobility into reality.

The global polymer and resin market is notably influenced by the quick growth of the packaging industry in the several developing countries. The ongoing trend of the city lifestyle and e-commerce activities are some of the factors driving the demand for rigid, flexible, and specialty packaging materials.

Polymers such as polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), and polystyrene (PS) are the main materials used in packaging as they are lightweight, cheap, and strong. The total global packaging demand was more than US$ 1 Trillion in 2024 as per the World Packaging Organization, with the Asia-Pacific region contributing significantly to the total consumption, and this was mainly due to the rapid growth in China, Indonesia, and Vietnam.

Resins like epoxy, acrylic, and polyester are essentially used in laminations, coatings, and adhesives to improve the beauty, durability, and barrier properties of the packaging materials. The food & beverages and pharmaceutical sectors in the emerging markets is one of the major consumers of polymer-based packaging, which, in turn, is promoting the demand for tamper-resistant, hygienic, and eco-friendly solutions.

China’s packaging output exceeded 68 million metric tons in 2024, which is an indication of the sector’s fast scaling. Additionally, the rising investment in recyclable and biodegradable polymer packaging goes well with the global sustainability goals, thus, the packaging industry is positioned as one of the major drivers to the polymer and resin market over the upcoming period.

The synthetic segment leads the global polymer and resin market. This is because synthetic polymers and resins that are the products of petrochemical feedstock like propylene, ethylene, and styrene, are opted for their higher chemical resistance, mechanical strength, and lower cost.

The four major synthetic polymers, namely polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and polyethylene terephthalate (PET) that are collectively responsible for over 80% of the worldwide polymer demand, are mainly driven by their extensive use in the automotive, packaging, construction, and electronics industries.

Synthetic resins like phenolic, epoxy, urea-formaldehyde, and alkyd are dominant in adhesives, coatings, and composites, where they deliver impressive thermal and convert structural properties. The availability of petrochemical raw materials and the advancements in polymerization technology have paved the way for mass production that is economical in the major markets such as China, the U.S., and the Middle East. As per Plastics Europe, global plastics production was around 400.3 Mn metric tons in 2022, with the major part of it being synthetic polymers.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific region leads the market for polymers and resins globally. The market in the region is influenced by the growing industrial capacity, rapid urbanization, and the increased use of resins in the automotive, packaging, and construction industries.

Asia Pacific is the source of over 34% of global polymer demand, with the bulk of it coming from the leading economies of Japan, China, and South Korea. China alone is the largest producer of plastics in the world, with an output of over 120 Mn metric tons per year.

Europe is the second largest market characterized by advanced manufacturing technologies and stern environmental regulations that encourage the use of bio-based and recyclable polymers. France and Germany, for instance, are the leaders regarding the use of high-performance resins in the aerospace and automotive sectors.

North America stands third, contributing to about 22% to the global consumption of polymers. The region’s demand for polymers is mainly from construction, packaging, and electronics industries. The United States is still a major exporter of epoxy resins and polyethylene and thus is one of the main economies to benefit from the well-established polymers and plentiful shale gas feedstock.

BASF SE is a global leader in the polymer & resin market. It is known for its wide product range, eco-friendly manufacturing processes, and technological innovation. The company offers a full line of high-performance polymers and resins like polyamides, acrylics, polyurethanes, and epoxy systems that are used in the construction, automotive, packaging, and electronics industries.

One of the major contributors to the global polymers and resins market is SABIC, which is based in Riyadh. Some of the major products supplied by the company are polypropylene (PP), polyethylene (PE), polycarbonate (PC), and performance resins. Through its many plants worldwide that are well integrated into the petrochemical market, SABIC is able to make provisions for polymer solutions that are tailored to the needs of diverse industries like automotive, healthcare, packaging, and construction.

Eastman Chemical Company, Chevron Phillips Chemical, LyondellBasell, Avient Corporation, Braskem SA, DuPont de Nemours, Inc, Celanese Corporation, Arkema SA, Toray Industries Inc, Huntsman Corporation, Evonik Industries AG, Covestro AG, Mitsubishi Chemical Group, LG Chem Ltd, Tejin Limited, Syensqo, Wacker Chemie AG, Formosa Plastics Corporation are the companies in the global polymer and resin industry.

Each of these players has been profiled in the polymer and resin market research report based on parameters such as financial overview, company overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 576.3 Billion |

| Market Forecast Value in 2035 | US$ 998.4 Billion |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | USD Billion for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Polymer and Resin market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Resin Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The polymer and resin market was valued at US$ 576.3 Bn in 2024

The polymer and resin industry is expected to grow at a CAGR of 5.2% from 2025 to 2035

Rising demand from the automotive and transportation sector, and expansion of the packaging industry across emerging economies.

Synthetic was the largest source segment in the global polymer and resin market.

Asia Pacific was the most lucrative region in 2024

Eastman Chemical Company, Chevron Phillips Chemical, LyondellBasell, Avient Corporation, Braskem SA, DuPont de Nemours, Inc, Celanese Corporation, Arkema SA, Toray Industries Inc, Huntsman Corporation, Evonik Industries AG, Covestro AG, BASF SE, SABIC, Mitsubishi Chemical Group, LG Chem Ltd, Tejin Limited, Syensqo, Wacker Chemie AG, Formosa Plastics Corporation are the major companies in the global polymer and resin market.

Table 1 Global Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 2 Global Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 3 Global Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 4 Global Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 5 Global Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology 2020 to 2035

Table 6 Global Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology 2020 to 2035

Table 7 Global Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 8 Global Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 10 Global Polymer and Resin Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 11 Global Polymer and Resin Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 12 Global Polymer and Resin Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 14 North America Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 15 North America Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 16 North America Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 17 North America Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology 2020 to 2035

Table 18 North America Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology 2020 to 2035

Table 19 North America Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 North America Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 North America Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 North America Polymer and Resin Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 North America Polymer and Resin Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 24 North America Polymer and Resin Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 U.S. Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 26 U.S. Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 27 U.S. Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 28 U.S. Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 29 U.S. Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology 2020 to 2035

Table 30 U.S. Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 31 U.S. Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 U.S. Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 U.S. Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 U.S. Polymer and Resin Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Canada Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 36 Canada Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 37 Canada Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 38 Canada Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 39 Canada Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 40 Canada Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 41 Canada Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Canada Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Canada Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Canada Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 46 Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 47 Europe Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 48 Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 49 Europe Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology 2020 to 2035

Table 50 Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 51 Europe Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Europe Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Europe Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 Europe Polymer and Resin Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 58 Germany Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 59 Germany Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 60 Germany Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 61 Germany Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 62 Germany Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 63 Germany Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Germany Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Germany Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Germany Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 67 France Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 68 France Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 69 France Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 70 France Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 71 France Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 72 France Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 73 France Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 74 France Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 France Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 76 France Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 77 U.K. Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 78 U.K. Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 79 U.K. Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 80 U.K. Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 81 U.K. Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 82 U.K. Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 83 U.K. Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 U.K. Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 U.K. Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 U.K. Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Italy Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 88 Italy Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 89 Italy Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 90 Italy Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 91 Italy Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 92 Italy Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 93 Italy Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 94 Italy Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 95 Italy Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 96 Italy Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 97 Spain Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 98 Spain Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 99 Spain Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 100 Spain Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 101 Spain Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 102 Spain Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 103 Spain Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 104 Spain Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Spain Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 Spain Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 Russia & CIS Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 108 Russia & CIS Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 109 Russia & CIS Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 110 Russia & CIS Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 111 Russia & CIS Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 112 Russia & CIS Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 113 Russia & CIS Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 114 Russia & CIS Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Russia & CIS Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 116 Russia & CIS Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 117 Rest of Europe Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 118 Rest of Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 119 Rest of Europe Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 120 Rest of Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 121 Rest of Europe Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 122 Rest of Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 123 Rest of Europe Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 124 Rest of Europe Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Rest of Europe Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 126 Rest of Europe Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 128 Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 129 Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 130 Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 131 Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 132 Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 133 Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 140 China Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type 2020 to 2035

Table 141 China Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 142 China Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 143 China Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 144 China Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 145 China Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 146 China Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 147 China Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 148 China Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 149 Japan Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 150 Japan Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 151 Japan Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 152 Japan Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 153 Japan Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 154 Japan Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 155 Japan Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 Japan Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 Japan Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 Japan Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 159 India Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 160 India Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 161 India Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 162 India Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 163 India Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 164 India Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 165 India Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 166 India Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 167 India Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 168 India Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 169 ASEAN Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 170 ASEAN Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 171 ASEAN Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 172 ASEAN Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 173 ASEAN Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 174 ASEAN Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 175 ASEAN Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 ASEAN Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 ASEAN Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 ASEAN Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 180 Rest of Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 181 Rest of Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 182 Rest of Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 183 Rest of Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 184 Rest of Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 185 Rest of Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 186 Rest of Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Rest of Asia Pacific Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 188 Rest of Asia Pacific Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 Latin America Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 190 Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 191 Latin America Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 192 Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 193 Latin America Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 194 Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 195 Latin America Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 196 Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 197 Latin America Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 198 Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 199 Latin America Polymer and Resin Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 202 Brazil Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 203 Brazil Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 204 Brazil Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 205 Brazil Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 206 Brazil Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 207 Brazil Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 208 Brazil Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 209 Brazil Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 210 Brazil Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 211 Mexico Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 212 Mexico Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 213 Mexico Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 214 Mexico Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 215 Mexico Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 216 Mexico Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 217 Mexico Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Mexico Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Mexico Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Mexico Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 221 Rest of Latin America Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 222 Rest of Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 223 Rest of Latin America Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 224 Rest of Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 225 Rest of Latin America Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 226 Rest of Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 227 Rest of Latin America Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 228 Rest of Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 229 Rest of Latin America Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 230 Rest of Latin America Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 231 Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 232 Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 233 Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 234 Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 235 Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 236 Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 237 Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 238 Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 239 Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 240 Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 241 Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 244 GCC Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 245 GCC Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 246 GCC Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 247 GCC Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 248 GCC Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 249 GCC Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 250 GCC Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 251 GCC Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 252 GCC Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 253 South Africa Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 254 South Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 255 South Africa Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 256 South Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 257 South Africa Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 258 South Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 259 South Africa Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 260 South Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 South Africa Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 262 South Africa Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 264 Rest of Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 265 Rest of Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 266 Rest of Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 267 Rest of Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Processing Technology, 2020 to 2035

Table 268 Rest of Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Processing Technology, 2020 to 2035

Table 269 Rest of Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 270 Rest of Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 271 Rest of Middle East & Africa Polymer and Resin Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 272 Rest of Middle East & Africa Polymer and Resin Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Polymer and Resin Market Volume Share Analysis, by Resin Type, 2024, 2028, and 2035

Figure 2 Global Polymer and Resin Market Attractiveness, by Resin Type

Figure 3 Global Polymer and Resin Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 4 Global Polymer and Resin Market Attractiveness, by Source

Figure 5 Global Polymer and Resin Market Volume Share Analysis, by Processing Technology, 2024, 2028, and 2035

Figure 6 Global Polymer and Resin Market Attractiveness, by Processing Technology

Figure 7 Global Polymer and Resin Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Global Polymer and Resin Market Attractiveness, by Application

Figure 9 Global Polymer and Resin Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 10 Global Polymer and Resin Market Attractiveness, by End-use

Figure 11 Global Polymer and Resin Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 12 Global Polymer and Resin Market Attractiveness, by Region

Figure 13 North America Polymer and Resin Market Volume Share Analysis, by Resin Type, 2024, 2028, and 2035

Figure 14 North America Polymer and Resin Market Attractiveness, by Resin Type

Figure 15 North America Polymer and Resin Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 16 North America Polymer and Resin Market Attractiveness, by Source

Figure 17 North America Polymer and Resin Market Volume Share Analysis, by Processing Technology, 2024, 2028, and 2035

Figure 18 North America Polymer and Resin Market Attractiveness, by Processing Technology

Figure 19 North America Polymer and Resin Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 20 North America Polymer and Resin Market Attractiveness, by Application

Figure 21 North America Polymer and Resin Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22 North America Polymer and Resin Market Attractiveness, by End-use

Figure 23 North America Polymer and Resin Market Attractiveness, by Country and Sub-region

Figure 24 Europe Polymer and Resin Market Volume Share Analysis, by Resin Type, 2024, 2028, and 2035

Figure 25 Europe Polymer and Resin Market Attractiveness, by Resin Type

Figure 26 Europe Polymer and Resin Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 27 Europe Polymer and Resin Market Attractiveness, by Source

Figure 28 Europe Polymer and Resin Market Volume Share Analysis, by Processing Technology, 2024, 2028, and 2035

Figure 29 Europe Polymer and Resin Market Attractiveness, by Processing Technology

Figure 30 Europe Polymer and Resin Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 31 Europe Polymer and Resin Market Attractiveness, by Application

Figure 32 Europe Polymer and Resin Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 33 Europe Polymer and Resin Market Attractiveness, by End-use

Figure 34 Europe Polymer and Resin Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 35 Europe Polymer and Resin Market Attractiveness, by Country and Sub-region

Figure 36 Asia Pacific Polymer and Resin Market Volume Share Analysis, by Resin Type, 2024, 2028, and 2035

Figure 37 Asia Pacific Polymer and Resin Market Attractiveness, by Resin Type

Figure 38 Asia Pacific Polymer and Resin Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 39 Asia Pacific Polymer and Resin Market Attractiveness, by Source

Figure 40 Asia Pacific Polymer and Resin Market Volume Share Analysis, by Processing Technology, 2024, 2028, and 2035

Figure 41 Asia Pacific Polymer and Resin Market Attractiveness, by Processing Technology

Figure 42 Asia Pacific Polymer and Resin Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 43 Asia Pacific Polymer and Resin Market Attractiveness, by Application

Figure 44 Asia Pacific Polymer and Resin Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 45 Asia Pacific Polymer and Resin Market Attractiveness, by End-use

Figure 46 Asia Pacific Polymer and Resin Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Asia Pacific Polymer and Resin Market Attractiveness, by Country and Sub-region

Figure 48 Latin America Polymer and Resin Market Volume Share Analysis, by Resin Type, 2024, 2028, and 2035

Figure 49 Latin America Polymer and Resin Market Attractiveness, by Resin Type

Figure 50 Latin America Polymer and Resin Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 51 Latin America Polymer and Resin Market Attractiveness, by Source

Figure 52 Latin America Polymer and Resin Market Volume Share Analysis, by Processing Technology, 2024, 2028, and 2035

Figure 53 Latin America Polymer and Resin Market Attractiveness, by Processing Technology

Figure 54 Latin America Polymer and Resin Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 55 Latin America Polymer and Resin Market Attractiveness, by Application

Figure 56 Latin America Polymer and Resin Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 57 Latin America Polymer and Resin Market Attractiveness, by End-use

Figure 58 Latin America Polymer and Resin Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 59 Latin America Polymer and Resin Market Attractiveness, by Country and Sub-region

Figure 60 Middle East & Africa Polymer and Resin Market Volume Share Analysis, by Resin Type, 2024, 2028, and 2035

Figure 61 Middle East & Africa Polymer and Resin Market Attractiveness, by Resin Type

Figure 62 Middle East & Africa Polymer and Resin Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 63 Middle East & Africa Polymer and Resin Market Attractiveness, by Source

Figure 64 Middle East & Africa Polymer and Resin Market Volume Share Analysis, by Processing Technology, 2024, 2028, and 2035

Figure 65 Middle East & Africa Polymer and Resin Market Attractiveness, by Processing Technology

Figure 66 Middle East & Africa Polymer and Resin Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 67 Middle East & Africa Polymer and Resin Market Attractiveness, by Application

Figure 68 Middle East & Africa Polymer and Resin Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 69 Middle East & Africa Polymer and Resin Market Attractiveness, by End-use

Figure 70 Middle East & Africa Polymer and Resin Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 71 Middle East & Africa Polymer and Resin Market Attractiveness, by Country and Sub-region