Reports

Reports

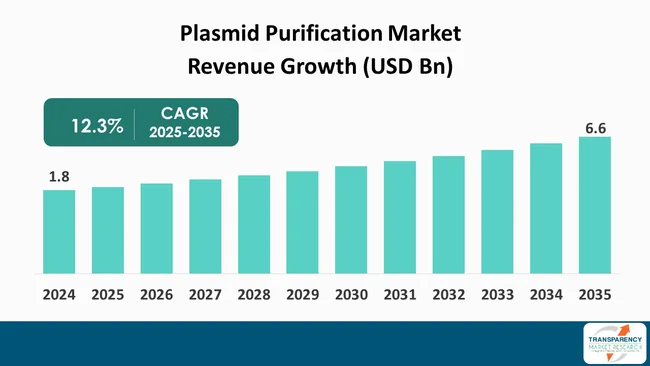

The global plasma purification market size was valued at US$ 1.8 billion in 2024 and is projected to reach US$ 6.6 billion by 2035, expanding at a CAGR of 12.3 % from 2025 to 2035. The plasmid purification market is majorly influenced to expand from the global rise of gene-related research, the increased use of plasmids in advanced therapies, and the general trend of moving towards high-efficiency workflows in molecular biology. Overall, the industry is being fueled by new users that are being attracted by the automated purification systems adoption, reagent chemistry improvements, and the demand for high-quality plasmid DNA in applications like gene therapy, vaccine development, and synthetic biology.

The global plasmid purification market is rapidly expanding. It gets its impetus from the rising need for mRNA vaccines, gene therapies, and cutting-edge molecular diagnostics. The ongoing trends such as investments in R&D and the shift to large-scale plasmid production are resulting in a continuous requirement of purification technologies that are highly pure, can be scaled up, and also used for single-use solutions.

Competitive dynamics that refer to the situation where traditional providers of chromatography and filtration are challenged by the introduction of novel, faster purification chemistries and automated platforms. Also, these regional growth hotspots can be found in the Asia-Pacific and North America. A rapidly increasing use of plasmid DNA in the development of vaccines and in therapeutic applications of cells and genes is the main factor expanding the market scope. It is also perceived that the establishment of strategic collaborations between biotech companies and contract development organizations (CDMOs) will create the necessary conditions for satisfying the demand for GMP-grade plasmids which keeps getting higher.

The plasmid purification market implies a segment of the biotechnology and life sciences industry that deals with the processes of isolation, extraction, and purification of plasmid DNA derived from the bacterial cultures to be used in diverse downstream applications.

Plasmid DNA is a pivotal tool in vaccine production, genetic engineering, molecular diagnostics, and gene therapy. The market offers kits, columns, reagents, and automated systems made for purity and high yield. The market growth is basically attributed to the increased frequency of biopharmaceutical research innovations, the higher demand for gene-based therapies and recombinant proteins, and the increased application of plasmids in the DNA vaccines.

Moreover, the demand for purification solutions that are scalable, efficient, and in compliance with regulations keeps on increasing as pharmaceutical and biotechnological companies increase production. This trend is positively impacting the market across the globe.

For instance, The U.S. FDA came up with a document titled Guidance for Industry - Considerations for Plasmid DNA Vaccines for Infectious Disease Indications, which elaborates on what plasmid DNA vaccines are and their regulation by Section 351 of the Public Health Service Act (42 U.S.C. 262).

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increased need for plasmid DNA is one of the biggest consequences of the development of cell and gene therapies. High-class plasmid DNA has become increasingly essential as the number of clinical trials followed by approved therapies for genetic and rare diseases keeps rising. For instance, the World Health Organization (WHO) and international health organizations have released new statements about the growing numbers, and worsening effects of genetic and uncommon diseases across the globe. The World Health Organization (WHO) reports that approximately 7.9 million babies are born every year with genetic or partially genetic conditions. This represents about 6% of all worldwide births.

Plasmid DNA is a fundamental source material that is necessary for creating viral vectors, mRNA, and the other gene-based therapeutic products. Such a rise in the number of therapeutics in the pipeline is leading to a need for scaled-up, GMP-compliant plasmid manufacturing, and purification technologies. The FDA's Center for Biologics Evaluation and Research (CBER) regulates plasmid DNA products in the U.S. The agency releases guidance documents including the Considerations for Plasmid DNA Vaccines, which offer detailed recommendations for manufacturing processes and quality testing, and preclinical safety assessments, and final product release procedures for clinical-use products.

The plasmid purification market is being majorly influenced by technological advancements that are making the production workflows more efficient and of better quality. One of the main effects of automation has been the increase in throughput, consistency, and reduction of manual intervention in laboratories and manufacturers, which, in general, is leading to fewer mistakes and less variability in purification results.

For instance, the FDA's manual "Chemistry, Manufacturing, and Control (CMC) Information for Human Gene Therapy Investigational New Drug Applications (INDs)" has given an explanation regarding the role of plasmid DNA intermediates in the form of materials for viral-vector or gene therapy productions.

Moreover, innovations in chromatography methods like affinity chromatography and anion exchange have significantly improved plasmid DNA yield, purity, and selectivity. These advanced systems provide reproducible and scalable purification processes. Thus, they are perfect for both - research and large-scale GMP manufacturing settings.

For instance, USP has published a draft General Chapter entitled "Quality Considerations of Plasmid DNA as a Starting Material for Cell and Gene Therapies (USP <1040>)," which describes the production and quality control requirements for plasmid DNA used in cell & gene therapy products. The document is also inclusive of details such as GMP/clinical-grade sourcing, documentation, characterization.

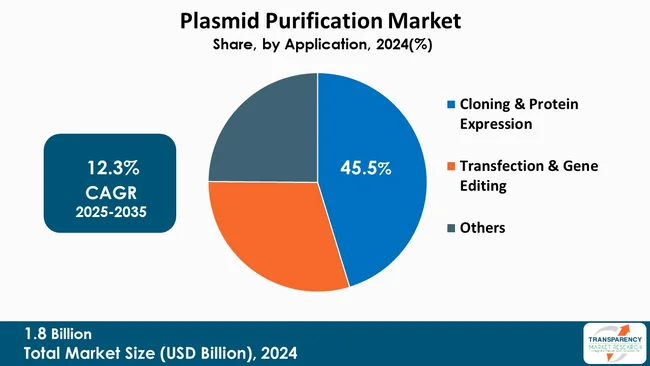

Cloning & protein expression is the major application segment that drives the plasmid purification market globally with 45.5% market share. The segment keeps the highest share as plasmids are the most common carriers are thus indispensable for gene cloning, recombinant protein production, and functional studies in both academic and industrial research.

The need for purified plasmid DNA to facilitate large-scale protein expression workflows is one of the main factors that, along with the continuous growth of biotechnology R&D and bio manufacturing, cloning and protein expression have remained the chief contributors to the consumption of plasmid purification products in laboratories and production facilities globally.

One of the main reasons for the continuance of its monopoly is the implementation of plasmid-based systems in synthetic biology and engineered therapeutics trending currently. Moreover, a constant focus on innovation for high-yield plasmid workflows is what keeps this segment in front of the field of other application areas.

A significant part of its leadership is therefore attributed to the trend that follows large-volume expression studies which require high-purity plasmids thus inciting a recurring demand from research and bio production labs. The increasing application of sophisticated expression vectors and the availability of scalable purification kits are the main factors behind this segment's strong hold.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America leads the global plasmid purification market with market share of 40.5%. The main factors behind this leadership in life science are the robust pharmaceutical and biotechnological ecosystem, higher R&D investment, and quick adoption of advanced technologies in molecular diagnostics, gene therapy, and vaccine development. The market expansion has been further enabled by well-established regulatory frameworks, presence of fully-fledged contract development and manufacturing organizations (CDMOs), and a huge number of ongoing clinical trials.

North America is also consolidating its position as the largest regional contributor to the market with the steady demand for high-quality plasmid purification products and services being driven by collaborative activities between academic institutions, research centers, and biopharma companies in the region.

Genetic research and cell and gene therapies in North America are largely supported by the governments through funding and various initiatives, which increase the demand for plasmid purification. For instance, the U.S. Department of Health and Human Services (HHS) operates the Advanced Research Projects Agency for Health (ARPA-H), which had launched the Genetic Medicines and Individualized Manufacturing for Everyone (GIVE) program.

The project focuses on creating flexible gene therapy manufacturing systems through decentralized production methods at scale. This program aims to position the U.S. as a leader in advanced manufacturing methods for high-quality genetic medicines, while also dealing issues of cost, complexity, and accessibility.

Merck KGaA, QIAGEN, Thermo Fisher Scientific, Inc., Takara Bio Inc., Promega Corporation, Zymo Research Corporation, MP Biomedicals, New England Biolabs, MCLAB, Applied Biological Materials Inc., GenScript, Illumina, Inc., MP Biomedicals, NIPPON Genetics EUROPE, BIONEER CORPORATION, and others are some of the leading manufacturers operating in the global plasmid purification market.

Each of these companies has been profiled in the plasmid purification market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.8 Bn |

| Forecast Value in 2035 | More than US$ 6.6 Bn |

| CAGR | 12.3 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product & Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global plasmid purification market was valued at US$ 1.8 Bn in 2024

The global plasmid purification industry is projected to reach more than US$ 6.6 Bn by the end of 2035

Increased demand for cell and gene therapies and advancement in technology are some of the factors driving the expansion of plasmid purification market.

The CAGR is anticipated to be 12.3 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Merck KGaA, QIAGEN, Thermo Fisher Scientific, Inc., Takara Bio Inc., Promega Corporation, Zymo Research Corporation, MP Biomedicals, New England Biolabs, MCLAB, Applied Biological Materials Inc., GenScript, Illumina, Inc., MP Biomedicals, NIPPON Genetics EUROPE, BIONEER CORPORATION, and other prominent players.

Table 01: Global Plasmid Purification Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 02: Global Plasmid Purification Market Value (US$ Bn) Forecast, By Grade, 2020 to 2035

Table 03: Global Plasmid Purification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Plasmid Purification Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Plasmid Purification Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Plasmid Purification Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Plasmid Purification Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 08: North America Plasmid Purification Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 09: North America Plasmid Purification Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 10: North America Plasmid Purification Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: Europe Plasmid Purification Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Plasmid Purification Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 13: Europe Plasmid Purification Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 14: Europe Plasmid Purification Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: Europe Plasmid Purification Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Plasmid Purification Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Plasmid Purification Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 18: Asia Pacific Plasmid Purification Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 19: Asia Pacific Plasmid Purification Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Asia Pacific Plasmid Purification Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America Plasmid Purification Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Plasmid Purification Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 23: Latin America Plasmid Purification Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 24: Latin America Plasmid Purification Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25: Latin America Plasmid Purification Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East and Africa Plasmid Purification Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Plasmid Purification Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 28: Middle East and Africa Plasmid Purification Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 29: Middle East and Africa Plasmid Purification Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 30: Middle East and Africa Plasmid Purification Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Plasmid Purification Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 02: Global Plasmid Purification Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 03: Global Plasmid Purification Market Revenue (US$ Bn), by Products, 2020 to 2035

Figure 04: Global Plasmid Purification Market Revenue (US$ Bn), by Instruments, 2020 to 2035

Figure 05: Global Plasmid Purification Market Revenue (US$ Bn), by Kits & Reagents, 2020 to 2035

Figure 06: Global Plasmid Purification Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 07: Global Plasmid Purification Market Value Share Analysis, by Grade, 2024 and 2035

Figure 08: Global Plasmid Purification Market Attractiveness Analysis, by Grade, 2025 to 2035

Figure 09: Global Plasmid Purification Market Revenue (US$ Bn), by Molecular Grade, 2020 to 2035

Figure 10: Global Plasmid Purification Market Revenue (US$ Bn), by Transfection Grade, 2020 to 2035

Figure 11: Global Plasmid Purification Market Value Share Analysis, by Application, 2024 and 2035

Figure 12: Global Plasmid Purification Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 13: Global Plasmid Purification Market Revenue (US$ Bn), by Cloning & Protein Expression, 2020 to 2035

Figure 14: Global Plasmid Purification Market Revenue (US$ Bn), by Transfection & Gene Editing, 2020 to 2035

Figure 15: Global Plasmid Purification Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Plasmid Purification Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: Global Plasmid Purification Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 18: Global Plasmid Purification Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2025 to 2035

Figure 19: Global Plasmid Purification Market Revenue (US$ Bn), by Academic & Research Institutes, 2020 to 2035

Figure 20: Global Plasmid Purification Market Revenue (US$ Bn), by Contract Research Organizations, 2020 to 2035

Figure 21: Global Plasmid Purification Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Plasmid Purification Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Plasmid Purification Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America Plasmid Purification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: North America Plasmid Purification Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Plasmid Purification Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Plasmid Purification Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 28: North America Plasmid Purification Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 29: North America Plasmid Purification Value Share Analysis, by Grade, 2025 to 2035

Figure 30: North America Plasmid Purification Market Attractiveness Analysis, by Grade, 2025 to 2035

Figure 31: North America Plasmid Purification Market Value Share Analysis, by Application, 2025 to 2035

Figure 32: North America Plasmid Purification Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 33: North America Plasmid Purification Market Value Share Analysis, by End-user, 2024 and 2035

Figure 34: North America Plasmid Purification Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 35: Europe Plasmid Purification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Europe Plasmid Purification Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Europe Plasmid Purification Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: Europe Plasmid Purification Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 39: Europe Plasmid Purification Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 40: Europe Plasmid Purification Market Value Share Analysis, by Grade, 2024 and 2035

Figure 41: Europe Plasmid Purification Market Attractiveness Analysis, by Grade, 2025 to 2035

Figure 42: Europe Plasmid Purification Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: Europe Plasmid Purification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: Europe Plasmid Purification Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: Europe Plasmid Purification Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: Asia Pacific Plasmid Purification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Asia Pacific Plasmid Purification Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: Asia Pacific Plasmid Purification Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 49: Asia Pacific Plasmid Purification Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 50: Asia Pacific Plasmid Purification Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 51: Asia Pacific Plasmid Purification Market Value Share Analysis, by Grade, 2024 and 2035

Figure 52: Asia Pacific Plasmid Purification Market Attractiveness Analysis, by Grade, 2025 to 2035

Figure 53: Asia Pacific Plasmid Purification Market Value Share Analysis, By Application, 2024 and 2035

Figure 54: Asia Pacific Plasmid Purification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 55: Asia Pacific Plasmid Purification Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: Asia Pacific Plasmid Purification Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 57: Latin America Plasmid Purification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Latin America Plasmid Purification Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Latin America Plasmid Purification Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Latin America Plasmid Purification Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 61: Latin America Plasmid Purification Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 62: Latin America Plasmid Purification Market Value Share Analysis, by Grade, 2024 and 2035

Figure 63: Latin America Plasmid Purification Market Attractiveness Analysis, by Grade, 2025 to 2035

Figure 64: Latin America Plasmid Purification Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: Latin America Plasmid Purification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 66: Latin America Plasmid Purification Market Value Share Analysis, by End-user, 2024 and 2035

Figure 67: Latin America Plasmid Purification Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 68: Middle East and Africa Plasmid Purification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Middle East and Africa Plasmid Purification Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 70: Middle East and Africa Data Plasmid Purification Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 71: Middle East and Africa Plasmid Purification Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 72: Middle East and Africa Plasmid Purification Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 73: Middle East and Africa Plasmid Purification Market Value Share Analysis, by Grade, 2024 and 2035

Figure 74: Middle East and Africa Plasmid Purification Market Attractiveness Analysis, by Grade, 2025 to 2035

Figure 75: Middle East and Africa Plasmid Purification Market Value Share Analysis, by Application, 2024 and 2035

Figure 76: Middle East and Africa Plasmid Purification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 77: Middle East and Africa Plasmid Purification Market Value Share Analysis, by End-user, 2024 and 2035

Figure 78: Middle East and Africa Plasmid Purification Market Attractiveness Analysis, by End-user, 2025 to 2035