Reports

Reports

Analysts’ Viewpoint

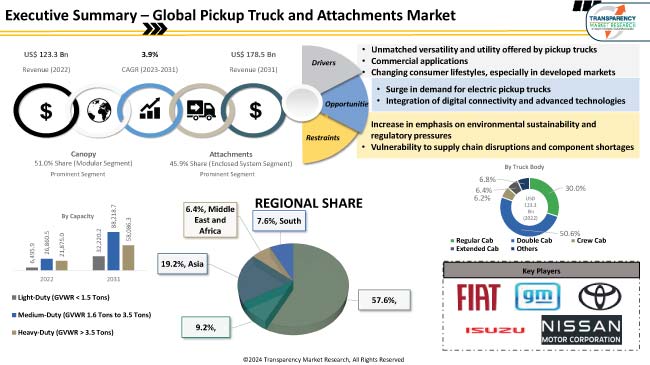

Versatility and adaptability to various lifestyles and purposes are driving the demand for pickup trucks. Furthermore, the automotive industry's shift toward electric vehicles (EVs) is influencing the pickup truck market. As major automakers introduce electric pickup trucks, it is leading to a corresponding demand for attachments tailored to electric platforms. Integration of advanced technologies, including IoT features, smart connectivity, and safety enhancements, is a prominent pickup truck and attachments market trend. Consumers increasingly seek tech-savvy accessories that enhance their overall driving experience.

Consumers now prefer online shopping for automotive accessories, providing manufacturers with a global market reach. Expansion into new regions and innovations in product development, including the introduction of cutting-edge materials and design features offer lucrative pickup truck and attachments market opportunities.

A pickup truck is a type of motor vehicle characterized by its distinct design, featuring a cargo bed at the rear of the vehicle. It is a versatile and popular vehicle choice known for its capability to transport both passengers in the front cabin and various types of cargo in the open bed at the back.

Pickup trucks come in different sizes, ranging from compact to full-size models, and are widely used for personal, commercial, and recreational purposes.

Attachments for pickup trucks refer to additional accessories, equipment, or modifications that can be added to enhance the functionality, aesthetics, or utility of the vehicle.

These attachments cater to the diverse needs of pickup truck owners and contribute to customization based on the intended use.

Pickup trucks can function as daily drivers for families, provide off-road capabilities for enthusiasts, and serve as reliable workhorses for businesses. This versatility contributes significantly to the widespread adoption of pickup trucks globally and is a key market catalyst.

Pickup trucks play a crucial role in various industries, including construction, agriculture, and logistics. The ability to transport goods, equipment, and tools with ease makes pickup trucks an essential asset for businesses.

As economies grow and construction activities increase, there is a corresponding rise in demand for pickup trucks for commercial applications, thus driving the pickup truck and attachments market value.

In the United States, where pickup trucks have been a staple of the automotive landscape, the Ford F-Series has consistently been one of the best-selling vehicles for decades.

Its popularity spans across personal, recreational, and commercial use. In emerging markets such as India, the Mahindra Scorpio and Tata Xenon are examples of pickup trucks gaining traction for both personal and commercial purposes.

The desire of consumers to customize their vehicles for specific uses is bolstering the pickup truck and attachments market growth. Attachments such as tonneau covers, bed liners, and camper shells not only enhance the aesthetic appeal of pickup trucks but also contribute to their functionality.

Pickup trucks have become synonymous with an outdoor and adventurous lifestyle. Consumers, especially in North America, Europe, and Australia, choose pickup trucks for recreational activities such as camping, boating, and off-roading.

The ability to transport outdoor gear and equipment makes pickup trucks attractive to consumers with active lifestyles.

Automakers are increasingly incorporating luxury and comfort features into pickup trucks. Premium materials, advanced infotainment systems, and driver-assistance technologies contribute to the appeal of pickup trucks as lifestyle vehicles.

The luxury pickup truck segment, represented by models such as the Ford F-150 Limited and the GMC Sierra Denali, caters to consumers who desire a high level of comfort and sophistication.

In Europe, pickup trucks including the Mercedes-Benz X-Class and the Volkswagen Amarok offer a balance of utility and premium features, appealing to consumers with discerning tastes.

Rapid urbanization has led to an increased preference for pickup trucks in urban environments. Pickup trucks are now seen as practical vehicles for navigating city streets, offering ample cargo space while being more maneuverable than larger SUVs. All these factors are boosting the pickup truck and attachments market size.

The pickup truck and attachments market segmentation based on truck body includes regular cab, double cab, crew cab, extended cab, and others. Double cab segment held a major share of the market in terms of volume and revenue in 2022.

Double cabs offer a versatile and practical solution that appeals to a broad range of consumers, serving a dual purpose by offering a spacious cargo bed for hauling goods and a comfortable cabin for passengers. Double cab pickup trucks have the ability to balance utility, passenger comfort, and adaptability to diverse needs.

As per the pickup truck and attachments market analysis, based on capacity, the medium-duty (GVWR 1.6 Tons to 3.5 Tons) segment held a major share in terms of volume and revenue in 2022.

Medium-duty trucks are often preferred for their versatility, striking a balance between efficiency and power. The medium-duty segment, with its payload capacity of 1.6 to 3.5 tons, caters to a wide range of applications, making it an attractive choice for businesses and individual buyers for commercial deliveries and personal use. Medium-duty trucks provide a cost-effective solution for businesses that require a balance between capacity and operational costs.

According to the latest pickup truck and attachments market forecast, North America holds a major share of the global landscape.

In North America, pickup trucks are often seen as more than just vehicles; they are regarded as tools for work. Many consumers use their pickup trucks for both professional and personal tasks, ranging from construction work and agriculture to recreational activities.

Their versatility as reliable work vehicles contributes significantly to their sustained demand and boosts the pickup truck and attachments market share in the region.

In North America, consumers use their trucks for activities such as camping, fishing, hunting, and towing recreational vehicles including boats and trailers. The off-road capabilities of many pickup trucks cater to the adventurous spirit of North American consumers.

As per the pickup truck and attachments industry report, a majority of firms are spending significantly on research & development of new products. Expansion of service offerings and organic expansion through mergers, acquisitions, and strategic partnerships are the major strategies adopted by key players.

Fiat Chrysler Automobile, Foton Motor Inc., General Motors, Great Wall Motors, Honda Motor, Isuzu Motors Ltd., Jiangling Motors Corporation Group, Mahindra & Mahindra Ltd., Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., Renault Group, SAIC Motor Corporation Limited, SsangYong, Toyota Motor Corporation, Volkswagen AG, Mercedes Benz Group AG, Tata Motors, Suzuki Motor Corporation, CHINA FAW GROUP CO., LTD., Dongfeng Motor Corporation, Iran Khodro, AutoStyling Truckman Group Limited, Alu-Cab, Ullstein Concepts GmbH, Aeroklas Co Ltd, ARB Corporation Limited, Pegasus 4×4 Parts Limited, LINE-X LLC, Lupotops, Agri-Cover, Inc., and RealTruck, Inc. are the prominent pickup truck and attachments manufacturers.

Each of these players has been profiled in the pickup truck and attachments market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 123.3 Bn |

| Market Forecast Value in 2031 | US$ 178.5 Bn |

| Growth Rate (CAGR) | 3.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at the global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 123.3 Bn in 2022

It is expected to grow at a CAGR of 3.9% from 2023 to 2031

It is likely to reach US$ 178.5 Bn by the end of 2031

Based on truck body, the double cab segment has the highest share

North America is the most lucrative region with dominant market share

Fiat Chrysler Automobile, Foton Motor Inc., General Motors, Great Wall Motors, Honda Motor, Isuzu Motors Ltd., Jiangling Motors Corporation Group, Mahindra & Mahindra Ltd., Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., Renault Group, SAIC Motor Corporation Limited, SsangYong, Toyota Motor Corporation, Volkswagen AG, Mercedes Benz Group AG, Tata Motors, Suzuki Motor Corporation, CHINA FAW GROUP CO., LTD., Dongfeng Motor Corporation, Iran Khodro, AutoStyling Truckman Group Limited, Alu-Ca

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Mn, 2017 - 2031

2.2. Competitive Dashboard Analysis

2.3. Go to Market Strategy

2.3.1. Demand & Supply Side Trends

2.3.2. Identification of Potential Market Spaces

2.3.3. Understanding the Buying Process of Customers

2.3.4. Preferred Sales & Marketing Strategy

2.4. TMR Analysis and Recommendations

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Value Chain Analysis

3.5. Regulatory Scenario

4. Key Trend Analysis

5. Key Specifications and Features for Top Pickup Truck Brands and Models, 2022

6. Global Pickup Truck Market, by Capacity

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Capacity

6.2.1. Light-Duty (GVWR < 1.5 Tons)

6.2.2. Medium-Duty (GVWR 1.6 Tons to 3.5 Tons)

6.2.3. Heavy-Duty (GVWR > 3.5 Tons)

7. Global Pickup Truck Market, by Truck Body

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Truck Body

7.2.1. Regular Cab

7.2.2. Double Cab

7.2.3. Crew Cab

7.2.4. Extended Cab

7.2.5. Others (Chassis Cab, etc.)

8. Global Pickup Truck Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. Global Pickup Truck Attachments Market, by Canopy

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Canopy

9.2.1. Modular

9.2.2. Removable

9.2.3. Isolated

10. Global Pickup Truck Attachments Market, by Attachments

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Attachments

10.2.1. Attachments

10.2.2. Gripping Solution

10.2.3. Enclosed System

11. Global Pickup Truck Attachments Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Pickup Truck and Attachments Market

12.1. Market Snapshot

12.2. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Capacity

12.2.1. Light-Duty (GVWR < 1.5 Tons)

12.2.2. Medium-Duty (GVWR 1.6 Tons to 3.5 Tons)

12.2.3. Heavy-Duty (GVWR > 3.5 Tons)

12.3. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Truck Body

12.3.1. Regular Cab

12.3.2. Double Cab

12.3.3. Crew Cab

12.3.4. Extended Cab

12.3.5. Others (Chassis Cab, etc.)

12.4. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Canopy

12.4.1. Modular

12.4.2. Removable

12.4.3. Isolated

12.5. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Attachments

12.5.1. Attachments

12.5.2. Gripping Solution

12.5.3. Enclosed System

12.6. Key Country Analysis – North America Tow Tractor Market Size Analysis & Forecast, 2017 - 2031

12.6.1. U.S.

12.6.2. Canada

12.6.3. Mexico

13. Europe Pickup Truck and Attachments Market

13.1. Market Snapshot

13.2. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Capacity

13.2.1. Light-Duty (GVWR < 1.5 Tons)

13.2.2. Medium-Duty (GVWR 1.6 Tons to 3.5 Tons)

13.2.3. Heavy-Duty (GVWR > 3.5 Tons)

13.3. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Truck Body

13.3.1. Regular Cab

13.3.2. Double Cab

13.3.3. Crew Cab

13.3.4. Extended Cab

13.3.5. Others (Chassis Cab, etc.)

13.4. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Canopy

13.4.1. Modular

13.4.2. Removable

13.4.3. Isolated

13.5. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Attachments

13.5.1. Attachments

13.5.2. Gripping Solution

13.5.3. Enclosed System

13.6. Key Country Analysis – Europe Tow Tractor Market Size Analysis & Forecast, 2017 - 2031

13.6.1. Germany

13.6.2. U. K.

13.6.3. France

13.6.4. Italy

13.6.5. Spain

13.6.6. Nordic Countries

13.6.7. Russia & CIS

13.6.8. Rest of Europe

14. Asia Pacific Pickup Truck and Attachments Market

14.1. Market Snapshot

14.2. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Capacity

14.2.1. Light-Duty (GVWR < 1.5 Tons)

14.2.2. Medium-Duty (GVWR 1.6 Tons to 3.5 Tons)

14.2.3. Heavy-Duty (GVWR > 3.5 Tons)

14.3. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Truck Body

14.3.1. Regular Cab

14.3.2. Double Cab

14.3.3. Crew Cab

14.3.4. Extended Cab

14.3.5. Others (Chassis Cab, etc.)

14.4. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Canopy

14.4.1. Modular

14.4.2. Removable

14.4.3. Isolated

14.5. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Attachments

14.5.1. Attachments

14.5.2. Gripping Solution

14.5.3. Enclosed System

14.6. Key Country Analysis – Asia-Pacific Tow Tractor Market Size Analysis & Forecast, 2017 - 2031

14.6.1. China

14.6.2. India

14.6.3. Japan

14.6.4. ASEAN Countries

14.6.5. South Korea

14.6.6. ANZ

14.6.7. Rest of Asia Pacific

15. Middle East & Africa Pickup Truck and Attachments Market

15.1. Market Snapshot

15.2. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Capacity

15.2.1. Light-Duty (GVWR < 1.5 Tons)

15.2.2. Medium-Duty (GVWR 1.6 Tons to 3.5 Tons)

15.2.3. Heavy-Duty (GVWR > 3.5 Tons)

15.3. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Truck Body

15.3.1. Regular Cab

15.3.2. Double Cab

15.3.3. Crew Cab

15.3.4. Extended Cab

15.3.5. Others (Chassis Cab, etc.)

15.4. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Canopy

15.4.1. Modular

15.4.2. Removable

15.4.3. Isolated

15.5. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Attachments

15.5.1. Attachments

15.5.2. Gripping Solution

15.5.3. Enclosed System

15.6. Key Country Analysis – Middle East & Africa Tow Tractor Market Size Analysis & Forecast, 2017 - 2031

15.6.1. GCC

15.6.2. South Africa

15.6.3. Turkey

15.6.4. Rest of Middle East & Africa

16. South America Pickup Truck and Attachments Market

16.1. Market Snapshot

16.2. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Capacity

16.2.1. Light-Duty (GVWR < 1.5 Tons)

16.2.2. Medium-Duty (GVWR 1.6 Tons to 3.5 Tons)

16.2.3. Heavy-Duty (GVWR > 3.5 Tons)

16.3. Pickup Truck Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Truck Body

16.3.1. Regular Cab

16.3.2. Double Cab

16.3.3. Crew Cab

16.3.4. Extended Cab

16.3.5. Others (Chassis Cab, etc.)

16.4. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Canopy

16.4.1. Modular

16.4.2. Removable

16.4.3. Isolated

16.5. Pickup Truck Attachments Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017 - 2031, By Attachments

16.5.1. Attachments

16.5.2. Gripping Solution

16.5.3. Enclosed System

16.6. Key Country Analysis – South America Tow Tractor Market Size Analysis & Forecast, 2017 - 2031

16.6.1. Brazil

16.6.2. Argentina

16.6.3. Rest of South America

17. Company Profiles/ Key Players – Pickup Truck and Attachments Market

17.1. Company Profile/ Key Players – Pickup Truck Attachments Market

17.1.1. AutoStyling Truckman Group Limited

17.1.1.1. Company Overview

17.1.1.2. Company Footprints

17.1.1.3. Product Portfolio

17.1.1.4. Competitors & Customers

17.1.1.5. Subsidiaries & Parent Organization

17.1.1.6. Recent Developments

17.1.1.7. Financial Analysis

17.1.2. Alu-Cab

17.1.2.1. Company Overview

17.1.2.2. Company Footprints

17.1.2.3. Product Portfolio

17.1.2.4. Competitors & Customers

17.1.2.5. Subsidiaries & Parent Organization

17.1.2.6. Recent Developments

17.1.2.7. Financial Analysis

17.1.3. Ullstein Concepts GmbH

17.1.3.1. Company Overview

17.1.3.2. Company Footprints

17.1.3.3. Product Portfolio

17.1.3.4. Competitors & Customers

17.1.3.5. Subsidiaries & Parent Organization

17.1.3.6. Recent Developments

17.1.3.7. Financial Analysis

17.1.4. Aeroklas Co Ltd

17.1.4.1. Company Overview

17.1.4.2. Company Footprints

17.1.4.3. Product Portfolio

17.1.4.4. Competitors & Customers

17.1.4.5. Subsidiaries & Parent Organization

17.1.4.6. Recent Developments

17.1.4.7. Financial Analysis

17.1.5. ARB Corporation Limited

17.1.5.1. Company Overview

17.1.5.2. Company Footprints

17.1.5.3. Product Portfolio

17.1.5.4. Competitors & Customers

17.1.5.5. Subsidiaries & Parent Organization

17.1.5.6. Recent Developments

17.1.5.7. Financial Analysis

17.1.6. Pegasus 4×4 Parts Limited

17.1.6.1. Company Overview

17.1.6.2. Company Footprints

17.1.6.3. Product Portfolio

17.1.6.4. Competitors & Customers

17.1.6.5. Subsidiaries & Parent Organization

17.1.6.6. Recent Developments

17.1.6.7. Financial Analysis

17.1.7. LINE-X LLC

17.1.7.1. Company Overview

17.1.7.2. Company Footprints

17.1.7.3. Product Portfolio

17.1.7.4. Competitors & Customers

17.1.7.5. Subsidiaries & Parent Organization

17.1.7.6. Recent Developments

17.1.7.7. Financial Analysis

17.1.8. Lupotops

17.1.8.1. Company Overview

17.1.8.2. Company Footprints

17.1.8.3. Product Portfolio

17.1.8.4. Competitors & Customers

17.1.8.5. Subsidiaries & Parent Organization

17.1.8.6. Recent Developments

17.1.8.7. Financial Analysis

17.1.9. Agri-Cover, Inc.

17.1.9.1. Company Overview

17.1.9.2. Company Footprints

17.1.9.3. Product Portfolio

17.1.9.4. Competitors & Customers

17.1.9.5. Subsidiaries & Parent Organization

17.1.9.6. Recent Developments

17.1.9.7. Financial Analysis

17.1.10. RealTruck, Inc.

17.1.10.1. Company Overview

17.1.10.2. Company Footprints

17.1.10.3. Product Portfolio

17.1.10.4. Competitors & Customers

17.1.10.5. Subsidiaries & Parent Organization

17.1.10.6. Recent Developments

17.1.10.7. Financial Analysis

17.1.11. Other Key Players

17.1.11.1. Company Overview

17.1.11.2. Company Footprints

17.1.11.3. Product Portfolio

17.1.11.4. Competitors & Customers

17.1.11.5. Subsidiaries & Parent Organization

17.1.11.6. Recent Developments

17.1.11.7. Financial Analysis

17.2. Company Profile/ Key Players – Pickup Truck Market

17.2.1. Fiat Chrysler Automobile

17.2.1.1. Company Overview

17.2.1.2. Company Footprints

17.2.1.3. Product Portfolio

17.2.1.4. Competitors & Customers

17.2.1.5. Subsidiaries & Parent Organization

17.2.1.6. Recent Developments

17.2.1.7. Financial Analysis

17.2.2. Foton Motor Inc.

17.2.2.1. Company Overview

17.2.2.2. Company Footprints

17.2.2.3. Product Portfolio

17.2.2.4. Competitors & Customers

17.2.2.5. Subsidiaries & Parent Organization

17.2.2.6. Recent Developments

17.2.2.7. Financial Analysis

17.2.3. General Motor

17.2.3.1. Company Overview

17.2.3.2. Company Footprints

17.2.3.3. Product Portfolio

17.2.3.4. Competitors & Customers

17.2.3.5. Subsidiaries & Parent Organization

17.2.3.6. Recent Developments

17.2.3.7. Financial Analysis

17.2.4. Great Wall Motor

17.2.4.1. Company Overview

17.2.4.2. Company Footprints

17.2.4.3. Product Portfolio

17.2.4.4. Competitors & Customers

17.2.4.5. Subsidiaries & Parent Organization

17.2.4.6. Recent Developments

17.2.4.7. Financial Analysis

17.2.5. Honda Motor

17.2.5.1. Company Overview

17.2.5.2. Company Footprints

17.2.5.3. Product Portfolio

17.2.5.4. Competitors & Customers

17.2.5.5. Subsidiaries & Parent Organization

17.2.5.6. Recent Developments

17.2.5.7. Financial Analysis

17.2.6. Isuzu Motors Ltd.

17.2.6.1. Company Overview

17.2.6.2. Company Footprints

17.2.6.3. Product Portfolio

17.2.6.4. Competitors & Customers

17.2.6.5. Subsidiaries & Parent Organization

17.2.6.6. Recent Developments

17.2.6.7. Financial Analysis

17.2.7. Mahindra & Mahindra Ltd.

17.2.7.1. Company Overview

17.2.7.2. Company Footprints

17.2.7.3. Product Portfolio

17.2.7.4. Competitors & Customers

17.2.7.5. Subsidiaries & Parent Organization

17.2.7.6. Recent Developments

17.2.7.7. Financial Analysis

17.2.8. MITSUBISHI MOTORS CORPORATION

17.2.8.1. Company Overview

17.2.8.2. Company Footprints

17.2.8.3. Product Portfolio

17.2.8.4. Competitors & Customers

17.2.8.5. Subsidiaries & Parent Organization

17.2.8.6. Recent Developments

17.2.8.7. Financial Analysis

17.2.9. Nissan Motor Co., Ltd.

17.2.9.1. Company Overview

17.2.9.2. Company Footprints

17.2.9.3. Product Portfolio

17.2.9.4. Competitors & Customers

17.2.9.5. Subsidiaries & Parent Organization

17.2.9.6. Recent Developments

17.2.9.7. Financial Analysis

17.2.10. Renault Group

17.2.10.1. Company Overview

17.2.10.2. Company Footprints

17.2.10.3. Product Portfolio

17.2.10.4. Competitors & Customers

17.2.10.5. Subsidiaries & Parent Organization

17.2.10.6. Recent Developments

17.2.10.7. Financial Analysis

17.2.11. SAIC Motor Corporation Limited

17.2.11.1. Company Overview

17.2.11.2. Company Footprints

17.2.11.3. Product Portfolio

17.2.11.4. Competitors & Customers

17.2.11.5. Subsidiaries & Parent Organization

17.2.11.6. Recent Developments

17.2.11.7. Financial Analysis

17.2.12. SsangYong

17.2.12.1. Company Overview

17.2.12.2. Company Footprints

17.2.12.3. Product Portfolio

17.2.12.4. Competitors & Customers

17.2.12.5. Subsidiaries & Parent Organization

17.2.12.6. Recent Developments

17.2.12.7. Financial Analysis

17.2.13. Toyota Motor Corporation

17.2.13.1. Company Overview

17.2.13.2. Company Footprints

17.2.13.3. Product Portfolio

17.2.13.4. Competitors & Customers

17.2.13.5. Subsidiaries & Parent Organization

17.2.13.6. Recent Developments

17.2.13.7. Financial Analysis

17.2.14. Volkswagen AG

17.2.14.1. Company Overview

17.2.14.2. Company Footprints

17.2.14.3. Product Portfolio

17.2.14.4. Competitors & Customers

17.2.14.5. Subsidiaries & Parent Organization

17.2.14.6. Recent Developments

17.2.14.7. Financial Analysis

17.2.15. Mercedes Benz Group AG

17.2.15.1. Company Overview

17.2.15.2. Company Footprints

17.2.15.3. Product Portfolio

17.2.15.4. Competitors & Customers

17.2.15.5. Subsidiaries & Parent Organization

17.2.15.6. Recent Developments

17.2.15.7. Financial Analysis

17.2.16. Tata Motors

17.2.16.1. Company Overview

17.2.16.2. Company Footprints

17.2.16.3. Product Portfolio

17.2.16.4. Competitors & Customers

17.2.16.5. Subsidiaries & Parent Organization

17.2.16.6. Recent Developments

17.2.16.7. Financial Analysis

17.2.17. Suzuki Motor Corporation

17.2.17.1. Company Overview

17.2.17.2. Company Footprints

17.2.17.3. Product Portfolio

17.2.17.4. Competitors & Customers

17.2.17.5. Subsidiaries & Parent Organization

17.2.17.6. Recent Developments

17.2.17.7. Financial Analysis

17.2.18. CHINA FAW GROUP CO., LTD.

17.2.18.1. Company Overview

17.2.18.2. Company Footprints

17.2.18.3. Product Portfolio

17.2.18.4. Competitors & Customers

17.2.18.5. Subsidiaries & Parent Organization

17.2.18.6. Recent Developments

17.2.18.7. Financial Analysis

17.2.19. Dongfeng Motor Corporation

17.2.19.1. Company Overview

17.2.19.2. Company Footprints

17.2.19.3. Product Portfolio

17.2.19.4. Competitors & Customers

17.2.19.5. Subsidiaries & Parent Organization

17.2.19.6. Recent Developments

17.2.19.7. Financial Analysis

17.2.20. Iran Khodro

17.2.20.1. Company Overview

17.2.20.2. Company Footprints

17.2.20.3. Product Portfolio

17.2.20.4. Competitors & Customers

17.2.20.5. Subsidiaries & Parent Organization

17.2.20.6. Recent Developments

17.2.20.7. Financial Analysis

17.2.21. Other Key Players

17.2.21.1. Company Overview

17.2.21.2. Company Footprints

17.2.21.3. Product Portfolio

17.2.21.4. Competitors & Customers

17.2.21.5. Subsidiaries & Parent Organization

17.2.21.6. Recent Developments

17.2.21.7. Financial Analysis

List of Tables

Table 1: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Table 2: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Table 3: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Table 4: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Table 5: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Table 6: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Table 7: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Table 8: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Table 9: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Region, 2017 - 2031

Table 10: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Region, 2017 - 2031

Table 11: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Table 12: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Table 13: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Table 14: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Table 15: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Table 16: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Table 17: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Table 18: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Table 19: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Table 20: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Table 21: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Table 22: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Table 23: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Table 24: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Table 25: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Table 26: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Table 27: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Table 28: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Table 29: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Table 30: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Table 31: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Table 32: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Table 33: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Table 34: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Table 35: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Table 36: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Table 37: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Table 38: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Table 39: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Table 40: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Table 41: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Table 42: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Table 43: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Table 44: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Table 45: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Table 46: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Table 47: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Table 48: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Table 49: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Table 50: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Table 51: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Table 52: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Table 53: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Table 54: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Table 55: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Table 56: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Table 57: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Table 58: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Table 59: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Table 60: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

List of Figures

Figure 1: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Figure 2: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Figure 3: Global Pickup Truck and Attachments Market, Incremental Opportunity, by Capacity, Value (US$ Mn), 2023 - 2031

Figure 4: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Figure 5: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Figure 6: Global Pickup Truck and Attachments Market, Incremental Opportunity, by Truck Body, Value (US$ Mn), 2023 - 2031

Figure 7: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Figure 8: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Figure 9: Global Pickup Truck and Attachments Market, Incremental Opportunity, by Canopy, Value (US$ Mn), 2023 - 2031

Figure 10: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Figure 11: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Figure 12: Global Pickup Truck and Attachments Market, Incremental Opportunity, by Attachments, Value (US$ Mn), 2023 - 2031

Figure 13: Global Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Region, 2017 - 2031

Figure 14: Global Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Region, 2017 - 2031

Figure 15: Global Pickup Truck and Attachments Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023 - 2031

Figure 16: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Figure 17: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Figure 18: North America Pickup Truck and Attachments Market, Incremental Opportunity, by Capacity, Value (US$ Mn), 2023 - 2031

Figure 19: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Figure 20: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Figure 21: North America Pickup Truck and Attachments Market, Incremental Opportunity, by Truck Body, Value (US$ Mn), 2023 - 2031

Figure 22: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Figure 23: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Figure 24: North America Pickup Truck and Attachments Market, Incremental Opportunity, by Canopy, Value (US$ Mn), 2023 - 2031

Figure 25: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Figure 26: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Figure 27: North America Pickup Truck and Attachments Market, Incremental Opportunity, by Attachments, Value (US$ Mn), 2023 - 2031

Figure 28: North America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Figure 29: North America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Figure 30: North America Pickup Truck and Attachments Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023 - 2031

Figure 31: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Figure 32: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Figure 33: Europe Pickup Truck and Attachments Market, Incremental Opportunity, by Capacity, Value (US$ Mn), 2023 - 2031

Figure 34: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Figure 35: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Figure 36: Europe Pickup Truck and Attachments Market, Incremental Opportunity, by Truck Body, Value (US$ Mn), 2023 - 2031

Figure 37: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Figure 38: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Figure 39: Europe Pickup Truck and Attachments Market, Incremental Opportunity, by Canopy, Value (US$ Mn), 2023 - 2031

Figure 40: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Figure 41: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Figure 42: Europe Pickup Truck and Attachments Market, Incremental Opportunity, by Attachments, Value (US$ Mn), 2023 - 2031

Figure 43: Europe Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Figure 44: Europe Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Figure 45: Europe Pickup Truck and Attachments Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023 - 2031

Figure 46: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Figure 47: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Figure 48: Asia-Pacific Pickup Truck and Attachments Market, Incremental Opportunity, by Capacity, Value (US$ Mn), 2023 - 2031

Figure 49: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Figure 50: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Figure 51: Asia-Pacific Pickup Truck and Attachments Market, Incremental Opportunity, by Truck Body, Value (US$ Mn), 2023 - 2031

Figure 52: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Figure 53: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Figure 54: Asia-Pacific Pickup Truck and Attachments Market, Incremental Opportunity, by Canopy, Value (US$ Mn), 2023 - 2031

Figure 55: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Figure 56: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Figure 57: Asia-Pacific Pickup Truck and Attachments Market, Incremental Opportunity, by Attachments, Value (US$ Mn), 2023 - 2031

Figure 58: Asia-Pacific Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Figure 59: Asia-Pacific Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Figure 60: Asia-Pacific Pickup Truck and Attachments Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023 - 2031

Figure 61: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Figure 62: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Figure 63: Middle East & Africa Pickup Truck and Attachments Market, Incremental Opportunity, by Capacity, Value (US$ Mn), 2023 - 2031

Figure 64: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Figure 65: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Figure 66: Middle East & Africa Pickup Truck and Attachments Market, Incremental Opportunity, by Truck Body, Value (US$ Mn), 2023 - 2031

Figure 67: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Figure 68: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Figure 69: Middle East & Africa Pickup Truck and Attachments Market, Incremental Opportunity, by Canopy, Value (US$ Mn), 2023 - 2031

Figure 70: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Figure 71: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Figure 72: Middle East & Africa Pickup Truck and Attachments Market, Incremental Opportunity, by Attachments, Value (US$ Mn), 2023 - 2031

Figure 73: Middle East & Africa Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Figure 74: Middle East & Africa Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Figure 75: Middle East & Africa Pickup Truck and Attachments Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023 - 2031

Figure 76: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Capacity, 2017 - 2031

Figure 77: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Capacity, 2017 - 2031

Figure 78: South America Pickup Truck and Attachments Market, Incremental Opportunity, by Capacity, Value (US$ Mn), 2023 - 2031

Figure 79: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Truck Body, 2017 - 2031

Figure 80: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Truck Body, 2017 - 2031

Figure 81: South America Pickup Truck and Attachments Market, Incremental Opportunity, by Truck Body, Value (US$ Mn), 2023 - 2031

Figure 82: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Canopy, 2017 - 2031

Figure 83: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Canopy, 2017 - 2031

Figure 84: South America Pickup Truck and Attachments Market, Incremental Opportunity, by Canopy, Value (US$ Mn), 2023 - 2031

Figure 85: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Attachments, 2017 - 2031

Figure 86: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Attachments, 2017 - 2031

Figure 87: South America Pickup Truck and Attachments Market, Incremental Opportunity, by Attachments, Value (US$ Mn), 2023 - 2031

Figure 88: South America Pickup Truck and Attachments Market Volume (Thousand Units) Forecast, by Country, 2017 - 2031

Figure 89: South America Pickup Truck and Attachments Market Value (U$ Mn) Forecast, by Country, 2017 - 2031

Figure 90: South America Pickup Truck and Attachments Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023 - 2031