Reports

Reports

Analysts’ Viewpoint

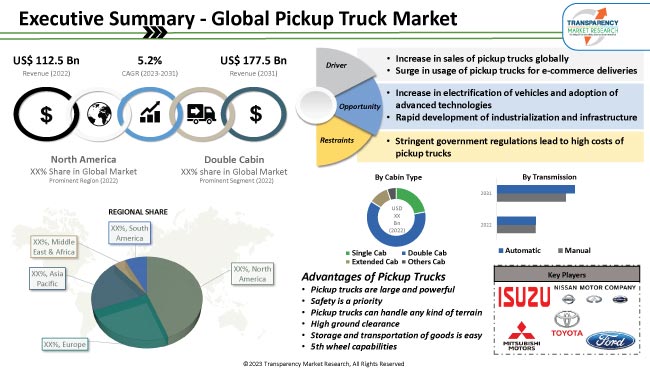

Consumer preference for online shopping, which predominately requires pickup trucks to carry goods, has increased due to the rapid rise in usage of smartphones and acceptance of swift internet services. A key factor driving the pickup truck industry growth is the increased preference for compact pickup trucks over SUVs, along with a surge in customer desire for fuel-efficient vehicles for outdoor activities such as boating and camping.

Major companies such as Toyota Motor Corporation, ISUZU MOTORS, Mitsubishi Motors, Ford Motor Company, etc., are increasing their spending on research and development activities to launch newer pickup trucks with enhanced functionalities, such as increased torque and enhanced cargo capacity. Consistent launches of new pickup trucks from top manufacturers create hype among consumers and increase their inclination to make impulsive purchases.

A pickup truck is a light-duty vehicle used mostly for the delivery of goods and freight. It has a closed-in cabin and a cargo bed at the back that is surrounded by three low walls, but it has no roof (occasionally the cargo bed back end also includes a tailboard and removable covering). Several countries in North America, including Mexico and the U.S., use such pickup trucks as passenger cars. These trucks have huge load capacities, which make them perfect for various commercial uses. These trucks are well-liked because they are utilized for diverse jobs such as pulling carriages and moving goods.

Utility vehicles, also known as pickups and coupés, are referred to as ‘ufte’ in Australia and New Zealand. All linguistic groups in South Africa use the name ‘bakkie’.

The pickup truck industry is expanding because of growing consumer demand for these vehicles, which are mostly utilized for business purposes and have a significant positive impact on sales. As an illustration, the proportion of tiny pickup trucks climbed from 12% in 2005 to 23% in 2022, while the increase in large pickup trucks has been at a steady pace in the last few years.

A rapid decarburization of the economy is necessary to prevent potentially catastrophic effects and limit climate change. Presently, transport accounts for 29% of all greenhouse gas (GHG) emissions in the U.S. Various technologies and several policies have been suggested to reduce these emissions; however, no one technology or strategy is sufficient to accomplish the reduction required to satisfy mitigation targets. One of the most significant initiatives being investigated to decarbonize the transportation industry is electrification.

Environmental crises are brought on by the rising levels of air pollution caused due to the emission that traditional automobiles produce. This has prompted automakers and truck makers to use electrification in order to encourage zero emissions while maintaining a clean, breathable environment.

The majority of pickup truck models, currently, come with mirror-mounted cameras that enable drivers to see the side of a trailer being hauled, making it easier for users to handle trucks and trailers once they are connected directly. Modern pickup trucks come with cutting-edge features like enhanced connection, all-wheel drive, and automatic transmission. Therefore, increased integration of advanced technologies in trucks is anticipated to propel the pickup truck market dynamics in the next few years.

Shift in customer preference toward making purchases online has fueled the usage of pickup trucks for last-mile deliveries in the e-commerce industry. Therefore, rise of online retail platforms is projected to augment the pickup truck market value. Furthermore, expansion of the market is anticipated to be fueled by an increase in demand for lightweight transportation solutions across various industries and commercial sectors.

Rising interest in lightweight, highly efficient, and technologically advanced pickup trucks among consumers is anticipated create significant business opportunities for manufacturers of pickup trucks. Additionally, increase in global consumption of goods and services is anticipated to propel the establishment of sales hubs, thereby driving the demand for pickup trucks.

Additionally, rising use of pickup trucks for off-roading competitions as well as increasing popularity of recreational activities and adventure sports is estimated to positively impact the pickup truck market forecast in the next few years. Additionally, the simple accessibility of pickup truck rental services at popular tourist destinations and the growth of the travel and tourism sector are both driving the market.

Based on cabin type, the double cab segment accounted for 64.05% of the global pickup truck market share in 2022. Double cab pickup trucks are the ideal workhorses for professionals and tradespeople who genuinely need off-road capability, as they are more durable and roomy than other types. The most contemporary double cab pickups, however, go beyond simply being more practical. Most manufacturers provide their top-of-the-line commercial pickup trucks with stunning stylistic details and the kind of opulent accoutrements buyers would expect in an executive vehicle.

The majority of double cab pickup trucks are integrated with modern features such as an infotainment system with Android Auto, power steering with variable flow control, an electrochromic interior rearview camera, cruise control, ADAS, ABS with EBD, vehicle stability control, airbags, parking sensors, and others.

Analysis of the latest global pickup truck market trends reveal that the U.S. and Canada are witnessing an increased demand for pickup trucks owing to the developed economy and higher average household disposable income in these nations. Major U.S. pickup truck manufacturers including Ford Motor Company, General Motors, and Honda Motors are key drivers of the global market.

Additionally, growing need for digitalization and rapid expansion of the e-commerce industry in North America are augmenting the expansion of online shopping platforms, which in turn is anticipated to fuel the demand for pickup trucks.

Europe witnesses a lower pickup truck penetration rate than other parts of the world due to a higher desire for SUVs than pickup trucks in Germany, the U.K., and the other countries in the region.

Asia Pacific accounts for a sizeable share of the global pickup truck industry due to rising annual vehicle production in several important nations in the region. Significant government initiatives and an increase in the use of autonomous and electric pickup trucks are anticipated to propel the market in the region during the forecast period.

The global pickup trucks industry is consolidated with the presence of key players across the globe. Prominent manufacturers are creating supply chain networks to increase their revenue share. However, key companies are consolidating their market position through collaborations, mergers, acquisitions, and expansion of product lines. Some of the key players in the global pickup truck business are Toyota Motor Corporation, ISUZU MOTORS, Mitsubishi Motors, Great Wall Motor, Hyundai Motor Company, Ford Motor Company, Nissan Motor Company, GMC, KIA, CHEVROLET, Jeep, SsangYong GB, Foton Motor Inc., MAXUS, JMC Motors, and MAZDA.

The pickup truck market report comprises profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 112.5 Bn |

|

Market Forecast Value in 2031 |

US$ 177.5 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

Volume (Thousand Units) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 112.5 Bn in 2022.

It is expected to expand at a CAGR of 5.2% by 2031.

The global business is estimated to be valued at US$ 177.5 Bn in 2031.

Surge in usage of pickup trucks for e-commerce deliveries and increase in sales of pickup trucks globally.

The double cabin segment accounted for 64.05% share in 2022.

North America was a highly lucrative region for pickup trucks in 2022.

Toyota Motor Corporation, ISUZU MOTORS, Mitsubishi Motors, Great Wall Motor, Hyundai Motor Company, Ford Motor Company, Nissan Motor Company, GMC, KIA, CHEVROLET, Jeep, SsangYong GB, Foton Motor Inc., MAXUS, JMC Motors, and MAZDA.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Mn, 2017-2031

2.2. Go to Market Strategy

2.2.1. Demand & Supply Side Trends

2.2.1.1. GAP Analysis

2.2.2. Identification of Potential Market Spaces

2.2.3. Understanding the Buying Process of the Customers

2.2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.3.3. Value Chain Analysis

3.4. Key Trend Analysis

3.5. Regulatory Scenario

3.6. Cost Structure Analysis

3.7. Profit Margin Analysis

4. Global Pickup Truck Market, by Cabin Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Cabin Type

4.2.1. Single Cab

4.2.1.1. Small Size

4.2.1.2. Mid-Size

4.2.1.3. Full Size

4.2.2. Double Cab

4.2.2.1. Small Size

4.2.2.2. Mid-Size

4.2.2.3. Full Size

4.2.3. Extended Cab

4.2.3.1. Small Size

4.2.3.2. Mid-Size

4.2.3.3. Full Size

4.2.4. Others Cab

4.2.4.1. Small Size

4.2.4.2. Mid-Size

4.2.4.3. Full Size

5. Global Pickup Truck Market, by Fuel Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Fuel Type

5.2.1. Gasoline

5.2.2. Diesel

5.2.3. Electric

6. Global Pickup Truck Market, by Transmission

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Transmission

6.2.1. Manual

6.2.2. Automatic

7. Global Pickup Truck Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Pickup Truck Market

8.1. Market Snapshot

8.2. North America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Cabin Type

8.2.1. Single Cab

8.2.1.1. Small Size

8.2.1.2. Mid-Size

8.2.1.3. Full Size

8.2.2. Double Cab

8.2.2.1. Small Size

8.2.2.2. Mid-Size

8.2.2.3. Full Size

8.2.3. Extended Cab

8.2.3.1. Small Size

8.2.3.2. Mid-Size

8.2.3.3. Full Size

8.2.4. Others Cab

8.2.4.1. Small Size

8.2.4.2. Mid-Size

8.2.4.3. Full Size

8.3. North America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Fuel Type

8.3.1. Gasoline

8.3.2. Diesel

8.3.3. Electric

8.4. North America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Transmission

8.4.1. Manual

8.4.2. Automatic

8.5. Key Country Analysis - North America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031

8.5.1. The U. S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Pickup Truck Market

9.1. Market Snapshot

9.2. North America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Cabin Type

9.2.1. Single Cab

9.2.1.1. Small Size

9.2.1.2. Mid-Size

9.2.1.3. Full Size

9.2.2. Double Cab

9.2.2.1. Small Size

9.2.2.2. Mid-Size

9.2.2.3. Full Size

9.2.3. Extended Cab

9.2.3.1. Small Size

9.2.3.2. Mid-Size

9.2.3.3. Full Size

9.2.4. Others Cab

9.2.4.1. Small Size

9.2.4.2. Mid-Size

9.2.4.3. Full Size

9.3. Europe Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Fuel Type

9.3.1. Gasoline

9.3.2. Diesel

9.3.3. Electric

9.4. Europe Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Transmission

9.4.1. Manual

9.4.2. Automatic

9.5. Key Country Analysis - Europe Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031

9.5.1. Germany

9.5.2. U. K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Pickup Truck Market

10.1. Market Snapshot

10.2. Asia Pacific Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Cabin Type

10.2.1. Single Cab

10.2.1.1. Small Size

10.2.1.2. Mid-Size

10.2.1.3. Full Size

10.2.2. Double Cab

10.2.2.1. Small Size

10.2.2.2. Mid-Size

10.2.2.3. Full Size

10.2.3. Extended Cab

10.2.3.1. Small Size

10.2.3.2. Mid-Size

10.2.3.3. Full Size

10.2.4. Others Cab

10.2.4.1. Small Size

10.2.4.2. Mid-Size

10.2.4.3. Full Size

10.3. Asia Pacific Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Fuel Type

10.3.1. Gasoline

10.3.2. Diesel

10.3.3. Electric

10.4. Asia Pacific Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Transmission

10.4.1. Manual

10.4.2. Automatic

10.5. Key Country Analysis - Asia Pacific Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Pickup Truck Market

11.1. Market Snapshot

11.2. Middle East & Africa Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Cabin Type

11.2.1. Single Cab

11.2.1.1. Small Size

11.2.1.2. Mid-Size

11.2.1.3. Full Size

11.2.2. Double Cab

11.2.2.1. Small Size

11.2.2.2. Mid-Size

11.2.2.3. Full Size

11.2.3. Extended Cab

11.2.3.1. Small Size

11.2.3.2. Mid-Size

11.2.3.3. Full Size

11.2.4. Others Cab

11.2.4.1. Small Size

11.2.4.2. Mid-Size

11.2.4.3. Full Size

11.3. Middle East & Africa Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Fuel Type

11.3.1. Gasoline

11.3.2. Diesel

11.3.3. Electric

11.4. Middle East & Africa Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Transmission

11.4.1. Manual

11.4.2. Automatic

11.5. Key Country Analysis - Middle East & Africa Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Pickup Truck Market

12.1. Market Snapshot

12.2. South America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Cabin Type

12.2.1. Single Cab

12.2.1.1. Small Size

12.2.1.2. Mid-Size

12.2.1.3. Full Size

12.2.2. Double Cab

12.2.2.1. Small Size

12.2.2.2. Mid-Size

12.2.2.3. Full Size

12.2.3. Extended Cab

12.2.3.1. Small Size

12.2.3.2. Mid-Size

12.2.3.3. Full Size

12.2.4. Others Cab

12.2.4.1. Small Size

12.2.4.2. Mid-Size

12.2.4.3. Full Size

12.3. South America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Fuel Type

12.3.1. Gasoline

12.3.2. Diesel

12.3.3. Electric

12.4. South America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Transmission

12.4.1. Manual

12.4.2. Automatic

12.5. Key Country Analysis - South America Pickup Truck Market Revenue (US$ Mn) Analysis & Forecast, 2017-2031

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

13.3. Company Profile/ Key Players - Pickup Truck Market

13.3.1. Toyota Motor Corporation

13.3.1.1. Company Overview

13.3.1.2. Company Footprints

13.3.1.3. Production Locations

13.3.1.4. Product Portfolio

13.3.1.5. Competitors & Customers

13.3.1.6. Subsidiaries & Parent Organization

13.3.1.7. Recent Developments

13.3.1.8. Financial Analysis

13.3.1.9. Profitability

13.3.1.10. Revenue Share

13.3.1.11. Executive Bios

13.3.2. ISUZU MOTORS

13.3.2.1. Company Overview

13.3.2.2. Company Footprints

13.3.2.3. Production Locations

13.3.2.4. Product Portfolio

13.3.2.5. Competitors & Customers

13.3.2.6. Subsidiaries & Parent Organization

13.3.2.7. Recent Developments

13.3.2.8. Financial Analysis

13.3.2.9. Profitability

13.3.2.10. Revenue Share

13.3.2.11. Executive Bios

13.3.3. Mitsubishi Motors

13.3.3.1. Company Overview

13.3.3.2. Company Footprints

13.3.3.3. Production Locations

13.3.3.4. Product Portfolio

13.3.3.5. Competitors & Customers

13.3.3.6. Subsidiaries & Parent Organization

13.3.3.7. Recent Developments

13.3.3.8. Financial Analysis

13.3.3.9. Profitability

13.3.3.10. Revenue Share

13.3.3.11. Executive Bios

13.3.4. Great Wall Motor

13.3.4.1. Company Overview

13.3.4.2. Company Footprints

13.3.4.3. Production Locations

13.3.4.4. Product Portfolio

13.3.4.5. Competitors & Customers

13.3.4.6. Subsidiaries & Parent Organization

13.3.4.7. Recent Developments

13.3.4.8. Financial Analysis

13.3.4.9. Profitability

13.3.4.10. Revenue Share

13.3.4.11. Executive Bios

13.3.5. Hyundai Motor Company

13.3.5.1. Company Overview

13.3.5.2. Company Footprints

13.3.5.3. Production Locations

13.3.5.4. Product Portfolio

13.3.5.5. Competitors & Customers

13.3.5.6. Subsidiaries & Parent Organization

13.3.5.7. Recent Developments

13.3.5.8. Financial Analysis

13.3.5.9. Profitability

13.3.5.10. Revenue Share

13.3.5.11. Executive Bios

13.3.6. Ford Motor Company

13.3.6.1. Company Overview

13.3.6.2. Company Footprints

13.3.6.3. Production Locations

13.3.6.4. Product Portfolio

13.3.6.5. Competitors & Customers

13.3.6.6. Subsidiaries & Parent Organization

13.3.6.7. Recent Developments

13.3.6.8. Financial Analysis

13.3.6.9. Profitability

13.3.6.10. Revenue Share

13.3.6.11. Executive Bios

13.3.7. Nissan Motor Company

13.3.7.1. Company Overview

13.3.7.2. Company Footprints

13.3.7.3. Production Locations

13.3.7.4. Product Portfolio

13.3.7.5. Competitors & Customers

13.3.7.6. Subsidiaries & Parent Organization

13.3.7.7. Recent Developments

13.3.7.8. Financial Analysis

13.3.7.9. Profitability

13.3.7.10. Revenue Share

13.3.7.11. Executive Bios

13.3.8. GMC

13.3.8.1. Company Overview

13.3.8.2. Company Footprints

13.3.8.3. Production Locations

13.3.8.4. Product Portfolio

13.3.8.5. Competitors & Customers

13.3.8.6. Subsidiaries & Parent Organization

13.3.8.7. Recent Developments

13.3.8.8. Financial Analysis

13.3.8.9. Profitability

13.3.8.10. Revenue Share

13.3.8.11. Executive Bios

13.3.9. Kia

13.3.9.1. Company Overview

13.3.9.2. Company Footprints

13.3.9.3. Production Locations

13.3.9.4. Product Portfolio

13.3.9.5. Competitors & Customers

13.3.9.6. Subsidiaries & Parent Organization

13.3.9.7. Recent Developments

13.3.9.8. Financial Analysis

13.3.9.9. Profitability

13.3.9.10. Revenue Share

13.3.9.11. Executive Bios

13.3.10. CHEVROLET

13.3.10.1. Company Overview

13.3.10.2. Company Footprints

13.3.10.3. Production Locations

13.3.10.4. Product Portfolio

13.3.10.5. Competitors & Customers

13.3.10.6. Subsidiaries & Parent Organization

13.3.10.7. Recent Developments

13.3.10.8. Financial Analysis

13.3.10.9. Profitability

13.3.10.10. Revenue Share

13.3.10.11. Executive Bios

13.3.11. Jeep

13.3.11.1. Company Overview

13.3.11.2. Company Footprints

13.3.11.3. Production Locations

13.3.11.4. Product Portfolio

13.3.11.5. Competitors & Customers

13.3.11.6. Subsidiaries & Parent Organization

13.3.11.7. Recent Developments

13.3.11.8. Financial Analysis

13.3.11.9. Profitability

13.3.11.10. Revenue Share

13.3.11.11. Executive Bios

13.3.12. SsangYong GB

13.3.12.1. Company Overview

13.3.12.2. Company Footprints

13.3.12.3. Production Locations

13.3.12.4. Product Portfolio

13.3.12.5. Competitors & Customers

13.3.12.6. Subsidiaries & Parent Organization

13.3.12.7. Recent Developments

13.3.12.8. Financial Analysis

13.3.12.9. Profitability

13.3.12.10. Revenue Share

13.3.12.11. Executive Bios

13.3.13. Foton Motor Inc.

13.3.13.1. Company Overview

13.3.13.2. Company Footprints

13.3.13.3. Production Locations

13.3.13.4. Product Portfolio

13.3.13.5. Competitors & Customers

13.3.13.6. Subsidiaries & Parent Organization

13.3.13.7. Recent Developments

13.3.13.8. Financial Analysis

13.3.13.9. Profitability

13.3.13.10. Revenue Share

13.3.13.11. Executive Bios

13.3.14. MAXUS

13.3.14.1. Company Overview

13.3.14.2. Company Footprints

13.3.14.3. Production Locations

13.3.14.4. Product Portfolio

13.3.14.5. Competitors & Customers

13.3.14.6. Subsidiaries & Parent Organization

13.3.14.7. Recent Developments

13.3.14.8. Financial Analysis

13.3.14.9. Profitability

13.3.14.10. Revenue Share

13.3.14.11. Executive Bios

13.3.15. JMC Motors

13.3.15.1. Company Overview

13.3.15.2. Company Footprints

13.3.15.3. Production Locations

13.3.15.4. Product Portfolio

13.3.15.5. Competitors & Customers

13.3.15.6. Subsidiaries & Parent Organization

13.3.15.7. Recent Developments

13.3.15.8. Financial Analysis

13.3.15.9. Profitability

13.3.15.10. Revenue Share

13.3.15.11. Executive Bios

13.3.16. MAZDA

13.3.16.1. Company Overview

13.3.16.2. Company Footprints

13.3.16.3. Production Locations

13.3.16.4. Product Portfolio

13.3.16.5. Competitors & Customers

13.3.16.6. Subsidiaries & Parent Organization

13.3.16.7. Recent Developments

13.3.16.8. Financial Analysis

13.3.16.9. Profitability

13.3.16.10. Revenue Share

13.3.16.11. Executive Bios

13.3.17. Other Key Players

13.3.17.1. Company Overview

13.3.17.2. Company Footprints

13.3.17.3. Production Locations

13.3.17.4. Product Portfolio

13.3.17.5. Competitors & Customers

13.3.17.6. Subsidiaries & Parent Organization

13.3.17.7. Recent Developments

13.3.17.8. Financial Analysis

13.3.17.9. Profitability

13.3.17.10. Revenue Share

13.3.17.11. Executive Bios

List of Tables

Table 1: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Table 2: Global Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017‒2031

Table 3: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 4: Global Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017‒2031

Table 5: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Table 6: Global Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017‒2031

Table 7: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 8: Global Pickup Truck Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Table 10: North America Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017‒2031

Table 11: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 12: North America Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017‒2031

Table 13: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Table 14: North America Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017‒2031

Table 15: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 16: North America Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Table 18: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017‒2031

Table 19: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 20: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017‒2031

Table 21: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Table 22: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017‒2031

Table 23: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Table 26: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017‒2031

Table 27: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 28: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017‒2031

Table 29: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Table 30: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017‒2031

Table 31: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Table 34: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017‒2031

Table 35: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 36: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017‒2031

Table 37: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Table 38: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017‒2031

Table 39: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Table 42: South America Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017‒2031

Table 43: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 44: South America Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017‒2031

Table 45: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Table 46: South America Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017‒2031

Table 47: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: South America Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Figure 2: Global Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017-2031

Figure 3: Global Pickup Truck Market, Incremental Opportunity, by Cabin Type, Value (US$ Bn), 2023-2031

Figure 4: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 5: Global Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 6: Global Pickup Truck Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 7: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Figure 8: Global Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017-2031

Figure 9: Global Pickup Truck Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2023-2031

Figure 10: Global Pickup Truck Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 11: Global Pickup Truck Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Pickup Truck Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Figure 14: North America Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017-2031

Figure 15: North America Pickup Truck Market, Incremental Opportunity, by Cabin Type, Value (US$ Bn), 2023-2031

Figure 16: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 17: North America Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 18: North America Pickup Truck Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 19: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Figure 20: North America Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017-2031

Figure 21: North America Pickup Truck Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2023-2031

Figure 22: North America Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 23: North America Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Pickup Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Figure 26: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017-2031

Figure 27: Europe Pickup Truck Market, Incremental Opportunity, by Cabin Type, Value (US$ Bn), 2023-2031

Figure 28: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 29: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 30: Europe Pickup Truck Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Figure 32: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017-2031

Figure 33: Europe Pickup Truck Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2023-2031

Figure 34: Europe Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: Europe Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Pickup Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Figure 38: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017-2031

Figure 39: Asia Pacific Pickup Truck Market, Incremental Opportunity, by Cabin Type, Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 41: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 42: Asia Pacific Pickup Truck Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Figure 44: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017-2031

Figure 45: Asia Pacific Pickup Truck Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Pickup Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Figure 50: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017-2031

Figure 51: Middle East & Africa Pickup Truck Market, Incremental Opportunity, by Cabin Type, Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 53: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 54: Middle East & Africa Pickup Truck Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Figure 56: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017-2031

Figure 57: Middle East & Africa Pickup Truck Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Pickup Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Cabin Type, 2017-2031

Figure 62: South America Pickup Truck Market Value (US$ Bn) Forecast, by Cabin Type, 2017-2031

Figure 63: South America Pickup Truck Market, Incremental Opportunity, by Cabin Type, Value (US$ Bn), 2023-2031

Figure 64: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 65: South America Pickup Truck Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 66: South America Pickup Truck Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 67: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Transmission, 2017-2031

Figure 68: South America Pickup Truck Market Value (US$ Bn) Forecast, by Transmission, 2017-2031

Figure 69: South America Pickup Truck Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2023-2031

Figure 70: South America Pickup Truck Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: South America Pickup Truck Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Pickup Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031