Reports

Reports

Analysts’ Viewpoint on PET Foam Market Scenario

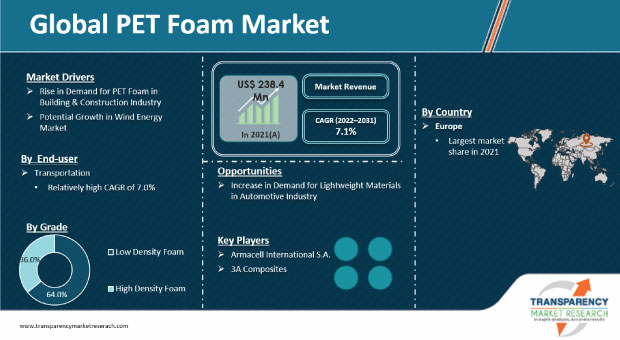

Rise in application of PET foam in building & construction, transportation, automotive, and wind energy industries is expected to drive the global PET foam market during the forecast period. PET foam offers resistance to water absorption, corrosion, temperature, and chemicals. Hence, it is increasingly used as a core composite material or sandwich material in various end-use industries. Ongoing R&D activities to explore innovative manufacturing processes are expected to fuel the global PET foam market during the forecast period. Companies operating in the global PET foam market are increasingly using recycled plastic (rPET) bottles as raw material for manufacturing PET foam in order to reduce the carbon footprint.

PET foam is a type of closed-cell thermoplastic structural foam. Polyester resin, also referred to as polyethylene terephthalate, is its primary constituent. PET foam is widely used for its structural properties such as specific shear and compression strength. It is lightweight and recyclable. It can also withstand high temperatures for a long time. PET foam can be easily heated and conformed to specific shapes. PET foam is used as a thermoplastic core material in various applications to improve performance. It is used in sandwich panel applications in wind power, shipbuilding, and railway trains. It offers good dimensional stability at high temperatures. PET foam core is employed in composite materials for prefabricated rooms for train carriages, wind turbines, and maritime applications. PET foam sheet is widely used in industries such as construction, aviation, marine, road transport, and wind turbine manufacturing. PET foam is also significantly used in the wind energy industry. It is widely used as a substitute for high-performance materials due to its high strength-to-weight ratio, durability, and versatility. Thus, PET foam helps improve performance, reduce cost, and achieve design flexibility. This ultimately results in an energy-efficient wind energy system.

PET foam is extensively used as a composite material in the construction industry for manufacturing window frames, roofs, domes, gates, and doors. Rise in investment in infrastructure development activities in developing countries is expected to drive the demand for PET foam. PET foam combines the properties of structural load-bearing and thermal insulation, which is beneficial as a building material in the construction industry. It also has lower density compared to the conventional construction material; thus, it helps lower installation and structural costs. In terms of volume, the global construction sector is expected to reach US$ 15.5 Trn by 2030. Currently, China, the U.S., and India account for 57% share of the global construction sector. Rise in construction activities is expected to boost residential and non-residential sectors in the near future. This, in turn, is anticipated to augment the demand for PET foam products.

Based on end-user, the PET foam market has been classified into transportation, wind energy, building & construction, marine engineering, packaging, and others. The transportation segment accounted for major share of 30.2% of the global market in 2021. The segment is estimated to grow at an above-average CAGR of 7.0% during the forecast period. The transportation industry includes roadways and railways. PET foam board is used as a core composite material in airplanes, cars, trucks, buses, and trains. It can help reduce automotive weight, fuel consumption, and thus CO2 emissions. PET foam is extensively used in the manufacture of automotive parts such as interior and exterior structural parts, floors, sidewalls of vehicles, wiper arms, and gear housings. Thus, it helps lower the cost of manufacturing. PET foam is employed as a substitute to reduce vehicle weight and metal parts in the automobile sector due to ease of mass production and molding, without compromising on the structural strength and stability. Thus, pet foam manufacturers are likely to gain lucrative opportunities in automotive and transportation sectors during the forecast period.

Wind energy is one of the major markets for PET foam. The foam is used in sandwich constructions for rotor blades, nacelles, and spinners. PET foam is increasingly used in the manufacture of wind blades and other structural components that can be employed in the wind energy sector due to its high strength-to-weight ratio, durability, and versatility. This helps achieve greater performance, cost reduction, flexible design, and increased energy efficiency. Nearly 1.7 kg of PET foam is used in onshore wind turbines. Increase in preference for using clean and renewable sources of energy over traditional fuels is driving the demand for wind energy. Various government-backed initiatives are encouraging the incorporation of PET foam in the wind energy sector. Increase in application of recycled pet foam is also expected to drive the pet foam market. Lower cost of PET foam compared to other high-performing materials such as polymethacrylamide and polyetherimide foams is driving the demand for PET foam in the wind energy sector.

Based on grade, the PET foam market has been bifurcated into high density foam and low density foam. The low density foam segment held major share of the global PET foam market in 2021. Low density PET foam is primarily used as a lightweight composite material in construction, automotive, transportation, and wind energy sectors. Low density pet foam possesses properties such as high strength and durability. It is also used as an alternative to polystyrene or balsa wood in structural sandwich materials. These structural sandwich materials are lightweight products that are increasingly used in packaging and marine engineering applications.

In terms of value, Europe held 36.0% share of the global PET foam market in 2021. The region is expected to be the most attractive market for PET foam in the next few years. Growth in application of PET foam as composite material in construction, transportation, and wind energy industries is driving the PET foam market in Europe. Increase in preference for renewables, rise in need for recycling PET bottles, and growth in demand for lightweight vehicles are boosting the PET foam market in Europe.

Asia Pacific and North America are also prominent regions of the global PET foam market. These regions held 31.2% and 22.7% share, respectively, of the global market in 2021. The market in Asia Pacific and North America is expected to grow at a CAGR of 7.4% and 6.8%, respectively, during the forecast period.

The PET foam market is partially consolidated. Expansion of manufacturing facilities worldwide is one of the key strategies adopted by major players to increase their footprint in the market. Key players also adopt strategies such as joint ventures and partnerships, new technology and product launches, and R&D activities. 3A Composites, Armacell International S.A., CoreLite Composites, Carbon-Core Corporation, BASF SE, and DIAB Group are the prominent entities operating in the global PET foam market.

Each of these players has been profiled in the global PET foam market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 238.4 Mn |

|

Market Forecast Value in 2031 |

US$ 474.1 Mn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Square Meters for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global PET foam market stood at US$ 238.4 Mn in 2021

The global PET foam market is expected to grow at a CAGR of 7.1% from 2022 to 2031

Rise in demand for PET foam in building & construction industry and growth in wind energy market are the key drivers for PET foam market

Low density PET foam was the largest grade segment that held 64% share in 2021

Europe was the most lucrative region of the PET foam market in 2021

3A Composites, Armacell International S.A., CoreLite Composites, Carbon-Core Corporation, BASF SE, and DIAB Group

1. Executive Summary

1.1. PET Foam Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Providers

2.6.2. List of Potential Customers

3. COVID-19 Impact Analysis

4. Global PET Foam Market Analysis and Forecast, by Grade, 2020–2031

4.1. Introduction and Definitions

4.2. Global PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

4.2.1. Low Density Foam

4.2.2. High Density Foam

4.3. Global PET Foam Market Attractiveness, by Grade

5. Global PET Foam Market Analysis and Forecast, by End-user, 2020–2031

5.1. Introduction and Definitions

5.2. Global PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

5.2.1. Transportation

5.2.1.1. Roadways

5.2.1.2. Railways

5.2.2. Wind Energy

5.2.3. Building & Construction

5.2.3.1. Automotive

5.2.3.2. Infrastructure

5.2.4. Marine

5.2.5. Packaging

5.2.6. Others

5.3. Global PET Foam Market Attractiveness, by End-user

6. Global PET Foam Market Analysis and Forecast, by Region, 2020–2031

6.1. Key Findings

6.2. Global PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Region, 2020–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global PET Foam Market Attractiveness, by Region

7. North America PET Foam Market Analysis and Forecast, 2020–2031

7.1. Key Findings

7.2. North America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.3. North America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

7.4. North America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country, 2020–2031

7.4.1. U.S. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.4.2. U.S. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

7.4.3. Canada PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.4.4. Canada PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

7.5. North America PET Foam Market Attractiveness Analysis

8. Europe PET Foam Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.3. Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4. Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

8.4.1. Germany PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.2. Germany PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4.3. France PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.4. France PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4.5. U.K. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.6. U.K. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4.7. Italy PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.8. Italy PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4.9. Spain PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.10. Spain PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4.11. Russia & CIS PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.12. Russia & CIS PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.4.13. Rest of Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.14. Rest of Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.5. Europe PET Foam Market Attractiveness Analysis

9. Asia Pacific PET Foam Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020-2031

9.3. Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

9.4. Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. China PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.2. China PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

9.4.3. Japan PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.4. Japan PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

9.4.5. India PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.6. India PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

9.4.7. ASEAN PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.8. ASEAN PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

9.4.9. Rest of Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.10. Rest of Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

9.5. Asia Pacific PET Foam Market Attractiveness Analysis

10. Latin America PET Foam Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.3. Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.4. Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Brazil PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.2. Brazil PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.4.3. Mexico PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.4. Mexico PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.4.5. Rest of Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.6. Rest of Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5. Latin America PET Foam Market Attractiveness Analysis

11. Middle East & Africa PET Foam Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.3. Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4. Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. GCC PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.2. GCC PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.3. South Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.4. South Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.5. Rest of Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.6. Rest of Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5. Middle East & Africa PET Foam Market Attractiveness Analysis

12. Global PET Foam Company Market Share Analysis, 2021

12.1. Competition Matrix

12.2. Market Footprint Analysis

12.2.1. By Grade

12.2.2. By End-user

12.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.3.1. Armacell International S.A.

12.3.1.1. Company Description

12.3.1.2. Business Overview

12.3.1.3. Financial Details

12.3.1.4. Strategic Overview

12.3.2. 3A Composites

12.3.2.1. Company Description

12.3.2.2. Business Overview

12.3.2.3. Financial Details

12.3.2.4. Strategic Overview

12.3.3. Gurit Holding

12.3.3.1. Company Description

12.3.3.2. Business Overview

12.3.3.3. Financial Details

12.3.3.4. Strategic Overview

12.3.4. DIAB Group

12.3.4.1. Company Description

12.3.4.2. Business Overview

12.3.4.3. Financial Details

12.3.4.4. Strategic Overview

12.3.5. BASF SE

12.3.5.1. Company Description

12.3.5.2. Business Overview

12.3.5.3. Financial Details

12.3.5.4. Strategic Overview

12.3.6. Sekisui Plastics Co. Ltd.

12.3.6.1. Company Description

12.3.6.2. Business Overview

12.3.6.3. Financial Details

12.3.6.4. Strategic Overview

12.3.7. Huntsman International LLC

12.3.7.1. Company Description

12.3.7.2. Business Overview

12.3.7.3. Financial Details

12.3.7.4. Strategic Overview

12.3.8. CoreLite Inc.

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Financial Details

12.3.8.4. Strategic Overview

12.3.9. Changzhou Tiansheng New Materials CO. Ltd.

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Financial Details

12.3.9.4. Strategic Overview

12.3.10. Carbon Core Corporation

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Financial Details

12.3.10.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 2: Global PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 3: Global PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 4: North America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 5: North America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 6: North America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 7: U.S. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 8: U.S. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 9: Canada PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 10: Canada PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 11: Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 12: Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 13: Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 14: Germany PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 15: Germany PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 16: France PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 17: France PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 18: U.K. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 19: U.K. PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 20: Italy PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 21: Italy PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 22: Spain PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 23: Spain PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 24: Russia & CIS PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 25: Russia & CIS PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 26: Rest of Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 27: Rest of Europe PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 28: Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 29: Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 30: Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 31: China PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade 2020–2031

Table 32: China PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 33: Japan PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 34: Japan PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 35: India PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 36: India PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 37: ASEAN PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 38: ASEAN PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 39: Rest of Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 40: Rest of Asia Pacific PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 41: Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 42: Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 43: Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 44: Brazil PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 45: Brazil PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 46: Mexico PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 47: Mexico PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 48: Rest of Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 49: Rest of Latin America PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 50: Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 51: Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 52: Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 54: GCC PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 55: GCC PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 56: South Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 57: South Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 58: Rest of Middle East & Africa PET Foam Market Volume (Thousand Square Meters) and Value (US$ Mn) Forecast, by Grade, 2020–2031

List of Figures

Figure 1: Global PET Foam Market Attractiveness, by Grade

Figure 2: Global PET Foam Market Attractiveness, by End-user

Figure 3: Global PET Foam Market Attractiveness, by Region

Figure 4: North America PET Foam Market Attractiveness, by Grade

Figure 5: North America PET Foam Market Attractiveness, by Country

Figure 6: Europe PET Foam Market Attractiveness, by Grade

Figure 7: Europe PET Foam Market Attractiveness, by End-user

Figure 8: Europe PET Foam Market Attractiveness, by Country and Sub-region

Figure 9: Asia Pacific PET Foam Market Attractiveness, by Grade

Figure 10: Asia Pacific PET Foam Market Attractiveness, by End-user

Figure 11: Asia Pacific PET Foam Market Attractiveness, by Country and Sub-region

Figure 12: Latin America PET Foam Market Attractiveness, by Grade

Figure 13: Latin America PET Foam Market Attractiveness, by End-user

Figure 14: Latin America PET Foam Market Attractiveness, by Country and Sub-region

Figure 15: Middle East & Africa PET Foam Market Attractiveness, by Grade

Figure 16: Middle East & Africa PET Foam Market Attractiveness, by End-user

Figure 17: Middle East & Africa PET Foam Market Attractiveness, by Country and Sub-region