Reports

Reports

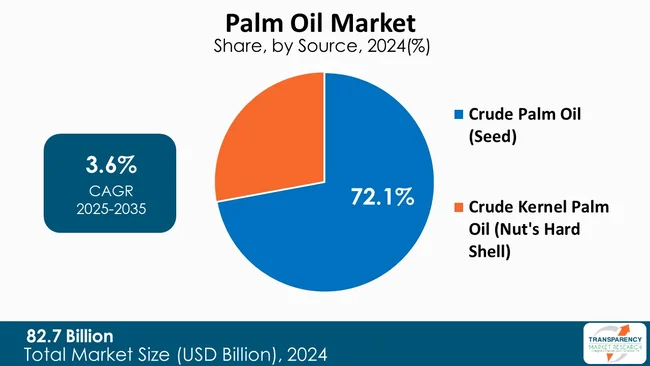

The global palm oil market size was valued at US$ 82.7 Bn in 2024 and is projected to reach US$ 121.2 Bn by 2035, expanding at a CAGR of 3.6% from 2025 to 2035. The market growth is driven by the rising demand for processed and convenience foods and expanding applications in personal care and home care

The palm oil global market is a highly integrated and complex ecosystem composed of several activities like cultivation, processing, refining, and distribution, which have already found extensive applications in the food, personal care, and industrial sectors of the world. The market is dominated by Crude Palm Oil because it yields more from the fruit mesocarp, is cheap, and has a wide range of applications in food and non-food areas, while Crude Palm Kernel Oil is more expensive and has a smaller, specialty-oriented segment.

The market embodies smallholder farmers, large estates, refineries, oleo chemical producers, and multinational consumer goods companies which reflect an interconnected value chain that spans several continents. The Asia-Pacific region geographically leads in palm oil production and consumption, and this is mainly due to the factors of conducive climatic conditions, fertile lands, infrastructure for the plantation already set up, and supply chains that are vertically integrated. The region's ability to cater to both local and global needs for palm oil cements its major position in the market.

The palm oil market is the worldwide framework inclusive of the processes like growing, cutting, processing, refining, trading, and eventually selling palm oil and its derivatives that are intended for both food and non-food industries. Palm oil is obtained from the oil palm tree (Elaeis guineensis) fruit, and palm kernel oil is from the seed. The operations cover activities from plantation in the upstream, to milling and refining in the midstream, and manufacturing of consumer and industrial products in the downstream.

Palm oil has found its way into many edible products like cooking oils, bakery fats, confections, snacks, and processed foods owing to its stability and neutral taste along with the long shelf life that is required of processed foods. Palm oil’s use in the non-food category is also vast and includes personal care products, home care, oleochemicals, pharmaceuticals, biofuels, and lubricants in the industry, as the derivatives from palm oil are very effective in providing emulsifying, cleansing, and moisturizing characteristics.

The structure of the market involves a multitude of participants, from small-scale farmers to large estate operators, refiners, processors, and multinational companies selling consumer goods. Hence, the palm oil industry is not only a very significant part of global agricultural and industrial economy but also an economically driven segment with its convenience, competitive pricing and extensive range of applications as an end-use.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The growing demand for processed and convenience foods is the primary driving factor behind the palm oil market’s expansion, especially because of the oil’s functionality and versatility in modern food manufacturing. Urbanization, faster and more affordable lifestyle choices eventually lead to consumers wanting more ready-to-eat meals, packaged snacks, bakery & confectionery products, and instant cooking solutions that save time and require little preparation.

Palm oil is one of the main ingredients used in processed foods due to its high-temperature stability, ability to enhance the texture and taste, and the fact that it does not require hydrogenation for extending the product’s shelf life. Being semi-solid at room temperature, it is perfectly suitable for the production of margarine, spreads, bakery shortenings, and frying fats. Besides that, manufacturers also prefer palm oil because it is more economical than most other vegetable oils and it provides quality that is consistent all through the year as a result of high yield and stable supply from major producing areas.

Food companies are continually moving towards developing new processed products which will be better aligned with consumer preferences such as convenience, price, and long shelf life; thus, palm oil becomes a critical ingredient in large-scale production support. Modern lifestyles like dual-income households, eating on the move, and the rising popularity of global packaged food brands are all contributing factors to the increasing consumption of processed foods that is taking place worldwide. This rising consumption, in turn, is directly supporting the demand for palm oil, hence making it the most important commodity in the global food processing industry, thereby placing it at the center of the expanding food economy driven by convenience.

The palm oil market has been heavily influenced by the expanding applications in personal care and home care areas as manufacturers are moving towards more plant-based, multifunctional, and cost-efficient ingredients. Palm oil and its derivatives like fatty acids, fatty alcohols, and glycerin, are the key ingredients in a wide range of consumer products that people use every day. These products include soap, shampoo, conditioner, moisturizer, detergent, and cleaning products for the house. The qualities of these ingredients are difficult to be imitated by synthetic methods.

The natural emulsification, foaming, cleansing, stability, and moisturizing properties that these ingredients provide are the ones that are very much needed in the performance of products. Demand for palm-derived components has spread across the entire range of personal care and home care categories from mass-market through premium as global consumers become more aware of ingredient transparency, sustainability, and skin-friendly formulations. The rapid urbanization together with lifestyle changes in the major developing regions has greatly increased the consumption of packaged personal hygiene and household cleaning products, thus encouraging companies to increase production and improve formulation efficiency.

The stable supply chain of palm oil, its low cost, and its adaptability to different product formats make it very suitable for applications in personal care and home care. The increasing inclination towards natural and biodegradable ingredients has also made the manufacturers swap petroleum-based surfactants with palm-derived alternatives thus putting palm oil in the position of a preferred input in the green product innovation. The increasing incorporation of palm oil in personal care and home care continuously creates palming demand for palm oil beyond its traditional food use.

Crude Palm Oil (Seed) dominates the Palm Oil market with 72.1% of the total market share. The main reason for this dominance is the very large quantity of crude palm oil made out of the mesocarp (fleshy part) of the oil palm fruit as compared to the oil from the kernel. The extraction of crude palm oil is not only very efficient but also cost-effective, hence enabling production in large scale that is compatible with global demand for food and non-food products.

Crude Palm Oil is a major part of the cooking oil, margarine, bakery fat, confectionery, processed foods, and frying applications due to its neutral taste, high oxidative stability, and long shelf life. It is also very popular in non-food areas such as biofuels, lubricants, and industrial-formulations, thereby continuing to strengthen its place in the market. The wide application of CPO in all kinds of mass consumption industries secures a stable demand volume, thus helping it to keep its superiority over kernel oil.

On the other hand, Crude Palm Kernel Oil, which comes from the nut's hard shell, is only a small segment in the market because of the low yield of extraction and the few application areas which are mostly in oleochemicals, cosmetics, and exclusive confectionery. In addition, the processing of kernel oil involves extra steps and hence incurs higher costs, thus making it less scalable. Consequently, the higher yield, lower production costs, and wider application base together firmly establish Crude Palm Oil (Seed) as the leading segment in the global palm oil industry.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia-Pacific region leads the global palm oil market with a market share of 49.1%. The main reason for such a stronghold is the region's favorable natural characteristics, effective well-established agricultural practices, and very much connected palm oil value chains. Indonesia and Malaysia are two of the countries that give the ideal tropical features with fertile soil and stable climate conditions enabling efficient and large-scale oil palm cultivation. These natural factors not only provide good yield but also maintain the productivity of the plantation for long periods in the whole region.

Moreover, the Asia-Pacific region has a strong and well-developed plantation and processing ecosystem which includes mills, refineries, and downstream oleochemical facilities that are located within a short distance from each other. This system of integration makes the region more competitive in both domestic and export markets.

The Asia-Pacific region is also the largest consumer of palm oil, with its wide applications including cooking, processed foods, personal care products, and home care products. The rapid growth of cities, a larger middle class, and a shift in consumption patterns have led to a greater dependence on packaged and easy-to-use products, thus creating a stronger internal demand. Furthermore, the measures taken by the governments to promote agricultural modernization, sustainability, and infrastructure development are very supportive and thus strengthen the regional leadership.

Key players in the palm oil market include AAK ABpubl, Adani Wilmar, Anglo Eastern Plantations, Boustead Plantations Berhad, Cargill, Golden Agri-Resources (GAR), IOI Group, Musim Mas Group, PT Bakrie Group, SIAT SA, Sime Darby Plantation, Socfin SA, Unilever, United Plantations Bhd, Wilmar International Ltd and other key players.

Each of these companies has been profiled in the palm oil market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 82.7 Bn |

| Market Forecast Value in 2035 | US$ 121.2 Bn |

| Growth Rate (CAGR 2025 to 2035) | 3.6% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Litres for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global palm oil market was valued at US$ 82.7 Bn in 2024

The global palm oil industry is projected to reach more than US$ 121.2 Bn by the end of 2035

Rising demand for processed and convenience foods and expanding applications in personal care and home care are some of the factors driving the expansion of palm oil market.

The CAGR is anticipated to be 3.6% from 2025 to 2035

AAK ABpubl, Anglo Eastern Plantations, Boustead Plantations Berhad, Cargill, Golden Agri-Resources (GAR), IOI Group, Musim Mas Group, PT Bakrie Group, SIAT SA, Sime Darby Plantation, Socfin SA, Unilever, United Plantations Bhd, Wilmar International Ltd, and others

Table 01: Global Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 02: Global Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 03: Global Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 04: Global Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 05: Global Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 06: Global Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 07: Global Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 08: Global Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 09: Global Palm Oil Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 10: Global Palm Oil Market Volume (Thousand Litres) Projection, By Region 2020 to 2035

Table 11: North America Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 12: North America Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 13: North America Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 14: North America Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 15: North America Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 16: North America Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 17: North America Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 18: North America Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 19: North America Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 20: North America Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Table 21: U.S. Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 22: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 23: U.S. Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 24: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 25: U.S. Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 26: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 27: U.S. Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 28: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 29: Canada Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 30: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 31: Canada Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 32: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 33: Canada Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 34: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 35: Canada Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 36: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 37: Europe Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 38: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 39: Europe Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 40: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 41: Europe Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 42: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 43: Europe Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 44: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 45: Europe Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 46: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Table 47: U.K. Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 48: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 49: U.K. Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 50: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 51: U.K. Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 52: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 53: U.K. Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 54: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 55: Germany Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 56: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 57: Germany Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 58: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 59: Germany Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 60: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 61: Germany Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 62: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 63: France Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 64: France Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 65: France Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 66: France Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 67: France Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 68: France Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 69: France Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 70: France Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 71: Italy Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 72: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 73: Italy Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 74: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 75: Italy Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 76: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 77: Italy Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 78: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 79: Spain Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 80: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 81: Spain Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 82: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 83: Spain Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 84: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 85: Spain Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 86: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 87: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 88: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 89: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 90: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 91: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 92: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 93: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 94: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 95: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 96: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 97: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 98: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 99: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 100: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 101: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 102: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 103: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Table 105: China Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 106: China Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 107: China Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 108: China Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 109: China Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 110: China Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 111: China Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 112: China Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 113: India Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 114: India Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 115: India Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 116: India Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 117: India Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 118: India Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 119: India Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 120: India Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 121: Japan Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 122: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 123: Japan Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 124: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 125: Japan Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 126: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 127: Japan Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 128: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 129: Australia Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 130: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 131: Australia Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 132: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 133: Australia Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 134: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 135: Australia Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 136: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 137: South Korea Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 138: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 139: South Korea Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 140: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 141: South Korea Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 142: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 143: South Korea Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 144: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 145: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 146: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 147: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 148: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 149: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 150: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 151: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 152: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 153: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 154: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 155: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 156: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 157: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 158: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 159: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 160: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 161: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Table 163: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 164: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 165: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 166: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 167: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 168: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 169: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 170: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 171: South Africa Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 172: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 173: South Africa Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 174: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 175: South Africa Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 176: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 177: South Africa Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 178: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 179: Latin America Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 180: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 181: Latin America Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 182: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 183: Latin America Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 184: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 185: Latin America Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 186: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 187: Latin America Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 188: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Table 189: Brazil Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 190: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 191: Brazil Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 192: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 193: Brazil Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 194: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 195: Brazil Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 196: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 197: Mexico Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 198: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 199: Mexico Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 200: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 201: Mexico Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 202: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 203: Mexico Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 204: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Table 205: Argentina Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Table 206: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Table 207: Argentina Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Table 208: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Table 209: Argentina Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 210: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Table 211: Argentina Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 212: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 02: Global Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 03: Global Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 04: Global Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 05: Global Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 06: Global Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 07: Global Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 08: Global Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 09: Global Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 10: Global Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Palm Oil Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global Palm Oil Market Volume (Thousand Litres) Projection, By Region 2020 to 2035

Figure 15: Global Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 17: North America Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 18: North America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 19: North America Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 20: North America Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 21: North America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 22: North America Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 23: North America Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 24: North America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 25: North America Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 30: North America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 32: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 33: U.S. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 34: U.S. Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 35: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 36: U.S. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 37: U.S. Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 38: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 39: U.S. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 40: U.S. Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 44: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 45: Canada Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 46: Canada Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 47: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 48: Canada Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 49: Canada Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 50: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 51: Canada Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 52: Canada Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 56: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 57: Europe Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 58: Europe Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 59: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 60: Europe Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 61: Europe Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 62: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 63: Europe Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 64: Europe Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 69: Europe Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 71: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 72: U.K. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 73: U.K. Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 74: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 75: U.K. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 76: U.K. Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 77: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 78: U.K. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 79: U.K. Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 83: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 84: Germany Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 85: Germany Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 86: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 87: Germany Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 88: Germany Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 89: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 90: Germany Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 91: Germany Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 95: France Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 96: France Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 97: France Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 98: France Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 99: France Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 100: France Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 101: France Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 102: France Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 103: France Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 107: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 108: Italy Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 109: Italy Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 110: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 111: Italy Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 112: Italy Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 113: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 114: Italy Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 115: Italy Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 119: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 120: Spain Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 121: Spain Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 122: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 123: Spain Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 124: Spain Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 125: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 126: Spain Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 127: Spain Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 131: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 132: The Netherlands Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 133: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 134: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 135: The Netherlands Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 136: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 137: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 138: The Netherlands Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 139: The Netherlands Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 143: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 144: Asia Pacific Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 145: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 146: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 147: Asia Pacific Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 148: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 149: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 150: Asia Pacific Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 151: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 158: China Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 159: China Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 160: China Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 161: China Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 162: China Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 163: China Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 164: China Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 165: China Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 166: China Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 170: India Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 171: India Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 172: India Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 173: India Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 174: India Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 175: India Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 176: India Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 177: India Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 178: India Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 182: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 183: Japan Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 184: Japan Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 185: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 186: Japan Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 187: Japan Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 188: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 189: Japan Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 190: Japan Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 194: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 195: Australia Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 196: Australia Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 197: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 198: Australia Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 199: Australia Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 200: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 201: Australia Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 202: Australia Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 206: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 207: South Korea Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 208: South Korea Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 209: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 210: South Korea Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 211: South Korea Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 212: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 213: South Korea Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 214: South Korea Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 218: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 219: ASEAN Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 220: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 221: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 222: ASEAN Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 223: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 224: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 225: ASEAN Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 226: ASEAN Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 230: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 231: Middle East & Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 232: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 233: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 234: Middle East & Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 235: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 236: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 237: Middle East & Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 238: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 245: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 246: GCC Countries Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 247: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 248: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 249: GCC Countries Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 250: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 251: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 252: GCC Countries Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 253: GCC Countries Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 257: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 258: South Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 259: South Africa Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 260: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 261: South Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 262: South Africa Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 263: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 264: South Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 265: South Africa Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 269: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 270: Latin America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 271: Latin America Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 272: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 273: Latin America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 274: Latin America Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 275: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 276: Latin America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 277: Latin America Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Palm Oil Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America Palm Oil Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 282: Latin America Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 284: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 285: Brazil Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 286: Brazil Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 287: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 288: Brazil Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 289: Brazil Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 290: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 291: Brazil Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 292: Brazil Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Mexico Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 296: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 297: Mexico Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 298: Mexico Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 299: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 300: Mexico Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 301: Mexico Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 302: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 303: Mexico Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 304: Mexico Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Mexico Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 306: Mexico Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Argentina Palm Oil Market Value (US$ Bn) Projection, By Source 2020 to 2035

Figure 308: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Source 2020 to 2035

Figure 309: Argentina Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Source 2025 to 2035

Figure 310: Argentina Palm Oil Market Value (US$ Bn) Projection, By Form 2020 to 2035

Figure 311: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Form 2020 to 2035

Figure 312: Argentina Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Form 2025 to 2035

Figure 313: Argentina Palm Oil Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 314: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 315: Argentina Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 316: Argentina Palm Oil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Argentina Palm Oil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 318: Argentina Palm Oil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035