Reports

Reports

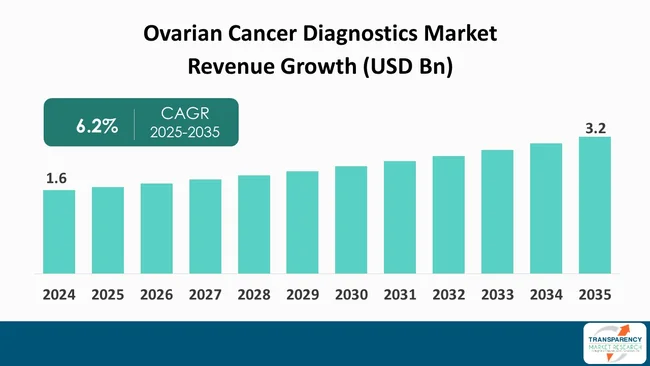

The global ovarian cancer diagnostics market size was valued at US$ 1.6 billion in 2024 and is projected to reach US$ 3.2 billion by 2035, expanding at a CAGR of 6.2% from 2025 to 2035. The market growth is driven by rising incidence of ovarian cancer, significant technological advancements in diagnostics such as liquid biopsies and next-generation sequencing, and increased funding for research and development.

Technological innovations in diagnostic methods are amongst the significant factors driving the ovarian cancer diagnostics market. Advancements in imaging technologies including MRI sequences and enhanced CT scanners, along with improvements in PET scans and ultrasound, enable physicians to characterize lesions more accurately accordingly.

At the same time, advancements in biomarker assays, such as multiplexed panels and high-sensitivity immunoassays, are supporting earlier detection coupled with refined prognostic stratification. The automation of laboratory workflows, reduction of per-test operational costs, and availability of advanced diagnostics in ambulatory and outpatient settings are the key factors driving an increased adoption of ovarian cancer diagnostics across numerous care pathways, thereby widening the market reach.

Supportive regulatory policies and expansion of reimbursement are considerable drivers that underpin market uptake. The uptake is simplified by the inclusion of tumor marker testing and advanced imaging in payer benefit designs. Public screening programs and targeted awareness campaigns elevate referral rates, diagnostic throughput, and increased funding from public grants and private investors accelerate the R&D activities.

Workforce training for radiologists and laboratory scientists increases capacity and investment in laboratory modernization. The enhanced interoperability of health IT systems and tele-radiology services offer further advantages for the scalable deployment.

Minimal invasive and blood-based diagnostics have been rapidly adopted as a recent market trend. Liquid biopsy assays are being used to detect circulating tumor DNA and extracellular vesicles have become popular for monitoring as well as for recurrence detection. Imaging processes are using artificial intelligence and machine learning technologies, which are being integrated to improve lesion detection, automate the quantification process as well as lower the variability.

The combination of proteomic, genomic, and epigenetic markers has led to the development of multiplexed, multi-omic panels that are increasingly becoming useful in diagnostic accuracy and risk stratification. The regulatory agencies have started to acknowledge the utility of novel diagnostics based on real-world evidence.

The competitive landscape in the ovarian cancer diagnostics market is influenced by strategic collaborations, integration of platforms and efforts toward clinical validation of products. The commercial strategies of companies may include contracts of bundled diagnostic services, pilot implementations with health systems, and value-based pricing agreements that are linked to clinical outcomes.

Ovarian cancer diagnostics refer to a line of medical examinations and imaging tests that are employed for the diagnosis, detection, and follow-up care of ovarian cancer. Diagnostics are essential in determining the disease at different stages of its progression, in differentiating between benign and malignant ovarian masses, and also for clinical decision-making. As the symptoms of ovarian cancer in its early stages are non-specific, a timely diagnosis increases the chances of the patient’s survival.

In majority of the cases, diagnosis is done through different imaging methods such as computed tomography (CT), ultrasound, positron emission tomography (PET) scans, and magnetic resonance imaging (MRI). Ovarian visualization with these methods provides details regarding tumor size and spread of the disease, facilitating treatment planning, and response to therapy evaluation along the time axis.

Besides, biochemical and molecular examinations represent critical investigative tools in the diagnosis of ovarian cancer. Tumor markers such as CA-125 and HE4 obtained from blood are highly valuable sources of information for screening of high-risk individuals and also for recurrence detection. Furthermore, BRCA1 and BRCA2 genetic testing not only allows for identification of inherited risk but also aids further in constructing the patient-specific treatment plans.

The development of diagnostic technologies like liquid biopsy and multi-omic profiling plays a key role in diagnosing ovarian cancer. The goal of these novel methods include early diagnosis, improved risk stratification and better disease control with further focus on cancer-specific biomarkers in blood or tissue samples.

| Attribute | Detail |

|---|---|

| Ovarian Cancer Diagnostics Market Drivers |

|

The ovarian cancer diagnostics market is largely influenced by the rising number of ovarian cancer cases. This worldwide rise in ovarian cancer has made it imperative to have diagnostic tools that are not only reliable and accurate but also readily available for the diagnosis of disease at its early stages. Such a continuous increase in the disease burden is leading to huge demands on healthcare system to adopt technologies that would enhance detection accuracy and patient’s quality of life.

Healthcare providers are increasingly prioritizing comprehensive diagnostic evaluation as more number of women are exhibiting symptoms or being identified as high-risk. The increased incidence necessitates that diagnostic centers and hospitals extend their diagnostic capabilities including biomarker testing, imaging systems, and molecular assays. The patient volume increase contributes to the introduction of advanced instruments, automated analyzers, and integrated diagnostic workflows into the market.

Additionally, government hospitals and cancer institutes offer funding to screening and awareness programs, which lead to early diagnosis of ovarian cancer. This has led to an increase in frequency of testing of tumor markers such as CA-125 and HE4, and imaging studies such as CT scan and MRI.

Besides, the increasing prevalence has led to a significant leap research funding for clinical trials to enhance the accuracy of diagnoses.

The paradigm shift toward precision medicine is another considerable driving factor influencing the ovarian cancer diagnostics market. Precision medicine is focused on providing patients with treatment that is based on the genetic and molecular characteristics of that particular tumor. The process, therefore, necessitates the provision of exceedingly specific diagnostic tools for the planning of personalized treatment..

The pharmaceutical and diagnostic companies are increasingly forming alliances that mutually benefit them in co-creating the companion diagnostics that are perfectly tailored for the targeted drug pipelines. Such a collaboration-based ecosystem is paving the way for the ease of the innovation process, the speed of regulatory approvals, and the facilitation of clinical practice, thus bolstering the ovarian cancer diagnostics Industry.

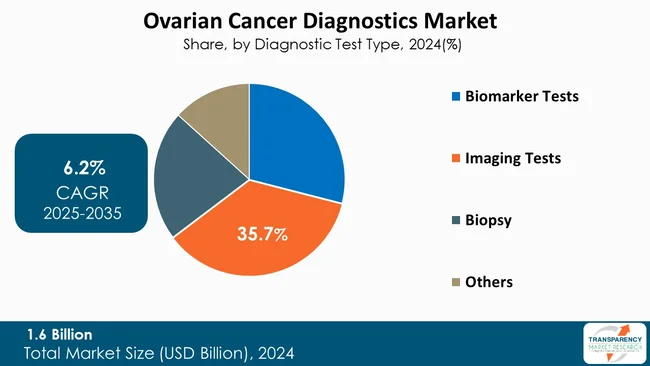

One of the most significant elements of ovarian cancer diagnostics market is its reliance on imaging tests. Imaging tests are used for successful staging, detection, and follow-up treatment of the disease. CT, ultrasound, PET scan, MRI, and others offer both - anatomical and functional information at a microscopic level, allowing clinicians to identify the nature of ovarian masses with a high degree of accuracy.

Moreover, imaging serves as the first-line diagnostic approach owing to its widespread availability in clinical settings and non-invasive nature. The incorporation of artificial intelligence in the interpretation of high-resolution modalities sand results as part of continuous improvements in technology have also been cited by several professionals as being instrumental in further confirming the predominance of diagnostic imaging as the very first choice in ovarian cancer diagnosis.

| Attribute | Detail |

|---|---|

| Leading Region |

|

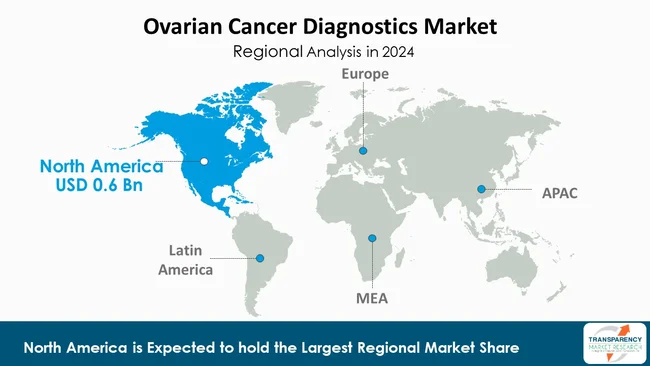

As per the latest ovarian cancer diagnostics market analysis, North America dominated in 2024, capturing a market share of 36.8%. This is basically due to the region’s sophisticated healthcare infrastructure, presence of several leading diagnostic companies, and the higher uptake of cutting-edge technologies. Imaging, biomarker-based, and molecular diagnostics have become prevalent due to the region’s extensive healthcare expenditure and well-established reimbursement model.

Moreover, the demand for diagnostic tests is being propelled by the rising awareness of early detection and screening programs. The presence of trained professionals, state-of-the-art laboratory facilities, and clinical research activities are some of the major factors that ensures the dominance of this region over the global ovarian cancer diagnostics market.

The companies operating in the ovarian cancer diagnostics market are focusing on strategic collaborations, technological innovation, and product portfolio expansion. These companies are banking on biomarker discovery, companion diagnostics development, and AI-based diagnostic tools. Besides, enterprises also look for opportunities in mergers, regulatory partnerships, and global distribution agreements as a means to increase their market presence and clinch faster adoption of their products.

F. Hoffmann-La Roche AG, Abbott, Siemens Healthineers AG, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Quest Diagnostics Incorporated, Illumina, Inc., Myriad Genetics, Inc., Koninklijke Philips N.V., QIAGEN, Ambry Genetics, AOA Dx, bioMérieux SA, Tulip Diagnostics (P) Ltd, Epitope Diagnostics, Inc., Creative Diagnostics, and Exact Sciences Corporation are some of the leading players operating in the global ovarian cancer diagnostics market.

Each of these players has been profiled in the ovarian cancer diagnostics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.6 Bn |

| Forecast Value in 2035 | US$ 3.2 Bn |

| CAGR | 6.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Diagnostic Test Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global ovarian cancer diagnostics market was valued at US$ 1.6 Bn in 2024

The global ovarian cancer diagnostics industry is projected to reach more than US$ 3.2 Bn by the end of 2035

The rising incidence of ovarian cancer, significant technological advancements in diagnostics such as liquid biopsies and next-generation sequencing, increased funding for research and development, improved patient and public awareness, and the shift towards precision medicine approaches using genetic and biomarker testing are some of the factors driving the expansion of ovarian cancer diagnostics market.

The CAGR is anticipated to be 6.2% from 2025 to 2035

F. Hoffmann-La Roche AG, Abbott, Siemens Healthineers AG, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Quest Diagnostics Incorporated, Illumina, Inc., Myriad Genetics, Inc., Koninklijke Philips N.V., QIAGEN, Ambry Genetics, AOA Dx, bioMérieux SA, Tulip Diagnostics (P) Ltd, Epitope Diagnostics, Inc., Creative Diagnostics, and Exact Sciences Corporation

Table 01: Global Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 02: Global Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Biomarker Tests, 2020 to 2035

Table 03: Global Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 04: Global Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Tumor Type, 2020 to 2035

Table 05: Global Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 09: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Biomarker Tests, 2020 to 2035

Table 10: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 11: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Tumor Type, 2020 to 2035

Table 12: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 15: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Biomarker Tests, 2020 to 2035

Table 16: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 17: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Tumor Type, 2020 to 2035

Table 18: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 21: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Biomarker Tests, 2020 to 2035

Table 22: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 23: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Tumor Type, 2020 to 2035

Table 24: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 27: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Biomarker Tests, 2020 to 2035

Table 28: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 29: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Tumor Type, 2020 to 2035

Table 30: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 33: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Biomarker Tests, 2020 to 2035

Table 34: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 35: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By Tumor Type, 2020 to 2035

Table 36: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Ovarian Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 02: Global Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 03: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Biomarker Tests, 2020 to 2035

Figure 04: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Imaging Tests, 2020 to 2035

Figure 05: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Biopsy, 2020 to 2035

Figure 06: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Ovarian Cancer Diagnostics Market Value Share Analysis, By Tumor Type, 2024 and 2035

Figure 08: Global Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Tumor Type, 2025 to 2035

Figure 09: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Epithelial Tumor, 2020 to 2035

Figure 10: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Germ Cell Tumor, 2020 to 2035

Figure 11: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Stromal Cell Tumor, 2020 to 2035

Figure 12: Global Ovarian Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 13: Global Ovarian Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 14: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Hospital Laboratories, 2020 to 2035

Figure 15: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Diagnostic Centers, 2020 to 2035

Figure 16: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Academic and Research Institutes, 2020 to 2035

Figure 17: Global Ovarian Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Ovarian Cancer Diagnostics Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America Ovarian Cancer Diagnostics Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America Ovarian Cancer Diagnostics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America Ovarian Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 24: North America Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 25: North America Ovarian Cancer Diagnostics Market Value Share Analysis, By Tumor Type, 2024 and 2035

Figure 26: North America Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Tumor Type, 2025 to 2035

Figure 27: North America Ovarian Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: North America Ovarian Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Europe Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe Ovarian Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 31: Europe Ovarian Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 32: Europe Ovarian Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 33: Europe Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 34: Europe Ovarian Cancer Diagnostics Market Value Share Analysis, By Tumor Type, 2024 and 2035

Figure 35: Europe Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Tumor Type, 2025 to 2035

Figure 36: Europe Ovarian Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Europe Ovarian Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Asia Pacific Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific Ovarian Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Asia Pacific Ovarian Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Asia Pacific Ovarian Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 42: Asia Pacific Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 43: Asia Pacific Ovarian Cancer Diagnostics Market Value Share Analysis, By Tumor Type, 2024 and 2035

Figure 44: Asia Pacific Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Tumor Type, 2025 to 2035

Figure 45: Asia Pacific Ovarian Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Asia Pacific Ovarian Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Latin America Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America Ovarian Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Latin America Ovarian Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Latin America Ovarian Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 51: Latin America Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 52: Latin America Ovarian Cancer Diagnostics Market Value Share Analysis, By Tumor Type, 2024 and 2035

Figure 53: Latin America Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Tumor Type, 2025 to 2035

Figure 54: Latin America Ovarian Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Latin America Ovarian Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Middle East & Africa Ovarian Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Middle East & Africa Ovarian Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Middle East & Africa Ovarian Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Middle East & Africa Ovarian Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 60: Middle East & Africa Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 61: Middle East & Africa Ovarian Cancer Diagnostics Market Value Share Analysis, By Tumor Type, 2024 and 2035

Figure 62: Middle East & Africa Ovarian Cancer Diagnostics Market Attractiveness Analysis, By Tumor Type, 2025 to 2035

Figure 63: Middle East & Africa Ovarian Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 64: Middle East & Africa Ovarian Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035