Reports

Reports

Analysts’ Viewpoint

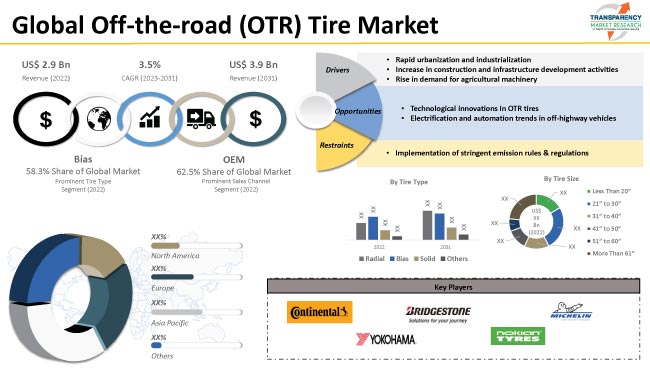

Rapid urbanization and industrialization, increase in construction and infrastructure development activities, and rise in demand for agricultural machinery are key factors driving the OTR tire industry growth. Off-the-road (OTR) tire is the ideal choice for vehicles with frequent or continuous off-road applications to avoid the cost of repairs and maintenance. Rise in electrification and automation trends in off-highway vehicles is projected to boost the off-the-road (OTR) tire market value during the forecast period.

Leading OTR tire brands are investing significantly in R&D activities in the field of OTR tires. These brands are engaged in incorporating advanced technologies in OTR tires in order to increase their market share.

Off-the-road (OTR) tires are primarily used in heavy equipment that is employed at construction, mining, and other sites that face challenging off-road terrain. These tires are built to support large amount of weight to guide vehicles through challenging conditions. They are built with blocky, heavy-duty tread patterns, and puncture-resistant sidewalls.

OTR tires often offer extensive support for machines utilized at various civil engineering sites. These tires help provide a secure grip on surfaces containing boulders, rocks, dirt, sand, and even snow. Off-road tires are available in a variety of designs that are ideal for varied driving circumstances.

Rapid urbanization, rise in global population, and increase in disposable income of the people are key factors driving the off-the-road (OTR) tire market share. Rapid growth in the construction sector is a major factor augmenting the global demand for OTR tires.

Several governments, particularly those from developing countries, are making significant investments in industrial development and smart city projects. Increase in government investment in infrastructure development is further contributing to market progress.

Demand for OTR tires is increasing with the rise in number of projects to construct bridges, highways, and buildings. The usage of heavy construction machinery and OTR tires significantly reduces project expenses. Need for off-highway vehicles to support construction operations is rising across the globe. This is augmenting OTR tire market dynamics.

Contemporary off-highway vehicles are widely used in oil and gas exploration activities. Innovative technologies are being adopted more frequently in the production of OTR tires for vehicles that routinely traverse challenging terrain. Development of modern OTR products that can function on different terrains is another factor fueling market statistics.

Based on tire type, the global OTR tire market has been segmented into radial, bias, solid, and others. The bias segment held 58.3% share in 2022. It is likely to lead the global business during the forecast period.

Bias tires offer a more comfortable journey on rough terrain than spiral tires. They are also more affordable. Furthermore, the sides of bias tires are more rigid. This allows them to support heavier loads.

Bias tires are widely used in Asia Pacific and South America. Demand for radial tires is increasing in North America and Europe. The solid segment is expected to grow at a significant pace during the forecast period, owing to the rise in sale of forklifts and warehouse trucks.

Based on sales channel, the global Off-the-road (OTR) tire market has been bifurcated into OEM and aftermarket. The OEM segment contributed major share of 62.5% in 2022. The segment is estimated to expand at a CAGR of more than 3.2% during the forecast period. This can be primarily ascribed to new advancements in radial tires and increase in penetration of these tires in the market.

Radial tires with longer trade life and advanced technology are gaining popularity across the globe. This is estimated to boost the OEM segment in the near future.

The aftermarket segment is projected to hold significant market share by the end of the forecast period. OTR tires need to be replaced regularly, as they undergo wear and tear due to their operation under heavy load and on rough terrains. Increase in demand for replacement of tires in construction, agriculture, mining, and other industries is fueling the segment.

Asia Pacific is likely to dominate the global landscape in the near future. Off-the-road (OTR) tire market growth in the region can be ascribed to rise in infrastructure development activities and expansion in the agriculture sector.

OTR tire market demand is rising in China, India, ASEAN, and Oceania. Furthermore, growth in the mining industry and increase in demand for port handling equipment are augmenting off-the-road (OTR) tire market development in Asia Pacific.

The market in Asia Pacific is likely to be followed by that in North America and Europe. The off-the-road (OTR) tire market size in Europe is anticipated to increase during the forecast period, owing to the rise in adoption of solid OTR tires in the industrial sector.

Increase in construction activities and growth in the mining industry in Middle East & Africa are fueling the off-the-road (OTR) tire industry share in the region.

The global market for off-the-road (OTR) tire is fragmented, with large number of players competing for market dominance. According to the latest off-the-road (OTR) tire market forecast analysis, key players are implementing growth strategies such as launch of new products, mergers, and acquisitions to expand their global footprint.

Trelleborg AB, Apollo Tyres Ltd., Continental AG, Balkrishna Industries Limited, China National Tire & Rubber Co., Ltd., Double Coin Tyre Group Ltd., Titan, International, Inc., Yokohama Tire Corporation, Bridgestone Corporation, The Goodyear Tire & Rubber Company, MICHELIN, Sumitomo Rubber Industries, Ltd., Prometeon Tyre Group S.R.L., Nokian Tyres, Qingdao Rhino Tyre Co., Ltd., and Triangle Group Co., Ltd. are some of the prominent off-the-road (OTR) tire market players.

Each of these players has been profiled in the Off-the-road (OTR) tire market report based on parameters such as financial overview, business strategies, company overview, recent developments, business segments, and product portfolio.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.9 Bn |

|

Market Forecast Value in 2031 |

US$ 3.9 Bn |

|

Growth Rate (CAGR) |

3.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.9 Bn in 2022.

It is anticipated to grow at a CAGR of 3.5% by 2031.

It would be worth US$ 3.9 Bn in 2031.

Increase in demand for construction equipment and agricultural tractors, rise in sale of off-highway vehicles, and growth in farm mechanization.

The bias tire type segment accounted for 58.3% share in 2022.

Asia Pacific is a highly lucrative region for vendors.

Apollo Tyres Ltd., Balkrishna Industries Limited., Bridgestone Corporation, China National Tire & Rubber Co., Ltd., Continental AG, Double Coin Tyre Group Ltd., MICHELIN, Nokian Tyres, Prometeon Tyre Group S.R.L., Qingdao Rhino Tyre Co., Ltd., Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Company, Titan, International, Inc., Trelleborg AB, Triangle Group Co., Ltd., and Yokohama Tire Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, Volume (Thousand Units), 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. Value Chain Analysis

2.4. Regulatory Scenario

2.5. Key Trend Analysis

2.6. Cost Structure Analysis

2.7. Profit Margin Analysis

3. COVID-19 Impact Analysis – Off-the-road (OTR) Tire Market

4. Global Off-the-road (OTR) Tire Market, By Tire Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

4.2.1. Radial

4.2.2. Bias

4.2.3. Solid

4.2.4. Others

5. Global Off-the-road (OTR) Tire Market, By Tire Size

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

5.2.1. Less Than 20”

5.2.2. 21” to 30”

5.2.3. 31” to 40”

5.2.4. 41” to 50”

5.2.5. 51” to 60”

5.2.6. More Than 61”

6. Global Off-the-road (OTR) Tire Market, By Application

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Application

6.2.1. Tractors

6.2.2. Trailers

6.2.3. Forwarders

6.2.4. Excavators

6.2.5. Backhoes

6.2.6. Bulldozers

6.2.7. Graders

6.2.8. Wheel Tractor Scrapers

6.2.9. Trenchers

6.2.10. Loaders

6.2.11. Tower Cranes

6.2.12. Compactors

6.2.13. Telehandlers

6.2.14. Dump Trucks

6.2.15. Wheel Loaders

6.2.16. Heavy Duty Forklifts

6.2.17. AGVs

6.2.18. Reach Stackers

6.2.19. Mobile Cranes

6.2.20. Material Handlers

6.2.21. Straddle Carriers

6.2.22. Terminal Trailers

6.2.23. Others

7. Global Off-the-road (OTR) Tire Market, By Sales Channel

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

7.2.1. OEM

7.2.2. Aftermarket

8. Global Off-the-road (OTR) Tire Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Off-the-road (OTR) Tire Market

9.1. Market Snapshot

9.2. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

9.2.1. Radial

9.2.2. Bias

9.2.3. Solid

9.2.4. Others

9.3. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

9.3.1. Less Than 20”

9.3.2. 21” to 30”

9.3.3. 31” to 40”

9.3.4. 41” to 50”

9.3.5. 51” to 60”

9.3.6. More Than 61”

9.4. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Application

9.4.1. Tractors

9.4.2. Trailers

9.4.3. Forwarders

9.4.4. Excavators

9.4.5. Backhoes

9.4.6. Bulldozers

9.4.7. Graders

9.4.8. Wheel Tractor Scrapers

9.4.9. Trenchers

9.4.10. Loaders

9.4.11. Tower Cranes

9.4.12. Compactors

9.4.13. Telehandlers

9.4.14. Dump Trucks

9.4.15. Wheel Loaders

9.4.16. Heavy Duty Forklifts

9.4.17. AGVs

9.4.18. Reach Stackers

9.4.19. Mobile Cranes

9.4.20. Material Handlers

9.4.21. Straddle Carriers

9.4.22. Terminal Trailers

9.4.23. Others

9.5. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

9.5.1. OEM

9.5.2. Aftermarket

9.6. Key Country Analysis – North America Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Off-the-road (OTR) Tire Market

10.1. Market Snapshot

10.2. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

10.2.1. Radial

10.2.2. Bias

10.2.3. Solid

10.2.4. Others

10.3. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

10.3.1. Less Than 20”

10.3.2. 21” to 30”

10.3.3. 31” to 40”

10.3.4. 41” to 50”

10.3.5. 51” to 60”

10.3.6. More Than 61”

10.4. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Application

10.4.1. Tractors

10.4.2. Trailers

10.4.3. Forwarders

10.4.4. Excavators

10.4.5. Backhoes

10.4.6. Bulldozers

10.4.7. Graders

10.4.8. Wheel Tractor Scrapers

10.4.9. Trenchers

10.4.10. Loaders

10.4.11. Tower Cranes

10.4.12. Compactors

10.4.13. Telehandlers

10.4.14. Dump Trucks

10.4.15. Wheel Loaders

10.4.16. Heavy Duty Forklifts

10.4.17. AGVs

10.4.18. Reach Stackers

10.4.19. Mobile Cranes

10.4.20. Material Handlers

10.4.21. Straddle Carriers

10.4.22. Terminal Trailers

10.4.23. Others

10.5. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Key Country Analysis – Europe Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Off-the-road (OTR) Tire Market

11.1. Market Snapshot

11.2. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

11.2.1. Radial

11.2.2. Bias

11.2.3. Solid

11.2.4. Others

11.3. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

11.3.1. Less Than 20”

11.3.2. 21” to 30”

11.3.3. 31” to 40”

11.3.4. 41” to 50”

11.3.5. 51” to 60”

11.3.6. More Than 61”

11.4. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Application

11.4.1. Tractors

11.4.2. Trailers

11.4.3. Forwarders

11.4.4. Excavators

11.4.5. Backhoes

11.4.6. Bulldozers

11.4.7. Graders

11.4.8. Wheel Tractor Scrapers

11.4.9. Trenchers

11.4.10. Loaders

11.4.11. Tower Cranes

11.4.12. Compactors

11.4.13. Telehandlers

11.4.14. Dump Trucks

11.4.15. Wheel Loaders

11.4.16. Heavy Duty Forklifts

11.4.17. AGVs

11.4.18. Reach Stackers

11.4.19. Mobile Cranes

11.4.20. Material Handlers

11.4.21. Straddle Carriers

11.4.22. Terminal Trailers

11.4.23. Others

11.5. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Key Country Analysis – Asia Pacific Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Off-the-road (OTR) Tire Market

12.1. Market Snapshot

12.2. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

12.2.1. Radial

12.2.2. Bias

12.2.3. Solid

12.2.4. Others

12.3. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

12.3.1. Less Than 20”

12.3.2. 21” to 30”

12.3.3. 31” to 40”

12.3.4. 41” to 50”

12.3.5. 51” to 60”

12.3.6. More Than 61”

12.4. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Application

12.4.1. Tractors

12.4.2. Trailers

12.4.3. Forwarders

12.4.4. Excavators

12.4.5. Backhoes

12.4.6. Bulldozers

12.4.7. Graders

12.4.8. Wheel Tractor Scrapers

12.4.9. Trenchers

12.4.10. Loaders

12.4.11. Tower Cranes

12.4.12. Compactors

12.4.13. Telehandlers

12.4.14. Dump Trucks

12.4.15. Wheel Loaders

12.4.16. Heavy Duty Forklifts

12.4.17. AGVs

12.4.18. Reach Stackers

12.4.19. Mobile Cranes

12.4.20. Material Handlers

12.4.21. Straddle Carriers

12.4.22. Terminal Trailers

12.4.23. Others

12.5. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Key Country Analysis – Middle East & Africa Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Off-the-road (OTR) Tire Market

13.1. Market Snapshot

13.2. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Type

13.2.1. Radial

13.2.2. Bias

13.2.3. Solid

13.2.4. Others

13.3. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Tire Size

13.3.1. Less Than 20”

13.3.2. 21” to 30”

13.3.3. 31” to 40”

13.3.4. 41” to 50”

13.3.5. 51” to 60”

13.3.6. More Than 61”

13.4. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Application

13.4.1. Tractors

13.4.2. Trailers

13.4.3. Forwarders

13.4.4. Excavators

13.4.5. Backhoes

13.4.6. Bulldozers

13.4.7. Graders

13.4.8. Wheel Tractor Scrapers

13.4.9. Trenchers

13.4.10. Loaders

13.4.11. Tower Cranes

13.4.12. Compactors

13.4.13. Telehandlers

13.4.14. Dump Trucks

13.4.15. Wheel Loaders

13.4.16. Heavy Duty Forklifts

13.4.17. AGVs

13.4.18. Reach Stackers

13.4.19. Mobile Cranes

13.4.20. Material Handlers

13.4.21. Straddle Carriers

13.4.22. Terminal Trailers

13.4.23. Others

13.5. Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. Key Country Analysis – South America Off-the-road (OTR) Tire Market Size Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Pricing comparison among key players

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14.4. Company Profile/ Key Players

14.4.1. Apollo Tyres Ltd

14.4.1.1. Company Overview

14.4.1.2. Company Footprints

14.4.1.3. Production Locations

14.4.1.4. Product Portfolio

14.4.1.5. Competitors & Customers

14.4.1.6. Subsidiaries & Parent Organization

14.4.1.7. Recent Developments

14.4.1.8. Financial Analysis

14.4.1.9. Profitability

14.4.1.10. Revenue Share

14.4.2. Balkrishna Industries Limited

14.4.2.1. Company Overview

14.4.2.2. Company Footprints

14.4.2.3. Production Locations

14.4.2.4. Product Portfolio

14.4.2.5. Competitors & Customers

14.4.2.6. Subsidiaries & Parent Organization

14.4.2.7. Recent Developments

14.4.2.8. Financial Analysis

14.4.2.9. Profitability

14.4.2.10. Revenue Share

14.4.3. Bridgestone Corporation

14.4.3.1. Company Overview

14.4.3.2. Company Footprints

14.4.3.3. Production Locations

14.4.3.4. Product Portfolio

14.4.3.5. Competitors & Customers

14.4.3.6. Subsidiaries & Parent Organization

14.4.3.7. Recent Developments

14.4.3.8. Financial Analysis

14.4.3.9. Profitability

14.4.3.10. Revenue Share

14.4.4. China National Tire & Rubber Co., Ltd.

14.4.4.1. Company Overview

14.4.4.2. Company Footprints

14.4.4.3. Production Locations

14.4.4.4. Product Portfolio

14.4.4.5. Competitors & Customers

14.4.4.6. Subsidiaries & Parent Organization

14.4.4.7. Recent Developments

14.4.4.8. Financial Analysis

14.4.4.9. Profitability

14.4.4.10. Revenue Share

14.4.5. Continental AG

14.4.5.1. Company Overview

14.4.5.2. Company Footprints

14.4.5.3. Production Locations

14.4.5.4. Product Portfolio

14.4.5.5. Competitors & Customers

14.4.5.6. Subsidiaries & Parent Organization

14.4.5.7. Recent Developments

14.4.5.8. Financial Analysis

14.4.5.9. Profitability

14.4.5.10. Revenue Share

14.4.6. Double Coin Tyre Group Ltd.

14.4.6.1. Company Overview

14.4.6.2. Company Footprints

14.4.6.3. Production Locations

14.4.6.4. Product Portfolio

14.4.6.5. Competitors & Customers

14.4.6.6. Subsidiaries & Parent Organization

14.4.6.7. Recent Developments

14.4.6.8. Financial Analysis

14.4.6.9. Profitability

14.4.6.10. Revenue Share

14.4.7. MICHELIN

14.4.7.1. Company Overview

14.4.7.2. Company Footprints

14.4.7.3. Production Locations

14.4.7.4. Product Portfolio

14.4.7.5. Competitors & Customers

14.4.7.6. Subsidiaries & Parent Organization

14.4.7.7. Recent Developments

14.4.7.8. Financial Analysis

14.4.7.9. Profitability

14.4.7.10. Revenue Share

14.4.8. Nokian Tyres

14.4.8.1. Company Overview

14.4.8.2. Company Footprints

14.4.8.3. Production Locations

14.4.8.4. Product Portfolio

14.4.8.5. Competitors & Customers

14.4.8.6. Subsidiaries & Parent Organization

14.4.8.7. Recent Developments

14.4.8.8. Financial Analysis

14.4.8.9. Profitability

14.4.8.10. Revenue Share

14.4.9. Prometeon Tyre Group S.R.L.

14.4.9.1. Company Overview

14.4.9.2. Company Footprints

14.4.9.3. Production Locations

14.4.9.4. Product Portfolio

14.4.9.5. Competitors & Customers

14.4.9.6. Subsidiaries & Parent Organization

14.4.9.7. Recent Developments

14.4.9.8. Financial Analysis

14.4.9.9. Profitability

14.4.9.10. Revenue Share

14.4.10. Qingdao Rhino Tyre Co., Ltd.

14.4.10.1. Company Overview

14.4.10.2. Company Footprints

14.4.10.3. Production Locations

14.4.10.4. Product Portfolio

14.4.10.5. Competitors & Customers

14.4.10.6. Subsidiaries & Parent Organization

14.4.10.7. Recent Developments

14.4.10.8. Financial Analysis

14.4.10.9. Profitability

14.4.10.10. Revenue Share

14.4.11. Sumitomo Rubber Industries, Ltd.

14.4.11.1. Company Overview

14.4.11.2. Company Footprints

14.4.11.3. Production Locations

14.4.11.4. Product Portfolio

14.4.11.5. Competitors & Customers

14.4.11.6. Subsidiaries & Parent Organization

14.4.11.7. Recent Developments

14.4.11.8. Financial Analysis

14.4.11.9. Profitability

14.4.11.10. Revenue Share

14.4.12. The Goodyear Tire & Rubber Company

14.4.12.1. Company Overview

14.4.12.2. Company Footprints

14.4.12.3. Production Locations

14.4.12.4. Product Portfolio

14.4.12.5. Competitors & Customers

14.4.12.6. Subsidiaries & Parent Organization

14.4.12.7. Recent Developments

14.4.12.8. Financial Analysis

14.4.12.9. Profitability

14.4.12.10. Revenue Share

14.4.13. Titan, International, Inc.

14.4.13.1. Company Overview

14.4.13.2. Company Footprints

14.4.13.3. Production Locations

14.4.13.4. Product Portfolio

14.4.13.5. Competitors & Customers

14.4.13.6. Subsidiaries & Parent Organization

14.4.13.7. Recent Developments

14.4.13.8. Financial Analysis

14.4.13.9. Profitability

14.4.13.10. Revenue Share

14.4.14. Trelleborg AB

14.4.14.1. Company Overview

14.4.14.2. Company Footprints

14.4.14.3. Production Locations

14.4.14.4. Product Portfolio

14.4.14.5. Competitors & Customers

14.4.14.6. Subsidiaries & Parent Organization

14.4.14.7. Recent Developments

14.4.14.8. Financial Analysis

14.4.14.9. Profitability

14.4.14.10. Revenue Share

14.4.15. Triangle Group Co., Ltd.

14.4.15.1. Company Overview

14.4.15.2. Company Footprints

14.4.15.3. Production Locations

14.4.15.4. Product Portfolio

14.4.15.5. Competitors & Customers

14.4.15.6. Subsidiaries & Parent Organization

14.4.15.7. Recent Developments

14.4.15.8. Financial Analysis

14.4.15.9. Profitability

14.4.15.10. Revenue Share

14.4.16. Yokohama Tire Corporation

14.4.16.1. Company Overview

14.4.16.2. Company Footprints

14.4.16.3. Production Locations

14.4.16.4. Product Portfolio

14.4.16.5. Competitors & Customers

14.4.16.6. Subsidiaries & Parent Organization

14.4.16.7. Recent Developments

14.4.16.8. Financial Analysis

14.4.16.9. Profitability

14.4.16.10. Revenue Share

14.4.17. Other Key Players

14.4.17.1. Company Overview

14.4.17.2. Company Footprints

14.4.17.3. Production Locations

14.4.17.4. Product Portfolio

14.4.17.5. Competitors & Customers

14.4.17.6. Subsidiaries & Parent Organization

14.4.17.7. Recent Developments

14.4.17.8. Financial Analysis

14.4.17.9. Profitability

14.4.17.10. Revenue Share

List of Tables

Table 1: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 2: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 3: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Table 4: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 5: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 6: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 7: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 9: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 11: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 12: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 13: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Table 14: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 15: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 16: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 17: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 19: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 22: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 23: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Table 24: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 25: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 26: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 27: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 29: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 32: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 33: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Table 34: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 35: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 36: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 37: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 39: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 42: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 43: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Table 44: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 45: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 47: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 49: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 51: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 52: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 53: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Table 54: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 55: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 56: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 57: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 2: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 3: Global Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 4: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Figure 5: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 6: Global Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 7: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 8: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global Off-the-road (OTR) Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 10: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Off-the-road (OTR) Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Off-the-road (OTR) Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 17: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 18: North America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 19: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Figure 20: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 21: North America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 22: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 23: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: North America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 25: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 32: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 33: Europe Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 34: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Figure 35: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 36: Europe Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 37: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 38: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 39: Europe Off-the-road (OTR) Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 40: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Off-the-road (OTR) Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: Europe Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Off-the-road (OTR) Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 47: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 48: Asia Pacific Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Figure 50: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 51: Asia Pacific Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 53: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: Asia Pacific Off-the-road (OTR) Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Off-the-road (OTR) Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Off-the-road (OTR) Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 62: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 63: Middle East & Africa Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Figure 65: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 66: Middle East & Africa Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: Middle East & Africa Off-the-road (OTR) Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Off-the-road (OTR) Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Off-the-road (OTR) Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 77: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 78: South America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 79: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Tire Size, 2017-2031

Figure 80: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 81: South America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 82: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 83: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 84: South America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 85: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: South America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: South America Off-the-road (OTR) Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: South America Off-the-road (OTR) Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Off-the-road (OTR) Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031