Reports

Reports

Analysts Viewpoint

Economic expansion has fueled investment in improvement of infrastructure across the globe, specifically across developing countries that are witnessing heavy construction of roads, railways, and industries. Moreover, expansion of existing industries is boosting the demand for off-road vehicles. Furthermore, advancements in technology, including two tire technology, smart tires, TreadStat, and Rim management system that help track the performance of tires, are expected to propel the rubber tire market growth.

Growing concern regarding emissions is prompting automakers to resort to light weighting solutions in order to enhance fuel efficiency and reduce emissions. Furthermore, developments in technology, including B-Tag Systems, to monitor tire pressure and temperature are anticipated to offer significant rubber tire market opportunities for major manufacturers across the globe.

Rubber tires are integral part of vehicles, as tires are the intermediate between path and vehicle body. Tires surround the wheel rim in order to provide smoother and more efficient ride. Main constituents of tire are natural rubber, synthetic rubber, wire, fabric, carbon black, and other chemical compounds.

Rise in adoption of personal and commercial vehicles, off-road vehicles, construction equipment, and industrial vehicles is projected to boost the rubber tire industry growth. Furthermore, increase in buying power of an individual across the globe is estimated to drive the rubber tire market value.

The impact of climate change, rising prices for fossil fuels, and the scarcity of natural resources are significant issues hampering the rubber tire market development. Furthermore, weakened economy, lack of consumer confidence, and high global unemployment rates have led to a decline in auto sales and aftermarket sales of tires. These factors are anticipated to restrain the rubber tire industry demand in the next few years.

Governments of developing countries, generally, provide better financing options with low interest and subsidies on farming equipment in order to enhance the production of farms and cater to the demand for food by the growing population. The sales of the agriculture tractors, construction & mining equipment is rising, globally, which in turn is estimated to boost the rubber tire market revenue.

Last mile deliveries and advent of e-commerce have spurred road transportation traffic. Furthermore, increase in number of miles driven by trucks is boosting the demand for rubber tires across the globe. Rubber tires also have a high aftermarket demand owing to the requirement of periodic replacement. Growing awareness among consumers regarding vehicle maintenance, adoption of tire monitoring systems by fleet managers, and expansion of retailer and dealers network in rural areas are expected to positively impact the rubber tire market outlook during the forecast period.

Major tire manufacturers are investing in technological developments, including B-Tag Systems, to monitor tire pressure and temperature. The system alerts the driver about the maintenance of tires to avoid operational down time. Using sensors, B-TAG reports tire pressure and temperature data to drivers and managers of mine operations in real time. The system is expected to help mine operators create a safer working environment and facilitate more efficient operations. This is anticipated to propel the demand for off-road tires across the globe.

Advancements in technology, including two tire technology ,smart tires, TreadStat and Rim management system, helps to track the performance of tires, which helps to avoid breakdown of the vehicle. TreadStat is an off-the-road tire and rim performance tracking solution that helps customers manage the life cycle cost of tires for increased efficiency and profitability. These advancements in technology are anticipated to propel the rubber tire industry during the forecast period.

According to the rubber tire market analysis, in terms of tire type, radial tires are the most common type of tires used on modern vehicles. They have a sidewall that runs straight up and down and are made of a single layer of steel cord plies that run at a 90-degree angle to the centerline of the tire. This offers a smoother, more comfortable ride, better grip on the road, providing improved handling and stability.

Radial tires are highly recommended for high-performance cars, SUV’s and trucks. Furthermore, the transportation and automotive sectors are experiencing a period of profound transformation. Presently, the trend of electrification is spreading rapidly in almost all segments of road transport, from passenger cars to commercial vehicles, buses and two- and three-wheelers. These factors are driving the demand for radial rubber tires.

In terms of value, Asia Pacific held a prominent rubber tire market share in 2022, owing to the increase in vehicle sales, expansion of road infrastructure, rise in integration of advanced technology in vehicles, and surge in adoption of agriculture equipment in China and India.

Demand for rubber tires is also high in North America and Europe. Increasing popularity of all-terrain vehicles (ATVs), such as dirt bikes, quads, and other off road vehicles, for various recreational activities and adventure sports is contributing to the increase in market size in the region. Additionally, OTR tires are employed in haul trucks, loaders, drilling rigs, longwall machines, and shuttle vehicles of the mining industry as they are capable of handling heavy loads and can withstand harsh operating conditions and challenging terrains.

The global rubber tire business is fairly consolidated with a few large players controlling majority of market share. Leading companies are following the latest rubber tire market trends and spending significantly on comprehensive research and development, primarily to develop highly advanced products. Expansion of product portfolios and mergers & acquisitions are the major strategies adopted by major manufacturers. A few of the prominent players operating in the global market are Apollo Tyres Ltd., Bridgestone Corporation, CEAT Ltd., China National Tire & Rubber Co., Ltd, Continental AG, Cooper Tire & Rubber Company, Giti Tire, Hangzhou Zhongce Rubber Co., Ltd., Hankook Tire, Kumho Tire Co., Inc., MICHELIN, Nexen Tire Corporation, Nokian Tyres plc, Pirelli & C. S.p.A., Qingdao Fullrun Tyre Corp., Ltd., Sumitomo Rubber Industries, Ltd, The Goodyear Tire & Rubber Company, Toyo Tire & Rubber Co., Ltd., Trelleborg AB, and Yokohama Tire Corporation.

Key players in the rubber tire market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 142.4 Bn |

| Market Forecast Value in 2031 | USD 209.2 Bn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

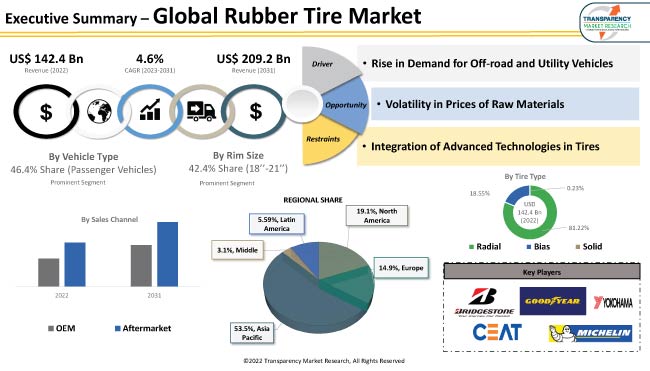

The global market was valued at US$ 142.4 Bn in 2022

It is expected to expand at a CAGR of 4.6% by 2031

It is projected to reach a value of US$ 209.2 Bn in 2031

Apollo Tyres Ltd., Bridgestone Corporation, CEAT Ltd., China National Tire & Rubber Co., Ltd, Continental AG, Cooper Tire & Rubber Company, Giti Tire, Hangzhou Zhongce Rubber Co., Ltd., Hankook Tire, Kumho Tire Co., Inc., MICHELIN, Nexen Tire Corporation, Nokian Tyres plc, Pirelli & C. S.p.A., Qingdao Fullrun Tyre Corp., Ltd., Sumitomo Rubber Industries, Ltd, The Goodyear Tire & Rubber Company, Toyo Tire & Rubber Co., Ltd., Trelleborg AB, and Yokohama Tire Corporation

Asia Pacific is a prominent market and held 53.5% of global share in 2022

The aftermarket segment accounted for the largest share in 2022

Rise in demand for off-road and utility vehicles and integration of advanced technology in tires

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2023-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Impact Factors: Rubber Tire

3.1. Emergence of Electric Vehicles

4. Global Rubber Tire Market, by Rim Size

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Rim Size

4.2.1. <11’’

4.2.2. 12’’-17’’

4.2.3. 18’’-21’’

4.2.4. >22’’-25’’

4.2.5. 29’’-49’’

4.2.6. 51’’-63’’

5. Global Rubber Tire Market, by Tire Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

5.2.1. Radial

5.2.2. Bias

5.2.3. Solid

6. Global Rubber Tire Market, by Sales Channel

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Sales Channel

6.2.1. OEM

6.2.2. Aftermarket

7. Global Rubber Tire Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Vehicle Type

7.2.1. Passenger Vehicle

7.2.2. Light Commercial Vehicle

7.2.3. Truck & Bus

7.2.4. Construction & Mining Vehicles

7.2.5. Agricultural Tractors

7.2.6. Industrial Vehicle

7.2.7. Motorcycle & Scooters

8. Global Rubber Tire Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Rubber Tire Market

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. North America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Rim Size

9.2.1. <11’’

9.2.2. 12’’-17’’

9.2.3. 18’’-21’’

9.2.4. >22’’-25’’

9.2.5. 29’’-49’’

9.2.6. 51’’-63’’

9.3. North America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

9.3.1. Radial

9.3.2. Bias

9.3.3. Solid

9.4. North America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Sales Channel

9.4.1. OEM

9.4.2. Aftermarket

9.5. North America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

9.5.1. Passenger Vehicle

9.5.2. Light Commercial Vehicle

9.5.3. Truck & Bus

9.5.4. Construction & Mining Vehicles

9.5.5. Agricultural Tractors

9.5.6. Industrial Vehicle

9.5.7. Motorcycle & Scooters

9.6. Key Country Analysis – North America Rubber Tire Market Size Analysis & Forecast, 2023-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Rubber Tire Market

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Europe Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Rim Size

10.2.1. <11’’

10.2.2. 12’’-17’’

10.2.3. 18’’-21’’

10.2.4. >22’’-25’’

10.2.5. 29’’-49’’

10.2.6. 51’’-63’’

10.3. Europe Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

10.3.1. Radial

10.3.2. Bias

10.3.3. Solid

10.4. Europe Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Sales Channel

10.4.1. OEM

10.4.2. Aftermarket

10.5. Europe Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

10.5.1. Passenger Vehicle

10.5.2. Light Commercial Vehicle

10.5.3. Truck & Bus

10.5.4. Construction & Mining Vehicles

10.5.5. Agricultural Tractors

10.5.6. Industrial Vehicle

10.5.7. Motorcycle & Scooters

10.6. Key Country Analysis – Europe Rubber Tire Market Size Analysis & Forecast, 2023-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Rubber Tire Market

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Asia Pacific Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Rim Size

11.2.1. <11’’

11.2.2. 12’’-17’’

11.2.3. 18’’-21’’

11.2.4. >22’’-25’’

11.2.5. 29’’-49’’

11.2.6. 51’’-63’’

11.3. Asia Pacific Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

11.3.1. Radial

11.3.2. Bias

11.3.3. Solid

11.4. Asia-Pacific Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Sales Channel

11.4.1. OEM

11.4.2. Aftermarket

11.5. Asia-Pacific Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

11.5.1. Passenger Vehicle

11.5.2. Light Commercial Vehicle

11.5.3. Truck & Bus

11.5.4. Construction & Mining Vehicles

11.5.5. Agricultural Tractors

11.5.6. Industrial Vehicle

11.5.7. Motorcycle & Scooters

11.6. Key Country Analysis – Asia Pacific Rubber Tire Market Size Analysis & Forecast, 2023-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Rubber Tire Market

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Middle East & Africa Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Rim Size

12.2.1. <11’’

12.2.2. 12’’-17’’

12.2.3. 18’’-21’’

12.2.4. >22’’-25’’

12.2.5. 29’’-49’’

12.2.6. 51’’-63’’

12.3. Middle East & Africa Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

12.3.1. Radial

12.3.2. Bias

12.3.3. Solid

12.4. Middle East & Africa Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Sales Channel

12.4.1. OEM

12.4.2. Aftermarket

12.5. Middle East & Africa Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

12.5.1. Passenger Vehicle

12.5.2. Light Commercial Vehicle

12.5.3. Truck & Bus

12.5.4. Construction & Mining Vehicles

12.5.5. Agricultural Tractors

12.5.6. Industrial Vehicle

12.5.7. Motorcycle & Scooters

12.6. Key Country Analysis – Middle East & Africa Rubber Tire Market Size Analysis & Forecast, 2023-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Rubber Tire Market

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. South America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Rim Size

13.2.1. <11’’

13.2.2. 12’’-17’’

13.2.3. 18’’-21’’

13.2.4. >22’’-25’’

13.2.5. 29’’-49’’

13.2.6. 51’’-63’’

13.3. South America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

13.3.1. Radial

13.3.2. Bias

13.3.3. Solid

13.4. South America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Sales Channel

13.4.1. OEM

13.4.2. Aftermarket

13.5. South America Rubber Tire Market Size Analysis & Forecast, 2023-2031, by Tire Type

13.5.1. Passenger Vehicle

13.5.2. Light Commercial Vehicle

13.5.3. Truck & Bus

13.5.4. Construction & Mining Vehicles

13.5.5. Agricultural Tractors

13.5.6. Industrial Vehicle

13.5.7. Motorcycle & Scooters

13.6. Key Country Analysis – South America Rubber Tire Market Size Analysis & Forecast, 2023-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player

Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

15. Company Profile/ Key Players

15.1. Apollo Tyres Ltd.

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Product Portfolio

15.1.4. Competitors & Customers

15.1.5. Subsidiaries & Parent Organization

15.1.6. Recent Developments

15.1.7. Financial Analysis

15.2. Bridgestone Corporation

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Product Portfolio

15.2.4. Competitors & Customers

15.2.5. Subsidiaries & Parent Organization

15.2.6. Recent Developments

15.2.7. Financial Analysis

15.3. CEAT Ltd.

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Product Portfolio

15.3.4. Competitors & Customers

15.3.5. Subsidiaries & Parent Organization

15.3.6. Recent Developments

15.3.7. Financial Analysis

15.4. China National Tire & Rubber Co., Ltd

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Product Portfolio

15.4.4. Competitors & Customers

15.4.5. Subsidiaries & Parent Organization

15.4.6. Recent Developments

15.4.7. Financial Analysis

15.5. Continental AG

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Product Portfolio

15.5.4. Competitors & Customers

15.5.5. Subsidiaries & Parent Organization

15.5.6. Recent Developments

15.5.7. Financial Analysis

15.6. Cooper Tire & Rubber Company

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Product Portfolio

15.6.4. Competitors & Customers

15.6.5. Subsidiaries & Parent Organization

15.6.6. Recent Developments

15.6.7. Financial Analysis

15.7. Giti Tire

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Product Portfolio

15.7.4. Competitors & Customers

15.7.5. Subsidiaries & Parent Organization

15.7.6. Recent Developments

15.7.7. Financial Analysis

15.8. Hangzhou Zhongce Rubber Co., Ltd.

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Product Portfolio

15.8.4. Competitors & Customers

15.8.5. Subsidiaries & Parent Organization

15.8.6. Recent Developments

15.8.7. Financial Analysis

15.9. Hankook Tire

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Product Portfolio

15.9.4. Competitors & Customers

15.9.5. Subsidiaries & Parent Organization

15.9.6. Recent Developments

15.9.7. Financial Analysis

15.10. Kumho Tire Co., Inc.

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Product Portfolio

15.10.4. Competitors & Customers

15.10.5. Subsidiaries & Parent Organization

15.10.6. Recent Developments

15.10.7. Financial Analysis

15.11. MICHELIN

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Product Portfolio

15.11.4. Competitors & Customers

15.11.5. Subsidiaries & Parent Organization

15.11.6. Recent Developments

15.11.7. Financial Analysis

15.12. Nexen Tire Corporation

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Product Portfolio

15.12.4. Competitors & Customers

15.12.5. Subsidiaries & Parent Organization

15.12.6. Recent Developments

15.12.7. Financial Analysis

15.13. Nokian Tyres plc

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Product Portfolio

15.13.4. Competitors & Customers

15.13.5. Subsidiaries & Parent Organization

15.13.6. Recent Developments

15.13.7. Financial Analysis

15.14. Pirelli & C. S.p.A.

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Product Portfolio

15.14.4. Competitors & Customers

15.14.5. Subsidiaries & Parent Organization

15.14.6. Recent Developments

15.14.7. Financial Analysis

15.15. Qingdao Fullrun Tyre Corp., Ltd.

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Product Portfolio

15.15.4. Competitors & Customers

15.15.5. Subsidiaries & Parent Organization

15.15.6. Recent Developments

15.15.7. Financial Analysis

15.16. Sumitomo Rubber Industries, Ltd

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Product Portfolio

15.16.4. Competitors & Customers

15.16.5. Subsidiaries & Parent Organization

15.16.6. Recent Developments

15.16.7. Financial Analysis

15.17. The Goodyear Tire & Rubber Company

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Product Portfolio

15.17.4. Competitors & Customers

15.17.5. Subsidiaries & Parent Organization

15.17.6. Recent Developments

15.17.7. Financial Analysis

15.18. Toyo Tire & Rubber Co., Ltd.

15.18.1. Company Overview

15.18.2. Company Footprints

15.18.3. Product Portfolio

15.18.4. Competitors & Customers

15.18.5. Subsidiaries & Parent Organization

15.18.6. Recent Developments

15.18.7. Financial Analysis

15.19. Trelleborg AB

15.19.1. Company Overview

15.19.2. Company Footprints

15.19.3. Product Portfolio

15.19.4. Competitors & Customers

15.19.5. Subsidiaries & Parent Organization

15.19.6. Recent Developments

15.19.7. Financial Analysis

15.20. Yokohama Tire Corporation

15.20.1. Company Overview

15.20.2. Company Footprints

15.20.3. Product Portfolio

15.20.4. Competitors & Customers

15.20.5. Subsidiaries & Parent Organization

15.20.6. Recent Developments

15.20.7. Financial Analysis

15.21. Other Key Players

15.21.1. Company Overview

15.21.2. Company Footprints

15.21.3. Product Portfolio

15.21.4. Competitors & Customers

15.21.5. Subsidiaries & Parent Organization

15.21.6. Recent Developments

15.21.7. Financial Analysis

List of Tables

Table 1: Global Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Table 2: Global Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Table 3: Global Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 4: Global Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 5: Global Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 6: North America Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Table 7: North America Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Table 8: North America Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 9: North America Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 10: North America Rubber Tire Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 11: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Table 12: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Table 13: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 14: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 15: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 16: Asia Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Table 17: Asia Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Table 18: Asia-Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 19: Asia-Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 20: Asia-Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 21: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Table 22: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Table 23: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 24: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 25: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 26: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Table 27: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Table 28: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 29: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 30: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Country, 2023-2031

List of Figures

Figure 1: Global Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Figure 2: Global Rubber Tire Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023‒2031

Figure 3: Global Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Figure 4: Global Rubber Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023‒2031

Figure 5: Global Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 6: Global Rubber Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023‒2031

Figure 7: Global Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 8: Global Rubber Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023‒2031

Figure 9: Global Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 10: Global Rubber Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 11: North America Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Figure 12: North America Rubber Tire Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023‒2031

Figure 13: North America Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Figure 14: North America Rubber Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023‒2031

Figure 15: North America Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 16: North America Rubber Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 17: North America Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 18: North America Rubber Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023‒2031

Figure 19: North America Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 20: North America Rubber Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023‒2031

Figure 21: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Figure 22: Europe Rubber Tire Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023‒2031

Figure 23: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Figure 24: Europe Rubber Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023‒2031

Figure 25: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 26: Europe Rubber Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 27: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 28: Europe Rubber Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023‒2031

Figure 29: Europe Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 30: Europe Rubber Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023‒2031

Figure 31: Asia Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Figure 32: Asia Pacific Rubber Tire Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023‒2031

Figure 33: Asia Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Figure 34: Asia Pacific Rubber Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023‒2031

Figure 35: Asia Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 36: Asia Pacific Rubber Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 37: Asia-Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 38: Asia-Pacific Rubber Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023‒2031

Figure 39: Asia-Pacific Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 40: Asia-Pacific Rubber Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023‒2031

Figure 41: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Figure 42: Middle East & Africa Rubber Tire Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023‒2031

Figure 43: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Figure 44: Middle East & Africa Rubber Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023‒2031

Figure 45: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 46: Middle East & Africa Rubber Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 47: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 48: Middle East & Africa Rubber Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023‒2031

Figure 49: Middle East & Africa Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 50: Middle East & Africa Rubber Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023‒2031

Figure 51: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Rim Size, 2023-2031

Figure 52: Latin America Rubber Tire Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023‒2031

Figure 53: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Tire Type, 2023-2031

Figure 54: Latin America Rubber Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023‒2031

Figure 55: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 56: Latin America Rubber Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 57: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 58: Latin America Rubber Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023‒2031

Figure 59: Latin America Rubber Tire Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 60: Latin America Rubber Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023‒2031