Reports

Reports

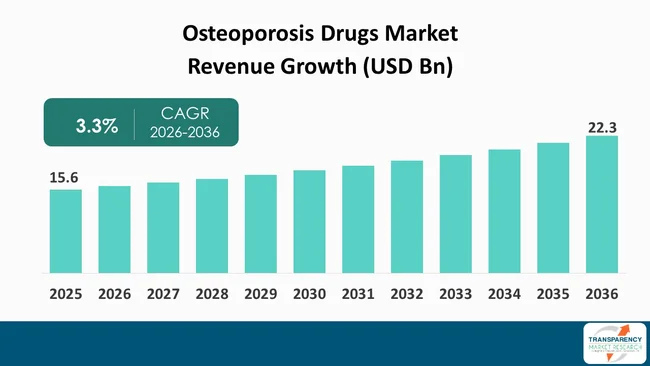

The global osteoporosis drugs market size was valued at US$ 15.6 Bn in 2025 and is projected to reach US$ 22.3 Bn by 2036, expanding at a CAGR of 3.3% from 2026 to 2036. The market growth is driven by rising osteoporosis prevalence among aging and postmenopausal populations, rising awareness and early diagnosis, ongoing advancements in drug development, and favorable reimbursement policies.

The major driving forces for the growth of the osteoporosis drug market include the exploding aging population worldwide and the increased incidences of osteoporosis among post-menopausal women and the aged population. In addition, the raised awareness of the importance of bone health, early detection of the condition with the help of screening technologies, and the importance of preventing fractures play an important role in the growth of the osteoporosis drug market.

Moreover, the progress being made in drug development has helped in the improvement of the efficacy of the drugs used for the treatment of the condition. In addition, the increase in healthcare expenditure and the availability of treatment in emerging markets and the favorable reimbursement policies in developed markets also play an important role in the growth of the market.

Some of the major trends that are currently affecting the osteoporosis drugs market are the rising acceptance of new therapeutic classes, including monoclonal antibodies and anabolics. There is on ongoing trend toward personalized medicine, where the choice of osteoporosis treatment is now based on patient-specific risk profiles. Digital health technologies are also proving to be beneficial for the elderly patient population. Biosimilar drugs are also helping to reduce the cost of osteoporosis treatment.

Osteoporosis implies a disease that progresses and impacts the skeleton. The impact of osteoporosis includes the reduction of density in the bones and the disruption of the microstructure in the bones. This disease makes people susceptible to fractures in different body parts.

The body parts that are commonly impacted by osteoporosis include the wrist, the hip, and the spine. The majority of people suffering from osteoporosis are women who have undergone menopause.

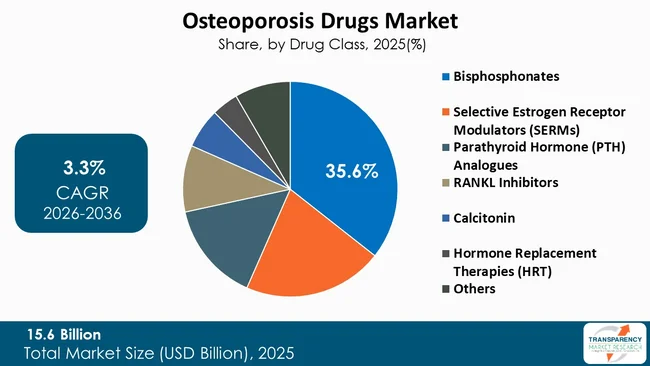

The commonly used drugs in the management of the disease include bisphosphonates, which are the primary drugs used in the management of the disease. The primary impact of the drugs includes the reduction of resorption. The second class of drugs is selective estrogen receptor modulators. This class of drugs is effective in the management of osteoporosis as it acts similarly to estrogen. The third class of drugs is parathyroid hormone analogs. The main action of parathyroid hormone analogs is that they increase bone formation. The last class of drugs is RANKL inhibitors. The main action of RANKL inhibitors is that they reduce the rate of bone resorption.

| Attribute | Detail |

|---|---|

| Osteoporosis Drugs Market Drivers |

|

The increasing number of people suffering from osteoporosis is one of the main contributors to the growth of the osteoporosis drugs market, especially due to the changing demographics worldwide. The increase in life expectancy leads to an ever-growing elderly population around the world, which includes many developing and developed countries.

With aging comes accelerated bone loss, reduced calcium absorption, and decreased remodeling of the bone. All this leads to a higher likelihood of having osteoporosis and related fractures. Since there are more number of people who are over 60 years old, the total number of people who require chronic treatment for osteoporosis also continues to rise, leading to further growth of the osteoporosis drug market as well.

Following the hormonal decline of estrogen after menopause, postmenopausal women form a high-risk group due to the rapid change in bone density related to an increase in bone resorption due to hormonal changes. The losses in mineral density due to the decrease in estrogen leave women susceptible to several major osteoporotic fractures, all of which contribute to increased morbidity, mortality, and healthcare costs.

Through increased awareness of the impact of postmenopausal osteoporosis from public health education campaigns and routine screening programs, diagnosis has occurred earlier and treatment has been instituted proactively leading to increased prescription volume of osteoporosis medications.

Further increasing the urgency for preventive treatment strategies, the clinical and economic burden created by osteoporotic fractures is causing healthcare systems to focus more on the prevention of such fractures through the use of preventive drug treatments. As a result of this rise in prevention and the demographic trends of increasing numbers of elderly individuals and postmenopausal women, the market outlook for osteoporosis drug therapies continues to improve.

The osteoporosis drug market is benefiting from the continued advancements that are taking place within the drug development process, as new and innovative products are being developed, which not only overcome the shortcomings that are found within the current product offerings but also provide the patient population that needs these drugs with the options that they require. Current osteoporosis drug therapies, such as the conventional bisphosphonates that are considered first-line treatment options, have traditionally focused primarily on the issue of bone resorption by inhibiting the process. However, concerns over the long-term safety profile and the difficulty that exists with the dosing regimen have created a need for many individuals within the industry to invest in research and development activities into the drug therapies that are being created.

Advancements in technology have resulted in the creation of biological drug classes and targeted therapies designed to focus on different molecular pathways involved in the process of bone remodeling (e.g., RANKL inhibitors inhibit bone loss through the inhibition of osteoclast activity; anabolic drugs, such as PTH analogues, stimulate the creation of new bone).

The advent of dual-action and next-generation anabolic therapies allows for the treatment of both - osteoporotic bone density increase and reduced risk of fracture, particularly in individuals who have experienced severe osteoporosis or have not responded to first-line treatment options. The introduction of these new therapies has greatly improved clinical outcomes from their predecessors and increased the potential scope from a pharmacological point of view.

| Attribute | Detail |

|---|---|

| Market Opportunities |

|

The opportunity for the development of novel dual-action and anabolic therapies is considerable in the osteoporosis drug market, as these are advanced treatments addressing the unmet clinical needs that are not fully covered by the conventional osteoporosis drug therapies.

Conventional osteoporosis drug therapies, such as bisphosphonates and SERMs, are generally focused on slowing the progression of bone loss, which is an outcome of the inhibition of bone resorption. These conventional therapies have shown little ability to rebuild lost bone. Anabolic therapies, which have the ability to build new bone, have shown considerable benefits to osteoporotic patients, particularly those with severe osteoporosis, high fracture risk, and treatment failure.

The advancement of new anabolic and dual-action medications are creating significant opportunities within the osteoporosis drug industry. These advancements are poised to meet clinical needs that were previously only addressed by existing anti-resorptive medications.

Traditional treatments such as bisphosphonates and SERM products target the slowing of bone loss by limiting/reducing bone re-absorptive activity while providing minimal to no ability to increase a person’s previously lost bone mass through the construction of new bone. The clinical application of new anabolic treatment options is now changing the way that osteoporosis is being treated, as well as broadening the range of therapeutic options available.

Anabolic and dual action products are becoming more accepted in use, as new treatment guidelines call for anabolic first and combination therapy for patients at high risk of multiple fractures. The growth of research and development pipelines, as well as increased rates of approvals will allow for continued use of both - anabolic and dual action product in the future. Therefore, the continued advancement of innovative anabolic and dual action treatment options for osteoporosis represent a high return opportunity.

Bisphosphonates have the largest share of the osteoporosis drug market. This is because they have been used for the longest time, have proven to be effective, and are relatively cheaper. Their ability to reduce the risk of fractures by inhibiting the degradation of bone tissue has made them the first line of treatment for osteoporosis. The various oral and injectable formulations available have given a wide range of treatment options. This has helped to increase the accessibility of these drugs to patients. Additionally, the availability of generic drugs has helped to make the treatment of osteoporosis relatively cheaper, thus increasing the accessibility of the treatment to many, including those in developing countries.

| Attribute | Detail |

|---|---|

| Leading Region |

|

According to a new market outlook report for osteoporosis drugs, North America is expected to make up about 39.2% of the total market share in 2025.

North America dominates the market for osteoporosis drugs in terms of market share. This is because North America has a sizable aging population; hence, the number of women in the postmenopausal age group is high. Such women are more prone to osteoporosis and subsequent fractures. Moreover, the high per capita expenditure on healthcare and the well-developed infrastructure enable the early detection and treatment of the condition. In addition, the awareness level regarding bone health among the population and the medical fraternity is high.

The recent developments in the osteoporosis drugs market are an increase in the number of clinical trials for new drugs, strategic partnerships to develop biologics and biosimilars, and focus on patient support programs to encourage patient compliance. There is also a focus on technology and education initiatives to encourage early diagnosis and treatment.

Amgen Inc., Eli Lilly and Company, Merck & Co., Inc., Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd, Sanofi, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Radius Health, Inc., Cipla Limited, UCB S.A., Chugai Pharmaceutical Co., Ltd., Boan Biotech, and Shanghai Fosun Pharmaceutical (Group) Co., Ltd. are some of the leading players operating in the global osteoporosis drugs market.

Each of these players has been profiled in the osteoporosis drugs market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 15.6 Bn |

| Forecast Value in 2036 | US$ 22.3 Bn |

| CAGR | 3.3% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Drug Class

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global osteoporosis drugs market was valued at US$ 15.6 Bn in 2025

The global osteoporosis drugs industry is projected to reach more than US$ 22.3 Bn by the end of 2036

Rising osteoporosis prevalence among aging and postmenopausal populations, rising awareness and early diagnosis, ongoing advancements in drug development, and favorable reimbursement policies are some of the factors driving the expansion of osteoporosis drugs market.

The CAGR is anticipated to be 3.3% from 2026 to 2036

Amgen Inc., Eli Lilly and Company, Merck & Co., Inc., Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd, Sanofi, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Radius Health, Inc., Cipla Limited, UCB S.A., Chugai Pharmaceutical Co., Ltd., Boan Biotech, and Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

Table 01: Global Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 02: Global Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 03: Global Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 04: Global Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 05: Global Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Region, 2021 to 2036

Table 06: North America Osteoporosis Drugs Market Value (US$ Bn) Forecast, by Country, 2021-2036

Table 07: North America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 08: North America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 09: North America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 10: North America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 11: U.S. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 12: U.S. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 13: U.S. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 14: U.S. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 15: Canada Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 16: Canada Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 17: Canada Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 18: Canada Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 19: Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021-2036

Table 20: Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 21: Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 22: Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 23: Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 24: Germany Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 25: Germany Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 26: Germany Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 27: Germany Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 28: U.K. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 29: U.K. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 30: U.K. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 31: U.K. Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 32: France Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 33: France Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 34: France Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 35: France Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 36: Italy Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 37: Italy Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 38: Italy Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 39: Italy Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 40: Spain Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 41: Spain Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 42: Spain Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 43: Spain Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 44: The Netherlands Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 45: The Netherlands Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 46: The Netherlands Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 47: The Netherlands Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 48: Rest of Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 49: Rest of Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 50: Rest of Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 51: Rest of Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 52: Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021-2036

Table 53: Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 54: Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 55: Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 56: Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 57: China Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 58: China Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 59: China Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 60: China Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 61: India Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 62: India Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 63: India Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 64: India Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 65: Japan Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 66: Japan Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 67: Japan Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 68: Japan Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 69: South Korea Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 70: South Korea Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 71: South Korea Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 72: South Korea Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 73: Australia & New Zealand Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 74: Australia & New Zealand Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 75: Australia & New Zealand Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 76: Australia & New Zealand Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 77: ASEAN Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 78: ASEAN Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 79: ASEAN Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 80: ASEAN Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 81: Rest of Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 82: Rest of Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 83: Rest of Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 84: Rest of Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 85: Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021-2036

Table 86: Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 87: Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 88: Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 89: Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 90: Brazil Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 91: Brazil Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 92: Brazil Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 93: Brazil Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 94: Argentina Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 95: Argentina Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 96: Argentina Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 97: Argentina Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 98: Mexico Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 99: Mexico Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 100: Mexico Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 101: Mexico Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 102: Rest of Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 103: Rest of Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 104: Rest of Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 105: Rest of Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 106: Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021-2036

Table 107: Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 108: Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 109: Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 110: Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 111: GCC Countries Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 112: GCC Countries Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 113: GCC Countries Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 114: GCC Countries Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 115: South Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 116: South Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 117: South Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 118: South Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 119: Rest of Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2021 to 2036

Table 120: Rest of Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2021 to 2036

Table 121: Rest of Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2021 to 2036

Table 122: Rest of Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Figure 01: Global Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 03: Global Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 04: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Bisphosphonates, 2021 to 2036

Figure 05: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Selective Estrogen Receptor Modulators (SERMs), 2021 to 2036

Figure 06: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Parathyroid Hormone (PTH) Analogues, 2021 to 2036

Figure 07: Global Osteoporosis Drugs Market Revenue (US$ Bn), by RANKL Inhibitors, 2021 to 2036

Figure 08: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Calcitonin, 2021 to 2036

Figure 09: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Hormone Replacement Therapies (HRT), 2021 to 2036

Figure 10: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 11: Global Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 12: Global Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 13: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Oral, 2021 to 2036

Figure 14: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Injectable, 2021 to 2036

Figure 15: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Intranasal, 2021 to 2036

Figure 16: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 17: Global Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 18: Global Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 19: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Branded, 2021 to 2036

Figure 20: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Generic, 2021 to 2036

Figure 21: Global Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 22: Global Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 23: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Hospital Pharmacies, 2021 to 2036

Figure 24: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Retail Pharmacies, 2021 to 2036

Figure 25: Global Osteoporosis Drugs Market Revenue (US$ Bn), by Online Pharmacies, 2021 to 2036

Figure 26: Global Osteoporosis Drugs Market Value Share Analysis, by Region, 2025 and 2036

Figure 27: Global Osteoporosis Drugs Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 28: North America Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 29: North America Osteoporosis Drugs Market Value Share Analysis, by Country, 2025 and 2036

Figure 30: North America Osteoporosis Drugs Market Attractiveness Analysis, by Country, 2026 to 2036

Figure 31: North America Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 32: North America Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 33: North America Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 34: North America Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 35: North America Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 36: North America Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 37: North America Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 38: North America Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 39: U.S. Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 40: U.S. Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 41: U.S. Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 42: U.S. Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 43: U.S. Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 44: U.S. Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 45: U.S. Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 46: U.S. Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 47: U.S. Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 48: Canada Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 49: Canada Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 50: Canada Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 51: Canada Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 52: Canada Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 53: Canada Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 54: Canada Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 55: Canada Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 56: Canada Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 57: Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 58: Europe Osteoporosis Drugs Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 59: Europe Osteoporosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 60: Europe Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 61: Europe Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 62: Europe Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 63: Europe Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 64: Europe Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 65: Europe Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 66: Europe Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 67: Europe Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 68: Germany Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 69: Germany Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 70: Germany Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 71: Germany Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 72: Germany Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 73: Germany Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 74: Germany Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 75: Germany Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 76: Germany Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 77: U.K. Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 78: U.K. Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 79: U.K. Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 80: U.K. Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 81: U.K. Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 82: U.K. Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 83: U.K. Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 84: U.K. Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 85: U.K. Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 86: France Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 87: France Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 88: France Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 89: France Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 90: France Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 91: France Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 92: France Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 93: France Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 94: France Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 95: Italy Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 96: Italy Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 97: Italy Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 98: Italy Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 99: Italy Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 100: Italy Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 101: Italy Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 102: Italy Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 103: Italy Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 104: Spain Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 105: Spain Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 106: Spain Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 107: Spain Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 108: Spain Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 109: Spain Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 110: Spain Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 111: Spain Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 112: Spain Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 113: The Netherlands Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 114: The Netherlands Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 115: The Netherlands Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 116: The Netherlands Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 117: The Netherlands Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 118: The Netherlands Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 119: The Netherlands Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 120: The Netherlands Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 121: The Netherlands Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 122: Rest of Europe Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 123: Rest of Europe Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 124: Rest of Europe Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 125: Rest of Europe Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 126: Rest of Europe Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 127: Rest of Europe Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 128: Rest of Europe Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 129: Rest of Europe Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 130: Rest of Europe Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 131: Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 132: Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 133: Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 134: Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 135: Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 136: Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 137: Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 138: Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 139: Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 140: Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 141: Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 142: China Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 143: China Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 144: China Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 145: China Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 146: China Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 147: China Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 148: China Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 149: China Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 150: China Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 151: India Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 152: India Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 153: India Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 154: India Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 155: India Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 156: India Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 157: India Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 158: India Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 159: India Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 160: Japan Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 161: Japan Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 162: Japan Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 163: Japan Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 164: Japan Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 165: Japan Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 166: Japan Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 167: Japan Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 168: Japan Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 169: South Korea Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 170: South Korea Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 171: South Korea Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 172: South Korea Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 173: South Korea Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 174: South Korea Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 175: South Korea Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 176: South Korea Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 177: South Korea Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 178: Australia & New Zealand Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 179: Australia & New Zealand Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 180: Australia & New Zealand Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 181: Australia & New Zealand Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 182: Australia & New Zealand Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 183: Australia & New Zealand Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 184: Australia & New Zealand Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 185: Australia & New Zealand Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 186: Australia & New Zealand Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 187: ASEAN Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 188: ASEAN Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 189: ASEAN Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 190: ASEAN Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 191: ASEAN Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 192: ASEAN Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 193: ASEAN Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 194: ASEAN Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 195: ASEAN Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 196: Rest of Asia Pacific Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 197: Rest of Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 198: Rest of Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 199: Rest of Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 200: Rest of Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 201: Rest of Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 202: Rest of Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 203: Rest of Asia Pacific Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 204: Rest of Asia Pacific Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 205: Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 206: Latin America Osteoporosis Drugs Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 207: Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 208: Latin America Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 209: Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 210: Latin America Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 211: Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 212: Latin America Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 213: Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 214: Latin America Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 215: Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 216: Brazil Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 217: Brazil Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 218: Brazil Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 219: Brazil Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 220: Brazil Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 221: Brazil Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 222: Brazil Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 223: Brazil Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 224: Brazil Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 225: Argentina Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 226: Argentina Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 227: Argentina Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 228: Argentina Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 229: Argentina Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 230: Argentina Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 231: Argentina Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 232: Argentina Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 233: Argentina Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 234: Mexico Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 235: Mexico Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 236: Mexico Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 237: Mexico Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 238: Mexico Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 239: Mexico Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 240: Mexico Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 241: Mexico Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 242: Mexico Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 243: Rest of Latin America Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 244: Rest of Latin America Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 245: Rest of Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 246: Rest of Latin America Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 247: Rest of Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 248: Rest of Latin America Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 249: Rest of Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 250: Rest of Latin America Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 251: Rest of Latin America Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 252: Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 253: Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 254: Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 255: Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 256: Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 257: Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 258: Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 259: Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 260: Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 261: Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 262: Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 263: GCC Countries Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 264: GCC Countries Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 265: GCC Countries Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 266: GCC Countries Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 267: GCC Countries Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 268: GCC Countries Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 269: GCC Countries Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 270: GCC Countries Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 271: GCC Countries Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 272: South Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 273: South Africa Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 274: South Africa Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 275: South Africa Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 276: South Africa Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 277: South Africa Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 278: South Africa Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 279: South Africa Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 280: South Africa Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 281: Rest of Middle East & Africa Osteoporosis Drugs Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 282: Rest of Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Drug Class, 2025 and 2036

Figure 283: Rest of Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Drug Class, 2026 to 2036

Figure 284: Rest of Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 285: Rest of Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 286: Rest of Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Drug Type, 2025 and 2036

Figure 287: Rest of Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Drug Type, 2026 to 2036

Figure 288: Rest of Middle East & Africa Osteoporosis Drugs Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 289: Rest of Middle East & Africa Osteoporosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036