Reports

Reports

The global oral proteins & peptides market is growing significantly due to the advent of technology that can effectively deliver biologics orally. The market is also growing due to rising incidences of chronic diseases (e.g. diabetes, osteoporosis, hormonal deficiencies, etc.) that require long-term therapeutic management. There have been rapid improvements in formulations/technologies, including nanoparticle encapsulation, mucoadhesive systems, and combinations with enzyme inhibitors that can provide evidence of stability and absorption in the stomach (GI) tract.

Companies such as Novo Nordisk, Eli Lilly, Pfizer, and Oramed Pharmaceuticals are already investing extensively into R&D activities that are specific to oral GLP-1 agonists and insulin analogs. With Novo Nordisk's oral semaglutide (Rybelsus) launch, they were able to create a roadmap on how the market can be approached moving forward.

Additionally, there is an increased patient preference for non-invasive methods of administration with help from regulatory strategy that also helps support changes to the biologics market. Analysts expect strong competition and partnerships to emerge between a variety of big pharmaceutical and biotech firms to improve the efficiency of formulations and extend their therapeutic capabilities.

The growth of the oral proteins & peptides market is mainly due to the demand for less invasive delivery methods. Clinicians and patients are paying attention to oral biologics, especially as the rates of diabetes and the other endocrinopathies continue to rise and given that an oral delivery method would be more patient-friendly than an injection.

New technologies in drug formulation, including absorption enhancers and protective coatings, assist in more stable delivery of proteins through the gastrointestinal tract. Furthermore, the emergence of newer oral peptide drugs and better reimbursements in advanced markets should also support uptake of oral protein and peptide drugs. Continued investments into the pharmaceutical industry for peptide synthesis and biopharmaceutical R&D activitiesare also expected to maintain growth in this market sector.

| Attribute | Detail |

|---|---|

| Oral Proteins & Peptides Market Drivers |

|

The increased incidences of chronic diseases around the world, particularly diabetes, osteoporosis, and hormonal-related diseases, have created demand for oral proteins and peptides. Oral delivery of these protein and peptide therapies provides potential avenue for an effective long-term treatment solution to manage chronic diseases and improve patient adherence. For instance - the International Diabetes Federation (IDF) reported that by the end of 2021 there were approximately 537 million adults battling diabetes worldwide, estimated to reach 643 million adults by 2030.

The increasing incidences of chronic diseases has certainly driven significant interest among companies regarding the oral delivery of insulin and GLP-1 receptor agonists that will ultimately treat chronic diseases more effectively while improving the patient adherence. Novo Nordisk's resident oral semaglutide product (Rybelsus) that was launched in 2019 was a major milestone in the delivery of oral peptide therapy for diabetes.

The product generated over US$ 2.7 Bn in sales in 2023, demonstrating the rapid emergence of oral biologics as emerging players in the treatment within chronic care disease areas and how this product is making an impact. It is timely to integrate an increasing array of oral peptide therapies into chronic healthcare areas to better manage the global burden of chronic disease.

Innovations are advancing the way that oral delivery systems can enhance the formulation, absorption, and metabolism of proteins and peptides. Developing oral delivery options for proteins and peptides has presented difficulties due to specific physical/chemical properties corresponding to stability/instability, faster enzymatic degradation in the gastrointestinal tract, and low permeability in the intestines.

The introduction of emergent innovations (e.g., permeation enhancers, nanoparticles, and enzyme inhibitors) has greatly improved peptide/protein bioavailability by showing they can provide a practical benefit. These innovations can enhance stability and allow for systemic protein and peptide absorption at levels comparable to being delivered by injection.

Oramed Pharmaceuticals Inc. is one company that has developed a proprietary POD™ (Protein Oral Delivery) technology using protective coatings to stabilize proteins and peptides in combination with absorption enhancers to deliver insulin by mouth. Their oral capsule insulin, ORMD-0801 has demonstrated favorable Phase III results, which may signal an upheaval in the treatment of diabetes. As this research continues, optimal peptide/protein structures, and delivery systems will continue to emerge; therapies will evolve beyond diabetes and into conditions such as cancer, hormones, and gastrointestinal conditions.

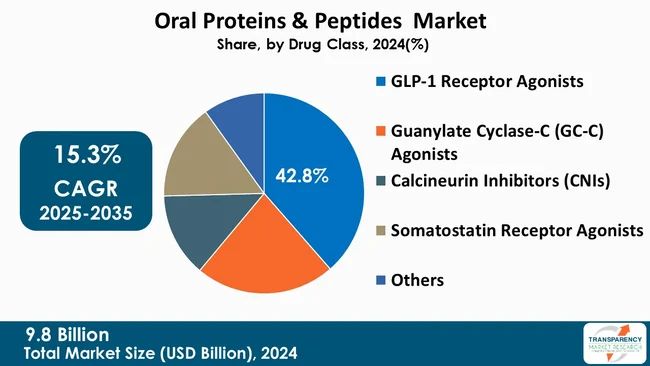

The GLP-1 receptor agonist category leads the worldwide oral protein and peptides industry on the account of its established effectiveness in treating type 2 diabetes and obesity. These drugs stimulate insulin release, inhibit glucagon release, and enhance weight loss, thereby representing a strong preference among clinicians and patients.

The successful move of GLP-1 analog drugs from injectables to oral formulations has sped up global adoption. Novo Nordisk’s oral semaglutide (Rybelsus) was the first oral GLP-1 agonist to be approved by the U.S. FDA in 2019, revolutionizing diabetic care with an easier form, as well as improved glucose control over extended time.

Increased adoption of resistant diabetic patients looking for alternatives to injections are adding to the dominance of the segment. The continual research and development of the next-generation oral incretin-based medications by Eli Lilly, AstraZeneca, and others also reinforce this category's dominance as new oral incretin-based medications enter the market with real world data. As obesity and diabetes become increasingly prevalent across the globe, this segment will continue to be the backbone of industry growth.

| Attribute | Detail |

|---|---|

| Leading Region |

|

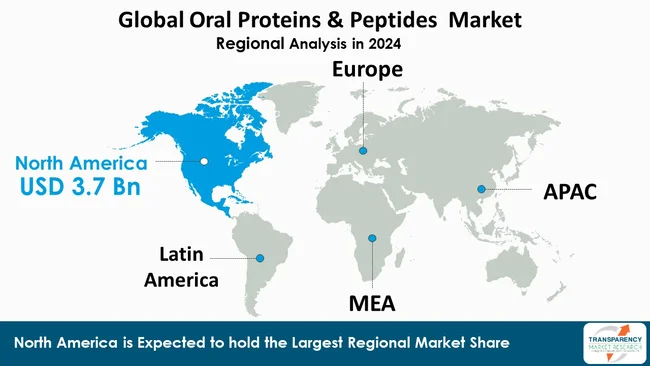

North America leads the oral proteins & peptides market, mainly due to its strong research- and development-oriented infrastructure, high levels of healthcare spending, and early adoption of advanced therapeutics. The U.S. currently has the largest share of the market due to the high prevalence of developed conditions like diabetes and obesity in conjunction with their market population including the presence of major players such as Novo Nordisk, Eli Lilly, and Pfizer.

The U.S. also benefits from an efficient regulatory process being in place in the form of the U.S. Food and Drug Administration (FDA) for drug development, which continues to foster clinical development and innovation in oral biologics.

According to the U.S. Centers for Disease Control and Prevention (CDC), 34.2 million Americans had diabetes in 2023, which would reasonably signify the higher demand for oral antidiabetic peptides. Also, well-established reimbursement models and growing providers’ awareness have continued to improve patient access to biologic therapies that can be more expensive for the patient.

North America's continued product launch, ongoing clinical trials, and substantial venture capital raising into oral peptide development contribute to maintaining a dominant position. Although Canada has a small market share as of now, it actively participates in biopharmaceutical research and is focused on harmonizing its regulatory process with the U.S.

Companies operating in the oral proteins & peptides market emphasize innovating their products, forging strategic collaborations, and validating the performance of their products across numerous clinical settings. These firms invest significantly in R&D related to cutting-edge microfluidic and non-invasive techniques, widen their distribution channels, and provide integrated service solutions for having a strong market presence and higher customer loyalty.

Novo Nordisk A/S, AbbVie Inc., Pfizer Inc., Merck & Co., Inc., Johnson & Johnson Services, Inc., Sanofi S.A., AstraZeneca PLC, GlaxoSmithKline PLC, Novartis AG, Eli Lilly and Company, Biocon Limited, Oramed Pharmaceuticals Inc., Proxima Limited, Chiesi Farmaceutici S.p.A., and Tarsa Therapeutics Inc. are some of the leading players operating in the global market.

Each of these players has been profiled in the oral proteins & peptides market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

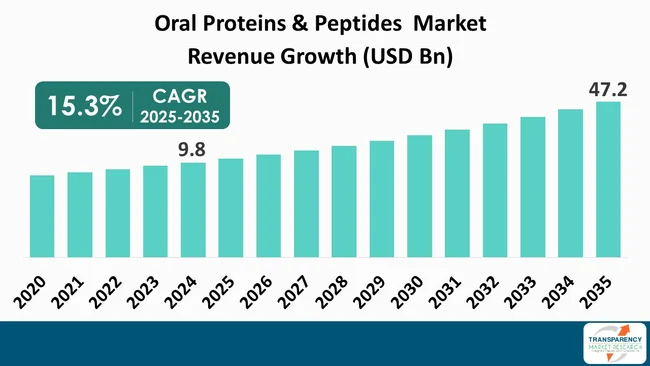

| Size in 2024 | US$ 9.8 Bn |

| Forecast Value in 2035 | US$ 47.2 Bn |

| CAGR | 15.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Oral Proteins & Peptides Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Drug Class

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global oral proteins & peptides market was valued at US$ 9.8 Bn in 2024

The global oral proteins & peptides industry is projected to reach more than US$ 47.2 Bn by the end of 2035

Growing prevalence of chronic diseases and technological advancements in oral drug delivery

The CAGR is anticipated to be 15.3% from 2025 to 2035

Novo Nordisk A/S, AbbVie Inc., Pfizer Inc., Merck & Co., Inc., Johnson & Johnson Services, Inc., Sanofi S.A., AstraZeneca PLC, GlaxoSmithKline PLC, Novartis AG, Eli Lilly and Company, Biocon Limited, Oramed Pharmaceuticals Inc., Proxima Limited, Chiesi Farmaceutici S.p.A., Tarsa Therapeutics Inc., and others

Table 01: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 02: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Gene Therapy, 2020 to 2035

Table 03: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Nucleic Acid-Based Therapies, 2020 to 2035

Table 04: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Molecule Type, 2020 to 2035

Table 05: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 06: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 07: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 08: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 09: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Gene Therapy, 2020 to 2035

Table 10: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Nucleic Acid-Based Therapies, 2020 to 2035

Table 11: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Molecule Type, 2020 to 2035

Table 12: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 13: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 14: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 15: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 16: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Gene Therapy, 2020 to 2035

Table 17: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Nucleic Acid-Based Therapies, 2020 to 2035

Table 18: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Molecule Type, 2020 to 2035

Table 19: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 20: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 21: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 23: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Gene Therapy, 2020 to 2035

Table 24: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Nucleic Acid-Based Therapies, 2020 to 2035

Table 25: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Molecule Type, 2020 to 2035

Table 26: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 27: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 28: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 29: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 30: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Gene Therapy, 2020 to 2035

Table 31: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Nucleic Acid-Based Therapies, 2020 to 2035

Table 32: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Molecule Type, 2020 to 2035

Table 33: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 34: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 35: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 36: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 37: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Gene Therapy, 2020 to 2035

Table 38: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Nucleic Acid-Based Therapies, 2020 to 2035

Table 39: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Molecule Type, 2020 to 2035

Table 40: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 41: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 42: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Figure 01: Global Oral Proteins & Peptides Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Oral Proteins & Peptides Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 03: Global Oral Proteins & Peptides Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 04: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by GLP-1 Receptor Agonists, 2020 to 2035

Figure 05: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Guanylate Cyclase-C (GC-C) Agonists, 2020 to 2035

Figure 06: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Calcineurin Inhibitors (CNIs), 2020 to 2035

Figure 07: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Somatostatin Receptor Agonists, 2020 to 2035

Figure 08: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 09: Global Oral Proteins & Peptides Market Value Share Analysis, by Molecule Type, 2024 and 2035

Figure 10: Global Oral Proteins & Peptides Market Attractiveness Analysis, by Molecule Type, 2025 to 2035

Figure 11: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Natural Proteins & Peptides, 2020 to 2035

Figure 12: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Synthetic Peptides, 2020 to 2035

Figure 13: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Recombinant Proteins, 2020 to 2035

Figure 14: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Biosimilar Peptides, 2020 to 2035

Figure 15: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Oral Proteins & Peptides Market Value Share Analysis, by Indication, 2024 and 2035

Figure 17: Global Oral Proteins & Peptides Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 18: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Diabetes and Metabolic Disorders, 2020 to 2035

Figure 19: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Cardiovascular Disorders, 2020 to 2035

Figure 20: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Gastrointestinal Disorders, 2020 to 2035

Figure 21: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Cancer, 2020 to 2035

Figure 22: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Central Nervous System (CNS) Disorders, 2020 to 2035

Figure 23: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Oral Proteins & Peptides Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 25: Global Oral Proteins & Peptides Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 26: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 27: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 28: Global Oral Proteins & Peptides Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 29: Global Oral Proteins & Peptides Market Value Share Analysis, by Region, 2024 and 2035

Figure 30: Global Oral Proteins & Peptides Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 31: North America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: North America Oral Proteins & Peptides Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 33: North America Oral Proteins & Peptides Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 34: North America Oral Proteins & Peptides Market Value Share Analysis, by Molecule Type, 2024 and 2035

Figure 35: North America Oral Proteins & Peptides Market Attractiveness Analysis, by Molecule Type, 2025 to 2035

Figure 36: North America Oral Proteins & Peptides Market Value Share Analysis, by Indication, 2024 and 2035

Figure 37: North America Oral Proteins & Peptides Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 38: North America Oral Proteins & Peptides Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 39: North America Oral Proteins & Peptides Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 40: North America Oral Proteins & Peptides Market Value Share Analysis, by Country, 2024 and 2035

Figure 41: North America Oral Proteins & Peptides Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 42: Europe Oral Proteins & Peptides Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Europe Oral Proteins & Peptides Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 44: Europe Oral Proteins & Peptides Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 45: Europe Oral Proteins & Peptides Market Value Share Analysis, by Molecule Type, 2024 and 2035

Figure 46: Europe Oral Proteins & Peptides Market Attractiveness Analysis, by Molecule Type, 2025 to 2035

Figure 47: Europe Oral Proteins & Peptides Market Value Share Analysis, by Indication, 2024 and 2035

Figure 48: Europe Oral Proteins & Peptides Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 49: Europe Oral Proteins & Peptides Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 50: Europe Oral Proteins & Peptides Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 51: Europe Oral Proteins & Peptides Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Europe Oral Proteins & Peptides Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 53: Asia Pacific Oral Proteins & Peptides Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Asia Pacific Oral Proteins & Peptides Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 55: Asia Pacific Oral Proteins & Peptides Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 56: Asia Pacific Oral Proteins & Peptides Market Value Share Analysis, by Molecule Type, 2024 and 2035

Figure 57: Asia Pacific Oral Proteins & Peptides Market Attractiveness Analysis, by Molecule Type, 2025 to 2035

Figure 58: Asia Pacific Oral Proteins & Peptides Market Value Share Analysis, by Indication, 2024 and 2035

Figure 59: Asia Pacific Oral Proteins & Peptides Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 60: Asia Pacific Oral Proteins & Peptides Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 61: Asia Pacific Oral Proteins & Peptides Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 62: Asia Pacific Oral Proteins & Peptides Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Asia Pacific Oral Proteins & Peptides Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Latin America Oral Proteins & Peptides Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 65: Latin America Oral Proteins & Peptides Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 66: Latin America Oral Proteins & Peptides Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 67: Latin America Oral Proteins & Peptides Market Value Share Analysis, by Molecule Type, 2024 and 2035

Figure 68: Latin America Oral Proteins & Peptides Market Attractiveness Analysis, by Molecule Type, 2025 to 2035

Figure 69: Latin America Oral Proteins & Peptides Market Value Share Analysis, by Indication, 2024 and 2035

Figure 70: Latin America Oral Proteins & Peptides Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 71: Latin America Oral Proteins & Peptides Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 72: Latin America Oral Proteins & Peptides Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 73: Latin America Oral Proteins & Peptides Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 74: Latin America Oral Proteins & Peptides Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 75: Middle East and Africa Oral Proteins & Peptides Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: Middle East and Africa Oral Proteins & Peptides Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 77: Middle East and Africa Oral Proteins & Peptides Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 78: Middle East and Africa Oral Proteins & Peptides Market Value Share Analysis, by Molecule Type, 2024 and 2035

Figure 79: Middle East and Africa Oral Proteins & Peptides Market Attractiveness Analysis, by Molecule Type, 2025 to 2035

Figure 80: Middle East and Africa Oral Proteins & Peptides Market Value Share Analysis, by Indication, 2024 and 2035

Figure 81: Middle East and Africa Oral Proteins & Peptides Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 82: Middle East and Africa Oral Proteins & Peptides Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 83: Middle East and Africa Oral Proteins & Peptides Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 84: Middle East and Africa Oral Proteins & Peptides Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 85: Middle East and Africa Oral Proteins & Peptides Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035