Reports

Reports

Emergence of topical treatments are creating incremental opportunities for manufacturers operating in the optic nerve disorders treatment market. For instance, Canadian manufacturers of eye health products Bausch & Lomb, announced the launch of VYZULTA® — a topical glaucoma treatment solution that gained acceptance by the Government of Canada.

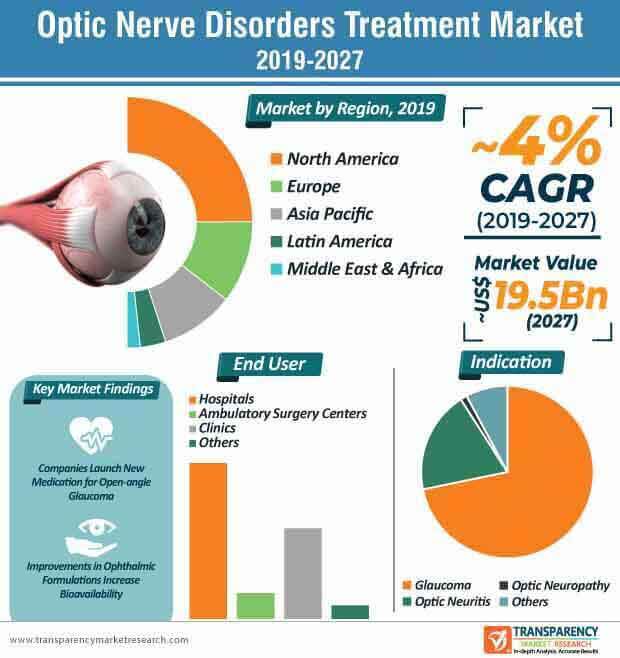

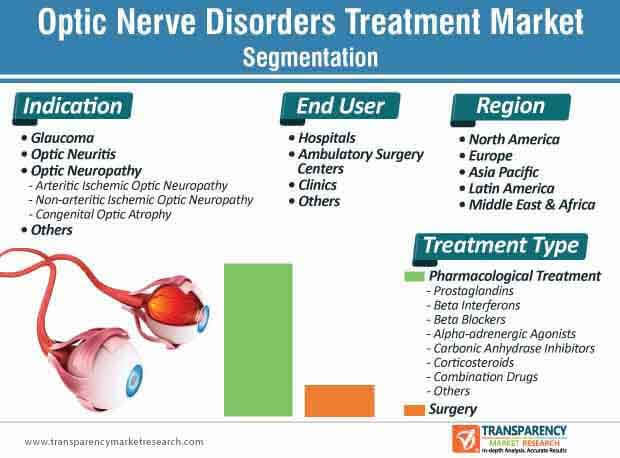

Companies in the optic nerve disorders treatment market are increasing treatment options for glaucoma, since the glaucoma indication segment of the optic nerve disorders treatment market is projected for exponential growth during the forecast period. The glaucoma segment is expected to reach a value of ~US$ 12.1 Bn by the end of 2023. Hence, manufacturers are increasing efficacy in precision medication to offer treatment options for glaucoma.

To innovate in precision medicines, manufacturers in the market for optic nerve disorders treatment are increasing research to understand the aqueous humor for anterior segment and trabecular meshwork tissue.

High prevalence of multiple sclerosis (MS) patients is one of the key drivers for the growth of optic nerve disorders treatment market. Hence, manufacturers are increasing production capabilities to develop immunosuppressive drugs that improve quality of life in patients. For instance, in September 2019, Swiss multinational healthcare company Roche revealed its proceedings on trials for OCREVUS® — an immunosuppressive drug, to understand its effects in relapsing and progressive MS.

Companies in the optic nerve disorders treatment market are increasing trials of immunosuppressive drugs with beta interferons to provide relief to MS patients. As such, the beta interferons sub-segment of the pharmacological treatment segment is estimated to reach a value of ~US$ 2.5 Bn by 2027. Hence, manufacturers in the optic nerve disorders treatment market are increasing production capabilities in beta interferons, since pharmacological treatment segment is anticipated for aggressive growth during the forecast period. Moreover, the neurofilament light chain-lowering capabilities of beta interferons are increasingly benefitting MS patients.

New drugs for rare neurologic eye diseases are being extensively researched for the treatment of MS and neuromyelitis optica. Striking correlation between neurologic diseases and rare eye conditions have opened the doors for innovation in the optic nerve disorders treatment market.

On the other hand, terminal complement inhibitors are under scrutiny of the European and Japanese health commissions. As such, companies are focusing to extend their product portfolios into Europe and Japan, since the two regions are projected for exponential growth during the forecast period. For instance, in June 2019, Alexion — a U.S. pharmaceutical company, announced that the European Medicines Agency and Japanese Ministry of Health, Labor and Welfare are assessing applications of SOLIRIS® for the treatment of neuromyelitis optica spectrum disorder (NMOSD).

The optic nerve disorders treatment market in Europe is expected to reach a value of ~US$ 4.2 Bn. Thus, manufacturers in the market for optic nerve disorders treatment are focusing on meeting the needs of patients in Europe, since NMOSD is a rare disease.

Innovations in topical ocular corticosteroids are proving to be beneficial for patients in the management of pain and inflammation post ocular surgery. However, limitations of these corticosteroids, such as limited bioavailability and class-associated adverse events (AE) are some of the barriers that companies in the optic nerve disorders treatment market have to counter. Hence, manufacturers in the optic nerve disorders treatment market are educating healthcare providers about drug-specific variables of topical ocular corticosteroids, such as AE profile, potency, and patient-specific administration needs for better outcomes in patients.

Companies in the market for optic nerve disorders treatment are aiming at minimizing precorneal drug loss and maximizing drug delivery to the anterior tissues with the help of improved corticosteroid formulations. They are adopting various strategies to enhance ocular penetration by including mucoadhesive formulations in the development of new corticosteroids. Strategies, such as drug-particle size reduction enable faster drug dissolution, which increases bioavailability and penetration. Hence, companies in the optic nerve disorders treatment market are increasing the production capacities of loteprednol etabonate corticosteroids using retrometabolic drug design.

Analysts’ Viewpoint

Companies in the optic nerve disorders treatment market are tapping into new opportunities to obtain new clues from drugs used in neurological disorders for treatment of vision-related diseases. For instance, in May 2019, Bionure — a Spanish biotechnology company, announced its successful investigation for its neuroprotectant BN201, which holds promising results in the treatment of MS and acute optic neuritis.

However, poor bioavailability of drugs for efficacious ocular drug delivery poses as a challenge for manufacturers. Hence, companies should innovate in ocular therapeutics to improve biopharmaceutical properties of drugs. They should focus on expanding product portfolio of drugs that treat optic neuritis, since this indication is projected to gain significant prominence during the forecast period.

Optic nerve disorders treatment market to reach a valuation of ~US$ 19.5 Bn by 2027

Optic nerve disorders treatment market is expected to expand at a CAGR of ~4% during the forecast period from 2019 to 2027

Optic nerve disorders treatment market is driven by increase in prevalence of eye disorders

North America accounted for a major share of the optic nerve disorders treatment market, and is projected to remain dominant during the forecast period

Key players in the global optic nerve disorders treatment market include Santen Pharmaceutical Co., Ltd., Allergan plc. Novartis AG, Pfizer, Inc., Bausch Health Companies

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Optic Nerve Disorders Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Treatment Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Optic Nerve Disorders Treatment Market Analysis and Forecasts, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Pipeline Analysis

5.2. Key Vendor and Distributor Analysis

5.3. Technological Advancements

5.4. Prevalence & Incidence of Optic Nerve Disorders

5.5. Regulatory Scenario Assessment

6. Global Optic Nerve Disorders Treatment Market Analysis and Forecasts, By Treatment Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Treatment Type, 2017–2027

6.3.1. Pharmacological Treatment

6.3.1.1. Prostaglandins

6.3.1.2. Beta Interferons

6.3.1.3. Beta Blockers

6.3.1.4. Alpha-adrenergic Agonist

6.3.1.5. Carbonic Anhydrase Inhibitors

6.3.1.6. Corticosteroids

6.3.1.7. Combination Drugs

6.3.1.8. Others

6.3.2. Surgery

6.4. Market Attractiveness By Treatment Type, 2019-2027

7. Global Optic Nerve Disorders Treatment Market Analysis and Forecasts, By Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Indication, 2017–2027

7.3.1. Glaucoma

7.3.2. Optic Neuritis

7.3.3. Optic Neuropathy

7.3.3.1. Arteritic ischemic optic neuropathy

7.3.3.2. Non-arteritic ischemic optic neuropathy

7.3.3.3. Congenital Optic Atrophy

7.3.4. Others

7.4. Market Attractiveness By Indication, 2019-2027

8. Global Optic Nerve Disorders Treatment Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017–2027

8.3.1. Hospitals

8.3.2. Ambulatory Surgery Centers

8.3.3. Clinics

8.3.4. Others

8.4. Market Attractiveness By End-user, 2019-2027

9. Global Optic Nerve Disorders Treatment Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region, 2019-2027

10. North America Optic Nerve Disorders Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Treatment Type, 2017–2027

10.2.1. Pharmacological Treatment

10.2.1.1. Prostaglandins

10.2.1.2. Beta Interferons

10.2.1.3. Beta Blockers

10.2.1.4. Alpha-adrenergic Agonist

10.2.1.5. Carbonic Anhydrase Inhibitors

10.2.1.6. Corticosteroids

10.2.1.7. Combination Drugs

10.2.1.8. Others

10.2.2. Surgery

10.3. Market Value Forecast By Indication, 2017–2027

10.3.1. Glaucoma

10.3.2. Optic Neuritis

10.3.3. Optic Neuropathy

10.3.3.1. Arteritic ischemic optic neuropathy

10.3.3.2. Non-arteritic ischemic optic neuropathy

10.3.3.3. Congenital Optic Atrophy

10.3.4. Others

10.4. Market Value Forecast By End-user, 2017–2027

10.4.1. Hospitals

10.4.2. Ambulatory Surgery Centers

10.4.3. Clinics

10.4.4. Others

10.5. Market Value Forecast By Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Treatment Type

10.6.2. By Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Optic Nerve Disorders Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast by Treatment Type, 2017–2027

11.2.1. Pharmacological Treatment

11.2.1.1. Prostaglandins

11.2.1.2. Beta Interferons

11.2.1.3. Beta Blockers

11.2.1.4. Alpha-adrenergic Agonist

11.2.1.5. Carbonic Anhydrase Inhibitors

11.2.1.6. Corticosteroids

11.2.1.7. Combination Drugs

11.2.1.8. Others

11.2.2. Surgery

11.3. Market Value Forecast by Indication, 2017–2027

11.3.1. Glaucoma

11.3.2. Optic Neuritis

11.3.3. Optic Neuropathy

11.3.3.1. Arteritic ischemic optic neuropathy

11.3.3.2. Non-arteritic ischemic optic neuropathy

11.3.3.3. Congenital Optic Atrophy

11.3.4. Others

11.4. Market Value Forecast by End-user, 2017–2027

11.4.1. Hospitals

11.4.2. Ambulatory Surgery Centers

11.4.3. Clinics

11.4.4. Others

11.5. Market Value Forecast by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Treatment Type

11.6.2. By Indication

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Optic Nerve Disorders Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast by Treatment Type, 2017–2027

12.2.1. Pharmacological Treatment

12.2.1.1. Prostaglandins

12.2.1.2. Beta Interferons

12.2.1.3. Beta Blockers

12.2.1.4. Alpha-adrenergic Agonist

12.2.1.5. Carbonic Anhydrase Inhibitors

12.2.1.6. Corticosteroids

12.2.1.7. Combination Drugs

12.2.1.8. Others

12.2.2. Surgery

12.3. Market Value Forecast by Indication, 2017–2027

12.3.1. Glaucoma

12.3.2. Optic Neuritis

12.3.3. Optic Neuropathy

12.3.3.1. Arteritic ischemic optic neuropathy

12.3.3.2. Non-arteritic ischemic optic neuropathy

12.3.3.3. Congenital Optic Atrophy

12.3.4. Others

12.4. Market Value Forecast by End-user, 2017–2027

12.4.1. Hospitals

12.4.2. Ambulatory Surgery Centers

12.4.3. Clinics

12.4.4. Others

12.5. Market Value Forecast by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Treatment Type

12.6.2. By Indication

12.6.3. By End-user

12.6.4. By Country

13. Latin America Optic Nerve Disorders Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast by Treatment Type, 2017–2027

13.2.1. Pharmacological Treatment

13.2.1.1. Prostaglandins

13.2.1.2. Beta Interferons

13.2.1.3. Beta Blockers

13.2.1.4. Alpha-adrenergic Agonist

13.2.1.5. Carbonic Anhydrase Inhibitors

13.2.1.6. Corticosteroids

13.2.1.7. Combination Drugs

13.2.1.8. Others

13.2.2. Surgery

13.3. Market Value Forecast by Indication, 2017–2027

13.3.1. Glaucoma

13.3.2. Optic Neuritis

13.3.3. Optic Neuropathy

13.3.3.1. Arteritic ischemic optic neuropathy

13.3.3.2. Non-arteritic ischemic optic neuropathy

13.3.3.3. Congenital Optic Atrophy

13.3.4. Others

13.4. Market Value Forecast by End-user, 2017–2027

13.4.1. Hospitals

13.4.2. Ambulatory Surgery Centers

13.4.3. Clinics

13.4.4. Others

13.5. Market Value Forecast By Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Treatment Type

13.6.2. By Indication

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Optic Nerve Disorders Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast by Treatment Type, 2017–2027

14.2.1. Pharmacological Treatment

14.2.1.1. Prostaglandins

14.2.1.2. Beta Interferons

14.2.1.3. Beta Blockers

14.2.1.4. Alpha-adrenergic Agonist

14.2.1.5. Carbonic Anhydrase Inhibitors

14.2.1.6. Corticosteroids

14.2.1.7. Combination Drugs

14.2.1.8. Others

14.2.2. Surgery

14.3. Market Value Forecast by Indication, 2017–2027

14.3.1. Glaucoma

14.3.2. Optic Neuritis

14.3.3. Optic Neuropathy

14.3.3.1. Arteritic ischemic optic neuropathy

14.3.3.2. Non-arteritic ischemic optic neuropathy

14.3.3.3. Congenital Optic Atrophy

14.3.4. Others

14.4. Market Value Forecast by End-user, 2017–2027

14.4.1. Hospitals

14.4.2. Ambulatory Surgery Centers

14.4.3. Clinics

14.4.4. Others

14.5. Market Value Forecast by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Treatment Type

14.6.2. By Indication

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Position/Ranking Analysis, By Tier and Size of the Company (2018)

15.3. Company Profiles

15.3.1. Santen Pharmaceutical Co., Ltd.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Allergan plc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. Novartis AG

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Company Financials

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. Pfizer, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Company Financials

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. Bausch Health Companies, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Company Financials

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Aerie Pharmaceuticals, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Company Financials

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. Teva Pharmaceutical Industries Ltd.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Company Financials

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. Bionure Farma, S.L.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Company Financials

15.3.8.3. Growth Strategies

15.3.8.4. SWOT Analysis

15.3.9. Mallinckrodt Pharmaceuticals

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Company Financials

15.3.9.3. Growth Strategies

15.3.9.4. SWOT Analysis

List of Tables

Table 01: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2027

Table 02: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Pharmacological Treatment, 2017–2027

Table 03: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 04: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Optic Neuropathy, 2017–2027

Table 05: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 06: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 07: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 08: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2027

Table 09: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Pharmacological Treatment, 2017–2027

Table 10: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 11: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Optic Neuropathy, 2017–2027

Table 12: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 13: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 14: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2027

Table 15: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Pharmacological Treatment, 2017–2027

Table 16: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 17: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Optic Neuropathy, 2017–2027

Table 18: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 19: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 20: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2027

Table 21: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Pharmacological Treatment, 2017–2027

Table 22: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 23: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Optic Neuropathy, 2017–2027

Table 24: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 25: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 26: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2027

Table 27: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Pharmacological Treatment, 2017–2027

Table 28: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 29: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Optic Neuropathy, 2017–2027

Table 30: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 31: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 32: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2027

Table 33: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Pharmacological Treatment, 2017–2027

Table 34: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 35: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by Optic Neuropathy, 2017–2027

Table 36: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Optic Nerve Disorders Treatment Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast, 2017–2027

Figure 03: Global Optic Nerve Disorders Treatment Market Value Share, by Treatment Type (2018)

Figure 04: Global Optic Nerve Disorders Treatment Market Value Share, by Pharmacological Treatment (2018)

Figure 05: Global Optic Nerve Disorders Treatment Market Value Share, by Indication (2018)

Figure 06: Global Optic Nerve Disorders Treatment Market Value Share, by End-user (2018)

Figure 07: Global Optic Nerve Disorders Treatment Market Value Share, by Region (2018)

Figure 08: Regulatory Approval Process - The U.S.

Figure 09: Regulatory Approval Process - Europe

Figure 10: Global Optic Nerve Disorders Treatment Market Value Share Analysis, by Treatment Type, 2018 and 2027

Figure 11: Global Optic Nerve Disorders Treatment Market Value Share Analysis, by Pharmacological Treatment, 2018 and 2027

Figure 12: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmacological Treatment, 2017–2027

Figure 13: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Surgery, 2017–2027

Figure 14: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Prostaglandins, 2017-2027

Figure 15: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Beta Interferons, 2017-2027

Figure 16: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Beta Blockers, 2017-2027

Figure 17: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Alpha-adrenergic agonist, 2017-2027

Figure 18: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Carbonic Anhydrase Inhibitors, 2017-2027

Figure 19: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Corticosteroidss, 2017-2027

Figure 20: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Combination Drugs, 2017-2027

Figure 21: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2027

Figure 22: Global Optic Nerve Disorders Treatment Market Attractiveness, by Treatment Type, 2019–2027

Figure 23: Global Optic Nerve Disorders Treatment Market Value Share Analysis, by Indication, 2018 and 2027

Figure 24: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Glaucoma, 2017-2027

Figure 25: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Optic Neuritis, 2017-2027

Figure 26: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Optic Neuropathy, 2017-2027

Figure 27: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2027

Figure 28: Global Optic Nerve Disorders Treatment Market Attractiveness, by Indication, 2019–2027

Figure 29: Global Optic Nerve Disorders Treatment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 30: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 31: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgery Centers, 2017–2027

Figure 32: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Clinics, 2017–2027

Figure 33: Global Optic Nerve Disorders Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Academic & Research Institutes, 2017–2027

Figure 34: Global Optic Nerve Disorders Treatment Market Attractiveness, by End-user, 2019–2027

Figure 35: Global Optic Nerve Disorders Treatment Market Value Share, by Region, 2018 and 2027

Figure 36: Global Optic Nerve Disorders Treatment Market Attractiveness, by Region, 2019–2027

Figure 37: North America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 38: North America Optic Nerve Disorders Treatment Market Value Share, by Country, 2018 and 2027

Figure 39: North America Optic Nerve Disorders Treatment Market Attractiveness, by Country, 2019–2027

Figure 40: North America Optic Nerve Disorders Treatment Market Value Share, by Treatment Type, 2018 and 2027

Figure 41: North America Optic Nerve Disorders Treatment Market Value Share, by Pharmacological Treatment, 2018 and 2027

Figure 42: North America Optic Nerve Disorders Treatment Market Attractiveness, by Treatment type, 2019–2027

Figure 43: North America Optic Nerve Disorders Treatment Market Value Share, by Indication, 2018 and 2027

Figure 44: North America Optic Nerve Disorders Treatment Market Attractiveness, by Indication, 2019–2027

Figure 45: North America Optic Nerve Disorders Treatment Market Value Share, by End-user, 2018 and 2027

Figure 46: North America Optic Nerve Disorders Treatment Market Attractiveness, by End-user, 2019–2027

Figure 47: Europe Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 48: Europe Optic Nerve Disorders Treatment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 49: Europe Optic Nerve Disorders Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 50: Europe Optic Nerve Disorders Treatment Market Value Share, by Treatment Type, 2018 and 2027

Figure 51: Europe Optic Nerve Disorders Treatment Market Value Share, by Pharmacological Treatment, 2018 and 2027

Figure 52: Europe Optic Nerve Disorders Treatment Market Attractiveness, by Treatment type, 2019–2027

Figure 53: Europe Optic Nerve Disorders Treatment Market Value Share, by Indication, 2018 and 2027

Figure 54: Europe Optic Nerve Disorders Treatment Market Attractiveness, by Indication, 2019–2027

Figure 55: Europe Optic Nerve Disorders Treatment Market Value Share, by End-user, 2018 and 2027

Figure 56: Europe Optic Nerve Disorders Treatment Market Attractiveness, by End-user, 2019–2027

Figure 57: Asia Pacific Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 58: Asia Pacific Optic Nerve Disorders Treatment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 59: Asia Pacific Optic Nerve Disorders Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 60: Asia Pacific Optic Nerve Disorders Treatment Market Value Share, by Treatment Type, 2018 and 2027

Figure 61: Asia Pacific Optic Nerve Disorders Treatment Market Value Share, by Pharmacological Treatment, 2018 and 2027

Figure 62: Asia Pacific Optic Nerve Disorders Treatment Market Attractiveness, by Treatment type, 2019–2027

Figure 63: Asia Pacific Optic Nerve Disorders Treatment Market Value Share, by Indication, 2018 and 2027

Figure 64: Asia Pacific Optic Nerve Disorders Treatment Market Attractiveness, by Indication, 2019–2027

Figure 65: Asia Pacific Optic Nerve Disorders Treatment Market Value Share, by End-user, 2018 and 2027

Figure 66: Asia Pacific Optic Nerve Disorders Treatment Market Attractiveness, by End-user, 2019–2027

Figure 67: Latin America Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 68: Latin America Optic Nerve Disorders Treatment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 69: Latin America Optic Nerve Disorders Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 70: Latin America Optic Nerve Disorders Treatment Market Value Share, by Treatment Type, 2018 and 2027

Figure 71: Latin America Optic Nerve Disorders Treatment Market Value Share, by Pharmacological Treatment, 2018 and 2027

Figure 72: Latin America Optic Nerve Disorders Treatment Market Attractiveness, by Treatment Type, 2019–2027

Figure 73: Latin America Optic Nerve Disorders Treatment Market Value Share, by Indication, 2018 and 2027

Figure 74: Latin America Optic Nerve Disorders Treatment Market Attractiveness, by Indication, 2019–2027

Figure 75: Latin America Optic Nerve Disorders Treatment Market Value Share, by End-user, 2018 and 2027

Figure 76: Latin America Optic Nerve Disorders Treatment Market Attractiveness, by End-user, 2019–2027

Figure 77: Middle East & Africa Optic Nerve Disorders Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 78: Middle East & Africa Optic Nerve Disorders Treatment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 79: Middle East & Africa Optic Nerve Disorders Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 80: Middle East & Africa Optic Nerve Disorders Treatment Market Value Share, by Treatment Type, 2018 and 2027

Figure 81: Middle East & Africa Optic Nerve Disorders Treatment Market Value Share, by Pharmacological Treatment, 2018 and 2027

Figure 82: Middle East & Africa Optic Nerve Disorders Treatment Market Attractiveness, by Treatment Type, 2019–2027

Figure 83: Middle East & Africa Optic Nerve Disorders Treatment Market Value Share, by Indication, 2018 and 2027

Figure 84: Middle East & Africa Optic Nerve Disorders Treatment Market Attractiveness, by Indication, 2019–2027

Figure 85: Middle East & Africa Optic Nerve Disorders Treatment Market Value Share, by End-user, 2018 and 2027

Figure 86: Middle East & Africa Optic Nerve Disorders Treatment Market Attractiveness, by End-user, 2019–2027

Figure 87: Market Position/Ranking Analysis, 2018, by Tier and Size of the Company