Reports

Reports

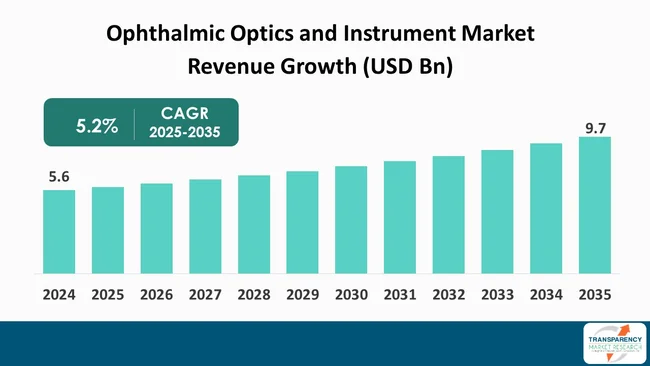

The global ophthalmic optics and instrument market size was valued at US$ 5.6 billion in 2024 and is projected to reach US$ 9.7 billion by 2035, expanding at a CAGR of 5.2% from 2025 to 2035. The market growth is driven by increasing incidence of eye disorders and expanding healthcare infrastructure.

The ophthalmic optics and instrument market is influenced by a number of factors. The primary factor is the growing prevalence of eye disorders, which are escalating the demand for advanced therapeutic and diagnostic tools. The growing incidences of disorders like glaucoma, cataracts, and diabetic retinopathy is calling for new innovative solutions that will enhance the outcomes of patients.

Besides, technological advancements are changing the entire field. Innovative technologies like optical coherence tomography (OCT), laser-assisted surgeries, and portable diagnostic devices are not only enhancing the accuracy of diagnosis but also facilitating eye care to a wider population.

Additionally, consumers' awareness of the importance of eye health is leading to more number of people going for regular eye check-ups and treatments. This preventive behavior is also teleophthalmology-enabled, which is removing the limitation of location. Thus, patients living in the farthest areas can still get quality eye care.

Nevertheless, the market experiences a situation of high costs for the most advanced instruments and strict regulations that can slow down the issuance of product approvals.

Ophthalmic optics and instruments refer to a broad range of the latest devices and technologies that help doctors in inspecting, treating, and managing patients with eye-related problems. This industry is a major healthcare component that is necessary for better vision health and successful patient care. Among the primary tools are tonometers, optical coherence tomography (OCT) machines, refractors, and laser systems, each being used for diverse purposes like assessing intraocular pressure, measuring refractive errors, and performing surgical procedures.

The primary factor driving the market is the increased incidences of eye diseases that affect the geriatric population and ailments such as macular degeneration and cataracts, which they are more susceptible to.

The consumers of eye care products and services are becoming more aware of the importance of eye health, and consequently, the demand for them increases. The need for eye check-ups, the purchase of prescription glasses, and contact lenses have gone up. The healthcare facility enhancements in the poor regions of the world are also great news for the ophthalmic instruments market as they open up many growth opportunities there.

On the other hand, there exist some barriers such as the high price of sophisticated devices and complex regulations. In summary, the ophthalmic optics and instrument market has an upward trajectory, supported by the continuous innovation and increasing awareness of the importance of eye health.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The ophthalmic optics and instrument market is visibly influenced by the rising number of eye disorders. With rise in the aging population worldwide followed by changes in lifestyle, the number of patients with cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration increase.

The World Health Organization states that globally uncorrected refractive errors and cataracts are the main causes of visual impairment, which affect millions of people. This dramatic rise in eye disorders calls for novel diagnostic and treatment solutions. As such, hospitals and doctors are upgrading their ophthalmic instruments to the latest models.

At present, the ophthalmic optics and instrument market is flourishing owing to the technological innovations and the enthusiastic patient demand for appropriate treatment. As healthcare systems respond to these challenges, companies have a great chance of supplying the sophisticated devices that are needed to tackle the heavy burden of eye care requirements. This pattern will still have a strong influence on the market in the upcoming period.

The ophthalmic optics and instrument market is significantly influenced by technological advancements. One of the major areas of improvement is the imaging technologies that have been completely changed by innovations like optical coherence tomography (OCT) and fundus photography. With these advanced imaging techniques, clinicians get clear and detailed images of the retina from various angles, thus they can detect the diseases even at the darkest stages and also can use the treatment plans more effectively.

The transition of laser-assisted surgical techniques is one of the major developmental changes in the health sector, which has led to a significant modification of the standard ophthalmic surgeries including cataract removal and refractive surgery. In doing so, precision and patient outcomes have largely improved. For instance, the use of femtosecond lasers enables a higher level of surgical accuracy and is less time-consuming in the recovery phase, thus eye surgeries are more attractive to patients and healthcare providers alike.

In addition, the teleophthalmology integration has come through as a major change in the healthcare sector, where patients residing in far-flung areas can get expert consultation and diagnoses via virtual platforms. This, in turn, facilitates the access to care and also makes the whole patient journey more pleasant.

At present, the ophthalmic optics and instrument market has a positive trend as a result of the technological innovations which are transforming the clinical practices and patient care. With the continual research and development going on, the market is forecasted to have more demand for new and feature-rich ophthalmic devices.

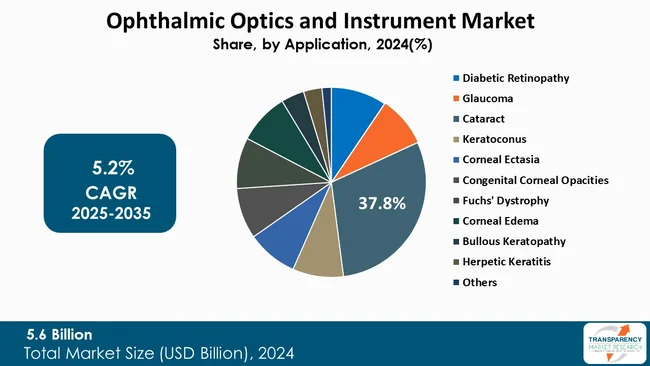

The cataract application segment represents the major growth driver of the ophthalmic optics and instrument market. This is mainly attributed to the high prevalence of cataracts and the consequent demand for effective treatment options.

Cataracts rank among the top causes of visual impairment worldwide, especially in the elderly population. With longer lifespans, the number of cataracts cases will increase, thus the need for surgical interventions and the diagnostic tools used in them will become very high.

One of the major reasons is the improvement of the cataract surgery, power of phacoemulsification techniques, and the usage of intraocular lenses (IOLs) that have made the operation more secure, rapid and result-oriented. Apart from better surgical outcomes, these innovations elevate patients' quality of life. Thus more people get acceptance, and, in turn, demand for cataract surgeries increases.

Additionally, more number of surgical instruments and equipment specially designed for cataract procedures are available, thus making it easy for healthcare providers to meet the demand. As a result, the cataract application segment is scheduled to grow continuously and hence a substantial contribution to the ophthalmic optics and instrument market will be made by it.

| Attribute | Detail |

|---|---|

| Leading Region |

|

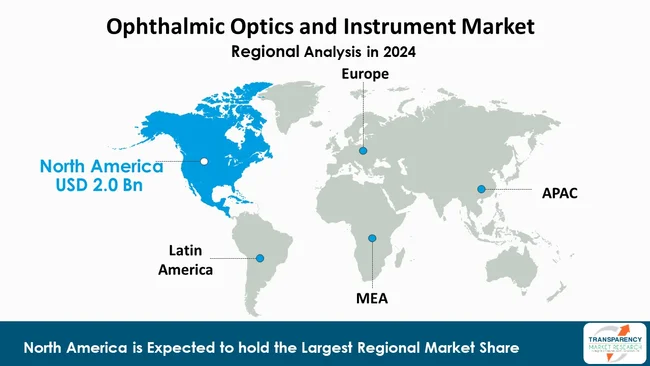

Several key factors have contributed to North America emerging as the leading market for ophthalmic optics and instruments, accounting for the largest revenue share of 36.2%. One of them is the region holding an advanced healthcare infrastructure that includes not only cutting-edge hospitals but also specialized eye care facilities that are innovative ophthalmic technologies.

Moreover, the rising occurrence of eye disorders, to be exact, the elderly population, is the main factor that pushes up the demand for ophthalmic instruments. In fact, North America is characterized by quite a large number of elderly people who are highly vulnerable to such diseases as cataracts and macular degeneration. The need for eye care services, therefore, has gone up considerably.

Besides, the region possesses a great healthcare budget that enables it to spend more on research and development thus bringing about new eye technologies. The presence of leading manufacturers and a shift toward clinical advancements are the factors that have been made to lead the market landscape further.

Alcon Inc, Johnson & Johnson, Carl Zeiss Meditec, Bausch & Lomb Pvt Ltd, Essilor, HOYA Corporation, Topcon Corporation, Rodenstock GmbH, Seiko Optical, Nikon Lenswear, Shanghai Conant Optical Co., Ltd., WANXIN, CHEMIGLAS CORP., Hongchen are the key players governing the global ophthalmic optics and instrument market.

Each of these players has been profiled in the ophthalmic optics and instrument market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 5.6 Bn |

| Forecast Value in 2035 | More than US$ 9.7 Bn |

| CAGR | 5.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.6 Bn in 2024

It is projected to cross US$ 9.7 Bn by the end of 2035

Increasing incidence of eye disorders and expanding healthcare infrastructure

It is anticipated to grow at a CAGR of 5.2% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Alcon Inc, Johnson & Johnson, Carl Zeiss Meditec, Bausch & Lomb Pvt Ltd, Essilor, HOYA Corporation, Topcon Corporation, Rodenstock GmbH, Seiko Optical, Nikon Lenswear, Shanghai Conant Optical Co., Ltd., WANXIN, CHEMIGLAS CORP., Hongchen, and others

Table 01: Global Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 07: North America Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: North America Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 10: Europe Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 11: Europe Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: Europe Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Asia Pacific Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: Asia Pacific Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 16: Asia Pacific Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Latin America Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 19: Latin America Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Latin America Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Middle East & Africa Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Middle East & Africa Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Middle East & Africa Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Ophthalmic Optics and Instrument Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Refractometer, 2020 to 2035

Figure 04: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Keratometers, 2020 to 2035

Figure 05: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Ophthalmoscopes, 2020 to 2035

Figure 06: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Fundus Cameras, 2020 to 2035

Figure 07: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Optical Coherence Tomography, 2020 to 2035

Figure 08: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Perimeter, 2020 to 2035

Figure 09: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Optical Biometry System, 2020 to 2035

Figure 10: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Tonometers, 2020 to 2035

Figure 11: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Optical Pachymeter, 2020 to 2035

Figure 12: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Contact Lens, 2020 to 2035

Figure 13: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Anomaloscope, 2020 to 2035

Figure 14: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Implantable Intraocular Pressure Monitoring System, 2020 to 2035

Figure 15: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Scleral Buckling Device, 2020 to 2035

Figure 16: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Vitrectomy System, 2020 to 2035

Figure 17: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Ophthalmic Cryosurgical System, 2020 to 2035

Figure 18: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Ophthalmic Excimer Laser System, 2020 to 2035

Figure 19: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Femtosecond Ophthalmic Laser System, 2020 to 2035

Figure 20: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Pupillometer, 2020 to 2035

Figure 21: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Phacoemulsification System, 2020 to 2035

Figure 22: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Intracorneal Ring, 2020 to 2035

Figure 23: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Slit Lamp, 2020 to 2035

Figure 24: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Retinoscope, 2020 to 2035

Figure 25: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Capsulorhexis Forceps, 2020 to 2035

Figure 26: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Epiretinal, 2020 to 2035

Figure 27: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Glaucoma Supraciliary Implant, 2020 to 2035

Figure 28: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 29: Global Ophthalmic Optics and Instrument Market Value Share Analysis, By Application, 2024 and 2035

Figure 30: Global Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 31: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Diabetic Retinopathy, 2020 to 2035

Figure 32: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Glaucoma, 2020 to 2035

Figure 33: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Cataract, 2020 to 2035

Figure 34: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Keratoconus, 2020 to 2035

Figure 35: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Corneal Ectasia, 2020 to 2035

Figure 36: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Congenital Corneal Opacities, 2020 to 2035

Figure 37: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Fuchs' Dystrophy, 2020 to 2035

Figure 38: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Corneal Edema, 2020 to 2035

Figure 39: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Bullous Keratopathy, 2020 to 2035

Figure 40: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Herpetic Keratitis, 2020 to 2035

Figure 41: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 42: Global Ophthalmic Optics and Instrument Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Global Ophthalmic Optics and Instrument Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 45: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Eye Clinics, 2020 to 2035

Figure 46: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Ambulatory Surgical Centers (ASCs), 2020 to 2035

Figure 47: Global Ophthalmic Optics and Instrument Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 48: Global Ophthalmic Optics and Instrument Market Value Share Analysis, By Region, 2024 and 2035

Figure 49: Global Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 50: North America - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: North America - Ophthalmic Optics and Instrument Market Value Share Analysis, by Country, 2024 and 2035

Figure 52: North America - Ophthalmic Optics and Instrument Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 53: North America Ophthalmic Optics and Instrument Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 54: North America Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 55: North America Ophthalmic Optics and Instrument Market Value Share Analysis, By Application, 2024 and 2035

Figure 56: North America Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 57: North America Ophthalmic Optics and Instrument Market Value Share Analysis, By End-user, 2024 and 2035

Figure 58: North America Ophthalmic Optics and Instrument Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 59: Europe - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Europe - Ophthalmic Optics and Instrument Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 61: Europe - Ophthalmic Optics and Instrument Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 62: Europe Ophthalmic Optics and Instrument Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 63: Europe Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 64: Europe Ophthalmic Optics and Instrument Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: Europe Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 66: Europe Ophthalmic Optics and Instrument Market Value Share Analysis, By End-user, 2024 and 2035

Figure 67: Europe Ophthalmic Optics and Instrument Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 68: Asia Pacific - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Asia Pacific - Ophthalmic Optics and Instrument Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 70: Asia Pacific - Ophthalmic Optics and Instrument Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 71: Asia Pacific Ophthalmic Optics and Instrument Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 72: Asia Pacific Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 73: Asia Pacific Ophthalmic Optics and Instrument Market Value Share Analysis, By Application, 2024 and 2035

Figure 74: Asia Pacific Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Asia Pacific Ophthalmic Optics and Instrument Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Asia Pacific Ophthalmic Optics and Instrument Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 77: Latin America - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 78: Latin America - Ophthalmic Optics and Instrument Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 79: Latin America - Ophthalmic Optics and Instrument Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 80: Latin America Ophthalmic Optics and Instrument Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 81: Latin America Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 82: Latin America Ophthalmic Optics and Instrument Market Value Share Analysis, By Application, 2024 and 2035

Figure 83: Latin America Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 84: Latin America Ophthalmic Optics and Instrument Market Value Share Analysis, By End-user, 2024 and 2035

Figure 85: Latin America Ophthalmic Optics and Instrument Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 86: Middle East & Africa - Ophthalmic Optics and Instrument Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 87: Middle East & Africa - Ophthalmic Optics and Instrument Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 88: Middle East & Africa - Ophthalmic Optics and Instrument Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 89: Middle East & Africa Ophthalmic Optics and Instrument Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 90: Middle East & Africa Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 91: Middle East & Africa Ophthalmic Optics and Instrument Market Value Share Analysis, By Application, 2024 and 2035

Figure 92: Middle East & Africa Ophthalmic Optics and Instrument Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 93: Middle East & Africa Ophthalmic Optics and Instrument Market Value Share Analysis, By End-user, 2024 and 2035

Figure 94: Middle East & Africa Ophthalmic Optics and Instrument Market Attractiveness Analysis, By End-user, 2025 to 2035