Reports

Reports

Analysts’ Viewpoint on Operating Room Equipment Market Scenario

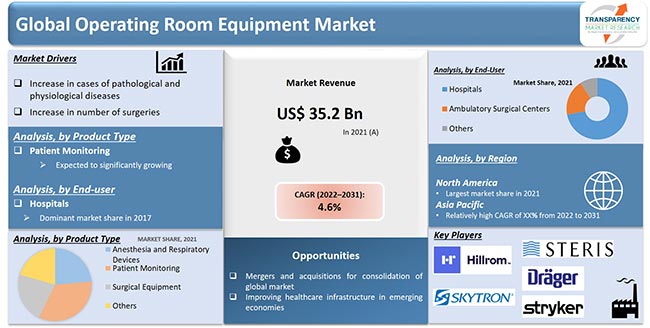

The global operating room equipment market is expected to be driven by increase in incidence of chronic diseases that require surgeries, rise in number of hospitals, and surge in government funding & grants. According to data published by the Ministry of Health & Family Welfare, Government of India, under the PMSSY scheme, six AIIMS-like institutions received approx. US$ 83 Mn toward the cost of construction and around US$ 27 Mn for the procurement of medical equipment and modular operation theaters. Such investments are likely to create novel opportunities for market players.

Due to the COVID-19 pandemic, healthcare organizations have been stressing on the importance of operating room management. Healthcare companies in the operating room equipment market have been ensuring robust operation theatre supplies across facilities to maintain patient quality of life.

Operating room theatre personnel are taking precautions such as utilizing personal protective equipment (PPE), pre-operative planning, and assessing negative pressure ventilation in operating theaters (OTs). Healthcare facilities are ensuring limited personnel in operating rooms and deployment of single-use equipment to avoid hospital-acquired infections (HAIs) and dedicated COVID-19 theaters to reduce the spread of the novel infection. Moreover, healthcare practitioners are making the use of regional anesthesia to minimize the duration of surgery.

Companies in the operating room equipment market are providing leading-edge patient monitoring equipment such as surgical imaging displays and vital signs monitoring devices in hospitals. 3D (3 dimensional) endoscopes are storming operating theaters where in the near future, surgeons will be seen wearing 3D glasses that hold potentials to solve limited depth perception in endoscopic surgeries.

Although 3D surgical imaging is anticipated to become more commonplace in OTs, there is a need for investment to build a robust healthcare infrastructure in developing countries such as India, Bangladesh, Vietnam, and the Philippines. Hence, companies in the operating room equipment market should collaborate with governments in these countries and invest in building healthcare facilities to improve overall public health in emerging economies.

Hybrid operating rooms, digital operating rooms, and integrated operating rooms are playing an instrumental role in improving patient outcomes. Hybrid O.R. is being publicized for use of mobile systems that offer advantages of flexibility in use of imaging systems during surgeries. Such innovations are fueling the demand for operating room supplies.

Digital O.R. on the other hand is gaining popularity for next-gen setup of software sources, images, and O.R. video integration, all at the same time. However, operating room integration system manufacturers are focused on automation of O.R. equipment, imaging devices, and patient information systems.

The high prevalence of chronic diseases in patients worldwide is fueling the demand for equipment for operation theatres. Manufacturers in the global operating room equipment market are innovating in operating room lights, surgical lights, and hospital lights to ease healthcare services for surgeons, healthcare staff, and practitioners. Surgical lights help to illuminate the operative site on a patient for optimal visualization during a procedure.

Operating room lights including luminance management device (LMD) are being developed by med-tech companies. Advantages of LMD include same luminance irrespective of the tissue, constant illumination during time-consuming surgeries, and automatic light adjustment to suit the surgeon’s ability and comfort.

One of the most commonly used operating room instruments is surgical instruments. Manufacturers are increasing output capacities for ratcheted forceps, babcock forceps, and gillies forceps, among others. An alarmingly high number of cardiovascular patients, diabetic patients, and obese patients are translating into revenue opportunities for surgical instrument manufacturers in the operating room equipment market.

The operating room equipment market is undergoing a significant change with innovations in operating tables. Manufacturers are developing O.R. tables such as orthopedic tables, general surgical tables, and radiolucent imaging tables to revolutionize healthcare facilities. Since the healthcare industry largely runs on faith between surgeons, doctors, and patients, robust operating room supplies has become the need of the hour in hospitals and ambulatory surgical centers.

Operating rooms (O.R.) are one of the most crucial departments in any given healthcare facility such as hospitals and ambulatory surgical centers. Since hospitals in North America are known for their favorable reimbursement policies and government support, healthcare corporations are enabling robust surgical supplies in healthcare systems to improve patient outcomes.

Healthcare companies are increasing the availability of operating room supplies such as instruments used for surgery and anesthesia systems to ensure the smooth functioning of healthcare facilities. These companies in the operating room equipment market are providing healthcare facilities with next-gen ordering and inventory tools that help track expenses in the facility and enter purchase order as per requirement.

Patient Monitoring Segment to Lead Operating Room Equipment Market

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 35.2 Bn |

|

Market Forecast Value in 2031 |

US$ 56.8 Bn |

|

Growth Rate (CAGR) |

4.6% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

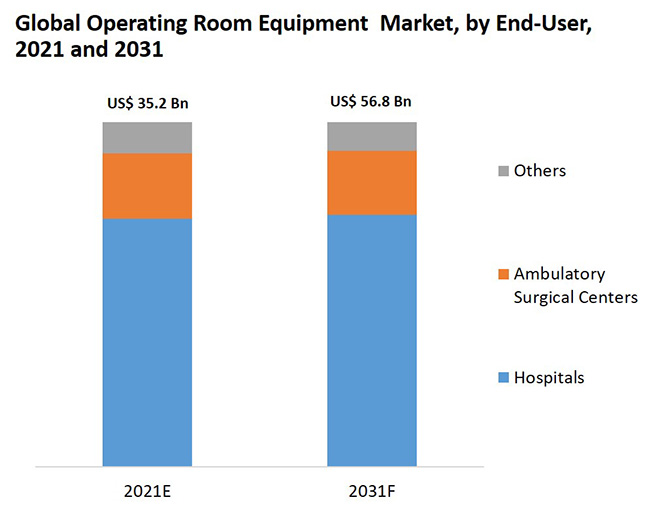

The global operating room equipment market was valued at US$ 35.2 Bn in 2021 and is projected to reach US$ 56.8 Bn by 2031

The global operating room equipment market is expected to expand at a CAGR of 4.6% during the forecast period

Increase in number of surgeries globally and technological advancements in medical devices are key drivers of the global market

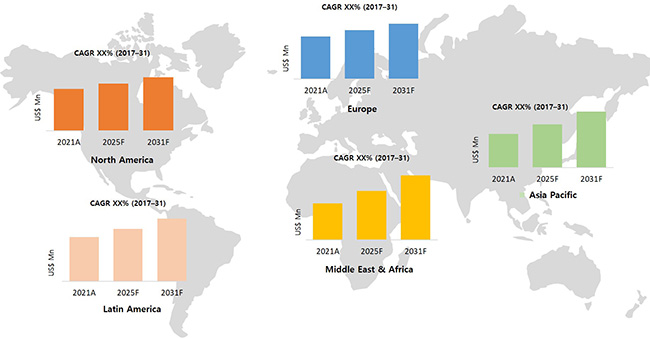

The market in Europe is likely to expand at the fastest CAGR during the forecast period

The patient monitoring segment is anticipated to accounted for the largest share of the market, in terms of revenue, in 2031

Steris plc., Hill-Rom, Koninklijke Philips N.V., and Stryker Corporation are prominent players in the global market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Operating Room Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Derivative Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Operating Room Equipment Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Product/ Brand Analysis

5.3. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

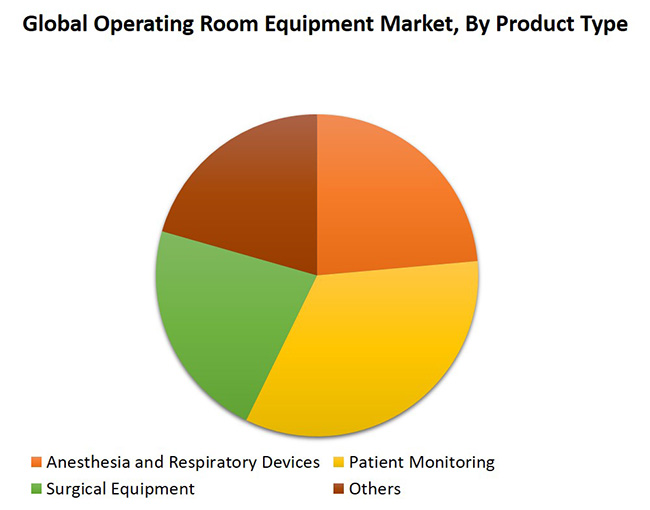

6. Global Operating Room Equipment Market Analysis, by Product Type

6.1. Key Findings

6.2. Introduction

6.3. Global Operating Room Equipment Market Value Share Analysis, by Product Type

6.4. Global Operating Room Equipment Market Forecast, by Product Type

6.4.1. Global Operating Room Equipment Market Value Share Analysis, by Anesthesia & Respiratory Devices

6.4.2. Global Operating Room Equipment Market Forecast, by Anesthesia & Respiratory Devices

6.4.3. Global Operating Room Equipment Market Value Share Analysis, by Patient Monitoring

6.4.4. Global Operating Room Equipment Market Forecast, by Patient Monitoring

6.4.5. Global Operating Room Equipment Market Value Share Analysis, by Surgical Equipment

6.4.6. Global Operating Room Equipment Market Forecast, by Surgical Equipment

6.4.7. Global Operating Room Equipment Market Value Share Analysis, by Others

6.4.8. Global Operating Room Equipment Market Forecast, by Others

6.4.9. Global Operating Room Equipment Market Analysis, by Product Type

6.4.10. Global Operating Room Equipment Market Analysis, by Anesthesia & Respiratory Devices

6.4.10.1. Anesthesia Systems

6.4.10.2. Patient Warmers

6.4.10.3. Ventilators

6.4.11. Global Operating Room Equipment Market Analysis, by Patient Monitoring

6.4.11.1. Surgical Imaging Displays

6.4.11.2. Movable Imaging Displays

6.4.11.3. Vital Signs Monitoring Devices

6.4.12. Global Operating Room Equipment Market Analysis, by Surgical Equipment

6.4.12.1. Electrical Surgical Units

6.4.12.2. Handheld Surgical Instruments

6.4.12.3. Operating Tables

6.4.12.4. Operating Room Lights

6.4.12.5. Surgical Booms

6.4.13. Global Operating Room Equipment Market Analysis, by Others

6.4.14. Global Operating Room Equipment Market Forecast, by Others

6.4.14.1. Microscopes

6.4.14.2. Endoscopes

6.4.14.3. Operating Room Integration Systems

6.4.15. Global Operating Room Equipment Market Attractiveness Analysis, by Product Type

7. Global Operating Room Equipment Market Analysis, by End-user

7.1. Key Findings

7.2. Introduction

7.3. Global Operating Room Equipment Market Value Share Analysis, by End-user

7.4. Global Operating Room Equipment Market Forecast, by End-user

7.5. Global Operating Room Equipment Market Analysis, by End-user

7.5.1. Hospitals

7.5.2. Ambulatory Surgical Centers

7.5.3. Others

8. Global Operating Room Equipment Market Analysis, by Region

8.1. Global Operating Room Equipment Market Value Share Analysis, by Region

8.2. Global Operating Room Equipment Market Forecast, by Region

9. North America Operating Room Equipment Market Analysis

9.1. Market Overview

9.2. Market Attractiveness Analysis, by Country

9.3. North America Operating Room Equipment Market Value Share Analysis, by Product Type

9.4. North America Operating Room Equipment Market Forecast, by Product Type

9.5. North America Operating Room Equipment Market Value Share Analysis, by Anesthesia & Respiratory Devices

9.6. North America Operating Room Equipment Market Forecast, by Anesthesia & Respiratory Devices

9.7. North America Operating Room Equipment Market Value Share Analysis, by Patient Monitoring

9.8. North America Operating Room Equipment Market Forecast, by Patient Monitoring

9.9. North America Operating Room Equipment Market Value Share Analysis, by Surgical Equipment

9.10. North America Operating Room Equipment Market Forecast, by Surgical Equipment

9.11. North America Operating Room Equipment Market Value Share Analysis, by Others

9.12. North America Operating Room Equipment Market Forecast, by Others

9.13. North America Operating Room Equipment Market Value Share Analysis, by End-user

9.14. North America Operating Room Equipment Market Forecast, by End-user

9.15. North America Operating Room Equipment Market Value Share Analysis, by Country

9.16. North America Operating Room Equipment Market Forecast, by Country

9.16.1. U.S.

9.16.2. Canada

10. Europe Operating Room Equipment Market Analysis

10.1. Market Overview

10.2. Europe Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region

10.3. Europe Operating Room Equipment Market Value Share Analysis, by Product Type

10.4. Europe Operating Room Equipment Market Forecast, by Product Type

10.5. Europe Operating Room Equipment Market Value Share Analysis, by Anesthesia & Respiratory Devices

10.6. Europe Operating Room Equipment Market Forecast, by Anesthesia & Respiratory Devices

10.7. Europe Operating Room Equipment Market Value Share Analysis, by Patient Monitoring

10.8. Europe Operating Room Equipment Market Forecast, by Patient Monitoring

10.9. Europe Operating Room Equipment Market Value Share Analysis, by Surgical Equipment

10.10. Europe Operating Room Equipment Market Forecast, by Surgical Equipment

10.11. Europe Operating Room Equipment Market Value Share Analysis, by Others

10.12. Europe Operating Room Equipment Market Forecast, by Others

10.13. Europe Operating Room Equipment Market Value Share Analysis, by End-user

10.14. Europe Operating Room Equipment Market Forecast, by End-user

10.15. Europe Operating Room Equipment Market Value Share Analysis, by Country/Sub-region

10.16. Europe Operating Room Equipment Market Forecast, by Country/Sub-region

10.16.1. Germany

10.16.2. U.K.

10.16.3. France

10.16.4. Spain

10.16.5. Italy

10.16.6. Rest of Europe

11. Asia Pacific Operating Room Equipment Market Analysis

11.1. Market Overview

11.2. Asia Pacific Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region

11.3. Asia Pacific Operating Room Equipment Market Value Share Analysis, by Product Type

11.4. Asia Pacific Operating Room Equipment Market Forecast, by Product Type

11.5. Asia Pacific Operating Room Equipment Market Value Share Analysis, by Anesthesia & Respiratory Devices

11.6. Asia Pacific Operating Room Equipment Market Forecast, by Anesthesia & Respiratory Devices

11.7. Asia Pacific Operating Room Equipment Market Value Share Analysis, by Patient Monitoring

11.8. Asia Pacific Operating Room Equipment Market Forecast, by Patient Monitoring

11.9. Asia Pacific Operating Room Equipment Market Value Share Analysis, by Surgical Equipment

11.10. Asia Pacific Operating Room Equipment Market Forecast, by Surgical Equipment

11.11. Asia Pacific Operating Room Equipment Market Value Share Analysis, by Others

11.12. Asia Pacific Operating Room Equipment Market Forecast, by Others

11.13. Asia Pacific Operating Room Equipment Market Value Share Analysis, by End-user

11.14. Asia Pacific Operating Room Equipment Market Forecast, by End-user

11.15. Asia Pacific Operating Room Equipment Market Value Share Analysis, by Country/Sub-region

11.16. Asia Pacific Operating Room Equipment Market Forecast, by Country/Sub-region

11.16.1. China

11.16.2. Japan

11.16.3. India

11.16.4. Australia & New Zealand

11.16.5. Rest of Asia Pacific

12. Latin America Operating Room Equipment Market Analysis

12.1. Market Overview

12.2. Latin America Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region

12.3. Latin America Operating Room Equipment Market Value Share Analysis, by Product Type

12.4. Latin America Operating Room Equipment Market Forecast, by Product Type

12.5. Latin America Operating Room Equipment Market Value Share Analysis, by Anesthesia & Respiratory Devices

12.6. Latin America Operating Room Equipment Market Forecast, by Anesthesia & Respiratory Devices

12.7. Latin America Operating Room Equipment Market Value Share Analysis, by Patient Monitoring

12.8. Latin America Operating Room Equipment Market Forecast, by Patient Monitoring

12.9. Latin America Operating Room Equipment Market Value Share Analysis, by Surgical Equipment

12.10. Latin America Operating Room Equipment Market Forecast, by Surgical Equipment

12.11. Latin America Operating Room Equipment Market Value Share Analysis, by Others

12.12. Latin America Operating Room Equipment Market Forecast, by Others

12.13. Latin America Operating Room Equipment Market Value Share Analysis, by End-user

12.14. Latin America Operating Room Equipment Market Forecast, by End-user

12.15. Latin America Operating Room Equipment Market Value Share Analysis, by Country/Sub-region

12.16. Latin America Operating Room Equipment Market Forecast, by Country/Sub-region

12.16.1. Brazil

12.16.2. Mexico

12.16.3. Rest of Latin America

13. Middle East & Africa Operating Room Equipment Market Analysis

13.1. Market Overview

13.2. Middle East & Africa Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region

13.3. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Product Type

13.4. Middle East & Africa Operating Room Equipment Market Forecast, by Product Type

13.5. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Anesthesia & Respiratory Devices

13.6. Middle East & Africa Operating Room Equipment Market Forecast, by Anesthesia & Respiratory Devices

13.7. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Patient Monitoring

13.8. Middle East & Africa Operating Room Equipment Market Forecast, by Patient Monitoring

13.9. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Surgical Equipment

13.10. Middle East & Africa Operating Room Equipment Market Forecast, by Surgical Equipment

13.11. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Others

13.12. Middle East & Africa Operating Room Equipment Market Forecast, by Others

13.13. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by End-user

13.14. Middle East & Africa Operating Room Equipment Market Forecast, by End-user

13.15. Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Country/Sub-region

13.16. Middle East & Africa Operating Room Equipment Market Forecast, by Country/Sub-region

13.16.1. GCC

13.16.2. South Africa

13.16.3. Rest of MEA

14. Company Profiles

14.1. Competition Matrix

14.2. Company Profiles

14.2.1. Stryker Corporation

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Financial Overview

14.2.1.3. Product Portfolio

14.2.1.4. SWOT Analysis

14.2.1.5. Strategic Overview

14.2.2. Hill-Rom Holdings, Inc.

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Financial Overview

14.2.2.3. Product Portfolio

14.2.2.4. SWOT Analysis

14.2.2.5. Strategic Overview

14.2.3. Skytron

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Financial Overview

14.2.3.3. Product Portfolio

14.2.3.4. SWOT Analysis

14.2.3.5. Strategic Overview

14.2.4. Steris plc.

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Financial Overview

14.2.4.3. Product Portfolio

14.2.4.4. SWOT Analysis

14.2.4.5. Strategic Overview

14.2.5. Dragerwerk AG & Co. KGaA

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Financial Overview

14.2.5.3. Product Portfolio

14.2.5.4. SWOT Analysis

14.2.5.5. Strategic Overview

14.2.6. Getinge AB

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Financial Overview

14.2.6.3. Product Portfolio

14.2.6.4. SWOT Analysis

14.2.6.5. Strategic Overview

14.2.7. GE Healthcare

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Financial Overview

14.2.7.3. Product Portfolio

14.2.7.4. SWOT Analysis

14.2.7.5. Strategic Overview

14.2.8. Koninklijke Philips N.V.

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Financial Overview

14.2.8.3. Product Portfolio

14.2.8.4. SWOT Analysis

14.2.8.5. Strategic Overview

14.2.9. Smiths Medical

14.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.9.2. Financial Overview

14.2.9.3. Product Portfolio

14.2.9.4. SWOT Analysis

14.2.9.5. Strategic Overview

14.2.10. Mizuho OSI

14.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.10.2. Financial Overview

14.2.10.3. Product Portfolio

14.2.10.4. SWOT Analysis

14.2.10.5. Strategic Overview

14.2.11. Storz Medical AG

14.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.11.2. Financial Overview

14.2.11.3. Product Portfolio

14.2.11.4. SWOT Analysis

14.2.11.5. Strategic Overview

List of Tables

Table 01: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by Anesthesia & Respiratory Devices, 2017–2031

Table 03: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring, 2017–2031

Table 04: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by Surgical Equipment, 2017–2031

Table 05: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 06: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Global Operating Room Equipment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 09: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by Anesthesia & Respiratory Devices, 2017–2031

Table 10: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring, 2017–2031

Table 11: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by Surgical Equipment, 2017–2031

Table 12: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 13: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 14: North America Operating Room Equipment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 15: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 16: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by Anesthesia & Respiratory Devices, 2017–2031

Table 17: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring, 2017–2031

Table 18: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by Surgical Equipment, 2017–2031

Table 19: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 20: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by Anesthesia & Respiratory Devices, 2017–2031

Table 24: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring, 2017–2031

Table 25: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by Surgical Equipment, 2017–2031

Table 26: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 27: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 28: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 29: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 30: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by Anesthesia & Respiratory Devices, 2017–2031

Table 31: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring, 2017–2031

Table 32: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by Surgical Equipment, 2017–2031

Table 33: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 34: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 35: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 36: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 37: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by Anesthesia & Respiratory Devices, 2017–2031

Table 38: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring, 2017–2031

Table 39: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by Surgical Equipment, 2017–2031

Table 40: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 41: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 42: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Operating Room Equipment Market Snapshot

Figure 02: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 03: Global Operating Room Equipment Market Value Share, by Product Type (2017)

Figure 04: Global Operating Room Equipment Market Value Share, by Patient Monitoring (2017)

Figure 05: Global Operating Room Equipment Market Value Share, by End-user (2017)

Figure 06: Global Operating Room Equipment Market Value Share, by Region (2017)

Figure 07: Global Operating Room Equipment Market Value Share, by Product Type, 2017 and 2031

Figure 08: Global Operating Room Equipment Market Value Share, by Anesthesia & Respiratory Devices, 2017 and 2031

Figure 09: Global Operating Room Equipment Market Value Share, by Patient Monitoring, 2017 and 2031

Figure 10: Global Operating Room Equipment Market Value Share, by Surgical Equipment, 2017 and 2031

Figure 11: Global Operating Room Equipment Market Value Share, by Others, 2017 and 2031

Figure 12: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Anesthesia & Respiratory Devices, 2017–2031

Figure 13: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Patient Monitoring, 2017–2031

Figure 14: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Surgical Equipment, 2017–2031

Figure 15: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2031

Figure 16: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Anesthesia Systems, 2017–2031

Figure 17: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Patient Warmers, 2017–2031

Figure 18: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Ventilators, 2017–2031

Figure 19: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Surgical Imaging Displays, 2017–2031

Figure 20: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Movable Imaging Displays, 2017–2031

Figure 21: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Vital Signs Monitoring Devices, 2017–2031

Figure 22: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Electrical Surgical Units, 2017–2031

Figure 23: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Handheld Surgical Instruments, 2017–2031

Figure 24: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Operating Tables, 2017–2031

Figure 25: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Operating Room Lights, 2017–2031

Figure 26: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Surgical Booms, 2017–2031

Figure 27: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Microscopes, 2017–2031

Figure 28: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Endoscopes, 2017–2031

Figure 29: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Operating Room Integration Systems, 2017–2031

Figure 30: Global Operating Room Equipment Market Attractiveness, by Product Type

Figure 31: Global Operating Room Equipment Market Value Share, by End-user, 2017 and 2031

Figure 32: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2017–2031

Figure 33: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Ambulatory Surgical Centers, 2017–2031

Figure 34: Global Operating Room Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2031

Figure 35: Global Operating Room Equipment Market Value Share, by Region, 2017 and 2031

Figure 36: North America Operating Room Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: North America Operating Room Equipment Market Attractiveness Analysis, by Country, 2022–2031

Figure 38: North America Operating Room Equipment Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 39: North America Operating Room Equipment Market Value Share, by Anesthesia & Respiratory Devices, 2017 and 2031

Figure 40: North America Operating Room Equipment Market Value Share, by Patient Monitoring, 2017 and 2031

Figure 41: North America Operating Room Equipment Market Value Share, by Surgical Equipment, 2017 and 2031

Figure 42: North America Operating Room Equipment Market Value Share, by Others, 2017 and 2031

Figure 43: North America Operating Room Equipment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 44: North America Operating Room Equipment Market Value Share Analysis, by Country, 2017 and 2031

Figure 45: Europe Operating Room Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Europe Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 47: Europe Operating Room Equipment Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 48: Europe Operating Room Equipment Market Value Share, by Anesthesia & Respiratory Devices, 2017 and 2031

Figure 49: Europe Operating Room Equipment Market Value Share, by Patient Monitoring, 2017 and 2031

Figure 50: Europe Operating Room Equipment Market Value Share, by Surgical Equipment, 2017 and 2031

Figure 51: Europe Operating Room Equipment Market Value Share, by Others, 2017 and 2031

Figure 52: Europe Operating Room Equipment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 53: Europe Operating Room Equipment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 54: Asia Pacific Operating Room Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Asia Pacific Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 56: Asia Pacific Operating Room Equipment Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 57: Asia Pacific Operating Room Equipment Market Value Share, by Anesthesia & Respiratory Devices, 2017 and 2031

Figure 58: Asia Pacific Operating Room Equipment Market Value Share, by Patient Monitoring, 2017 and 2031

Figure 59: Asia Pacific Operating Room Equipment Market Value Share, by Surgical Equipment, 2017 and 2031

Figure 60: Asia Pacific Operating Room Equipment Market Value Share, by Others, 2017 and 2031

Figure 61: Asia Pacific Operating Room Equipment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 62: Asia Pacific Operating Room Equipment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 63: Latin America Operating Room Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Latin America Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 65: Latin America Operating Room Equipment Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 66: Latin America Operating Room Equipment Market Value Share, by Anesthesia & Respiratory Devices, 2017 and 2031

Figure 67: Latin America Operating Room Equipment Market Value Share, by Patient Monitoring, 2017 and 2031

Figure 68: Latin America Operating Room Equipment Market Value Share, by Surgical Equipment, 2017 and 2031

Figure 69: Latin America Operating Room Equipment Market Value Share, by Others, 2017 and 2031

Figure 70: Latin America Operating Room Equipment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 71: Latin America Operating Room Equipment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 72: Middle East & Africa Operating Room Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 73: Middle East & Africa Operating Room Equipment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 74: Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 75: Middle East & Africa Operating Room Equipment Market Value Share, by Anesthesia & Respiratory Devices, 2017 and 2031

Figure 76: Middle East & Africa Operating Room Equipment Market Value Share, by Patient Monitoring, 2017 and 2031

Figure 77: Middle East & Africa Operating Room Equipment Market Value Share, by Surgical Equipment, 2017 and 2031

Figure 78: Middle East & Africa Operating Room Equipment Market Value Share, by Others, 2017 and 2031

Figure 79: Middle East & Africa Operating Room Equipment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 80: Middle East & Africa Operating Room Equipment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031