Reports

Reports

Analysts’ Viewpoint on Market Scenario

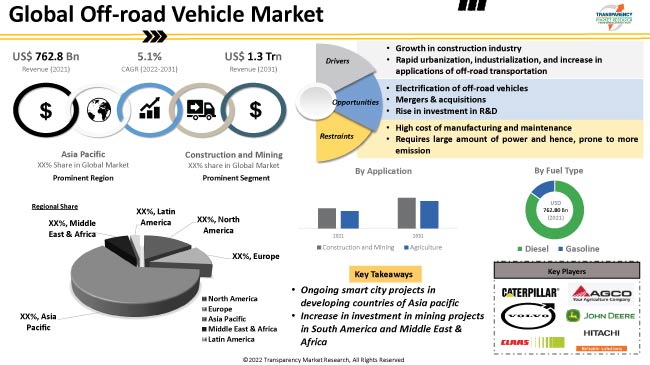

The global off-road vehicle business is estimated to grow significantly during the forecast period, due to the rise in construction and mining activities across the globe, rapid urbanization, and industrialization.

Globally, the use of agricultural tractors and equipment is increasing, supporting the worldwide off-road vehicle business. However, high cost of manufacturing and maintenance is anticipated to significantly restrict the market for off-road vehicles. Off-road vehicle manufacturers are focusing on the development of innovative vehicles, such as excavators, loaders, dozers, and rigid dump trucks, to gain revenue benefits.

Off-road vehicles are driven in rocky and off-road environments. They often feature sizable tires with open, deep treads, and flexible suspension. These vehicles are frequently used for exploration in places without asphalt roads. Access to trails and forest roads with poor traction and rocky ground is made possible by the use of stronger off-road vehicles. Off-road vehicles are majorly used in agriculture and construction industries.

Rapid expansion of construction and mining activities, rise in demand from agriculture and forestry sectors, and the expansion of port and material handling industries are contributing to the global off-road vehicle market growth during the forecast period. Furthermore, urbanization, industrialization, and increased import-export activity are also predicted to present lucrative off-road vehicle market opportunities.

According to the off-road vehicle market report, urbanization and growth in construction industry are driving the market for construction equipment. This is positively impacting the global off-road vehicle market share. Demand for minerals and metals, which are derived from their ores, is rising. Consequently, there is a high demand for mining machineries such as shovels, loaders, haul trucks, and draglines. The number of construction sites all over the world is increasing due to urbanization.

Population growth is another factor fueling the off-road vehicle industry statistics. Global population is estimated to cross 8.6 billion by 2030. The market for construction equipment is being driven by the increased construction of new residential and commercial spaces. Global economic growth has sparked investment in infrastructure renovation, particularly in developing nations, which are witnessing rapid development of roads, railroads, and industries.

The global market is primarily driven by the construction sector, which has witnessed tremendous growth in the last few years. Several governments, especially those in developing countries, are investing significantly in industrial development projects.

The market is expanding due to the rise in need for off-road vehicles to aid in construction activities. Additionally, smart cities are growing rapidly across the globe. Extensive usage of modern off-road vehicles in oil & gas exploration activities is another important factor spurring market expansion. Rise in adoption of cutting-edge technologies in the creation of off-road vehicles, which in turn further stimulates the market. This led to the introduction of special-purpose off-road vehicles that facilitate the removal of overburden from tunneling or shaft excavation in hydropower projects, and they are currently gaining significant market traction.

Several companies have also produced smartphone versions, which offer precise real-time data on every aspect of the equipment's performance for insightful analysis. Additional factors driving market expansion include rapid industrialization and increased product usage in the power and automotive industries.

Based on application, the construction and mining segment is anticipated to dominate the global off-road vehicle business. Increase in infrastructure development projects across the globe is driving the demand for construction and mining equipment. Additionally, off-road vehicles are being widely used in construction and mining sector, due to an increase in automation and the use of machinery to facilitate human labor.

The use of heavy construction machinery significantly reduces overall project expenses. Additionally, off-road vehicles are gaining tremendous popularity, as renting heavy construction equipment is more cost-effective than buying it.

Asia Pacific dominated the global market for off-road vehicles in 2021. The region is projected to maintain its dominance in the near future, owing to the growth in industrialization in major countries in the region. Furthermore, infrastructure development in countries such as China, India, and South Korea is projected to fuel market expansion in the next few years. Increase in demand for construction equipment along with growth in the agriculture sector is contributing to market growth in the region. Several governments are offering subsidies to purchase agricultural machinery such as tractors in Asia Pacific.

The North America off-road vehicle market size is likely to increase during the forecast period, owing to significant growth in construction and mining sectors in the region. The U.S. is a well-known producer of construction machinery. Increase in off-road vehicle production in the U.S. is also contributing to market growth in North America.

The global market is consolidated, with the presence of large numbers of manufacturers that control significant share. According to the global off-road vehicle market research report, manufacturers are adopting advanced technologies to consolidate their market position. Key players are expanding their product portfolios through acquisitions and partnerships.

Some of the key players identified in the off-road vehicle market across the globe are Caterpillar Inc., Deere & Company, CLAAS KGaA mbH, Valtra, Escorts Limited, KUBOTA Corporation, YANMAR CO., LTD., Mahindra & Mahindra Ltd., SAME DEUTZ-FAHR Italia S.p.A., AGCO Corporation, Doosan Infracore, AB Volvo, BELL Equipment., Hitachi, Ltd., Liebherr- International AG, CNH Industrial America LLC, Komatsu America Corp., ALLU Finland Oy, Terex Corporation, and Manitowoc.

Key players have been profiled in the off-road vehicle industry forecast report based on parameters such as financial overview, product portfolio, company overview, recent developments, business segments, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 762.8 Bn |

|

Market Forecast Value in 2031 |

US$ 1.3 Trn |

|

Growth Rate (CAGR) |

5.12% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn/Trn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 762.8 Bn in 2021.

It is expected to grow at a CAGR of 5.1% by 2031.

It would be worth US$ 1.3 Trn in 2031.

Growth in construction industry, rapid urbanization, industrialization, and increase in applications of off-road transportation.

The construction and mining segment accounted for largest share in 2021.

Asia Pacific is the most lucrative region for vendors.

Caterpillar Inc., Deere & Company, KUBOTA Corporation, Valtra, Escorts Limited, YANMAR CO., LTD., CLAAS KGaA mbH, Mahindra & Mahindra Ltd., Hitachi, Ltd., SAME DEUTZ-FAHR Italia S.p.A., AGCO Corporation, AB Volvo, Doosan Infracore, BELL Equipment., Liebherr- International AG, Komatsu America Corp., CNH Industrial America LLC, ALLU Finland Oy, Manitowoc, and Terex Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Thousand Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.4.3. Value Chain Analysis

2.5. Regulatory Scenario

2.6. Pricing Analysis

2.6.1. Cost Structure Analysis

2.6.2. Profit Margin Analysis

2.7. COVID-19 Impact Analysis – Off-road Vehicle Market

3. Key Industry Trends and Developments

4. Global Off-road Vehicle Market, by Application

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

4.2.1. Construction and Mining

4.2.1.1. Excavator

4.2.1.2. Loader

4.2.1.3. Dozer

4.2.1.4. Articulated Dump Truck

4.2.1.5. Rigid Dump Truck

4.2.1.6. Motor Scraper

4.2.1.7. Motor Grader

4.2.2. Agriculture

4.2.2.1. Tractor

4.2.2.2. Other Agriculture Equipment

5. Global Off-road Vehicle Market, by Fuel Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Fuel Type

5.2.1. Diesel

5.2.2. Gasoline

6. Global Off-road Vehicle Market, by Engine Size

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Engine Size

6.2.1. Less Than 100 HP

6.2.2. 100-200 HP

6.2.3. 201-400 HP

6.2.4. Greater Than 400 HP

7. Global Off-road Vehicle Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Off-road Vehicle Market

8.1. Market Snapshot

8.2. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

8.2.1. Construction and Mining

8.2.1.1. Excavator

8.2.1.2. Loader

8.2.1.3. Dozer

8.2.1.4. Articulated Dump Truck

8.2.1.5. Rigid Dump Truck

8.2.1.6. Motor Scraper

8.2.1.7. Motor Grader

8.2.2. Agriculture

8.2.2.1. Tractor

8.2.2.2. Other Agriculture Equipment

8.3. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Fuel Type

8.3.1. Diesel

8.3.2. Gasoline

8.4. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Engine Size

8.4.1. Less Than 100 HP

8.4.2. 100-200 HP

8.4.3. 201-400 HP

8.4.4. Greater Than 400 HP

8.5. Key Country Analysis – North America Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

8.5.1. U. S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Off-road Vehicle Market

9.1. Market Snapshot

9.2. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

9.2.1. Construction and Mining

9.2.1.1. Excavator

9.2.1.2. Loader

9.2.1.3. Dozer

9.2.1.4. Articulated Dump Truck

9.2.1.5. Rigid Dump Truck

9.2.1.6. Motor Scraper

9.2.1.7. Motor Grader

9.2.2. Agriculture

9.2.2.1. Tractor

9.2.2.2. Other Agriculture Equipment

9.3. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Fuel Type

9.3.1. Diesel

9.3.2. Gasoline

9.4. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Engine Size

9.4.1. Less Than 100 HP

9.4.2. 100-200 HP

9.4.3. 201-400 HP

9.4.4. Greater Than 400 HP

9.5. Key Country Analysis – Europe Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

9.5.1. Germany

9.5.2. U. K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Off-road Vehicle Market

10.1. Market Snapshot

10.2. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

10.2.1. Construction and Mining

10.2.1.1. Excavator

10.2.1.2. Loader

10.2.1.3. Dozer

10.2.1.4. Articulated Dump Truck

10.2.1.5. Rigid Dump Truck

10.2.1.6. Motor Scraper

10.2.1.7. Motor Grader

10.2.2. Agriculture

10.2.2.1. Tractor

10.2.2.2. Other Agriculture Equipment

10.3. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Fuel Type

10.3.1. Diesel

10.3.2. Gasoline

10.4. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Engine Size

10.4.1. Less Than 100 HP

10.4.2. 100-200 HP

10.4.3. 201-400 HP

10.4.4. Greater Than 400 HP

10.5. Key Country Analysis – Asia Pacific Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Off-road Vehicle Market

11.1. Market Snapshot

11.2. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

11.2.1. Construction and Mining

11.2.1.1. Excavator

11.2.1.2. Loader

11.2.1.3. Dozer

11.2.1.4. Articulated Dump Truck

11.2.1.5. Rigid Dump Truck

11.2.1.6. Motor Scraper

11.2.1.7. Motor Grader

11.2.2. Agriculture

11.2.2.1. Tractor

11.2.2.2. Other Agriculture Equipment

11.3. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Fuel Type

11.3.1. Diesel

11.3.2. Gasoline

11.4. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Engine Size

11.4.1. Less Than 100 HP

11.4.2. 100-200 HP

11.4.3. 201-400 HP

11.4.4. Greater Than 400 HP

11.5. Key Country Analysis – Middle East & Africa Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Off-road Vehicle Market

12.1. Market Snapshot

12.2. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

12.2.1. Construction and Mining

12.2.1.1. Excavator

12.2.1.2. Loader

12.2.1.3. Dozer

12.2.1.4. Articulated Dump Truck

12.2.1.5. Rigid Dump Truck

12.2.1.6. Motor Scraper

12.2.1.7. Motor Grader

12.2.2. Agriculture

12.2.2.1. Tractor

12.2.2.2. Other Agriculture Equipment

12.3. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Fuel Type

12.3.1. Diesel

12.3.2. Gasoline

12.4. Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Engine Size

12.4.1. Less Than 100 HP

12.4.2. 100-200 HP

12.4.3. 201-400 HP

12.4.4. Greater Than 400 HP

12.5. Key Country Analysis – South America Off-road Vehicle Market Size (Thousand Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2021

13.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

13.3. Company Profile/ Key Players – Off-road Vehicle Market

13.3.1. Caterpillar Inc.

13.3.1.1. Company Overview

13.3.1.2. Company Footprints

13.3.1.3. Production Locations

13.3.1.4. Product Portfolio

13.3.1.5. Competitors & Customers

13.3.1.6. Subsidiaries & Parent Organization

13.3.1.7. Recent Developments

13.3.1.8. Financial Analysis

13.3.1.9. Profitability

13.3.1.10. Revenue Share

13.3.1.11. Executive Bios

13.3.2. Deere & Company

13.3.2.1. Company Overview

13.3.2.2. Company Footprints

13.3.2.3. Production Locations

13.3.2.4. Product Portfolio

13.3.2.5. Competitors & Customers

13.3.2.6. Subsidiaries & Parent Organization

13.3.2.7. Recent Developments

13.3.2.8. Financial Analysis

13.3.2.9. Profitability

13.3.2.10. Revenue Share

13.3.2.11. Executive Bios

13.3.3. KUBOTA Corporation

13.3.3.1. Company Overview

13.3.3.2. Company Footprints

13.3.3.3. Production Locations

13.3.3.4. Product Portfolio

13.3.3.5. Competitors & Customers

13.3.3.6. Subsidiaries & Parent Organization

13.3.3.7. Recent Developments

13.3.3.8. Financial Analysis

13.3.3.9. Profitability

13.3.3.10. Revenue Share

13.3.3.11. Executive Bios

13.3.4. Valtra

13.3.4.1. Company Overview

13.3.4.2. Company Footprints

13.3.4.3. Production Locations

13.3.4.4. Product Portfolio

13.3.4.5. Competitors & Customers

13.3.4.6. Subsidiaries & Parent Organization

13.3.4.7. Recent Developments

13.3.4.8. Financial Analysis

13.3.4.9. Profitability

13.3.4.10. Revenue Share

13.3.4.11. Executive Bios

13.3.5. Escorts Limited

13.3.5.1. Company Overview

13.3.5.2. Company Footprints

13.3.5.3. Production Locations

13.3.5.4. Product Portfolio

13.3.5.5. Competitors & Customers

13.3.5.6. Subsidiaries & Parent Organization

13.3.5.7. Recent Developments

13.3.5.8. Financial Analysis

13.3.5.9. Profitability

13.3.5.10. Revenue Share

13.3.5.11. Executive Bios

13.3.6. YANMAR CO., LTD.

13.3.6.1. Company Overview

13.3.6.2. Company Footprints

13.3.6.3. Production Locations

13.3.6.4. Product Portfolio

13.3.6.5. Competitors & Customers

13.3.6.6. Subsidiaries & Parent Organization

13.3.6.7. Recent Developments

13.3.6.8. Financial Analysis

13.3.6.9. Profitability

13.3.6.10. Revenue Share

13.3.6.11. Executive Bios

13.3.7. CLAAS KGaA mbH

13.3.7.1. Company Overview

13.3.7.2. Company Footprints

13.3.7.3. Production Locations

13.3.7.4. Product Portfolio

13.3.7.5. Competitors & Customers

13.3.7.6. Subsidiaries & Parent Organization

13.3.7.7. Recent Developments

13.3.7.8. Financial Analysis

13.3.7.9. Profitability

13.3.7.10. Revenue Share

13.3.7.11. Executive Bios

13.3.8. Mahindra & Mahindra Ltd.

13.3.8.1. Company Overview

13.3.8.2. Company Footprints

13.3.8.3. Production Locations

13.3.8.4. Product Portfolio

13.3.8.5. Competitors & Customers

13.3.8.6. Subsidiaries & Parent Organization

13.3.8.7. Recent Developments

13.3.8.8. Financial Analysis

13.3.8.9. Profitability

13.3.8.10. Revenue Share

13.3.8.11. Executive Bios

13.3.9. Hitachi, Ltd.

13.3.9.1. Company Overview

13.3.9.2. Company Footprints

13.3.9.3. Production Locations

13.3.9.4. Product Portfolio

13.3.9.5. Competitors & Customers

13.3.9.6. Subsidiaries & Parent Organization

13.3.9.7. Recent Developments

13.3.9.8. Financial Analysis

13.3.9.9. Profitability

13.3.9.10. Revenue Share

13.3.9.11. Executive Bios

13.3.10. SAME DEUTZ-FAHR Italia S.p.A.

13.3.10.1. Company Overview

13.3.10.2. Company Footprints

13.3.10.3. Production Locations

13.3.10.4. Product Portfolio

13.3.10.5. Competitors & Customers

13.3.10.6. Subsidiaries & Parent Organization

13.3.10.7. Recent Developments

13.3.10.8. Financial Analysis

13.3.10.9. Profitability

13.3.10.10. Revenue Share

13.3.10.11. Executive Bios

13.3.11. AGCO Corporation

13.3.11.1. Company Overview

13.3.11.2. Company Footprints

13.3.11.3. Production Locations

13.3.11.4. Product Portfolio

13.3.11.5. Competitors & Customers

13.3.11.6. Subsidiaries & Parent Organization

13.3.11.7. Recent Developments

13.3.11.8. Financial Analysis

13.3.11.9. Profitability

13.3.11.10. Revenue Share

13.3.11.11. Executive Bios

13.3.12. AB Volvo

13.3.12.1. Company Overview

13.3.12.2. Company Footprints

13.3.12.3. Production Locations

13.3.12.4. Product Portfolio

13.3.12.5. Competitors & Customers

13.3.12.6. Subsidiaries & Parent Organization

13.3.12.7. Recent Developments

13.3.12.8. Financial Analysis

13.3.12.9. Profitability

13.3.12.10. Revenue Share

13.3.12.11. Executive Bios

13.3.13. Doosan Infracore

13.3.13.1. Company Overview

13.3.13.2. Company Footprints

13.3.13.3. Production Locations

13.3.13.4. Product Portfolio

13.3.13.5. Competitors & Customers

13.3.13.6. Subsidiaries & Parent Organization

13.3.13.7. Recent Developments

13.3.13.8. Financial Analysis

13.3.13.9. Profitability

13.3.13.10. Revenue Share

13.3.13.11. Executive Bios

13.3.14. BELL Equipment.

13.3.14.1. Company Overview

13.3.14.2. Company Footprints

13.3.14.3. Production Locations

13.3.14.4. Product Portfolio

13.3.14.5. Competitors & Customers

13.3.14.6. Subsidiaries & Parent Organization

13.3.14.7. Recent Developments

13.3.14.8. Financial Analysis

13.3.14.9. Profitability

13.3.14.10. Revenue Share

13.3.14.11. Executive Bios

13.3.15. Liebherr- International AG

13.3.15.1. Company Overview

13.3.15.2. Company Footprints

13.3.15.3. Production Locations

13.3.15.4. Product Portfolio

13.3.15.5. Competitors & Customers

13.3.15.6. Subsidiaries & Parent Organization

13.3.15.7. Recent Developments

13.3.15.8. Financial Analysis

13.3.15.9. Profitability

13.3.15.10. Revenue Share

13.3.15.11. Executive Bios

13.3.16. Komatsu America Corp.

13.3.16.1. Company Overview

13.3.16.2. Company Footprints

13.3.16.3. Production Locations

13.3.16.4. Product Portfolio

13.3.16.5. Competitors & Customers

13.3.16.6. Subsidiaries & Parent Organization

13.3.16.7. Recent Developments

13.3.16.8. Financial Analysis

13.3.16.9. Profitability

13.3.16.10. Revenue Share

13.3.16.11. Executive Bios

13.3.17. CNH Industrial America LLC

13.3.17.1. Company Overview

13.3.17.2. Company Footprints

13.3.17.3. Production Locations

13.3.17.4. Product Portfolio

13.3.17.5. Competitors & Customers

13.3.17.6. Subsidiaries & Parent Organization

13.3.17.7. Recent Developments

13.3.17.8. Financial Analysis

13.3.17.9. Profitability

13.3.17.10. Revenue Share

13.3.17.11. Executive Bios

13.3.18. ALLU Finland Oy

13.3.18.1. Company Overview

13.3.18.2. Company Footprints

13.3.18.3. Production Locations

13.3.18.4. Product Portfolio

13.3.18.5. Competitors & Customers

13.3.18.6. Subsidiaries & Parent Organization

13.3.18.7. Recent Developments

13.3.18.8. Financial Analysis

13.3.18.9. Profitability

13.3.18.10. Revenue Share

13.3.18.11. Executive Bios

13.3.19. Manitowoc

13.3.19.1. Company Overview

13.3.19.2. Company Footprints

13.3.19.3. Production Locations

13.3.19.4. Product Portfolio

13.3.19.5. Competitors & Customers

13.3.19.6. Subsidiaries & Parent Organization

13.3.19.7. Recent Developments

13.3.19.8. Financial Analysis

13.3.19.9. Profitability

13.3.19.10. Revenue Share

13.3.19.11. Executive Bios

13.3.20. Terex Corporation

13.3.20.1. Company Overview

13.3.20.2. Company Footprints

13.3.20.3. Production Locations

13.3.20.4. Product Portfolio

13.3.20.5. Competitors & Customers

13.3.20.6. Subsidiaries & Parent Organization

13.3.20.7. Recent Developments

13.3.20.8. Financial Analysis

13.3.20.9. Profitability

13.3.20.10. Revenue Share

13.3.20.11. Executive Bios

13.3.21. Other Key Players

13.3.21.1. Company Overview

13.3.21.2. Company Footprints

13.3.21.3. Production Locations

13.3.21.4. Product Portfolio

13.3.21.5. Competitors & Customers

13.3.21.6. Subsidiaries & Parent Organization

13.3.21.7. Recent Developments

13.3.21.8. Financial Analysis

13.3.21.9. Profitability

13.3.21.10. Revenue Share

13.3.21.11. Executive Bios

List of Tables

Table 1: Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 2: Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 3: Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 4: Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 5: Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Table 6: Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Table 7: Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 8: Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 9: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 10: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 11: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 12: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 13: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Table 14: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Table 15: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country 2017-2031

Table 16: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Country 2017-2031

Table 17: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 18: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 19: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 20: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 21: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Table 22: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Table 23: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 26: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 27: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 28: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 29: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Table 30: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Table 31: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 34: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 35: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 36: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 37: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Table 38: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Table 39: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 42: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 43: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 44: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 45: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Table 46: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Table 47: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1; Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 2; Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 3; Global Off-road Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 4; Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 5; Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 6; Global Off-road Vehicle Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 7; Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Figure 8; Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Figure 9; Global Off-road Vehicle Market, Incremental Opportunity, by Engine Size, Value (US$ Bn), 2022-2031

Figure 10: Global Off-road Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 11: Global Off-road Vehicle Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Off-road Vehicle Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 13: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 14: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: North America Off-road Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 16: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 17: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 18: North America Off-road Vehicle Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 19: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Figure 20: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Figure 21: North America Off-road Vehicle Market, Incremental Opportunity, by Engine Size, Value (US$ Bn), 2022-2031

Figure 22: North America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 23: North America Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Off-road Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 26: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 27: Europe Off-road Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 28: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 29: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 30: Europe Off-road Vehicle Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 31: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Figure 32: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Figure 33: Europe Off-road Vehicle Market, Incremental Opportunity, by Engine Size, Value (US$ Bn), 2022-2031

Figure 34: Europe Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: Europe Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Off-road Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 38: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 39: Asia Pacific Off-road Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 40: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 41: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 42: Asia Pacific Off-road Vehicle Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 43: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Figure 44: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Figure 45: Asia Pacific Off-road Vehicle Market, Incremental Opportunity, by Engine Size, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Off-road Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 50: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Middle East & Africa Off-road Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 52: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 53: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 54: Middle East & Africa Off-road Vehicle Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 55: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Figure 56: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Figure 57: Middle East & Africa Off-road Vehicle Market, Incremental Opportunity, by Engine Size, Value (US$ Bn), 2022-2031

Figure 58: Middle East & Africa Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Off-road Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 62: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 63: South America Off-road Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 64: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 65: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 66: South America Off-road Vehicle Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2022-2031

Figure 67: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Engine Size, 2017-2031

Figure 68: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Engine Size, 2017-2031

Figure 69: South America Off-road Vehicle Market, Incremental Opportunity, by Engine Size, Value (US$ Bn), 2022-2031

Figure 70: South America Off-road Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: South America Off-road Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Off-road Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031