Reports

Reports

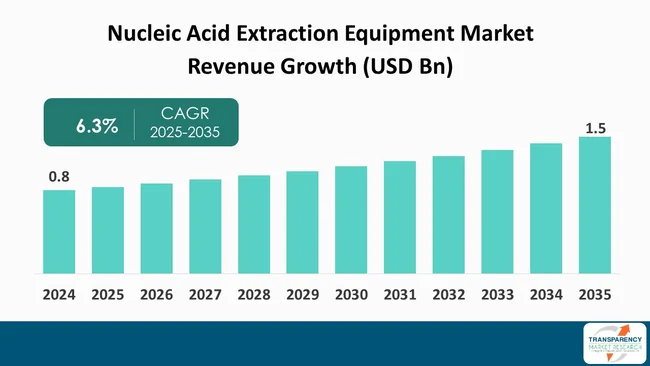

The global nucleic acid extraction equipment market size was valued at US$ 0.8 billion in 2024 and is projected to reach US$ 1.5 billion by 2035, expanding at a CAGR of 6.3% from 2025 to 2035. The market growth is driven by increasing prevalence of genetic disorders and infectious diseases, advancements in genomics and next-generation sequencing (NGS) and growth in biopharmaceutical and research funding.

The nucleic acid extraction equipment market is poised for substantial growth, driven by the increasing demand for molecular diagnostics and the rising prevalence of genetic disorders. As healthcare advances toward personalized medicine, the demand for efficient and precise nucleic acid extraction techniques has increased. Technology developments in extraction such as automated systems and extraction kits that enhance purity and yield are significantly contributing to research and clinical labs.

Additionally, increased demand in the fields of genomics, proteomics, and forensic testing are pushing market growth. Increased investment in extraction machines to provide rapid and effective testing during the COVID-19 pandemic era also boosted the demand for nucleic acid testing. Market growth is, however, thwarted by the fact that equipment are costly and there is a need for experienced personnel.

Despite such adversities, increasing focus on research and development activities as well as technologies in biotechnology offer promising opportunities for operators in the industry. The companies that are capable of innovating and perfecting extraction processes have a good opportunity. Overall, the nucleic acid extraction equipment industry is set to grow on a healthy note as it moves toward precision medicine and premium diagnostics.

Nucleic acid extract systems could be categorized as molecular biology and diagnostics, thereby isolating DNA and RNA from a wide range of biological samples. They are essential for proteomics and genomics platforms, clinical diagnostics, and forensic investigations. Nucleic acid extraction involves disrupting cellular matrices for liberating nucleic acids and subsequently purifying them of any contaminants that would interfere with downstream applications. The market for nucleic acid extraction equipment has grown tremendously with the growing needs for genetic analysis and personalized medicine.

Numerous extraction methods like magnetic bead-based, silica-based, and organic solvent-based are available, each customized to meet individual research requirements. With global interest in genomic research gaining pace, fueled by increases in biotechnology and the increasing incidences of genetic diseases, the demand for nucleic acid extraction equipment will only head one way. More significantly, the increasing applications within the fields of CRISPR technology and next-generation sequencing put even greater premium on the integrity of nucleic acid extraction in contemporary scientific inquiry and medical practice.

| Attribute | Detail |

|---|---|

| Nucleic Acid Extraction Equipment Market Drivers |

|

The increasing need for molecular diagnostics and genetic testing is a strong force behind the nucleic acid extraction equipment market. In response to the shift toward precision medicine in the healthcare sector, the ongoing trend implies effective diagnostic equipment useful and precise. Molecular diagnostics let doctors diagnose disease at the genetic level, thereby enabling them to design special treatment programs that result in better patient outcomes. This is especially pronounced in infectious diseases, oncology, and genetic disorders.

The increasing incidences of chronic diseases and genetic disorders has created an increased requirement of test procedures in the form of high-quality nucleic acid extraction. The advent of technologies such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) further makes precise nucleic acid extraction procedures inevitable since the quality of isolated DNA/RNA is responsible for making such as analytical tests reliable.

Moreover, the global health crises such as the COVID-19 pandemic have accelerated the utilization of molecular testing technologies at breakneck pace, particularly the importance of nucleic acid extraction for ensuring timely diagnoses. Laboratories are, as an outcome, investing in cutting-edge extraction equipment that are capable of automating procedures, enhancing extraction efficiency, and yield. This increased demand not only drives the nucleic acid extraction equipment market but also inspires innovation, thereby resulting in future-proof extraction technology that answers the altering requirements of the healthcare sector.

The increasing emphasis on personalized medicine and genomics research is the key driver to the nucleic acid extraction equipment market. With the medical technology moving toward more personalized treatment modes, analyzing the genetic information of an individual becomes even more important. Nucleic acid extraction is a vital procedure herein, which facilitates the isolation of DNA and RNA for use in genomic sequencing, targeted therapy, and biomarker identification.

Personalized medicine utilizes specific genetic information for optimizing medical treatment choices to be less harmful and more efficient. Increased spending on genome research spurred by advances in technologies like next-generation sequencing (NGS) has boosted the requirement of high-quality nucleic acid extraction techniques. Scientists need reliable and efficient extraction techniques for maintaining the purity and integrity of the nucleic acids to be correctly analyzed.

In addition, collaborations among biotechnology firms, research centers, and healthcare organizations are driving innovation in extraction equipment, leading to more automated and comprehensive equipment. This emphasis not only improves research but also leads to the creation of new drugs.

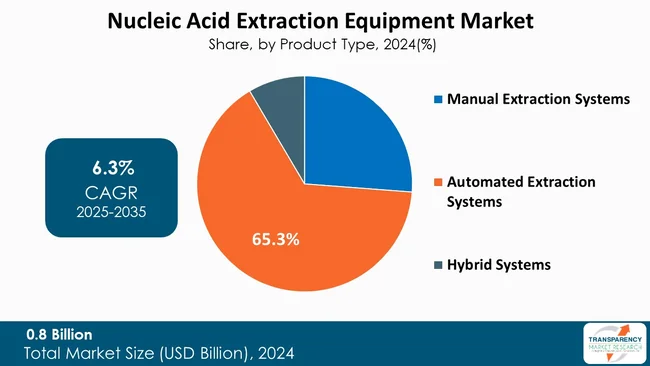

Automated extraction platforms are dominating the nucleic acid extraction hardware market due to their remarkable efficiency and precision benefits. The platforms simplify the process of extraction, thereby minimizing human effort and the probability of human error. By automating laborious steps, they not only maximize throughput but also render consistent quality and reproducibility of the extracted nucleic acids, which is more important for downstream activities like diagnostics and sequencing

Also, the rising need for high-throughput testing, especially from the research institutions and clinical labs, is driving the adoption of automated platforms. These systems can run multiple samples at a time, which is well-suited for big projects, such as population genomics research or large-scale clinical trials.

Furthermore, the use of robots and process optimization software has improved the efficiency of automated extraction systems. The technologies facilitate more rapid processing times as well as increased yield and purity of nucleic acids.

As the molecular diagnostics industry expands, so does demand for accurate and efficient extraction methods. Automated systems not only fulfill this demand but also align with the general trend of laboratory automation.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America dominates the nucleic acid extraction equipment market, holding the largest revenue share of 37.5% due to various factors. Firstly, the region has a strong healthcare system with a sizable investment in research and development activities, including biotechnology and the pharmaceutical sector. This promotes innovation and investment in cutting-edge extraction technologies.

Apart from this, the growing number of genetic diseases and the rising focus on personalized medicine fuel the demand for efficient molecular diagnostics, thereby fueling the demand for quality nucleic acid extraction technologies.

Further, existing players in the company and the growing saturation of research centers and academic institutions across the United States and Canada fuel the market. Such institutions engage in continuous collaborations to advance extraction procedures and techniques.

Key players in the global nucleic acid extraction equipment market are investing in technological advancements, innovation, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and obtain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Thermo Fisher Scientific Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Danaher Corporation, Merck KGaA, Promega Corporation, Tecan Group Ltd., Zymo Research Corporation, PerkinElmer, Inc., Analytik Jena AG, Hamilton Company, Beckman Coulter, Inc., Takara Bio Inc. are some of the leading players.

Each of these players has been profiled in the nucleic acid extraction equipment market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail | |

|---|---|---|

| Size in 2024 | US$ 0.8 Bn | |

| Forecast Value in 2035 | US$ 1.5 Bn | |

| CAGR | 6.3% | |

| Forecast Period | 2025-2035 | |

| Historical Data Available for | 2020-2023 | |

| Quantitative Units | US$ Bn | |

| Nucleic Acid Extraction Equipment Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. | |

| Competition Landscape |

|

|

| Format | Electronic (PDF) + Excel | |

| Segmentation | Product Type

|

|

| Regions Covered |

|

|

| Countries Covered |

|

|

| Companies Profiled |

|

|

| Customization Scope | Available upon request | |

| Pricing | Available upon request |

The global nucleic acid extraction equipment market was valued at US$ 0.8 Bn in 2024

The global nucleic acid extraction equipment market is projected to cross US$ 1.5 Bn by the end of 2035

Growing demand for molecular diagnostics and genetic testing and rising focus on personalized medicine and genomics research

It is anticipated to grow at a CAGR of 6.3% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Thermo Fisher Scientific Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Danaher Corporation, Merck KGaA, Promega Corporation, Tecan Group Ltd., Zymo Research Corporation, PerkinElmer, Inc., Analytik Jena AG, Hamilton Company, Beckman Coulter, Inc., Takara Bio Inc., and others

Table 01: Global Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 03: Global Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Country, 2020 to 2035

Table 07: North America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 08: North America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 09: North America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Country or Sub-region, 2020 to 2035

Table 12: Europe Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 13: Europe Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 14: Europe Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Country or Sub-region, 2020 to 2035

Table 17: Asia Pacific Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 18: Asia Pacific Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 19: Asia Pacific Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Country or Sub-region, 2020 to 2035

Table 22: Latin America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Latin America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 24: Latin America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East and Africa Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Country or Sub-region, 2020 to 2035

Table 27: Middle East and Africa Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 28: Middle East and Africa Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 29: Middle East and Africa Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East and Africa Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Nucleic Acid Extraction Equipment Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Manual Extraction Systems, 2020 to 2035

Figure 04: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Automated Extraction Systems, 2020 to 2035

Figure 05: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Hybrid Systems, 2020 to 2035

Figure 06: Global Nucleic Acid Extraction Equipment Market Value Share Analysis, By Technology, 2024 and 2035

Figure 07: Global Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 08: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Silica Membrane-Based Extraction, 2020 to 2035

Figure 09: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Magnetic-bead based Extraction, 2020 to 2035

Figure 10: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Liquid-based Extraction, 2020 to 2035

Figure 11: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global Nucleic Acid Extraction Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 13: Global Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 14: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Clinical Diagnostics, 2020 to 2035

Figure 15: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Research and Development, 2020 to 2035

Figure 16: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Forensics, 2020 to 2035

Figure 17: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Nucleic Acid Extraction Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 19: Global Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 20: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Hospitals and Diagnostic Laboratories, 2020 to 2035

Figure 21: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Academic and Research Institutes, 2020 to 2035

Figure 22: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 23: Global Nucleic Acid Extraction Equipment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Nucleic Acid Extraction Equipment Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Nucleic Acid Extraction Equipment Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Nucleic Acid Extraction Equipment Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 30: North America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 31: North America Nucleic Acid Extraction Equipment Market Value Share Analysis, By Technology, 2024 and 2035

Figure 32: North America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 33: North America Nucleic Acid Extraction Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 34: North America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 35: North America Nucleic Acid Extraction Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 36: North America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 37: Europe Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: Europe Nucleic Acid Extraction Equipment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 39: Europe Nucleic Acid Extraction Equipment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 40: Europe Nucleic Acid Extraction Equipment Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 41: Europe Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 42: Europe Nucleic Acid Extraction Equipment Market Value Share Analysis, By Technology, 2024 and 2035

Figure 43: Europe Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 44: Europe Nucleic Acid Extraction Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 45: Europe Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 46: Europe Nucleic Acid Extraction Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 47: Europe Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 48: Asia Pacific Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Asia Pacific Nucleic Acid Extraction Equipment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Asia Pacific Nucleic Acid Extraction Equipment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Asia Pacific Nucleic Acid Extraction Equipment Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 52: Asia Pacific Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 53: Asia Pacific Nucleic Acid Extraction Equipment Market Value Share Analysis, By Technology, 2024 and 2035

Figure 54: Asia Pacific Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 55: Asia Pacific Nucleic Acid Extraction Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 56: Asia Pacific Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 57: Asia Pacific Nucleic Acid Extraction Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 58: Asia Pacific Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 59: Latin America Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Latin America Nucleic Acid Extraction Equipment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 61: Latin America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 62: Latin America Nucleic Acid Extraction Equipment Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 63: Latin America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 64: Latin America Nucleic Acid Extraction Equipment Market Value Share Analysis, By Technology, 2024 and 2035

Figure 65: Latin America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 66: Latin America Nucleic Acid Extraction Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: Latin America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 68: Latin America Nucleic Acid Extraction Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 69: Latin America Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 70: Middle East & Africa Nucleic Acid Extraction Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: Middle East & Africa Nucleic Acid Extraction Equipment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 72: Middle East & Africa Nucleic Acid Extraction Equipment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 73: Middle East & Africa Nucleic Acid Extraction Equipment Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 74: Middle East & Africa Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 75: Middle East & Africa Nucleic Acid Extraction Equipment Market Value Share Analysis, By Technology, 2024 and 2035

Figure 76: Middle East & Africa Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 77: Middle East & Africa Nucleic Acid Extraction Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Middle East & Africa Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 79: Middle East & Africa Nucleic Acid Extraction Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 80: Middle East & Africa Nucleic Acid Extraction Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035