Reports

Reports

Analysts’ Viewpoint

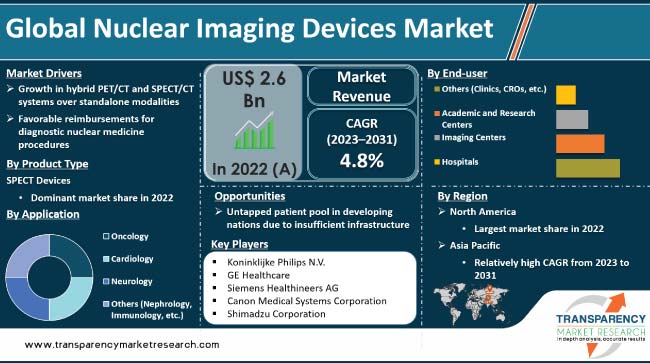

The global nuclear imaging devices market is poised for substantial growth, driven by key factors shaping its trajectory. The increase in prevalence of chronic diseases, such as cancer and cardiovascular disorders, is a major factor propelling the nuclear imaging devices industry growth.

Technological advancements, particularly in hybrid imaging modalities including SPECT/CT and PET/CT, enhance the diagnostic accuracy and expand the clinical applications of nuclear imaging devices.

Increase in investments in research and development activities are fostering the continuous evolution of imaging technologies, offering lucrative opportunities for market expansion. Furthermore, the rising geriatric population, which is more prone to various diseases requiring nuclear imaging for diagnosis, fuels market statistics.

The adoption of nuclear imaging devices is expected to increase as healthcare infrastructures worldwide continue to modernize.

Nuclear imaging devices play a crucial role in non-invasive imaging, offering valuable insights into physiological functions for a range of medical conditions and aid in early disease detection. Increase in prevalence of chronic diseases, rise in geriatric population, and continuous technological advancements in imaging modalities are key factors propelling the market.

Introduction of hybrid imaging technologies, such as SPECT/CT and PET/CT, has revolutionized diagnostic capabilities, providing enhanced accuracy and expanded clinical applications. Nuclear imaging devices are integral in early disease detection and monitoring, contributing to improved patient outcomes.

With a proactive approach to diagnostic precision, the global nuclear imaging devices market stands at the forefront of medical imaging innovation, offering a promising future for enhanced healthcare diagnostics.

The continual introduction of new radiotracers and tailored biomarkers is broadening the scope of molecular imaging and driving market development.

Pharmaceutical corporations and university research institutions are significantly investing in the development of radiolabeled substances that can better evaluate disease states and therapy responses. For example, radiolabeled tracers tailored for prostate-specific membrane antigen (PSMA) have showed tremendous promise in identifying metastatic prostate cancer with more sensitivity than traditional methods.This has spurred growing demand for hybrid PET/CT scans.

The approval of new tracers for cardiovascular applications, such as 18F-sodium fluoride and 18F-flurpiridaz F 18, is proving useful in imaging vascular inflammation/calcification and stent patency, facilitating risk prediction and intervention planning.

Furthermore, advances in targeted radionuclide treatment are connecting biomarkers such as PSMA and receptors to therapeutic radiotracers, indicating individualized tailored radiation with little side effects. Innovation is driving upgrade cycles and new purchases of improved PET/SPECT/hybrid equipment, thus bolstering the nuclear imaging devices market value.

The nuclear imaging devices market segmentation in terms of product type includes PET devices, SPECT devices, and planar imaging devices. The SPECT devices segment held significant market share in 2022. SPECT devices play a pivotal role in nuclear medicine by providing detailed three-dimensional images of internal organs and tissues, facilitating accurate diagnosis and treatment planning.

SPECT is particularly effective in imaging bone, cardiac, and neurological conditions, offering a comprehensive and functional view of physiological processes. The diagnostic capabilities of SPECT devices contribute to their widespread adoption in oncology, cardiology, and neurology, addressing a spectrum of medical conditions.

The leading position of SPECT devices underscores their critical role in providing clinicians with valuable insights for informed decision-making. As the demand for precise and non-invasive diagnostic solutions continues to grow, SPECT devices maintain their leadership, solidifying their position as a cornerstone in nuclear imaging devices industry growth.

According to the nuclear imaging devices market analysis, the oncology segment is projected to account for dominant share based on application, during the forecast period.

Oncology applications utilize nuclear imaging technologies such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT) to visualize and analyze the metabolic and functional activity of tissues, aiding in the detection and characterization of tumors.

Nuclear imaging devices offer unparalleled precision in oncology, allowing for early and accurate identification of cancerous lesions. PET scans, for instance, can highlight areas with increased metabolic activity, aiding in staging and determining the extent of cancer spread. Additionally, SPECT imaging provides valuable insights into the functional characteristics of tumors.

As per the nuclear imaging devices market report, the hospitals segment is emerging as a robust end-user segment.

Nuclear imaging devices, including positron emission tomography (PET) and single-photon emission computed tomography (SPECT), find extensive use in hospitals for their capability to provide detailed and accurate images of physiological processes, aiding in the diagnosis and monitoring of various medical conditions.

Larger hospitals often have the financial capacity to invest in state-of-the-art medical infrastructure, including advanced imaging technologies. This positions them as key contributors, boosting the nuclear imaging devices market revenue.

According to the latest nuclear imaging devices market forecast, North America dominated the landscape, with the United States leading the region in 2022. The U.S. stands at the forefront of advancements in healthcare technology, boasting a sophisticated healthcare infrastructure and a robust research and development ecosystem.

The high prevalence of chronic diseases, coupled with a proactive approach to adopting innovative medical imaging solutions, positions the U.S. as a key contributor to the regional market's dominance.

A rising geriatric population and increasing incidence of diseases that necessitate advanced diagnostic capabilities further boosts market dynamics. The U.S. healthcare sector's continuous investments in cutting-edge technologies, coupled with favorable reimbursement policies, enable the widespread adoption of nuclear imaging devices.

The global nuclear imaging devices market is consolidated, with the presence of a small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies implemented by leading players.

Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, Canon Medical Systems Corporation, Shimadzu Corporation, MR Solutions, Neusoft Medical Systems Co., Ltd., Mediso Ltd., and MiE GmbH, are the prominent nuclear imaging devices manufacturers.

Each of these players has been profiled in the nuclear imaging devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 2.6 Bn |

| Market Forecast Value in 2031 | US$ 4.0 Bn |

| Growth Rate (CAGR) | 4.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.6 Bn in 2022

It is projected to reach more than US$ 4.0 Bn by the end of 2031

The CAGR is anticipated to be 4.8% from 2023 to 2031

Based on product type, the SPECT devices segment accounted for leading share in 2022

North America is anticipated to account for leading share during the forecast period

Neusoft Medical Systems Co., Ltd., Canon Medical Systems Corporation, Shimadzu Corporation, Koninklijke Philips N.V., GE Healthcare, and Siemens Healthineers AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Nuclear Imaging Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Nuclear Imaging Device Market Analysis and Forecasts, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario

5.2. Technological Advancements

5.3. Key Industry Events

5.4. COVID-19 Pandemic Impact on Industry

6. Global Nuclear Imaging Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017 - 2031

6.3.1. PET Devices

6.3.1.1. Standalone PET

6.3.1.2. PET/CT

6.3.1.3. PET/MRI

6.3.2. SPECT Devices

6.3.2.1. Standalone SPECT

6.3.2.2. SPECT/CT

6.3.2.3. SPECT/MRI

6.3.3. Planar Imaging Devices

6.4. Market Attractiveness Analysis, by Product Type

7. Global Nuclear Imaging Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017 - 2031

7.3.1. Oncology

7.3.2. Cardiology

7.3.3. Neurology

7.3.4. Others (Nephrology, Immunology, etc.)

7.4. Market Attractiveness Analysis, by Application

8. Global Nuclear Imaging Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Imaging Centers

8.3.3. Academic and Research Centers

8.3.4. Others (Clinics, CROs, etc.)

8.4. Market Attractiveness Analysis, by End-user

9. Global Nuclear Imaging Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017 - 2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Nuclear Imaging Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017 - 2031

10.2.1. PET Devices

10.2.1.1. Standalone PET

10.2.1.2. PET/CT

10.2.1.3. PET/MRI

10.2.2. SPECT Devices

10.2.2.1. Standalone SPECT

10.2.2.2. SPECT/CT

10.2.2.3. SPECT/MRI

10.2.3. Planar Imaging Devices

10.3. Market Value Forecast, by Application, 2017 - 2031

10.3.1. Oncology

10.3.2. Cardiology

10.3.3. Neurology

10.3.4. Others (Nephrology, Immunology, etc.)

10.4. Market Value Forecast, by End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Imaging Centers

10.4.3. Academic and Research Centers

10.4.4. Others (Clinics, CROs, etc.)

10.5. Market Value Forecast, by Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Nuclear Imaging Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017 - 2031

11.2.1. PET Devices

11.2.1.1. Standalone PET

11.2.1.2. PET/CT

11.2.1.3. PET/MRI

11.2.2. SPECT Devices

11.2.2.1. Standalone SPECT

11.2.2.2. SPECT/CT

11.2.2.3. SPECT/MRI

11.2.3. Planar Imaging Devices

11.3. Market Value Forecast, by Application, 2017 - 2031

11.3.1. Oncology

11.3.2. Cardiology

11.3.3. Neurology

11.3.4. Others (Nephrology, Immunology, etc.)

11.4. Market Value Forecast, by End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Imaging Centers

11.4.3. Academic and Research Centers

11.4.4. Others (Clinics, CROs, etc.)

11.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Nuclear Imaging Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017 - 2031

12.2.1. PET Devices

12.2.1.1. Standalone PET

12.2.1.2. PET/CT

12.2.1.3. PET/MRI

12.2.2. SPECT Devices

12.2.2.1. Standalone SPECT

12.2.2.2. SPECT/CT

12.2.2.3. SPECT/MRI

12.2.3. Planar Imaging Devices

12.3. Market Value Forecast, by Application, 2017 - 2031

12.3.1. Oncology

12.3.2. Cardiology

12.3.3. Neurology

12.3.4. Others (Nephrology, Immunology, etc.)

12.4. Market Value Forecast, by End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Imaging Centers

12.4.3. Academic and Research Centers

12.4.4. Others (Clinics, CROs, etc.)

12.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Nuclear Imaging Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017 - 2031

13.2.1. PET Devices

13.2.1.1. Standalone PET

13.2.1.2. PET/CT

13.2.1.3. PET/MRI

13.2.2. SPECT Devices

13.2.2.1. Standalone SPECT

13.2.2.2. SPECT/CT

13.2.2.3. SPECT/MRI

13.2.3. Planar Imaging Devices

13.3. Market Value Forecast, by Application, 2017 - 2031

13.3.1. Oncology

13.3.2. Cardiology

13.3.3. Neurology

13.3.4. Others (Nephrology, Immunology, etc.)

13.4. Market Value Forecast, by End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Imaging Centers

13.4.3. Academic and Research Centers

13.4.4. Others (Clinics, CROs, etc.)

13.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Nuclear Imaging Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017 - 2031

14.2.1. PET Devices

14.2.1.1. Standalone PET

14.2.1.2. PET/CT

14.2.1.3. PET/MRI

14.2.2. SPECT Devices

14.2.2.1. Standalone SPECT

14.2.2.2. SPECT/CT

14.2.2.3. SPECT/MRI

14.2.3. Planar Imaging Devices

14.3. Market Value Forecast, by Application, 2017 - 2031

14.3.1. Oncology

14.3.2. Cardiology

14.3.3. Neurology

14.3.4. Others (Nephrology, Immunology, etc.)

14.4. Market Value Forecast, by End-user, 2017 - 2031

14.4.1. Hospitals

14.4.2. Imaging Centers

14.4.3. Academic and Research Centers

14.4.4. Others (Clinics, CROs, etc.)

14.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Koninklijke Philips N.V.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. GE Healthcare

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Canon Medical Systems Corporation

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Siemens Healthineers AG

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Shimadzu Corporation

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. MR Solutions

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Neusoft Medical Systems Co., Ltd.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Mediso Ltd.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. MiE GmbH

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

List of Tables

Table 01: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Product Type, 2017 - 2031

Table 02: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by PET Devices, 2017 - 2031

Table 03: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by SPECT Devices, 2017 - 2031

Table 04: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017 - 2031

Table 05: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 06: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Region, 2017 - 2031

Table 07: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Product Type, 2017 - 2031

Table 08: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by PET Devices, 2017 - 2031

Table 09: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by SPECT Devices, 2017 - 2031

Table 10: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017 - 2031

Table 11: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 12: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Country, 2017 - 2031

Table 13: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Product Type, 2017 - 2031

Table 14: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by PET Devices, 2017 - 2031

Table 15: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by SPECT Devices, 2017 - 2031

Table 16: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017 - 2031

Table 17: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 18: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 19: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Product Type, 2017 - 2031

Table 20: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by PET Devices, 2017 - 2031

Table 21: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by SPECT Devices, 2017 - 2031

Table 22: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017 - 2031

Table 23: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 24: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 25: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Product Type, 2017 - 2031

Table 26: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by PET Devices, 2017 - 2031

Table 27: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by SPECT Devices, 2017 - 2031

Table 28: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017 - 2031

Table 29: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 30: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2031

Table 31: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Product Type, 2017 - 2031

Table 32: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by PET Devices, 2017 - 2031

Table 33: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by SPECT Devices, 2017 - 2031

Table 34: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Application, 2017 - 2031

Table 35: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by End-user, 2017 - 2031

Table 36: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017

List of Figures

Figure 01: Global Nuclear Imaging Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 02: Global Nuclear Imaging Devices Market Value Share Analysis, by Product Type, 2022 - 2031

Figure 03: Global Nuclear Imaging Devices Market Value Share Analysis, by PET Devices, 2022 - 2031

Figure 04: Global Nuclear Imaging Devices Market Value Share Analysis, by Standalone PET, 2022 - 2031

Figure 05: Global Nuclear Imaging Devices Market Value Share Analysis, by PET/CT, 2022 - 2031

Figure 06: Global Nuclear Imaging Devices Market Value Share Analysis, by PET/MRI, 2022 - 2031

Figure 07: Global Nuclear Imaging Devices Market Value Share Analysis, by SPECT Devices, 2022 - 2031

Figure 08: Global Nuclear Imaging Devices Market Value Share Analysis, by Standalone SPECT, 2022 - 2031

Figure 09: Global Nuclear Imaging Devices Market Value Share Analysis, by SPECT/CT, 2022 - 2031

Figure 10: Global Nuclear Imaging Devices Market Value Share Analysis, by SPECT/MRI, 2022 - 2031

Figure 11: Global Nuclear Imaging Devices Market Value Share Analysis, by Planar Imaging Devices, 2022 - 2031

Figure 12: Global Nuclear Imaging Devices Market Attractiveness Analysis, by Product Type, 2023 - 2031

Figure 13: Global Nuclear Imaging Devices Market Value Share Analysis, by Application 2022 - 2031

Figure 14: Global Nuclear Imaging Devices Market Value Share Analysis, by Oncology, 2022 - 2031

Figure 15: Global Nuclear Imaging Devices Market Value Share Analysis, by Cardiology, 2022 - 2031

Figure 16: Global Nuclear Imaging Devices Market Value Share Analysis, by Neurology, 2022 - 2031

Figure 17: Global Nuclear Imaging Devices Market Value Share Analysis, by Others (Nephrology, Immunology, etc.), 2022 - 2031

Figure 18: Global Nuclear Imaging Devices Market Attractiveness Analysis, by Application, 2023 - 2031

Figure 19: Global Nuclear Imaging Devices Market Value Share Analysis, by End-user, 2022 - 2031

Figure 20: Global Nuclear Imaging Devices Market Value Share Analysis, by Hospitals, 2022 - 2031

Figure 21: Global Nuclear Imaging Devices Market Value Share Analysis, by Imaging Centers, 2022 - 2031

Figure 22: Global Nuclear Imaging Devices Market Value Share Analysis, by Academic and Research Centers, 2022 - 2031

Figure 23: Global Nuclear Imaging Devices Market Value Share Analysis, by Others (Clinics, CROs, etc.), 2022 - 2031

Figure 24: Global Nuclear Imaging Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 25: Global Nuclear Imaging Devices Market Value Share Analysis, by Region, 2022 - 2031

Figure 26: Global Nuclear Imaging Devices Market Attractiveness Analysis, by Region, 2023 - 2031

Figure 27: North America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 28: North America Nuclear Imaging Devices Market Value Share Analysis, by Product Type, 2022 - 2031

Figure 29: North America Nuclear Imaging Devices Market Attractiveness Analysis, by Product Type, 2023 - 2031

Figure 30: North America Nuclear Imaging Devices Market Value Share Analysis, by Application, 2022 - 2031

Figure 31: North America Nuclear Imaging Devices Market Attractiveness Analysis, by Application, 2023 - 2031

Figure 32: North America Nuclear Imaging Devices Market Value Share Analysis, by End-user, 2022 - 2031

Figure 33: North America Nuclear Imaging Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 34: North America Nuclear Imaging Devices Market Value Share Analysis, by Country, 2022 - 2031

Figure 35: North America Nuclear Imaging Devices Market Attractiveness Analysis, by Country, 2023 - 2031

Figure 36: Europe Nuclear Imaging Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 37: Europe Nuclear Imaging Devices Market Value Share Analysis, by Product Type, 2022 - 2031

Figure 38: Europe Nuclear Imaging Devices Market Attractiveness Analysis, by Product Type, 2023 - 2031

Figure 39: Europe Nuclear Imaging Devices Market Value Share Analysis, by Application, 2022 - 2031

Figure 40: Europe Nuclear Imaging Devices Market Attractiveness Analysis, by Application, 2023 - 2031

Figure 41: Europe Nuclear Imaging Devices Market Value Share Analysis, by End-user, 2022 - 2031

Figure 42: Europe Nuclear Imaging Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 43: Europe Nuclear Imaging Devices Market Value Share Analysis, by Country/Sub-region, 2022 - 2031

Figure 44: Europe Nuclear Imaging Devices Market Attractiveness Analysis, by Country/Sub-region, 2023 - 2031

Figure 45: Asia Pacific Nuclear Imaging Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 46: Asia Pacific Nuclear Imaging Devices Market Value Share Analysis, by Product Type, 2022 - 2031

Figure 47: Asia Pacific Nuclear Imaging Devices Market Attractiveness Analysis, by Product Type, 2023 - 2031

Figure 48: Asia Pacific Nuclear Imaging Devices Market Value Share Analysis, by Application 2022 - 2031

Figure 49: Asia Pacific Nuclear Imaging Devices Market Attractiveness Analysis, by Application, 2023 - 2031

Figure 50: Asia Pacific Nuclear Imaging Devices Market Value Share Analysis, by End-user, 2022 - 2031

Figure 51: Asia Pacific Nuclear Imaging Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 52: Asia Pacific Nuclear Imaging Devices Market Value Share Analysis, by Country/Sub-region, 2022 - 2031

Figure 53: Asia Pacific Nuclear Imaging Devices Market Attractiveness Analysis, by Country/Sub-region, 2023 - 2031

Figure 54: Latin America Nuclear Imaging Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 55: Latin America Nuclear Imaging Devices Market Value Share Analysis, by Product Type, 2022 - 2031

Figure 56: Latin America Nuclear Imaging Devices Market Attractiveness Analysis, by Product Type, 2023 - 2031

Figure 57: Latin America Nuclear Imaging Devices Market Value Share Analysis, by Application, 2022 - 2031

Figure 58: Latin America Nuclear Imaging Devices Market Attractiveness Analysis, by Application, 2023 - 2031

Figure 59: Latin America Nuclear Imaging Devices Market Value Share Analysis, by End-user, 2022 - 2031

Figure 60: Latin America Nuclear Imaging Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 61: Latin America Nuclear Imaging Devices Market Value Share Analysis, by Country/Sub-region, 2022 - 2031

Figure 62: Latin America Nuclear Imaging Devices Market Attractiveness Analysis, by Country/Sub-region, 2023 - 2031

Figure 63: Middle East & Africa Nuclear Imaging Devices Market Value (US$ Mn) Forecast, 2017 - 2031

Figure 64: Middle East & Africa Nuclear Imaging Devices Market Value Share Analysis, by Product Type, 2022 - 2031

Figure 65: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis, by Product Type, 2023 - 2031

Figure 66: Middle East & Africa Nuclear Imaging Devices Market Value Share Analysis, by Application, 2022 - 2031

Figure 67: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis, by Application, 2023 - 2031

Figure 68: Middle East & Africa Nuclear Imaging Devices Market Value Share Analysis, by End-user, 2022 - 2031

Figure 69: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis, by End-user, 2023 - 2031

Figure 70: Middle East & Africa Nuclear Imaging Devices Market Value Share Analysis, by Country/Sub-region, 2022 - 2031

Figure 71: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis, by Country/Sub-region, 2023 - 2031

Figure 72: Global Nuclear Imaging Devices Market Share Analysis, by Company, 2022