Reports

Reports

Analysts’ Viewpoint

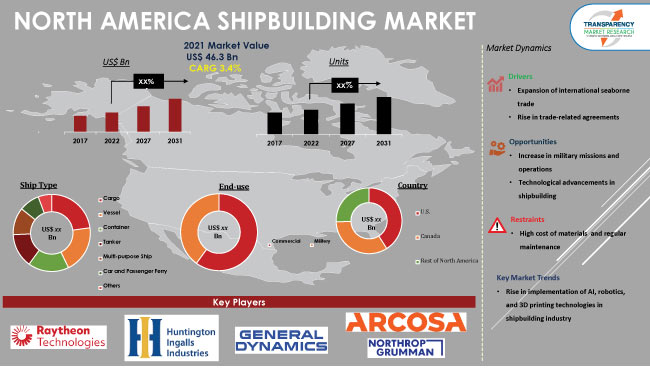

Increase in seaborne trade, growth in economy, rise in energy consumption, surge in demand for environmentally-friendly ships and shipping services, and advent of robotics in the shipbuilding business are projected to fuel the North America shipbuilding market in the next few years. Increase in demand for traded commodities such as crude oil and gold is contributing to market development.

Rise in demand for fuel-efficient ships for international trade is also anticipated to drive market expansion in the region. Technological advancements in multi-fuel engines and increase in implementation of 3D printing, AI, and robotics technologies in shipbuilding are likely to create lucrative opportunities for market players in the near future.

The North America shipbuilding market size is expected to grow at a moderate pace during the forecast period, due to the rise in maritime transport in the region. Shipbuilding is the construction process of ships and floating vessels in shipyards. These ships or floating vessels are constructed for military and commercial applications.

Shipbuilding includes the construction of passenger, cargo, and naval vessels in addition to container and cargo ships. Shipbuilding, repair, conversion, and alteration; creation of prefabricated ship and barge components; and provision of specialist services such as ship scale models are part of ship building yard operations. Lucrative presence of key players in North America is positively impacting market statistics in the region.

Global trade and manufacturing supply chains are supported by marine transportation. Demand for maritime transportation has been rising in North America since the last few years. This is leading to an increase in volume of imports and exports in the region. Maritime transport is the backbone of global trade and manufacturing supply chain; more than four-fifth of the world's merchandise trade is carried through the sea route. This is estimated to fuel the North America shipbuilding market growth during the forecast period.

Several trade-related agreements have been executed between various countries for the movement of goods. As a result, suppliers have been shifting their preference to waterways since it is a better and more efficient mode of transportation. This increase in trend has prompted cargo ship manufacturers to develop better and more efficient container carriers of various sizes and capacities. This is anticipated to augment the shipbuilding market in North America in the near future.

Free trade agreements lead to a reduction in government duties and taxes. Countries in the trade bloc are lifting bans and making trade more flexible. Thus, rise in trade-related agreements has led to an increase in demand for stronger containers, thereby boosting the North America shipbuilding market share.

In terms of ship type segment, the shipbuilding business has been segmented into cargo, vessel, container, tanker, multi-purpose ship, car and passenger ferry, and others. The cargo segment is projected to register the highest CAGR during the forecast period due to the expansion of international seaborne trade.

Cargo refers to the delivery of goods or merchandise for commercial benefit. It is a highly economical transportation mode for goods and raw materials. Various types of cargo include liquid bulk, breakbulk, containerized cargo, dry bulk, and ro-ro. Rapid rise in import and export of goods, and increase in demand for low-cost and efficient cargo shipping are the key factors contributing to the segment growth.

Based on end-user, the market has been bifurcated into commercial and military. The commercial segment dominated the industry in 2021. It is expected to witness higher CAGR during the forecast period.

Commercial ships are used for movement of passengers and goods. Rapid growth in the maritime tourism sector and rise in trade activities are driving the commercial segment. Increase in foreign direct investments, growth in population in emerging countries, and surge in number of passenger cruise ships are also fueling the segment.

The U.S. is expected to lead the market in North America during the forecast period. It is a major country for shipping trade. Rise in operational efficiency and decrease in environmental impact are expected to boost the shipbuilding industry in the country during the forecast period.

Increase in risk of enemy interference in coastal areas is likely to drive the demand for energy vessels in the U.S. This is expected to augment the market growth in the country. Furthermore, surge in investments in the defense sector is estimated to fuel market expansion in the U.S.

Key players in the North America shipbuilding market are actively focusing on research and development activities to gain revenue benefits. Shipbuilding companies are primarily focusing on technological advancements, geographical expansion, capacity expansion, and strategic partnerships to create lucrative opportunities in the market. The North America shipbuilding market forecast report highlights major drivers, growth opportunities, and analysis of key market players.

Northrop Grumman Newport News Inc, Huntington Ingalls Industries Inc., General Dynamics Corporation, Raytheon Technologies Corporation, Arcosa, Inc., Oceaneering International Inc, Trinity Industries, Inc., American Commercial Barge Lines Holding Corporation, Brp US Inc., and Vigor Industrial LLC are the top 10 shipbuilding companies in North America.

The North America shipbuilding market research report profiles key players in terms of parameters such as business strategies, company overview, recent developments, financial overview, business segments, and product portfolio.

|

Attribute |

Detail |

|

Market Value of Shipbuilding in 2021 |

US$ 46.3 Bn |

|

Market Forecast Value in 2031 |

US$ 67.4 Bn |

|

Growth Rate (CAGR) |

3.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at North America as well as country levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 46.3 Bn in 2021

It is expected to reach US$ 67.4 Bn by 2031

Expansion of international seaborne trade and rise in trade-related agreements

Cargo ship contributed the largest share in 2021

The U.S. is expected to hold major share in the near future

Raytheon Technologies Corporation, Huntington Ingalls Industries Inc., General Dynamics Corporation, Northrop Grumman Newport News Inc, Arcosa, Inc., Oceaneering International Inc, Trinity Industries, Inc., American Commercial Barge Lines Holding Corporation, Brp US Inc., and Vigor Industrial LLC

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Roadmap

5.9. North America Shipbuilding Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Units)

6. North America Shipbuilding Market Analysis and Forecast, By Ship Type

6.1. North America Shipbuilding Market Size (US$ Bn and Units), By Ship Type, 2017 - 2031

6.1.1. Cargo

6.1.2. Vessel

6.1.3. Container

6.1.4. Tanker

6.1.5. Multi-purpose Ship

6.1.6. Car and Passenger Ferry

6.1.7. Others

6.2. Incremental Opportunity, By Ship Type

7. North America Shipbuilding Market Analysis and Forecast, By End-user

7.1. North America Shipbuilding Market Size (US$ Bn and Units), By End-user, 2017 - 2031

7.1.1. Commercial

7.1.2. Military

7.2. Incremental Opportunity, By End-user

8. North America Shipbuilding Market Analysis and Forecast, By Country

8.1. North America Shipbuilding Market Size (US$ Bn and Units), By Country, 2017 - 2031

8.1.1. U.S.

8.1.2. Canada

8.1.3. Rest of North America

8.2. Incremental Opportunity, By Country

9. U.S. Shipbuilding Market Analysis and Forecast

9.1. Country Snapshot

9.2. Price Trend Analysis

9.2.1. Weighted Average Selling Price (US$)

9.3. Key Trends Analysis

9.3.1. Demand Side Analysis

9.3.2. Supply Side Analysis

9.4. Shipbuilding Market Size (US$ Bn and Units), By Ship Type, 2017 - 2031

9.4.1. Cargo

9.4.2. Vessel

9.4.3. Container

9.4.4. Tanker

9.4.5. Multi-purpose Ship

9.4.6. Car and Passenger Ferry

9.4.7. Others

9.5. Shipbuilding Market Size (US$ Bn and Units), By End-user, 2017 - 2031

9.5.1. Commercial

9.5.2. Military

9.6. Incremental Opportunity Analysis

10. Canada Shipbuilding Market Analysis and Forecast

10.1. Country Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Key Trends Analysis

10.3.1. Demand Side Analysis

10.3.2. Supply Side Analysis

10.4. Shipbuilding Market Size (US$ Bn and Units), By Ship Type, 2017 - 2031

10.4.1. Cargo

10.4.2. Vessel

10.4.3. Container

10.4.4. Tanker

10.4.5. Multi-purpose Ship

10.4.6. Car and Passenger Ferry

10.4.7. Others

10.5. Shipbuilding Market Size (US$ Bn and Units), By End-user, 2017 - 2031

10.5.1. Commercial

10.5.2. Military

10.6. Incremental Opportunity Analysis

11. Competition Landscape

11.1. Market Player – Competition Dashboard

11.2. Market Share Analysis (%), 2021

11.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

11.3.1. Raytheon Technologies Corporation

11.3.1.1. Company Overview

11.3.1.2. Sales Area/Geographical Presence

11.3.1.3. Financial/Revenue

11.3.1.4. Strategy & Business Overview

11.3.1.5. Sales Channel Analysis

11.3.1.6. Size Portfolio

11.3.2. Huntington Ingalls Industries Inc.

11.3.2.1. Company Overview

11.3.2.2. Sales Area/Geographical Presence

11.3.2.3. Financial/Revenue

11.3.2.4. Strategy & Business Overview

11.3.2.5. Sales Channel Analysis

11.3.2.6. Size Portfolio

11.3.3. General Dynamics Corporation

11.3.3.1. Company Overview

11.3.3.2. Sales Area/Geographical Presence

11.3.3.3. Financial/Revenue

11.3.3.4. Strategy & Business Overview

11.3.3.5. Sales Channel Analysis

11.3.3.6. Size Portfolio

11.3.4. Northrop Grumman Newport News Inc

11.3.4.1. Company Overview

11.3.4.2. Sales Area/Geographical Presence

11.3.4.3. Financial/Revenue

11.3.4.4. Strategy & Business Overview

11.3.4.5. Sales Channel Analysis

11.3.4.6. Size Portfolio

11.3.5. Arcosa, Inc.

11.3.5.1. Company Overview

11.3.5.2. Sales Area/Geographical Presence

11.3.5.3. Financial/Revenue

11.3.5.4. Strategy & Business Overview

11.3.5.5. Sales Channel Analysis

11.3.5.6. Size Portfolio

11.3.6. Oceaneering International Inc

11.3.6.1. Company Overview

11.3.6.2. Sales Area/Geographical Presence

11.3.6.3. Financial/Revenue

11.3.6.4. Strategy & Business Overview

11.3.6.5. Sales Channel Analysis

11.3.6.6. Size Portfolio

11.3.7. Trinity Industries, Inc.

11.3.7.1. Company Overview

11.3.7.2. Sales Area/Geographical Presence

11.3.7.3. Financial/Revenue

11.3.7.4. Strategy & Business Overview

11.3.7.5. Sales Channel Analysis

11.3.7.6. Size Portfolio

11.3.8. American Commercial Barge Lines Holding Corporation

11.3.8.1. Company Overview

11.3.8.2. Sales Area/Geographical Presence

11.3.8.3. Financial/Revenue

11.3.8.4. Strategy & Business Overview

11.3.8.5. Sales Channel Analysis

11.3.8.6. Size Portfolio

11.3.9. Brp US Inc.

11.3.9.1. Company Overview

11.3.9.2. Sales Area/Geographical Presence

11.3.9.3. Financial/Revenue

11.3.9.4. Strategy & Business Overview

11.3.9.5. Sales Channel Analysis

11.3.9.6. Size Portfolio

11.3.10. Vigor Industrial LLC

11.3.10.1. Company Overview

11.3.10.2. Sales Area/Geographical Presence

11.3.10.3. Financial/Revenue

11.3.10.4. Strategy & Business Overview

11.3.10.5. Sales Channel Analysis

11.3.10.6. Size Portfolio

12. Key Takeaway

12.1. Identification of Potential Market Spaces

12.1.1. Ship Type

12.1.2. End-user

12.1.3. Country

12.2. Understanding the Buying Process of Customers

12.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Shipbuilding Market, By Ship Type, Units, 2017-2031

Table 2: North America Shipbuilding Market, By Ship Type, US$ Bn, 2017-2031

Table 3: North America Shipbuilding Market, By End-user, Units, 2017-2031

Table 4: North America Shipbuilding Market, By End-user, US$ Bn, 2017-2031

Table 5: U.S. Shipbuilding Market, By Country, Units, 2017-2031

Table 6: U.S. Shipbuilding Market, By Country, US$ Bn, 2017-2031

Table 7: U.S. Shipbuilding Market, By Ship Type, Units, 2017-2031

Table 8: U.S. Shipbuilding Market, By Ship Type, US$ Bn, 2017-2031

Table 9: U.S. Shipbuilding Market, By End-user, Units, 2017-2031

Table 10: U.S. Shipbuilding Market, By End-user, US$ Bn, 2017-2031

Table 11: Canada Shipbuilding Market, By Ship Type, Units, 2017-2031

Table 12: Canada Shipbuilding Market, By Ship Type, US$ Bn, 2017-2031

Table 13: Canada Shipbuilding Market, By End-user, Units, 2017-2031

Table 14: Canada Shipbuilding Market, By End-user, US$ Bn, 2017-2031

List of Figures

Figure 1: North America Shipbuilding Market, By Ship Type, Units, 2017-2031

Figure 2: North America Shipbuilding Market, By Ship Type, US$ Bn, 2017-2031

Figure 3: North America Shipbuilding Market Incremental Opportunity, By Ship Type, US$ Bn, 2022-2031

Figure 4: North America Shipbuilding Market, By End-user, Units, 2017-2031

Figure 5: North America Shipbuilding Market, By End-user, US$ Bn, 2017-2031

Figure 6: North America Shipbuilding Market Incremental Opportunity, By End-user, US$ Bn, 2022-2031

Figure 7: U.S. Shipbuilding Market, By Country, Units, 2017-2031

Figure 8: U.S. Shipbuilding Market, By Country, US$ Bn, 2017-2031

Figure 9: U.S. Shipbuilding Market Incremental Opportunity, By Country, US$ Bn, 2022-2031

Figure 10: U.S. Shipbuilding Market, By Ship Type, Units, 2017-2031

Figure 11: U.S. Shipbuilding Market, By Ship Type, US$ Bn, 2017-2031

Figure 12: U.S. Shipbuilding Market Incremental Opportunity, By Ship Type, US$ Bn, 2022-2031

Figure 13: U.S. Shipbuilding Market, By End-user, Units, 2017-2031

Figure 14: U.S. Shipbuilding Market, By End-user, US$ Bn, 2017-2031

Figure 15: U.S. Shipbuilding Market Incremental Opportunity, By End-user, US$ Bn, 2022-2031

Figure 16: Canada Shipbuilding Market, By Ship Type, Units, 2017-2031

Figure 17: Canada Shipbuilding Market, By Ship Type, US$ Bn, 2017-2031

Figure 18: Canada Shipbuilding Market Incremental Opportunity, By Ship Type, US$ Bn, 2022-2031

Figure 19: Canada Shipbuilding Market, By End-user, Units, 2017-2031

Figure 20: Canada Shipbuilding Market, By End-user, US$ Bn, 2017-2031

Figure 21: Canada Shipbuilding Market Incremental Opportunity, By End-user, US$ Bn, 2022-2031