Reports

Reports

Analysts’ Viewpoint

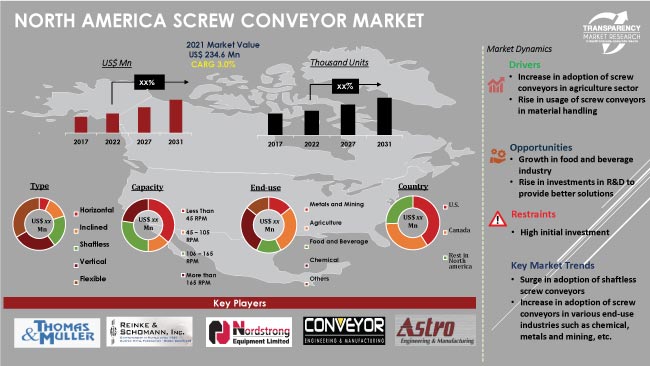

Demand for screw conveyors is estimated to increase at a steady pace in North America, due to the rise in adoption of these products in end-use industries such as food and beverage, agriculture, chemical, construction, and waste management. Screw conveyors are primarily used for mixing raw materials in the food and beverage sector. Demand for fruits, grains, and cereals is rising in North America due to the growth in population and economic development. Thus, increase in demand for product mixing equipment in the agriculture sector is a key factor that is expected to fuel the North America screw conveyor market growth in the next few years.

Technological advancements in screw conveyors are projected to augment industry expansion in North America. Key manufacturers are focusing on designing innovative screw conveyors, such as horizontal screw conveyors and shaftless screw conveyors, to gain incremental opportunities.

Screw conveyors or auger screw conveyors are used to move bulk materials from one part of the process to another. They can be used as collectors, distributors, feeders, or mixers. The function of a screw conveyor is to push materials, as the screw rotates in a fixed pipe, trough, or enclosure.

The device has the shape of a typical screw with the auger held in place by bearings at both ends. This simple screw conveyor design makes it suitable for conveying grain, powder, granules, and flakes. Key players are focusing on North America screwing conveyor market trends to create lucrative opportunities in the near future.

Screw conveyor manufacturers make use of the product to harvest, grow, and process wheat, rice, corn, etc. in the agriculture sector. Demand for screw conveyors is rising in North America due to the increase in agriculture activities in the region. Growth in population has led to an increase in demand for food, which is contributing to the North America screw conveyor market revenue growth.

Screw conveyors are also employed in the mining sector to extract metals and minerals. Furthermore, increase in demand for pharmaceuticals is estimated to fuel sales of screw conveyors in the region during the forecast period.

Screw conveyors are used in various bulk materials, which need to be conveyed and distributed to different locations as per the requirement. Screw feeders or screw conveyors are employed as metering devices in the material handling process. Screw conveyors are also used to minimize waste in the material handling industry. Hence, the North America screw conveyor market demand is projected to increase during the forecast period.

Manufacturers are focusing on product development and technological advancements to expand the customer base of screw conveyors.

Horizontal, inclined, shaftless, vertical, and flexible are the major screw conveyor types used across various end-use industries. Demand for horizontal screw conveyors is estimated to be high in North America during the forecast period. Horizontal screw conveyors are available in different sizes, capacities, and configurations. They are used to convey bulk materials from one part of a process to another. These screw conveyors are designed in such a way that they can convey bulk materials through loading, based on characteristics of those materials.

The North America screw conveyor market share is projected to increase during the forecast period, owing to the rise in demand for horizontal screw conveyors in various industries.

Screw conveyors are extensively used in food and beverage processing companies for mixing of raw materials. They are also used to deliver materials from one workstation to another. Food and beverage companies deal with a large proportion of powder components on a daily basis. Increase in demand for a mechanized conveying systems to move these components or raw materials safely and quickly throughout the production process is anticipated to fuel North America screw conveyor industry growth during the forecast period.

Screw conveyors are widely employed in companies engaged in food powder processing, ingredient processing, ready-to-eat food manufacturing, brewing, and dairy production. Key manufacturers are increasingly designing innovative screw conveyors to comply with FDA (Food and Drug Administration) and USDA (United States Department of Agriculture) sanitation standards.

The U.S. is projected to record significant market progress during the forecast period. Demand for screw conveyors is expected to rise significantly in various end-use industries in the country. Lucrative presence of leading players and advancements in technology are also likely to fuel market development in the U.S. in the near future.

Rise in construction activities and growth in the food and beverage sector are boosting market statistics in the U.S. Canada is also expected to witness prominent market expansion opportunities in the near future.

Key players in the North America screw conveyor market are actively focusing on research and development activities to offer market-specific solutions. Advancement in technology, geographical expansion, capacity expansion, and strategic partnerships are the key focus areas of screw conveyor companies operating in the region.

Astro Engineering & Manufacturing Inc., Conveyor Engineering and Manufacturing, Flexicon Corporation, Jurado Srls, KWS Manufacturing Company Ltd., Mega-Tech Engineering Ltd., Spiroflow Systems, Inc., Thomas & Muller Systems Ltd, VAC-U-MAX, Vecoplan LLC, and WAMGROUP S.p.A. are the prominent market players.

The North America screw conveyor industry research report profiles prominent players based on parameters such as product portfolio, company overview, business strategies, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 234.6 Mn |

|

Market Forecast Value in 2031 |

US$ 313.8 Mn |

|

Growth Rate (CAGR) |

3.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the North America as well as country levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 234.6 Mn in 2021

It is expected to reach US$ 313.8 Mn by 2031

Increase in adoption of screw conveyors in agriculture sector and rise in usage of screw conveyors in material handling

The horizontal type segment contributed the largest share in 2021

The U.S. more attractive country for vendors

WAMGROUP S.p.A., KWS Manufacturing Company Ltd., Flexicon Corporation, Spiroflow Systems, Inc., Jurado Srls, VAC-U-MAX, Vecoplan LLC, Astro Engineering & Manufacturing Inc., Conveyor Engineering and Manufacturing, Mega-Tech Engineering Ltd., and Thomas & Muller Systems Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Roadmap

5.9. North America Screw Conveyor Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. North America Screw Conveyor Market Analysis and Forecast, By Type

6.1. North America Screw Conveyor Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

6.1.1. Horizontal

6.1.2. Inclined

6.1.3. Shaftless

6.1.4. Vertical

6.1.5. Flexible

6.2. Incremental Opportunity, By Type

7. North America Screw Conveyor Market Analysis and Forecast, By Capacity

7.1. North America Screw Conveyor Market Size (US$ Mn and Thousand Units), By Capacity, 2017 - 2031

7.1.1. Less Than 45 RPM

7.1.2. 45 – 105 RPM

7.1.3. 106 – 165 RPM

7.1.4. More than 165 RPM

7.2. Incremental Opportunity, By Capacity

8. North America Screw Conveyor Market Analysis and Forecast, By End-use

8.1. North America Screw Conveyor Market Size (US$ Mn and Thousand Units), By End-use, 2017 - 2031

8.1.1. Metals and Mining

8.1.2. Agriculture

8.1.3. Food and Beverage

8.1.4. Chemical

8.1.5. Others

8.2. Incremental Opportunity, By End-use

9. North America Screw Conveyor Market Analysis and Forecast, By Country

9.1. North America Screw Conveyor Market Size (US$ Mn and Thousand Units), By Country, 2017 - 2031

9.1.1. U.S.

9.1.2. Canada

9.1.3. Rest of North America

9.2. Incremental Opportunity, By Country

10. U.S. Screw Conveyor Market Analysis and Forecast

10.1. Country Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Key Trends Analysis

10.3.1. Demand Side Analysis

10.3.2. Supply Side Analysis

10.4. Screw Conveyor Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

10.4.1. Horizontal

10.4.2. Inclined

10.4.3. Shaftless

10.4.4. Vertical

10.4.5. Flexible

10.5. Screw Conveyor Market Size (US$ Mn and Thousand Units), By Capacity, 2017 - 2031

10.5.1. Less Than 45 RPM

10.5.2. 45 – 105 RPM

10.5.3. 106 – 165 RPM

10.5.4. More than 165 RPM

10.6. Screw Conveyor Market Size (US$ Mn and Thousand Units), By End-use, 2017 - 2031

10.6.1. Metals and Mining

10.6.2. Agriculture

10.6.3. Food and Beverage

10.6.4. Chemical

10.6.5. Others

10.7. Incremental Opportunity Analysis

11. Canada Screw Conveyor Market Analysis and Forecast

11.1. Country Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Screw Conveyor Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

11.4.1. Horizontal

11.4.2. Inclined

11.4.3. Shaftless

11.4.4. Vertical

11.4.5. Flexible

11.5. Screw Conveyor Market Size (US$ Mn and Thousand Units), By Capacity, 2017 - 2031

11.5.1. Less Than 45 RPM

11.5.2. 45 – 105 RPM

11.5.3. 106 – 165 RPM

11.5.4. More than 165 RPM

11.6. Screw Conveyor Market Size (US$ Mn and Thousand Units), By End-use, 2017 - 2031

11.6.1. Metals and Mining

11.6.2. Agriculture

11.6.3. Food and Beverage

11.6.4. Chemical

11.6.5. Others

11.7. Incremental Opportunity Analysis

12. Competition Landscape

12.1. Market Player – Competition Dashboard

12.2. Market Share Analysis (%), 2021

12.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

12.3.1. Astro Engineering & Manufacturing Inc.

12.3.1.1. Company Overview

12.3.1.2. Sales Area/Geographical Presence

12.3.1.3. Financial/Revenue

12.3.1.4. Strategy & Business Overview

12.3.1.5. Sales Channel Analysis

12.3.1.6. Size Portfolio

12.3.2. Conveyor Engineering and Manufacturing

12.3.2.1. Company Overview

12.3.2.2. Sales Area/Geographical Presence

12.3.2.3. Financial/Revenue

12.3.2.4. Strategy & Business Overview

12.3.2.5. Sales Channel Analysis

12.3.2.6. Size Portfolio

12.3.3. Flexicon Corporation

12.3.3.1. Company Overview

12.3.3.2. Sales Area/Geographical Presence

12.3.3.3. Financial/Revenue

12.3.3.4. Strategy & Business Overview

12.3.3.5. Sales Channel Analysis

12.3.3.6. Size Portfolio

12.3.4. Jurado Srls

12.3.4.1. Company Overview

12.3.4.2. Sales Area/Geographical Presence

12.3.4.3. Financial/Revenue

12.3.4.4. Strategy & Business Overview

12.3.4.5. Sales Channel Analysis

12.3.4.6. Size Portfolio

12.3.5. KWS Manufacturing Company Ltd.

12.3.5.1. Company Overview

12.3.5.2. Sales Area/Geographical Presence

12.3.5.3. Financial/Revenue

12.3.5.4. Strategy & Business Overview

12.3.5.5. Sales Channel Analysis

12.3.5.6. Size Portfolio

12.3.6. Mega-Tech Engineering Ltd.

12.3.6.1. Company Overview

12.3.6.2. Sales Area/Geographical Presence

12.3.6.3. Financial/Revenue

12.3.6.4. Strategy & Business Overview

12.3.6.5. Sales Channel Analysis

12.3.6.6. Size Portfolio

12.3.7. Spiroflow Systems, Inc.

12.3.7.1. Company Overview

12.3.7.2. Sales Area/Geographical Presence

12.3.7.3. Financial/Revenue

12.3.7.4. Strategy & Business Overview

12.3.7.5. Sales Channel Analysis

12.3.7.6. Size Portfolio

12.3.8. Thomas & Muller Systems Ltd

12.3.8.1. Company Overview

12.3.8.2. Sales Area/Geographical Presence

12.3.8.3. Financial/Revenue

12.3.8.4. Strategy & Business Overview

12.3.8.5. Sales Channel Analysis

12.3.8.6. Size Portfolio

12.3.9. VAC-U-MAX

12.3.9.1. Company Overview

12.3.9.2. Sales Area/Geographical Presence

12.3.9.3. Financial/Revenue

12.3.9.4. Strategy & Business Overview

12.3.9.5. Sales Channel Analysis

12.3.9.6. Size Portfolio

12.3.10. Vecoplan LLC

12.3.10.1. Company Overview

12.3.10.2. Sales Area/Geographical Presence

12.3.10.3. Financial/Revenue

12.3.10.4. Strategy & Business Overview

12.3.10.5. Sales Channel Analysis

12.3.10.6. Size Portfolio

12.3.11. WAMGROUP S.p.A.

12.3.11.1. Company Overview

12.3.11.2. Sales Area/Geographical Presence

12.3.11.3. Financial/Revenue

12.3.11.4. Strategy & Business Overview

12.3.11.5. Sales Channel Analysis

12.3.11.6. Size Portfolio

13. Key Takeaway

13.1. Identification of Potential Market Spaces

13.1.1. Type

13.1.2. Capacity

13.1.3. End-use

13.1.4. Country

13.2. Understanding the Buying Process of the Customers

13.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Screw Conveyor Market, By Type, Thousand Units, 2017-2031

Table 2: North America Screw Conveyor Market, By Type, US$ Mn, 2017-2031

Table 3: North America Screw Conveyor Market, By Capacity, Thousand Units, 2017-2031

Table 4: North America Screw Conveyor Market, By Capacity US$ Mn, 2017-2031

Table 5: North America Screw Conveyor Market, By End-use, Thousand Units, 2017-2031

Table 6: North America Screw Conveyor Market, By End-use, US$ Mn, 2017-2031

Table 7: North America Screw Conveyor Market, By Country, Thousand Units, 2017-2031

Table 8: North America Screw Conveyor Market, By Country, US$ Mn, 2017-2031

Table 9: U.S. Screw Conveyor Market, By Type, Thousand Units, 2017-2031

Table 10: U.S. Screw Conveyor Market, By Type, US$ Mn, 2017-2031

Table 11: U.S. Screw Conveyor Market, By Capacity, Thousand Units, 2017-2031

Table 12: U.S. Screw Conveyor Market, By Capacity US$ Mn, 2017-2031

Table 13: U.S. Screw Conveyor Market, By End-use, Thousand Units, 2017-2031

Table 14: U.S. Screw Conveyor Market, By End-use, US$ Mn, 2017-2031

Table 15: Canada Screw Conveyor Market, By Type, Thousand Units, 2017-2031

Table 16: Canada Screw Conveyor Market, By Type, US$ Mn, 2017-2031

Table 17: Canada Screw Conveyor Market, By Capacity, Thousand Units, 2017-2031

Table 18: Canada Screw Conveyor Market, By Capacity US$ Mn, 2017-2031

Table 19: Canada Screw Conveyor Market, By End-use, Thousand Units, 2017-2031

Table 20: Canada Screw Conveyor Market, By End-use, US$ Mn, 2017-2031

List of Figures

Figure 1: North America Screw Conveyor Market, By Type, Thousand Units, 2017-2031

Figure 2: North America Screw Conveyor Market, By Type, US$ Mn, 2017-2031

Figure 3: North America Screw Conveyor Market Incremental Opportunity, By Type, US$ Mn, 2022-2031

Figure 4: North America Screw Conveyor Market, By Capacity, Thousand Units, 2017-2031

Figure 5: North America Screw Conveyor Market, By Capacity US$ Mn, 2017-2031

Figure 6: North America Screw Conveyor Market Incremental Opportunity, By Capacity US$ Mn, 2022-2031

Figure 7: North America Screw Conveyor Market, By End-use, Thousand Units, 2017-2031

Figure 8: North America Screw Conveyor Market, By End-use, US$ Mn, 2017-2031

Figure 9: North America Screw Conveyor Market Incremental Opportunity, By End-use, US$ Mn, 2022-2031

Figure 10: North America Screw Conveyor Market, By Country, Thousand Units, 2017-2031

Figure 11: North America Screw Conveyor Market, By Country, US$ Mn, 2017-2031

Figure 12: North America Screw Conveyor Market Incremental Opportunity, By Country, US$ Mn, 2022-2031

Figure 13: U.S. Screw Conveyor Market, By Type, Thousand Units, 2017-2031

Figure 14: U.S. Screw Conveyor Market, By Type, US$ Mn, 2017-2031

Figure 15: U.S. Screw Conveyor Market Incremental Opportunity, By Type, US$ Mn, 2022-2031

Figure 16: U.S. Screw Conveyor Market, By Capacity, Thousand Units, 2017-2031

Figure 17: U.S. Screw Conveyor Market, By Capacity US$ Mn, 2017-2031

Figure 18: U.S. Screw Conveyor Market Incremental Opportunity, By Capacity US$ Mn, 2022-2031

Figure 19: U.S. Screw Conveyor Market, By End-use, Thousand Units, 2017-2031

Figure 20: U.S. Screw Conveyor Market, By End-use, US$ Mn, 2017-2031

Figure 21: U.S. Screw Conveyor Market Incremental Opportunity, By End-use, US$ Mn, 2022-2031

Figure 22: Canada Screw Conveyor Market, By Type, Thousand Units, 2017-2031

Figure 23: Canada Screw Conveyor Market, By Type, US$ Mn, 2017-2031

Figure 24: Canada Screw Conveyor Market Incremental Opportunity, By Type, US$ Mn, 2022-2031

Figure 25: Canada Screw Conveyor Market, By Capacity, Thousand Units, 2017-2031

Figure 26: Canada Screw Conveyor Market, By Capacity US$ Mn, 2017-2031

Figure 27: Canada Screw Conveyor Market Incremental Opportunity, By Capacity US$ Mn, 2022-2031

Figure 28: Canada Screw Conveyor Market, By End-use, Thousand Units, 2017-2031

Figure 29: Canada Screw Conveyor Market, By End-use, US$ Mn, 2017-2031

Figure 30: Canada Screw Conveyor Market Incremental Opportunity, By End-use, US$ Mn, 2022-2031