Reports

Reports

Analysts’ Viewpoint on Market Scenario

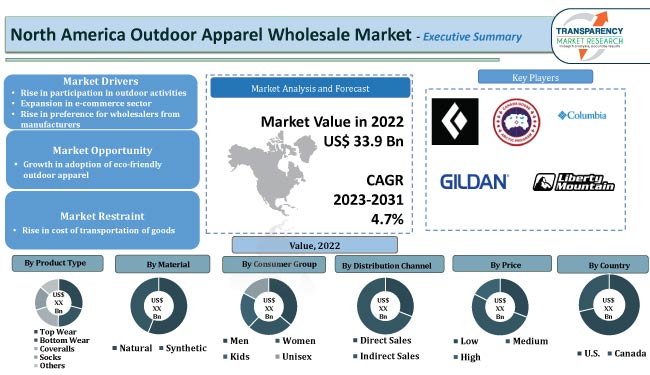

Rise in health awareness worldwide has led to surge in participation in outdoor activities. This is expected to propel the North America outdoor apparel wholesale market size in the near future. Growth in the tourism sector is also boosting market expansion.

Growth in adoption of eco-friendly outdoor apparel is likely to offer lucrative opportunities for vendors in the North America outdoor apparel wholesale industry. Vendors are establishing new distribution centers to broaden their regional presence. They are also investing in online distribution channels to increase their North America outdoor apparel wholesale market share.

The outdoor apparel wholesale industry refers to the selling of outdoor wear, such as top wear, bottom wear, coverall, and socks, through wholesalers. The market also includes different outdoor wear used during hiking, skiing, camping, and mountaineering. Several outdoor apparel manufacturers are increasingly preferring wholesalers due to their expertise in regional markets.

Outdoor apparel are constructed using durable materials that can withstand rugged environments, rough terrains, and repetitive use. They are often designed to be water-resistant, windproof, and breathable, ensuring protection from the elements, while allowing moisture and sweat to escape.

Individuals participating in outdoor activities, such as running, jogging, hiking, and bicycling, are increasingly preferring technically advanced and novel products. According to the U.S. Bureau of Economic Analysis (BEA), the outdoor recreation economy generated a record US$ 682 Bn in economic output and 1.9% of total GDP in the U.S. in 2021.

Furthermore, as per the Outdoor Industry Association, in 2021, 164.2 million people in the U.S., or 54% of Americans aged 6 and up, participated in outdoor recreation at least once. Participation rates are rising across demographics, with encouraging indicators for children, females of all ages, and men overall. Thus, increase in participation in outdoor activities, changes in lifestyles, and surge in disposable income are driving the North America outdoor apparel wholesale market value.

Significant growth of the e-commerce industry is anticipated to have a positive contribution to the North America outdoor apparel wholesale market growth. This can be ascribed to the e-commerce industry’s ability to reach out to a wider range of consumers, which is resulting in a surge in the placement of outdoor apparel products on online distribution channels among wholesalers.

Several outdoor apparel businesses are partnering with wholesalers to assist in boosting their sales. For instance, as per the 2022 annual report of Columbia Sportswear, the company's 53.9% of sales come from its wholesalers. This indicates that manufacturers are increasingly dependent on wholesalers for the growth of their business.

According to the latest North America outdoor apparel wholesale market trends, the top wear product type segment is anticipated to dominate the industry during the forecast period. This can be ascribed to the availability of a wider range of top-wear products in different styles and designs in comparison with other types of products.

On the other hand, bottom wear, coveralls, socks, and others (gloves, neck warmers, etc.) segments are anticipated to grow at a steady pace in the near future. Vendors are carrying out attractive marketing campaigns such as discounts, rewards, and loyal programs to draw and retain more consumers in these segments.

According to the latest North America outdoor apparel wholesale market forecast, the U.S. is projected to hold largest share from 2023 to 2031. Rise in participation in outdoor sports and high purchasing power of consumers are driving market dynamics in the country.

The industry in Canada and the Rest of North American countries is anticipated to grow at a steady pace in the near future. Surge in health awareness and growth in participation in various physical activities, such as hiking, jogging, and stretching, are fueling market statistics in these countries.

Several wholesalers and B2B vendors are moving online. They are offering huge volumes at discounted or competitive pricing, dedicated customer assistance, and approval workflows to make purchasing simple and cost-effective. B2B e-commerce companies are incorporating additional functionality onto their sites such as quote management, pricing negotiation, easy ordering, and inventory management.

They are providing free shipping and freight for orders over a certain amount, chatbots, focus on customer journey mapping, omnichannel communication strategies, and a greater emphasis on customer feedback. Big data is also being used by businesses to provide a more personalized client experience. Businesses are utilizing digital marketing, sponsored ads, or social media for growth.

Black Diamond Equipment, Ltd., Canada Goose Inc., Columbia Sportswear Company, Gildan Activewear S.R.L., Liberty Mountain, Marmot Mountain, LLC, Mountain Hardwear, Outdoor Research, Patagonia, Inc., and Wordans are major players operating in this industry.

Key players have been profiled in the North America outdoor apparel wholesale market report based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 33.9 Bn |

|

Market Forecast Value in 2031 |

US$ 51.1 Bn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 33.9 Bn in 2022

It is estimated to be 4.7% from 2023 to 2031

Rise in participation in outdoor activities along with expansion in e-commerce sector and rise in preference for wholesalers from manufacturers

The top wear product type segment is expected to hold largest share during the forecast period

The U.S. is expected to record the highest demand during the forecast period

Black Diamond Equipment, Ltd., Canada Goose Inc., Columbia Sportswear Company, Gildan Activewear S.R.L., Liberty Mountain, Marmot Mountain, LLC, Mountain Hardwear, Outdoor Research, Patagonia, Inc., and Wordans

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Raw Material Analysis

5.8. COVID-19 Impact Analysis

5.9. North America Outdoor Apparel Wholesale Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Million Units)

6. North America Outdoor Apparel Wholesale Market Analysis and Forecast, by Product Type

6.1. North America Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Product Type, 2017 - 2031

6.1.1. Top Wear

6.1.1.1. Shirts

6.1.1.2. T-shirts

6.1.1.3. Jackets & Hoodies

6.1.1.4. Blazers & Coats

6.1.1.5. Others (Sweaters, Tunics, etc.)

6.1.2. Bottom Wear

6.1.2.1. Trousers

6.1.2.2. Jeans

6.1.2.3. Shorts

6.1.2.4. Leggings & Tights

6.1.2.5. Others (Skirts, etc.)

6.1.3. Coveralls

6.1.4. Socks

6.1.5. Others (Gloves, Neck Warmers, etc.)

6.2. Incremental Opportunity, by Product Type

7. North America Outdoor Apparel Wholesale Market Analysis and Forecast, by Material

7.1. North America Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Material, 2017 - 2031

7.1.1. Natural

7.1.1.1. Cotton

7.1.1.2. Wool

7.1.1.3. Leather

7.1.1.4. Others (Silk, etc.)

7.1.2. Synthetic

7.1.2.1. Nylon

7.1.2.2. Polyester

7.1.2.3. Others (Rayon, etc.)

7.2. Incremental Opportunity, by Material

8. North America Outdoor Apparel Wholesale Market Analysis and Forecast, by Consumer Group

8.1. North America Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Consumer Group, 2017 - 2031

8.1.1. Men

8.1.2. Women

8.1.3. Kids

8.1.4. Unisex

8.2. Incremental Opportunity, by Consumer Group

9. North America Outdoor Apparel Wholesale Market Analysis and Forecast, by Price

9.1. North America Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, by Price

10. North America Outdoor Apparel Wholesale Market Analysis and Forecast, by Distribution Channel

10.1. North America Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Distribution Channel, 2017 -2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. North America Outdoor Apparel Wholesale Market Analysis and Forecast, by Country

11.1. North America Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Country, 2017 - 2031

11.1.1. U.S.

11.1.2. Canada

11.1.3. Rest of North America

11.2. Incremental Opportunity, by Country

12. U.S. Outdoor Apparel Wholesale Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Trend Analysis

12.2.1. Demand Side

12.2.2. Supply Side

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Product Type, 2017 - 2031

12.5.1. Top Wear

12.5.1.1. Shirts

12.5.1.2. T-shirts

12.5.1.3. Jackets & Hoodies

12.5.1.4. Blazers & Coats

12.5.1.5. Others (Sweaters, Tunics, etc.)

12.5.2. Bottom Wear

12.5.2.1. Trousers

12.5.2.2. Jeans

12.5.2.3. Shorts

12.5.2.4. Leggings & Tights

12.5.2.5. Others (Skirts, etc.)

12.5.3. Coveralls

12.5.4. Socks

12.5.5. Others (Gloves, Neck Warmers, etc.)

12.6. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Material, 2017 - 2031

12.6.1. Natural

12.6.1.1. Cotton

12.6.1.2. Wool

12.6.1.3. Leather

12.6.1.4. Others (Silk, etc.)

12.6.2. Synthetic

12.6.2.1. Nylon

12.6.2.2. Polyester

12.6.2.3. Others (Rayon, etc.)

12.7. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Consumer Group, 2017 - 2031

12.7.1. Men

12.7.2. Women

12.7.3. Kids

12.7.4. Unisex

12.8. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Price, 2017 - 2031

12.8.1. Low

12.8.2. Medium

12.8.3. High

12.9. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Incremental Opportunity Analysis

13. Canada Outdoor Apparel Wholesale Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Trend Analysis

13.2.1. Demand Side

13.2.2. Supply Side

13.3. Key Supplier Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Outdoor Apparel Wholesale Market Size US$ Bn and Million Units) Forecast, by Product Type, 2017 - 2031

13.5.1. Top Wear

13.5.1.1. Shirts

13.5.1.2. T-shirts

13.5.1.3. Jackets & Hoodies

13.5.1.4. Blazers & Coats

13.5.1.5. Others (Sweaters, Tunics, etc.)

13.5.2. Bottom Wear

13.5.2.1. Trousers

13.5.2.2. Jeans

13.5.2.3. Shorts

13.5.2.4. Leggings & Tights

13.5.2.5. Others (Skirts, etc.)

13.5.3. Coveralls

13.5.4. Socks

13.5.5. Others (Gloves, Neck Warmers, etc.)

13.6. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Material, 2017 - 2031

13.6.1. Natural

13.6.1.1. Cotton

13.6.1.2. Wool

13.6.1.3. Leather

13.6.1.4. Others (Silk, etc.)

13.6.2. Synthetic

13.6.2.1. Nylon

13.6.2.2. Polyester

13.6.2.3. Others (Rayon, etc.)

13.7. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Consumer Group, 2017 - 2031

13.7.1. Men

13.7.2. Women

13.7.3. Kids

13.7.4. Unisex

13.8. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Price, 2017 - 2031

13.8.1. Low

13.8.2. Medium

13.8.3. High

13.9. Outdoor Apparel Wholesale Market Size (US$ Bn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player - Competition Dashboard

14.2. Market Share Analysis-2022 (%)

14.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

14.3.1. Black Diamond Equipment, Ltd.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Financial/Revenue (Segmental Revenue)

14.3.1.4. Strategy & Business Overview

14.3.1.5. Sales Channel Analysis

14.3.1.6. Product Portfolio & Pricing

14.3.2. Canada Goose Inc.

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Financial/Revenue (Segmental Revenue)

14.3.2.4. Strategy & Business Overview

14.3.2.5. Sales Channel Analysis

14.3.2.6. Product Portfolio & Pricing

14.3.3. Columbia Sportswear Company

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Financial/Revenue (Segmental Revenue)

14.3.3.4. Strategy & Business Overview

14.3.3.5. Sales Channel Analysis

14.3.3.6. Product Portfolio & Pricing

14.3.4. Gildan Activewear S.R.L.

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Financial/Revenue (Segmental Revenue)

14.3.4.4. Strategy & Business Overview

14.3.4.5. Sales Channel Analysis

14.3.4.6. Product Portfolio & Pricing

14.3.5. Liberty Mountain

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Financial/Revenue (Segmental Revenue)

14.3.5.4. Strategy & Business Overview

14.3.5.5. Sales Channel Analysis

14.3.5.6. Product Portfolio & Pricing

14.3.6. Marmot Mountain, LLC

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Financial/Revenue (Segmental Revenue)

14.3.6.4. Strategy & Business Overview

14.3.6.5. Sales Channel Analysis

14.3.6.6. Product Portfolio & Pricing

14.3.7. Mountain Hardwear

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Financial/Revenue (Segmental Revenue)

14.3.7.4. Strategy & Business Overview

14.3.7.5. Sales Channel Analysis

14.3.7.6. Product Portfolio & Pricing

14.3.8. Outdoor Research

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Financial/Revenue (Segmental Revenue)

14.3.8.4. Strategy & Business Overview

14.3.8.5. Sales Channel Analysis

14.3.8.6. Product Portfolio & Pricing

14.3.9. Patagonia, Inc.

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Financial/Revenue (Segmental Revenue)

14.3.9.4. Strategy & Business Overview

14.3.9.5. Sales Channel Analysis

14.3.9.6. Product Portfolio & Pricing

14.3.10. Wordans

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Financial/Revenue (Segmental Revenue)

14.3.10.4. Strategy & Business Overview

14.3.10.5. Sales Channel Analysis

14.3.10.6. Product Portfolio & Pricing

14.3.11. Other Key Players

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Financial/Revenue (Segmental Revenue)

14.3.11.4. Strategy & Business Overview

14.3.11.5. Sales Channel Analysis

14.3.11.6. Product Portfolio & Pricing

15. Go To Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Outdoor Apparel Wholesale Market, by Product Type, Million Units, 2017-2031

Table 2: North America Outdoor Apparel Wholesale Market, by Product Type, US$ Bn, 2017-2031

Table 3: North America Outdoor Apparel Wholesale Market, by Material, Million Units, 2017-2031

Table 4: North America Outdoor Apparel Wholesale Market, by Material, US$ Bn, 2017-2031

Table 5: North America Outdoor Apparel Wholesale Market, by Consumer Group, Million Units, 2017-2031

Table 6: North America Outdoor Apparel Wholesale Market, by Consumer Group, US$ Bn, 2017-2031

Table 7: North America Outdoor Apparel Wholesale Market, by Price, Million Units, 2017-2031

Table 8: North America Outdoor Apparel Wholesale Market, by Price, US$ Bn, 2017-2031

Table 9: North America Outdoor Apparel Wholesale Market, by Distribution Channel, Million Units, 2017-2031

Table 10: North America Outdoor Apparel Wholesale Market, by Distribution Channel, US$ Bn, 2017-2031

Table 11: North America Outdoor Apparel Wholesale Market, by Country, Million Units, 2017-2031

Table 12: North America Outdoor Apparel Wholesale Market, by Country, US$ Bn, 2017-2031

Table 13: U.S. Outdoor Apparel Wholesale Market, by Product Type, Million Units, 2017-2031

Table 14: U.S. Outdoor Apparel Wholesale Market, by Product Type, US$ Bn, 2017-2031

Table 15: U.S. Outdoor Apparel Wholesale Market, by Material, Million Units, 2017-2031

Table 16: U.S. Outdoor Apparel Wholesale Market, by Material, US$ Bn, 2017-2031

Table 17: U.S. Outdoor Apparel Wholesale Market, by Consumer Group, Million Units, 2017-2031

Table 18: U.S. Outdoor Apparel Wholesale Market, by Consumer Group, US$ Bn, 2017-2031

Table 19: U.S. Outdoor Apparel Wholesale Market, by Price, Million Units, 2017-2031

Table 20: U.S. Outdoor Apparel Wholesale Market, by Price, US$ Bn, 2017-2031

Table 21: U.S. Outdoor Apparel Wholesale Market, by Distribution Channel, Million Units, 2017-2031

Table 22: U.S. Outdoor Apparel Wholesale Market, by Distribution Channel, US$ Bn, 2017-2031

Table 23: Canada Outdoor Apparel Wholesale Market, by Product Type, Million Units, 2017-2031

Table 24: Canada Outdoor Apparel Wholesale Market, by Product Type, US$ Bn, 2017-2031

Table 25: Canada Outdoor Apparel Wholesale Market, by Material, Million Units, 2017-2031

Table 26: Canada Outdoor Apparel Wholesale Market, by Material, US$ Bn, 2017-2031

Table 27: Canada Outdoor Apparel Wholesale Market, by Consumer Group, Million Units, 2017-2031

Table 28: Canada Outdoor Apparel Wholesale Market, by Consumer Group, US$ Bn, 2017-2031

Table 29: Canada Outdoor Apparel Wholesale Market, by Price, Million Units, 2017-2031

Table 30: Canada Outdoor Apparel Wholesale Market, by Price, US$ Bn, 2017-2031

Table 31: Canada Outdoor Apparel Wholesale Market, by Distribution Channel, Million Units, 2017-2031

Table 32: Canada Outdoor Apparel Wholesale Market, by Distribution Channel, US$ Bn, 2017-2031

List of Figures

Figure 1: North America Outdoor Apparel Wholesale Market, by Product Type, Million Units, 2017-2031

Figure 2: North America Outdoor Apparel Wholesale Market, by Product Type, US$ Bn, 2017-2031

Figure 3: North America Outdoor Apparel Wholesale Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 4: North America Outdoor Apparel Wholesale Market, by Material, Million Units, 2017-2031

Figure 5: North America Outdoor Apparel Wholesale Market, by Material, US$ Bn, 2017-2031

Figure 6: North America Outdoor Apparel Wholesale Market Incremental Opportunity, by Material, US$ Bn, 2017-2031

Figure 7: North America Outdoor Apparel Wholesale Market, by Consumer Group, Million Units, 2017-2031

Figure 8: North America Outdoor Apparel Wholesale Market, by Consumer Group, US$ Bn, 2017-2031

Figure 9: North America Outdoor Apparel Wholesale Market Incremental Opportunity, by Consumer Group, US$ Bn, 2017-2031

Figure 10: North America Outdoor Apparel Wholesale Market, by Price, Million Units, 2017-2031

Figure 11: North America Outdoor Apparel Wholesale Market, by Price, US$ Bn, 2017-2031

Figure 12: North America Outdoor Apparel Wholesale Market Incremental Opportunity, by Price, US$ Bn, 2017-2031

Figure 13: North America Outdoor Apparel Wholesale Market, by Distribution Channel, Million Units, 2017-2031

Figure 14: North America Outdoor Apparel Wholesale Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 15: North America Outdoor Apparel Wholesale Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 16: North America Outdoor Apparel Wholesale Market, by Country, Million Units, 2017-2031

Figure 17: North America Outdoor Apparel Wholesale Market, by Country, US$ Bn, 2017-2031

Figure 18: North America Outdoor Apparel Wholesale Market Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 19: U.S. Outdoor Apparel Wholesale Market, by Product Type, Million Units, 2017-2031

Figure 20: U.S. Outdoor Apparel Wholesale Market, by Product Type, US$ Bn, 2017-2031

Figure 21: U.S. Outdoor Apparel Wholesale Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 22: U.S. Outdoor Apparel Wholesale Market, by Material, Million Units, 2017-2031

Figure 23: U.S. Outdoor Apparel Wholesale Market, by Material, US$ Bn, 2017-2031

Figure 24: U.S. Outdoor Apparel Wholesale Market Incremental Opportunity, by Material, US$ Bn, 2017-2031

Figure 25: U.S. Outdoor Apparel Wholesale Market, by Consumer Group, Million Units, 2017-2031

Figure 26: U.S. Outdoor Apparel Wholesale Market, by Consumer Group, US$ Bn, 2017-2031

Figure 27: U.S. Outdoor Apparel Wholesale Market Incremental Opportunity, by Consumer Group, US$ Bn, 2017-2031

Figure 28: U.S. Outdoor Apparel Wholesale Market, by Price, Million Units, 2017-2031

Figure 29: U.S. Outdoor Apparel Wholesale Market, by Price, US$ Bn, 2017-2031

Figure 30: U.S. Outdoor Apparel Wholesale Market Incremental Opportunity, by Price, US$ Bn, 2017-2031

Figure 31: U.S. Outdoor Apparel Wholesale Market, by Distribution Channel, Million Units, 2017-2031

Figure 32: U.S. Outdoor Apparel Wholesale Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 33: U.S. Outdoor Apparel Wholesale Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 34: Canada Outdoor Apparel Wholesale Market, by Product Type, Million Units, 2017-2031

Figure 35: Canada Outdoor Apparel Wholesale Market, by Product Type, US$ Bn, 2017-2031

Figure 36: Canada Outdoor Apparel Wholesale Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 37: Canada Outdoor Apparel Wholesale Market, by Material, Million Units, 2017-2031

Figure 38: Canada Outdoor Apparel Wholesale Market, by Material, US$ Bn, 2017-2031

Figure 39: Canada Outdoor Apparel Wholesale Market Incremental Opportunity, by Material, US$ Bn, 2017-2031

Figure 40: Canada Outdoor Apparel Wholesale Market, by Consumer Group, Million Units, 2017-2031

Figure 41: Canada Outdoor Apparel Wholesale Market, by Consumer Group, US$ Bn, 2017-2031

Figure 42: Canada Outdoor Apparel Wholesale Market Incremental Opportunity, by Consumer Group, US$ Bn, 2017-2031

Figure 43: Canada Outdoor Apparel Wholesale Market, by Price, Million Units, 2017-2031

Figure 44: Canada Outdoor Apparel Wholesale Market, by Price, US$ Bn, 2017-2031

Figure 45: Canada Outdoor Apparel Wholesale Market Incremental Opportunity, by Price, US$ Bn, 2017-2031

Figure 46: Canada Outdoor Apparel Wholesale Market, by Distribution Channel, Million Units, 2017-2031

Figure 47: Canada Outdoor Apparel Wholesale Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 48: Canada Outdoor Apparel Wholesale Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031