Reports

Reports

Analysts’ Viewpoint

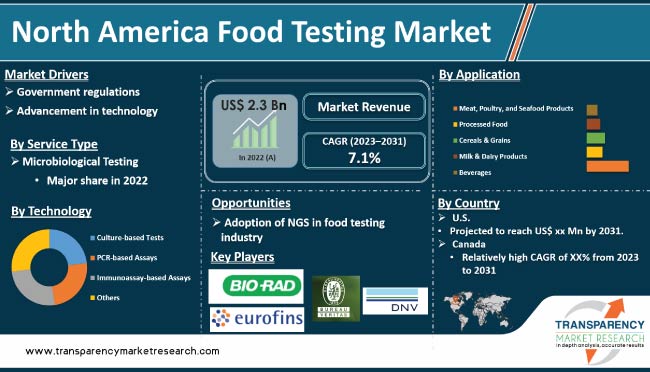

The food testing market in North America is driven by increase in concerns over food safety & quality and rise in awareness among consumers about the importance of food testing. Increase in importance of nutrition, surge in prevalence of chronic diseases, favorable regulatory environment, and rise in international trade are the other factors propelling market expansion. Furthermore, stringent regulations & standards implemented by countries in the region are expected to bolster market development.

Development of technologically advanced, accurate, and cost-efficient food testing equipment offers lucrative opportunities for manufacturers in the industry. Leading players are focusing on offering a range of food testing services, including microbiological testing, chemical analysis, and nutritional labeling.

Food testing refers to the process of analyzing and evaluating food products to ensure that they are safe, nutritious, and meet regulatory requirements. Food testing can be conducted at various stages of the food supply chain, including production, processing, distribution, and consumption. Food testing involves a range of techniques and methods such as physical, chemical, microbiological, and sensory analysis. Physical tests could examine the appearance, texture, and size of food products. Chemical analysis includes testing for contaminants, additives, and nutritional content. Microbiological testing could be used to detect harmful pathogens, while sensory analysis involves evaluating the taste, aroma, and texture of food products.

Food testing is an important aspect of food safety and quality assurance. It helps to identify potential hazards and risks associated with food products, and ensures that they meet industry and regulatory standards. Food testing is conducted by food manufacturers, regulatory agencies, and independent testing laboratories.

Government regulations are projected to augment the market in the region during the forecast period. Regulations can influence the availability, cost, and demand for products, which could affect the behavior of both producers and consumers.

Regulations on food safety and labeling could affect the availability and demand for certain foods. If regulations mandate more stringent labeling for certain food products, consumers may be more likely to purchase products that meet those requirements. This could lead to increase in demand for those products, which can affect the behavior of food producers.

Advancements in technology is likely to have a significant effect on the market. Technological advancements could lead to development of new food products or improvement in existing ones, increase in efficiency & productivity, and lower costs. Technology can also change the way consumers behave, as they are more likely to adopt new products or services. Development of the Internet and e-commerce technology has led to the creation of the online shopping market. Consumers can now shop from the comfort of their own homes and have food products delivered directly to them.

In terms of service type, the microbiological testing segment dominated the market in the region in 2022. Microbiological testing focuses on the analysis and detection of microorganisms, such as bacteria, viruses, and fungi, in food products. It is important for ensuring the safety and quality of food products, as some microorganisms could cause illness and spoilage.

Microbiological testing involves the usage of techniques such as culturing, polymerase chain reaction (PCR), and enzyme-linked immunosorbent assay (ELISA) to detect and quantify microorganisms in food samples. These can be taken from various stages of the food supply chain, including raw materials, processing equipment, and finished products.

Based on technology, the PCR-based assays segment accounted for major share of the market in North America in 2022. PCR-based assays refer to techniques that use polymerase chain reaction (PCR) to amplify specific DNA sequences in a sample. It is a powerful technique that allows for the amplification of a specific DNA fragment from a complex mixture of DNA. PCR-based assays are widely used in research, clinical diagnostics, and other applications.

In terms of application, the meat, poultry, and seafood products segment dominated the market in the region, with largest share in 2022. Testing for meat, poultry, and seafood products is important to ensure the safety and quality of these products for consumption. Samples of these products are collected and tested to determine the presence or absence of harmful bacteria. Chemical testing is used to detect the presence of harmful chemicals such as antibiotics, hormones, and heavy metals in meat, poultry, and seafood products. These chemicals could have negative health effects if consumed in large quantities. Furthermore, nutritional testing is used to determine the nutritional content of meat, poultry, and seafood products. This information can be used to help consumers make informed choices about their food.

The U.S. accounted for major share of the food testing market in North America in 2022. The market in the country is likely to expand at a high CAGR from 2023 to 2031. The food industry across the country continues to face new challenges and regulations. Hence, demand for reliable and accurate microbiological testing methods is expected to increase, thereby creating new opportunities in the food microbiological testing market. The microbiological testing segment offers significant opportunities for players owing to increase in demand for safe and high-quality food products.

The food testing market in Canada is driven by surge in food safety regulations, rise in demand for high quality food products, and adoption of advanced technologies. The food testing market in the country is propelled by increase in incidence of foodborne illnesses. The Canadian Food Inspection Agency (CFIA) estimates that nearly 4 million cases of foodborne illness are reported in the country each year, leading to significant health and economic costs. Hence, the food industry is focused on ensuring that food products are free from harmful contaminants such as bacteria, viruses, and toxins.

The food testing market in North America is consolidated, with the presence of small number of large companies. Majority of the players are investing significantly in research & development, primarily to develop environmentally friendly products. Expansion of product portfolio and merger & acquisition are the key strategies adopted by the leading players. Prominent players in the food testing market in North America are ALS Limited, AsureQuality, Bio-Rad Laboratories, Inc., Bureau Veritas SA, DNV GL, Eurofins Scientific, Intertek Group plc, Laboratory Corporation of America Holdings, SGS Société Générale de Surveillance SA, and TÜV SÜD.

Each of these players has been profiled in the food testing market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size Value in 2022 |

US$ 2.3 Bn |

|

Forecast (Value) in 2031 |

US$ 4.3 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry in the region was valued at US$ 2.3 Bn in 2022

It is projected to reach more than US$ 4.3 Bn by 2031

The CAGR is anticipated to be 7.1% from 2023 to 2031.

Government regulations and advancement in technology are driving the food testing market in the region.

The U.S. is expected to account for the largest share during the forecast period.

ALS Limited, AsureQuality, Bio-Rad Laboratories, Inc., Bureau Veritas SA, DNV GL, Eurofins Scientific, Intertek Group plc, Laboratory Corporation of America Holdings, SGS Société Générale de Surveillance SA, and TÜV SÜD are the prominent players in the food testing market in North America.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: North America Food Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. North America Food Testing Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario

5.3. List of High Profile Food Scares

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. North America Food Testing Market Analysis and Forecast, by Service Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Service Type, 2017–2031

6.3.1. Microbiological Testing

6.3.2. GMO Testing

6.3.3. Chemical & Nutritional Testing

6.3.4. Residues & Contamination Testing

6.3.5. Allergen Testing

6.3.6. Others

6.4. Market Attractiveness Analysis, by Service Type

7. North America Food Testing Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Culture-based Tests

7.3.2. PCR-based Assays

7.3.3. Immunoassay-based Assays

7.3.4. Others

7.4. Market Attractiveness Analysis, by Technology

8. North America Food Testing Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Meat, Poultry, and Seafood Products

8.3.2. Processed Food

8.3.3. Cereals & Grains

8.3.4. Milk & Dairy Products

8.3.5. Beverages

8.4. Market Attractiveness Analysis, by Application

9. North America Food Testing Market Analysis and Forecast, by Country

9.1. Key Findings

9.2. Market Value Forecast, by Country

9.2.1. U.S.

9.2.2. Canada

9.3. Market Attractiveness Analysis, by Country

10. U.S. Food Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Service Type, 2017–2031

10.2.1. Microbiological Testing

10.2.2. GMO Testing

10.2.3. Chemical & Nutritional Testing

10.2.4. Residues & Contamination Testing

10.2.5. Allergen Testing

10.2.6. Others

10.3. Market Value Forecast, by Technology, 2017–2031

10.3.1. Culture-based Tests

10.3.2. PCR-based Assays

10.3.3. Immunoassay-based Assays

10.3.4. Others

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Meat, Poultry, and Seafood Products

10.4.2. Processed Food

10.4.3. Cereals & Grains

10.4.4. Milk & Dairy Products

10.4.5. Beverages

10.5. Market Attractiveness Analysis

10.5.1. By Service Type

10.5.2. By Application

10.5.3. By Technology

11. Canada Food Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Service Type, 2017–2031

11.2.1. Microbiological Testing

11.2.2. GMO Testing

11.2.3. Chemical & Nutritional Testing

11.2.4. Residues & Contamination Testing

11.2.5. Allergen Testing

11.2.6. Others

11.3. Market Value Forecast, by Technology, 2017–2031

11.3.1. Culture-based Tests

11.3.2. PCR-based Assays

11.3.3. Immunoassay-based Assays

11.3.4. Others

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Meat, Poultry, and Seafood Products

11.4.2. Processed Food

11.4.3. Cereals & Grains

11.4.4. Milk & Dairy Products

11.4.5. Beverages

11.5. Market Attractiveness Analysis

11.5.1. By Service Type

11.5.2. By Application

11.5.3. By Technology

12. Competition Landscape

12.1. Market Player - Competition Matrix (by tier and size of companies)

12.2. Market Share Analysis, by Company, 2022

12.3. Company Profiles

12.3.1. Eurofins Scientific

12.3.1.1. Company Overview

12.3.1.2. Product Portfolio

12.3.1.3. SWOT Analysis

12.3.1.4. Strategic Overview

12.3.2. Intertek Group plc

12.3.2.1. Company Overview

12.3.2.2. Product Portfolio

12.3.2.3. SWOT Analysis

12.3.2.4. Strategic Overview

12.3.3. SGS Société Générale de Surveillance SA

12.3.3.1. Company Overview

12.3.3.2. Product Portfolio

12.3.3.3. SWOT Analysis

12.3.3.4. Strategic Overview

12.3.4. ALS Limited

12.3.4.1. Company Overview

12.3.4.2. Product Portfolio

12.3.4.3. SWOT Analysis

12.3.4.4. Strategic Overview

12.3.5. AsureQuality

12.3.5.1. Company Overview

12.3.5.2. Product Portfolio

12.3.5.3. SWOT Analysis

12.3.5.4. Strategic Overview

12.3.6. Bio-Rad Laboratories, Inc.

12.3.6.1. Company Overview

12.3.6.2. Product Portfolio

12.3.6.3. SWOT Analysis

12.3.6.4. Strategic Overview

12.3.7. Bureau Veritas SA

12.3.7.1. Company Overview

12.3.7.2. Product Portfolio

12.3.7.3. SWOT Analysis

12.3.7.4. Strategic Overview

12.3.8. DNV GL

12.3.8.1. Company Overview

12.3.8.2. Product Portfolio

12.3.8.3. SWOT Analysis

12.3.8.4. Strategic Overview

12.3.9. Laboratory Corporation of America Holdings

12.3.9.1. Company Overview

12.3.9.2. Product Portfolio

12.3.9.3. SWOT Analysis

12.3.9.4. Strategic Overview

12.3.10. TÜV SÜD

12.3.10.1. Company Overview

12.3.10.2. Product Portfolio

12.3.10.3. SWOT Analysis

12.3.10.4. Strategic Overview

List of Tables

Table 01: North America Food Testing Market Value (US$ Mn) Forecast, by Service Type, 2017–2031

Table 02: North America Food Testing Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: North America Food Testing Market Value (US$ Mn) Forecast, by Technology Type, 2017–2031

Table 04: North America Food Testing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: U.S. Food Testing Market Value (US$ Mn) Forecast, by Service Type, 2017‒2031

Table 06: U.S. Food Testing Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 07: U.S. Food Testing Market Value (US$ Mn) Forecast, by Technology Type, 2017–2031

Table 08: Canada Food Testing Market Value (US$ Mn) Forecast, by Service Type, 2017‒2031

Table 09: Canada Food Testing Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 10: Canada Food Testing Market Value (US$ Mn) Forecast, by Technology Type, 2017–2031

List of Figures

Figure 01: North America Food Testing Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 02: North America Food Testing Market Attractiveness Analysis, by Service Type, 2023–2031

Figure 03: North America Food Testing Market Revenue (US$ Mn), by Microbiological Testing, 2017–2031

Figure 04: North America Food Testing Market Revenue (US$ Mn), by GMO Testing, 2017–2031

Figure 05: North America Food Testing Market Revenue (US$ Mn), by Chemical & Nutritional Testing, 2017–2031

Figure 06: North America Food Testing Market Revenue (US$ Mn), by Residues & Contamination Testing, 2017–2031

Figure 07: North America Food Testing Market Revenue (US$ Mn), by Allergen Testing, 2017–2031

Figure 08: North America Food Testing Market Revenue (US$ Mn), by Others, 2017–2031

Figure 09: North America Food Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 10: North America Food Testing Market Attractiveness Analysis, by Application, 2023–2031

Figure 11: North America Food Testing Market Revenue (US$ Mn), by Meat, Poultry, and Seafood Products, 2017–2031

Figure 12: North America Food Testing Market Revenue (US$ Mn), by Processed Food, 2017–2031

Figure 13: North America Food Testing Market Revenue (US$ Mn), by Cereals & Grains, 2017–2031

Figure 14: North America Food Testing Market Revenue (US$ Mn), by Milk & Dairy Products, 2017–2031

Figure 15: North America Food Testing Market Revenue (US$ Mn), by Others, 2017–2031

Figure 16: North America Food Testing Market Value Share Analysis, by Technology Type, 2022 and 2031

Figure 17: North America Food Testing Market Attractiveness Analysis, by Technology Type, 2023–2031

Figure 18: North America Food Testing Market Revenue (US$ Mn), by Culture-based Tests, 2017–2031

Figure 19: North America Food Testing Market Revenue (US$ Mn), by PCR-based Assays, 2017–2031

Figure 20: North America Food Testing Market Revenue (US$ Mn), by Immunoassay-based Assays, 2017–2031

Figure 21: North America Food Testing Market Revenue (US$ Mn), by Others, 2017–2031

Figure 22: North America Food Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 23: North America Food Testing Market Attractiveness Analysis, by Country, 2023–2031

Figure 24: U.S. Food Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 25: U.S. Food Testing Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 26: U.S. Food Testing Market Attractiveness Analysis, by Service Type, 2023-2031

Figure 27: U.S. Food Testing Market Value Share Analysis, by Application, 2021 and 2031

Figure 28: U.S. Food Testing Market Attractiveness Analysis, by Application, 2022-2031

Figure 29: U.S. Food Testing Market Value Share Analysis, by Technology Type, 2022 and 2031

Figure 30: U.S. Food Testing Market Attractiveness Analysis, by Technology Type, 2023–2031

Figure 31: Canada Food Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: Canada Food Testing Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 33: Canada Food Testing Market Attractiveness Analysis, by Service Type, 2023-2031

Figure 34: Canada Food Testing Market Value Share Analysis, by Application, 2021 and 2031

Figure 35: Canada Food Testing Market Attractiveness Analysis, by Application, 2022-2031

Figure 36: Canada Food Testing Market Value Share Analysis, by Technology Type, 2022 and 2031

Figure 37: Canada Food Testing Market Attractiveness Analysis, by Technology Type, 2023–2031