Reports

Reports

Decline in In-person Office Visits Affecting Market Growth amid COVID-19 Pandemic

The COVID-19 pandemic and the associated community mitigation efforts enacted have altered the delivery of and access to healthcare across the U.S. It has been found that the emergency department (ED) visits are down by a significant percentage in many communities across the country. Such trends are affecting the growth of the North America fluoroscopy navigation technology market. Nevertheless, in-person office visits are being transformed into telehealth visits and is anticipated to revive market growth with increased healthcare utilization.

Elective procedures are being postponed indefinitely and other forms of healthcare delivery methods are being changed to accommodate social distancing & community mitigation measures. Such findings are projected to increase revenue flow in the North America fluoroscopy navigation technology market.

Smart Instruments Hold Potentials to Reduce User Interaction with Navigation Software

One of the main challenges of fluoroscopic navigation is to reduce the invasiveness of bone anchoring devices and the time to prepare & attach them. In order to take the current fluoroscopic navigation systems to the next level, dedicated application workflows are needed which guide the surgeon step by step through the application.

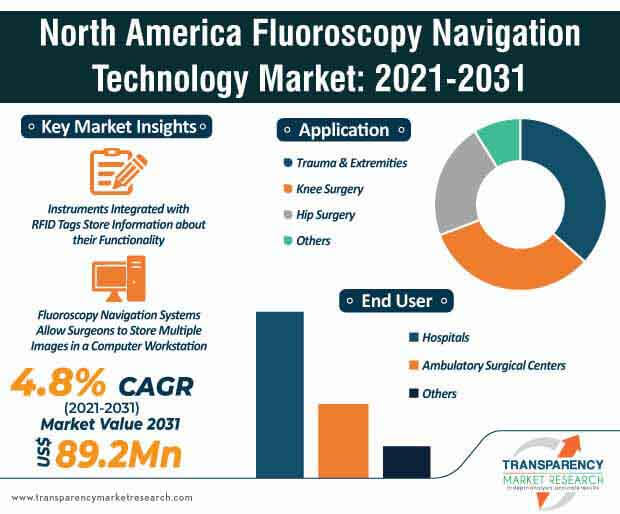

Smart instruments will eliminate the need for instrument calibration and reduce user interaction with the navigation software. Companies in the North America fluoroscopy navigation technology market are increasing R&D to innovate in instruments integrated with RFID (Radio Frequency Identification) tags, which store information about their geometry and functionality. The moment a surgeon starts using a navigated instrument, the software automatically progresses to the corresponding screen and the instrument’s geometry is loaded.

Orthopedic Trauma a Potential Impact Area for Fluoroscopy Navigation Technology

The North America fluoroscopy navigation technology market is projected to reach US$ 89.2 Mn by 2031. Computer assisted orthopedic surgery is slowly making its way into routine orthopedic practice. Such insights are creating incremental opportunities for market stakeholders since virtual fluoroscopy, also known as fluoroscopy navigation, is being publicized as a versatile technology for fracture treatment.

Orthopedic trauma has long been identified as a potential impact area for the fluoroscopy navigation technology. Fluoroscopy navigation systems allow surgeons to store multiple intraoperative fluoroscopic images in a computer workstation.

Navigation-assisted Fluoroscopy Gaining Prominence in Spinal Surgery Procedures

Minimally invasive surgery (MIS) is dependent on intraoperative fluoroscopic imaging for visualization, which drastically increases exposure to radiation. Companies in the North America fluoroscopy navigation technology market are taking advantage of this opportunity to increase the availability of navigation-assisted fluoroscopy (NAV), which helps to potentially decrease radiation exposure and improve the operating room environment by reducing the need for real-time fluoroscopy.

MIS techniques for the spine have been developed with the goal of minimizing soft-tissue trauma associated with spinal surgery. NAV is gaining prominence for spinal surgery procedures and helping to decrease dependence on conventional intraoperative fluoroscopy. NAV systems use fixed reference frame markers on the patient and specialized surgical instruments that are simultaneously captured & tracked by an intraoperative camera attached to a navigation computer.

Analysts’ Viewpoint

Healthcare entities experiencing financial impacts due to the COVID-19 pandemic should review financial assistance programs provided by the government. Since current navigation systems are only focused on instrument navigation, companies in the North America fluoroscopy navigation technology market should increase R&D in smart instruments that eliminate the need of instrument calibration and reduce user interaction with the navigation software. Market stakeholders should tap revenue opportunities in orthopedic surgery, since fluoroscopic navigation systems help to update images after fracture manipulation. Companies are increasing efforts to improve the integration of navigation into the operating room environment to enable quick set-up and intuitive usage of fluoroscopic navigation systems.

North America Fluoroscopy Navigation Technology Market: Overview

North America Fluoroscopy Navigation Technology Market: Key Segments

Companies Covered in North America Fluoroscopy Navigation Technology Market Report

North America Fluoroscopy Navigation Technology Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 53.3 Mn |

|

Market Forecast Value in 2031 |

US$ 89.2 Mn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

The report scope includes segment analysis of North America. Moreover, qualitative analysis includes drivers, restraints, opportunities, key industry events, product analysis, and technological advancement. |

|

Competition Landscape |

Company profiles section includes overview, business overview, strategy & recent developments, key financials, etc. |

|

Format |

Electronic (PDF) + Excel |

|

Countries Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

North America fluoroscopy navigation technology market to reach valuation Of US$ 89.2 Mn by 2031

North America fluoroscopy navigation technology market is projected to expand at a CAGR of 4.8% from 2021 to 2031

North America fluoroscopy navigation technology market is driven by increase in incidence of osteoarthritis and surge in usage of fluoroscopy navigation system in trauma surgeries

The 3D fluoroscopy system segment accounted for major share of the fluoroscopy navigation technology market in 2020 and the trend is anticipated to continue during the forecast period

Key players operating in the fluoroscopy navigation technology market in North America are Stryker, Zimmer Biomet Holdings, Inc., Smith+Nephew, DePuy Synthes, Orthogrid, Medtronic plc, Radlink, Intellijoint Surgical, Siemens Healthineers, Brainlab

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: U.S. and Canada Fluoroscopy Navigation Technology Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Canada Fluoroscopy Navigation Technology Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Fluoroscopy Navigation Technology Market business models and Licensing models (based on effort)

5.2. Overview of Fluoroscopy Navigation Technology - markers, registration/time, etc.

5.3. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.4. Technological Advancements

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.6. Fluoroscopy vs. Orthopedic Navigation Technology

5.7. Fluoroscopy use in the Primary Anterior THA, Primary Posterior (complex) THA, and Revision THA in U.S. and Canada

5.8. Overview of Orthopedic Navigation Technology

5.9. Fluoroscopy Navigation Market shares Vs. other navigation tech (procedures and market shares)

5.10. C-arm use in Spine procedures in U.S. and Canada

6. U.S. Fluoroscopy Navigation Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. 2D Fluoroscopy System

6.3.2. 3D Fluoroscopy System

6.4. Market Attractiveness Analysis, by Type

7. U.S. Fluoroscopy Navigation Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Trauma & Extremities

7.3.2. Knee Surgery

7.3.3. Hip Surgery

7.3.4. Others

8. U.S. Fluoroscopy Navigation Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Canada Fluoroscopy Navigation Market Analysis and Forecast, by Type

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Type, 2017–2031

9.3.1. 2D Fluoroscopy System

9.3.2. 3D Fluoroscopy System

9.4. Market Attractiveness Analysis, by Type

10. Canada Fluoroscopy Navigation Market Analysis and Forecast, by Application

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Trauma & Extremities

10.3.2. Knee Surgery

10.3.3. Hip Surgery

10.3.4. Others

10.4. Market Attractiveness Analysis, by Application

11. Canada Fluoroscopy Navigation Market Analysis and Forecast, by End-user

11.1. Introduction & Definition

11.2. Key Findings / Developments

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Others

11.4. Market Attractiveness Analysis, by End-user

12. Competition Landscape

12.1. Market Player - Competition Matrix (by tier and size of companies)

12.2. Company Profiles

12.2.1. Stryker

12.2.1.1. Company Overview

12.2.1.2. Company Financials

12.2.1.3. Growth Strategies

12.2.1.4. SWOT Analysis

12.2.2. Zimmer Biomet Holdings, Inc.

12.2.2.1. Company Overview

12.2.2.2. Company Financials

12.2.2.3. Growth Strategies

12.2.2.4. SWOT Analysis

12.2.3. Smith+Nephew

12.2.3.1. Company Overview

12.2.3.2. Company Financials

12.2.3.3. Growth Strategies

12.2.3.4. SWOT Analysis

12.2.4. DePuy Synthes

12.2.4.1. Company Overview

12.2.4.2. Company Financials

12.2.4.3. Growth Strategies

12.2.4.4. SWOT Analysis

12.2.5. Orthogrid

12.2.5.1. Company Overview

12.2.5.2. Company Financials

12.2.5.3. Growth Strategies

12.2.5.4. SWOT Analysis

12.2.6. Medtronic plc

12.2.6.1. Company Overview

12.2.6.2. Company Financials

12.2.6.3. Growth Strategies

12.2.6.4. SWOT Analysis

12.2.7. Radlink

12.2.7.1. Company Overview

12.2.7.2. Company Financials

12.2.7.3. Growth Strategies

12.2.7.4. SWOT Analysis

12.2.8. Intellijoint Surgical

12.2.8.1. Company Overview

12.2.8.2. Company Financials

12.2.8.3. Growth Strategies

12.2.8.4. SWOT Analysis

12.2.9. Siemens Healthineers

12.2.9.1. Company Overview

12.2.9.2. Company Financials

12.2.9.3. Growth Strategies

12.2.9.4. SWOT Analysis

12.2.10. Brainlab

12.2.10.1. Company Overview

12.2.10.2. Company Financials

12.2.10.3. Growth Strategies

12.2.10.4. SWOT Analysis

12.2.11. Fiagon

12.2.11.1. Company Overview

12.2.11.2. Company Financials

12.2.11.3. Growth Strategies

12.2.11.4. SWOT Analysis

12.2.12. GE Healthcare

12.2.12.1. Company Overview

12.2.12.2. Company Financials

12.2.12.3. Growth Strategies

12.2.12.4. SWOT Analysis

12.2.13. MicroPort Scientific Corporation

12.2.13.1. Company Overview

12.2.13.2. Company Financials

12.2.13.3. Growth Strategies

12.2.13.4. SWOT Analysis

12.2.14. OrthoAlign

12.2.14.1. Company Overview

12.2.14.2. Company Financials

12.2.14.3. Growth Strategies

12.2.14.4. SWOT Analysis

12.2.15. Orthokey Italia SRL.

12.2.15.1. Company Overview

12.2.15.2. Company Financials

12.2.15.3. Growth Strategies

12.2.15.4. SWOT Analysis

List of Tables

Table 1: U.S. Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 2: U.S. Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 3: U.S. & Canada Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 4: Canada Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 5: Canada Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 6: Canada Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: U.S. Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 02: U.S. Fluoroscopy Navigation Technology Market Value Share Analysis, by Type, 2020 and 2031

Figure 03: U.S. Fluoroscopy Navigation Technology Market Attractiveness Analysis, by Type, 2021–2031

Figure 04: U.S. Fluoroscopy Navigation Technology Market Value Share Analysis, by Application, 2020 and 2031

Figure 05: U.S. Fluoroscopy Navigation Technology Market Attractiveness Analysis, by Application, 2021–2031

Figure 06: U.S. Fluoroscopy Navigation Technology Market Value Share Analysis, by End-user, 2020 and 2031

Figure 07: U.S. Fluoroscopy Navigation Technology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 08: Canada Fluoroscopy Navigation Technology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 09: Canada Fluoroscopy Navigation Technology Market Value Share Analysis, by Type, 2020 and 2031

Figure 10: Canada Fluoroscopy Navigation Technology Market Attractiveness Analysis, by Type, 2021–2031

Figure 11: Canada Fluoroscopy Navigation Technology Market Value Share Analysis, by Application, 2020 and 2031

Figure 12: Canada Fluoroscopy Navigation Technology Market Attractiveness Analysis, by Application, 2021–2031

Figure 13: Canada Fluoroscopy Navigation Technology Market Value Share Analysis, by End-user, 2020 and 2031

Figure 14: Canada Fluoroscopy Navigation Technology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 15: Breakdown of Net Sales (%), by Region, 2020

Figure 16: Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020