Reports

Reports

Analysts’ Viewpoint

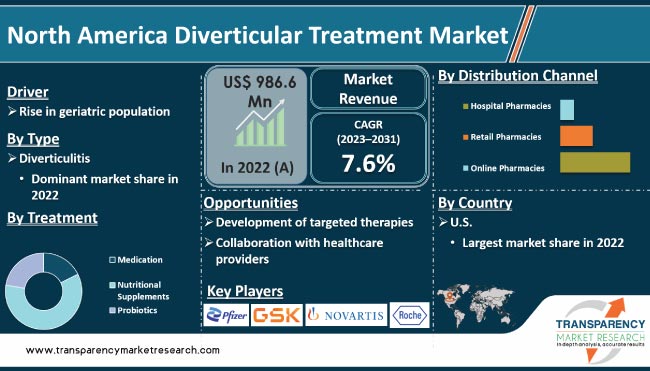

Surge in prevalence of diverticular diseases, rise in healthcare expenditure, and increase in awareness about the disease are driving North America diverticular treatment market demand. Surge in geriatric population in the region is another factor propelling market progress. Sedentary lifestyle, consumption of diet having low fiber, and intake of high processed foods are expected to bolster North America diverticular treatment market value.

Increase in investment in development of advanced treatment options is projected to offer lucrative opportunities to market players. Post the COVID-19 pandemic, diverticular treatment companies are making data-driven decisions before investing in new products. They are investing significantly in the research and development of advanced diverticular treatment options.

Diverticula are small, bulging pouches that can develop in the lining of the digestive tract, most commonly in the large intestine (colon). When these pouches become inflamed or infected, the condition is known as diverticulitis.

Diverticular treatment refers to the management and medical interventions used to address diverticulitis and its associated symptoms.

Prevalence of diverticular disease has been increasing in North America, posing a significant healthcare challenge. The disease is typically associated with age, and its prevalence tends to increase with advancing age.

According to an article published in the Gastroenterology Journal, more than 50% of Americans older than 60 years of age have diverticulosis, and diverticulitis is highly prevalent.

According to the National Institutes of Health (NIH), the prevalence of diverticular disease reaches as high as 65% by 85 years of age and estimated to be as low as 5% in those 40 years of age or younger in the U.S. Diverticulosis is quite common, especially as people age.

More than 30% of the U.S. adults between the ages of 50 and 59 and more than 70% of those older than 80 years have diverticulosis. Less than 5% of people with diverticulosis develop diverticulitis. In the U.S., about 200,000 people are hospitalized for diverticulitis and about 71,000 people for diverticular bleeding each year.

Rise in life expectancy across the world is increasing the number of elderly individuals. Older people are at higher risk of having diverticular disease, with studies showing that more than half of individuals over the age of 60 have diverticula in their colon.

Changes in dietary habits and lifestyle factors also play a major role in rise in prevalence of diverticular disease. A diet low in fiber and high in processed foods, combined with sedentary lifestyles, could contribute to constipation and increased pressure in the colon, leading to the formation of diverticula.

Obesity has become a major health concern in the region. It is linked to an increased risk of diverticular disease. Excess weight puts additional pressure on the colon, which can contribute to the development of diverticula. These factors are fueling market expansion in the region.

In terms of type, the diverticulitis segment accounted for largest North America diverticular treatment market share in 2022. The trend is expected to continue during the forecast period. Incidence of diverticulitis tends to increase with age, and it is more common in individuals over the age of 50. According to the National Institute of Diabetes, Digestive, and Kidney Diseases (NIDDK), approximately 200,000 cases of acute diverticulitis occur in the U.S. annually.

Based on treatment, the medication segment dominated the diverticular treatment market in North America in 2022. This is ascribed to high demand for diverticular bleeding and diverticulitis treatment antibiotics and anti-inflammatory drugs, which are the most common complications of the diverticular disease.

According to NIDDK, diverticulitis and diverticular bleeding occur in 10% to 25% and up to 15% of people with diverticulosis, respectively. This could require hospitalization and medical interventions. These factors are driving the medication segment.

In terms of route of administration, the oral segment accounted for major market share in 2022. The trend is likely to continue during the forecast period due to ease of administration, high patient compliance, and availability of a range of oral drugs for the treatment of diverticular disease.

Rise in preference for non-invasive treatment options and high demand for antibiotics and anti-inflammatory drugs are expected to bolster the oral segment.

Based on distribution channel, the retail pharmacies segment dominated the market in North America in 2022. This can be ascribed to widespread presence of retail pharmacies. Convenience of retail pharmacies is also a key factor propelling the segment, as patients can easily buy medicine for diverticulitis from retail pharmacies, especially in rural areas where online and hospital pharmacies may be less accessible.

Retail pharmacies also offer personalized and timely services, including counseling, prescription filling, and medication management, which enhance patient satisfaction and loyalty.

According to North America diverticular treatment industry research report, the U.S. accounted for significant share of the regional market in 2022. This can be ascribed to large patient population in the U.S., high prevalence of diverticular disease, availability & adoption of advanced medical treatments on a large scale, and high healthcare spending.

The U.S. also has a well-established pharmaceutical industry, which is influencing the market statistics in the country.

The North America diverticular treatment market report concludes with the company profiles section that includes key information about the major players. Companies focus on strategies such as new product launches, mergers, and partnerships & collaborations to compete in the marketplace. They consider developing new treatments for diverticulitis to strengthen market position.

Major North America diverticular treatment market leaders are Pfizer, Inc., Novartis AG, Bayer AG, F. Hoffmann-La Roche Ltd. Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Johnson & Johnson, Mallinckrodt Pharmaceuticals, Abbott Laboratories, and GSK plc.

Prominent players have been profiled in the report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 986.6 Mn |

|

Forecast (Value) in 2031 |

More than US$ 1.9 Bn |

|

Growth Rate (CAGR) |

7.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment as well as country-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry in the region was valued at US$ 986.6 Mn in 2022

It is projected to reach more than US$ 1.9 Bn by 2031

The market in the region is anticipated to expand at a CAGR of 7.6% from 2023 to 2031

Rise in geriatric population is driving the market in the region.

The U.S. is expected to account for largest market share

Pfizer, Inc., Novartis AG, Bayer AG, F. Hoffmann-La Roche Ltd. Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Johnson & Johnson, Mallinckrodt Pharmaceuticals, Abbott Laboratories, and GSK plc

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: North America Diverticular Treatment Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. North America Diverticular Treatment Market Value Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Disease Prevalence & Incidence Rate

5.2. Pipeline Analysis

5.3. COVID-19 Impact Analysis

6. North America Diverticular Treatment Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Diverticulosis

6.3.2. Diverticulitis

6.3.3. Diverticular Hemorrhage

6.4. Market Attractiveness Analysis, by Type

7. North America Diverticular Treatment Market Analysis and Forecast, by Treatment

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Treatment, 2017-2031

7.3.1. Medication

7.3.1.1. Pain Reliever

7.3.1.2. Antibiotics

7.3.1.2.1. Amebicides

7.3.1.2.2. Sulfonamides

7.3.1.2.3. Quinolones and Fluoroquinolones

7.3.1.2.4. Lincomycin Derivatives

7.3.1.2.5. Miscellaneous Antibiotics

7.3.1.3. Anticholinergics/Antispasmodics

7.3.2. Nutritional Supplements

7.3.3. Probiotics

7.4. Market Attractiveness Analysis, by Treatment

8. North America Diverticular Treatment Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Route of Administration, 2017-2031

8.3.1. Oral

8.3.2. Parenteral

8.4. Market Attractiveness Analysis, by Route of Administration

9. North America Diverticular Treatment Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. North America Diverticular Treatment Market Analysis and Forecast, by Country

10.1. Key Findings

10.2. Market Value Forecast, by Country

10.2.1. U.S.

10.2.2. Canada

10.3. Market Attractiveness Analysis, by Country

11. U.S. Diverticular Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2031

11.2.1. Diverticulosis

11.2.2. Diverticulitis

11.2.3. Diverticular Hemorrhage

11.3. Market Value Forecast, by Treatment, 2017-2031

11.3.1. Medication

11.3.1.1. Pain Reliever

11.3.1.2. Antibiotics

11.3.1.2.1. Amebicides

11.3.1.2.2. Sulfonamides

11.3.1.2.3. Quinolones and Fluoroquinolones

11.3.1.2.4. Lincomycin Derivatives

11.3.1.2.5. Miscellaneous Antibiotics

11.3.1.3. Anticholinergics/Antispasmodics

11.3.2. Nutritional Supplements

11.3.3. Probiotics

11.4. Market Value Forecast, by Route of Administration, 2017-2031

11.4.1. Oral

11.4.2. Parenteral

11.5. Market Value Forecast, by Distribution Channel, 2017-2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Treatment

11.6.3. By Route of Administration

11.6.4. By Distribution Channel

12. Canada Diverticular Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Diverticulosis

12.2.2. Diverticulitis

12.2.3. Diverticular Hemorrhage

12.3. Market Value Forecast, by Treatment, 2017-2031

12.3.1. Medication

12.3.1.1. Pain Reliever

12.3.1.2. Antibiotics

12.3.1.2.1. Amebicides

12.3.1.2.2. Sulfonamides

12.3.1.2.3. Quinolones and Fluoroquinolones

12.3.1.2.4. Lincomycin Derivatives

12.3.1.2.5. Miscellaneous Antibiotics

12.3.1.3. Anticholinergics/Antispasmodics

12.3.2. Nutritional Supplements

12.3.3. Probiotics

12.4. Market Value Forecast, by Route of Administration, 2017-2031

12.4.1. Oral

12.4.2. Parenteral

12.5. Market Value Forecast, by Distribution Channel, 2017-2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Treatment

12.6.3. By Route of Administration

12.6.4. By Distribution Channel

13. Competition Landscape

13.1. Market Player - Competition Matrix (by tier and size of companies)

13.2. Market Share Analysis, by Company, 2022

13.3. Company Profiles

13.3.1. Pfizer, Inc.

13.3.1.1. Company Overview

13.3.1.2. Product Portfolio

13.3.1.3. SWOT Analysis

13.3.1.4. Strategic Overview

13.3.2. Novartis AG

13.3.2.1. Company Overview

13.3.2.2. Product Portfolio

13.3.2.3. SWOT Analysis

13.3.2.4. Strategic Overview

13.3.3. Bayer AG

13.3.3.1. Company Overview

13.3.3.2. Product Portfolio

13.3.3.3. SWOT Analysis

13.3.3.4. Strategic Overview

13.3.4. F. Hoffmann-La Roche Ltd.

13.3.4.1. Company Overview

13.3.4.2. Product Portfolio

13.3.4.3. SWOT Analysis

13.3.4.4. Strategic Overview

13.3.5. Teva Pharmaceutical Industries Ltd

13.3.5.1. Company Overview

13.3.5.2. Product Portfolio

13.3.5.3. SWOT Analysis

13.3.5.4. Strategic Overview

13.3.6. Sun Pharmaceutical Industries Ltd.

13.3.6.1. Company Overview

13.3.6.2. Product Portfolio

13.3.6.3. SWOT Analysis

13.3.6.4. Strategic Overview

13.3.7. Johnson & Johnson

13.3.7.1. Company Overview

13.3.7.2. Product Portfolio

13.3.7.3. SWOT Analysis

13.3.7.4. Strategic Overview

13.3.8. Mallinckrodt Pharmaceuticals

13.3.8.1. Company Overview

13.3.8.2. Product Portfolio

13.3.8.3. SWOT Analysis

13.3.8.4. Strategic Overview

13.3.9. Abbott Laboratories

13.3.9.1. Company Overview

13.3.9.2. Product Portfolio

13.3.9.3. SWOT Analysis

13.3.9.4. Strategic Overview

13.3.10. GSK plc

13.3.10.1. Company Overview

13.3.10.2. Product Portfolio

13.3.10.3. SWOT Analysis

13.3.10.4. Strategic Overview

List of Tables

Table 01: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017-2031

Table 03: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Medication, 2017-2031

Table 04: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Antibiotics, 2017-2031

Table 05: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 06: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 07: North America Diverticular Treatment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 09: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017-2031

Table 10: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, by Medication, 2017-2031

Table 11: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, by Antibiotics, 2017-2031

Table 12: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 13: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 14: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 15: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017-2031

Table 16: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, by Medication, 2017-2031

Table 17: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, by Antibiotics, 2017-2031

Table 18: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 19: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: North America Diverticular Treatment Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: North America Diverticular Treatment Market Value Share, by Type, 2022

Figure 03: North America Diverticular Treatment Market Value Share, by Treatment, 2022

Figure 04: North America Diverticular Treatment Market Value Share, by Route of Administration, 2022

Figure 05: North America Diverticular Treatment Market Value Share, by Distribution Channel, 2022

Figure 06: North America Diverticular Treatment Market Value Share Analysis, by Type, 2022 and 2031

Figure 07: North America Diverticular Treatment Market Attractiveness Analysis, by Type, 2023-2031

Figure 08: North America Diverticular Treatment Market (US$ Mn), by Diverticulosis, 2017-2031

Figure 09: North America Diverticular Treatment Market (US$ Mn), by Diverticulitis, 2017-2031

Figure 10: North America Diverticular Treatment Market (US$ Mn), by Diverticular Hemorrhage, 2017-2031

Figure 11: North America Diverticular Treatment Market Value Share Analysis, by Treatment, 2022 and 2031

Figure 12: North America Diverticular Treatment Market Attractiveness Analysis, by Treatment, 2023-2031

Figure 13: North America Diverticular Treatment Market (US$ Mn), by Medication, 2017-2031

Figure 14: North America Diverticular Treatment Market (US$ Mn), by Nutritional Supplements, 2017-2031

Figure 15: North America Diverticular Treatment Market (US$ Mn), by Probiotics, 2017-2031

Figure 16: North America Diverticular Treatment Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 17: North America Diverticular Treatment Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 18: North America Diverticular Treatment Market (US$ Mn), by Oral, 2017-2031

Figure 19: North America Diverticular Treatment Market (US$ Mn), by Parenteral, 2017-2031

Figure 20: North America Diverticular Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 21: North America Diverticular Treatment Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 22: North America Diverticular Treatment Market (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 23: North America Diverticular Treatment Market (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 24: North America Diverticular Treatment Market (US$ Mn), by Online Pharmacies, 2017-2031

Figure 25: North America Diverticular Treatment Market Value Share Analysis, by Country, 2022 and 2031

Figure 26: North America Diverticular Treatment Market Attractiveness Analysis, by Country, 2023-2031

Figure 27: U.S. Diverticular Treatment Market Value (US$ Mn) Forecast, 2017-2031

Figure 28: U.S. Diverticular Treatment Market Value Share Analysis, by Type, 2022 and 2031

Figure 29: U.S. Diverticular Treatment Market Attractiveness Analysis, by Type, 2023-2031

Figure 30: U.S. Diverticular Treatment Market Value Share Analysis, by Treatment, 2022 and 2031

Figure 31: U.S. Diverticular Treatment Market Attractiveness Analysis, by Treatment, 2023-2031

Figure 32: U.S. Diverticular Treatment Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 33: U.S. Diverticular Treatment Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 34: U.S. Diverticular Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 35: U.S. Diverticular Treatment Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 36: Canada Diverticular Treatment Market Value (US$ Mn) Forecast, 2017-2031

Figure 37: Canada Diverticular Treatment Market Value Share Analysis, by Type, 2022 and 2031

Figure 38: Canada Diverticular Treatment Market Attractiveness Analysis, by Type, 2023-2031

Figure 39: Canada Diverticular Treatment Market Value Share Analysis, by Treatment, 2022 and 2031

Figure 40: Canada Diverticular Treatment Market Attractiveness Analysis, by Treatment, 2023-2031

Figure 41: Canada Diverticular Treatment Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 42: Canada Diverticular Treatment Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 43: Canada Diverticular Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 44: Canada Diverticular Treatment Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 45: North America Diverticular Treatment Market Share, by Company, 2022