Reports

Reports

Analysts’ Viewpoint

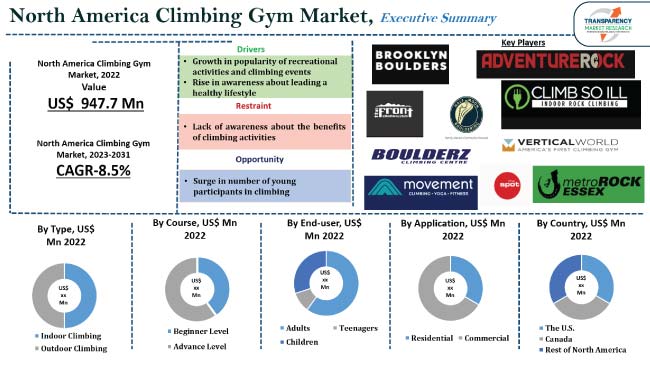

Surge in concern among the population about health and wellness is one of the key factors fueling the North America climbing gym market size. The presence of a significant number of players operating in the market is further fueling the growth of North America adventure sports facilities.

The North America climbing gym market is anticipated to prosper in the next few years, ascribed to the advantages associated with climbing, which include mental benefits, full body workout, and cardiorespiratory fitness.

The growth in popularity of recreational activities including climbing, and high instances of health issues such as obesity is further expected to offer North America climbing gym market opportunities during the forecast period. Expansion of geographic presence and partnerships are the key strategies of players in the market.

Climbing is the activity of using the hands, feet, and other body parts to move up a steep topographical object - which can be anything from little rocks to the tallest mountains. A gym with an artificial wall and grips for the hands and feet used for climbing is called a climbing gym.

The layout and equipment of the walls can be altered to accommodate various climbing techniques. Climbing gyms offer personal safety to end-users by giving top-notch equipment and providing expert guidance.

There are climbing gyms that feature fast climbing walls and those that have auto belays, which are motors that enable end-users to climb without the help of a belayer. Unlike traditional gyms, climbing gyms emphasize a full-body workout that engages every muscle in the body, promoting balanced development.

The many advantages associated with climbing gyms include full body workout, mental workout, and stress relief. Enhancing flexibility, balance, and coordination is possible by climbing, which calls for stretching, body awareness, and balance.

Recreational activities provide a number of advantages that enhance overall health, making them essential to sustaining a healthy and balanced lifestyle. End-users are drawn to climbing because of the increased appeal of recreational activities due to their health benefits.

The unique and comprehensive fitness experience offered by climbing gyms and growing popularity of recreational activities is expected to fuel the North America climbing gym market share during the forecast period.

Climbing is gaining popularity in North American countries such as the US, and Canada, due to the growing number of outdoor and indoor climbing championships. For instance, the IFSC Climbing World Championships is a world championship event held once in every two years.

The event is held in three disciplines of climbing competition: competition lead climbing, competition bouldering, and competition speed climbing.

The North American Cup Series launched in 2021 is another climbing competition event organized by USA Climbing, and Climbing Escalade Canada (CEC) that features the three individual disciplines of climbing: bouldering, lead, and speed. Participation in outdoor recreation increased by 2.3% in 2022 to 168.1 million people, representing 55% of the U.S. population.

Thus, the growing popularity of recreational activities and climbing events is bolstering the North America climbing gym market value.

Increasing number of people are realizing the importance of leading a healthy lifestyle, with sufficient relaxation, exercise, sleep, and nutrition, and with an emphasis on nurturing the body, mind, and soul through good lifestyle choices.

Notably, research indicates that younger generations place a higher priority on aspects such as mental and physical well-being, as well as good food and exercise, than previous generations.

The COVID-19 pandemic also had a major impact on the development of proactive approaches to nutrition and well-being as well as a global movement in consumer behavior toward preventative health measures. Furthermore, individuals are paying more attention to fitness and leading healthy lifestyles because obesity is common in North American nations, with prevalence of obesity at over 36% in the US.

Individuals with obesity are practicing rock climbing at various types of North America climbing gyms such as indoor and outdoor climbing gyms. All these factors are projected to offer lucrative opportunities for market expansion.

The North America climbing gym market segmentation based on type includes indoor climbing and outdoor climbing. The indoor climbing segment held the largest share in the year 2022 due to their safety and accessibility. Indoor climbing is frequently seen as safer particularly for beginners than outdoor climbing due to the regulated environment, trained personnel, and padded surfaces.

Indoor climbing facilities offer a stable and predictable setting for practice and pleasure of climbing throughout the year, regardless of the weather. Climbers can improve their skills by using indoor climbing as a training ground for outdoor climbing, which is mainly beneficial for people who live far away from natural rock climbing structures.

Indoor bouldering gyms in North America are an appealing option for people seeking a reliable, social, and safe climbing experience, which is expected to drive the North America climbing gym industry during the forecast period.

As per the latest North America climbing gym market forecast, the U.S. held the largest share in 2022, ascribed to the surge in participation in indoor and outdoor climbing. On an average, 50 new climbing gyms are opening in the U.S. on a yearly basis. The gradual increase in smaller, bouldering-focused gym construction that has been witnessed in the U.S. climbing gym industry since the beginning of the 2010s, is one of the major North America climbing gym market trends.

The last 10 years in particular, has seen a noticeable increase in the number of new bouldering gym openings relative to the number of new roped climbing gyms and mixed climbing gyms (i.e., gyms that provide both boulders and ropes).

Bouldering gyms accounted for 50% of all new climbing gyms that opened in the U.S. between 2013 and 2022, which is a record high. A significant number of players, including Brooklyn Boulders, and Climb So iLL, operate in the country, owing to the large number of customers who are more inclined to lead a healthy and fit lifestyle.

The North America climbing gym market analysis evaluates the financials, recent developments, and strategies of key players. Majority of players are spending significantly on expanding their presence, primarily in the prominent areas of the region.

Brooklyn Boulders, Climb So iLL, HIGH POINT, MetroRock, Momentum Climbing Gym, Sender One Climbing LLC, Stone Summit LLC, Texas Rock Gym, The Front, and Vertical Endeavors are the prominent North America climbing gym manufacturers.

Key players have been profiled in the North America climbing gym market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 947.7 Mn |

| Market Forecast Value in 2031 | US$ 1.9 Bn |

| Growth Rate (CAGR) | 8.5% |

| Forecast Period | 2023-2031 |

| Historical data Available for | 2017-2021 |

| Quantitative Units | US$ Mn/Bn for value |

| Market Analysis | Regional qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Country Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 947.7 Mn in 2022

It is expected to reach US$ 1.9 Bn by the end of 2031

Growth in popularity of recreational activities & climbing events, and surge in awareness about leading a healthy lifestyle

The indoor climbing segment contributed the highest share in 2022

The U.S. contributed about 34.5% in terms of share in 2022

Brooklyn Boulders, Climb So iLL, HIGH POINT, MetroRock, Momentum Climbing Gym, Sender One Climbing LLC, Stone Summit LLC, Texas Rock Gym, The Front, and Vertical Endeavors

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Adventurous Sports Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Standards & Regulations

5.8. North America Climbing Gym Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Mn)

6. North America Climbing Gym Market Analysis and Forecast, By Type

6.1. Climbing Gym Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

6.1.1. Indoor Climbing

6.1.1.1. Bouldering

6.1.1.2. Lead Climbing

6.1.1.3. Top Rope Climbing

6.1.2. Outdoor Climbing

6.1.2.1. Bouldering

6.1.2.2. Lead Climbing

6.1.2.3. Top Rope Climbing

6.1.2.4. Trad Climbing

6.1.2.5. Others

6.2. Incremental Opportunity, By Type

7. North America Climbing Gym Market Analysis and Forecast, By Course

7.1. Climbing Gym Market Size (US$ Mn) Forecast, By Course, 2017 - 2031

7.1.1. Beginner Level

7.1.2. Advance Level

7.2. Incremental Opportunity, By Course

8. North America Climbing Gym Market Analysis and Forecast, By End-user

8.1. Climbing Gym Market Size (US$ Mn) Forecast, By End-user, 2017 - 2031

8.1.1. Adults

8.1.2. Teenagers

8.1.3. Children

8.2. Incremental Opportunity, By End-user

9. North America Climbing Gym Market Analysis and Forecast, By Application

9.1. Climbing Gym Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

9.1.1. Residential

9.1.2. Commercial

9.1.2.1. Malls/Gaming Arcades

9.1.2.2. Mountain Climbing Training Centers & Gyms

9.1.2.3. Others (Resorts, Entertainment Parks)

9.2. Incremental Opportunity, By Application

10. North America Climbing Gym Market Analysis and Forecast, By Country

10.1. Climbing Gym Market Size (US$ Mn) Forecast, By Country, 2017 - 2031

10.1.1. US

10.1.2. Canada

10.2. Incremental Opportunity, By Country

11. US Climbing Gym Market Analysis and Forecast

11.1. Country Snapshot

11.2. Demographic Overview

11.3. Key Trend Analysis

11.4. Consumer Behavior Analysis

11.5. Climbing Gym Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

11.5.1. Indoor Climbing

11.5.1.1. Bouldering

11.5.1.2. Lead Climbing

11.5.1.3. Top Rope Climbing

11.5.2. Outdoor Climbing

11.5.2.1. Bouldering

11.5.2.2. Lead Climbing

11.5.2.3. Top Rope Climbing

11.5.2.4. Trad Climbing

11.5.2.5. Others

11.6. Climbing Gym Market Size (US$ Mn) Forecast, By Course, 2017 - 2031

11.6.1. Beginner Level

11.6.2. Advance Level

11.7. Climbing Gym Market Size (US$ Mn) Forecast, By End-user, 2017 - 2031

11.7.1. Adults

11.7.2. Teenagers

11.7.3. Children

11.8. Climbing Gym Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

11.8.1. Residential

11.8.2. Commercial

11.8.2.1. Malls/Gaming Arcades

11.8.2.2. Mountain Climbing Training Centers & Gyms

11.8.2.3. Others (Resorts, Entertainment Parks)

11.9. Incremental Opportunity Analysis

12. Canada Climbing Gym Market Analysis and Forecast

12.1. Country Snapshot

12.2. Demographic Overview

12.3. Key Trend Analysis

12.4. Consumer Behavior Analysis

12.5. Climbing Gym Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

12.5.1. Indoor Climbing

12.5.1.1. Bouldering

12.5.1.2. Lead Climbing

12.5.1.3. Top Rope Climbing

12.5.2. Outdoor Climbing

12.5.2.1. Bouldering

12.5.2.2. Lead Climbing

12.5.2.3. Top Rope Climbing

12.5.2.4. Trad Climbing

12.5.2.5. Others

12.6. Climbing Gym Market Size (US$ Mn) Forecast, By Course, 2017 - 2031

12.6.1. Beginner Level

12.6.2. Advance Level

12.7. Climbing Gym Market Size (US$ Mn) Forecast, By End-user, 2017 - 2031

12.7.1. Adults

12.7.2. Teenagers

12.7.3. Children

12.8. Climbing Gym Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

12.8.1. Residential

12.8.2. Commercial

12.8.2.1. Malls/Gaming Arcades

12.8.2.2. Mountain Climbing Training Centers & Gyms

12.8.2.3. Others (Resorts, Entertainment Parks)

12.9. Incremental Opportunity Analysis

13. Competition Landscape

13.1. Market Player – Competition Dashboard

13.2. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Business Overview, Services Offered)

13.2.1. Brooklyn Boulders

13.2.1.1. Company Overview

13.2.1.2. Sales Area

13.2.1.3. Geographical Presence

13.2.1.4. Business Overview

13.2.1.5. Services Offered

13.2.2. Climb So iLL.

13.2.2.1. Company Overview

13.2.2.2. Sales Area

13.2.2.3. Geographical Presence

13.2.2.4. Business Overview

13.2.2.5. Services Offered

13.2.3. HIGH POINT

13.2.3.1. Company Overview

13.2.3.2. Sales Area

13.2.3.3. Geographical Presence

13.2.3.4. Business Overview

13.2.3.5. Services Offered

13.2.4. MetroRock

13.2.4.1. Company Overview

13.2.4.2. Sales Area

13.2.4.3. Geographical Presence

13.2.4.4. Business Overview

13.2.4.5. Services Offered

13.2.5. Momentum Climbing Gym

13.2.5.1. Company Overview

13.2.5.2. Sales Area

13.2.5.3. Geographical Presence

13.2.5.4. Business Overview

13.2.5.5. Services Offered

13.2.6. Sender One Climbing LLC

13.2.6.1. Company Overview

13.2.6.2. Sales Area

13.2.6.3. Geographical Presence

13.2.6.4. Business Overview

13.2.6.5. Services Offered

13.2.7. Stone Summit LLC

13.2.7.1. Company Overview

13.2.7.2. Sales Area

13.2.7.3. Geographical Presence

13.2.7.4. Business Overview

13.2.7.5. Services Offered

13.2.8. Texas Rock Gym

13.2.8.1. Company Overview

13.2.8.2. Sales Area

13.2.8.3. Geographical Presence

13.2.8.4. Business Overview

13.2.8.5. Services Offered

13.2.9. The Front

13.2.9.1. Company Overview

13.2.9.2. Sales Area

13.2.9.3. Geographical Presence

13.2.9.4. Business Overview

13.2.9.5. Services Offered

13.2.10. Vertical Endeavors

13.2.10.1. Company Overview

13.2.10.2. Sales Area

13.2.10.3. Geographical Presence

13.2.10.4. Business Overview

13.2.10.5. Services Offered

13.2.11. Other Key Players

13.2.11.1. Company Overview

13.2.11.2. Sales Area

13.2.11.3. Geographical Presence

13.2.11.4. Business Overview

13.2.11.5. Services Offered

14. Go To Market Strategy

14.1. Identification of Potential Market Spaces

14.2. Understanding the Buying Process of Customers

14.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Climbing Gym Market Value, By Type, US$ Mn, 2017 - 2031

Table 2: North America Climbing Gym Market Value, By Course, US$ Mn, 2017 - 2031

Table 3: North America Climbing Gym Market Value, By End-user, US$ Mn, 2017 - 2031

Table 4: North America Climbing Gym Market Value, By Application, US$ Mn, 2017 - 2031

Table 5: North America Climbing Gym Market Value, By Country, US$ Mn, 2017 - 2031

Table 6: U.S. Climbing Gym Market Value, By Type, US$ Mn, 2017 - 2031

Table 7: U.S. Climbing Gym Market Value, By Course, US$ Mn, 2017 - 2031

Table 8: U.S. Climbing Gym Market Value, By End-user, US$ Mn, 2017 - 2031

Table 9: U.S. Climbing Gym Market Value, By Application, US$ Mn, 2017 - 2031

Table 10: Canada Climbing Gym Market Value, By Type, US$ Mn, 2017 - 2031

Table 11: Canada Climbing Gym Market Value, By Course, US$ Mn, 2017 - 2031

Table 12: Canada Climbing Gym Market Value, By End-user, US$ Mn, 2017 - 2031

Table 13: Canada Climbing Gym Market Value, By Application, US$ Mn, 2017 - 2031

List of Figures

Figure 1: North America Climbing Gym Market Value, By Type, US$ Mn, 2017 - 2031

Figure 2: North America Climbing Gym Market Incremental Opportunity, By Type, 2023 - 2031

Figure 3: North America Climbing Gym Market Value, By Course, US$ Mn, 2017 - 2031

Figure 4: North America Climbing Gym Market Incremental Opportunity, By Course, 2023 - 2031

Figure 5: North America Climbing Gym Market Value, By End-user, US$ Mn, 2017 - 2031

Figure 6: North America Climbing Gym Market Incremental Opportunity, By End-user, 2023 - 2031

Figure 7: North America Climbing Gym Market Value, By Application, US$ Mn, 2017 - 2031

Figure 8: North America Climbing Gym Market Incremental Opportunity, By Application, 2023 - 2031

Figure 9: North America Climbing Gym Market Value, By Country, US$ Mn, 2017 - 2031

Figure 10: North America Climbing Gym Market Incremental Opportunity, By Country, 2023 - 2031

Figure 11: U.S. Climbing Gym Market Value, By Type, US$ Mn, 2017 - 2031

Figure 12: U.S. Climbing Gym Market Incremental Opportunity, By Type, 2023 - 2031

Figure 13: U.S. Climbing Gym Market Value, By Course, US$ Mn, 2017 - 2031

Figure 14: U.S. Climbing Gym Market Incremental Opportunity, By Course, 2023 - 2031

Figure 15: U.S. Climbing Gym Market Value, By End-user, US$ Mn, 2017 - 2031

Figure 16: U.S. Climbing Gym Market Incremental Opportunity, By End-user, 2023 - 2031

Figure 17: U.S. Climbing Gym Market Value, By Application, US$ Mn, 2017 - 2031

Figure 18: U.S. Climbing Gym Market Incremental Opportunity, By Application, 2023 - 2031

Figure 19: Canada Climbing Gym Market Value, By Type, US$ Mn, 2017 - 2031

Figure 20: Canada Climbing Gym Market Incremental Opportunity, By Type, 2023 - 2031

Figure 21: Canada Climbing Gym Market Value, By Course, US$ Mn, 2017 - 2031

Figure 22: Canada Climbing Gym Market Incremental Opportunity, By Course, 2023 - 2031

Figure 23: Canada Climbing Gym Market Value, By End-user, US$ Mn, 2017 - 2031

Figure 24: Canada Climbing Gym Market Incremental Opportunity, By End-user, 2023 - 2031

Figure 25: Canada Climbing Gym Market Value, By Application, US$ Mn, 2017 - 2031

Figure 26: Canada Climbing Gym Market Incremental Opportunity, By Application, 2023 - 2031